兩年多來(lái),蘋(píng)果的股價(jià)又翻了一番,,而巴菲特旗下的伯克希爾-哈撒韋公司一直都是蘋(píng)果的大股東,。據(jù)巴菲特披露,蘋(píng)果目前已經(jīng)占據(jù)了他2145億美元股票投資總和中近44%的份額,。受到新冠疫情影響,,他在4月時(shí)還是選擇拋售了航空股,這也進(jìn)一步促使蘋(píng)果成為了其投資組合中的“半壁江山”,。

當(dāng)然,,在巴菲特的投資被“蘋(píng)果化”之后,這位股神的“法器”似乎也喪失了原先的多元性與平衡性,。一些金融觀察人士認(rèn)為,,雖然蘋(píng)果的股價(jià)在今年大漲了30%,但反過(guò)來(lái)看,,蘋(píng)果的股市表現(xiàn)有多好,,巴菲特所持其余股票的股市表現(xiàn)就有多差。事實(shí)上,,巴菲特投資的第二大股票——美國(guó)銀行,,其股價(jià)今年以來(lái)已經(jīng)下跌了34%。隨后是可口可樂(lè)和美國(guó)運(yùn)通,,分別下降了19%和25%,。

對(duì)巴菲特而言,就算在蘋(píng)果上加倍下注,,也不太能夠輕易挽回頹勢(shì),。今年,美國(guó)標(biāo)普500指數(shù)的降幅還未達(dá)到2%,,但巴菲特所持股票卻平均下降了12%,。其中唯一一只強(qiáng)勢(shì)上漲的股票是亞馬遜,半年來(lái)已經(jīng)飆升了67%,股市表現(xiàn)甚至超過(guò)了蘋(píng)果,。不過(guò),,巴菲特手中僅有價(jià)值16億美元的亞馬遜股份,遠(yuǎn)低于蘋(píng)果的935億美元,。

受到上述影響,,巴菲特的伯克希爾-哈撒韋公司本身也不被市場(chǎng)看好。該公司的股市表現(xiàn)甚至要比它所投資的企業(yè)還差,,更是遜于大盤(pán),。截至目前,伯克希爾的股價(jià)已經(jīng)下跌了近20%,。股神巴菲特似乎不再這樣神圣,,從投資回報(bào)率來(lái)看,普通投資者或投資機(jī)構(gòu)也可以比他做的更好,,即便后者沒(méi)有如此雄厚的財(cái)力,。

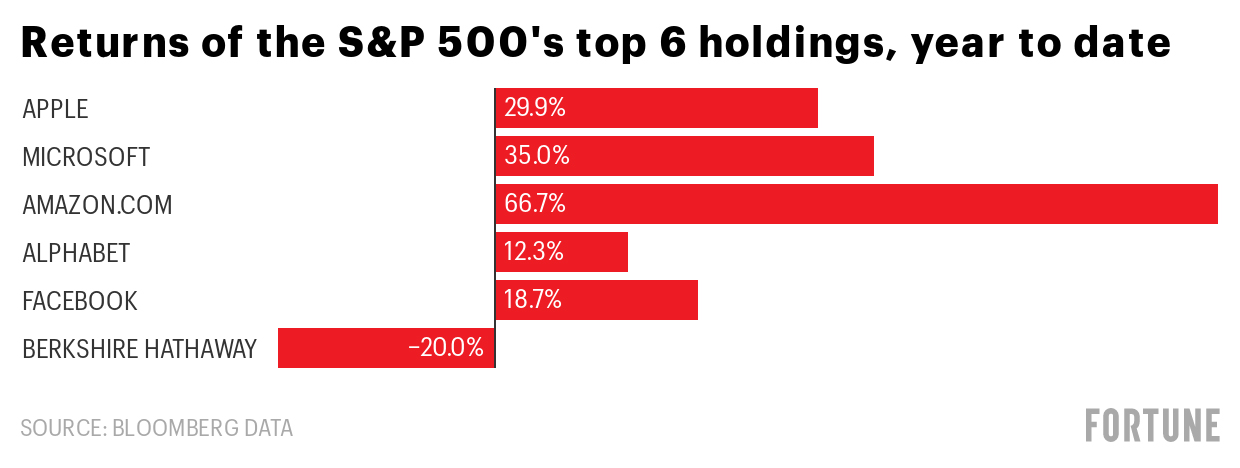

標(biāo)普500指數(shù)前6大上市公司今年以來(lái)的投資回報(bào)率參考

毋庸置疑,蘋(píng)果在美國(guó)各大股指及共同基金中占據(jù)著主導(dǎo)地位,。蘋(píng)果是全球市值最高的公司,,其估價(jià)達(dá)1.66萬(wàn)億美元,遠(yuǎn)高于標(biāo)普500指數(shù)成分股平均水平,??v觀標(biāo)普500在美上市公司的市值總和,其中6%的份額是屬于蘋(píng)果的,。換而言之,,在市場(chǎng)震蕩之際,蘋(píng)果的這一權(quán)重有效地提振了投資者的回報(bào)率,。

