美國陷入高通脹已經(jīng)整整一年了,。

不論是房租、二手車價格還是肉價菜價,,總之在美國,,有關(guān)衣食住行的一切都在漲價,,2021年,,美國的通脹水平不斷刷新紀(jì)錄,本輪通脹被公認(rèn)為近40年來最嚴(yán)重的一次,。

在本輪通脹的背后,,有一些客觀原因是真實(shí)存在的,比如消費(fèi)者的需求空前高漲,,同時企業(yè)卻廣泛存在勞動力短缺和供應(yīng)鏈不繼的問題,。除此之外,我們不禁也會想到另一個問題:是不是還有一些企業(yè)在以通脹為借口哄抬物價,,借機(jī)發(fā)“國難財(cái)”呢,?

持有這種看法的人不在少數(shù),美國總統(tǒng)喬·拜登政府里的不少高官,,包括一些消費(fèi)者權(quán)益保護(hù)人士甚至一些經(jīng)濟(jì)學(xué)家都是這么認(rèn)為的,。例如馬薩諸塞州參議員伊麗莎白·沃倫本月致信美國司法部(Department of Justice),敦促后者對一些涉嫌違反反壟斷法和哄抬物價的企業(yè)采取措施,。沃倫在信中指出:“美國的通脹已經(jīng)達(dá)到幾十年來的最高水平,,這在相當(dāng)程度上是企業(yè)的貪婪和反競爭行為造成的,聯(lián)邦政府必須采取一切手段避免有人哄抬物價,,為美國人民把物價降下來,。”

最讓普通消費(fèi)者感到壓力的,,是食品和家庭用品價格的上漲,。《財(cái)富》雜志的一項(xiàng)分析顯示,,在“《財(cái)富》美國500強(qiáng)”中上榜的28家食品與消費(fèi)品制造商中,,有半數(shù)企業(yè)的平均凈利潤率甚至較新冠疫情前有所上升。不過雖然它們的利潤上漲了,,卻很難說這是不是與價格的上漲直接相關(guān),。

那么,,這些企業(yè)真的在哄抬物價嗎?它們是借疫情發(fā)“國難財(cái)”的奸商嗎,?首先需要強(qiáng)調(diào)的是,,我們在本文中探討的并不是法律問題,因?yàn)槟壳?,美國在?lián)邦層面尚無具體法律規(guī)范這種行為,。

其次,股市是這種貪婪,,投資者會“用腳投票”“口嫌體直”地回報上市公司的這種貪婪,。不過股市畢竟不等同于經(jīng)濟(jì)本身,一個東西在技術(shù)層面合法,,并不代表它就是好的,。有些東西對投資者來說是好事,但很有可能對普通老百姓來說就是一件壞事,。

什么是健康的利潤,?

首先需要說明一下,,企業(yè)追逐健康的利潤,與哄抬物價甚至借疫情之機(jī)不當(dāng)?shù)美⒉皇且换厥隆渭兊貪q價也并不構(gòu)成哄抬物價,。

奧本大學(xué)哈伯特商學(xué)院(Auburn University’s Harbert College of Business)的供應(yīng)鏈管理系主任格倫·里奇對《財(cái)富》雜志表示:“不知道出于什么原因,,現(xiàn)在企業(yè)的利潤變得更高了,?!彼J(rèn)為,這既有可能是出于企業(yè)經(jīng)營的必要,,但也有可能是出于企業(yè)高管的“機(jī)會主義行為”,。

里奇指出,在討論漲價的問題時,,很多人會將投機(jī)倒把與哄抬物價混為一談,,但它們實(shí)際上是兩碼事。投機(jī)倒把主要是指企業(yè)試圖賺取超量或不公平利潤的行為,。

哄抬物價是指銷售者將商品或服務(wù)的價格提升到遠(yuǎn)高于合理或公平的水平,。這種情況經(jīng)常發(fā)生在自然災(zāi)害之后,比如某地遭遇了颶風(fēng)災(zāi)害,,當(dāng)?shù)氐纳碳揖陀锌赡芎逄锉匦杵返膬r格,。

