如今,,北美正在面臨歷史性的木材短缺危機。為此,,房屋建筑商惴惴不安,。因為擔心無法購買到春夏項目所需的木材,他們花費數(shù)周時間,就木材期貨展開了激烈的競價,。目前,,這種瘋狂的價格戰(zhàn)似乎已經(jīng)到頭了:自5月10日以來,每千板英尺2×4英寸的7月期貨合約價格從1,700美元以上跌至1,453美元,。盡管這一價格仍然遠遠高于新冠肺炎疫情前的水平(當時的交易價格大多在300美元至500美元之間),,但此次木材價格的回落依舊讓許多業(yè)內(nèi)人士相信,價格飆升的最糟糕時期已經(jīng)過去,。

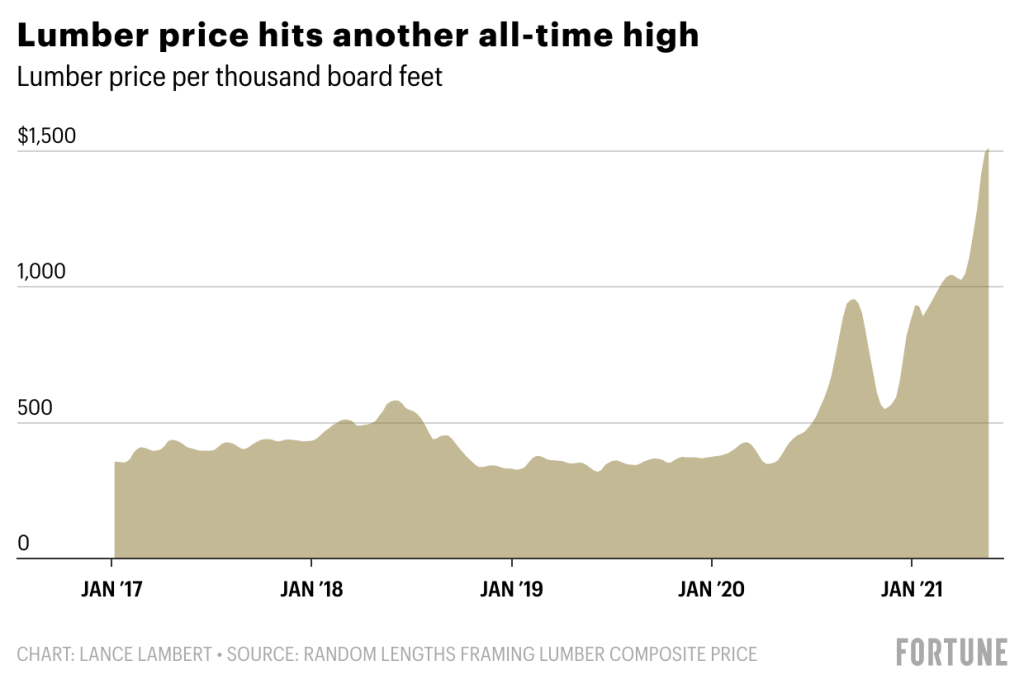

但如果你指望家得寶(Home Depot)或勞氏公司(Lowe's)降價出售木材,,那就大錯特錯了。雖然期貨價格有所回落,,但目前的“現(xiàn)貨”價格(鋸木廠向經(jīng)銷商和批發(fā)商收取的價格)剛剛創(chuàng)下歷史新高,。據(jù)全球木材產(chǎn)業(yè)調(diào)研機構Random Lengths的數(shù)據(jù),5月21日,,每千板英尺木材現(xiàn)貨價格攀升至1,514美元,,和2020年4月的價格相比,上漲幅度達到了令人震驚的323%,。

“當前的木材期貨價格有可能會讓房屋建筑商在未來盡量少用木材,。”Sherwood Lumber公司的首席執(zhí)行官安迪?古德曼在接受《財富》雜志采訪時表示,?!啊磥怼攀沁@句話的關鍵所在——7月期貨合約是指當月裝運、8月運抵經(jīng)銷商,,之后再運抵零售商的散裝木材——因此,,此輪木材價格上漲的影響,至少要持續(xù)到下半年,。”

