2021年年初,SPAC(特殊目的收購公司)的狂熱到達頂峰,。

FactSet的數(shù)據(jù)顯示,,今年第一季度,SPAC占所有IPO(首次公開募股)的68.5%,。與此同時,,2021年前三個月的SPAC發(fā)行量就超過了2020年的總量,而2020年數(shù)據(jù)已經(jīng)突破歷史紀錄,。

在市場上SPAC過剩的情況下,監(jiān)管機構需要更加謹慎,,美國證券交易委員會(Securities and Exchange Commission)關于會計實務的新指導方針導致SPAC發(fā)行量大幅下降。不過,,盡管SPAC的飆升已經(jīng)明顯降溫,,但“盡管監(jiān)管方面的不確定性持續(xù)存在,SPAC的發(fā)行最近仍然在加速,,”高盛集團(Goldman Sachs)的策略師大衛(wèi)·戈斯坦在9月15日的一份報告中寫道,。

但在這些活動的背后,隱藏著一個更令人沮喪的信息:SPAC熱潮下的產(chǎn)品基本上都沒有給投資者帶來太大的回報,。

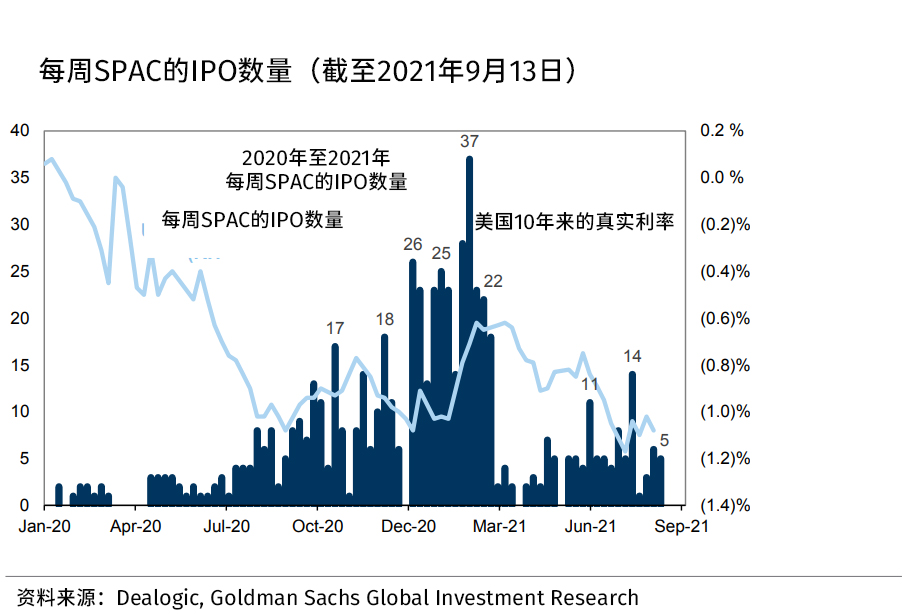

高盛的策略師指出,,第三季度到目前為止,SPAC的成績還不算差到家:“平均每周有6家SPAC完成IPO,融資總額12億美元,?!边@一數(shù)字高于第二季度的平均每周不到4家SPAC,,但仍然低于第一季度狂熱時期每周平均21家SPAC融資60億美元的水平,。(見下面高盛的圖表。)

“實際利率偏低似乎為SPAC的發(fā)行提供了新動力,?!备呤F隊稱。但監(jiān)管和法律方面的擔憂并未消失,,“仍然給發(fā)行前景蒙上陰影,。”

但除了數(shù)字之外,,對投資者來說,,最引人關注的是SPAC的市場回報令人失望。

即便是在2021年年初的繁榮期,,也有報告顯示SPAC的回報低于平均水平,,尤其是合并后(即SPAC收購了一家公司后)的回報。今年4月,,精品投資銀行PJ Solomon的首席執(zhí)行官馬克·庫珀向《財富》雜志表示,,作為投資者,“最需要關注的”是“這些公司退出SPAC后的表現(xiàn)”,。

果然,,根據(jù)高盛的分析,截至9月,,“SPAC的回報一直很低,,尤其是在交易完成之后?!?/p>

用“疲軟”來形容可能還不太夠。高盛寫道:“2月見頂以來,,一個涵蓋不同SPAC整個生命周期各個階段的ETF(基金代碼:SPAK)的回報率為-35%,,而標準普爾500指數(shù)(S&P 500)的回報率為+14%。”同時,,市場上其他“高增長和利率敏感型股票”,比如長期股和非盈利性科技股,,“表現(xiàn)好一些,但也出現(xiàn)了下跌,?!?/p>

