雖然在疫苗方面獲得積極進(jìn)展,但新冠疫情遠(yuǎn)未結(jié)束,。

不過在經(jīng)濟(jì)方面有持續(xù)改善跡象。隨著春夏兩季各州陸續(xù)放松封鎖,美國經(jīng)濟(jì)從歷史上的最嚴(yán)重收縮轉(zhuǎn)變?yōu)閺?fù)蘇最迅速的經(jīng)濟(jì)體之一,。事實上,,4月美國失業(yè)率達(dá)到14.7%的高點后,,到10月已經(jīng)降至6.9%。

然而,,美國經(jīng)濟(jì)并未走出困境,。隨著受疫情影響嚴(yán)重的企業(yè)現(xiàn)金耗盡,,越來越多的企業(yè)瀕臨倒閉,。而且在疲軟的勞動力市場中,,在職者很難加薪,數(shù)百萬失業(yè)者找工作也很艱難,。經(jīng)濟(jì)是在恢復(fù),但并不是所有人都能夠感覺到,。

為了幫助《財富》雜志讀者更深入了解經(jīng)濟(jì)形勢和發(fā)展方向,,下面來分析危機期間一直跟蹤的8項經(jīng)濟(jì)指標(biāo):

疫情中的封鎖對GDP造成了巨大損失,。今年一季度,GDP年度增長率下降5%,,二季度GDP下降31.4%,創(chuàng)下歷史紀(jì)錄,。在此期間,全球各地的經(jīng)濟(jì)學(xué)家陷入恐慌,,擔(dān)心美國以及其他地區(qū)是否面臨新一輪經(jīng)濟(jì)蕭條。

在各州開始放松封鎖后,,美國經(jīng)濟(jì)從大幅收縮迅速轉(zhuǎn)到高速增長,。根據(jù)美國經(jīng)濟(jì)分析局(U.S. Bureau of Economic Analysis)公布的經(jīng)濟(jì)數(shù)據(jù),,三季度美國GDP同比增長33%。

但GDP總量仍然在下降。前兩個季度,美國的年化GDP從21.8萬億美元下降到19.5萬億美元,。三季度回升到約21.2萬億美元,。預(yù)計2021年某個時點將全面反彈,。

