從牛油果吐司的興起,,到健身房的消亡,再到布餐巾的終結(jié),,千禧一代被認(rèn)為是造成諸多社會混亂的罪魁禍?zhǔn)?。但根?jù)Nerdwallet在2023年進(jìn)行的一項(xiàng)民意調(diào)查,有一領(lǐng)域他們并沒有破壞:預(yù)算規(guī)劃,。

Nerdwallet發(fā)現(xiàn),,超過2.56億美國人在他們的月度規(guī)劃中采用了某種形式的預(yù)算策略。高達(dá)83%的千禧一代堅(jiān)持每月編制預(yù)算,,而嬰兒潮一代和X世代的這一比例分別為67%和74%,。

Armstrong, Fleming & Moore, Inc.負(fù)責(zé)人、注冊理財(cái)規(guī)劃師瑞恩·弗萊明(Ryan Fleming)表示:“預(yù)算一詞常被視為貶義詞,,或帶有某種負(fù)面含義,。因此,我們傾向于將其稱為‘支出計(jì)劃’,。不論你如何稱呼它,,關(guān)鍵在于掌握收入狀況,并清楚資金流入和流出情況,?!?/p>

制定預(yù)算并嚴(yán)格遵守是任何希望財(cái)務(wù)生活井然有序的人的首要任務(wù)。新年是下定決心和重啟新篇章的時(shí)節(jié),,因此,,這是審視現(xiàn)有預(yù)算計(jì)劃的好時(shí)機(jī),或是如果你之前從未制定過預(yù)算,,這也是開始制定新預(yù)算的好時(shí)機(jī),。

如何編制預(yù)算:五大預(yù)算策略

弗萊明表示,制定預(yù)算并不復(fù)雜,。只需了解你的所有支出和收入來源,,這樣,你就能在每一美元有可能被隨意揮霍或讓你陷入困境之前,,為其分配好明確的用途,。你可以將這一過程想象成與金錢進(jìn)行對話:“你要負(fù)責(zé)支付房租,你要購買食品雜貨,,還有你——沒錯(cuò),,就是你,排在后面的那位——你要承擔(dān)起為我積累儲蓄的任務(wù)?!?/p>

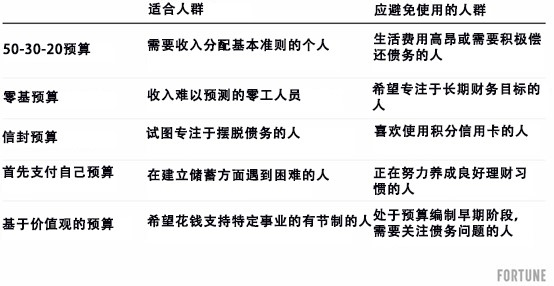

也就是說,,存在多種多樣的預(yù)算策略可供選擇。讓我們回顧一下最常見的五種預(yù)算編制方法,,并探討它們最適合哪類人群,。

1. 50-30-20預(yù)算

50-30-20預(yù)算是一種預(yù)算編制公式,為特定類別分配一定比例的收入:

? 50%用于需求,,如住房,、食品、交通,、保險(xiǎn)和最低限度的債務(wù)償還,。

? 30%用于愿望,比如訂閱服務(wù),、電影票,、音樂會和旅行。

? 20%用于儲蓄,,包括應(yīng)急基金,、退休儲蓄和額外的債務(wù)償還。

這一規(guī)則為人們?nèi)绾蝺π钆c消費(fèi)提供了極為實(shí)用的基本指導(dǎo),。弗萊明建議那些正尋求新起點(diǎn)的人群采用這種預(yù)算策略——比如初次著手制定預(yù)算的年輕人,,或是剛剛結(jié)束一段關(guān)系、作為單身人士其財(cái)務(wù)狀況可能發(fā)生變化的人,。

Bull Oak Capital的創(chuàng)始人兼投資組合經(jīng)理瑞安·A·休斯(Ryan A. Hughes)提醒大家在某些情況下不要采用這種預(yù)算法,。“在住房成本高昂的環(huán)境下,,尤其是在灣區(qū),、南加州、紐約和其他高消費(fèi)的城市地區(qū),,采用這種預(yù)算法可能會頗具挑戰(zhàn)性,。你的抵押貸款或租金很容易超過稅后收入的50%?!?

