夏季正在過去,,眾多潛在風險正從市場上涌現,其中就包括美聯儲縮減購債規(guī)模的步伐,、債務最高限額的爭論,,以及即將在10月出現的政府停擺。

9月21日,,美國眾議院通過了一項緊急融資方案,,旨在防止政府在9月底關門(如果議員們未能通過新的預算)以及即將出現的政府債務違約情形,。但是,這一方案在參議院面臨著巨大障礙,,加劇了人們對10月可能發(fā)生政府停擺的擔憂,。

股票投資者對目前市場中許多潛在的不利因素表達了不安情緒,但是,,高盛集團(Goldman Sachs)的策略師認為,,從歷史來看,政府停擺本身對市場的影響并不太大,,但仍然有其他因素或將影響股市,。

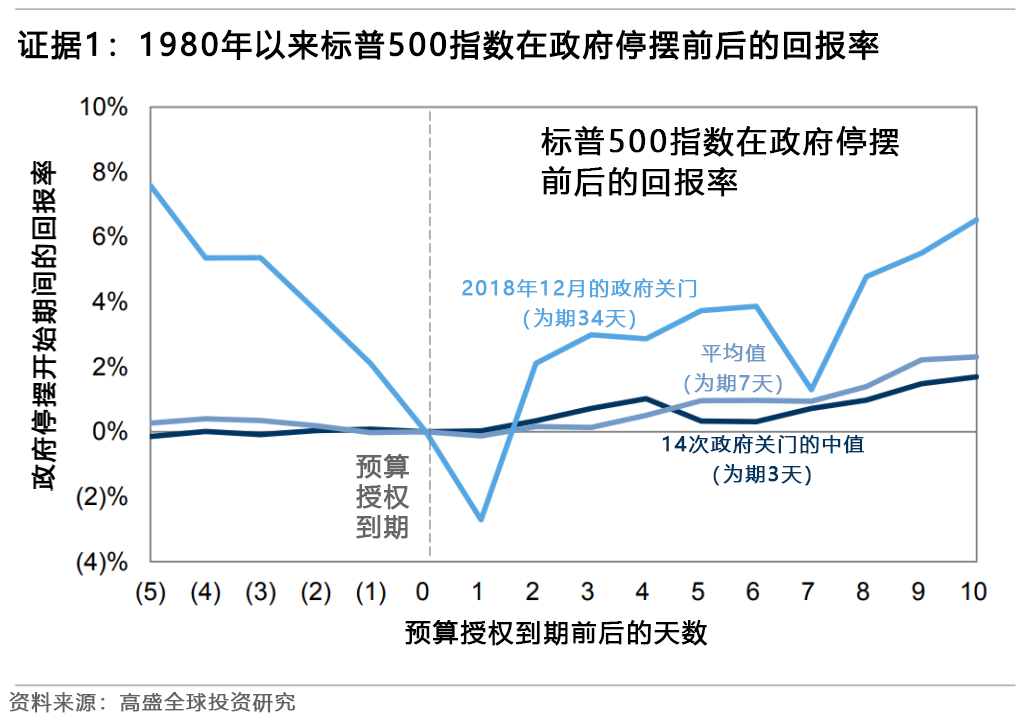

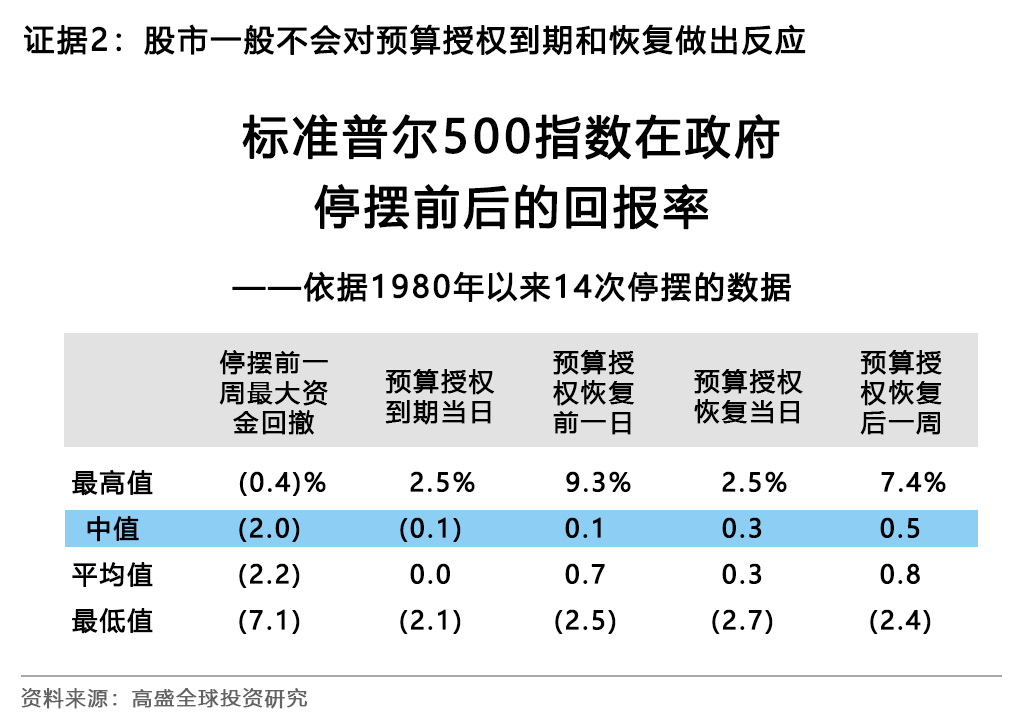

“歷史表明,美國政府關門通常不會對股票回報產生實質性影響,?!备呤⒌牟呗詭煷笮l(wèi)·科斯廷在9月21日晚間發(fā)布的一份報告中寫道,“在1980年以來發(fā)生的14次政府停擺中,,標準普爾500指數(S&P 500)的中值回報率數值,,在預算授權到期之日為-0.1%,在停擺期間為0.1%,,在重新開門之日為0.3%,。”

有一個例外是在2018年12月,,也就是最近一次政府停擺期間,。當時,標準普爾500指數在支出授權到期時下跌了2%,?!暗牵谴蜗碌赡苤饕鲇谕顿Y者對美聯儲收緊政策的擔憂,?!彼麄冋f。