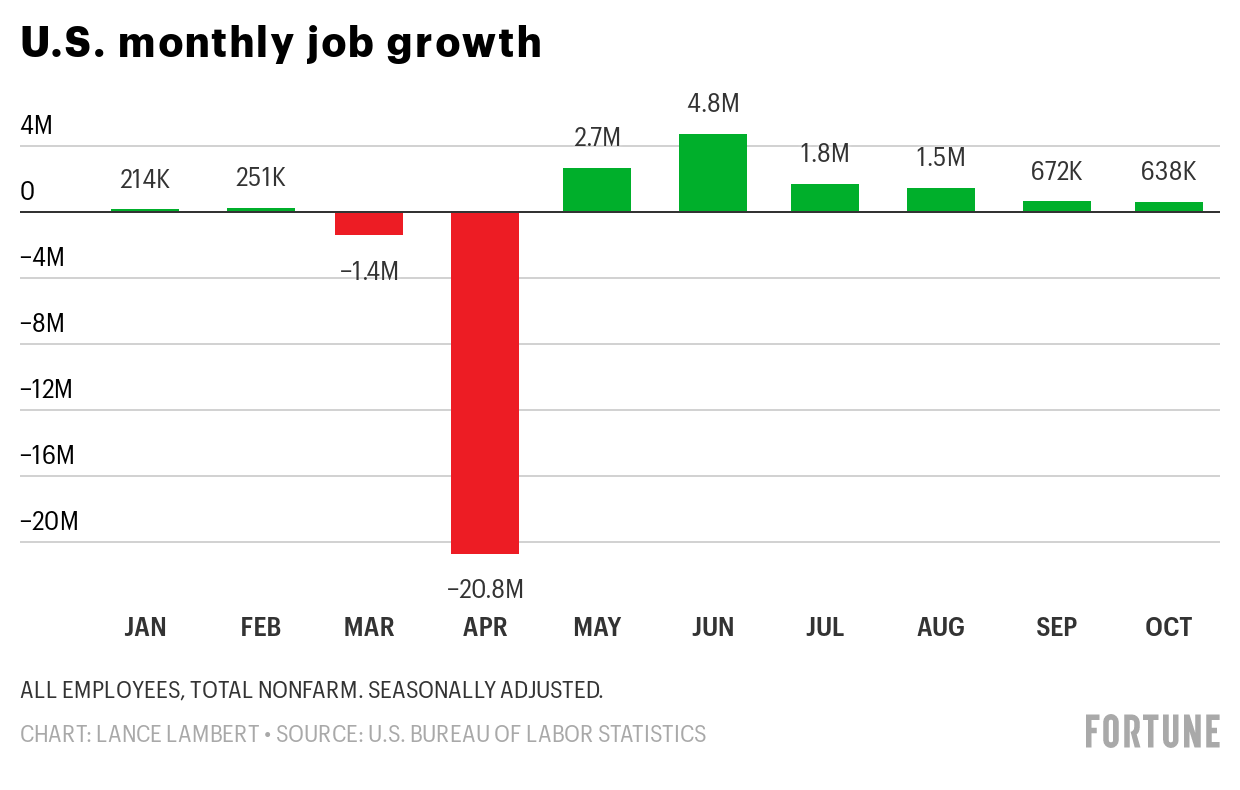

盡管美國GDP接近V型復(fù)蘇,,就業(yè)情況卻并非如此。10月美國新增就業(yè)63.8萬,。如果按照該速度繼續(xù),需要16個月的時間,,也就是到2022年才可以恢復(fù)疫情經(jīng)濟(jì)衰退期間失去的工作崗位,。但這還不是最糟的消息,。多數(shù)經(jīng)濟(jì)學(xué)家預(yù)計就業(yè)速度將進(jìn)一步放緩,也就是說可能要等到2023年或更久之后就業(yè)才能夠全面復(fù)蘇。

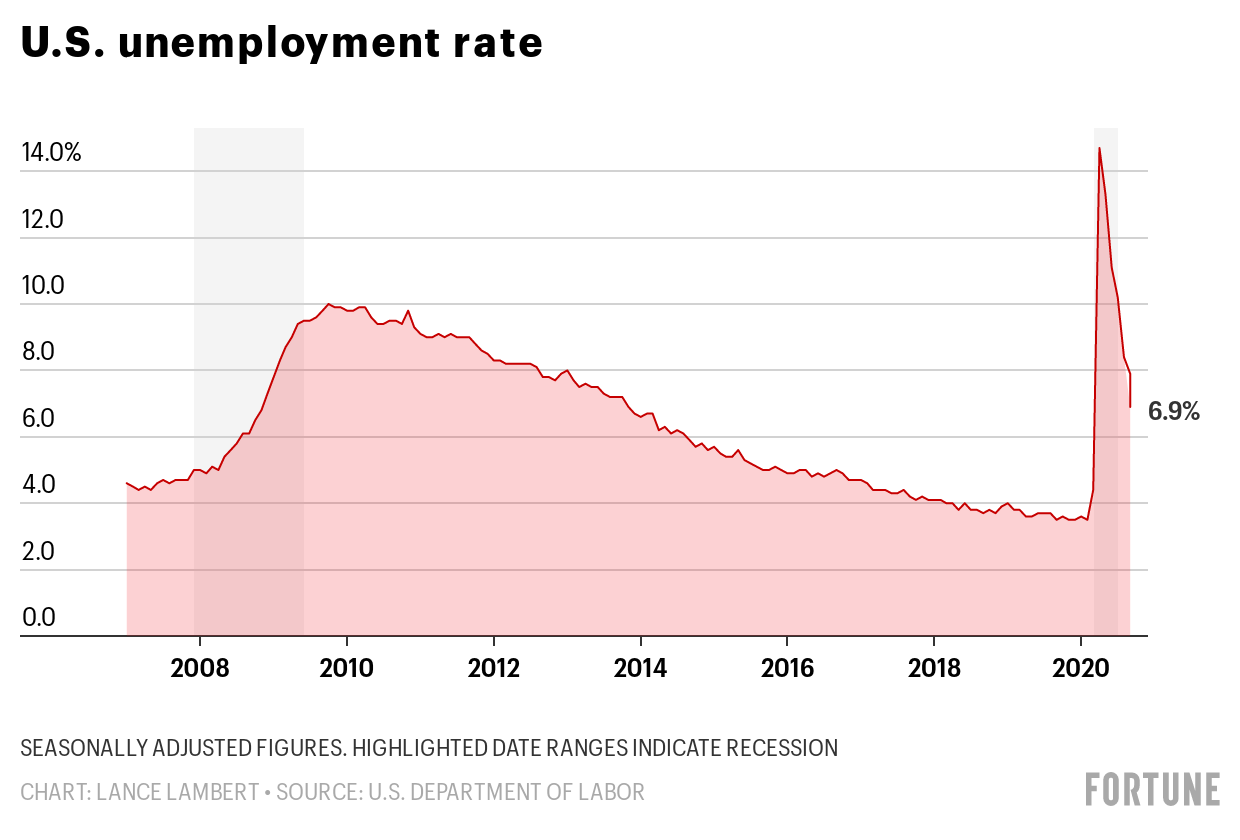

3月停產(chǎn)之后,,美國經(jīng)濟(jì)遭逢史上最嚴(yán)重收縮。失業(yè)率從2月的3.5%躍升至4月的14.7%,,為1940年以來最高,。

此后的復(fù)蘇比很多經(jīng)濟(jì)學(xué)家預(yù)期中更快。截至10月的失業(yè)率為6.9%,,比起5月國會預(yù)算辦公室(Congressional Budget Office)預(yù)測2021年年底9.5%的失業(yè)率好很多,。

在大衰退期間,,2009年10月的失業(yè)率達(dá)到10%的峰值,。直到2013年11月,失業(yè)率才回落到6.9%,。因此,,以近期歷史經(jīng)驗來看,復(fù)蘇相當(dāng)迅速,。