休斯補(bǔ)充道,,盡管這種做法并不值得推薦,但有些家庭會通過壓縮30%愿望支出的比例來抵消較高的住房成本,。

2. 零基預(yù)算

零基預(yù)算指的是將每一筆收入都分配到支出以及諸如儲蓄和債務(wù)償還等財(cái)務(wù)目標(biāo)上,。將所有收入分配到特定類別的最終結(jié)果是,收入減去支出后余額為零,,因此得名,。

這是我個(gè)人使用的方法,。我們會將當(dāng)月所獲得的全部收入用于下個(gè)月的預(yù)算——因?yàn)檫@些資金在編制預(yù)算和支出之前就已到賬,因此無需猜測,。當(dāng)下個(gè)月到來時(shí),,我們確切地知道每個(gè)預(yù)算類別的可支出金額,,而且如有需要,,還能通過重新分配資金來實(shí)現(xiàn)靈活調(diào)整。

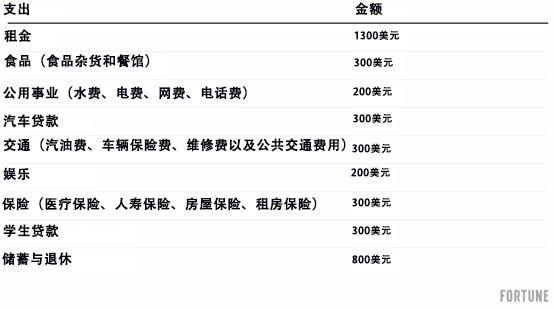

對于那些收入不穩(wěn)定的人來說,,這種提前一個(gè)月制定計(jì)劃的方法是個(gè)不錯(cuò)的選擇,,因?yàn)檫@樣一來,你所動(dòng)用的始終都是銀行賬戶里已經(jīng)到賬的資金,。讓我們來看一個(gè)真實(shí)的例子,。如果一個(gè)沒有受撫養(yǎng)人的單身人士每月收入為4000美元,那么包括儲蓄和債務(wù)在內(nèi)的總支出也應(yīng)為4000美元,。大致的預(yù)算如下:

請記住,,這只是預(yù)算細(xì)目,實(shí)際生活中各項(xiàng)費(fèi)用會因居住地的不同而存在顯著差異,。對于已婚,、需要承擔(dān)子女撫養(yǎng)費(fèi)用和/或贍養(yǎng)父母經(jīng)濟(jì)責(zé)任的人來說,其預(yù)算分配情況也會有很大不同,。

3. 信封預(yù)算

信封系統(tǒng)是戴夫·拉姆齊(Dave Ramsey)推廣的一種預(yù)算方法,,適用于那些希望償還債務(wù)的人群。這一以現(xiàn)金管理為核心的策略要求你每月將特定金額的現(xiàn)金分別裝入不同的實(shí)體信封中,,每個(gè)信封對應(yīng)一個(gè)預(yù)算類別,。這些信封里的現(xiàn)金必須專款專用,,不能挪作他用,。一旦某個(gè)信封中的現(xiàn)金用完,就表示該預(yù)算類別下的消費(fèi)已達(dá)到限額,,需停止該類別的額外消費(fèi),。

采用這種方法編制預(yù)算旨在防止超支現(xiàn)象的發(fā)生。相較于現(xiàn)金使用受到限制,,刷借記卡或信用卡很容易超出限額,。因此,這種方法要求使用者具備良好的預(yù)見性和高度的自律性,。

當(dāng)然,,這種方法也有其弊端??偛课挥诓ㄊ款D的員工財(cái)務(wù)健康平臺Origin的咨詢主管,、注冊理財(cái)規(guī)劃師大衛(wèi)·布萊洛克(David Blaylock)表示:“隨著我們的社會日益趨向于無現(xiàn)金交易,,挑戰(zhàn)在于難以將該方法付諸實(shí)踐?!贝送?,現(xiàn)金容易丟失或被盜,而且在建立個(gè)人信用方面并無助益,。

4. 首先支付自己預(yù)算

假設(shè)你收支平衡,,但在滿足基本生活需求與即時(shí)欲望上的開銷過大,以至于難以為未來儲蓄,。如果是這種情況,,那么,“首先支付自己”的預(yù)算方法或許能為你提供一種新思路,。