不過,要想精準(zhǔn)評判很多哄抬物價行為是不是由企業(yè)策劃的,,這卻是一件很困難的事情,,因?yàn)槲飪r受到很多因素影響,而且制造商通常不會直接制定零售價格,。一般來說,,制造商只會給出一個建議零售價,,零售商可以接受,也可以不接受,。晨星公司(Morningstar)的消費(fèi)板塊證券研究主管埃林·拉什指出:“光看這些干巴巴的數(shù)字,,并不一定能夠反映故事的全貌?!?/p>

拉什在接受《財(cái)富》雜志采訪時稱:“從歷史上看,,大多數(shù)時候,企業(yè)在漲價時都會明確表示,,這不是為了抵消通脹造成的全部成本,,而是為了抵消部分成本?!币哉{(diào)味料生產(chǎn)商味好美(McCormick & Company)為例,,該公司也在2021年上調(diào)了價格。

味好美公司的首席執(zhí)行官勞倫斯·庫茲尤斯在今年1月的財(cái)報會議上說:“為了抵消部分成本的上漲,,我們?nèi)ツ暝谶m當(dāng)時機(jī)提高了價格,。隨著成本繼續(xù)加速上漲,,我們將在2022年再次適時提價,。”

另外,,也不是每家公司在漲價后都可以獲得更高的利潤,。比如“《財(cái)富》美國500強(qiáng)”上榜企業(yè)金佰利公司(Kimberly Clark)的首席執(zhí)行官邁克爾·蘇在近期的財(cái)報會議上指出,金佰利公司已經(jīng)實(shí)施了“數(shù)輪”的“重大定價行動”,。