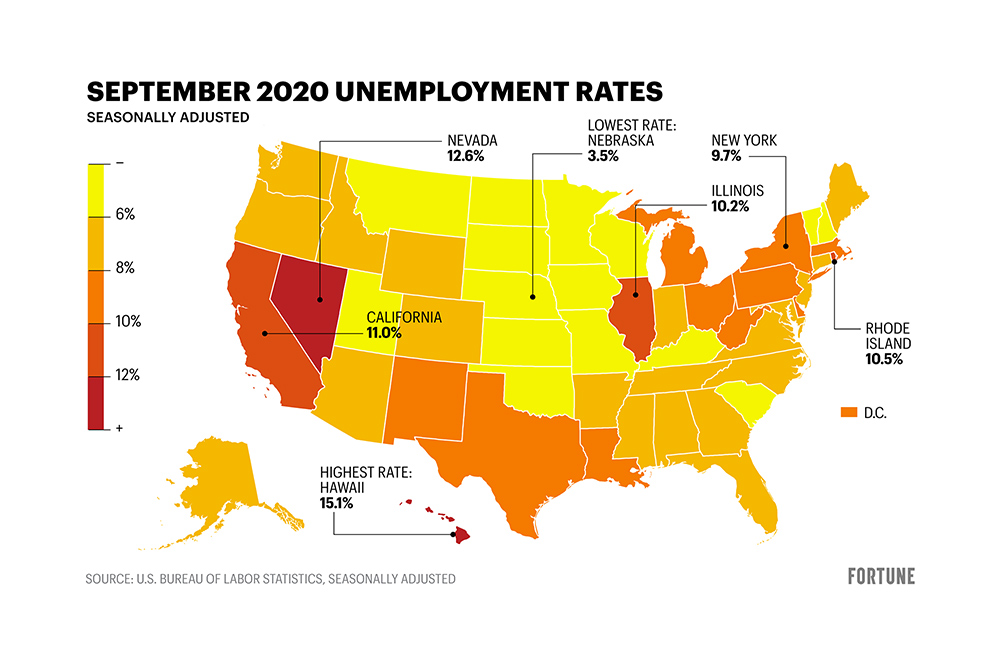

不過本輪經(jīng)濟(jì)復(fù)蘇絕非一帆風(fēng)順。9月內(nèi)布拉斯加州失業(yè)率為3.5%,,內(nèi)華達(dá)州失業(yè)率達(dá)12.6%,。

為何差異如此明顯?很大程度上取決于各州經(jīng)濟(jì)中崗位構(gòu)成,??梢钥纯绰糜螛I(yè)重振內(nèi)華達(dá)州的情況,失業(yè)率從2月的3.8%飆升至4月的30.1%,。雖然后來內(nèi)華達(dá)州的失業(yè)率回調(diào)至12.6%,,但在拉斯維加斯旅游業(yè)恢復(fù)之前很難徹底扭轉(zhuǎn)。而在疫情控制住之前,,旅游業(yè)想恢復(fù)幾乎不可能,。

與此同時,愛荷華和內(nèi)布拉斯加等農(nóng)業(yè)經(jīng)濟(jì)比例較高的州的復(fù)蘇速度更快,。

失業(yè)率持續(xù)下降標(biāo)志著經(jīng)濟(jì)從衰退走向增長,但失業(yè)率數(shù)據(jù)嚴(yán)重低估了失業(yè)情況,。主要原因是美國勞工統(tǒng)計局(Bureau of Labor Statistics)計算官方失業(yè)率的方式。只有失業(yè)后正在找新工作的人才能算失業(yè)者,。如果失業(yè)者不找工作,,就不會算在勞動力市場之內(nèi),。(失業(yè)率計算方法是美國失業(yè)人數(shù)除以勞動力總?cè)藬?shù)。)

疫情期間就屬于此類情況,數(shù)百萬美國人失業(yè)后重新找工作之前,,選擇在家等疫情過去,,等居家隔離令解除,,要么就在家陪著孩子上網(wǎng)課,??傮w而言,勞動力從2月的1.645億下降到4月的1.565億,。此后回升到1.609億人,但還是減少了360萬人,。

據(jù)《財富》雜志估算,,如果360萬尚未重返勞動力市場的失業(yè)人口也統(tǒng)計在內(nèi),那么10月《財富》雜志認(rèn)為的“實際”失業(yè)率應(yīng)該為8.9%,,遠(yuǎn)高于勞工統(tǒng)計局公布的6.9%官方失業(yè)率,。