首先支付自己是指每月從收入中一次性或按一定比例劃出一部分資金,,用于儲蓄和投資。這樣做能夠確保你為未來生活做好準(zhǔn)備,,并養(yǎng)成儲蓄和投資的習(xí)慣,。由于你先支付自己,然后再將剩余資金用于其他支出,,你可能會發(fā)現(xiàn)這種方法有助于你更快地積累儲蓄,。這種方法有時(shí)被Afford Anything的保拉·潘特(Paula Pant)稱為“反預(yù)算”策略。

5. 基于價(jià)值觀的預(yù)算

如果你的年度關(guān)鍵詞是“意向性”,,那么你可能會發(fā)現(xiàn)基于價(jià)值觀的預(yù)算規(guī)劃與你的目標(biāo)相契合,。有時(shí)我們很容易心血來潮,讓金錢從指縫中溜走,,事后回想起來卻會因所購之物而感到內(nèi)疚或不滿,。

應(yīng)對這種不滿情緒的方法就是制定基于價(jià)值觀的預(yù)算。這種預(yù)算方式與百分比和程序的關(guān)系不大,,更多的是要確定自己的消費(fèi)模式,,并根據(jù)自己的價(jià)值觀做出相應(yīng)的調(diào)整。例如,,你可能會重視外出就餐和新體驗(yàn),、為有價(jià)值的事業(yè)捐款或支付舞蹈課程的費(fèi)用。

首先列出你所珍視的事物,。然后為每個(gè)類別分配資金,,以確保相關(guān)資金能夠支持你的價(jià)值觀。這種預(yù)算方式能帶來更多的滿足感,,并讓你思維清晰,,從而有助于避免不必要的開支。

應(yīng)避免的預(yù)算錯(cuò)誤

正如有許多不同的預(yù)算編制方法可以嘗試一樣,,預(yù)算編制過程中也伴隨著一些容易踏入的誤區(qū),。應(yīng)當(dāng)定期修改預(yù)算,,尤其是在諸如結(jié)婚、生子,、離婚,、遷居或失業(yè)等重大生活變化期間。

在努力養(yǎng)成新預(yù)算習(xí)慣的過程中,,你應(yīng)該注意以下幾種潛在的誤區(qū):

? 未對所有支出做好規(guī)劃,。每月相同的固定支出可能很容易規(guī)劃,但在開始記錄日常開銷之前,,要估算諸如外出就餐或夜晚娛樂之類的可自由支配支出就頗具挑戰(zhàn)性了,。說到這一點(diǎn)......

? 不記錄支出,。如果你制定了預(yù)算,,卻不記錄支出,你如何知道自己是否真正遵循了預(yù)算規(guī)劃呢,?不妨考慮注冊像“You Need a Budget”(YNAB)或“Rocket Money”的預(yù)算應(yīng)用程序,,以此來對自己的財(cái)務(wù)行為負(fù)責(zé)。

? 不修改預(yù)算,。當(dāng)編制預(yù)算并記錄支出一段時(shí)間后,,你應(yīng)該審視一下結(jié)果,并在必要時(shí)調(diào)整行為,。你是否發(fā)現(xiàn)自己在外出就餐上的開銷超出了計(jì)劃,?你是否失去了一種收入來源?面對這些“偏離計(jì)劃”的時(shí)刻,,切勿氣餒,。相反,要將這些時(shí)刻視為調(diào)整的契機(jī)(為未來做好準(zhǔn)備),,以確保自己始終沿著正確的財(cái)務(wù)軌道前行,。

? 因?yàn)槭杖氩环€(wěn)定而放棄預(yù)算編制。如果你是自由職業(yè)者,、零工人員或從事傭金制工作,,你的月收入可能每個(gè)月都有所不同。這可能會給預(yù)算編制帶來挑戰(zhàn),,但這并不意味著無法編制預(yù)算,。像50-30-20這樣的預(yù)算方法可能很適合你,這樣一來,,無論你的收入如何,,都有百分比作為指導(dǎo)。