策略師指出,,指數影響減弱在標準普爾500指數類股票內部也是一致的,。

“無論著眼于標準普爾500指數的成分股還是因素變化,政府停擺前后的回報率中值差異都非常小,。在此前的14次停擺當中,在預算到期前后的幾周內,,成分和因素的超額回報中值都在正百分之一到負百分之一之間,。”他們寫道,。

但債務上限期限過去曾經對市場產生過影響,。高盛的策略師指出,,在2011年和2013年的債務上限截止日期前后,某些“政府收入”敞口股票“表現略遜于標普400中型股”,。這些公司包括洛克希德-馬丁公司(Lockheed Martin),、諾斯洛普格拉曼公司(Northrop Grumman)、通用動力公司(General Dynamics)和雷神技術公司(Raytheon Technologies)等工業(yè)股,;以及Anthem,、聯合健康集團(UnitedHealth Group)、吉利德科學公司(Gilead Sciences)和哈門那公司(Humana)等醫(yī)療股,。

正如英聯邦金融網絡(Commonwealth Financial Network)的首席投資官布拉德·麥克米倫等人對《財富》雜志所說:“我認為政府關門不會發(fā)生,,但即使它真的發(fā)生了,我認為其影響也會比人們想象的小得多,。人們都知道美國國債債臺高筑,。人們都知道政府終將付出代價?!?/p>

