插圖:JAMIE CULLEN

插圖:JAMIE CULLEN你正坐在沙發(fā)上看新聞,。全是令人沮喪的消息。新冠肺炎感染者數(shù)量持續(xù)攀升,,股市繼續(xù)暴跌,。你拿起手機(jī)看了看自己買(mǎi)的股票。唉,!全在下跌,!怎么辦?

賣(mài)掉,?

勇敢點(diǎn),,進(jìn)場(chǎng)抄底?

繼續(xù)持有,?

每一種做法都可以看作是一種策略,,但卻很難讓人感到安慰。

我們剛剛經(jīng)歷了史上最糟糕的第一季度,。那是道瓊斯指數(shù)自1987年以來(lái)表現(xiàn)最差的一個(gè)季度,。1987年正是發(fā)生臭名昭著的“黑色星期一”股災(zāi)的那一年。標(biāo)普500指數(shù)的糟糕表現(xiàn),,只有2008年金融危機(jī)最嚴(yán)重的時(shí)候才能與之“相媲美”,。

而且不止是股市。大宗商品市場(chǎng)也難以幸免,。由于全球出行禁令,、工廠停工和全球勞動(dòng)者居家隔離,原油價(jià)格下跌了60%,。由于難以想象的零息債券成為可能,,導(dǎo)致美國(guó)10年期國(guó)債收益率暴跌122個(gè)基點(diǎn),這表明投資者陷入極度恐慌,。市場(chǎng)在最糟糕的時(shí)候所要表達(dá)的信息已經(jīng)很清楚:零回報(bào)總好過(guò)賠錢(qián)。