專門研究木材價格的FastMarket RISI的高級經(jīng)濟學家達斯廷?賈爾伯特也認為,,木材零售價格應該會很快下降一點,,但他補充道:“這遠沒有達成協(xié)議?!彪m然4月新開工率下降9%的跡象表明,,一些建筑商最終因為木材價格過高而受到抑制,但需求仍然異常強勁,。盡管上個月開盤有所下降,,但自2006年年底以來,除了5個月外,,它們?nèi)匀槐绕渌械脑露紡妱?。除非需求進一步回落,鋸木廠仍然將繼續(xù)努力與之相匹配,。

正如《財富》雜志此前所解釋的,,這一歷史性的木材短缺是由于新冠疫情期間引發(fā)的一場風暴所推動的,。當新冠疫情在2020年春季爆發(fā)時,鋸木廠由于擔心即將來臨的房屋市場崩盤而削減生產(chǎn)和減少庫存,。然而這次崩盤并沒有發(fā)生,,與之相反的情況卻出現(xiàn)了。煩悶的,、被隔離的美國人急忙趕到家得寶和勞氏公司購買自己動手項目的材料,,而經(jīng)濟衰退引發(fā)的利率則有助于刺激房地產(chǎn)繁榮。由于大量千禧一代開始達到購房高峰,,導致房屋庫存枯竭,,并讓購房者尋找新建筑,這進一步加劇了此類繁榮景象,。另外,,因為家庭改造和建筑房屋需要大量木材,而鋸木廠也無法跟上這種需求,,因此產(chǎn)生了創(chuàng)紀錄的價格,。

目前,市場上存在的需求上升和供給受限情況仍然存在,,而這也是價格調(diào)整可能依然需要數(shù)月才能夠實現(xiàn)的原因,。

古德曼在接受《財富》雜志采訪時說:“由于需求被抑制、供應中斷,、工作場所的活動被推遲,,所以我們看到項目將延長到今年夏季和秋季。這一供需缺口可能要到2021年年底或2022年年初才可以填補,,這意味著在此之前,,廠家大量的成本節(jié)約措施不會傳導到消費者?!保ㄘ敻恢形木W(wǎng))

譯者:郝秀

審校:汪皓

如今,,北美正在面臨歷史性的木材短缺危機。為此,,房屋建筑商惴惴不安,。因為擔心無法購買到春夏項目所需的木材,他們花費數(shù)周時間,,就木材期貨展開了激烈的競價,。目前,這種瘋狂的價格戰(zhàn)似乎已經(jīng)到頭了:自5月10日以來,,每千板英尺2×4英寸的7月期貨合約價格從1,700美元以上跌至1,453美元,。盡管這一價格仍然遠遠高于新冠肺炎疫情前的水平(當時的交易價格大多在300美元至500美元之間),但此次木材價格的回落依舊讓許多業(yè)內(nèi)人士相信,價格飆升的最糟糕時期已經(jīng)過去,。

但如果你指望家得寶(Home Depot)或勞氏公司(Lowe's)降價出售木材,,那就大錯特錯了。雖然期貨價格有所回落,,但目前的“現(xiàn)貨”價格(鋸木廠向經(jīng)銷商和批發(fā)商收取的價格)剛剛創(chuàng)下歷史新高,。據(jù)全球木材產(chǎn)業(yè)調(diào)研機構Random Lengths的數(shù)據(jù),5月21日,,每千板英尺木材現(xiàn)貨價格攀升至1,514美元,,和2020年4月的價格相比,上漲幅度達到了令人震驚的323%,。

“當前的木材期貨價格有可能會讓房屋建筑商在未來盡量少用木材,。”Sherwood Lumber公司的首席執(zhí)行官安迪?古德曼在接受《財富》雜志采訪時表示,?!啊磥怼攀沁@句話的關鍵所在——7月期貨合約是指當月裝運、8月運抵經(jīng)銷商,,之后再運抵零售商的散裝木材——因此,,此輪木材價格上漲的影響,至少要持續(xù)到下半年,?!?/p>

專門研究木材價格的FastMarket RISI的高級經(jīng)濟學家達斯廷?賈爾伯特也認為,木材零售價格應該會很快下降一點,,但他補充道:“這遠沒有達成協(xié)議,。”雖然4月新開工率下降9%的跡象表明,,一些建筑商最終因為木材價格過高而受到抑制,,但需求仍然異常強勁。盡管上個月開盤有所下降,,但自2006年年底以來,,除了5個月外,它們?nèi)匀槐绕渌械脑露紡妱?。除非需求進一步回落,鋸木廠仍然將繼續(xù)努力與之相匹配,。

