Tattooed Mom酒吧內(nèi)部從地板到天花板上,,都畫滿了涂鴉,。這家位于費城南街的酒吧已經(jīng)有23年歷史,但它卻無法阻止追求時髦的主顧們變得精明起來,。雖然有忠實顧客選擇了外賣用餐,,但酒吧所面臨的問題是涂鴉難以掩蓋的。酒吧無法盈利,,銷售額比疫情之前下滑了70%,。羅伯特?佩里表示,他的酒吧會維持下去,,但它附近的許多商鋪卻難以為繼,。佩里表示:“在一個街區(qū)內(nèi)就已經(jīng)有六家餐廳倒閉了。你每周都能聽說更多商鋪倒閉的消息,,這讓我很傷心,。”

一些傳統(tǒng)銀行業(yè)者可能很快就會有同樣的感受,。疫情導(dǎo)致酒吧,、健身房,、酒店等商戶生意慘淡,這可能會給商業(yè)地產(chǎn)承租人帶來危機,,導(dǎo)致數(shù)十億美元的貸款出現(xiàn)變數(shù),。明尼阿波利斯聯(lián)邦儲備銀行行長尼爾?卡什卡利告訴《財富》雜志,商業(yè)地產(chǎn)是最脆弱的金融部門,,可能會對整個金融體系造成沖擊,。卡什卡利表示:“數(shù)以千計的小企業(yè)已經(jīng)倒閉……這會波及到商業(yè)地產(chǎn)市場,,并影響到銀行業(yè)?!?/p>

