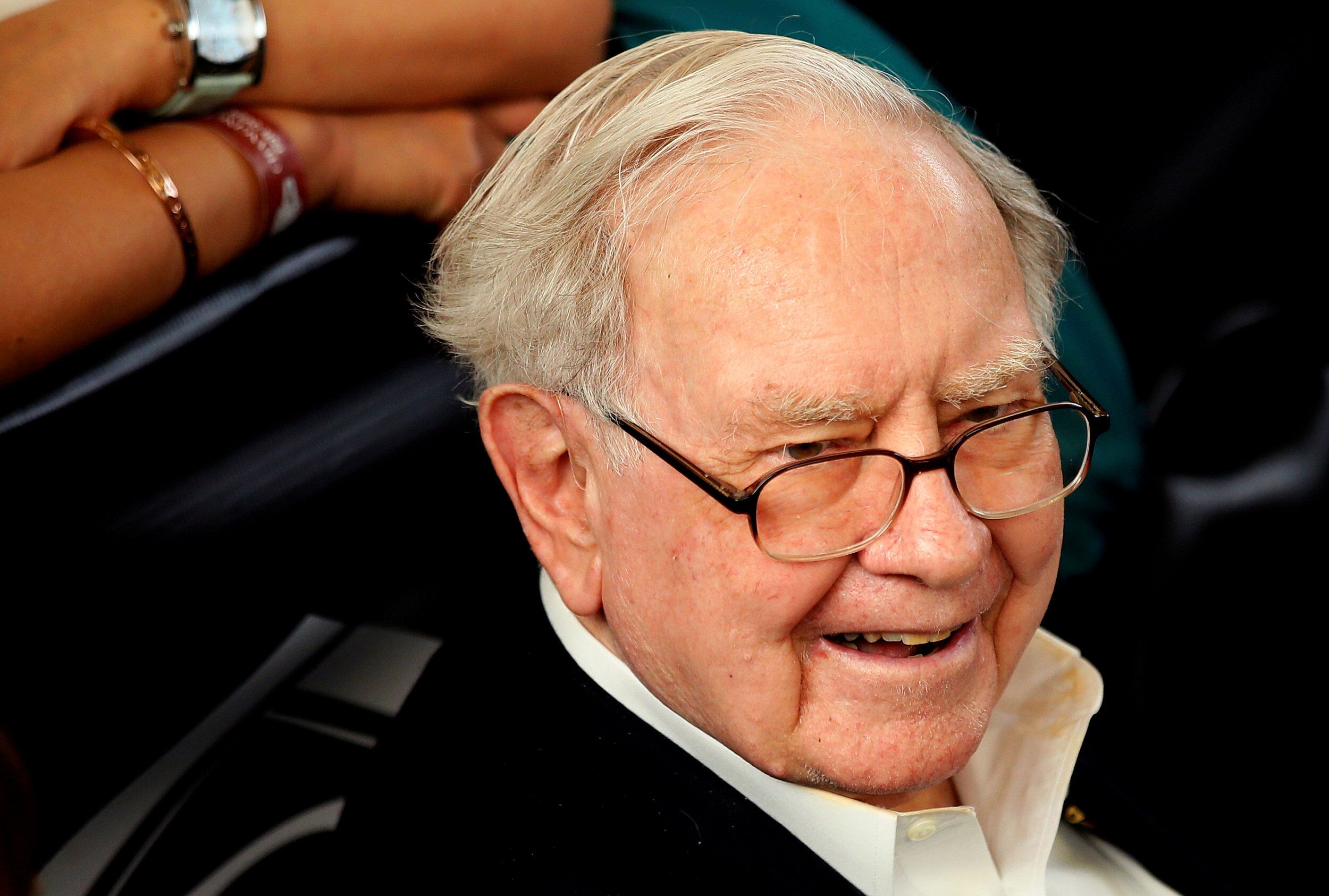

巴菲特在公司年度會(huì)議上的精彩語(yǔ)錄

?

?