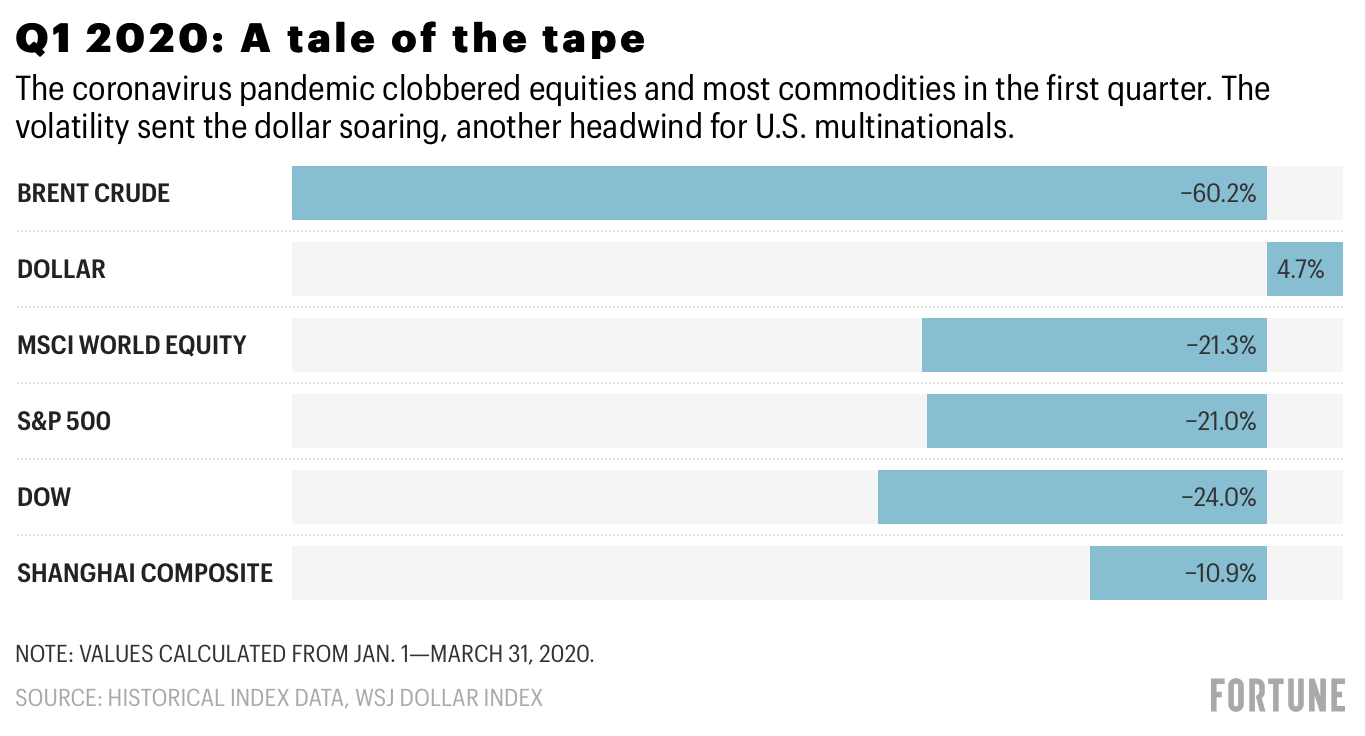

圖:2020年1季度,,布倫特原油,、美元、摩根士丹利資本國(guó)際全球股票指數(shù),、標(biāo)準(zhǔn)普爾500指數(shù),、道瓊斯指數(shù)、上證綜指的浮動(dòng)情況,。

圖:2020年1季度,,布倫特原油,、美元、摩根士丹利資本國(guó)際全球股票指數(shù),、標(biāo)準(zhǔn)普爾500指數(shù),、道瓊斯指數(shù)、上證綜指的浮動(dòng)情況,。工廠停工和停止出行等舉措,,最大程度抑制了疫情傳播,,但卻讓原油期貨和全球股市在第一季度大幅下跌。

但現(xiàn)在有一些好消息,。雖然標(biāo)普500指數(shù)在第一季度下跌了21%(見(jiàn)上圖),,但看看該指數(shù)在過(guò)去兩周的表現(xiàn)你會(huì)有截然不同的發(fā)現(xiàn)。從3月23日收盤(pán)至4月6日收盤(pán),,標(biāo)普500指數(shù)上漲了19%,。真希望你聽(tīng)到了腦海中那個(gè)告訴你“勇敢點(diǎn)”的聲音。

但在震蕩行情中,,事后評(píng)價(jià)自己的行為沒(méi)有任何意義,。即使專(zhuān)業(yè)人士也會(huì)犯錯(cuò)。更重要的是,,99.99%的投資者并不是專(zhuān)業(yè)人士,。所以不要自責(zé)了!

紐約大學(xué)斯特恩商學(xué)院的經(jīng)濟(jì)學(xué)教授尼古拉斯·伊科諾米季斯表示:“在金融市場(chǎng),,多數(shù)人并沒(méi)有足夠的專(zhuān)業(yè)知識(shí),。這并非他們的本職工作?!倍乙粓?chǎng)百年不遇的大疫情導(dǎo)致全球股市暴跌,,很快你就會(huì)看到那些毫無(wú)經(jīng)驗(yàn)的401(k)計(jì)劃投資者在股市的浪潮中苦苦掙扎。

伊科諾米季斯有哪些建議,?他表示,,在當(dāng)前的市場(chǎng)環(huán)境下,不要與鯊魚(yú)一起游泳,。等到風(fēng)平浪靜之后再下水:“為什么要觀望,?如果你沒(méi)有專(zhuān)業(yè)知識(shí),現(xiàn)在的任何動(dòng)作可能讓你全盤(pán)皆輸,,這是愚蠢的行為,。”

每個(gè)投資者都有各自不同的風(fēng)險(xiǎn)狀況,。有的投資者有條件嘗試預(yù)測(cè)反彈的時(shí)間,,從而讓自己的獲利最大化。但有的投資者必須等到市場(chǎng)穩(wěn)定在一定區(qū)間之后,,再去計(jì)劃下一步,。