? 不將資金挪作他用,。即使使用信封系統(tǒng),,如果某一預(yù)算類別的支出達(dá)到上限,,需要進(jìn)行調(diào)整,你也可以從其他預(yù)算類別中調(diào)配資金,。例如,,如果你的汽油費(fèi)已達(dá)到本月限額,但突發(fā)緊急情況需要出行,,你可以隨時(shí)從娛樂信封中調(diào)配資金來支付這些費(fèi)用,。

要點(diǎn)

制定預(yù)算的過程就如同尋找一條合身的牛仔褲——可能需要經(jīng)過反復(fù)試驗(yàn),但一旦找到最適合自己的那條,,你就會好奇在沒有它之前的日子你是如何度過的,。你可以嘗試這些不同的預(yù)算編制方法,看看哪種與你的需求和生活方式最為契合,,但最好的方法是那種你能堅(jiān)持并經(jīng)常使用的,。

請務(wù)必根據(jù)需要更新預(yù)算,并持續(xù)跟蹤你的財(cái)務(wù)狀況和未來走向,。未來的你(以及你的錢包)會感謝你的,。(財(cái)富中文網(wǎng))

梅勒妮·洛克特(Melanie Lockert)對本文亦有貢獻(xiàn)。

譯者:中慧言-王芳

從牛油果吐司的興起,,到健身房的消亡,,再到布餐巾的終結(jié),千禧一代被認(rèn)為是造成諸多社會混亂的罪魁禍?zhǔn)?。但根?jù)Nerdwallet在2023年進(jìn)行的一項(xiàng)民意調(diào)查,,有一領(lǐng)域他們并沒有破壞:預(yù)算規(guī)劃。

Nerdwallet發(fā)現(xiàn),,超過2.56億美國人在他們的月度規(guī)劃中采用了某種形式的預(yù)算策略,。高達(dá)83%的千禧一代堅(jiān)持每月編制預(yù)算,而嬰兒潮一代和X世代的這一比例分別為67%和74%,。

Armstrong, Fleming & Moore, Inc.負(fù)責(zé)人,、注冊理財(cái)規(guī)劃師瑞恩·弗萊明(Ryan Fleming)表示:“預(yù)算一詞常被視為貶義詞,或帶有某種負(fù)面含義,。因此,,我們傾向于將其稱為‘支出計(jì)劃’。不論你如何稱呼它,,關(guān)鍵在于掌握收入狀況,,并清楚資金流入和流出情況?!?/p>

制定預(yù)算并嚴(yán)格遵守是任何希望財(cái)務(wù)生活井然有序的人的首要任務(wù),。新年是下定決心和重啟新篇章的時(shí)節(jié),因此,,這是審視現(xiàn)有預(yù)算計(jì)劃的好時(shí)機(jī),,或是如果你之前從未制定過預(yù)算,,這也是開始制定新預(yù)算的好時(shí)機(jī)。

如何編制預(yù)算:五大預(yù)算策略

弗萊明表示,,制定預(yù)算并不復(fù)雜,。只需了解你的所有支出和收入來源,這樣,,你就能在每一美元有可能被隨意揮霍或讓你陷入困境之前,,為其分配好明確的用途。你可以將這一過程想象成與金錢進(jìn)行對話:“你要負(fù)責(zé)支付房租,,你要購買食品雜貨,,還有你——沒錯(cuò),就是你,,排在后面的那位——你要承擔(dān)起為我積累儲蓄的任務(wù),。”

也就是說,,存在多種多樣的預(yù)算策略可供選擇,。讓我們回顧一下最常見的五種預(yù)算編制方法,并探討它們最適合哪類人群,。

1. 50-30-20預(yù)算

50-30-20預(yù)算是一種預(yù)算編制公式,為特定類別分配一定比例的收入:

? 50%用于需求,,如住房,、食品、交通,、保險(xiǎn)和最低限度的債務(wù)償還,。

? 30%用于愿望,比如訂閱服務(wù),、電影票,、音樂會和旅行。

? 20%用于儲蓄,,包括應(yīng)急基金,、退休儲蓄和額外的債務(wù)償還。

這一規(guī)則為人們?nèi)绾蝺π钆c消費(fèi)提供了極為實(shí)用的基本指導(dǎo),。弗萊明建議那些正尋求新起點(diǎn)的人群采用這種預(yù)算策略——比如初次著手制定預(yù)算的年輕人,,或是剛剛結(jié)束一段關(guān)系、作為單身人士其財(cái)務(wù)狀況可能發(fā)生變化的人,。