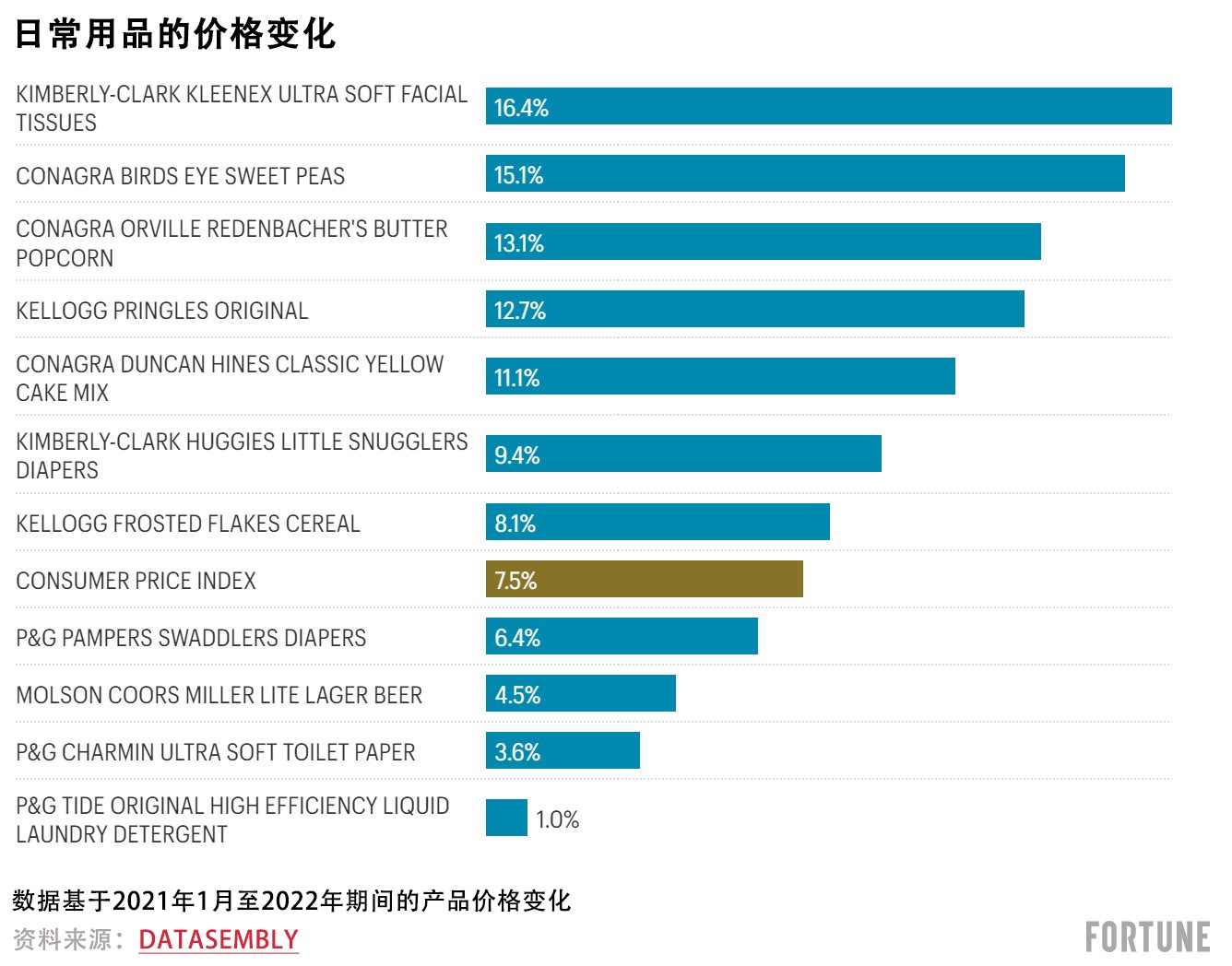

由Datasembly公司為《財(cái)富》雜志進(jìn)行的一項(xiàng)分析顯示,,2021年,金佰利公司生產(chǎn)的舒潔(Kleenex)紙巾和好奇(Huggies Little Snugglers)紙尿褲的價格分別上漲了16.4%和9.4%,。但根據(jù)《財(cái)富》雜志的分析,,即便是在漲價之后,目前金伯利的利潤率仍然只有9.4%,,低于新冠疫情以前的水平,。

漲價

毫無疑問,現(xiàn)在不光是美國企業(yè),,就連很多外國公司也在全面漲價,。目前不光是消費(fèi)者物價指數(shù)(CPI)這種基準(zhǔn)指數(shù)在上漲,各大公司也是喊漲聲一片,。

有些公司坦承,,它們之所以被迫提價,是因?yàn)樽陨沓杀旧蠞q得過高了,。比如“《財(cái)富》美國500強(qiáng)”上榜的零食和飲料公司億滋國際(Mondelez)今年1月宣布要將產(chǎn)品價格上漲6%至7%,。億滋國際的首席執(zhí)行官德克·范迪普特在1月的財(cái)報會議上表示:“我們已經(jīng)大幅上調(diào)了產(chǎn)品價格,,以確保能夠保價有效對沖大宗商品的通脹風(fēng)險,另外我們也在持續(xù)提升生產(chǎn)率指標(biāo),?!彼矝]有排除今年晚些時候會進(jìn)一步漲價的可能。

寶潔公司(P&G)表示,,該公司之所以漲價,,主要是為了抵消供應(yīng)鏈風(fēng)險,以及下步有可能會面臨的匯率風(fēng)險,。寶潔公司的首席財(cái)務(wù)官安德烈·舒爾滕在1月的財(cái)報會議上稱:“我們將通過漲價和生產(chǎn)環(huán)節(jié)中的節(jié)約來抵消一部分成本壓力,。”寶潔公司的產(chǎn)品包括剃須刀,、尿布和洗衣粉等各種日用品,。舒爾滕指出,寶潔在美國銷售的所有產(chǎn)品類別都將漲價,。這也是寶潔公司自2019年春季以來實(shí)施的最大規(guī)模的漲價,。