|

在伯克希爾·哈撒韋公司(Berkshire Hathaway)的年度會(huì)議上,沃倫·巴菲特和他的商業(yè)伙伴查理·芒格會(huì)針對(duì)股東提出的任何問(wèn)題,,提供觀點(diǎn)和建議,。 2017年的年度會(huì)議于上周六在奧馬哈舉行,,涉及的內(nèi)容五花八門(mén),包括谷歌(Google)和亞馬遜(Amazon)的股價(jià),、富國(guó)銀行(Wells Fargo),、人工智能、共和黨醫(yī)療法案,,以及伯克希爾·哈撒韋的股票是否進(jìn)行分紅,。 不過(guò)年度會(huì)議上最值得關(guān)注的,是86歲的巴菲特和93歲的芒格如何把對(duì)復(fù)雜技術(shù)問(wèn)題的回答提煉成意味深長(zhǎng),、簡(jiǎn)潔有力的智慧結(jié)晶,,甚至讓新手投資者也能理解。 為此,,我們編輯了2017年伯克希爾·哈撒韋年度會(huì)議上巴菲特對(duì)于熱門(mén)話題的經(jīng)典語(yǔ)錄,。畢竟,他被稱作奧馬哈的先知不是沒(méi)有道理的,。 關(guān)于富國(guó)銀行的虛假賬戶丑聞 “富國(guó)銀行犯了三個(gè)嚴(yán)重的錯(cuò)誤,,其中一個(gè)比其他的更加糟糕……主要問(wèn)題在于他們知道以后沒(méi)有采取行動(dòng)……如果存在嚴(yán)重的問(wèn)題,首席執(zhí)行官總會(huì)得到風(fēng)聲,。那就是關(guān)鍵點(diǎn)了,,首席執(zhí)行官必須采取措施。如果他們了解情況的話,,就會(huì)發(fā)現(xiàn)這是個(gè)極其巨大的錯(cuò)誤,,而且我肯定他們得到了一些消息,但是他們忽略了這些,,把它們?nèi)踊亟o下級(jí)去處理了,。” 關(guān)于人工智能和自動(dòng)駕駛汽車(chē) “我要說(shuō),,自動(dòng)駕駛卡車(chē)給北伯靈頓(Burlington Northern)帶來(lái)的威脅要比機(jī)遇更多,。而且如果無(wú)人駕駛卡車(chē)普及開(kāi)來(lái),那只可能是因?yàn)樗鼈兏影踩?,也就是說(shuō)汽車(chē)導(dǎo)致的損失給整體經(jīng)濟(jì)帶來(lái)的代價(jià)會(huì)降低,,這也會(huì)導(dǎo)致Geico的保險(xiǎn)收入減少。所以總結(jié)起來(lái)就是:無(wú)人汽車(chē)的普及會(huì)傷害我們,,如果這種普及蔓延到了卡車(chē),,那還會(huì)傷害我們的汽車(chē)保險(xiǎn)業(yè)務(wù)?!?/p> 關(guān)于可口可樂(lè)和節(jié)食減肥 “我想說(shuō),,我這一輩子都在吃自己喜歡的東西??煽诳蓸?lè),,這種12盎司裝的可口可樂(lè),,我一天要喝五罐,。其中大概有1.2盎司的糖,。去看看別人如何攝取糖類(lèi)和卡路里,你會(huì)發(fā)現(xiàn)來(lái)源各不一樣,。我認(rèn)為我喜歡從可樂(lè)中獲取卡路里,,我喜歡這樣……如果你告訴我,只吃西藍(lán)花或蘆筍或其他什么東西,,就能比攝取我喜歡的可口可樂(lè),、牛排、土豆煎餅等多活一年的話(而且我也不認(rèn)為這樣就能多活),,那我寧愿選擇吃我喜歡的,,享受吃的過(guò)程,而不是再多活一年,?!?/p> “而且我確實(shí)認(rèn)為選擇權(quán)應(yīng)該在我。也許糖類(lèi)有害,,也許你想呼吁政府禁止糖類(lèi)……但我認(rèn)為可口可樂(lè)對(duì)于美國(guó)和世界都有正面的影響,。而且我真的不希望有人說(shuō)我不能喝可樂(lè)。我覺(jué)得活得高興也是長(zhǎng)壽的因素之一,?!?/p> 關(guān)于IBM和蘋(píng)果 “六年前我購(gòu)買(mǎi)IBM股票,是認(rèn)為他們?cè)谶@些年會(huì)有更好的表現(xiàn),。說(shuō)到IBM和蘋(píng)果(Apple),,我認(rèn)為這兩家是很不一樣的公司……我在前一家公司上看走了眼,之后大家可以看看我對(duì)后一家公司的做法是否正確,。不過(guò)我并不認(rèn)為他們是一種類(lèi)型的公司,,當(dāng)然也不認(rèn)為他們風(fēng)馬牛不相及。他們的關(guān)系在這兩種之間,?!?/p> 關(guān)于共和黨的醫(yī)療法案和稅務(wù) “醫(yī)療費(fèi)用是影響經(jīng)濟(jì)競(jìng)爭(zhēng)力的寄生蟲(chóng)。但稅務(wù)系統(tǒng)沒(méi)有損害伯克希爾在全球的競(jìng)爭(zhēng)力,,或是導(dǎo)致類(lèi)似的問(wèn)題,。我們的醫(yī)療費(fèi)用出現(xiàn)了驚人的增長(zhǎng),而且還會(huì)提高許多……這個(gè)問(wèn)題正在給社會(huì)帶來(lái)很多麻煩,,未來(lái)麻煩還會(huì)更多,,無(wú)論是哪一個(gè)黨派執(zhí)政都是如此?!?/p> “至于幾天前通過(guò)的新法案和奧巴馬政府的(可支付醫(yī)保)法案,,這很有趣,。我能告訴你的就是,新法案對(duì)個(gè)人的影響會(huì)體現(xiàn)在稅費(fèi)上,,如果法案得到實(shí)施,,我去年的聯(lián)邦所得稅就會(huì)降低17%。所以對(duì)于我這樣的人來(lái)說(shuō),,新法案大大減少了稅費(fèi),。” 關(guān)于亞馬遜和首席執(zhí)行官杰夫·貝佐斯 “他在公司的兩大業(yè)務(wù)幾乎同時(shí)從零開(kāi)始時(shí),,就擔(dān)任首席執(zhí)行官了,。英特爾(Intel)的安迪·格魯夫曾經(jīng)說(shuō)過(guò),如果你有一顆銀色子彈,,射出去就能消滅掉一個(gè)競(jìng)爭(zhēng)者,,那你會(huì)選誰(shuí)?我認(rèn)為,,云計(jì)算和零售領(lǐng)域都會(huì)有很多人會(huì)選擇向他射出這顆銀色子彈……我們完全錯(cuò)過(guò)了他,。我們從來(lái)沒(méi)有持有過(guò)亞馬遜的股份……我太遲鈍了,沒(méi)有意識(shí)到在發(fā)生什么,。我欣賞杰夫,,但我沒(méi)想到他能取得這么大的成功,我甚至沒(méi)有去想他在云服務(wù)上做到這些的可能性,。