股神今年戰(zhàn)績欠佳,,大幅跑輸標(biāo)普500指數(shù)

|

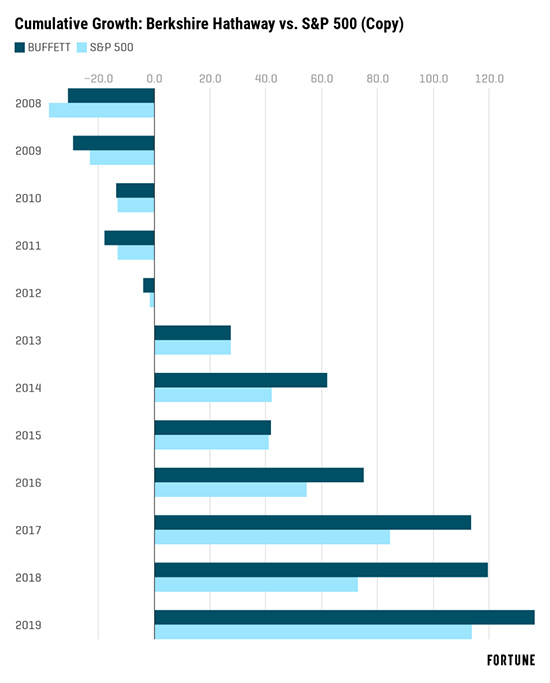

實(shí)際情況表明,以往的表現(xiàn)無法保證今后的業(yè)績。多年來一直在用伯克希爾-哈撒韋的表現(xiàn)和標(biāo)普500指數(shù)進(jìn)行比較的沃倫·巴菲特確實(shí)看到了這一點(diǎn),。 截至11月14日,,伯克希爾-哈撒韋的股價在2019年上漲了8.3%。聽起來很不錯,,但要知道,,標(biāo)普500指數(shù)的漲幅達(dá)到了23%。 長期以來,,巴菲特一直將標(biāo)普500指數(shù)作為自己以及合伙人查理·芒格的工作成績比較基準(zhǔn),。2019年2月,巴菲特給股東的最新年度信件的開頭就是1965年以來伯克希爾-哈撒韋和標(biāo)普500指數(shù)的比較表,。 但目前的落后并不意味著“奧馬哈先知”失去了魔力,。《財富》雜志對2008年1月2日以來的表現(xiàn)進(jìn)行了分析,,結(jié)果發(fā)現(xiàn)就長期而言,,巴菲特處于領(lǐng)先位置。 標(biāo)普500障礙 衡量任何投資策略的實(shí)力都需要一個基準(zhǔn),,而標(biāo)普500指數(shù)可以充當(dāng)這樣的角色,。一項(xiàng)覆蓋2016年之前15年的研究發(fā)現(xiàn),標(biāo)普500指數(shù)跑贏了絕大多數(shù)的基金,,包括92%的大盤股基金,、89.3%的中盤股基金和85.5%的小盤股基金。 所謂的被動型基金在2019年9月跨越了一個里程碑——投資者對美國指數(shù)基金和ETF的投資首次超過了主動管理型共同基金,。 大多數(shù)人可能都無法跑贏大盤,。但在財務(wù)方面有遠(yuǎn)大目標(biāo)的人會去嘗試。巴菲特和他的公司經(jīng)常取得勝利,,他們把標(biāo)普指數(shù)作為自身策略的試金石,。 大衰退以來巴菲特和標(biāo)普500指數(shù)的比較 我們沒有回到1965年,相反,,我們比較的階段是2008年,,也就是從大衰退全面爆發(fā)到2018年。 在此期間,,伯克希爾-哈撒韋在八個年頭里領(lǐng)先于標(biāo)普指數(shù),,幾乎占全部時間的73%。 《財富》雜志還分析了每年截至11月14日二者的表現(xiàn)(如果當(dāng)天是周末,,就將截止日期定在接下來的一個開盤日),。從2008年到2018年,巴菲特截至11月14日的表現(xiàn)落后于標(biāo)普500指數(shù),,但在年底反敗為勝的只有一年,,具體來說是2017年。 五個因素壓低了伯克希爾2019年的表現(xiàn) 如下圖所示,,雖然巴菲特在2019年表現(xiàn)良好,,但標(biāo)普500指數(shù)截至11月中期的走勢可謂精彩。 |

