美聯(lián)儲(Federal Reserve)官員去年夏天曾堅信,,隨著經(jīng)濟挺過由疫情引發(fā)的供需震蕩,物價上漲現(xiàn)象將有望出現(xiàn)逆轉,。然而,,有鑒于美國通脹數(shù)據(jù)最新創(chuàng)下39年新高,這一“曇花一現(xiàn)”的觀點在本月基本上被人們拋之腦后,。在該報告發(fā)布不久后,,美聯(lián)儲主席杰羅米·鮑威爾表示,頑固的高通脹率意味著,,背負著維持最大就業(yè)率和穩(wěn)定物價這一雙重國會任務的美國央行,,更有可能“祭出加速縮債”的手段。

該聲明引發(fā)了房地產(chǎn)行業(yè)的關注,。如果美聯(lián)儲決定加息,,并減少對抵押擔保證券的購買,那么此舉會導致房貸利率的上升,。在疫情爆發(fā)的最初幾周,,美聯(lián)儲的舉措使得抵押貸款利率降至歷史最低水平,此舉催生了現(xiàn)代史上最強勢的房地產(chǎn)市場,。然而,,不斷增長的房貸利率從理論上來講會在2022年阻礙房地產(chǎn)市場的發(fā)展:它會為房價增速帶來下行壓力,因為一些買家會被市場拒之門外,。

盡管如此,,至于2022年利率會升至多高,房地產(chǎn)行業(yè)并沒有一個統(tǒng)一的意見,,更不用說不斷上升的房貸利率會對如火如荼的房產(chǎn)市場帶來多大的降溫作用,。房產(chǎn)市場的一些巨頭預測,不斷上升的利率多少會導致市場出現(xiàn)震蕩現(xiàn)象,,而其他人認為,,房地產(chǎn)市場已足夠強勁,即便貸款利率大漲也能消化,。

