在投資領域,,強烈的情緒會左右人們的決策。2020年,,環(huán)境,、社會和治理(ESG)股票基金領域尤為如此,投資者對地球環(huán)保的激情,、擔憂和希望造就了這個業(yè)績創(chuàng)紀錄的年份,。

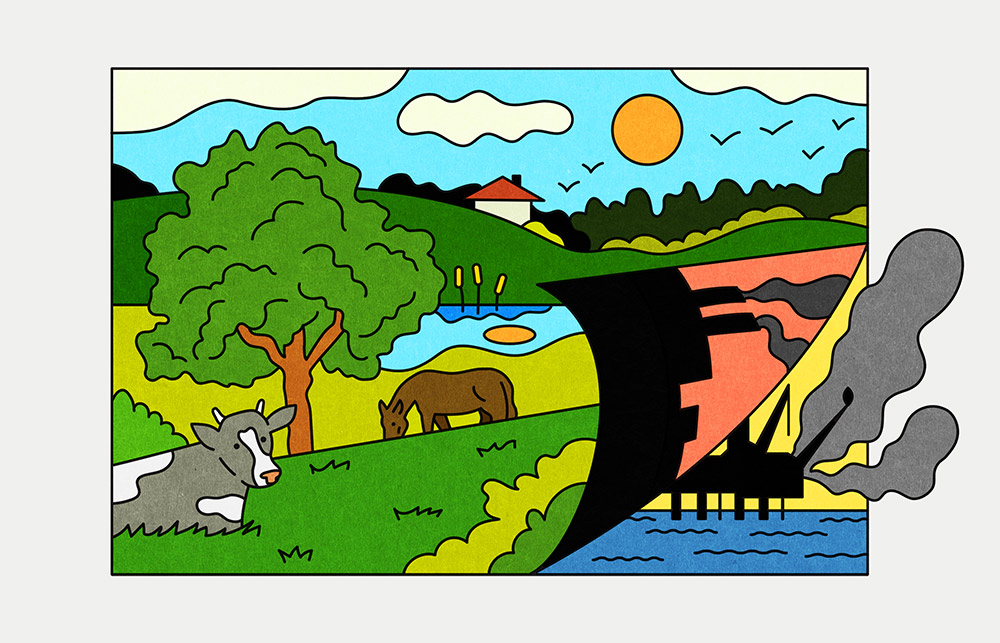

ESG基金致力于投資那些避免危害或從事公益事業(yè)的公司。隨著全球各國應對新冠疫情封鎖,、社會動蕩和生態(tài)災害,,資金流入這些基金的速度比破損油管漏油的速度還要快。Morningstar稱,,2020年,,新投資凈額達到了511億美元,是2019年記錄的兩倍多,。即便股票市場的表現(xiàn)出乎意料的好,,但ESG投資者的回報有過之而無不及:在美國,可持續(xù)基金的回報率中值高出傳統(tǒng)基金4%還要多,。

可持續(xù)與負責任投資論壇(Forum for Sustainable and Responsible Investment)稱,,這些數(shù)字在一定程度上反映了投資者將其資產(chǎn)與其價值進行匹配的長期趨勢:流入各類基金的約三分之一資金如今都會投向“可持續(xù)發(fā)展載體”,。(ESG基金通常貼著“可持續(xù)發(fā)展”的標簽,盡管有時候他們關注的更多是社會或治理問題而不是環(huán)境問題,。)然而,,這些潛在的社會改良公司當前面臨著一個困境:隨著ESG投資變得越發(fā)流行,越來越多的基金都在爭相為自己貼上這一標簽,,而且對于自身是否名副其實毫不在意,。

ESG咨詢公司KKS Advisors創(chuàng)始人的一份研究稱,超過6600支基金如今稱自己是“道德的”,,這一數(shù)值是2013年的兩倍,。在歐盟,依據(jù)3月開始生效的法規(guī),,以ESG導向自居的基金必須披露其策略到底如何幫助解決社會問題,。然而,美國沒有這類法規(guī),,辨別真?zhèn)蔚闹負匀痪吐涞搅送顿Y者的身上,。