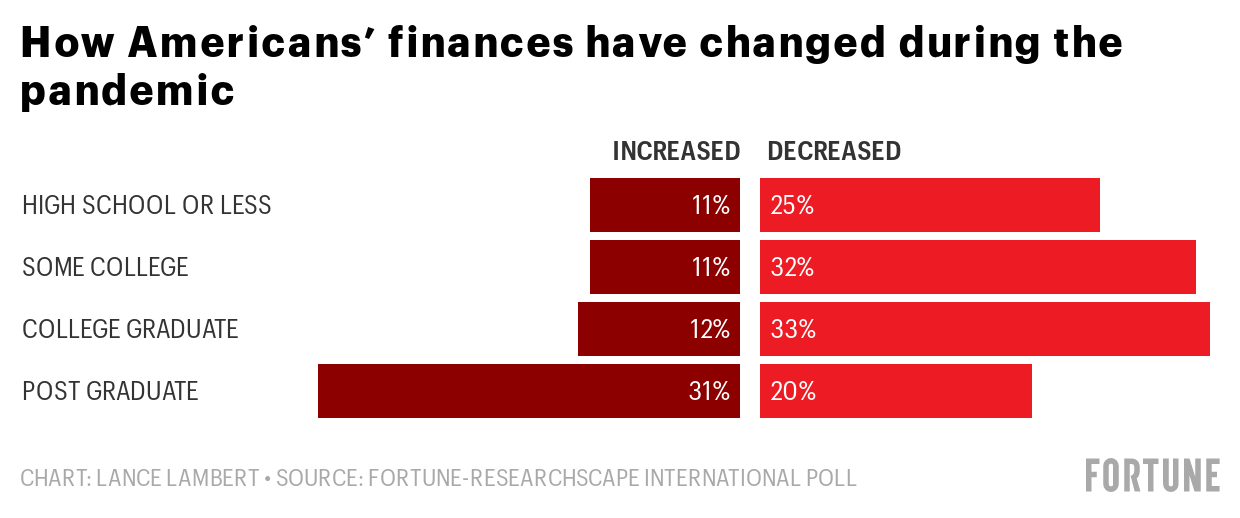

疫情期間,美國人財務(wù)狀況如何變化,。圖片來源:《財富》-Researchscape International調(diào)查

一部分美國人努力維持生計之際,,另一些躲過裁員的人財務(wù)狀況則更好,主要是因為省下了通勤,、外出就餐或旅游的錢,。10月3日至10月19日,,《財富》雜志與Researchscape International對3133名美國成年人進(jìn)行了調(diào)查,結(jié)果顯示在擁有研究生學(xué)位的美國人中,,31%的人表示財務(wù)狀況有所改善,,而高中及以下學(xué)歷的人當(dāng)中只有11%表示經(jīng)濟(jì)狀況更好,而這類人群從事受疫情影響最嚴(yán)重領(lǐng)域工作的可能性更大,。