擾亂市場的因素

其實,,在股市停擺期間(甚至是其他任何時候),最可能影響股市的是更廣泛的宏觀經濟形勢,。

高盛的策略師表示,,盡管“歷史回報率顯示,政府停擺或近期債務上限問題,,對標準普爾500指數沒有產生持續(xù)的影響,,但宏觀環(huán)境的基本面,對股市來說則相當重要”,?!拔覀兊恼谓洕鷮W家將日益增加的風險歸咎于即將到來的債務上限,并認為這與2011年和2013年的經歷類似,。但其實,,在這兩年中,標準普爾500指數在2011年下跌,,但在2013年債務上限期間是反彈的,。”策略師寫道,。

區(qū)別如何,?2011年,歐洲債務危機爆發(fā),,標準普爾下調了美國主權債務評級,,經濟增長也出現了下滑。相比之下,,2013年的宏觀環(huán)境更為有利,。

事實上,,或許秋季之后的宏觀形勢才可能成為更大的擔憂。

“讓我擔心的不是政府關門的可能性本身,,而是一系列與之密切相關的其他事情,。”麥克米倫說,。

這些事情包括經濟增長擔憂涌現,,最近幾周,華爾街公司還下調了GDP預期,,此外,,還有美聯儲縮減資產購買和支持的時限,以及中國恒大集團債務危機的影響,。與此同時,,市場的季節(jié)性和技術調整可能也助長了最近的市場暴跌。

對麥克米倫來說,,消費者信心和支出也是他將關注的問題,。

“我擔心的是對消費者信心的影響?!彼f,,“聯邦政策已經拖累了信心。正如我們之前所看到的,,如果政府關門,,人們會對是否支付社會保險、是否支付其他補充款項增加關注,。人們看到了這些頭條新聞,,即使沒有直接影響,他們也會開始認為事情開始變糟糕了,?!?/p>

毫無疑問的是,在股市之外,,政府關門對整體經濟的陣痛依舊,。但根據高盛的分析,投資者們現在或許不必擔心“政府關門”所帶來的影響,。

麥克米倫說得更加直白:“這些都是噪音,。盡管風險有所上升,但基本面仍然相當堅挺,。只要基本面保持健康,,這一切都會過去?!保ㄘ敻恢形木W)

編譯:楊二一

夏季正在過去,,眾多潛在風險正從市場上涌現,其中就包括美聯儲縮減購債規(guī)模的步伐,、債務最高限額的爭論,,以及即將在10月出現的政府停擺。

9月21日,,美國眾議院通過了一項緊急融資方案,,旨在防止政府在9月底關門(如果議員們未能通過新的預算)以及即將出現的政府債務違約情形。但是,,這一方案在參議院面臨著巨大障礙,,加劇了人們對10月可能發(fā)生政府停擺的擔憂。

股票投資者對目前市場中許多潛在的不利因素表達了不安情緒,,但是,,高盛集團(Goldman Sachs)的策略師認為,從歷史來看,,政府停擺本身對市場的影響并不太大,,但仍然有其他因素或將影響股市。

“歷史表明,,美國政府關門通常不會對股票回報產生實質性影響,。”高盛的策略師大衛(wèi)·科斯廷在9月21日晚間發(fā)布的一份報告中寫道,,“在1980年以來發(fā)生的14次政府停擺中,,標準普爾500指數(S&P 500)的中值回報率數值,在預算授權到期之日為-0.1%,,在停擺期間為0.1%,,在重新開門之日為0.3%?!?/p>

有一個例外是在2018年12月,,也就是最近一次政府停擺期間。當時,,標準普爾500指數在支出授權到期時下跌了2%,。“但是,,那次下跌可能主要出于投資者對美聯儲收緊政策的擔憂,。”他們說,。