寶潔公司的財(cái)報顯示,2021年第4季度(截至12月31日),,該公司的銷售額較上年同期增長了6%,,這一定程度上可能也是由于漲價造成的。

實(shí)際上,,到目前為止,,美國很多大型食品和消費(fèi)品生產(chǎn)商都已經(jīng)實(shí)施了漲價。受《財(cái)富》雜志委托,,Datasembly公司對2021年1月至2022年1月間“《財(cái)富》美國500強(qiáng)”上榜食品和消費(fèi)品企業(yè)生產(chǎn)的18種主要產(chǎn)品的全美平均售價進(jìn)行了調(diào)查,,結(jié)果發(fā)現(xiàn),有11種產(chǎn)品的價格漲幅已經(jīng)超過了通脹水平,。

調(diào)查顯示,,在美國的主要食品與消費(fèi)品生產(chǎn)企業(yè)中,JBS,、家樂氏(Kellogg),、金佰利和泰森食品(Tyson Foods)等,其部分產(chǎn)品的漲價幅度均超過了今年1月美國的通脹幅度(7.5%),。

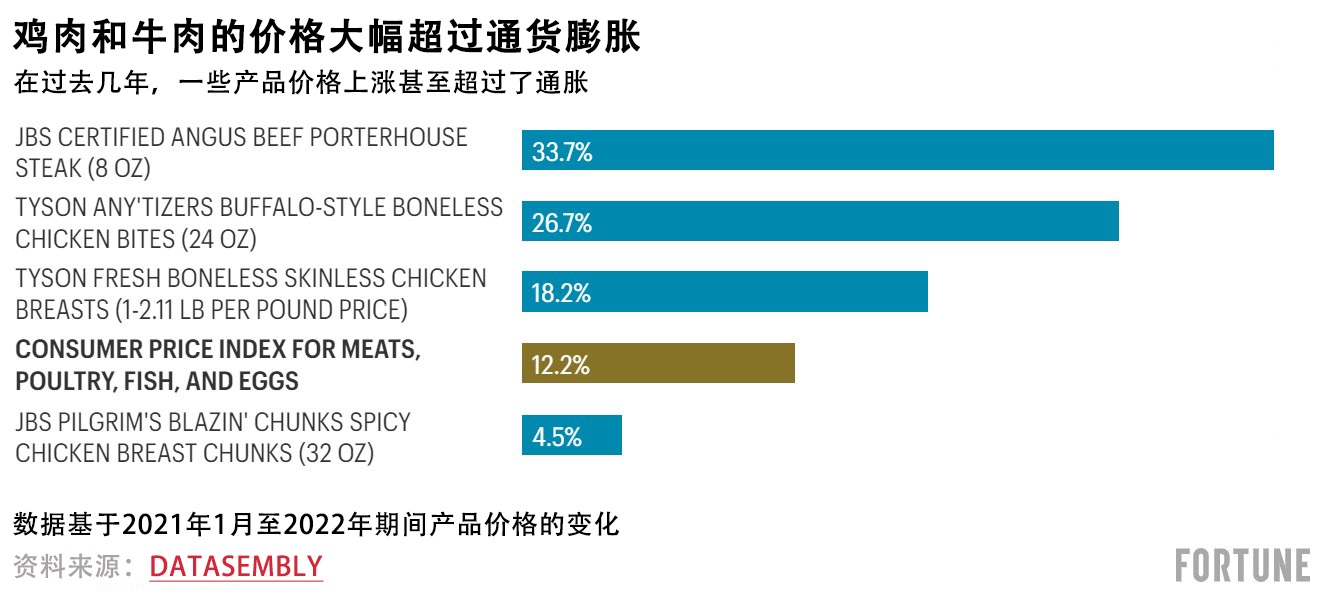

該調(diào)查顯示,,在被調(diào)查的產(chǎn)品中,漲價幅度最高的是有JBS公司品牌認(rèn)證的8盎司安格斯牛排(Angus Beef),,其去年的漲價幅度達(dá)到了34%,。泰森食品的一款無骨雞肉的價格也從2021年1月的6.62美元上漲到上個月的8.39美元,漲幅達(dá)到26.7%,。相比之下,,今年1月發(fā)布的CPI指數(shù)顯示,,2021年美國的牛肉價格上漲了16%,雞肉價格上漲了10.3%,。

