圖片來(lái)源:ROBERT NICKELSBERG—GETTY IMAGES

圖片來(lái)源:ROBERT NICKELSBERG—GETTY IMAGES

上周,,當(dāng)美國(guó)財(cái)政部部長(zhǎng)珍妮特·耶倫表示利率可能會(huì)上升時(shí),所有投資者都聽(tīng)出了“通貨膨脹”和股市下跌的意思,。耶倫很快又退了一步說(shuō):“我認(rèn)為不會(huì)有通貨膨脹的問(wèn)題,,但如果真的出現(xiàn),我們還可以寄希望于美聯(lián)儲(chǔ)來(lái)解決,?!?/p>

美聯(lián)儲(chǔ)的確預(yù)見(jiàn)了物價(jià)將在2021年以更快的速度上漲,但美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾將其稱(chēng)之為“暫時(shí)性”的通脹,。隨著經(jīng)濟(jì)全面復(fù)蘇,,所有商品和服務(wù)的價(jià)格都將飆升。自新冠疫情開(kāi)始以來(lái),僅木材一項(xiàng)就已經(jīng)增長(zhǎng)了280%,。但是,,當(dāng)市場(chǎng)需求被壓抑后的“報(bào)復(fù)性回彈”過(guò)去,2021年的漲價(jià)潮就會(huì)慢慢回到正軌,。至少美聯(lián)儲(chǔ)是這么說(shuō)的,。

那么美國(guó)人對(duì)潛在的物價(jià)上漲有何反應(yīng)?為了找出答案,,《財(cái)富》雜志與SurveyMonkey合作,,在4月30日至5月3日期間,對(duì)2113名美國(guó)成年人展開(kāi)了調(diào)查,。*該調(diào)查的模型化誤差估計(jì)為正負(fù)3個(gè)百分點(diǎn),。

《財(cái)富》雜志與SurveyMonkey的調(diào)研發(fā)現(xiàn),87%的成年美國(guó)人都擔(dān)心通貨膨脹,,其中58%表示“非常擔(dān)心”,。這種擔(dān)心已經(jīng)能夠改變消費(fèi)者的行為了:當(dāng)人們擔(dān)心物價(jià)上漲時(shí),他們就會(huì)趁價(jià)格還穩(wěn)定在當(dāng)前水平,,盡快消費(fèi),。這可能會(huì)引起對(duì)住房或汽車(chē)等物品的搶購(gòu)大戰(zhàn)。

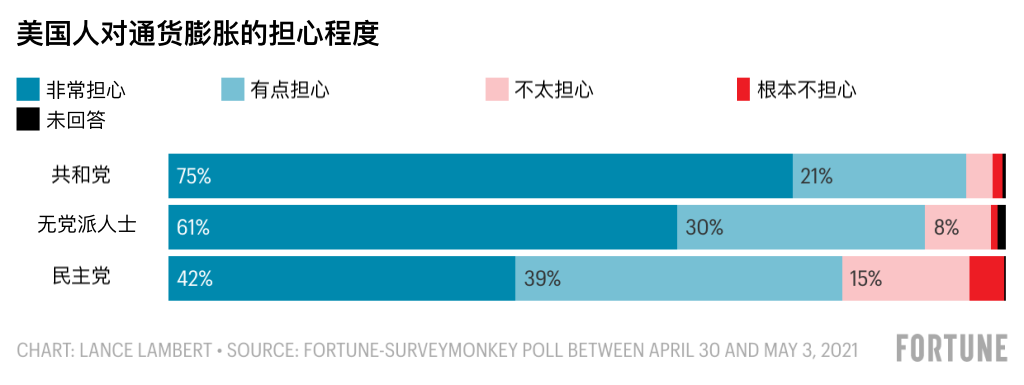

美國(guó)人對(duì)經(jīng)濟(jì)的看法通常還取決于他們支持的黨派是否當(dāng)政,。下圖是《財(cái)富》雜志此前的一張分析圖表,,從中就可以看出,在喬·拜登上臺(tái)后,,共和黨人和民主黨人是如何改變他們的看法的,。因此,,共和黨人中(75%)表示“非常關(guān)注”通脹的人數(shù)遠(yuǎn)遠(yuǎn)超過(guò)民主黨(42%)就不足為奇,。無(wú)黨派人士(61%)則處在中間水平。現(xiàn)在,,人們非常擔(dān)心物價(jià)上漲,,而賬面上的通貨膨脹率仍然很低,問(wèn)題就來(lái)了:如果通貨膨脹上升,,這會(huì)成為一個(gè)政治問(wèn)題嗎,?

