美國時間周三早上,,有消息透露稱高盛集團將在客戶電話會議上分享其對比特幣的看法。此種風聲一起,,加密貨幣圈頓時一片嘩然,。高盛會明確看好加密貨幣么?比特幣的價格又會不會因此而暴漲?

但答案恐怕要讓幣迷們失望了,。最近,,一份高盛內部幻燈片被泄露到社交媒體上。主題不帶任何感情色彩,,只是名為“美國經(jīng)濟展望及對通貨膨脹,、黃金和比特幣的現(xiàn)行政策”。

高盛在其中的一張幻燈片中指出,,以比特幣為代表的加密數(shù)字貨幣甚至都不能算作是一種資產類別,,它們既不能提供現(xiàn)金流,也不能對沖通脹,。

高盛還總結道:“比特幣屬于一種投機型證券,,它的價值僅僅取決于有沒有下家愿意以更高的價格接盤,我們不建議客戶對其進行投資,?!?630年代發(fā)生的荷蘭郁金香事件就很好地例證了投機行為所可能造成的巨大金融泡沫,高盛擔心加密貨幣會加重這種通脹現(xiàn)象,。

以上這些都還不是最糟的,,隨后的一張幻燈片顯示,加密貨幣的另一個顯著特征就是能為非法活動提供渠道,?;诩用茇泿趴鐕场⒖缙脚_的匿名特性,,許多龐氏騙局和勒索軟件都可以借助加密數(shù)字貨幣來完成洗錢和資產轉移,。

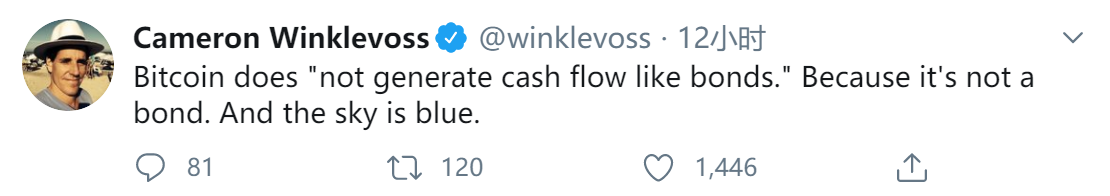

不出所料,高盛的評點引發(fā)了諸多爭議,,一些比特幣的狂熱粉絲們在推特上對其進行了猛烈抨擊,,其中就包括泰勒和卡梅隆?文克萊沃斯兄弟。這對兄弟早前由于起訴校友馬克?扎克伯格而名聲大噪,,2012年以后兩人開始購買比特幣,,如今已成為億萬“比特幣富翁”。他們指責高盛對比特幣的說辭是無知且虛偽的:

與此同時,,密碼研究公司Messari的首席執(zhí)行官瑞安?塞爾基斯,,再次用“吸血烏賊”的老綽號來類比高盛集團對比特幣的態(tài)度。

貨幣研究中心(Coin Center)的尼拉杰?阿格拉瓦爾也指出,,高盛在2018年就開始入局比特幣項目了,,該行還打算自建一個加密交易平臺。

面對不同的質疑聲,高盛方面的發(fā)言人拒絕發(fā)表評論,,只是說“我沒有什么要補充的,。”

以長遠的眼光來看,,周三發(fā)生的這場“比特幣之爭”只是一個起點,,往后比特幣的支持者與傳統(tǒng)金融機構之間仍然可能持續(xù)不和。在沃倫?巴菲特看來,,比特幣市場就好像是一塊“鋪滿老鼠藥”的小地方,,摩根大通的首席執(zhí)行官杰米?戴蒙更是將其比作一場從頭到尾的“欺詐”騙局。

然而,,盡管雙方在社交網(wǎng)絡表現(xiàn)得水火不容,,但在現(xiàn)實中卻有跡象表明他們正尋求合作。本月早些時候,,據(jù)《華爾街日報》報道,,摩根大通正在為加密貨幣交易所Coinbase提供銀行服務。本周三,,Coinbase還宣布,,該公司即將收購另一家由傳統(tǒng)金融高管創(chuàng)辦的交易公司,,其中的一名高管正是來自高盛,。(財富中文網(wǎng))

編譯:陳怡軒

美國時間周三早上,有消息透露稱高盛集團將在客戶電話會議上分享其對比特幣的看法,。此種風聲一起,,加密貨幣圈頓時一片嘩然,。高盛會明確看好加密貨幣么?比特幣的價格又會不會因此而暴漲,?

