對投資者來說,,2021年的股市堪稱精彩,標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)的年度漲幅在21世紀(jì)排名第三位,。

留心的人們都知道,,基準(zhǔn)指數(shù)上漲了26.9%。受到能源,、金融和大型科技股的推動,,加上股息的話,標(biāo)準(zhǔn)普爾500指數(shù)的總回報率達(dá)28.7%,。不過如果仔細(xì)研究數(shù)據(jù),,就會發(fā)現(xiàn)背后的貧富不均。

高盛集團(tuán)(Goldman Sachs)發(fā)現(xiàn),,整整一年里,,蘋果(Apple)、微軟(Microsoft),、英偉達(dá)(Nvidia),、特斯拉(Tesla)和Alphabet旗下的谷歌(Google)五只股票的回報占標(biāo)準(zhǔn)普爾總回報的32.6%。高盛警告稱,,市場如此狹窄往往意味著沉悶,。換句話說就是:投資者傾向盡可能長時間跟著贏家走,卻容易忽略市場上其他有希望的領(lǐng)域,。

果然,,年終數(shù)據(jù)充分顯示出大型科技股對投資者投資組合的影響力,。納斯達(dá)克100指數(shù)(Nasdaq 100)上漲26.6%,標(biāo)準(zhǔn)普爾500指數(shù)的科技板塊漲幅為33.4%,。

再往東看,,2021年股市情況就沒有那么亮眼了,。中國政府治理高增長科技股,再加上一系列數(shù)據(jù)顯示全球第二大經(jīng)濟(jì)體增長開始放緩,,所以中國股市受到影響,。

加密貨幣、大宗商品和咖啡

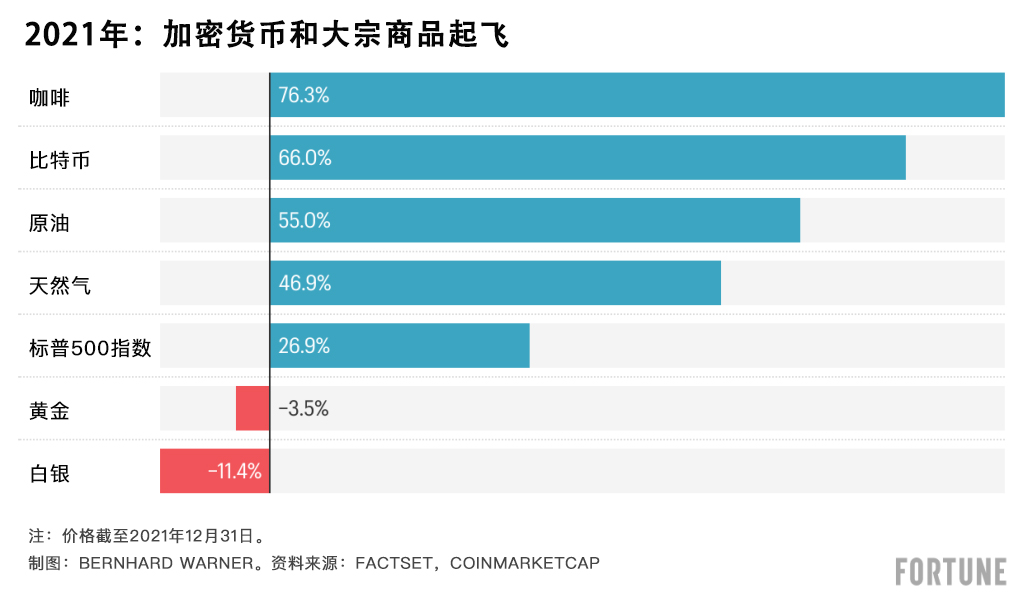

要想找到2021年的大贏家,,只看大宗商品和加密貨幣就夠了,。盡管2021年12月的比特幣(Bitcoin)走勢跌宕起伏,全年卻仍然上漲了66%,。而且在過去三年中,,堪稱另類貨幣之王的比特幣的漲幅超過400%。但比特幣想爭奪2021年的回報最佳還差一點,。因為該項榮譽(yù)歸屬低調(diào)的咖啡豆,。受地緣政治、氣候災(zāi)難和新冠疫情影響,,過去一年的咖啡期貨合約暴漲,,2021年的漲幅達(dá)到驚人的76.3%。