另外,,其中一些公司的利潤率也確實(shí)比新冠疫情前更高了。在“《財(cái)富》美國500強(qiáng)”的上榜食品和消費(fèi)品制造商中,,有13家公司2021年的平均利潤高于2019年,,其中11家公司的利潤增幅高于通脹率。不過這也未必表明它們一定有投機(jī)牟利行為,。

比如,,據(jù)《財(cái)富》雜志調(diào)查,酒精飲料巨頭摩森康勝(Molson Coors)和日用品龍頭企業(yè)寶潔公司有5款產(chǎn)品的提價幅度基本與通脹水平一致,,甚至略低于通脹率,。但摩森康勝和寶潔去年的利潤率卻比新冠疫情前的水平翻了一番。這兩家公司的利潤上漲,,有可能與銷量上漲或者與削減開支有關(guān),,不過也有可能與售價的小幅上漲有關(guān)。

泰森食品和JBS的利潤率也出現(xiàn)了顯著的增長——雖然漲幅不算業(yè)界最高,,但也相當(dāng)可觀,。如前所述,2021年,,它們的一些關(guān)鍵產(chǎn)品的價格出現(xiàn)了大幅上漲,。家樂氏的利潤率也有一定上漲,,而且它旗下的幾款產(chǎn)品的售價漲幅也超過了通脹率,。

寶潔公司于2月18日對《財(cái)富》雜志指出,該公司的生產(chǎn)成本近來持續(xù)上升,,最近兩個季度,,它的大宗商品成本和運(yùn)輸成本環(huán)比上漲了13億美元(稅后成本)。寶潔公司發(fā)言人稱:“這是近20年來我們看到的最大幅度的成本上漲,,雖然我們需要轉(zhuǎn)嫁部分成本,,但我們也將同時推動各方面的創(chuàng)新,以繼續(xù)為消費(fèi)者帶來巨大價值,?!?/p>

這位發(fā)言人還表示,寶潔公司專注于“為消費(fèi)者提供最佳性能的優(yōu)異產(chǎn)品,,從而最終為消費(fèi)者帶去價值,。”但他并未直接評論公司的利潤率為何變高的問題,。

摩森康勝和ADM公司拒絕就此發(fā)表評論,。JBS公司則未回應(yīng)《財(cái)富》雜志的置評請求,。

困難是真實(shí)存在的

穆迪投資者服務(wù)公司(Moody's Investors Service)的零售與消費(fèi)品部高級副總裁裁琳達(dá)·蒙塔格指出,目前,,幾乎每家公司都面臨著供應(yīng)鏈卡脖子,、“用工荒”和大宗商品成本上漲的問題,這些問題導(dǎo)致了企業(yè)運(yùn)營預(yù)算上漲,、利潤率下降,。而且就算企業(yè)宣布漲價,從漲價到利潤上漲之間,,往往也還有一個時間差,。

比如據(jù)拉什介紹,上個季度寶潔公司公布的毛利率是49.11%,。其中,,通脹因素對公司利潤的影響達(dá)到了負(fù)4%,運(yùn)費(fèi)上漲對利潤的影響也有負(fù)0.6%,。

家樂氏公司的發(fā)言人克里斯·巴納指出,,目前,全球?qū)Υ笞谏唐返男枨蟪掷m(xù)增加,,而供應(yīng)卻相對緊張,,這種供需失衡的影響是不容忽視的?!斑@導(dǎo)致食用油,、小麥、玉米,、大米,、紙張和硬紙板等食品生產(chǎn)銷售所需的原材料價格包括運(yùn)輸成本創(chuàng)下歷史新高?!蓖瑫r巴納也對《財(cái)富》雜志表示:“我們這個行業(yè)對哄抬物價和網(wǎng)絡(luò)詐騙等違法欺詐行為是零容忍的,。”