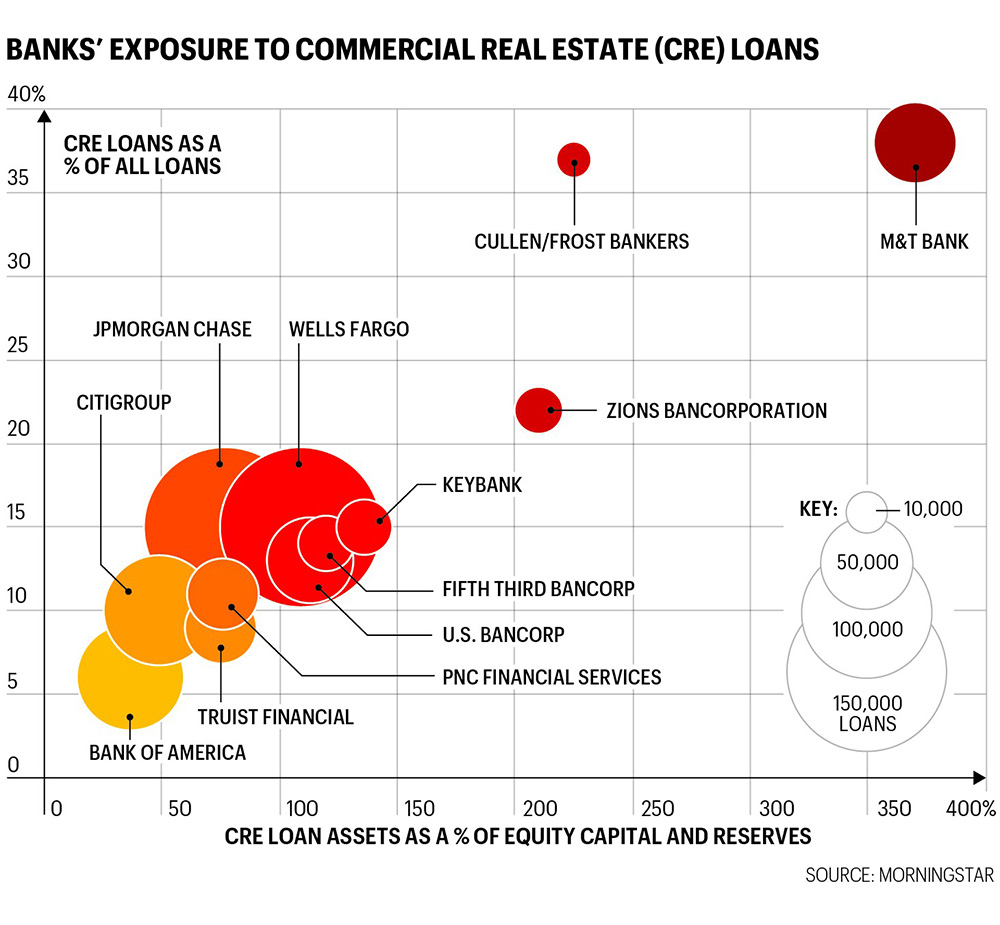

中小銀行面臨最大的風(fēng)險,。如下圖所示,據(jù)Morningstar統(tǒng)計,,在美國銀行和摩根大通,,商業(yè)地產(chǎn)貸款分別僅占其貸款總額的6%和15%。但在位于大水牛城的M&T銀行和來自德克薩斯的庫倫佛寺銀行,,商業(yè)地產(chǎn)貸款所占的比例分別高達(dá)38%和37%,。庫倫佛寺銀行在1月份進(jìn)行了近20年來的首次裁員。這些銀行都在為貸款違約做準(zhǔn)備:2020年,,M&T銀行將信貸損失風(fēng)險計提增加到8億美元,,較前一年提高了355%。

任何危機的醞釀時間都可持續(xù)數(shù)年,。除了酒店以外,,到目前為止,商業(yè)地產(chǎn)并沒有出現(xiàn)異常的低價拋售潮,。但房地產(chǎn)私募股權(quán)基金Corigin的總裁格雷戈?格利森認(rèn)為,,銀行和業(yè)主為了擺脫空置資產(chǎn),會低價出售更多商業(yè)地產(chǎn),。分析公司CoStar預(yù)測,,到2022年,低價拋售的商業(yè)地產(chǎn)價值將達(dá)到1,260億美元,,到2025年將增加到超過3,200億美元,。如果在疫情結(jié)束之后,居家辦公趨勢繼續(xù)存在,,將使辦公樓市場陷入危機,,未來商業(yè)地產(chǎn)的前景可能更糟糕?!敦敻弧放c德勤在12月合作開展的CEO調(diào)查顯示,,到目前為止,,有75%的公司計劃租用更小的辦公室。

但卡什卡利認(rèn)為,,只要銀行提高對貸款組合的警惕,,商業(yè)地產(chǎn)風(fēng)險依舊是可控的。他建議關(guān)注全國疫苗接種的推進(jìn)情況:控制病毒需要的時間越長,,就會有更多公司停業(yè),,銀行所面臨的風(fēng)險就會越高。(財富中文網(wǎng))

本文發(fā)表于2021年2月/3月的《財富》雜志,,文章標(biāo)題為《疫情導(dǎo)致的商業(yè)地產(chǎn)危機或?qū)⒉般y行系統(tǒng)》,。

翻譯:劉進(jìn)龍

審校:汪皓

在俄亥俄州克利夫蘭的底特律-肖爾韋,一家被永久關(guān)閉的餐廳酒吧,。攝影:Dustin Franz —— 彭博社/蓋蒂圖片社

Tattooed Mom酒吧內(nèi)部從地板到天花板上,,都畫滿了涂鴉。這家位于費城南街的酒吧已經(jīng)有23年歷史,,但它卻無法阻止追求時髦的主顧們變得精明起來,。雖然有忠實顧客選擇了外賣用餐,但酒吧所面臨的問題是涂鴉難以掩蓋的,。酒吧無法盈利,,銷售額比疫情之前下滑了70%。羅伯特?佩里表示,,他的酒吧會維持下去,,但它附近的許多商鋪卻難以為繼。佩里表示:“在一個街區(qū)內(nèi)就已經(jīng)有六家餐廳倒閉了,。你每周都能聽說更多商鋪倒閉的消息,,這讓我很傷心?!?/p>

一些傳統(tǒng)銀行業(yè)者可能很快就會有同樣的感受,。疫情導(dǎo)致酒吧、健身房,、酒店等商戶生意慘淡,,這可能會給商業(yè)地產(chǎn)承租人帶來危機,導(dǎo)致數(shù)十億美元的貸款出現(xiàn)變數(shù),。明尼阿波利斯聯(lián)邦儲備銀行行長尼爾?卡什卡利告訴《財富》雜志,,商業(yè)地產(chǎn)是最脆弱的金融部門,可能會對整個金融體系造成沖擊,??ㄊ部ɡ硎荆骸皵?shù)以千計的小企業(yè)已經(jīng)倒閉……這會波及到商業(yè)地產(chǎn)市場,并影響到銀行業(yè),?!?/p>