事實(shí)上,專(zhuān)家認(rèn)為,,不要嘗試預(yù)測(cè)“反彈”或“上漲”的時(shí)間,,更明智的做法是預(yù)測(cè)市場(chǎng)“平靜”的時(shí)間,即從每日暴漲變成幅度較小但循序漸進(jìn)的波動(dòng)。

比如:多數(shù)市場(chǎng)觀察員依舊在嘗試預(yù)測(cè)市場(chǎng)低點(diǎn),,而不是它會(huì)漲到多高,。因此,摩根大通分析師最近指出,,波動(dòng)性成為他們?nèi)找嬷匾囊粋€(gè)指標(biāo),。分析師們最近專(zhuān)門(mén)研究了芝加哥期權(quán)交易所波動(dòng)率指數(shù),并將該指數(shù)與新冠肺炎感染人數(shù)和死亡人數(shù)相匹配,。他們通過(guò)微積分運(yùn)算得出標(biāo)普500指數(shù)的最低點(diǎn)在2,100點(diǎn)左右(標(biāo)普500指數(shù)在3月份第三周跌至2,193點(diǎn),,最接近這一水平,但之后開(kāi)始反彈),。

我知道你在想什么,。2100點(diǎn)?現(xiàn)在比2100點(diǎn)高出了20%以上,。我們還會(huì)下跌到那個(gè)水平嗎,?

請(qǐng)記住:熊市的平均跌幅為32.7%,。在所有熊市中下跌幅度最大的是上一次,,即從2007年至2009年全球金融危機(jī)最嚴(yán)重的時(shí)期。這一次,,標(biāo)普指數(shù)從最高點(diǎn)至最低點(diǎn)的跌幅為34.1%,;但從3月23日跌至最低點(diǎn)至今,標(biāo)普指數(shù)已經(jīng)收復(fù)了超過(guò)一半失地,。

第二季度會(huì)帶來(lái)什么,?

第一季度出現(xiàn)了各種極端行情。標(biāo)普500指數(shù)在2月份漲至歷史新高,,不到兩周后就跌入了回調(diào)區(qū)間,。但最終它卻以強(qiáng)勁的表現(xiàn)結(jié)束了第一季度。目前還有許多問(wèn)題值得擔(dān)憂,,比如創(chuàng)紀(jì)錄的失業(yè)率,、全球經(jīng)濟(jì)衰退以及距離結(jié)束遙遙無(wú)期的全球致命疫情。

現(xiàn)在的市場(chǎng)并不適合追求短期回報(bào),。但從長(zhǎng)遠(yuǎn)來(lái)看,,市場(chǎng)依舊會(huì)強(qiáng)勢(shì)上揚(yáng)。

安聯(lián)人壽高級(jí)市場(chǎng)副總裁凱利·拉維尼表示:“過(guò)去幾周,,美國(guó)投資者眼看著他們的投資和退休儲(chǔ)蓄大幅縮水,,他們或許會(huì)想是否應(yīng)該采取行動(dòng)止血。好消息是對(duì)于多數(shù)人而言,,還是理智占了上風(fēng),許多人似乎清楚,他們必須有長(zhǎng)遠(yuǎn)眼光,,盡量渡過(guò)難關(guān),。”

最新一期安聯(lián)季度市場(chǎng)認(rèn)知研究詢(xún)問(wèn)了投資者對(duì)未來(lái)的態(tài)度,。結(jié)果顯示,,并不是所有人都是悲觀的心態(tài)。大部分(63%)受訪者表示他們擔(dān)心經(jīng)濟(jì)衰退,,超過(guò)一半(52%)受訪者表示他們現(xiàn)在非常焦慮,,不敢繼續(xù)投資。