展望2022年

雖然2021年的股市漲幅可觀,,但華爾街卻幾乎沒有人預(yù)測2022年的大漲能夠再現(xiàn),。高盛對標(biāo)準(zhǔn)普爾500指數(shù)的年終點位預(yù)期是5100點,比當(dāng)前水平增長約7%,。這一預(yù)測已經(jīng)相當(dāng)樂觀,。摩根士丹利(Morgan Stanley)的財富管理首席投資官麗薩·沙萊特表示,“預(yù)計標(biāo)準(zhǔn)普爾500指數(shù)將在區(qū)間內(nèi)上下波動,?!泵楞y證券(BofA Securities)預(yù)計今年年底的標(biāo)準(zhǔn)普爾指數(shù)點位為4600點,,意味著今年股市將下跌。

受一系列因素影響,,未來一年市場前景愈加復(fù)雜,。其中包括央行態(tài)度更加強(qiáng)硬、通脹加劇,、供應(yīng)鏈困境至少持續(xù)到2022年上半年,,以及美國總統(tǒng)喬·拜登的“重建更好未來”(Build Back Better)刺激支出計劃想要在美國國會通過還面臨長期困難等等。

利率和減量

華爾街有越來越多的人認(rèn)為,,今年3月美聯(lián)儲(Federal Reserve)將結(jié)束資產(chǎn)購買,,而且2022年上半年某個時候?qū)⑻嵘鶞?zhǔn)貸款利率。傳統(tǒng)情況下,,此類環(huán)境中價值股(比如金融股)表現(xiàn)要比沒有利潤的成長股好一些,。有些投資者已經(jīng)意識到這點,開始拯救多只2020年代的成長型股票,。

通貨膨脹

2021年年底,,通貨膨脹開始升溫。預(yù)計通脹至少持續(xù)到2022年上半年,。供應(yīng)鏈混亂應(yīng)該有所緩解,,不過隨著企業(yè)著手應(yīng)付極其緊缺的就業(yè)市場,勞動力成本上升料將持續(xù),。

這一情況必然會影響股市,。高盛的美國首席股票策略師大衛(wèi)·科斯汀直言:“2022年投資者應(yīng)該關(guān)注高增長、高利潤的股票,,避開可能出現(xiàn)薪資通脹風(fēng)險的公司,。”

無法重建,?

2022年年初,,基礎(chǔ)設(shè)施、消費者和氣候相關(guān)股票可能坎坷不斷,,尤其當(dāng)前拜登政府1.75萬億美元的支出閃電戰(zhàn)似乎已經(jīng)成為泡影,。高盛就預(yù)期“重建更好未來”無法在美國國會通過。如果真如預(yù)期一樣無法通過,,就可能打擊經(jīng)濟(jì)增長,,因為向來是美國經(jīng)濟(jì)引擎的消費者沒有足夠的彈藥來消費、消費,、消費,。2021年市場上最令人驚訝的力量之一,即大批散戶投資者可能也會受影響。

新冠疫情

2021年11月,,本就混亂的市場因為奧密克戎變異毒株而越發(fā)動蕩?,F(xiàn)在要預(yù)料該傳染性超強(qiáng)的變異毒株對全球經(jīng)濟(jì)的影響有多嚴(yán)重,可能為時過早,。然而企業(yè)紛紛被迫重新考慮開放的計劃,,航空公司取消了數(shù)以千計的航班。旅游和休閑股受創(chuàng),,大規(guī)?!爸匦麻_放”也增加了不確定性。最近,,德意志銀行(Deutsche Bank)在一份投資者報告中警告稱,,奧密克戎變異毒株將“增加短期阻力?!保ㄘ敻恢形木W(wǎng))

譯者:馮豐

對投資者來說,,2021年的股市堪稱精彩,標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)的年度漲幅在21世紀(jì)排名第三位,。

留心的人們都知道,基準(zhǔn)指數(shù)上漲了26.9%,。受到能源,、金融和大型科技股的推動,加上股息的話,,標(biāo)準(zhǔn)普爾500指數(shù)的總回報率達(dá)28.7%,。不過如果仔細(xì)研究數(shù)據(jù),就會發(fā)現(xiàn)背后的貧富不均,。

高盛集團(tuán)(Goldman Sachs)發(fā)現(xiàn),,整整一年里,蘋果(Apple),、微軟(Microsoft),、英偉達(dá)(Nvidia)、特斯拉(Tesla)和Alphabet旗下的谷歌(Google)五只股票的回報占標(biāo)準(zhǔn)普爾總回報的32.6%,。高盛警告稱,,市場如此狹窄往往意味著沉悶。換句話說就是:投資者傾向盡可能長時間跟著贏家走,,卻容易忽略市場上其他有希望的領(lǐng)域,。

果然,年終數(shù)據(jù)充分顯示出大型科技股對投資者投資組合的影響力,。納斯達(dá)克100指數(shù)(Nasdaq 100)上漲26.6%,,標(biāo)準(zhǔn)普爾500指數(shù)的科技板塊漲幅為33.4%。