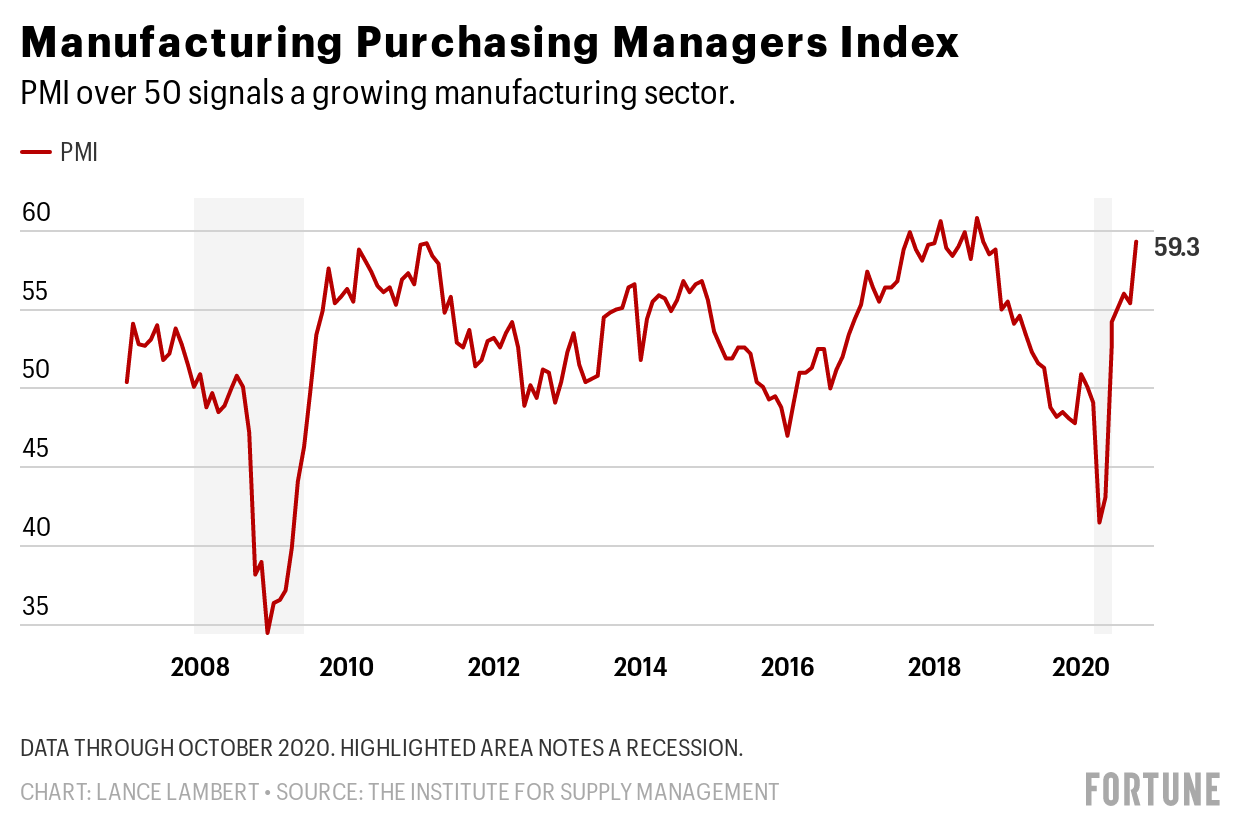

之前的大衰退曾經(jīng)重創(chuàng)制造業(yè),但本次制造業(yè)卻是亮點之一,。美國供應(yīng)管理協(xié)會(Institute for Supply Management)公布10月的采購經(jīng)理人指數(shù)(PMI)為59.3,,高于4月的低點41.5。PMI低于50意味著制造業(yè)正在收縮,,PMI超過50則意味著制造業(yè)已經(jīng)連續(xù)五個月實現(xiàn)增長,。

在春季停工期間,多家工廠關(guān)停,,導(dǎo)致普遍短缺,。而在不久的將來,制造商將忙著補上需求,。

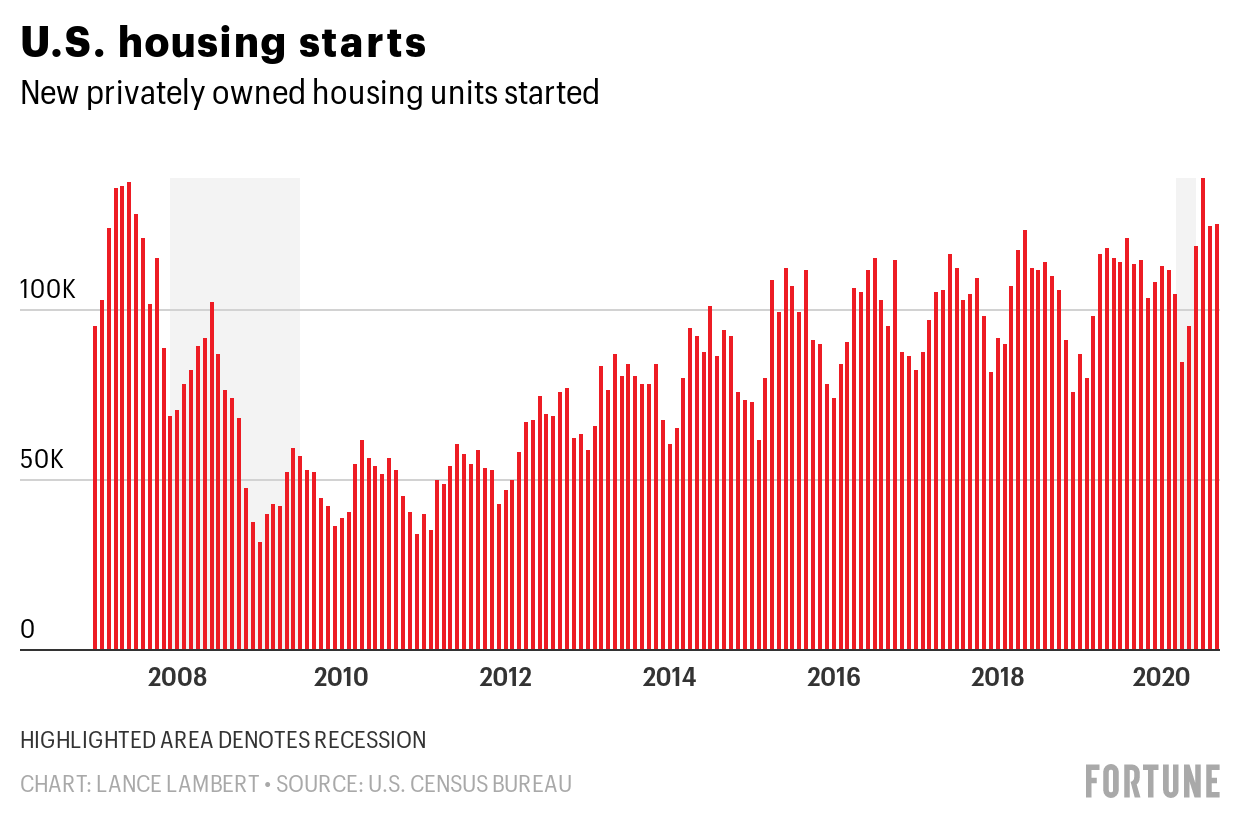

地產(chǎn)開發(fā)商上次如此忙碌還是喬治·W·布什執(zhí)掌白宮的時候??傮w計算,9月建筑工人開始建造140萬套新房子,,比去年同期增長了11%,。由于地產(chǎn)開發(fā)反彈太強勁,導(dǎo)致木材短缺狀況加劇,。一段時間里,,木材價格飆升了130%。