除了蘋(píng)果以外,,標(biāo)普500中微軟、亞馬遜,、Alphabet,、Facebook這四大科技巨頭公司的股價(jià)也在今年逆勢(shì)上漲,快速幫助股指從3月的熊市中恢復(fù)過(guò)來(lái),。

總的來(lái)說(shuō),,巴菲特在今年年初的時(shí)候押錯(cuò)了寶,沒(méi)有預(yù)料到疫情對(duì)非科技產(chǎn)業(yè)所能造成的致命打擊,。一邊是科技股在不斷地瘋漲,,另一邊是其它產(chǎn)業(yè)在持續(xù)地崩潰瓦解,此情此景下,,比起持倉(cāng)巴菲特的伯克希爾,,投資者自然更愿意把資金轉(zhuǎn)移到ETF(開(kāi)放式指數(shù)基金)中,以此降低自己的投資風(fēng)險(xiǎn),或者直接把錢(qián)交給蘋(píng)果來(lái)“保管”,。如此一來(lái),,伯克希爾的跌勢(shì)也就不足為奇了。

其實(shí),,巴菲特的伯克希爾-哈撒韋公司一直在拖累整個(gè)大盤(pán),。可以看到,,伯克希爾在標(biāo)普500成分股中排名第六,,僅次于前五大科技公司。包括伯克希爾在內(nèi),,這六家公司的總市值一共占標(biāo)普500指數(shù)全體在美上市公司的25%左右,。如果沒(méi)有伯克希爾的話,目前的標(biāo)普500指數(shù)可能會(huì)更接近正值,。(財(cái)富中文網(wǎng))

編譯:陳怡軒

兩年多來(lái),蘋(píng)果的股價(jià)又翻了一番,,而巴菲特旗下的伯克希爾-哈撒韋公司一直都是蘋(píng)果的大股東,。據(jù)巴菲特披露,蘋(píng)果目前已經(jīng)占據(jù)了他2145億美元股票投資總和中近44%的份額,。受到新冠疫情影響,,他在4月時(shí)還是選擇拋售了航空股,這也進(jìn)一步促使蘋(píng)果成為了其投資組合中的“半壁江山”,。

當(dāng)然,,在巴菲特的投資被“蘋(píng)果化”之后,這位股神的“法器”似乎也喪失了原先的多元性與平衡性,。一些金融觀察人士認(rèn)為,,雖然蘋(píng)果的股價(jià)在今年大漲了30%,但反過(guò)來(lái)看,,蘋(píng)果的股市表現(xiàn)有多好,,巴菲特所持其余股票的股市表現(xiàn)就有多差。事實(shí)上,,巴菲特投資的第二大股票——美國(guó)銀行,,其股價(jià)今年以來(lái)已經(jīng)下跌了34%。隨后是可口可樂(lè)和美國(guó)運(yùn)通,,分別下降了19%和25%,。

對(duì)巴菲特而言,就算在蘋(píng)果上加倍下注,,也不太能夠輕易挽回頹勢(shì),。今年,美國(guó)標(biāo)普500指數(shù)的降幅還未達(dá)到2%,但巴菲特所持股票卻平均下降了12%,。其中唯一一只強(qiáng)勢(shì)上漲的股票是亞馬遜,,半年來(lái)已經(jīng)飆升了67%,股市表現(xiàn)甚至超過(guò)了蘋(píng)果,。不過(guò),,巴菲特手中僅有價(jià)值16億美元的亞馬遜股份,遠(yuǎn)低于蘋(píng)果的935億美元,。

受到上述影響,,巴菲特的伯克希爾-哈撒韋公司本身也不被市場(chǎng)看好。該公司的股市表現(xiàn)甚至要比它所投資的企業(yè)還差,,更是遜于大盤(pán),。截至目前,伯克希爾的股價(jià)已經(jīng)下跌了近20%,。股神巴菲特似乎不再這樣神圣,,從投資回報(bào)率來(lái)看,普通投資者或投資機(jī)構(gòu)也可以比他做的更好,,即便后者沒(méi)有如此雄厚的財(cái)力,。

