盡管受中國股市拖累,《財富》2018年選股表面尚好

|

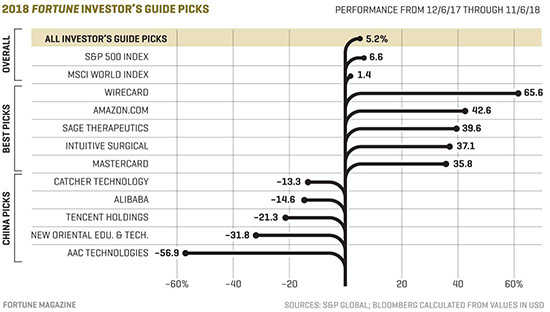

一年前,,《財富》雜志投資團隊選出了一個“全科技股投資組合”,。我們的主題是無論屬于哪個行業(yè),已經(jīng)證明最善于利用科技的公司將為投資者帶來最好的業(yè)績,。 這一投資組合在市場上表現(xiàn)如何呢,?到目前為止情況良好——在過去12個月市場出現(xiàn)異常波動的情況下,我們的全球投資組合(31只股票中有8只不是美股)實現(xiàn)的回報率為5.2%,,輕松擊敗MSCI世界指數(shù),,只比標普500指數(shù)6.6%的回報率低一點兒,。如果剔除其中的5只中國股票,,其回報率將高達11.5%,當然我們不會這樣做,。以下我們將對這個組合的表現(xiàn)進行總結(jié),。 |

A year ago, the Fortune investment team picked an “All-Tech Portfolio.” Our thesis was that the companies that proved best at leveraging technology—no matter their industry—would deliver the best results for ?investors. How did that thesis play out in the markets? So far, so good: During an unusually volatile 12 months, our global portfolio (eight of 31 stocks were non-U.S.) returned 5.2%. That handily beat the MSCI World stock index, and fell just shy of the S&P 500’s 6.6% return. And if you exclude our five Chinese stocks—which, of course, we won’t—we delivered a hefty 11.5% return. Here’s a roundup of what did and didn’t work. |

|

金融科技股呈上升趨勢:我們的投資組合中表現(xiàn)最好的是金融股,信用卡巨頭萬事達和德國支付處理公司W(wǎng)irecard這一年的表現(xiàn)都很強勁,。二者在打造電子商務工具和升級數(shù)字金融基礎設施方面都是領跑者,,投資者也注意到了這一點。 醫(yī)療股回歸:外界預計Sage Therapeutics的產(chǎn)后抑郁癥治療藥物將獲得美國食品和藥物管理局的批準,,推動該公司的股價上升,。同時,Intuitive Surgical繼續(xù)借助機器人在市場上高歌猛進,。該公司的達芬奇外科手術機器人有助于縮短術后康復時間并降低成本,,受到醫(yī)院方面熱捧。 科技股暴跌:我們沒有預見到Facebook會陷入數(shù)據(jù)隱私漩渦,,我們將其納入投資組合以來,,F(xiàn)acebook的股價已下跌15%(但現(xiàn)在我們認為又可以買進它了)。中美貿(mào)易戰(zhàn)可能怎樣干擾科技供應鏈的擔憂影響到了整個芯片制造業(yè),,包括我們推薦的兩只股票——應用材料和德國公司英飛凌,。 說說中國:今年,貿(mào)易戰(zhàn)擔憂加上GDP增速放緩拉低了大多數(shù)中國股票(見上圖),,我們挑選的5只中國股票都至少下跌了13%,,其中表現(xiàn)最慘淡的是手機觸覺反饋器件制造商瑞聲科技,。(財富中文網(wǎng)) 本文的另一版本刊登在2018年12月1日出版的《財富》雜志,是報道《2019投資者指南》的一部分,。 譯者:Charlie 審校:夏林 |

Fintech on the Rise: Our best-performing picks were financial stocks, where credit card giant Mastercard and German payment processor Wirecard had monster years. Both are leaders in building e-commerce tools and upgrading digital financial infrastructures, and investors took notice. Healthy Returns: Anticipation of FDA approval of its postpartum depression drug lifted the shares of Sage Therapeutics. Meanwhile, Intuitive Surgical continued to ride robots to big market gains. Its da Vinci Surgical System can help reduce postoperative recovery times and slash costs, making it catnip for hospital customers. Turmoil in Tech: We didn’t foresee the data-privacy face-plant at Facebook, whose shares are down 15% since we picked them (but which we now see as a buy again). Fears about how a U.S.-China trade war might disrupt the tech supply chain hurt chipmakers in general, including two that we recommended, Applied Materials and Germany’s Infineon. Speaking of China: Those trade fears, along with a slowdown in GDP growth, dragged down most Chinese stocks this year (see the chart in this story), and each of our five China picks lost at least 13%. The hardest-hit: AAC Technologies, which makes “haptics” that create clicking and vibrating sensations in mobile phones. A version of this article appears in the December 1, 2018 issue of Fortune, as part of the “2019 Investor’s Guide.” |