公司上市的最佳時(shí)機(jī)顯然是在疫情期間,因?yàn)樽罾硐氲纳鲜袝r(shí)間是在通脹飛速攀升,、勞動(dòng)力不足和供應(yīng)鏈問(wèn)題日益嚴(yán)重的時(shí)期,。

IPO制度研究與投資產(chǎn)品公司Renaissance Capital的數(shù)據(jù)顯示,截至2021年12月中旬,,接近400家私有公司在美國(guó)股市上市,,融資1,425億美元。這是在12個(gè)月內(nèi)公司上市融資的最高總金額,。

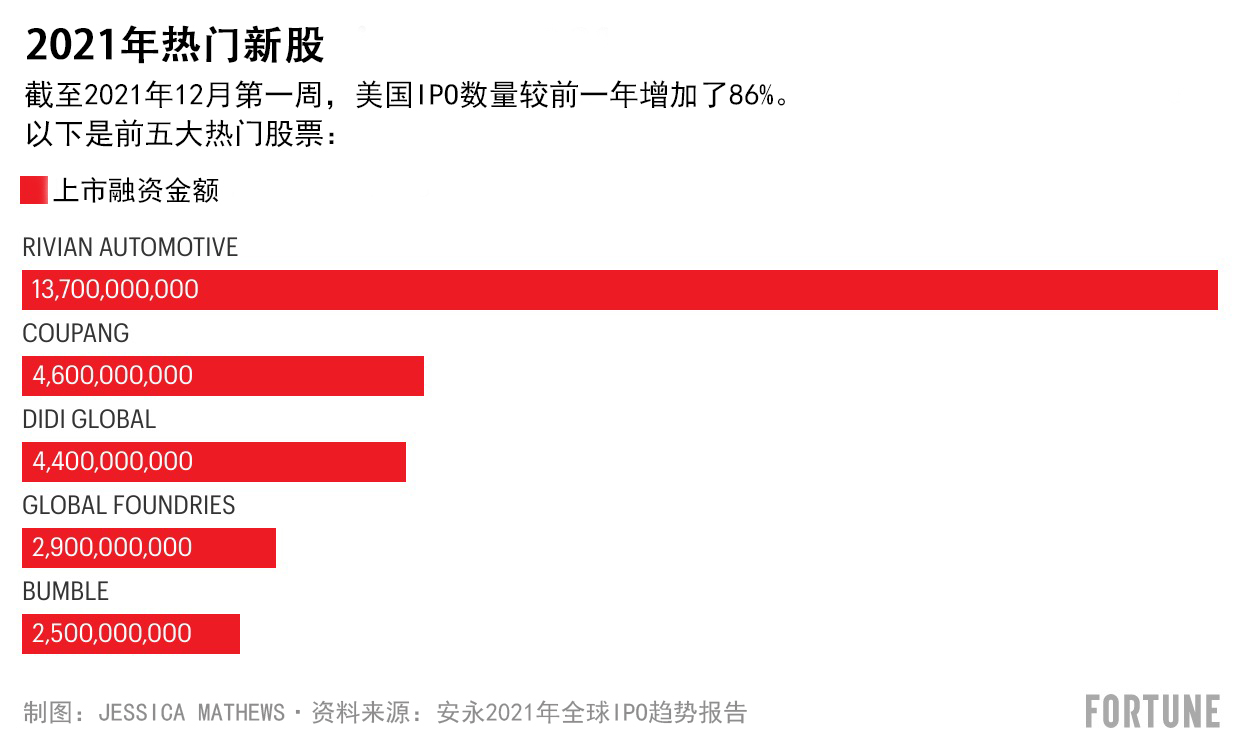

在當(dāng)前高估值和股市整體暴漲的大背景下,,選擇上市的公司源源不斷,例如Affirm,、ThredUp,、Coursera、Oatly,、Bumble,、Duolingo、Rent the Runway,、Rivian Motors,、Robinhood等公司都在這段時(shí)間上市。