我從來(lái)沒(méi)有考慮過(guò)持有亞馬遜的股份,。” “如果你以前問(wèn)我,,在他經(jīng)營(yíng)零售業(yè)的時(shí)候,,還能不能做些事情來(lái)顛覆科技行業(yè),我會(huì)認(rèn)為這個(gè)成功率不大,。我確實(shí)低估了他們出色的執(zhí)行力,。有夢(mèng)想是一回事,能做好是另一回事……(亞馬遜的股價(jià))看起來(lái)總是很高,,我真的也沒(méi)想到他能做到這一切,。他真的很棒,不過(guò)在三年,、五年,、八年前,我不認(rèn)為他能達(dá)到如今這樣的地位,?!?/p> 關(guān)于美聯(lián)航和航空業(yè) “我們實(shí)際上是四大航空公司最大的股東,這件事更多是這個(gè)行業(yè)的警笛……我們購(gòu)買(mǎi)美國(guó)運(yùn)通(American Express)、美國(guó)聯(lián)合航空(United Airlines)或可口可樂(lè)的股份,,并不是因?yàn)槲覀冋J(rèn)為他們絕對(duì)不會(huì)遭遇問(wèn)題,,也不會(huì)有競(jìng)爭(zhēng)……你列出了一系列導(dǎo)致糟糕業(yè)績(jī)的因素。這是個(gè)競(jìng)爭(zhēng)激烈的行業(yè),,問(wèn)題是它是否像過(guò)去一樣,,競(jìng)爭(zhēng)是趨向于自殺性的。我的意思是,,當(dāng)你發(fā)現(xiàn)所有大型運(yùn)營(yíng)商和幾十家小型運(yùn)營(yíng)商都開(kāi)始走向破產(chǎn),,那你可能投資了一個(gè)錯(cuò)誤的行業(yè)……老實(shí)說(shuō),,我認(rèn)為他們可能會(huì)在未來(lái)五至十年中提高載客量,,而不是推出歷史新低的折扣,讓所有運(yùn)營(yíng)商都走向破產(chǎn),。他們是否會(huì)繼續(xù)在票價(jià)上自取滅亡,,還有待觀察……在未來(lái)十年內(nèi),整個(gè)行業(yè)的價(jià)格敏感性要比過(guò)去100年更高,,這并不是一件易事,,不過(guò)這方面的情況已經(jīng)有所改善……不過(guò)這與收購(gòu)See’s Candies不一樣?!?/p> “我喜歡這種情況,。顯然,購(gòu)買(mǎi)四家航空公司的股票,,表明我們很難辨別誰(shuí)會(huì)做得最好……會(huì)有低成本的競(jìng)爭(zhēng)者加入,,比如國(guó)際上的Spirits和美國(guó)的捷藍(lán)(JetBlues)等,不過(guò)我猜測(cè)擁有所有這四家公司的股票,,會(huì)讓我們有更高的收入,。問(wèn)題在于他們的營(yíng)業(yè)比率——利潤(rùn)越高,他們的凈發(fā)股票就會(huì)越少,。所以即便他們的實(shí)際價(jià)值就和現(xiàn)在的市值一樣,,我們也能掙到相當(dāng)多的錢(qián)。不過(guò)長(zhǎng)期來(lái)看這并不容易,?!?/p> 關(guān)于伯克希爾·哈撒韋的未來(lái) “我認(rèn)為如果我今晚去世了,明天股價(jià)就會(huì)上漲,?!?/p> 關(guān)于裁員和聯(lián)手3G收購(gòu)卡夫·亨氏 “我們一點(diǎn)都不享受提高生產(chǎn)率的過(guò)程。因?yàn)檫@讓人很不愉快……在一家裁員的公司,,不如在一家擴(kuò)大招聘的公司那么有趣,。所以查理和我會(huì)避免讓伯克希爾收購(gòu)那些主要盈利點(diǎn)在于員工更少的公司。” “不過(guò)我認(rèn)為,,提高生產(chǎn)率的想法是利于社會(huì)的,,而且3G的員工在這方面做得很好……當(dāng)卡夫·亨氏(Kraft Heinz)發(fā)現(xiàn)他們可以用更少的人做成事情時(shí),就像美國(guó)公司做了幾百年的那樣去裁員了,。老實(shí)說(shuō)我不喜歡那樣……不過(guò)改變就是痛苦的,。我認(rèn)為提高生產(chǎn)率對(duì)于美國(guó)來(lái)說(shuō)是必要的,因?yàn)橹挥心愕娜司a(chǎn)率提升了,,人均消費(fèi)才可能提升,。” 查理·芒格:“我沒(méi)覺(jué)得提高生產(chǎn)率有什么問(wèn)題,。另一方面,,關(guān)于反生產(chǎn)率的宣傳也不少。你做對(duì)了,,也并不代表你得一直去那么做……對(duì)于經(jīng)歷裁員的人來(lái)說(shuō),,這實(shí)在是非常不愉快。那么為什么要陷入這種反復(fù)讓我們進(jìn)行裁員的公司呢,?我們之前在情非得已時(shí)有過(guò)裁員,。我認(rèn)為3G沒(méi)有任何道德錯(cuò)誤,不過(guò)我確實(shí)看到了它引發(fā)的政治反應(yīng),,這對(duì)任何人都沒(méi)有好處,。”(財(cái)富中文網(wǎng)) 譯者:嚴(yán)匡正 |

Every year at the Berkshire Hathawayannual meeting, Warren Buffett and his business partner, Charlie Munger, deliver their views and advice on just about any subject their shareholders ask about. The 2017 meeting, which took place in Omaha Saturday, covered topics as diverse as Google and Amazonstock, Wells Fargo, artificial intelligence, the Republican health care bill, and whether Berkshire Hathaway stock will ever pay a dividend. But what is most remarkable about the annual meeting is the way Buffett, 86, and Munger, 93, distill their responses to complex, technical