為何房市如此穩(wěn)???首先,利率下跌,、股市創(chuàng)紀(jì)錄上漲以及富裕的城市居民購買第二套住房,,都可以提振房地產(chǎn)行業(yè)。這也與人口統(tǒng)計學(xué)相關(guān),。千禧一代出生人數(shù)最多的年份是1989年至1993年,,隨著這群人陸續(xù)到30歲,也就是購房高峰期,,推動了房地產(chǎn)五年繁榮,。千禧一代涌入推動了房地產(chǎn)價格上漲,。

總之,通過經(jīng)濟(jì)數(shù)據(jù)能夠看到經(jīng)濟(jì)發(fā)展?fàn)顩r,。而從當(dāng)前數(shù)據(jù)可以看出什么,?其實是兩次復(fù)蘇的故事,其中一些人,、某些職業(yè)和地區(qū)迅速恢復(fù)(或者從一開始就不是很痛苦),,另一些人還在艱難跋涉,努力挽回疫情中失去的財富,。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

雖然在疫苗方面獲得積極進(jìn)展,,但新冠疫情遠(yuǎn)未結(jié)束。

不過在經(jīng)濟(jì)方面有持續(xù)改善跡象,。隨著春夏兩季各州陸續(xù)放松封鎖,,美國經(jīng)濟(jì)從歷史上的最嚴(yán)重收縮轉(zhuǎn)變?yōu)閺?fù)蘇最迅速的經(jīng)濟(jì)體之一。事實上,,4月美國失業(yè)率達(dá)到14.7%的高點后,,到10月已經(jīng)降至6.9%。

然而,,美國經(jīng)濟(jì)并未走出困境,。隨著受疫情影響嚴(yán)重的企業(yè)現(xiàn)金耗盡,越來越多的企業(yè)瀕臨倒閉,。而且在疲軟的勞動力市場中,,在職者很難加薪,數(shù)百萬失業(yè)者找工作也很艱難,。經(jīng)濟(jì)是在恢復(fù),,但并不是所有人都能夠感覺到。

為了幫助《財富》雜志讀者更深入了解經(jīng)濟(jì)形勢和發(fā)展方向,,下面來分析危機期間一直跟蹤的8項經(jīng)濟(jì)指標(biāo):

疫情中的封鎖對GDP造成了巨大損失,。今年一季度,GDP年度增長率下降5%,,二季度GDP下降31.4%,,創(chuàng)下歷史紀(jì)錄。在此期間,,全球各地的經(jīng)濟(jì)學(xué)家陷入恐慌,,擔(dān)心美國以及其他地區(qū)是否面臨新一輪經(jīng)濟(jì)蕭條。

在各州開始放松封鎖后,,美國經(jīng)濟(jì)從大幅收縮迅速轉(zhuǎn)到高速增長,。根據(jù)美國經(jīng)濟(jì)分析局(U.S. Bureau of Economic Analysis)公布的經(jīng)濟(jì)數(shù)據(jù),三季度美國GDP同比增長33%,。

但GDP總量仍然在下降,。前兩個季度,,美國的年化GDP從21.8萬億美元下降到19.5萬億美元。三季度回升到約21.2萬億美元,。預(yù)計2021年某個時點將全面反彈,。

盡管美國GDP接近V型復(fù)蘇,就業(yè)情況卻并非如此,。10月美國新增就業(yè)63.8萬,。如果按照該速度繼續(xù),需要16個月的時間,,也就是到2022年才可以恢復(fù)疫情經(jīng)濟(jì)衰退期間失去的工作崗位,。但這還不是最糟的消息。多數(shù)經(jīng)濟(jì)學(xué)家預(yù)計就業(yè)速度將進(jìn)一步放緩,,也就是說可能要等到2023年或更久之后就業(yè)才能夠全面復(fù)蘇,。

3月停產(chǎn)之后,美國經(jīng)濟(jì)遭逢史上最嚴(yán)重收縮,。失業(yè)率從2月的3.5%躍升至4月的14.7%,,為1940年以來最高。

此后的復(fù)蘇比很多經(jīng)濟(jì)學(xué)家預(yù)期中更快,。截至10月的失業(yè)率為6.9%,,比起5月國會預(yù)算辦公室(Congressional Budget Office)預(yù)測2021年年底9.5%的失業(yè)率好很多。

在大衰退期間,,2009年10月的失業(yè)率達(dá)到10%的峰值,。直到2013年11月,失業(yè)率才回落到6.9%,。因此,,以近期歷史經(jīng)驗來看,復(fù)蘇相當(dāng)迅速,。

不過本輪經(jīng)濟(jì)復(fù)蘇絕非一帆風(fēng)順。9月內(nèi)布拉斯加州失業(yè)率為3.5%,,內(nèi)華達(dá)州失業(yè)率達(dá)12.6%,。

為何差異如此明顯?很大程度上取決于各州經(jīng)濟(jì)中崗位構(gòu)成,??梢钥纯绰糜螛I(yè)重振內(nèi)華達(dá)州的情況,失業(yè)率從2月的3.8%飆升至4月的30.1%,。雖然后來內(nèi)華達(dá)州的失業(yè)率回調(diào)至12.6%,,但在拉斯維加斯旅游業(yè)恢復(fù)之前很難徹底扭轉(zhuǎn)。而在疫情控制住之前,,旅游業(yè)想恢復(fù)幾乎不可能,。