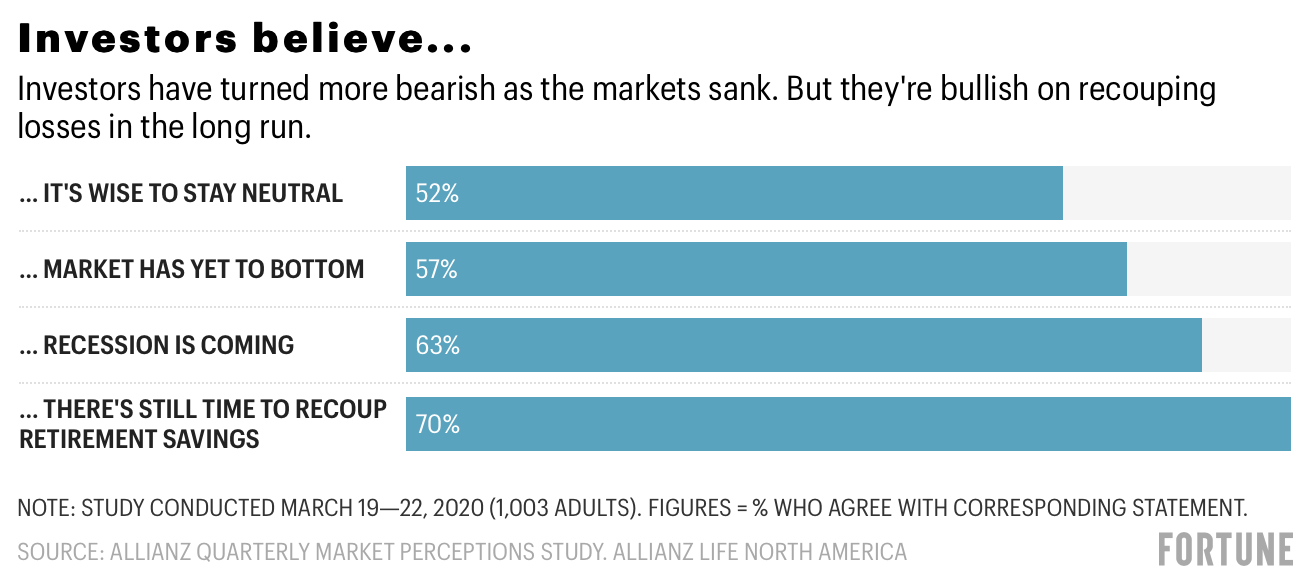

圖:3月19-22日進(jìn)行的調(diào)查發(fā)現(xiàn),,52%的受訪者認(rèn)為應(yīng)按兵不動(dòng),,57%認(rèn)為市場(chǎng)還未見(jiàn)底,63%認(rèn)為衰退正在來(lái)臨,,70%認(rèn)為有時(shí)間重新增加他們的退休儲(chǔ)蓄金,。

圖:3月19-22日進(jìn)行的調(diào)查發(fā)現(xiàn),,52%的受訪者認(rèn)為應(yīng)按兵不動(dòng),,57%認(rèn)為市場(chǎng)還未見(jiàn)底,63%認(rèn)為衰退正在來(lái)臨,,70%認(rèn)為有時(shí)間重新增加他們的退休儲(chǔ)蓄金,。但從整體來(lái)看,投資者的情緒更為樂(lè)觀,。報(bào)告稱(chēng):“接近70%的投資者認(rèn)為,,即使市場(chǎng)繼續(xù)下跌,他們也有時(shí)間重新增加他們的退休儲(chǔ)蓄金,?!?/p>

大部分投資者可以帶著這種情緒堅(jiān)持下去。(財(cái)富中文網(wǎng))

譯者:BIZ

你正坐在沙發(fā)上看新聞,。全是令人沮喪的消息,。新冠肺炎感染者數(shù)量持續(xù)攀升,股市繼續(xù)暴跌,。你拿起手機(jī)看了看自己買(mǎi)的股票,。唉!全在下跌,!怎么辦,?

賣(mài)掉?

勇敢點(diǎn),,進(jìn)場(chǎng)抄底,?

繼續(xù)持有?