美國商會(U.S. Chamber of Commerce)的常務(wù)副會長兼首席政策官尼爾·布拉德利于今年1月在一份聲明中表示:“與許多其他產(chǎn)品一樣,,推動肉類價格上漲的因素包括需求上升,、疫情導(dǎo)致的供應(yīng)鏈問題,以及投入成本上升等等,,特別是能源和勞動力成本的上升,。”

普渡大學(xué)(Purdue University)的農(nóng)業(yè)經(jīng)濟(jì)學(xué)系主任杰森·盧斯克指出,,2021年,,用于飼養(yǎng)牲畜的谷物和油籽價格有所上漲,這反過來也推高了牲畜和家禽的飼養(yǎng)成本。

全美雞肉協(xié)會(National Chicken Council)的發(fā)言人湯姆·休珀指出,,盡管玉米,、大豆、汽油,、包裝和運(yùn)輸成本都上漲了至少兩位數(shù),,但美國雞肉價格的漲幅卻僅僅略高于總體通脹率(今年1月發(fā)布的2021年美國雞肉價格增幅為10.3%,而美國的總體通脹率為7.5%),。

泰森食品的發(fā)言人加里·米克爾森在回答《財(cái)富》雜志關(guān)于漲價和利潤的問題時稱:“經(jīng)濟(jì)學(xué)家和行業(yè)分析師都已經(jīng)證明,,目前肉類價格的上漲,是供應(yīng)鏈?zhǔn)芟?,以及糧食,、勞動力、能源等投入成本上漲,,加上消費(fèi)者需求強(qiáng)勁共同作用的直接結(jié)果,。”

穆迪投資者服務(wù)公司的零售與消費(fèi)品部高級副總裁裁琳達(dá)·蒙塔格認(rèn)為:“問題的癥結(jié)并非是有些公司想發(fā)‘國難財(cái)’,?!彪m然目前有些公司的利潤率有所上升,但這種情形未必會一直持續(xù)下去,。例如,,一些公司利潤率上升的原因,可能是由于在新冠疫情期間砍掉了一些營銷預(yù)算,,或者是銷量增加了,。還有一些公司加大了生產(chǎn)和銷售速度,這也有助于緩沖運(yùn)營成本上升帶來的影響,。

“通脹是真實(shí)存在的,。”蒙塔格認(rèn)為,,任何聲稱企業(yè)漲價是為了哄抬物價,、投機(jī)倒把的人都是在“信口胡說”。

是“體制問題”在鼓勵企業(yè)漲價,?

盡管通脹問題引發(fā)了極大擔(dān)憂,但去年美國經(jīng)濟(jì)的增長率仍然達(dá)到了5.7%——或許這其中還有通脹的功勞,。這不禁令人思考,,對于40年來早已習(xí)慣了低通脹和全球化的美國來說,目前這種高需求,、高就業(yè)率甚至是高通脹的環(huán)境,,是否才是經(jīng)濟(jì)增長真正應(yīng)有的樣子?當(dāng)然,,美國經(jīng)濟(jì)目前還在從新冠疫情泥潭中復(fù)蘇的路上,,但自20世紀(jì)中葉以來,,美國還沒有經(jīng)歷過像這樣的真正的經(jīng)濟(jì)繁榮。而在那一次的繁榮期,,美國也遭遇了高通脹問題,。

也有一些專家認(rèn)為,目前美國的高通脹并不是經(jīng)濟(jì)健康增長的表現(xiàn),,甚至也不是為了抵消運(yùn)營成本的上漲,,而是放松監(jiān)管和缺乏競爭的結(jié)果。

美國前勞工部長,、經(jīng)濟(jì)學(xué)家羅伯特·賴克最近就這個話題撰文稱:“如果市場是具有競爭性的,,企業(yè)就會壓低價格,以防止競爭對手搶走顧客,?!?/p>