策略師指出,,指數影響減弱在標準普爾500指數類股票內部也是一致的。

“無論著眼于標準普爾500指數的成分股還是因素變化,,政府停擺前后的回報率中值差異都非常小,。在此前的14次停擺當中,,在預算到期前后的幾周內,成分和因素的超額回報中值都在正百分之一到負百分之一之間,?!彼麄儗懙馈?/p>

但債務上限期限過去曾經對市場產生過影響,。高盛的策略師指出,,在2011年和2013年的債務上限截止日期前后,某些“政府收入”敞口股票“表現略遜于標普400中型股”,。這些公司包括洛克希德-馬丁公司(Lockheed Martin),、諾斯洛普格拉曼公司(Northrop Grumman)、通用動力公司(General Dynamics)和雷神技術公司(Raytheon Technologies)等工業(yè)股,;以及Anthem,、聯合健康集團(UnitedHealth Group)、吉利德科學公司(Gilead Sciences)和哈門那公司(Humana)等醫(yī)療股,。

正如英聯邦金融網絡(Commonwealth Financial Network)的首席投資官布拉德·麥克米倫等人對《財富》雜志所說:“我認為政府關門不會發(fā)生,,但即使它真的發(fā)生了,我認為其影響也會比人們想象的小得多,。人們都知道美國國債債臺高筑,。人們都知道政府終將付出代價?!?/p>

擾亂市場的因素

其實,,在股市停擺期間(甚至是其他任何時候),最可能影響股市的是更廣泛的宏觀經濟形勢,。

高盛的策略師表示,,盡管“歷史回報率顯示,政府停擺或近期債務上限問題,,對標準普爾500指數沒有產生持續(xù)的影響,,但宏觀環(huán)境的基本面,對股市來說則相當重要”,?!拔覀兊恼谓洕鷮W家將日益增加的風險歸咎于即將到來的債務上限,并認為這與2011年和2013年的經歷類似,。但其實,,在這兩年中,標準普爾500指數在2011年下跌,,但在2013年債務上限期間是反彈的,。”策略師寫道。

區(qū)別如何,?2011年,,歐洲債務危機爆發(fā),標準普爾下調了美國主權債務評級,,經濟增長也出現了下滑,。相比之下,,2013年的宏觀環(huán)境更為有利,。

事實上,或許秋季之后的宏觀形勢才可能成為更大的擔憂,。

“讓我擔心的不是政府關門的可能性本身,,而是一系列與之密切相關的其他事情?!丙溈嗣讉愓f,。

這些事情包括經濟增長擔憂涌現,最近幾周,,華爾街公司還下調了GDP預期,,此外,還有美聯儲縮減資產購買和支持的時限,,以及中國恒大集團債務危機的影響,。與此同時,市場的季節(jié)性和技術調整可能也助長了最近的市場暴跌,。

對麥克米倫來說,,消費者信心和支出也是他將關注的問題。

“我擔心的是對消費者信心的影響,?!彼f,“聯邦政策已經拖累了信心,。正如我們之前所看到的,,如果政府關門,人們會對是否支付社會保險,、是否支付其他補充款項增加關注,。人們看到了這些頭條新聞,即使沒有直接影響,,他們也會開始認為事情開始變糟糕了,。”

毫無疑問的是,,在股市之外,,政府關門對整體經濟的陣痛依舊。但根據高盛的分析,投資者們現在或許不必擔心“政府關門”所帶來的影響,。

麥克米倫說得更加直白:“這些都是噪音,。盡管風險有所上升,但基本面仍然相當堅挺,。只要基本面保持健康,,這一切都會過去?!保ㄘ敻恢形木W)

編譯:楊二一

As we leave the summer months behind, the market is facing a multitude of potential risks, including the pace of Federal Reserve tapering, the debt ceiling debate, and a looming government shutdown set for October.

On September 21, the House passed a stopgap funding package aimed at preventing a shutdown at the end of September (if legislators fail to pass a new budget) and a looming government debt default. But the bill faces big hurdles in the Senate, ratcheting up fears that a government shutdown may occur in October.