但答案恐怕要讓幣迷們失望了,。最近,一份高盛內部幻燈片被泄露到社交媒體上,。主題不帶任何感情色彩,,只是名為“美國經(jīng)濟展望及對通貨膨脹、黃金和比特幣的現(xiàn)行政策”,。

高盛在其中的一張幻燈片中指出,,以比特幣為代表的加密數(shù)字貨幣甚至都不能算作是一種資產類別,它們既不能提供現(xiàn)金流,,也不能對沖通脹,。

高盛還總結道:“比特幣屬于一種投機型證券,它的價值僅僅取決于有沒有下家愿意以更高的價格接盤,,我們不建議客戶對其進行投資,。”1630年代發(fā)生的荷蘭郁金香事件就很好地例證了投機行為所可能造成的巨大金融泡沫,,高盛擔心加密貨幣會加重這種通脹現(xiàn)象,。

以上這些都還不是最糟的,隨后的一張幻燈片顯示,,加密貨幣的另一個顯著特征就是能為非法活動提供渠道,。基于加密貨幣跨國境,、跨平臺的匿名特性,,許多龐氏騙局和勒索軟件都可以借助加密數(shù)字貨幣來完成洗錢和資產轉移。

不出所料,,高盛的評點引發(fā)了諸多爭議,,一些比特幣的狂熱粉絲們在推特上對其進行了猛烈抨擊,其中就包括泰勒和卡梅隆?文克萊沃斯兄弟,。這對兄弟早前由于起訴校友馬克?扎克伯格而名聲大噪,,2012年以后兩人開始購買比特幣,如今已成為億萬“比特幣富翁”,。他們指責高盛對比特幣的說辭是無知且虛偽的:

與此同時,,密碼研究公司Messari的首席執(zhí)行官瑞安?塞爾基斯,再次用“吸血烏賊”的老綽號來類比高盛集團對比特幣的態(tài)度,。

貨幣研究中心(Coin Center)的尼拉杰?阿格拉瓦爾也指出,,高盛在2018年就開始入局比特幣項目了,該行還打算自建一個加密交易平臺,。

面對不同的質疑聲,,高盛方面的發(fā)言人拒絕發(fā)表評論,,只是說“我沒有什么要補充的?!?

以長遠的眼光來看,,周三發(fā)生的這場“比特幣之爭”只是一個起點,往后比特幣的支持者與傳統(tǒng)金融機構之間仍然可能持續(xù)不和,。在沃倫?巴菲特看來,,比特幣市場就好像是一塊“鋪滿老鼠藥”的小地方,摩根大通的首席執(zhí)行官杰米?戴蒙更是將其比作一場從頭到尾的“欺詐”騙局,。

然而,,盡管雙方在社交網(wǎng)絡表現(xiàn)得水火不容,但在現(xiàn)實中卻有跡象表明他們正尋求合作,。本月早些時候,,據(jù)《華爾街日報》報道,摩根大通正在為加密貨幣交易所Coinbase提供銀行服務,。本周三,,Coinbase還宣布,該公司即將收購另一家由傳統(tǒng)金融高管創(chuàng)辦的交易公司,,其中的一名高管正是來自高盛,。(財富中文網(wǎng))

編譯:陳怡軒

News that Goldman Sachs would be briefing clients about Bitcoin set the cryptocurrency world abuzz on Wednesday morning. Would the famous investment bank deliver a seal of approval to digital currency? Would the briefing cause the price of Bitcoin to soar?

Alas, for crypto fans, the answer came as a resounding no when slides of Goldman's presentation, dryly titled "US Economic Outlook & Implications of Current Policies for Inflation, Gold and Bitcoin," leaked on social media.

One slide offered the withering perspective that cryptocurrencies like Bitcoin are not even an asset class in the first place, and that they offer neither cash flow nor a hedge against inflation.

"We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients," the slide concluded. It could also invoke the Dutch tulip mania again. Ouch.

That wasn't the worst of it. A follow-up slide suggested the other most notable feature of cryptocurrency is as a "conduit for illegal activity," including Ponzi schemes and ransomware.

Not surprisingly, Bitcoin's many ardent fans on Twitter lashed out at Goldman Sachs. These included Tyler and Cameron Winklevoss, the twins who gained fame for their legal tussles with Mark Zuckerberg before becoming Bitcoin billionaires. They jabbed the bank over its alleged ignorance and hypocrisy about cryptocurrency:

?

Meanwhile, Ryan Selkis, the CEO of crypto research firm Messari, revived Goldman's "vampire squid" moniker to compare the bank's performance to Bitcoin.

And Neeraj Agrawal of the industry group Coin Center couldn't resist reminding the bank of its 2018 flirtation with building a crypto trading desk—and the questionable hairstyles of its would-be Bitcoin executives.

A spokesperson for Goldman Sachs declined to comment on the Twitter contretemps, saying, "I'm not sure there's much to add."

In the bigger picture, Wednesday's dustup is likely to become just another footnote in the long-running feud between Bitcoin boosters and the traditional financial establishment—a feud that has seen Warren Buffett tar Bitcoin as "rat poison squared" and JPMorgan CEO Jamie Dimon declare it a "fraud.

Despite the social media melodrama, however, there are signs the two worlds are coming together. Earlier this month, the Wall Street Journal reported JPMorgan was taking on crypto giant Coinbase as a banking client while, on Wednesday, Coinbase announced it was acquiring a trading firm composed of traditional financial executives—including one from Goldman Sachs.