海外方面,,2021年斯托克歐洲600指數(shù)(Stoxx Europe 600)上漲22.2%,,超過納斯達(dá)克(Nasdaq)和道瓊斯工業(yè)指數(shù)(Dow Jones industrial average),。1月3日,歐洲股市開盤即上漲,,各大前景良好的板塊紛紛走高,。不過在此需要警告:倫敦富時指數(shù)(FTSE)假期休市,成交量清淡,;因此,,不要對看似頗有希望的開門紅過分解讀。

再往東看,,2021年股市情況就沒有那么亮眼了,。中國政府治理高增長科技股,再加上一系列數(shù)據(jù)顯示全球第二大經(jīng)濟(jì)體增長開始放緩,,所以中國股市受到影響,。

加密貨幣、大宗商品和咖啡

要想找到2021年的大贏家,,只看大宗商品和加密貨幣就夠了,。盡管2021年12月的比特幣(Bitcoin)走勢跌宕起伏,全年卻仍然上漲了66%,。而且在過去三年中,,堪稱另類貨幣之王的比特幣的漲幅超過400%。但比特幣想爭奪2021年的回報最佳還差一點,。因為該項榮譽(yù)歸屬低調(diào)的咖啡豆,。受地緣政治、氣候災(zāi)難和新冠疫情影響,,過去一年的咖啡期貨合約暴漲,,2021年的漲幅達(dá)到驚人的76.3%。

展望2022年

雖然2021年的股市漲幅可觀,,但華爾街卻幾乎沒有人預(yù)測2022年的大漲能夠再現(xiàn),。高盛對標(biāo)準(zhǔn)普爾500指數(shù)的年終點位預(yù)期是5100點,比當(dāng)前水平增長約7%,。這一預(yù)測已經(jīng)相當(dāng)樂觀,。摩根士丹利(Morgan Stanley)的財富管理首席投資官麗薩·沙萊特表示,“預(yù)計標(biāo)準(zhǔn)普爾500指數(shù)將在區(qū)間內(nèi)上下波動,?!泵楞y證券(BofA Securities)預(yù)計今年年底的標(biāo)準(zhǔn)普爾指數(shù)點位為4600點,意味著今年股市將下跌,。

受一系列因素影響,,未來一年市場前景愈加復(fù)雜。其中包括央行態(tài)度更加強(qiáng)硬、通脹加劇,、供應(yīng)鏈困境至少持續(xù)到2022年上半年,,以及美國總統(tǒng)喬·拜登的“重建更好未來”(Build Back Better)刺激支出計劃想要在美國國會通過還面臨長期困難等等。

利率和減量

華爾街有越來越多的人認(rèn)為,,今年3月美聯(lián)儲(Federal Reserve)將結(jié)束資產(chǎn)購買,,而且2022年上半年某個時候?qū)⑻嵘鶞?zhǔn)貸款利率。傳統(tǒng)情況下,,此類環(huán)境中價值股(比如金融股)表現(xiàn)要比沒有利潤的成長股好一些,。有些投資者已經(jīng)意識到這點,開始拯救多只2020年代的成長型股票,。

通貨膨脹

2021年年底,,通貨膨脹開始升溫。預(yù)計通脹至少持續(xù)到2022年上半年,。供應(yīng)鏈混亂應(yīng)該有所緩解,,不過隨著企業(yè)著手應(yīng)付極其緊缺的就業(yè)市場,勞動力成本上升料將持續(xù),。

這一情況必然會影響股市,。高盛的美國首席股票策略師大衛(wèi)·科斯汀直言:“2022年投資者應(yīng)該關(guān)注高增長、高利潤的股票,,避開可能出現(xiàn)薪資通脹風(fēng)險的公司,。”

無法重建,?

2022年年初,基礎(chǔ)設(shè)施,、消費者和氣候相關(guān)股票可能坎坷不斷,,尤其當(dāng)前拜登政府1.75萬億美元的支出閃電戰(zhàn)似乎已經(jīng)成為泡影。高盛就預(yù)期“重建更好未來”無法在美國國會通過,。如果真如預(yù)期一樣無法通過,,就可能打擊經(jīng)濟(jì)增長,因為向來是美國經(jīng)濟(jì)引擎的消費者沒有足夠的彈藥來消費,、消費,、消費。2021年市場上最令人驚訝的力量之一,,即大批散戶投資者可能也會受影響,。

新冠疫情

2021年11月,本就混亂的市場因為奧密克戎變異毒株而越發(fā)動蕩?,F(xiàn)在要預(yù)料該傳染性超強(qiáng)的變異毒株對全球經(jīng)濟(jì)的影響有多嚴(yán)重,,可能為時過早。然而企業(yè)紛紛被迫重新考慮開放的計劃,航空公司取消了數(shù)以千計的航班,。旅游和休閑股受創(chuàng),,大規(guī)模“重新開放”也增加了不確定性,。最近,,德意志銀行(Deutsche Bank)在一份投資者報告中警告稱,奧密克戎變異毒株將“增加短期阻力,?!保ㄘ敻恢形木W(wǎng))

譯者:馮豐

Last year was a banner year for investors, with the S&P 500 racking up its third-best yearly performance in the 21st century.