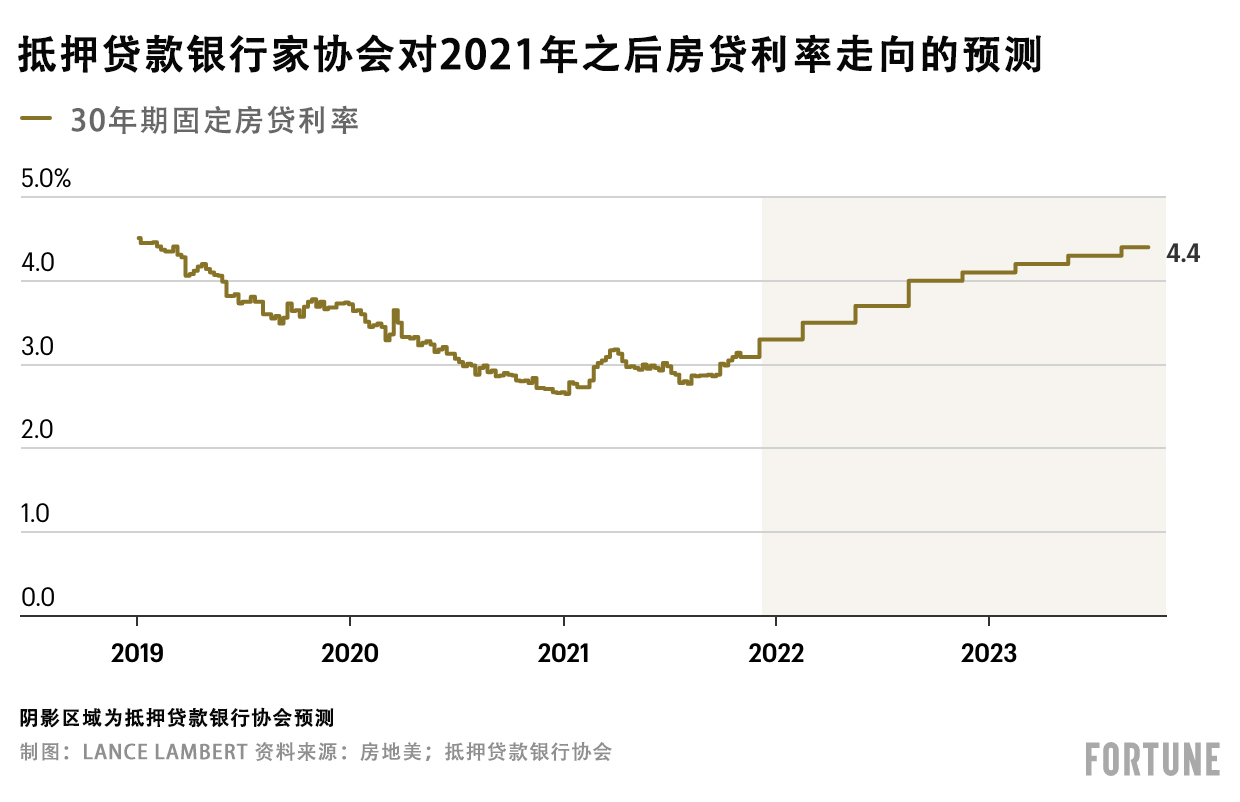

認為利率上升會給市場帶來些許震蕩的陣營包括美國抵押貸款銀行家協(xié)會(Mortgage Bankers Association),。總部位于華盛頓特區(qū)的該行業(yè)組織預測,30年期平均固定房貸利率(當前為3.1%)將在2022年底增至4%,。該組織稱,,上述利率增幅有助于將現(xiàn)有房產(chǎn)明年的價格中值壓低2.5%。這意味著去年房價19.5%的躍升會出現(xiàn)重大反轉,。

然而,,并非所有機構都贊同抵押貸款銀行家協(xié)會的預測,也不認同房貸利率的增長對于房價的影響,。房利美(Fannie Mae)便是其中之一,,它預測2022年底30年期平均房貸利率為3.3%。

抵押貸款銀行家協(xié)會與房利美預測之間的差別可能要比乍看起來的更大,。舉個例子:如果一位借貸人以3.3%的利率借貸50萬美元的30年期固定利率按揭貸款,,那么其月供為2190美元。如果按照4%的利率計算,,其月供將增至2387美元,,也就是30年內(nèi)多還70900美元。后者的還款額度將讓更多的買家望而卻步,,同時還會讓一些借款方失去抵押貸款資質(zhì),,因為貸款發(fā)放依據(jù)的是嚴格的負債收入比。這也解釋了為什么抵押貸款銀行家協(xié)會的房貸利率預測與其明年房價將下滑2.5%的預測出奇的一致,。正是因為這個原因,,房利美在預測利率會溫和上漲的同時還預測房價將在2022年繼續(xù)增長7.9%,幾乎是1980年以來房價平均漲幅(4.6%)的兩倍,。

即便房貸利率不會大幅增長,,我們也不能理所當然地得出房價就會下滑的結論。Home.LLC首席執(zhí)行官尼克·沙阿向《財富》雜志透露,,他的公司同樣預測房貸利率在2022年底將增至4%,。Home.LLC是一家向購房者提供首付協(xié)助,,并以此獲得房屋未來轉售利潤分成權的初創(chuàng)企業(yè),。然而,與抵押貸款銀行家協(xié)會不同的是,,他指出,,“[2022年]房價將繼續(xù)上漲,只是增速會有所放緩,?!?/p>

既然房貸利率從理論上來講將出現(xiàn)大幅躍升,房價為何能夠繼續(xù)保持強勁的增長態(tài)勢呢,?沙阿提到了房產(chǎn)市場供需之間一直存在的失衡問題,。我們當前正處于五年窗口期的中期階段(2019年-2023年),于千禧一代出生人口最多的五年期間(1989年-1993年)降生的人群將在此時迎來其30歲生日,也就是最重要的首次購房年齡,。與此同時,,這些潛在的買家面臨的是可售流通房屋處于40多年來最低水平的境況??偟膩碚f,,房地美(Freddie Mac)估計,美國當前可售房屋的數(shù)量與買家需求之間存在400萬套的差距,。受這一局勢的影響,,盡管房貸利率會有所增長,但房產(chǎn)市場在未來數(shù)年內(nèi)依然是賣家的天下,。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