安永(EY)美洲區(qū)IPO負(fù)責(zé)人雷切爾·格林談到今年公司上市的超高估值時(shí)表示:“這種情況顯然會(huì)吸引公司考慮上市,,而不是選擇其他融資方式,。”幾年前,,科技公司一直在艱難地維持其在上市之前從風(fēng)險(xiǎn)投資家和私募股權(quán)基金那里獲得的估值。麥肯錫(McKinsey)2016年的一份報(bào)告顯示,,獨(dú)角獸公司因?yàn)檫@個(gè)原因選擇推遲上市,。

特殊目的收購(gòu)公司上市同樣火爆,這類公司上市速度更快、更簡(jiǎn)單,,而且更適合小公司,。特殊目的收購(gòu)公司已經(jīng)存在了二十多年,但過(guò)去幾年才成為頗受公司歡迎的一種上市方式,。安永的IPO報(bào)告顯示,,截至12月8日,共有近150家空白支票公司在美國(guó)上市,。

但隨著2021年接近尾聲,,IPO繁榮似乎也即將結(jié)束,至少目前是這樣,。

最近幾周,,受到多重因素的影響,美股市場(chǎng)變得更不穩(wěn)定,,包括具有極強(qiáng)傳染力的奧米克戎變異株引發(fā)的擔(dān)憂,、持續(xù)時(shí)間超出預(yù)期的通貨膨脹、勞動(dòng)力不足和供應(yīng)鏈中斷等,。無(wú)論是因?yàn)槟姆N原因,,新上市公司的表現(xiàn)突然間變得好壞不一?!敦?cái)富》雜志本月早些時(shí)候的一項(xiàng)分析顯示,,今年上市的前100只股票中,有超過(guò)一半的交易價(jià)格低于首次發(fā)行價(jià),。

格林表示:“這對(duì)于計(jì)劃上市的公司來(lái)說(shuō)并非好消息,。”他認(rèn)為公司可能會(huì)因此推遲上市計(jì)劃,。 “我并不認(rèn)為這會(huì)讓市場(chǎng)關(guān)閉,,但絕對(duì)會(huì)產(chǎn)生影響?!?/p>

自本月初以來(lái),,企業(yè)提交的S-1文件越來(lái)越少。依舊有一些私營(yíng)企業(yè)正在準(zhǔn)備上市(其中最值得關(guān)注的是Reddit,。該公司最近表示已經(jīng)向美國(guó)證監(jiān)會(huì)秘密提交了上市登記報(bào)告草案),。

但2022年上市的公司可能會(huì)懷念2021年疫情肆虐、通脹攀升的那段美好時(shí)光,。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

公司上市的最佳時(shí)機(jī)顯然是在疫情期間,,因?yàn)樽罾硐氲纳鲜袝r(shí)間是在通脹飛速攀升、勞動(dòng)力不足和供應(yīng)鏈問(wèn)題日益嚴(yán)重的時(shí)期,。

IPO制度研究與投資產(chǎn)品公司Renaissance Capital的數(shù)據(jù)顯示,,截至2021年12月中旬,,接近400家私有公司在美國(guó)股市上市,融資1,425億美元,。這是在12個(gè)月內(nèi)公司上市融資的最高總金額,。

在當(dāng)前高估值和股市整體暴漲的大背景下,選擇上市的公司源源不斷,,例如Affirm,、ThredUp、Coursera,、Oatly,、Bumble、Duolingo,、Rent the Runway,、Rivian Motors、Robinhood等公司都在這段時(shí)間上市,。

安永(EY)美洲區(qū)IPO負(fù)責(zé)人雷切爾·格林談到今年公司上市的超高估值時(shí)表示:“這種情況顯然會(huì)吸引公司考慮上市,,而不是選擇其他融資方式?!睅啄昵?,科技公司一直在艱難地維持其在上市之前從風(fēng)險(xiǎn)投資家和私募股權(quán)基金那里獲得的估值。麥肯錫(McKinsey)2016年的一份報(bào)告顯示,,獨(dú)角獸公司因?yàn)檫@個(gè)原因選擇推遲上市,。

特殊目的收購(gòu)公司上市同樣火爆,這類公司上市速度更快,、更簡(jiǎn)單,,而且更適合小公司。特殊目的收購(gòu)公司已經(jīng)存在了二十多年,,但過(guò)去幾年才成為頗受公司歡迎的一種上市方式,。安永的IPO報(bào)告顯示,截至12月8日,,共有近150家空白支票公司在美國(guó)上市,。