questions into eloquent and pithy nuggets of wisdom that even novice investors can understand. To that end, we've compiled the best Buffett quotes on the hottest topics from the Berkshire Hathaway annual meeting 2017. After all, they don't call Buffett the Oracle of Omaha for nothing. On Wells Fargo's Fake Accounts Scandal "At Wells Fargo (wfc, -0.13%) there were three very significant mistakes, but there was one that was worse than all the others ... The main problem was that they didn’t act when they learned about it ... at some point if there's a major problem, the CEO will get wind of it. And at that moment, that’s the key to everything, because the CEO has to act. It was a huge, huge, huge error if they were getting, and I'm sure they were getting, some communications and they ignored them or they just sent them back down to somebody down below." On Artificial Intelligence and Self-Driving Cars "I would say that driverless trucks are a lot more of a threat than an opportunity to the Burlington Northern. And I would say that if driverless trucks became pervasive, it would only be because they are safer, and that would mean that the overall economic cost of auto-related losses had gone down, and that would drive down the premium income of Geico. So I would say both of those: Autonomous vehicles widespread would hurt us, if they spread to trucks, and they would hurt our auto insurance business." On Coca-Cola and Dieting "I would say I've been eating things I like to eat all my life. And Coca-Cola(ko, +0.46%), this Coca-Cola 12 ounces, I drink about five a day. It has about 1.2 ounces of sugar in it. And if you look at what different people get their sugar and calories from, they get them from all kinds of things. I happen to believe I like to get my calories from this, I enjoy it ... If you told me that I would live one year longer—and I don’t think I would—if I'd live one year longer if I ate only broccoli or asparagus or whatever, or if I eat what I like including Coca-Colas and steak and hash browns, I'd rather eat what I like and enjoy eating what I like than eat something I don't and live another year. "And I do think that choice should be mine. Maybe sugar is harmful and maybe you'd encourage the government to ban sugar ... But I think Coca-Cola has been a very positive factor in the country and the world. And I really don’t want anyone telling me I can’t drink it. I think there’s something in longevity of feeling happy about your life." On IBM and Apple "When I bought IBM(ibm, -0.34%) six years ago, I thought it would do better in the six years that have elapsed than it has. In terms of IBM and Apple(aapl, +2.72%), I regard them as being quite different businesses ... I was wrong on the first one, and we’ll find out whether I'm