比特幣價(jià)格下跌,,Coinbase系統(tǒng)宕機(jī)

|

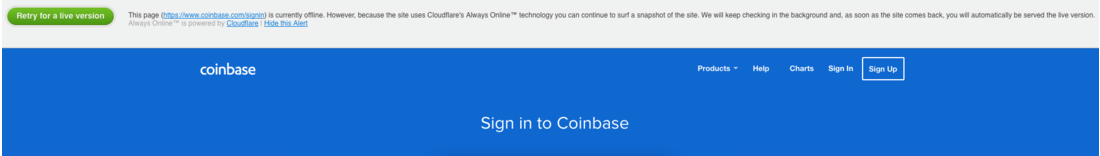

數(shù)字貨幣市場(chǎng)陷入一片混亂。上周五上午,,比特幣價(jià)格跌破12,000美元,,比其最近的高點(diǎn)下跌了約40%,,而其他加密貨幣的價(jià)格也出現(xiàn)了相同幅度甚至更大幅度的下跌,。 與此同時(shí),大規(guī)模拋售似乎導(dǎo)致備受歡迎的數(shù)字貨幣交易平臺(tái)在周五出現(xiàn)短暫宕機(jī),??蛻粼诿绹?guó)東部時(shí)間上午9:30左右訪問(wèn)該交易平臺(tái)時(shí),看到一條信息稱該網(wǎng)站處于離線狀態(tài),,只能提供“快照”視圖: |

The digital currency markets are in turmoil. On Friday morning the price of bitcoindropped below $12,000, which is around 40% off its recent high, while other crypto-currencies are falling as much or further. Meanwhile, the mass sell-off appears to have forced the popular digital currency exchange, Coinbase, to go down for short stretches on Friday. Customers who visited the exchange around 9:30 a.m. ET saw a message the site is currently offline, and that only a “snapshot” view was available: |

|

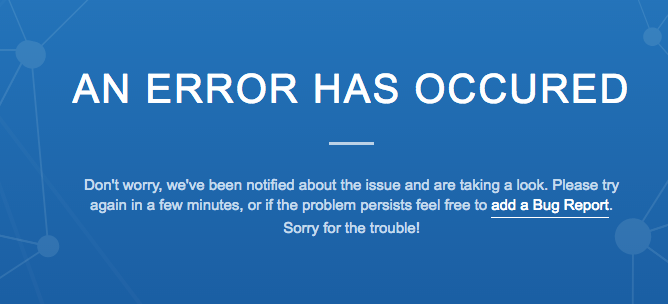

而試圖登陸的用戶則收到了下列信息: |

Meanwhile, those who tried to log-in received the following message: |

|

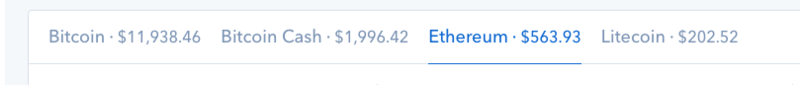

到美國(guó)東部時(shí)間上午10點(diǎn),,Coinbase的網(wǎng)站才重新上線。該公司尚未就宕機(jī)的原因發(fā)布聲明,,但有熟悉Coinbase的人士告訴《財(cái)富》雜志,,宕機(jī)的原因是龐大的網(wǎng)絡(luò)流量和交易量,與惡意行為無(wú)關(guān),。 美國(guó)東部時(shí)間上午11點(diǎn)之后不久,,Coinbase宣布已經(jīng)暫停了部分交易: 該公司在現(xiàn)狀更新網(wǎng)頁(yè)中表示:“由于昨天的高網(wǎng)絡(luò)流量,買賣功能可能臨時(shí)下線,。我們正在努力恢復(fù)全部功能,。” 熟悉Coinbase的人士還否認(rèn)了Reddit和社交媒體上流傳的有關(guān)該公司面臨流動(dòng)性緊縮的傳聞,。這些傳聞似乎并沒(méi)有可信的依據(jù),,可能與做空比特幣的賣家和試圖打擊加密貨幣市場(chǎng)的其他人有關(guān)。正如彭博社的報(bào)道所說(shuō): 倫敦黃金交易商Sharps Pixley的首席執(zhí)行官羅斯·諾曼表示:“嗜血的鯊魚(yú)已經(jīng)開(kāi)始集結(jié),,而期貨市場(chǎng)為他們提供了一個(gè)打擊比特幣市場(chǎng)的平臺(tái),。”Sharps Pixley提供黃金兌換比特幣的服務(wù),。他表示:“比特幣價(jià)格主要的推動(dòng)力一直來(lái)自于零售投資者,,但未來(lái)將會(huì)有一些激進(jìn)的基金,會(huì)尋找合適的機(jī)會(huì)來(lái)打擊比特幣市場(chǎng),?!? 另外,,到Coinbase的網(wǎng)站恢復(fù)時(shí),其提供的四種加密貨幣的價(jià)格均進(jìn)一步下跌: |