美聯(lián)儲(Federal Reserve)官員去年夏天曾堅信,,隨著經(jīng)濟挺過由疫情引發(fā)的供需震蕩,物價上漲現(xiàn)象將有望出現(xiàn)逆轉,。然而,,有鑒于美國通脹數(shù)據(jù)最新創(chuàng)下39年新高,這一“曇花一現(xiàn)”的觀點在本月基本上被人們拋之腦后,。在該報告發(fā)布不久后,,美聯(lián)儲主席杰羅米·鮑威爾表示,頑固的高通脹率意味著,,背負著維持最大就業(yè)率和穩(wěn)定物價這一雙重國會任務的美國央行,,更有可能“祭出加速縮債”的手段。

該聲明引發(fā)了房地產(chǎn)行業(yè)的關注,。如果美聯(lián)儲決定加息,,并減少對抵押擔保證券的購買,那么此舉會導致房貸利率的上升,。在疫情爆發(fā)的最初幾周,,美聯(lián)儲的舉措使得抵押貸款利率降至歷史最低水平,此舉催生了現(xiàn)代史上最強勢的房地產(chǎn)市場,。然而,,不斷增長的房貸利率從理論上來講會在2022年阻礙房地產(chǎn)市場的發(fā)展:它會為房價增速帶來下行壓力,因為一些買家會被市場拒之門外,。

盡管如此,,至于2022年利率會升至多高,房地產(chǎn)行業(yè)并沒有一個統(tǒng)一的意見,,更不用說不斷上升的房貸利率會對如火如荼的房產(chǎn)市場帶來多大的降溫作用,。房產(chǎn)市場的一些巨頭預測,不斷上升的利率多少會導致市場出現(xiàn)震蕩現(xiàn)象,,而其他人認為,,房地產(chǎn)市場已足夠強勁,,即便貸款利率大漲也能消化。

認為利率上升會給市場帶來些許震蕩的陣營包括美國抵押貸款銀行家協(xié)會(Mortgage Bankers Association),??偛课挥谌A盛頓特區(qū)的該行業(yè)組織預測,30年期平均固定房貸利率(當前為3.1%)將在2022年底增至4%,。該組織稱,,上述利率增幅有助于將現(xiàn)有房產(chǎn)明年的價格中值壓低2.5%。這意味著去年房價19.5%的躍升會出現(xiàn)重大反轉,。

然而,,并非所有機構都贊同抵押貸款銀行家協(xié)會的預測,也不認同房貸利率的增長對于房價的影響,。房利美(Fannie Mae)便是其中之一,,它預測2022年底30年期平均房貸利率為3.3%。

抵押貸款銀行家協(xié)會與房利美預測之間的差別可能要比乍看起來的更大,。舉個例子:如果一位借貸人以3.3%的利率借貸50萬美元的30年期固定利率按揭貸款,,那么其月供為2190美元。如果按照4%的利率計算,,其月供將增至2387美元,,也就是30年內(nèi)多還70900美元。后者的還款額度將讓更多的買家望而卻步,,同時還會讓一些借款方失去抵押貸款資質(zhì),,因為貸款發(fā)放依據(jù)的是嚴格的負債收入比。這也解釋了為什么抵押貸款銀行家協(xié)會的房貸利率預測與其明年房價將下滑2.5%的預測出奇的一致,。正是因為這個原因,,房利美在預測利率會溫和上漲的同時還預測房價將在2022年繼續(xù)增長7.9%,幾乎是1980年以來房價平均漲幅(4.6%)的兩倍,。

即便房貸利率不會大幅增長,,我們也不能理所當然地得出房價就會下滑的結論。Home.LLC首席執(zhí)行官尼克·沙阿向《財富》雜志透露,,他的公司同樣預測房貸利率在2022年底將增至4%,。Home.LLC是一家向購房者提供首付協(xié)助,并以此獲得房屋未來轉售利潤分成權的初創(chuàng)企業(yè),。然而,,與抵押貸款銀行家協(xié)會不同的是,他指出,,“[2022年]房價將繼續(xù)上漲,只是增速會有所放緩,?!?/p>