每一種做法都可以看作是一種策略,,但卻很難讓人感到安慰,。

我們剛剛經(jīng)歷了史上最糟糕的第一季度。那是道瓊斯指數(shù)自1987年以來(lái)表現(xiàn)最差的一個(gè)季度,。1987年正是發(fā)生臭名昭著的“黑色星期一”股災(zāi)的那一年,。標(biāo)普500指數(shù)的糟糕表現(xiàn),,只有2008年金融危機(jī)最嚴(yán)重的時(shí)候才能與之“相媲美”。

而且不止是股市,。大宗商品市場(chǎng)也難以幸免,。由于全球出行禁令、工廠停工和全球勞動(dòng)者居家隔離,,原油價(jià)格下跌了60%,。由于難以想象的零息債券成為可能,導(dǎo)致美國(guó)10年期國(guó)債收益率暴跌122個(gè)基點(diǎn),,這表明投資者陷入極度恐慌,。市場(chǎng)在最糟糕的時(shí)候所要表達(dá)的信息已經(jīng)很清楚:零回報(bào)總好過(guò)賠錢(qián)。

工廠停工和停止出行等舉措,,最大程度抑制了疫情傳播,,但卻讓原油期貨和全球股市在第一季度大幅下跌。

但現(xiàn)在有一些好消息,。雖然標(biāo)普500指數(shù)在第一季度下跌了21%(見(jiàn)上圖),,但看看該指數(shù)在過(guò)去兩周的表現(xiàn)你會(huì)有截然不同的發(fā)現(xiàn)。從3月23日收盤(pán)至4月6日收盤(pán),,標(biāo)普500指數(shù)上漲了19%,。真希望你聽(tīng)到了腦海中那個(gè)告訴你“勇敢點(diǎn)”的聲音。

但在震蕩行情中,,事后評(píng)價(jià)自己的行為沒(méi)有任何意義,。即使專(zhuān)業(yè)人士也會(huì)犯錯(cuò)。更重要的是,,99.99%的投資者并不是專(zhuān)業(yè)人士,。所以不要自責(zé)了!

紐約大學(xué)斯特恩商學(xué)院的經(jīng)濟(jì)學(xué)教授尼古拉斯·伊科諾米季斯表示:“在金融市場(chǎng),,多數(shù)人并沒(méi)有足夠的專(zhuān)業(yè)知識(shí),。這并非他們的本職工作?!倍乙粓?chǎng)百年不遇的大疫情導(dǎo)致全球股市暴跌,,很快你就會(huì)看到那些毫無(wú)經(jīng)驗(yàn)的401(k)計(jì)劃投資者在股市的浪潮中苦苦掙扎。

伊科諾米季斯有哪些建議,?他表示,,在當(dāng)前的市場(chǎng)環(huán)境下,不要與鯊魚(yú)一起游泳,。等到風(fēng)平浪靜之后再下水:“為什么要觀望,?如果你沒(méi)有專(zhuān)業(yè)知識(shí),現(xiàn)在的任何動(dòng)作可能讓你全盤(pán)皆輸,,這是愚蠢的行為,?!?/p>

每個(gè)投資者都有各自不同的風(fēng)險(xiǎn)狀況。有的投資者有條件嘗試預(yù)測(cè)反彈的時(shí)間,,從而讓自己的獲利最大化,。但有的投資者必須等到市場(chǎng)穩(wěn)定在一定區(qū)間之后,再去計(jì)劃下一步,。

事實(shí)上,專(zhuān)家認(rèn)為,,不要嘗試預(yù)測(cè)“反彈”或“上漲”的時(shí)間,,更明智的做法是預(yù)測(cè)市場(chǎng)“平靜”的時(shí)間,即從每日暴漲變成幅度較小但循序漸進(jìn)的波動(dòng),。