Past performance, it turns out, is no guarantee of future results. After years of comparing the performance of his Berkshire Hathaway to the S&P 500, Warren Buffett is seeing exactly that. As of November 14, Berkshire Hathaway shares were up 8.3% year to date. Sounds pretty good—till you calculate the S&P 500 was up 23%. Buffett has long used the S&P 500 as a benchmark for his efforts and those of his partner Charlie Munger. Buffett’s latest annual letter to shareholders, which came out in February 2019, starts with a comparative table of Berkshire Hathaway and S&P 500 performance since 1965. But a current rout doesn’t mean the “Oracle of Omaha” has lost his touch. A Fortune analysis of performance since Jan. 2, 2008 found Buffett stays ahead in the long run. Plus, in the back-and-forth of who’s on top, investors can learn some important lessons. The S&P 500 hurdle Measuring the strength of any investment strategy needs a benchmark, and the S&P 500 index can be a taskmaster. One study looked at a 15-year period ending with 2016 and found the S&P 500 beat the bulk of funds: 92% of large-cap funds, 89.3% of mid-caps, and 85.5% of small-cap. So-called passive funds passed a milestone in September 2019. For the first time, investors had more money in U.S. index funds and ETFs than actively managed mutual funds. Most people probably can’t beat the market. But the fiscally ambitious try. Buffett and company often succeed, using the S&P as a touchstone to test their strategies. Buffett vs. S&P 500 since the Great Recession Instead of going back to 1965, consider the performance from 2008—the full start of the Great Recession—through 2018. During this period, Berkshire Hathaway outperformed the S&P index in eight years, or almost 73% of the time. Fortune also analyzed the performance of both through Nov. 14 of each year. (When the date fell on a weekend, Fortune chose the next weekday the markets were open.) From 2008 through 2018, there was only one year, in 2017, when Buffett trailed the S&P 500 on Nov. 14 but was able to outdo the index by year’s end. 5 factors weighed on Berkshire’s 2019 performance As the chart below shows, while Buffett has had a good 2019, the S&P 500 has had a great year through mid-November. |

|

造成二者表現(xiàn)差異的因素有幾個: 看重現(xiàn)金 Spark Asset Management的總裁兼首席投資官蒂姆·貝恩說:“巴菲特手中保留了大量現(xiàn)金,,有近1300億美元,[大約]占伯克希爾-哈撒韋總市值的四分之一,?!爆F(xiàn)金的增值速度沒有股票那么快,但這不會嚇退巴菲特,,他會留著現(xiàn)金,,而不是用他認(rèn)為不明智的方法把這些錢投出去。 討厭科技 Babylon Wealth Management的創(chuàng)始人斯托揚(yáng)·帕納依奧托夫說:“伯克希爾在投資科技和高增長公司方面一直很保守,,而過去10年,,超低的利率一直在推動股市上行?!?/p> 一筆壞賬 然后是卡夫亨氏,。這是伯克希爾-哈撒韋最大的持股之一。Integrity Advisory的首席投資官馬特·阿倫斯說:“今年2月,,這部分股票的價值蒸發(fā)了25%,。” 金融股走勢落后 克瑞頓大學(xué)海德商學(xué)院(Heider College of Business of Creighton University)的金融學(xué)教授羅伯特·約翰遜35年來一直是伯克希爾的股東,。他說:“巴菲特倉位最集中的領(lǐng)域之一就是金融板塊,,包括大型銀行和保險公司,而直到最近,,此類股票一直不受人們青睞,。”這拖累了巴菲特的業(yè)績,。他在這個板塊中的許多持倉“都以比市價低幾乎50%的水平賣掉了,。” 賬面價值 第五個因素較為復(fù)雜,,那就是長期以來巴菲特一直都注重伯克希爾的賬面價值,。這是公司價值的底線,也就是資產(chǎn)減去負(fù)債,。由于利率低,,對希望實(shí)現(xiàn)增長的投資者來說按賬目價值計(jì)算出的資產(chǎn)價值增長的不夠快。因此,,人們已經(jīng)不關(guān)注賬面價值了,,而且投資者也不想以那樣的高價買進(jìn)伯克希爾的股票。Smead Capital Management的研究主管兼證券投資經(jīng)理托尼·謝勒指出,伯克希爾對賬面價值的依賴以及投資者越發(fā)不看重這個指標(biāo)是標(biāo)普500指數(shù)跑贏伯克希爾股價的一個重要原因,。 不過,,2019年只是短短的一年,觀察這么短的一段時間是一種誤導(dǎo)行為,。最終的問題還會歸結(jié)為長期來看誰表現(xiàn)的更好,。下圖展示了從2008年1月2日到某一年年底(2019年是截至11月中旬)的累計(jì)漲幅,或者說,,是2008年到某一年的所有漲跌的總和,。 |