與此同時,,愛荷華和內(nèi)布拉斯加等農(nóng)業(yè)經(jīng)濟(jì)比例較高的州的復(fù)蘇速度更快。

失業(yè)率持續(xù)下降標(biāo)志著經(jīng)濟(jì)從衰退走向增長,,但失業(yè)率數(shù)據(jù)嚴(yán)重低估了失業(yè)情況,。主要原因是美國勞工統(tǒng)計局(Bureau of Labor Statistics)計算官方失業(yè)率的方式。只有失業(yè)后正在找新工作的人才能算失業(yè)者,。如果失業(yè)者不找工作,,就不會算在勞動力市場之內(nèi)。(失業(yè)率計算方法是美國失業(yè)人數(shù)除以勞動力總?cè)藬?shù),。)

疫情期間就屬于此類情況,,數(shù)百萬美國人失業(yè)后重新找工作之前,選擇在家等疫情過去,,等居家隔離令解除,,要么就在家陪著孩子上網(wǎng)課??傮w而言,,勞動力從2月的1.645億下降到4月的1.565億。此后回升到1.609億人,,但還是減少了360萬人,。

據(jù)《財富》雜志估算,如果360萬尚未重返勞動力市場的失業(yè)人口也統(tǒng)計在內(nèi),,那么10月《財富》雜志認(rèn)為的“實際”失業(yè)率應(yīng)該為8.9%,,遠(yuǎn)高于勞工統(tǒng)計局公布的6.9%官方失業(yè)率。

一部分美國人努力維持生計之際,,另一些躲過裁員的人財務(wù)狀況則更好,,主要是因為省下了通勤、外出就餐或旅游的錢,。10月3日至10月19日,,《財富》雜志與Researchscape International對3133名美國成年人進(jìn)行了調(diào)查,結(jié)果顯示在擁有研究生學(xué)位的美國人中,,31%的人表示財務(wù)狀況有所改善,,而高中及以下學(xué)歷的人當(dāng)中只有11%表示經(jīng)濟(jì)狀況更好,而這類人群從事受疫情影響最嚴(yán)重領(lǐng)域工作的可能性更大,。

之前的大衰退曾經(jīng)重創(chuàng)制造業(yè),,但本次制造業(yè)卻是亮點之一。美國供應(yīng)管理協(xié)會(Institute for Supply Management)公布10月的采購經(jīng)理人指數(shù)(PMI)為59.3,,高于4月的低點41.5,。PMI低于50意味著制造業(yè)正在收縮,PMI超過50則意味著制造業(yè)已經(jīng)連續(xù)五個月實現(xiàn)增長,。

在春季停工期間,,多家工廠關(guān)停,,導(dǎo)致普遍短缺。而在不久的將來,,制造商將忙著補上需求,。

地產(chǎn)開發(fā)商上次如此忙碌還是喬治·W·布什執(zhí)掌白宮的時候??傮w計算,,9月建筑工人開始建造140萬套新房子,比去年同期增長了11%,。由于地產(chǎn)開發(fā)反彈太強勁,,導(dǎo)致木材短缺狀況加劇。一段時間里,,木材價格飆升了130%,。

為何房市如此穩(wěn)健,?首先,,利率下跌、股市創(chuàng)紀(jì)錄上漲以及富裕的城市居民購買第二套住房,,都可以提振房地產(chǎn)行業(yè),。這也與人口統(tǒng)計學(xué)相關(guān)。千禧一代出生人數(shù)最多的年份是1989年至1993年,,隨著這群人陸續(xù)到30歲,,也就是購房高峰期,推動了房地產(chǎn)五年繁榮,。千禧一代涌入推動了房地產(chǎn)價格上漲,。

總之,通過經(jīng)濟(jì)數(shù)據(jù)能夠看到經(jīng)濟(jì)發(fā)展?fàn)顩r,。而從當(dāng)前數(shù)據(jù)可以看出什么,?其實是兩次復(fù)蘇的故事,其中一些人,、某些職業(yè)和地區(qū)迅速恢復(fù)(或者從一開始就不是很痛苦),,另一些人還在艱難跋涉,努力挽回疫情中失去的財富,。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

Even with positive developments on the vaccine front, the pandemic is far from over.

But on the economic front, we’re continuing to see improvement. As states eased lockdown restrictions in the spring and summer, the economy switched from the worst contraction in history to one of the fastest recoveries. Indeed, the unemployment rate that hit a peak of 14.7% in April has since come down to 6.9% as of October.

That said, we aren’t out of the woods yet. More business failures are on the way as companies hardest hit by the pandemic run out of cash. Not to mention the weak labor market makes it hard for the employed to get raises and the millions of unemployed Americans to find a paycheck. We’re in recovery, but not all of us are feeling it.

To give Fortune readers a better understanding of where the economy is and where it’s heading, here’s a look at eight economic measurements we’ve been tracking throughout the crisis:

The lockdowns took a massive toll on gross domestic product. In the first quarter, GDP declined 5% on an annualized basis, followed by a record 31.4% annualized GDP decline in the second quarter. During that period economists around the world were in a panic and questioning if the United States—as well as the rest of the world—was on the cusp of an economic depression.