正如《財富》雜志此前所解釋的,,這一歷史性的木材短缺是由于新冠疫情期間引發(fā)的一場風暴所推動的。當新冠疫情在2020年春季爆發(fā)時,,鋸木廠由于擔心即將來臨的房屋市場崩盤而削減生產(chǎn)和減少庫存,。然而這次崩盤并沒有發(fā)生,與之相反的情況卻出現(xiàn)了。煩悶的,、被隔離的美國人急忙趕到家得寶和勞氏公司購買自己動手項目的材料,,而經(jīng)濟衰退引發(fā)的利率則有助于刺激房地產(chǎn)繁榮。由于大量千禧一代開始達到購房高峰,,導致房屋庫存枯竭,,并讓購房者尋找新建筑,這進一步加劇了此類繁榮景象,。另外,,因為家庭改造和建筑房屋需要大量木材,而鋸木廠也無法跟上這種需求,,因此產(chǎn)生了創(chuàng)紀錄的價格,。

目前,市場上存在的需求上升和供給受限情況仍然存在,,而這也是價格調(diào)整可能依然需要數(shù)月才能夠實現(xiàn)的原因,。

古德曼在接受《財富》雜志采訪時說:“由于需求被抑制、供應中斷,、工作場所的活動被推遲,,所以我們看到項目將延長到今年夏季和秋季。這一供需缺口可能要到2021年年底或2022年年初才可以填補,,這意味著在此之前,,廠家大量的成本節(jié)約措施不會傳導到消費者?!保ㄘ敻恢形木W(wǎng))

譯者:郝秀

審校:汪皓

We're amid a historic North American lumber shortage. It's why home builders, who are worried they won't get the materials they need for spring and summer projects, spent weeks engaging in a fierce bidding war over lumber futures. That frenzy seems to have reached its climax: Since May 10, the July futures contract price per thousand board feet of two-by-fours has fallen from over $1,700 to $1,453. While that's still well above pre-pandemic levels—when it typically traded in the $300 to $500 range—the pullback has many in the industry believing the worst of the price surges is over.

But don't expect to find a lumber discount in the aisles of Home Depot or Lowe's just yet. While the futures price has pulled back a bit, the current "cash" price (the price sawmills charge distributors and wholesalers) just hit a new all-time high. On May 21, the cash price per thousand board feet of lumber climbed to $1,514, according to industry trade publication Random Lengths. That's up a staggering 323% since April 2020.

"Lumber futures are indicating that potential savings could happen in the future," Andy Goodman, CEO of Sherwood Lumber, tells Fortune. "However, 'future' is the operative word. The July contract represents bulk lumber that ships in that month and arrives in August to the distributor and then the retailer."

Dustin Jalbert, a senior economist at Fastmarkets RISI where he specializes in wood prices, also thinks retail lumber prices should dip a bit soon, but adds, "It's far from a done deal." While April's 9% dip in new housing starts signaled that some builders are finally balking at exorbitant prices for lumber, demand remains incredibly strong. Even though starts were down last month, they're still stronger than all but five other months since the end of 2006. Unless demand pulls back further, sawmills will continue to struggle to match it.

As Fortune has previously explained, this historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. When COVID-19 broke out in spring 2020, sawmills cut production and unloaded inventory in fears of a looming housing crash. The crash didn't happen—instead, the opposite occurred. Bored, quarantining Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects, while recession-induced interest rates helped spur a housing boom. That boom, which was exacerbated by a large cohort of millennials starting to hit their peak home-buying years, dried up housing inventory and sent buyers in search of new construction. Home improvements and construction require a lot of lumber, and mills couldn't keep up. Cue record prices.

That elevated demand and constrained supply remain the reality. It's also why a price correction could take months to materialize.

"With the pent up demand, fractured supply, and delayed job site activity, we see projects extending deep into the summer and fall," Goodman tells Fortune. "This supply and demand gap likely will not be filled until late 2021 or early 2022, meaning that substantial cost savings will not trickle down to the consumer until then."