比如:多數(shù)市場(chǎng)觀察員依舊在嘗試預(yù)測(cè)市場(chǎng)低點(diǎn),,而不是它會(huì)漲到多高。因此,,摩根大通分析師最近指出,,波動(dòng)性成為他們?nèi)找嬷匾囊粋€(gè)指標(biāo)。分析師們最近專(zhuān)門(mén)研究了芝加哥期權(quán)交易所波動(dòng)率指數(shù),,并將該指數(shù)與新冠肺炎感染人數(shù)和死亡人數(shù)相匹配,。他們通過(guò)微積分運(yùn)算得出標(biāo)普500指數(shù)的最低點(diǎn)在2,100點(diǎn)左右(標(biāo)普500指數(shù)在3月份第三周跌至2,193點(diǎn),最接近這一水平,,但之后開(kāi)始反彈),。

我知道你在想什么。2100點(diǎn),?現(xiàn)在比2100點(diǎn)高出了20%以上,。我們還會(huì)下跌到那個(gè)水平嗎?

請(qǐng)記?。盒苁械钠骄鶠?2.7%,。在所有熊市中下跌幅度最大的是上一次,即從2007年至2009年全球金融危機(jī)最嚴(yán)重的時(shí)期,。這一次,,標(biāo)普指數(shù)從最高點(diǎn)至最低點(diǎn)的跌幅為34.1%;但從3月23日跌至最低點(diǎn)至今,,標(biāo)普指數(shù)已經(jīng)收復(fù)了超過(guò)一半失地,。

第二季度會(huì)帶來(lái)什么?

第一季度出現(xiàn)了各種極端行情,。標(biāo)普500指數(shù)在2月份漲至歷史新高,,不到兩周后就跌入了回調(diào)區(qū)間。但最終它卻以強(qiáng)勁的表現(xiàn)結(jié)束了第一季度,。目前還有許多問(wèn)題值得擔(dān)憂,,比如創(chuàng)紀(jì)錄的失業(yè)率,、全球經(jīng)濟(jì)衰退以及距離結(jié)束遙遙無(wú)期的全球致命疫情。

現(xiàn)在的市場(chǎng)并不適合追求短期回報(bào),。但從長(zhǎng)遠(yuǎn)來(lái)看,,市場(chǎng)依舊會(huì)強(qiáng)勢(shì)上揚(yáng)。

安聯(lián)人壽高級(jí)市場(chǎng)副總裁凱利·拉維尼表示:“過(guò)去幾周,,美國(guó)投資者眼看著他們的投資和退休儲(chǔ)蓄大幅縮水,,他們或許會(huì)想是否應(yīng)該采取行動(dòng)止血。好消息是對(duì)于多數(shù)人而言,,還是理智占了上風(fēng),,許多人似乎清楚,他們必須有長(zhǎng)遠(yuǎn)眼光,,盡量渡過(guò)難關(guān),。”

最新一期安聯(lián)季度市場(chǎng)認(rèn)知研究詢(xún)問(wèn)了投資者對(duì)未來(lái)的態(tài)度,。結(jié)果顯示,,并不是所有人都是悲觀的心態(tài)。大部分(63%)受訪者表示他們擔(dān)心經(jīng)濟(jì)衰退,,超過(guò)一半(52%)受訪者表示他們現(xiàn)在非常焦慮,,不敢繼續(xù)投資。

但從整體來(lái)看,,投資者的情緒更為樂(lè)觀,。報(bào)告稱(chēng):“接近70%的投資者認(rèn)為,即使市場(chǎng)繼續(xù)下跌,,他們也有時(shí)間重新增加他們的退休儲(chǔ)蓄金,。”

大部分投資者可以帶著這種情緒堅(jiān)持下去,。(財(cái)富中文網(wǎng))

譯者:BIZ

ILLUSTRATION BY JAMIE CULLEN

You’re sitting on the couch watching the news. It’s depressing. Coronavirus infections are climbing, the markets are sinking. You reach for your smartphone to check on your portfolio. Gulp. Red flashes across the tiny screen. What do you do?

Sell?

Be bold, and buy on the dip?