Once states began to ease lockdown restrictions, the U.S. economy sprung from deep contraction to high growth. In the third quarter, from July to September, GDP climbed 33.1% on an annualized basis, according to data released by the U.S. Bureau of Economic Analysis.

But GDP is still down. Over the course of the first two quarters, annualized U.S. GDP fell from $21.8 trillion to $19.5 trillion. In the third quarter that swung back up to about $21.2 trillion. It’s expected to fully rebound sometime in 2021.

While GDP is seeing something closer to a V-shaped recovery—bouncing back nearly as fast as it fell—that isn’t the case for U.S. employment. The U.S. added 638,000 jobs in October. If that pace were to continue, it would take over 16 months—into 2022—to recover all the jobs lost during the COVID-19 recession. And that’s not even the bad news. Most economists actually expect that pace of hiring to slow further, meaning a full employment recovery could take until 2023 or longer.

The economic contraction following the March shutdowns was the sharpest in U.S. history: The jobless rate jumped from 3.5% in February—a 50-year low—to 14.7% in April——the highest level since 1940.

We’ve since shifted into a recovery that is moving faster than many economists expected. The unemployment rate stands at 6.9% as of October. That beats the timeline the Congressional Budget Office projected in May, when it forecasted a 9.5% unemployment rate at the end of 2021.

During the Great Recession era, the unemployment rate peaked at 10% in October 2009. And it didn’t make it back down to 6.9% until November 2013. So by recent historical standards, this recovery is moving at a swift pace.

But this economic recovery is anything but even. While the unemployment rate in September in Nebraska sits at 3.5%, Nevada has a jobless rate of 12.6%.

How did these economies get so divided? A lot of it boils down to what types of jobs make up each state’s economy. Look no further than tourism-heavy Nevada which saw its jobless rate soar from 3.8% in February to a staggering 30.1% in April. While Nevada has since improved to a 12.6% jobless rate, it will struggle to fully recover until the Las Vegas tourism business has returned to normal—something that is unlikely to happen until the pandemic is under control.

Meanwhile, rural agriculture-heavy economies like Iowa and Nebraska are recovering at a much faster clip.

While the sustained drop in the unemployment rate signals an economy moving from recession to growth, it’s also severely undercounting joblessness. It boils down to how the Bureau of Labor Statistics (BLS) calculates the official unemployment rate: Only out-of-work Americans who are searching for new positions are categorized as unemployed. If the jobless aren’t searching, they get thrown out of the civilian labor force altogether. (The unemployment rate is calculated by dividing the number of unemployedAmericans by the civilian labor force count).

That’s been the case during the pandemic, with millions of jobless Americans choosing to wait out the virus and stay-at-home order before starting their job search, or to stay home with their kids who have not resumed in-person learning. Overall the civilian labor force declined from 164.5 million in February to 156.5 million in April. It has since climbed up to 160.9 million—but it’s still down 3.6 million.

If the 3.6 million jobless Americans who’ve yet to return to the workforce were to be included in the unemployment rate—what Fortune considers the “real” unemployment rate—it would sit at 8.9% in October, Fortunecalculates. That’s well above the 6.9% official unemployment rate calculated by the BLS.

While some Americans are struggling to make ends meet, others who have escaped layoffs are actually better off financially as they save money that would have been spent on commuting, eating out, or traveling. And that divide is happening along class lines: Among Americans with a postgraduate degree, 31% say their finances have improved, finds a Fortune–Researchscape International poll of 3,133 U.S. adults conducted between Oct. 3 and Oct. 19. While only 11% of U.S. adults with a high school degree or less—who are more likely to work in fields hardest hit by the pandemic—say they’re financially better off now.

While the Great Recession hammered manufacturing, this time around the sector is among our bright spots. The Institute for Supply Management’s Purchasing Managers Index (PMI) came in at 59.3 in October, up from its 41.5 bottom in April. A PMI below 50 signals a contracting manufacturing sector, while a rate over 50 signals growth—something we’ve achieved for five consecutive months.

The spring lockdowns closed numerous factories, which led to widespread shortages. In the immediate future, manufacturers are busy making up for those shortfalls.

The last time homebuilders were this busy George W. Bush was in the White House. In total, construction crews started working on 1.4 million new homes in September, up 11% from a year prior. The rebound in homebuilding is so strong that it has worsened the national lumber shortage; for a period lumber prices spiked 130%.

How can housing be so robust? For starters the sector has been helped by falling interest rates, a record stock market, and wealthy city dwellers buying up second homes. But it’s also demographics. The biggest years for millennial births ranged from 1989 to 1993. And we’re currently amid the five-year period when all these young millennials will hit their thirties—the peak years for homebuying. That rush of millennials into the market is causing real estate to push upward.

Overall, economic data is most helpful to piece together a story about the economy. What’s this one telling us? It’s truly a tale of two recoveries whereby some people, professions, and geographic areas have recovered swiftly (or never felt too much pain in the first place), while others are mired in a long slog, trying to recapture the gains so swiftly lost to a deadly pandemic.