While stock investors may be feeling jittery about many of the potential headwinds swirling in the market right now, strategists at Goldman Sachs suggest that based on history, shutdowns in and of themselves aren’t too impactful to markets—but there are other factors that could affect stocks.

"History shows that U.S. government shutdowns generally have not meaningfully impacted equity returns," Goldman Sachs strategists led by David Kostin wrote in a September 21 evening note. "In the 14 government shutdowns since 1980, the S&P 500 generated median returns of -0.1% on the dates of budget authority expiration, 0.1% during the shutdown periods, and 0.3% on the dates of resolution." (See Goldman's chart below.)

One exception, they note, was in December 2018, during the most recent shutdown, when the S&P 500 fell 2% on that spending authority expiration date. "However, this decline was likely driven primarily by investor concerns about Fed tightening," they suggest.

The muted index impact is also consistent within the S&P 500 sectors, the strategists note.

"S&P 500 sectors and factors have evidenced very small median returns around government shutdowns. The median excess returns of sectors and factors across the 14 episodes all range between +1 [percentage point] and -1 [percentage point] in the weeks before and after budget expiry," they wrote.

But debt limit deadlines have impacted some parts of the market in the past. The Goldman strategists note certain "government revenue" exposed stocks "underperformed the midcap S&P 400 around the 2011 and 2013 debt limit deadlines." Those include industrials like Lockheed Martin, Northrop Grumman, General Dynamics, and Raytheon Technologies; and health care stocks like Anthem, UnitedHealth Group, Gilead Sciences, and Humana.

Ultimately, those like Brad McMillan, chief investment officer of Commonwealth Financial Network, argue that "even if [a government shutdown] were to happen, which I don't think it will, I think the impact would be a lot less than people think. People know U.S. debt is money-good. People know the government will pay eventually," he told Fortune.

What could rattle the markets

However, what could affect stocks during shutdowns (and, frankly, at any other time) is the broader macroeconomic picture.

While "historical returns show no consistent impact to the S&P 500 from government shutdowns or the recent debt ceiling showdowns…the underlying macro environment has been more important for equity performance," the Goldman strategists suggest. "Our political economist has ascribed increasing risk to the upcoming debt limit and sees parallels to the experiences in 2011 and 2013." During those years, "the S&P 500 fell in 2011 but rallied throughout the 2013 debt limit experience."

The difference? "2011 was plagued by the European debt crisis, S&P’s downgrade of U.S. sovereign debt, and declining economic growth. In contrast, the macro environment was more favorable in 2013," they note.

Indeed, perhaps the bigger worry right now is the state of that macro picture heading into the fall.

"I think what concerns me about it is not so much the potential for a shutdown itself but the fact that it's in conjunction with a bunch of other things," McMillan said.

Those include concerns about economic growth and Wall Street firms downgrading GDP forecasts in recent weeks, the Fed's timing on tapering asset purchases and support, and the implications of China's Evergrande debt crisis. Seasonality and technical signals in the market, meanwhile, may have also been feeding into the recent rout in the markets.

For McMillan, consumer confidence and spending are also things he's going to be watching.

"Where I do worry about it is the impact on consumer confidence," he said. "There's already this kind of federal policy-related drag on confidence. And as we've seen before, if you start to get a shutdown, that starts to raise headlines about whether…Social Security's gonna get paid, whether other supplemental payments [are going to get paid]. People see the headlines, and even if it doesn't affect them directly, they start to think things are starting to get broken."

To be sure, outside of the stock market, the consequences of a government shutdown to the broader economy could be painful. But based on Goldman's analysis, investors likely don't need to add "government shutdown" to their list of worries right now.

McMillan puts it in more blunt terms: "It's all noise. As long as the economic fundamentals remain sound—and although the risks have gone up a bit, the fundamentals are still quite solid—this too will pass."