Bull Oak Capital的創(chuàng)始人兼投資組合經(jīng)理瑞安·A·休斯(Ryan A. Hughes)提醒大家在某些情況下不要采用這種預(yù)算法,。“在住房成本高昂的環(huán)境下,,尤其是在灣區(qū),、南加州,、紐約和其他高消費(fèi)的城市地區(qū),采用這種預(yù)算法可能會頗具挑戰(zhàn)性,。你的抵押貸款或租金很容易超過稅后收入的50%,。”

休斯補(bǔ)充道,,盡管這種做法并不值得推薦,,但有些家庭會通過壓縮30%愿望支出的比例來抵消較高的住房成本。

2. 零基預(yù)算

零基預(yù)算指的是將每一筆收入都分配到支出以及諸如儲蓄和債務(wù)償還等財(cái)務(wù)目標(biāo)上,。將所有收入分配到特定類別的最終結(jié)果是,,收入減去支出后余額為零,因此得名,。

這是我個(gè)人使用的方法,。我們會將當(dāng)月所獲得的全部收入用于下個(gè)月的預(yù)算——因?yàn)檫@些資金在編制預(yù)算和支出之前就已到賬,因此無需猜測,。當(dāng)下個(gè)月到來時(shí),,我們確切地知道每個(gè)預(yù)算類別的可支出金額,而且如有需要,,還能通過重新分配資金來實(shí)現(xiàn)靈活調(diào)整,。

對于那些收入不穩(wěn)定的人來說,這種提前一個(gè)月制定計(jì)劃的方法是個(gè)不錯(cuò)的選擇,,因?yàn)檫@樣一來,,你所動(dòng)用的始終都是銀行賬戶里已經(jīng)到賬的資金。讓我們來看一個(gè)真實(shí)的例子,。如果一個(gè)沒有受撫養(yǎng)人的單身人士每月收入為4000美元,,那么包括儲蓄和債務(wù)在內(nèi)的總支出也應(yīng)為4000美元。大致的預(yù)算如下:

請記住,,這只是預(yù)算細(xì)目,,實(shí)際生活中各項(xiàng)費(fèi)用會因居住地的不同而存在顯著差異。對于已婚,、需要承擔(dān)子女撫養(yǎng)費(fèi)用和/或贍養(yǎng)父母經(jīng)濟(jì)責(zé)任的人來說,,其預(yù)算分配情況也會有很大不同。

3. 信封預(yù)算

信封系統(tǒng)是戴夫·拉姆齊(Dave Ramsey)推廣的一種預(yù)算方法,,適用于那些希望償還債務(wù)的人群,。這一以現(xiàn)金管理為核心的策略要求你每月將特定金額的現(xiàn)金分別裝入不同的實(shí)體信封中,每個(gè)信封對應(yīng)一個(gè)預(yù)算類別,。這些信封里的現(xiàn)金必須??顚S茫荒芘沧魉谩R坏┠硞€(gè)信封中的現(xiàn)金用完,,就表示該預(yù)算類別下的消費(fèi)已達(dá)到限額,,需停止該類別的額外消費(fèi)。

采用這種方法編制預(yù)算旨在防止超支現(xiàn)象的發(fā)生,。相較于現(xiàn)金使用受到限制,,刷借記卡或信用卡很容易超出限額。因此,,這種方法要求使用者具備良好的預(yù)見性和高度的自律性,。

當(dāng)然,這種方法也有其弊端,??偛课挥诓ㄊ款D的員工財(cái)務(wù)健康平臺Origin的咨詢主管、注冊理財(cái)規(guī)劃師大衛(wèi)·布萊洛克(David Blaylock)表示:“隨著我們的社會日益趨向于無現(xiàn)金交易,,挑戰(zhàn)在于難以將該方法付諸實(shí)踐,。”此外,,現(xiàn)金容易丟失或被盜,,而且在建立個(gè)人信用方面并無助益。

4. 首先支付自己預(yù)算

假設(shè)你收支平衡,,但在滿足基本生活需求與即時(shí)欲望上的開銷過大,,以至于難以為未來儲蓄。如果是這種情況,,那么,,“首先支付自己”的預(yù)算方法或許能為你提供一種新思路。