For those keeping score, the benchmark index climbed 26.9%. Add in dividends, and the S&P 500 total return was 28.7%, powered by energy, finance, and large-cap tech stocks. But a peek inside those numbers reveals a market of haves and have-nots.

For the full year, Goldman Sachs found that a batch of just five stocks—Apple, Microsoft, Nvidia, Tesla and Alphabet’s Google—delivered 32.6% of all S&P returns. Such narrow market breath tends to be a sticky phenomenon, Goldman warns. Translation: Investors tend to ride the winners as long as they can, neglecting other promising areas of the market.

Sure enough, the year-end numbers showed the power of Big Tech on investor portfolios. The Nasdaq 100 gained 26.6%, and the S&P 500 technology sector gained 33.4%.

Overseas, the Stoxx Europe 600 gained 22.2% last year, a performance that beat out both the Nasdaq and Dow Jones industrial average. European bourses on January 3 started the year in the green with every sector in positive territory out of the gates. The caveat: Trading volume is light with London’s FTSE closed for the holiday; so don’t read too much into the promising start.

Further east, it wasn’t nearly so pretty last year. Chinese stocks took a hammering as Beijing cracked down on high-growth tech stocks and a volley of data revealed growth in the world’s No. 2 economy is beginning to slow.

Crypto, commodities, and coffee

To find 2021’s big winners, one need look no further than commodities and crypto. Despite a choppy December, Bitcoin finished the year up 66%. And, the king of alt-coins is up more than 400% over the past three years. But it cannot quite take the crown for Best Return of 2021. That honor goes to the humble coffee bean. Thanks to geopolitics, climate havoc, and COVID, futures contracts on coffee have been skyrocketing for the past year, up an astounding 76.3% in 2021.

The year ahead

As impressive as last year was, few if any on Wall Street are predicting a repeat performance for 2022. Goldman Sachs’s year-end target for the S&P 500 is 5100, a roughly 7% gain from today’s level. That’s one of the more rosy forecasts. Morgan Stanley wealth management chief investment officer Lisa Shalett says, “We expect the S&P 500 to be range-bound and volatile.” And BofA Securities has a year-end 4600 handle on the S&P, which would mean stocks will go backward this year.

A whole swirl of factors are complicating market outlooks in the year to come. They include more hawkish central banks, elevated inflation, and supply chain woes lingering at least through the first half of 2022, and the long odds President Joe Biden faces in getting his Build Back Better stimulus spending plan to pass in Congress.

Interest rates and tapering

There is growing consensus on Wall Street that the Federal Reserve will wind down its asset purchases by March and begin raising the benchmark lending rate at some point in the first half of 2022. Traditionally, value stocks (think financials) outperform unprofitable growth stocks in such an environment. Sensing this, investors already began bailing on many of 2020’s growth-stock darlings.

Inflation

At the close of 2021, inflation was running hot. That’s expected to continue at least through the first part of 2022. Supply chain snarls should ease, but elevated labor costs are expected to linger as employers deal with the tightest job market in memory.

That reality is bound to impact stocks. Goldman Sachs chief U.S. equity strategist David Kostin bluntly advises that “for 2022, investors should focus on stocks with high growth and high margins and avoid firms with high exposure to wage inflation.”

Build Back Never?

Infrastructure-, consumer-, and climate-related stocks could be in for a bumpy ride in early 2022, particularly now that the Biden administration’s $1.75 trillion spending blitz looks dead in the water. Goldman Sachs, for one, is banking on Build Back Better dying in Congress. That presumed defeat will hit likely economic growth as the consumer, the engine of the U.S. economy, will have less firepower to spend, spend, spend. It’s also likely to put a damper on one of the most surprising forces of the 2021 markets: the flush retail investor.

COVID

Omicron added a fresh dose of volatility into already turbulent markets in November. It's still too early to say how severe an effect the highly infectious strain will have on the global economy. Already, companies are compelled to rethink reopening plans, and the airlines have been canceling flights by the thousands. That’s rocking travel and leisure stocks and adding uncertainty to the larger “reopening” trade. “Omicron,” Deutsche Bank warned in a recent investor note, will “add to near-term headwinds.”