因此,隨著這類基金群體的不斷發(fā)展壯大,,我們應如何加以分辨,?與任何基金一樣,一開始要評估其表現(xiàn)和費用,。為了進一步縮窄你的選項,,我們有必要了解行業(yè)的子門類,并弄清楚哪個門類與你的投資風格更契合,。Morningstar美國可持續(xù)性研究負責人瓊·海爾表示,,由于可持續(xù)性設計沒有既定的規(guī)則,因此基金采取了“一系列方式”,。投資者也可以采取這種方式,,混合或對標以下三種模式:

回避型

最基本的ESG方法專注于避免不良因素。大多數(shù)基金經(jīng)理都會關注某個特定的投資領域——例如美國大市值股票,,并忽視那些在特定ESG因素領域表現(xiàn)排名后三分之一的基金,,例如環(huán)境影響或雇員公平待遇。(這里有一整個專注于打造這類排名的子行業(yè),。)基金的招股說明書會解釋其經(jīng)理如何決定投資誰,,不投資誰。

一些ESG基金在投資時會刻意放棄不合格的股票并持有幾乎其他所有股票,。該領域的佼佼者是 Vanguard FTSE Social Index Fund Admiral Shares (VFTAX),。它會跟蹤FTSE4Good U.S. Select Index;在3月中旬,,該基金持有468支大市值美國股票,。去年該基金的回報率為23%,,相比之下,標普500指數(shù)的回報率為18%,,而且該基金的管理費更是低至0.14%,。

探索型

其他基金會更有選擇性地專注于非特定門類股票中的優(yōu)勝者。一些基金經(jīng)理不僅是積極的股票選擇者,,同時也是使用其股東投票權推動其所投公司變化的激進人士,。這些基金通常會發(fā)布“接洽報告”,并在報告中列出他們向公司管理層提出的種種問題,,及其代理投票活動的綜述,。一些基金會更進一步,發(fā)布影響力報告,,詳細列明了其投資策略如何打算帶來積極的影響,。Morningstar的海爾說,“這些報告應被視作最佳實踐”,,這是基金公司承諾完成其使命的標志,。(承諾的另一個標志:活躍的基金經(jīng)理應在ESG投資領域擁有豐富的經(jīng)驗。)

自2013年以來,,以“道德”自居的基金的數(shù)量翻了一番。

總部位于舊金山的Parnassus Investments是ESG股票選擇領域的資深公司,,而且Parnassus Core Equity Investor (PRBLX)基金自1992年成立以來一直都處于頂級表現(xiàn)陣營,,其平均年回報率為11.4%(2020年達到了21%)。聯(lián)合經(jīng)理托德·阿爾斯滕自2001年以來一直是基金的執(zhí)掌者,,而且其團隊既善于選股,,也熱衷于社會事業(yè)。例如,,Parnassus最近幫助說服了零食巨頭億滋國際 (Mondelez)使用更有利于回收的包裝,。

專家型

詹妮弗·肯寧是Align Impact的首席執(zhí)行官,該公司致力于與個人客戶和金融顧問合作,,打造可持續(xù)的資產(chǎn)組合,。她對富有激情的投資者所提的一條重要建議在于:與其研究整個ESG格局,不如專注于“你能夠實現(xiàn)的某件事情”,。ESG基金的大規(guī)模滲透,,尤其是ETF(交易所交易基金)也讓人們更容易專注于某個具體行業(yè):投資者可以專注于支持清潔技術(包括 iShares Global Clean Energy,ICLN等眾多選擇),;支持女性友好性公司(如:SPDR SSGA Gender Diversity Index, SHE),;甚至消除動物剝削,包括制造或銷售肉類產(chǎn)品的公司(如:U.S. Vegan Climate, VEGN),。

ESG基金在2020年的業(yè)績普遍跑贏大盤的原因在于,,其中沒有幾支基金持有化石燃料股票,,而這些股票在去年可謂是一蹶不振。然而,,清潔能源是一個范圍更小的關注點,,其長期愿景依然強勁。該領域有兩支頗有前景的ETF都由一名共同經(jīng)理人執(zhí)掌,,他就是有著14年ESG投資經(jīng)驗的資深人士皮特·哈巴德,,這兩支基金分別是Invesco Solar (TAN)和Invesco WilderHill Clean Energy (PBW)。TAN基金持有約50家主要專注于太陽能的公司,,該基金的20%分別流入了美國Enphase Energy公司和以色列SolarEdge Technologies公司,。PBW基金則投資更廣泛領域的能源公司。盡管其投資者在2020年的表現(xiàn)可能并不突出,,但當這兩支ETF的股價增幅超過200%時,,投資者便有可能繼續(xù)從日漸更加注重環(huán)保動議的經(jīng)濟中獲益。(財富中文網(wǎng))