Several factors are contributing to the gap in performance: Focus on cash “Buffett maintains a huge cash position—nearly $130 billion—which represents [roughly] a quarter of the entire market cap of Berkshire Hathaway,” says Tim Bain, president and chief investment officer at Spark Asset Management. Cash isn’t appreciating in value as fast as stocks, but that doesn’t deter Buffett, who will leave it parked rather than invest it in a way he deems unwise. Distaste for tech “Berkshire has been slow in investing in tech, and high growth companies as the investors’ appetite for risk and ultra-low interest rates have pushed the markets up in the last decade,” says Stoyan Panayotov, founder of Babylon Wealth Management. One bad bet Then there’s Kraft Heinz. It is one of Berkshire Hathaway’s largest holdings, and it “l(fā)ost 25% of its value in February,” says Matt Ahrens, chief investment officer at Integrity Advisory. Lagging financials “One of his largest concentrations is in the financial sector—largely banks and insurance companies—and, until recently, those sectors have been out of favor,” says Robert Johnson, professor of finance at Heider College of Business of Creighton University and a 35-year-long Berkshire shareholder. That slowed performance. Many of Buffett’s holdings in this sector “are selling at a discount of almost 50% to the market.” Book value The fifth, and more complicated, factor is Buffett’s long-held emphasis on Berkshire’s book value—the bottom-line worth of the company, determined by subtracting liabilities from assets. With low interest rates, the asset values as calculated by book value don’t grow quickly enough for investors, who want growth. Book value has fallen out of favor, as a result, and investors don’t want to pay as much for Berkshire shares. Berkshire’s reliance on book value—and investors cooling on the metric—is a big reason the S&P 500 has grown faster than Berkshire shares, notes Tony Sherrer, director of research and portfolio manager at Smead Capital Management. Still, 2019 is only one year and looking at such a short period is an act of misdirection. The question ultimately comes down to who does better in the long run. Here is another chart that shows cumulative multi-year growth from Jan. 2, 2018 through the end of each year (for 2019, it’s through mid-November)—in other words, the collection of all the gains and losses between 2008 and a given year. |

|

盡管有些年份出現(xiàn)了下跌,,但伯克希爾-哈撒韋的長期表現(xiàn)遠(yuǎn)遠(yuǎn)好于標(biāo)普500指數(shù)。從2008年到2018年,,這家公司的累計(jì)漲幅為119.7%,,而標(biāo)普500指數(shù)為73.2%。算上今年年初以來標(biāo)普指數(shù)的強(qiáng)勁走勢,,2008年至今該指數(shù)上漲了114%,,而伯克希爾的漲幅為136.4%。 而且,,聰明的資金已經(jīng)知道永遠(yuǎn)也不要把巴菲特排除在外,。 約翰遜說:“在1999年《巴倫》周刊(Barron’s)的最后一期中,安德魯·巴里寫的封面文章題目是‘怎么回事沃倫,?’這篇文章認(rèn)為巴菲特對科技股缺乏經(jīng)驗(yàn),,從而導(dǎo)致了他的失敗。我們都知道后來的情況——互聯(lián)網(wǎng)泡沫破裂,,伯克希爾則處于很好的位置,。” 對約翰遜來說,,底線就是不要和奧馬哈先知對著干,。(財富中文網(wǎng)) 譯者:Charlie 審校:夏林 |

Even with some down years, Berkshire Hathaway shares have seen significantly greater growth in the long run than the S&P 500. From 2008 through 2018, the company saw cumulative growth of 119.7%, versus 73.2% for the S&P 500. And even with the boost the S&P has seen so far this year, the growth from 2008 through mid-November of 2019 is 114%. For Berkshire, it’s 136.4%. And, the smart money has learned never to count Buffett out. “In the last Barron’s issue in 1999, Andrew Bary wrote a cover story entitled ‘What’s Wrong Warren?’” Johnson says. “The article contended that Buffett’s lack of expertise in technology stocks was leading to his demise. We all know what happened: The dot com bubble burst and Berkshire was well positioned.” The bottom line, according to Johnson? Don’t bet against the Oracle of Omaha. |