Hold tight?

All three moves qualify as a strategy, but that’s hardly comforting.

We just came out of the worst first quarter ever. It was the Dow’s weakest quarter overall since 1987, the year of the infamous Black Monday crash. And you have to go back to the height of the 2008 financial crisis to find a stretch this bad for the S&P 500.

And it wasn’t just equities. Commodities tanked. Crude fell 60% as global travel ground to a halt, factories went on lockdown, and the global workforce slept in, with nowhere to go. In a sign of extreme investor jitters, the yield on 10-year Treasury notes bombed downward 122 basis points as the unthinkable—zero-bearing rates—became a distinct possibility. At its worst, what the markets were saying was clear: a return of zero beats losses.

The move to shutter factories and ground global travel to minimize the spread of the coronavirus outbreak sank crude oil futures and global equities in the first quarter.

But now, here’s some good news. While the S&P 500 fell 21% in the first quarter (see chart), the performance over the past two weeks shows a far different story. Between the March 23 close and the April 6 close, the S&P 500 is up 19%. If only you had listened to that voice saying, “Be bold.”

But in a volatile market, it makes no sense to second-guess your moves. Even the pros get it wrong. And, more important, 99.99% of investors are not professionals themselves. So stop kicking yourself!

“Most people don’t have enough expertise in financial markets. It’s not their job,” says Nicholas Economides, a professor of economics at NYU Stern School of Business. Add a once-in-a-lifetime pandemic that causes a global crash, and you quickly see armchair 401(k) investors are in over their head in choppy waters.

What does Economides advise? In markets like this, he says, don’t swim with the sharks. Wait for calmer waters: “Why wait and see? If you don’t have expertise in something, it’s kind of foolish taking action that could be completely wrong.”

Every investor’s risk profile is different. Some can afford to try to time the rebound to maximize the gains. Others will have to wait until the markets settle into a range before plotting the next move.

In fact, experts say, rather than timing the “rally” or the “upswing,” a better move is to time the “calm,” the point when the wild daily spikes flatten to more progressive—even dull—moves.

Consider: Most market watchers are still trying to figure out how low this market can go, not how high it will soar. As such, JPMorgan Chase analysts recently noted that volatility has become an increasingly big metric for them. They watch the Cboe Volatility Index intently and match that with the coronavirus infection and death numbers. That calculus helped them arrive at a floor for the S&P 500 at around 2,100 (the closest the index came to that was 2,193 in the third week of March, before climbing).

I know what you’re thinking. 2,100? We’re more than 20% above that right now. Could we fall back to that point?

Keep in mind: Bear markets have, on average, fallen by 32.7%. The deepest of all bears was the last one—spanning from 2007 to the depths of the global financial crisis in 2009. This time around, the S&P peak-to-trough drop was 34.1%; it’s recouped more than half that since the March 23 bottom.

What will Q2 bring?

The first quarter was marked by extremes. The S&P 500 hit an all-time high in February, and less than two weeks later was in correction territory. It then finished the quarter on a strong run. And yet there are a lot of concerns: record unemployment, a global recession, and a deadly global pandemic that hasn’t yet run its full course.

It’s not a market for short-term returns. But the longer term view looks strong.

“Americans who have watched their investments and retirement savings plummet over the past few weeks might be wondering if they should take action to stem the bleeding,” said Kelly LaVigne, vice president of advanced markets for Allianz Life. “The good news is that, for the majority, calmer heads prevail, and many seem to understand that they need to take a longer-term view and try to ride it out.”

The latest Allianz Quarterly Market Perceptions Study asked investors how they feel about the future. It wasn’t all doom and gloom. A majority of respondents (63%) say they are worried about a recession, and over half (52%) say they’re too unnerved to jump back in and invest.

But zoom out a bit, and the sentiment gets more positive. “Nearly 70% believe that, even if the market continues to decline, they will have time to rebuild their retirement savings,” the report notes.

A sentiment most investors can live by.