標(biāo)普500指數(shù)前6大上市公司今年以來(lái)的投資回報(bào)率參考

毋庸置疑,蘋(píng)果在美國(guó)各大股指及共同基金中占據(jù)著主導(dǎo)地位,。蘋(píng)果是全球市值最高的公司,,其估價(jià)達(dá)1.66萬(wàn)億美元,遠(yuǎn)高于標(biāo)普500指數(shù)成分股平均水平,??v觀標(biāo)普500在美上市公司的市值總和,其中6%的份額是屬于蘋(píng)果的,。換而言之,,在市場(chǎng)震蕩之際,蘋(píng)果的這一權(quán)重有效地提振了投資者的回報(bào)率,。

除了蘋(píng)果以外,,標(biāo)普500中微軟、亞馬遜,、Alphabet,、Facebook這四大科技巨頭公司的股價(jià)也在今年逆勢(shì)上漲,快速幫助股指從3月的熊市中恢復(fù)過(guò)來(lái),。

總的來(lái)說(shuō),,巴菲特在今年年初的時(shí)候押錯(cuò)了寶,沒(méi)有預(yù)料到疫情對(duì)非科技產(chǎn)業(yè)所能造成的致命打擊,。一邊是科技股在不斷地瘋漲,,另一邊是其它產(chǎn)業(yè)在持續(xù)地崩潰瓦解,,此情此景下,比起持倉(cāng)巴菲特的伯克希爾,,投資者自然更愿意把資金轉(zhuǎn)移到ETF(開(kāi)放式指數(shù)基金)中,,以此降低自己的投資風(fēng)險(xiǎn),或者直接把錢(qián)交給蘋(píng)果來(lái)“保管”,。如此一來(lái),,伯克希爾的跌勢(shì)也就不足為奇了。

其實(shí),,巴菲特的伯克希爾-哈撒韋公司一直在拖累整個(gè)大盤(pán),。可以看到,,伯克希爾在標(biāo)普500成分股中排名第六,,僅次于前五大科技公司。包括伯克希爾在內(nèi),,這六家公司的總市值一共占標(biāo)普500指數(shù)全體在美上市公司的25%左右,。如果沒(méi)有伯克希爾的話,目前的標(biāo)普500指數(shù)可能會(huì)更接近正值,。(財(cái)富中文網(wǎng))

編譯:陳怡軒

For more than two years, Apple stock has been the largest holding in Warren Buffett's Berkshire Hathaway portfolio, roughly doubling in value over that time. The coronavirus pandemic has tipped the scales further: Apple now accounts for nearly 44% of Buffett's roughly $214.5 billion in stocks, based on the investor's most recent disclosures—including his announcement that he sold out of airline stocks in April.

Of course, while the heavy concentration in Apple has, as some observers have pointed out, left the Oracle of Omaha's portfolio lopsided and less than diversified, that's as much a reflection of how well Apple stock has performed this year—up some 30% year to date—as it is of how poorly Buffett's other holdings have done. Indeed, Buffett's second-largest holding, Bank of America stock, has plunged 34% so far this year; his next largest, Coca-Cola, has fallen 19%; after that, American Express is down 25%.

Even doubling down on Apple wasn't enough for Buffett to make up for those dismal returns: In a year in which the S&P 500 is down less than 2% so far, the stocks Buffett owns have fallen an average of nearly 12%. The only stock that did better than Apple in Berkshire's holdings is Amazon, up almost 67%—but Buffett's stake in the company, worth $1.6 billion, makes it a tiny holding next to Apple, of which the investor owns $93.5 billion in shares.

Holding those cards, Berkshire Hathaway stock itself has underperformed many of the companies in its own portfolio, as well as the broader market. Berkshire shares have fallen 20% year to date. Though Buffett is known for his investing prowess, it's likely many average investors' returns have easily outperformed his—even if they don't have nearly half of their money invested in Apple.

Apple has become such a juggernaut, with a $1.66 trillion market cap that makes it the most valuable company in the world, that it dominates every major U.S. stock index and many broad-based mutual funds. Apple accounts for nearly 6% of the value of the S&P 500—a weighting that has helped buoy investors' returns amid spiking market volatility.

It's not just Apple, either: The other big four tech companies at the top of the S&P 500—Microsoft, Amazon, Alphabet, and Facebook—have gained significantly in 2020, helping to power the stock index's comeback from a bear market in March.

Meanwhile, Buffett's light helping of tech stocks besides Apple has hurt his relative performance compared to the broader market, as tech companies have continued surging this year while other industries faltered. Ultimately, investors would have been better off putting their money in an S&P 500 exchange-traded fund (ETF)—or just Apple stock itself—than they would have been by investing in Berkshire Hathaway.

And here's an odd twist: Buffett's own portfolio has been dragging down the broader market. After the five big tech stocks, Buffett's company, Berkshire Hathaway, is the sixth-biggest constituent in the S&P 500, right after Facebook. Together, those six companies make up a quarter—or 25%—of the total index. Without Berkshire, the S&P 500 might be closer to positive territory by now.