高盛的策略師指出,,在自2020年年初以來完成交易的172家SPAC中,“從IPO到宣布交易的過程中,,它們的中位數(shù)表現(xiàn)優(yōu)于羅素3000指數(shù)(Russell 3000),?!钡霸诮灰淄瓿珊蟮?個月里,它們的中位數(shù)表現(xiàn)比羅素3000指數(shù)低了42個百分點,?!?/p>

從另一個角度來看,按照復興資本的肯尼迪的說法,,根據(jù)他的數(shù)據(jù),,今年迄今為止,SPAC的70%的IPO交易價格低于10美元的報價(這是截至9月15日的數(shù)據(jù),,包括已經(jīng)宣布的和一些已經(jīng)完成合并的),。復興資本的數(shù)據(jù)顯示,在2021年完成合并的SPAC中,,58%的交易價格低于最初的報價,。

復興資本在9月發(fā)布的一份報告稱,“由于SPAC回報普遍下降,,美國證券交易委員會監(jiān)管收緊,,與2021年年初相比,正在籌備中的SPAC將更難籌集IPO資金,?!?/p>

當然,并不是說所有的SPAC都是糟糕的投資,??夏岬现赋觯骸熬蛡€案來說……我們看到有一些能力非常出眾,、經(jīng)驗豐富的SPAC贊助商找到了好公司?!?/p>

但投資者似乎比以往任何時候都更需要精挑細選,。(財富中文網(wǎng))

譯者:Agatha

2021年年初,SPAC(特殊目的收購公司)的狂熱到達頂峰,。

FactSet的數(shù)據(jù)顯示,,今年第一季度,SPAC占所有IPO(首次公開募股)的68.5%,。與此同時,,2021年前三個月的SPAC發(fā)行量就超過了2020年的總量,,而2020年數(shù)據(jù)已經(jīng)突破歷史紀錄,。

在市場上SPAC過剩的情況下,監(jiān)管機構需要更加謹慎,,美國證券交易委員會(Securities and Exchange Commission)關于會計實務的新指導方針導致SPAC發(fā)行量大幅下降,。不過,盡管SPAC的飆升已經(jīng)明顯降溫,,但“盡管監(jiān)管方面的不確定性持續(xù)存在,,SPAC的發(fā)行最近仍然在加速,”高盛集團(Goldman Sachs)的策略師大衛(wèi)·戈斯坦在9月15日的一份報告中寫道,。

但在這些活動的背后,,隱藏著一個更令人沮喪的信息:SPAC熱潮下的產(chǎn)品基本上都沒有給投資者帶來太大的回報。

高盛的策略師指出,,第三季度到目前為止,,SPAC的成績還不算差到家:“平均每周有6家SPAC完成IPO,融資總額12億美元,?!边@一數(shù)字高于第二季度的平均每周不到4家SPAC,但仍然低于第一季度狂熱時期每周平均21家SPAC融資60億美元的水平,。(見下面高盛的圖表,。)

“實際利率偏低似乎為SPAC的發(fā)行提供了新動力?!备呤F隊稱,。但監(jiān)管和法律方面的擔憂并未消失,“仍然給發(fā)行前景蒙上陰影,?!?/p>

復興資本(Renaissance Capital)的IPO高級策略師馬修·肯尼迪向《財富》雜志表示,“值得注意的是,,盡管我們的IPO規(guī)模較第一季度大幅下滑,,但與前幾年相比,仍然在以有史以來的最快速度增長,?!?/p>

但除了數(shù)字之外,對投資者來說,,最引人關注的是SPAC的市場回報令人失望,。

即便是在2021年年初的繁榮期,也有報告顯示SPAC的回報低于平均水平,,尤其是合并后(即SPAC收購了一家公司后)的回報,。今年4月,精品投資銀行PJ Solomon的首席執(zhí)行官馬克·庫珀向《財富》雜志表示,,作為投資者,,“最需要關注的”是“這些公司退出SPAC后的表現(xiàn)”。

果然,,根據(jù)高盛的分析,,截至9月,“SPAC的回報一直很低,,尤其是在交易完成之后,。”

用“疲軟”來形容可能還不太夠,。高盛寫道:“2月見頂以來,,一個涵蓋不同SPAC整個生命周期各個階段的ETF(基金代碼:SPAK)的回報率為-35%,而標準普爾500指數(shù)(S&P 500)的回報率為+14%,?!蓖瑫r,市場上其他“高增長和利率敏感型股票”,,比如長期股和非盈利性科技股,,“表現(xiàn)好一些,但也出現(xiàn)了下跌,?!?/p>