首先支付自己是指每月從收入中一次性或按一定比例劃出一部分資金,,用于儲蓄和投資。這樣做能夠確保你為未來生活做好準(zhǔn)備,,并養(yǎng)成儲蓄和投資的習(xí)慣,。由于你先支付自己,然后再將剩余資金用于其他支出,,你可能會發(fā)現(xiàn)這種方法有助于你更快地積累儲蓄,。這種方法有時(shí)被Afford Anything的保拉·潘特(Paula Pant)稱為“反預(yù)算”策略。

5. 基于價(jià)值觀的預(yù)算

如果你的年度關(guān)鍵詞是“意向性”,,那么你可能會發(fā)現(xiàn)基于價(jià)值觀的預(yù)算規(guī)劃與你的目標(biāo)相契合,。有時(shí)我們很容易心血來潮,讓金錢從指縫中溜走,,事后回想起來卻會因所購之物而感到內(nèi)疚或不滿,。

應(yīng)對這種不滿情緒的方法就是制定基于價(jià)值觀的預(yù)算。這種預(yù)算方式與百分比和程序的關(guān)系不大,更多的是要確定自己的消費(fèi)模式,,并根據(jù)自己的價(jià)值觀做出相應(yīng)的調(diào)整,。例如,你可能會重視外出就餐和新體驗(yàn),、為有價(jià)值的事業(yè)捐款或支付舞蹈課程的費(fèi)用,。

首先列出你所珍視的事物。然后為每個(gè)類別分配資金,,以確保相關(guān)資金能夠支持你的價(jià)值觀,。這種預(yù)算方式能帶來更多的滿足感,并讓你思維清晰,,從而有助于避免不必要的開支,。

應(yīng)避免的預(yù)算錯(cuò)誤

正如有許多不同的預(yù)算編制方法可以嘗試一樣,預(yù)算編制過程中也伴隨著一些容易踏入的誤區(qū),。應(yīng)當(dāng)定期修改預(yù)算,,尤其是在諸如結(jié)婚、生子,、離婚,、遷居或失業(yè)等重大生活變化期間。

在努力養(yǎng)成新預(yù)算習(xí)慣的過程中,,你應(yīng)該注意以下幾種潛在的誤區(qū):

? 未對所有支出做好規(guī)劃,。每月相同的固定支出可能很容易規(guī)劃,但在開始記錄日常開銷之前,,要估算諸如外出就餐或夜晚娛樂之類的可自由支配支出就頗具挑戰(zhàn)性了,。說到這一點(diǎn)......

? 不記錄支出。如果你制定了預(yù)算,,卻不記錄支出,,你如何知道自己是否真正遵循了預(yù)算規(guī)劃呢?不妨考慮注冊像“You Need a Budget”(YNAB)或“Rocket Money”的預(yù)算應(yīng)用程序,,以此來對自己的財(cái)務(wù)行為負(fù)責(zé),。

? 不修改預(yù)算。當(dāng)編制預(yù)算并記錄支出一段時(shí)間后,,你應(yīng)該審視一下結(jié)果,,并在必要時(shí)調(diào)整行為。你是否發(fā)現(xiàn)自己在外出就餐上的開銷超出了計(jì)劃,?你是否失去了一種收入來源,?面對這些“偏離計(jì)劃”的時(shí)刻,切勿氣餒,。相反,,要將這些時(shí)刻視為調(diào)整的契機(jī)(為未來做好準(zhǔn)備),,以確保自己始終沿著正確的財(cái)務(wù)軌道前行。

? 因?yàn)槭杖氩环€(wěn)定而放棄預(yù)算編制,。如果你是自由職業(yè)者,、零工人員或從事傭金制工作,你的月收入可能每個(gè)月都有所不同,。這可能會給預(yù)算編制帶來挑戰(zhàn),,但這并不意味著無法編制預(yù)算。像50-30-20這樣的預(yù)算方法可能很適合你,,這樣一來,,無論你的收入如何,都有百分比作為指導(dǎo),。

? 不將資金挪作他用,。即使使用信封系統(tǒng),如果某一預(yù)算類別的支出達(dá)到上限,,需要進(jìn)行調(diào)整,,你也可以從其他預(yù)算類別中調(diào)配資金。例如,,如果你的汽油費(fèi)已達(dá)到本月限額,,但突發(fā)緊急情況需要出行,你可以隨時(shí)從娛樂信封中調(diào)配資金來支付這些費(fèi)用,。