right or wrong on the second. But I don’t regard them as apples and apples, and I don't quite regard them as apples and oranges. It's somewhere in between on that." On the Republican Health Care Bill and Taxes "Medical costs are the tapeworm of economic competitiveness. But the tax system is not crippling Berkshire’s competitiveness around the world or anything of the sort. Our health costs have gone up incredibly and will go up a lot more ... And that is a problem that society is having trouble with and is going to have more trouble with, regardless of which party is in power, or anything of the sort. "In terms of the new act which was passed a couple days ago, vs. the Obama administration [Affordable Care] act, it’s a very interesting thing. All I can tell you is the net effect of that act on one person is that my taxes, my federal income taxes, would have gone down 17% last year if what was proposed went into effect. So it is a huge tax cut for guys like me." On Amazon and CEO Jeff Bezos "He has been the CEO almost simultaneously of two businesses starting from scratch. Andy Grove at Intel (intc, -0.76%) used to say if you had a silver bullet and you could shoot it and get rid of one of your competitors who would it be? I think that both in the cloud and in retail, there are a lot of people who would aim the silver bullet at Jeff ... And we missed it entirely. We never owned a share of Amazon (amzn, +1.44%) ... I was too dumb to realize what was going to happen. I admired Jeff, but I did not think he’d succeed on the scale that he has, and I didn’t even think of the possibility that he’d do the things with the cloud services. I never even considered buying Amazon. "If you asked me if while he was building up the retail operation he’d also be doing something that would disrupt the tech industry, that would have been a long shot for me. I really underestimated the brilliance of the execution. It's one thing to dream about, it's another thing to do it ... [Amazon stock] always looked expensive, and I really never thought he would do what he did today. I thought he was really brilliant, but I didn't think he'd be where he is today when I looked at it three, five, eight years ago anyway." On United Airlines and the Industry "We actually are the largest holder of the four largest airlines, and that is much more of an industry call ... We did not buy American Express or United Airlines or Coca-Cola with the idea they would never have problems or never have competition ... And you’ve named a number of factors that just make for a terrible economics. It’s a fiercely competitive industry, the question is whether it's a suicidally competitive industry, which it used to be. I mean, when you get virtually every one of the major carriers and dozens and dozens