美國(guó)人對(duì)通貨膨脹的擔(dān)心程度。資料來(lái)源:《財(cái)富》與SurveyMonkey于2021年4月30日至5月3日期間進(jìn)行的調(diào)研

美國(guó)人對(duì)通貨膨脹的擔(dān)心程度。資料來(lái)源:《財(cái)富》與SurveyMonkey于2021年4月30日至5月3日期間進(jìn)行的調(diào)研房?jī)r(jià)已經(jīng)開(kāi)始飆升,,成交價(jià)的中位數(shù)同比增長(zhǎng)16%,。這從人口統(tǒng)計(jì)學(xué)上也有跡可循——千禧一代進(jìn)入了購(gòu)房高峰階段,加上現(xiàn)在的房貸利率處于歷史低位,,大批購(gòu)房者涌入數(shù)量有限的住房市場(chǎng),。根據(jù)房屋交易網(wǎng)站realtor.com的數(shù)據(jù)顯示,待售房屋的數(shù)量同比下降了50%以上。

從服務(wù)業(yè)經(jīng)濟(jì)上看,,從夜生活,、游樂(lè)園到愛(ài)彼迎民宿,之前被新冠疫情壓抑的需求也出現(xiàn)驚人的“報(bào)復(fù)性反彈”,。這也為價(jià)格急劇上漲奠定了基礎(chǔ),。機(jī)票預(yù)訂量明顯增加,機(jī)票價(jià)格也明顯上漲,。

但漲幅最大的還是商品:玉米,、鋼鐵和銅等。但木材的漲幅幾乎是最高的:根據(jù)木材行業(yè)資訊網(wǎng)站Random Lengths報(bào)道,,5月7日,,每千板英尺木材的價(jià)格飆升至創(chuàng)下歷史新高的1414美元。自疫情爆發(fā)以來(lái),,木材價(jià)格暴漲了295%,。這樣的結(jié)果是木材的供需關(guān)系出現(xiàn)史無(wú)前例的失衡導(dǎo)致的——在疫情爆發(fā)帶來(lái)的種種后果中,這也很符合常理,。

美聯(lián)儲(chǔ)很可能是對(duì)的:住房,、商品和服務(wù)成本的迅速上漲是“暫時(shí)的”。但這一點(diǎn)并不妨礙它可能發(fā)展成一個(gè)政治問(wèn)題——只需要回顧一下20世紀(jì)70年代和本世紀(jì)00年代的兩次“暫時(shí)性”的石油危機(jī)以及后續(xù)的政治后果就能夠知道答案了,。(財(cái)富中文網(wǎng))

編譯:陳聰聰

上周,,當(dāng)美國(guó)財(cái)政部部長(zhǎng)珍妮特·耶倫表示利率可能會(huì)上升時(shí),所有投資者都聽(tīng)出了“通貨膨脹”和股市下跌的意思,。耶倫很快又退了一步說(shuō):“我認(rèn)為不會(huì)有通貨膨脹的問(wèn)題,,但如果真的出現(xiàn),我們還可以寄希望于美聯(lián)儲(chǔ)來(lái)解決,?!?/p>

美聯(lián)儲(chǔ)的確預(yù)見(jiàn)了物價(jià)將在2021年以更快的速度上漲,但美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾將其稱(chēng)之為“暫時(shí)性”的通脹,。隨著經(jīng)濟(jì)全面復(fù)蘇,,所有商品和服務(wù)的價(jià)格都將飆升。自新冠疫情開(kāi)始以來(lái),,僅木材一項(xiàng)就已經(jīng)增長(zhǎng)了280%,。但是,當(dāng)市場(chǎng)需求被壓抑后的“報(bào)復(fù)性回彈”過(guò)去,,2021年的漲價(jià)潮就會(huì)慢慢回到正軌,。至少美聯(lián)儲(chǔ)是這么說(shuō)的。

那么美國(guó)人對(duì)潛在的物價(jià)上漲有何反應(yīng),?為了找出答案,,《財(cái)富》雜志與SurveyMonkey合作,,在4月30日至5月3日期間,對(duì)2113名美國(guó)成年人展開(kāi)了調(diào)查,。*該調(diào)查的模型化誤差估計(jì)為正負(fù)3個(gè)百分點(diǎn),。

《財(cái)富》雜志與SurveyMonkey的調(diào)研發(fā)現(xiàn),87%的成年美國(guó)人都擔(dān)心通貨膨脹,,其中58%表示“非常擔(dān)心”,。這種擔(dān)心已經(jīng)能夠改變消費(fèi)者的行為了:當(dāng)人們擔(dān)心物價(jià)上漲時(shí),他們就會(huì)趁價(jià)格還穩(wěn)定在當(dāng)前水平,,盡快消費(fèi),。這可能會(huì)引起對(duì)住房或汽車(chē)等物品的搶購(gòu)大戰(zhàn)。

美國(guó)人對(duì)經(jīng)濟(jì)的看法通常還取決于他們支持的黨派是否當(dāng)政,。下圖是《財(cái)富》雜志此前的一張分析圖表,,從中就可以看出,在喬·拜登上臺(tái)后,,共和黨人和民主黨人是如何改變他們的看法的,。因此,共和黨人中(75%)表示“非常關(guān)注”通脹的人數(shù)遠(yuǎn)遠(yuǎn)超過(guò)民主黨(42%)就不足為奇,。無(wú)黨派人士(61%)則處在中間水平?,F(xiàn)在,人們非常擔(dān)心物價(jià)上漲,,而賬面上的通貨膨脹率仍然很低,,問(wèn)題就來(lái)了:如果通貨膨脹上升,這會(huì)成為一個(gè)政治問(wèn)題嗎,?