要點(diǎn)

制定預(yù)算的過程就如同尋找一條合身的牛仔褲——可能需要經(jīng)過反復(fù)試驗(yàn),,但一旦找到最適合自己的那條,你就會好奇在沒有它之前的日子你是如何度過的,。你可以嘗試這些不同的預(yù)算編制方法,,看看哪種與你的需求和生活方式最為契合,但最好的方法是那種你能堅(jiān)持并經(jīng)常使用的,。

請務(wù)必根據(jù)需要更新預(yù)算,,并持續(xù)跟蹤你的財(cái)務(wù)狀況和未來走向。未來的你(以及你的錢包)會感謝你的,。(財(cái)富中文網(wǎng))

梅勒妮·洛克特(Melanie Lockert)對本文亦有貢獻(xiàn),。

譯者:中慧言-王芳

From the rise of avocado toast, to the death of gyms and the end of cloth napkins, Millennials have been blamed for an eccentric variety of social disruptions. But according to a 2023 Nerdwallet poll, there’s one thing they haven’t ruined: budgeting.

Nerdwallet found that over 256 million Americans employ some form of budgeting in their monthly planning. A whopping 83% of millennials adhere to a monthly budget, compared to just 67% of boomers and 74% of Gen Xers.

“Budgeting is often thought of as a bad word or has some negative connotation,” says Ryan Fleming, CFP, principal at Armstrong, Fleming & Moore, Inc. “So we like to call it a ‘spending plan.’ Whatever you call it, it’s about knowing your income and understanding the inflows and outflows of your money.”

Making a budget—and sticking to it—is job one for anyone who wants a well-ordered financial life. The new year is a season of resolutions and fresh starts, and that makes it a great time to review your existing budget plan or get started with a new budget if it’s something you’ve not done before.

How to budget: Top 5 budget strategies

Making a budget shouldn’t be complicated, says Fleming. It’s as simple as understanding all of your expenses and sources of income, so that you can give every dollar a job before it has a chance to wander off and get into trouble. Think of it as telling your money: “You’re going to pay rent, you’re buying groceries, and you—yes, you in the back—you’re going to build up my savings.”

That said, there are plenty of budget strategies to choose from. Let’s review five of the most common approaches to budgeting and examine who they are best for.

1. The 50/30/20 budget

The 50/30/20 budget is a formula for budgeting that divides percentages of your income between specific categories:

? 50% for needs, such as housing, food, transportation, insurance, and minimum debt payments.

? 30% toward wants, like subscriptions, movie tickets, concerts, and travel.

? 20% for savings, including emergency funds, retirement savings, and extra debt payments.

This rubric is great for providing basic guidance on how to save and spend. Fleming recommends this type of budget strategy for people who are looking for a fresh start—younger people starting to budget for the first time, or someone who is leaving a partnership and whose finances may be different as a single person.

Ryan A. Hughes, Founder & Portfolio Manager at Bull Oak Capital, cautions against this method in some cases. “It can be challenging in an environment where housing costs are high, especially in areas like the Bay Area, Southern California, New York, and other expensive urban areas. Your mortgage or rent can easily exceed 50% of your after-tax income.”

Hughes adds that while it’s not recommended, some households compromise by reducing the 30% bucket to offset the higher housing costs.

2. The zero-based budget

Zero-based budgeting refers to allocating every dollar of your income toward expenses and financial goals like saving and debt repayment. The net result of allocating all of your income toward specific categories is that you can get “zero” when subtracting your expenses from your income, hence the name.

This is the method I personally use. We take all income for the current month and use that money to create a budget for the following month—since that money hits our account before we budget and spend it, there’s no guesswork necessary. When the new month arrives we know exactly what we’re able to spend on each budget category, and can adjust on the fly by reallocating funds if need be.

This method of planning things out a month in advance makes it a great option for those with unpredictable incomes since you’re always only working with money you’ve already got in the bank. Let’s consider a real-world example. If a single person with no dependents earns $4,000 per month, their total expenses including savings and debt should also equal $4,000. A rough budget might look like:

Remember, this is just an example breakdown and actual costs will vary wildly depending on where you live. This budget would also look very different for someone who is married, must financially support children and/or parents, etc.