and dozens of minor carriers going bankrupt, there ought to come a point you find that maybe you're in the wrong industry ... I think it's fair to say they will operate at higher degrees of capacity over the next five or 10 years than the historical rates which caused all of them to go broke. Whether they will do suicidal things in terms of pricing remains to be seen ... It is no cinch that the industry will have some more pricing sensibility in the next 10 years than they had in the last 100 years, but the conditions have improved for that ... But it's not like buying See’s Candies. I like the position. Obviously by buying all four it means it’s very hard to distinguish who will do the best ... There will be low-cost people who come in, the Spirits of the world and JetBlues, whatever it may be, but my guess is that all four of the companies we have will have higher revenues. The question is what their operating ratio is—they will have fewer shares outstanding by a significant margin. So even if they're worth what they're worth today, we could make a fair amount of money. But it is no cinch, by a long shot." On the Future of Berkshire Hathaway "If I died tonight, I think the stock would go up tomorrow." On Layoffs and Partnering with 3G on Kraft Heinz "We don’t enjoy the process at all of getting more productive. Because it’s unpleasant ... It's just not as much fun to be in a business that cuts job as one that adds jobs. So Charlie and I would avoid personally having Berkshire buy businesses where the main benefits are actually having fewer workers. "But I think it’s pro-social to think in terms of improving productivity, and I think the people at 3G do a very good job of that ... When Kraft Heinz(khc, -0.17%) finds whatever amount of business they can do, and they can do it with fewer people, they’re doing what American businesses have done for a couple hundred years and why we live so well. But they do it very fast. They don’t want to have two people doing the job that one could do. I frankly don’t like going through that ... But change is painful. I think it's absolutely essential to America that we become more productive because that is the only way you have more consumption per capita, more productivity per capita." Charlie Munger: "I don’t see anything wrong with increasing productivity. On the other hand, there’s a lot of counterproductive publicity to doing it. Just because you’re right doesn’t mean you should always do it ... It’s terribly unpleasant for the people that have to go through it. And why would we want to get into the business of doing that over and over ourselves? We did it in the past where we had to. I don't see any moral fault in 3G at all, but I do see there is some political reaction that doesn’t do anybody any good." |