但隨著2021年接近尾聲,IPO繁榮似乎也即將結(jié)束,,至少目前是這樣,。

最近幾周,受到多重因素的影響,,美股市場(chǎng)變得更不穩(wěn)定,,包括具有極強(qiáng)傳染力的奧米克戎變異株引發(fā)的擔(dān)憂、持續(xù)時(shí)間超出預(yù)期的通貨膨脹,、勞動(dòng)力不足和供應(yīng)鏈中斷等,。無(wú)論是因?yàn)槟姆N原因,,新上市公司的表現(xiàn)突然間變得好壞不一,?!敦?cái)富》雜志本月早些時(shí)候的一項(xiàng)分析顯示,今年上市的前100只股票中,,有超過(guò)一半的交易價(jià)格低于首次發(fā)行價(jià),。

格林表示:“這對(duì)于計(jì)劃上市的公司來(lái)說(shuō)并非好消息?!彼J(rèn)為公司可能會(huì)因此推遲上市計(jì)劃,。 “我并不認(rèn)為這會(huì)讓市場(chǎng)關(guān)閉,但絕對(duì)會(huì)產(chǎn)生影響,?!?/p>

自本月初以來(lái),企業(yè)提交的S-1文件越來(lái)越少,。依舊有一些私營(yíng)企業(yè)正在準(zhǔn)備上市(其中最值得關(guān)注的是Reddit,。該公司最近表示已經(jīng)向美國(guó)證監(jiān)會(huì)秘密提交了上市登記報(bào)告草案)。

但2022年上市的公司可能會(huì)懷念2021年疫情肆虐,、通脹攀升的那段美好時(shí)光,。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

The best time to take a company public is apparently during a pandemic, ideally while inflation is spiking, labor shortages are rampant and crippling supply chain issues prevail.

Nearly 400 private companies raised $142.5 billion by going public on the U.S. stock exchange by mid-December 2021, according to data from Renaissance Capital, an IPO institutional research and investment product company. That’s more funding than companies have ever managed to raise in a 12-month period.

The stream of public debuts was near-constant: Affirm, ThredUp, Coursera, Oatly, Bumble, Duolingo, Rent the Runway, Rivian Motors, Robinhood, to name a few, all listed shares—with the backdrop of a bloated valuation environment and soaring stock market.

“That clearly makes it attractive for companies to consider a public listing, versus other alternative methods of accessing capital,” says Rachel Gerring, IPO Leader at EY Americas, of the hefty valuations companies have obtained this year. Only a few years ago, tech companies were struggling to maintain the private valuations they secured from venture capitalists and private equity firms on their way into the public market. A 2016 McKinsey report indicated that unicorns were staying private longer as a result.

There’s also the boom in SPACs, or special purpose acquisition companies, which have made it quicker and simpler to list on an exchange—and more accessible to smaller companies. SPACs have really only become a popular means for companies to go public in the last few years, despite being an available method for a couple decades. Nearly 150 blank check companies had listed on a U.S. exchange by December 8, according to an EY IPO report.

But as 2021 comes to a close, it's looking like the IPO boom is over, at least for now.

The stock market has become more erratic in recent weeks, which could be stemming from concerns about the highly contagious Omicron variant, inflation that has persisted for longer than expected, labor shortages, and breaks in the supply chain. Whatever the reasons, performance for newly listed companies has suddenly been quite spotty. A Fortune analysis from earlier this month showed that more than half of the 100 largest IPOs this year were trading below their initial offering price.

“That does not bode well for those who are looking to go public,” says Gerring, who notes companies may be tempted to push back planned listings. "I don't think it itself shuts down the market, but it certainly influences the market."

S-1 filings have slowed to a trickle since the beginning of this month. Although there are still some private companies in transit to the public markets (one of the most notable on the agenda being Reddit, which recently said it had confidentially filed a draft registration statement with the SEC).

For those companies that do make it to the public markets in 2022, however, they may find themselves wishing for the good old days of pandemic-ridden, inflation-plagued 2021.