房?jī)r(jià)已經(jīng)開(kāi)始飆升,,成交價(jià)的中位數(shù)同比增長(zhǎng)16%。這從人口統(tǒng)計(jì)學(xué)上也有跡可循——千禧一代進(jìn)入了購(gòu)房高峰階段,,加上現(xiàn)在的房貸利率處于歷史低位,,大批購(gòu)房者涌入數(shù)量有限的住房市場(chǎng)。根據(jù)房屋交易網(wǎng)站realtor.com的數(shù)據(jù)顯示,,待售房屋的數(shù)量同比下降了50%以上,。

從服務(wù)業(yè)經(jīng)濟(jì)上看,,從夜生活,、游樂(lè)園到愛(ài)彼迎民宿,之前被新冠疫情壓抑的需求也出現(xiàn)驚人的“報(bào)復(fù)性反彈”,。這也為價(jià)格急劇上漲奠定了基礎(chǔ),。機(jī)票預(yù)訂量明顯增加,機(jī)票價(jià)格也明顯上漲,。

但漲幅最大的還是商品:玉米,、鋼鐵和銅等,。但木材的漲幅幾乎是最高的:根據(jù)木材行業(yè)資訊網(wǎng)站Random Lengths報(bào)道,5月7日,,每千板英尺木材的價(jià)格飆升至創(chuàng)下歷史新高的1414美元,。自疫情爆發(fā)以來(lái),木材價(jià)格暴漲了295%,。這樣的結(jié)果是木材的供需關(guān)系出現(xiàn)史無(wú)前例的失衡導(dǎo)致的——在疫情爆發(fā)帶來(lái)的種種后果中,,這也很符合常理。

美聯(lián)儲(chǔ)很可能是對(duì)的:住房,、商品和服務(wù)成本的迅速上漲是“暫時(shí)的”,。但這一點(diǎn)并不妨礙它可能發(fā)展成一個(gè)政治問(wèn)題——只需要回顧一下20世紀(jì)70年代和本世紀(jì)00年代的兩次“暫時(shí)性”的石油危機(jī)以及后續(xù)的政治后果就能夠知道答案了。(財(cái)富中文網(wǎng))

編譯:陳聰聰

When Treasury Secretary Janet Yellen said last week that interest rates could rise, all investors heard was the I-word and stocks dropped. Yellen quickly walked back that statement: "I don’t think there’s going to be an inflationary problem, but if there is, the Fed can be counted on to address it."

The Federal Reserve does see prices rising at a faster pace in 2021, but Chair Jerome Powell calls it "transitory" inflation. As the economy hits full gear, prices for everything from commodities to services will spike. Lumber alone is already up 280% since the onset of the pandemic. But once the burst from pent-up demand passes, 2021 price hikes should correct. At least that's the Fed's narrative.

So how are Americans reacting to the potential for price hikes? To find out, Fortune teamed up with SurveyMonkey to poll 2,113 adults in the U.S. between April 30 and May 3.* The poll's modeled error estimate is plus or minus 3 percentage points.

The Fortune-SurveyMonkey poll finds 87% of U.S. adults are concerned about inflation, including 58% who say they are "very concerned." That can already cause a change in consumer behavior: When people are afraid of prices rising, they spend money faster in order to lock in a price. This could result in bidding wars on things such as homes or cars.

Americans' view of the economy often depends on whether their party occupies the White House. Just look at this past Fortune Analytics chart and see how Republicans and Democrats flipped views after Biden took office. So it isn't surprising that the share of Republicans (75%) who are "very concerned" about inflation is much higher than Democrats (42%). And Independents (61%) are right in the middle. Given how high those concern levels are now—with inflation still pretty low on paper—it poses the question: If inflation takes off, will it become a political issue?

Already, prices are soaring in the housing market, with the median sales price up 16% year over year. That's the result of demographics—millennials hitting their peak home-buying years—and historically low mortgage rates combining to create an influx of buyers who bid up a limited number of homes. The number of homes for sales is down over 50% year over year, according to realtor.com.

There's also an incredible amount of pent-up demand in the service side of the economy, for everything from nightlife to amusement parks to Airbnb rentals. That's also setting the stage for steep price hikes. We're already seeing a huge rise in booked flights—and upped flight prices.

But the biggest price hikes are in commodities: corn, steel, and copper, for instance. But none more so than lumber: On May 7, the price per thousand board feet of lumber soared to an all-time high of $1,414, according to Random Lengths. Since the onset of the pandemic, the price of lumber has skyrocketed 295%. This is the result of an unprecedented mismatch in lumber supply and demand—something set off by pandemic-spurred trends in TK.

The Fed very well could be right: The rapid rise in housing, commodities, and services costs is "transitory." But that alone won't prevent it from becoming a political issue. Just look back at the temporary oil shocks in the 1970s and 2000s—and the subsequent political backlash.