高盛的策略師指出,在自2020年年初以來完成交易的172家SPAC中,,“從IPO到宣布交易的過程中,,它們的中位數(shù)表現(xiàn)優(yōu)于羅素3000指數(shù)(Russell 3000)?!钡霸诮灰淄瓿珊蟮?個月里,,它們的中位數(shù)表現(xiàn)比羅素3000指數(shù)低了42個百分點?!?/p>

從另一個角度來看,,按照復興資本的肯尼迪的說法,,根據(jù)他的數(shù)據(jù),今年迄今為止,,SPAC的70%的IPO交易價格低于10美元的報價(這是截至9月15日的數(shù)據(jù),,包括已經(jīng)宣布的和一些已經(jīng)完成合并的)。復興資本的數(shù)據(jù)顯示,,在2021年完成合并的SPAC中,,58%的交易價格低于最初的報價。

復興資本在9月發(fā)布的一份報告稱,,“由于SPAC回報普遍下降,,美國證券交易委員會監(jiān)管收緊,與2021年年初相比,,正在籌備中的SPAC將更難籌集IPO資金,。”

當然,,并不是說所有的SPAC都是糟糕的投資,。肯尼迪指出:“就個案來說……我們看到有一些能力非常出眾,、經(jīng)驗豐富的SPAC贊助商找到了好公司?!?/p>

但投資者似乎比以往任何時候都更需要精挑細選,。(財富中文網(wǎng))

譯者:Agatha

Back in early 2021, the SPAC frenzy was at its nose-bleed height.

During the first quarter of this year, SPACs, or special purpose acquisition companies, made up 68.5% of all IPOs, per FactSet data. Meanwhile, SPAC issuance topped its record 2020 total in the first three months of 2021.

Amid the glut of SPACs in the market, regulators have grown more wary, and the Securities and Exchange Commission's new guidelines around accounting practices sent SPAC issuance into a nosedive. Still, although the SPAC surge has markedly cooled, "SPAC issuance has accelerated recently despite continued regulatory uncertainty," strategists at Goldman Sachs led by David Gostin wrote in a September 15 report.

But underneath that activity lies a more somber message: The products of the SPAC boom largely haven't yielded great returns for investors.

So far in the third quarter, SPACs aren't down for the count: "An average of 6 SPAC IPOs have raised $1.2 billion in total capital each week," the Goldman strategists point out. That's up from the fewer than four SPAC IPOs completed in the average week in the second quarter, though still below the average 21 SPACs raising $6 billion in capital each week during the frenzied first quarter. (See Goldman's chart below.)

"Lower real rates appear to have provided a renewed tailwind to SPAC issuance," the Goldman team notes—but those regulatory and legal worries aren't out of the picture, and "continue to cloud the issuance outlook."

Matthew Kennedy, senior IPO strategist at Renaissance Capital, tells Fortune that "it's important to note that even though we've come down significantly from the first quarter, we're still on a record pace from previous years."

But aside from the sheer number, the headline for investors is that SPAC returns in the market have been disappointing.

Even back in the booming days of early 2021, there were reports suggesting SPAC returns, notably returns post-merger (once the SPAC has acquired a company), have been subpar. The "most important thing to keep your eye on" as an investor is "the performance of these companies once they de-SPAC," Marc Cooper, the CEO of boutique investment bank PJ Solomon, told Fortune back in April.

Sure enough, according to Goldman's analysis as of September, "SPAC returns have been weak, especially following deal closure."

Weak may be understating it a little. "Since its February peak, an ETF of SPACs across stages of the lifecycle (ticker: SPAK) has returned -35%, vs. +14% for the S&P 500," they note. Meanwhile other "high growth and interest rate-sensitive pockets of the market," like long duration stocks and non-profitable tech stocks, "have fared better but also declined."

Of the 172 SPACs that have closed a deal since the start of 2020, "the median has outperformed the Russell 3000 from its IPO to deal announcement," the Goldman strategists note. But "in the six months after deal closure, the median SPAC underperformed the Russell 3000 by 42 [percentage points]."

Looking at it another way, Renaissance Capital's Kennedy notes that based on his data, 70% of SPAC IPOs so far this year are trading below their $10 offer price (that's through September 15, and includes those that have announced and a few that have completed mergers). And of the SPACs that have completed mergers in 2021, 58% trade below their original offer price, according to Renaissance data.

Moving forward, "the SPACs in the pipeline will have a harder time raising IPO capital compared to early 2021, due to a broad-based decline in SPAC returns and greater regulatory scrutiny from the SEC," per a September report from Renaissance Capital.

That's not to say all SPACs are bad investments, of course. Kennedy notes that, "on an individual basis...we've definitely seen very competent, experienced SPAC sponsors find the good companies."

But it seems investors may need to be choosier than ever.