本文刊載于《財富》雜志2021年4/5月刊,。

譯者:馮豐

審校:夏林

在投資領域,,強烈的情緒會左右人們的決策。2020年,,環(huán)境,、社會和治理(ESG)股票基金領域尤為如此,投資者對地球環(huán)保的激情,、擔憂和希望造就了這個業(yè)績創(chuàng)紀錄的年份,。

ESG基金致力于投資那些避免危害或從事公益事業(yè)的公司。隨著全球各國應對新冠疫情封鎖,、社會動蕩和生態(tài)災害,,資金流入這些基金的速度比破損油管漏油的速度還要快。Morningstar稱,,2020年,,新投資凈額達到了511億美元,是2019年記錄的兩倍多,。即便股票市場的表現(xiàn)出乎意料的好,,但ESG投資者的回報有過之而無不及:在美國,可持續(xù)基金的回報率中值高出傳統(tǒng)基金4%還要多,。

可持續(xù)與負責任投資論壇(Forum for Sustainable and Responsible Investment)稱,,這些數(shù)字在一定程度上反映了投資者將其資產(chǎn)與其價值進行匹配的長期趨勢:流入各類基金的約三分之一資金如今都會投向“可持續(xù)發(fā)展載體”。(ESG基金通常貼著“可持續(xù)發(fā)展”的標簽,,盡管有時候他們關注的更多是社會或治理問題而不是環(huán)境問題,。)然而,這些潛在的社會改良公司當前面臨著一個困境:隨著ESG投資變得越發(fā)流行,,越來越多的基金都在爭相為自己貼上這一標簽,,而且對于自身是否名副其實毫不在意,。

ESG咨詢公司KKS Advisors創(chuàng)始人的一份研究稱,超過6600支基金如今稱自己是“道德的”,,這一數(shù)值是2013年的兩倍,。在歐盟,依據(jù)3月開始生效的法規(guī),,以ESG導向自居的基金必須披露其策略到底如何幫助解決社會問題,。然而,美國沒有這類法規(guī),,辨別真?zhèn)蔚闹負匀痪吐涞搅送顿Y者的身上,。

因此,隨著這類基金群體的不斷發(fā)展壯大,,我們應如何加以分辨,?與任何基金一樣,一開始要評估其表現(xiàn)和費用,。為了進一步縮窄你的選項,,我們有必要了解行業(yè)的子門類,并弄清楚哪個門類與你的投資風格更契合,。Morningstar美國可持續(xù)性研究負責人瓊·海爾表示,,由于可持續(xù)性設計沒有既定的規(guī)則,因此基金采取了“一系列方式”,。投資者也可以采取這種方式,,混合或對標以下三種模式:

回避型

最基本的ESG方法專注于避免不良因素。大多數(shù)基金經(jīng)理都會關注某個特定的投資領域——例如美國大市值股票,,并忽視那些在特定ESG因素領域表現(xiàn)排名后三分之一的基金,例如環(huán)境影響或雇員公平待遇,。(這里有一整個專注于打造這類排名的子行業(yè),。)基金的招股說明書會解釋其經(jīng)理如何決定投資誰,不投資誰,。

一些ESG基金在投資時會刻意放棄不合格的股票并持有幾乎其他所有股票,。該領域的佼佼者是 Vanguard FTSE Social Index Fund Admiral Shares (VFTAX)。它會跟蹤FTSE4Good U.S. Select Index,;在3月中旬,,該基金持有468支大市值美國股票。去年該基金的回報率為23%,,相比之下,,標普500指數(shù)的回報率為18%,而且該基金的管理費更是低至0.14%,。