By 10 a.m. ET the Coinbase site was back online. The company has yet to issue a statement explaining the outage, though a person familiar with Coinbase told Fortuneit was the result of large traffic and trading volume, and not malicious activity. Shortly after 11am ET, Coinbase said it has suspended some trading: “Due to today’s high traffic, buys and sells may be temporarily offline. We’re working on restoring full availability as soon as possible,” the company said on its status updatepage. The person familiar with Coinbase also disavowed rumors, circulating on corners of Reddit and social media, that the company faced a liquidity crunch. The rumors, which do not appear to have been based on any credible information, may be tied to short shellers and others trying to hammer the crypto markets. As Bloomberg reports: “The sharks are beginning to circle here, and the futures markets may give them a venue to strike,” Ross Norman, chief executive officer of London-based bullion dealer Sharps Pixley, which offers gold in exchange for bitcoin. “Bitcoin’s been heavily driven by retail investors, but there’ll be some aggressive funds looking for the right opportunity to hammer this thing lower.” Meanwhile, by the time Coinbase’s site recovered, prices had fallen further across all four crypto-currencies it offers: |

|

雖然本周數(shù)字資產(chǎn)價(jià)格的下跌幅度巨大(部分原因是比特幣內(nèi)部人士之間的混戰(zhàn)),,但這并非是前所未有的,。眾所周知,數(shù)字貨幣市場(chǎng)波動(dòng)性大,,過(guò)去曾經(jīng)歷過(guò)多次大規(guī)模崩盤,,但最后全都實(shí)現(xiàn)了反彈。 甚至最近呼吁人們“負(fù)責(zé)任投資”的Coinbase CEO布萊恩·阿姆斯特朗也表示,,加密貨幣市場(chǎng)過(guò)度膨脹: 他在最近召開(kāi)的全體大會(huì)之后告訴《財(cái)富》雜志:“我們可能處在泡沫之中,。”所有加密貨幣的總市場(chǎng)估值遠(yuǎn)高于5,000億美元,,但這些貨幣投入實(shí)際應(yīng)用的機(jī)會(huì)很少,,因此阿姆斯特朗擔(dān)心“我們并沒(méi)有獲得這五千億美元的真正價(jià)值?!钡凑账慕?jīng)驗(yàn),,每次比特幣價(jià)格暴漲時(shí),即便經(jīng)過(guò)了下跌,,比特幣的估值都穩(wěn)定保持在了一個(gè)更高的水平之上,。 暴跌不久,比特幣價(jià)格再次開(kāi)始強(qiáng)力反彈,。(財(cái)富中文網(wǎng)) 譯者:劉進(jìn)龍/汪皓 |

While this week’s collapse of digital asset prices—tied in part to infighting among Bitcoin insiders—has been dramatic, it’s hardly unprecedented. The market is notoriously volatile and has experienced major crashes in the past, only to recover. Even Coinbase CEO Brian Armstrong, who recently urged people to “invest responsibly,” has said the market is overly-inflated: “We probably are in a bubble,” Brian Armstrong confide[d] to Fortune following a recent all-hands meeting. With the total market valuation of all cryptocurrencies well above $500 billion, and few opportunities to put these coins to real use, Armstrong worries that “we haven’t really earned the value of that half trillion.” Nonetheless, in his experience, each time Bitcoin’s price has surged, the valuation has leveled off at a higher plateau—even after crashes. By mid-morning, bitcoin prices had begun to tick upwards again with bitcoin back near the $13,000 mark. |