既然房貸利率從理論上來講將出現(xiàn)大幅躍升,,房價為何能夠繼續(xù)保持強勁的增長態(tài)勢呢?沙阿提到了房產(chǎn)市場供需之間一直存在的失衡問題,。我們當前正處于五年窗口期的中期階段(2019年-2023年),,于千禧一代出生人口最多的五年期間(1989年-1993年)降生的人群將在此時迎來其30歲生日,也就是最重要的首次購房年齡,。與此同時,,這些潛在的買家面臨的是可售流通房屋處于40多年來最低水平的境況??偟膩碚f,,房地美(Freddie Mac)估計,美國當前可售房屋的數(shù)量與買家需求之間存在400萬套的差距,。受這一局勢的影響,,盡管房貸利率會有所增長,但房產(chǎn)市場在未來數(shù)年內(nèi)依然是賣家的天下,。(財富中文網(wǎng))

譯者:馮豐

審校:夏林

Federal Reserve officials were confident through the summer that spiking prices would reverse as the economy worked through supply and demand shocks caused by the pandemic. But that "transitory" narrative has been all but abandoned this month as the latest reading of U.S. inflation hit a 39-year high. Soon after that report came out, Fed Chair Jerome Powell acknowledged that stubbornly high inflation means that the central bank—which has a dual mandate from Congress to maintain maximum employment and stable prices—is more likely to "look at speeding up the taper."

That statement got the attention of the real estate industry. If the Fed goes through with upping interest rates and reducing its purchases of mortgage-backed securities, it could result in higher mortgage rates. During the early weeks of the pandemic, Fed action pushed mortgage rates down to the lowest levels on record—which has helped to spur one of the most competitive housing markets in modern history. But rising mortgage rates would in theory do the opposite in 2022: They would put downward pressure on home price growth as some buyers get locked out of the market.

That said, there's no consensus in the housing industry on how high rates will rise in 2022—let alone how much rising mortgage rates would do to cool off a housing market that is still red-hot. Some big players in the real estate market are predicting rising rates will cause something of a market shock, while others think the housing market is strong enough to absorb even a big uptick in mortgage rates.

The camp that thinks rising rates will shock the market a bit includes the Mortgage Bankers Association. The industry trade group, based in Washington, D.C., is forecasting that the average 30-year fixed mortgage rate (which is currently at 3.1%) will rise to 4% by the end of 2022. That rate jump, the group says, will help to push the median price of existing homes down 2.5% next year. That would represent a major reversal from the 19.5% jump in home prices we've seen over the past year.

But not everyone agrees with the MBA's forecast—nor about the impact higher mortgage rates would have on home prices. Look no further than Fannie Mae, which is predicting the average 30-year mortgage rate will come in at 3.3% by the end of 2022.

The differences between the forecasts of the MBA and Fannie Mae are bigger than they might first appear. To illustrate: A borrower who takes out a $500,000 30-year fixed mortgage at a 3.3% rate would owe a $2,190 monthly payment. At a 4% rate, that payment jumps to $2,387—or an additional $70,900 over three decades. Not only would the latter burden price out more buyers, it would also lock some borrowers out of mortgage eligibility—given that loans are issued based on strict debt-to-income ratios. That explains why the MBA's mortgage rate forecast coincides with its forecast that home prices will drop 2.5% next year. Accordingly, Fannie Mae's forecast of a more mild jump in rates is accompanied with the firm's forecast that home prices will jump another 7.9% in 2022—or almost double the average home price uptick (4.6%) the market has seen since 1980.

If a big jump in mortgage rates does come to fruition, it doesn't mean we should automatically accept that we're headed for lower prices. Nik Shah, CEO of Home.LLC, a startup that provides down payment assistance to homebuyers in return for a share of any profits from the home's future resale, tells Fortune his firm is also forecasting mortgage rates will climb to 4% by the end of 2022. However, unlike the Mortgage Bankers Association, he says that "home prices will continue to increase [in 2022], just at a decelerated rate."

How is it possible that home prices could still continue posting solid growth despite a theoretical big jump in mortgage rates? Shah points to the ongoing mismatch between supply and demand in the housing market. We're currently in the middle of the five-year window (2019 through 2023) when the millennials born during that generation's five largest birth years (between 1989 and 1993) will hit the all-important first-time homebuying age of 30. At the same time, those potential buyers are plunging into a market in which active homes for sale are at the lowest level in more than four decades. In total, Freddie Mac estimates the nation is 4 million homes short of current buyer demand. That dynamic—even in the face of higher mortgage rates—could keep this a seller’s market for years to come.