探索型

其他基金會更有選擇性地專注于非特定門類股票中的優(yōu)勝者,。一些基金經(jīng)理不僅是積極的股票選擇者,,同時也是使用其股東投票權推動其所投公司變化的激進人士。這些基金通常會發(fā)布“接洽報告”,,并在報告中列出他們向公司管理層提出的種種問題,,及其代理投票活動的綜述。一些基金會更進一步,,發(fā)布影響力報告,,詳細列明了其投資策略如何打算帶來積極的影響。Morningstar的海爾說,,“這些報告應被視作最佳實踐”,,這是基金公司承諾完成其使命的標志。(承諾的另一個標志:活躍的基金經(jīng)理應在ESG投資領域擁有豐富的經(jīng)驗,。)

自2013年以來,,以“道德”自居的基金的數(shù)量翻了一番。

總部位于舊金山的Parnassus Investments是ESG股票選擇領域的資深公司,,而且Parnassus Core Equity Investor (PRBLX)基金自1992年成立以來一直都處于頂級表現(xiàn)陣營,,其平均年回報率為11.4%(2020年達到了21%)。聯(lián)合經(jīng)理托德·阿爾斯滕自2001年以來一直是基金的執(zhí)掌者,,而且其團隊既善于選股,,也熱衷于社會事業(yè)。例如,,Parnassus最近幫助說服了零食巨頭億滋國際 (Mondelez)使用更有利于回收的包裝,。

專家型

詹妮弗·肯寧是Align Impact的首席執(zhí)行官,該公司致力于與個人客戶和金融顧問合作,,打造可持續(xù)的資產(chǎn)組合,。她對富有激情的投資者所提的一條重要建議在于:與其研究整個ESG格局,不如專注于“你能夠實現(xiàn)的某件事情”,。ESG基金的大規(guī)模滲透,,尤其是ETF(交易所交易基金)也讓人們更容易專注于某個具體行業(yè):投資者可以專注于支持清潔技術(包括 iShares Global Clean Energy,ICLN等眾多選擇),;支持女性友好性公司(如:SPDR SSGA Gender Diversity Index, SHE),;甚至消除動物剝削,包括制造或銷售肉類產(chǎn)品的公司(如:U.S. Vegan Climate, VEGN),。

ESG基金在2020年的業(yè)績普遍跑贏大盤的原因在于,,其中沒有幾支基金持有化石燃料股票,而這些股票在去年可謂是一蹶不振,。然而,,清潔能源是一個范圍更小的關注點,其長期愿景依然強勁。該領域有兩支頗有前景的ETF都由一名共同經(jīng)理人執(zhí)掌,,他就是有著14年ESG投資經(jīng)驗的資深人士皮特·哈巴德,,這兩支基金分別是Invesco Solar (TAN)和Invesco WilderHill Clean Energy (PBW)。TAN基金持有約50家主要專注于太陽能的公司,,該基金的20%分別流入了美國Enphase Energy公司和以色列SolarEdge Technologies公司,。PBW基金則投資更廣泛領域的能源公司。盡管其投資者在2020年的表現(xiàn)可能并不突出,,但當這兩支ETF的股價增幅超過200%時,,投資者便有可能繼續(xù)從日漸更加注重環(huán)保動議的經(jīng)濟中獲益。(財富中文網(wǎng))

本文刊載于《財富》雜志2021年4/5月刊,。

譯者:馮豐

審校:夏林

In investing, powerful emotions drive people’s decisions. And nowhere was that more true in 2020 than in environmental, social, and governance (ESG) stock funds—where investors’ passions, fears, and hopes about the state of the planet fueled a record-shattering year.

ESG funds promise to steer their assets toward companies that avoid harm or do social good. And as the world reacted to COVID-19 lockdowns, social unrest, and ecological disasters, money flowed into these funds faster than oil sprays out of a broken pipeline. Net new investment reached $51.1 billion in 2020, according to Morningstar—more than double the record set the previous year. And even as stock markets did unexpectedly well, ESG investors did even better: In the U.S., the median sustainable fund outperformed its traditional peers by more than four percentage points.

These numbers in part reflect a long-term trend of investors aligning their assets with their values: About one of every three dollars invested in funds now goes toward “sustainability vehicles,” according to the Forum for Sustainable and Responsible Investment. (ESG funds are generally labeled “sustainable,” even when they focus more on social or governance issues than on the environment.) But would-be do-gooders now face a quandary: As ESG investing grows more popular, more funds are sprinting to adopt the label—whether or not they’re working hard to earn it.