3. The envelope budget

The envelope system is a type of budgeting method that has been popularized by Dave Ramsey and is geared toward people looking to pay off debt. With this cash-centric method, you fill physical envelopes each month with a specific amount of cash for various budget categories. The cash in each envelope is used for that specific category and nothing else. If the cash is gone, the budgeting limit has been hit and no more should be spent in that category.

Budgeting this way is used to combat overspending, as it’s very easy to exceed your limits when swiping a debit or credit card compared to the physical limitation of cash. As such, this method takes a good bit of foresight and discipline.

Of course, this method also has its drawbacks. “The challenging part is that with our increasingly cashless society, it can be difficult to manage,” says David Blaylock, CFP, head of advice at Boston-based Origin, an employee financial wellness platform. Additionally, cash can easily get lost or stolen and doesn’t help build credit.

4. The pay yourself first budget

Let’s say you’re making ends meet, but spending so much on necessary expenses and the things you want now that you’re struggling to save up for the future. If that’s the case, the “pay yourself first” method might help adjust your thinking.

Paying yourself first means setting aside a lump sum or percentage of your income each month toward your savings and investments. Doing so ensures that you’re preparing for the future and building a habit of saving and investing. Since you’re paying yourself first before allotting the remaining funds toward your other expenses, you may find that this method helps you build your savings more quickly. This method is sometimes referred to as the “Anti-budget” by Paula Pant of Afford Anything.

5. The values-based budget

If your word of the year is “intentionality,” you may find that values-based budgeting alignes with your goals. It’s all too easy sometimes to let money slip through our fingers on a whim, then look back and feel guilt or dissatisfaction about what was purchased.

The remedy to this dissatisfaction is creating a values-based budget. This option is less about percentages and procedures, and more about identifying your spending patterns and adjusting them to line up with your values. For example, you may value dining out and having new experiences, donating to worthy causes, or paying for dance classes.

Start by writing a list of what you value. Then allot funds for each category to ensure your money supports your values. This type of budgeting can bring more satisfaction and clarity and help avoid trivial spending.

Budgeting blunders to avoid

Just as there are many different budgeting methods to try out, there are budgeting mistakes to be made. Budgets should be revised on a regular basis, especially during big life changes such as marriage, childbirth, divorce, moving, or a job layoff.

There are a few potential mistakes you should watch out for as you work to form new habits with your budget:

? Not planning for all of your expenses. The fixed payments that are the same each month may be easy to plan for, but until you start tracking your usual expenses it’s a lot more challenging to estimate discretionary spending like restaurants or opportunities for a night out. Speaking of which…

? Not tracking your expenses. If you set a budget but don’t track your spending, how will you know if you’re actually sticking to it? Consider signing up for a budgeting app like You Need a Budget (YNAB) or Rocket Money to hold yourself accountable.

? Not revising your budget. Once you’ve been budgeting and tracking expenses for a while, you should take a look at your results and adjust behaviors where necessary. Do you find yourself spending more on dining out than you planned for? Did you lose a source of income? Don’t be discouraged by “failure.” Instead, use these moments as opportunities to tweak things for the future and keep yourself on track.

? Forgoing a budget because of a variable income. If you’re a freelancer, gig worker, or have a commission-based job, your monthly income likely varies month-to-month. That can make it tough to budget, but it doesn’t mean it’s impossible. Methods such as the 50/30/20 budget may be a good fit, so you have percentages as a guide regardless of how much you’re making.

? Not reassigning funds for other purposes. Even with the envelope system, you may dip into other budget categories if you’re at capacity in one category and need to make an adjustment. For example, if you already hit your limit on gas for the month but have an emergency and need to make an unexpected trip, you can always pull funds from your entertainment envelope to cover those costs.

The takeaway

Setting up a budget is like finding the perfect pair of jeans—it might take some trial and error, but once you find the right fit, you'll wonder how you ever lived without it. You can try these various budgeting methods to see which option works for your needs and lifestyle, but the best one will be the one you can stick with and use on a regular basis.

Just be sure to update your budget as needed and continue tracking where you’re at and where you’re going. Your future self (and your wallet) will thank you.

Melanie Lockert contributed to this article.