中小銀行面臨最大的風(fēng)險,。如下圖所示,據(jù)Morningstar統(tǒng)計,,在美國銀行和摩根大通,,商業(yè)地產(chǎn)貸款分別僅占其貸款總額的6%和15%。但在位于大水牛城的M&T銀行和來自德克薩斯的庫倫佛寺銀行,,商業(yè)地產(chǎn)貸款所占的比例分別高達(dá)38%和37%,。庫倫佛寺銀行在1月份進(jìn)行了近20年來的首次裁員。這些銀行都在為貸款違約做準(zhǔn)備:2020年,,M&T銀行將信貸損失風(fēng)險計提增加到8億美元,,較前一年提高了355%。

任何危機的醞釀時間都可持續(xù)數(shù)年,。除了酒店以外,,到目前為止,商業(yè)地產(chǎn)并沒有出現(xiàn)異常的低價拋售潮,。但房地產(chǎn)私募股權(quán)基金Corigin的總裁格雷戈?格利森認(rèn)為,銀行和業(yè)主為了擺脫空置資產(chǎn),,會低價出售更多商業(yè)地產(chǎn),。分析公司CoStar預(yù)測,到2022年,,低價拋售的商業(yè)地產(chǎn)價值將達(dá)到1,260億美元,,到2025年將增加到超過3,200億美元。如果在疫情結(jié)束之后,,居家辦公趨勢繼續(xù)存在,,將使辦公樓市場陷入危機,未來商業(yè)地產(chǎn)的前景可能更糟糕,?!敦敻弧放c德勤在12月合作開展的CEO調(diào)查顯示,到目前為止,,有75%的公司計劃租用更小的辦公室,。

但卡什卡利認(rèn)為,只要銀行提高對貸款組合的警惕,,商業(yè)地產(chǎn)風(fēng)險依舊是可控的,。他建議關(guān)注全國疫苗接種的推進(jìn)情況:控制病毒需要的時間越長,就會有更多公司停業(yè),,銀行所面臨的風(fēng)險就會越高,。(財富中文網(wǎng))

本文發(fā)表于2021年2月/3月的《財富》雜志,文章標(biāo)題為《疫情導(dǎo)致的商業(yè)地產(chǎn)危機或?qū)⒉般y行系統(tǒng)》,。

翻譯:劉進(jìn)龍

審校:汪皓

Floor-to-ceiling, the interior of Tattooed Mom is covered in graffiti. The bar, which has been open for 23 years on South Street in Philadelphia, doesn’t stop its hipster patrons from getting crafty. But even with its faithful clientele transitioning to takeout, Tattooed Mom has problems that can’t be painted over. It’s unprofitable, and sales remain down 70% from pre-pandemic levels. Robert Perry says his bar will survive, but many of its neighbors won’t. “Within a one-block radius there are six restaurants that are already gone,” he says. “Every week you read about new closures, and it breaks my heart.”

Some buttoned-down bankers could soon share his pain. As the pandemic wears down bars, gyms, hotels, and other businesses, it runs the risk of causing a commercial real estate (CRE) tenant crisis, which could put billions of dollars’ worth of loans in jeopardy. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, tells Fortune that CRE is the most vulnerable financial sector—with the potential to cause a shock to the system. “Thousands of small businesses have already or will go under?…?That rolls up into the commercial real estate market and rolls up into the banking sector,” Kashkari says.

Small to midsize banks face the greatest risk. At Bank of America and JPMorgan Chase, CRE makes up only 6% and 15% of all loans, respectively, according to Morningstar. But that figure is 38% at Buffalo-based M&T Bank and 37% at Texas’s Cullen/Frost Bankers—which in January conducted its first layoffs in nearly two decades. Banks like these are bracing for defaults: In 2020, M&T increased its provision for credit losses to $800 million, up 355% from the prior year.

Any crisis could take years to brew. Outside of hotels, distressed sales of commercial property aren’t abnormally high to date. But Greg Gleason, president of real estate private equity firm Corigin, says more such sales loom, as banks and owners unload vacant assets. Through 2022, analytics firm CoStar forecasts $126 billion in distressed CRE sales, with the total rising to over $320 billion by 2025. The outlook could be grimmer if work-from-home trends outlast the pandemic, creating trouble for office buildings. As of now, 75% of companies plan to use less office space in the future, according to a Fortune survey of CEOs in December in collaboration with Deloitte.

Still, Kashkari says the CRE risks should be manageable if banks are vigilant about their portfolios. Keep an eye on the vaccine rollout, he advises: The longer it takes to tame the virus, the more businesses will close—and the shakier some banks will look.

This article appears in the February/March 2021 issue of Fortune with the headline, "First bars, then banks?"