According to research by founders of the ESG consulting firm KKS Advisors, more than 6,600 funds now identify as “ethical,” twice as many as in 2013. In the European Union, under rules that began to take effect in March, funds that market themselves as ESG-oriented must disclose exactly how their strategies help solve social problems. But there’s no such regulation in the U.S.—so the onus is on investors to separate substance from hype.

So how should you vet this sprawling field of suitors? As with any funds, start by assessing performance and fees. To narrow your options further, it helps to understand the industry’s subcategories and see which ones align best with your investing style. With no set rule for sustainable designs, funds have adopted “a collection of approaches,” says Jon Hale, U.S. head of sustainability research for Morningstar. Investors can do the same, mixing and matching among these three styles:

The shunners

The most basic ESG methodology focuses on avoiding bad actors. Managers of most funds will look at a given investing universe—say, U.S. large-cap stocks—and disqualify those that rank at the bottom third of a given ESG factor, like environmental impact or fair treatment of employees. (There’s a whole subindustry geared to creating such rankings.) A fund’s prospectus should explain how its managers decide who’s in and who’s out.

Some ESG funds invest with a conscience by dropping disqualified stocks and holding almost everything else. One strong performer in this category is Vanguard FTSE Social Index Fund Admiral Shares (VFTAX). It tracks the FTSE4Good U.S. Select Index; in mid-March, it owned 468 large-cap U.S. stocks. It returned 23% last year, compared with 18% for the S&P 500, and annual expenses are just $14 per $10,000 invested.

The seekers

Other funds focus more selectively on top performers among the non-excluded stocks. And some of their managers are not only active stock pickers, but also activists—using their shareholder votes to seek change at companies in which they invest. These funds often publish “engagement reports,” outlining the issues they have addressed with company management, along with roundups of their proxy voting activity. Some go further and publish impact reports, outlining exactly how their investment strategy is intended to have a positive effect. Those reports “should be considered a best practice,” says Morningstar’s Hale—a sign of a fund company that’s committed to its mission. (Another sign of commitment: An active fund’s managers should have extensive previous experience in ESG investing.)

The number of funds that categorize themselves as “ethical” has doubled since 2013.

San Francisco-based Parnassus Investments is a veteran in ESG stock picking, and the Parnassus Core Equity Investor (PRBLX) fund has been a top performer since its inception in 1992, with average annual returns of 11.4% (and 21% in 2020). Comanager Todd Ahlsten has helmed the fund since 2001, and his team has been both savvy at stock picking and conscientious about social causes. For example, Parnassus recently helped persuade snack giant Mondelez to use more recyclable packaging.

The specialists

Jennifer Kenning is the CEO of Align Impact, which works with individual clients and financial advisers to build sustainable portfolios. One of her key pieces of advice for passionate investors: Instead of researching the entire ESG landscape, focus on “one thing you can move the needle on.” The massive proliferation of ESG funds, especially ETFs, has made it easier to target a specific cause: Investors can focus on backing clean technology (the many options include iShares Global Clean Energy, ICLN); supporting women-friendly companies (SPDR SSGA Gender Diversity Index, SHE); or even avoiding animal exploitation, including companies that make or sell meat-based products (U.S. Vegan Climate, VEGN).

One reason ESG funds in general outperformed the broader market in 2020 is that few of them own fossil-fuel stocks, which generally tanked last year. But clean energy is a narrower focus whose long-term outlook remains strong. Two promising ETFs in the space share a comanager: Peter Hubbard, a 14-year ESG veteran, oversees both Invesco Solar (TAN) and Invesco WilderHill Clean Energy (PBW). TAN holds about 50 primarily solar-focused companies, with 20% of the fund split between the U.S. company Enphase Energy and Israel’s SolarEdge Technologies; PBW invests in a broader range of energy firms. While their investors may never outdo 2020, when shares in both ETFs rose more than 200%, they’re likely to keep benefiting from an economy that’s gradually embracing the imperative of getting greener.

This story appears in the April/May 2021 issue of Fortune.