拜登政府最近也點(diǎn)名批評一些行業(yè)缺乏競爭,并指出這有可能導(dǎo)致成本上升,。美國四大肉制品公司嘉吉(Cargill),、JBS、國家牛肉包裝公司(National Beef Packing)和泰森食品就在被點(diǎn)名之列,,這四家公司控制了美國豬肉,、牛肉和雞肉市場的大半壁江山。美國財(cái)政部(Treasury Department)近期也發(fā)布了一份63頁的報告,,指出百威英博公司(nheuser-Busch InBev)和摩森康勝公司控制了美國啤酒市場65%的收入,。因此有批評人士指出,這些公司之所以能夠隨心所欲地漲價,,就是因?yàn)橄M(fèi)者沒有太多的品牌和產(chǎn)品可以選擇,。

今年1月,美國總統(tǒng)拜登曾經(jīng)指出:“我們在過去幾十年里看到的情況是,,競爭越來越少,,集中程度越來越高,這實(shí)際上阻礙了經(jīng)濟(jì)的發(fā)展,,很多行業(yè)都是由少數(shù)幾個大公司主導(dǎo)著整個市場,。”

不過,,北美肉類協(xié)會(North American Meat Institute)的會長兼首席執(zhí)行官朱莉·安娜·波茨并不這樣認(rèn)為,。她表示,美國的肉類行業(yè)并不像拜登政府描述的那樣集中化,,25年來,,美國肉類市場的結(jié)構(gòu)基本上沒有變化。“如果是集中化導(dǎo)致了近期肉禽產(chǎn)品價格上漲,,那么5年前或者10年前,,集中化為什么沒有導(dǎo)致肉禽產(chǎn)品價格上漲呢?”美國四大肉制品公司都是該協(xié)會的會員,,不過它們并未專門對《財(cái)富》雜志就拜登政府的有關(guān)言論作出評論,。

美國啤酒協(xié)會(Beer Institute)的會長兼首席執(zhí)行官吉姆·麥克格里維也指出,美國財(cái)政部的報告“曲解了繁榮發(fā)展中的美國啤酒產(chǎn)業(yè),?!彼赋觯?010年以來,,美國新注冊的啤酒廠超過1萬家,。“消費(fèi)者也受益于越來越多的啤酒廠和進(jìn)口啤酒商,,他們有了比以往任何時候更多的選擇,。”百威英博和摩森康勝都是美國啤酒協(xié)會的會員,,不過他們也未對拜登政府的有關(guān)言論進(jìn)行評論,。

據(jù)《華盛頓郵報》(Washington Post)報道,即使在白宮內(nèi)部,,也有一些經(jīng)濟(jì)學(xué)家反對政府將通脹歸咎于企業(yè),。

蒙塔格指出,實(shí)際上,,食品和消費(fèi)品領(lǐng)域是存在著“大量激烈的競爭”的,。很多上市公司不僅互為競爭對手,還要面臨著很多非上市公司的競爭,。據(jù)美國自有品牌制造商協(xié)會(Private Label Manufacturers Association)統(tǒng)計(jì),,從銷售額上看,美國零售店的門店自有品牌大約占據(jù)了市場的17.7%,;從銷量上看,,則占據(jù)了市場的19.6%。

還有一些人認(rèn)為,,當(dāng)前的物價上漲是不合理的,。比如關(guān)注經(jīng)濟(jì)問題的激進(jìn)社會組織Groundwork Collaborative的首席經(jīng)濟(jì)學(xué)家拉金·馬布德對《財(cái)富》雜志表示,她認(rèn)為當(dāng)前企業(yè)紛紛漲價的現(xiàn)狀“非常不合理”,,理由是首席執(zhí)行官和企業(yè)高管們能夠任意向消費(fèi)者漲價,,但美國的普通老百姓卻毫無選擇,只能被迫支付更高的價格——但與此同時,,這些企業(yè)卻在分更高的紅利給股東。

大公司通過漲價獲得了創(chuàng)紀(jì)錄的利潤,首席執(zhí)行官們悄悄說了大實(shí)話——他們很樂意推高通脹,。

美國家庭支付了更高的物價,,企業(yè)高管獲得了更豐厚的獎金。你們自己看看高管們是怎么說的吧,。

——伊麗莎白·沃倫(@SenWarren),,2022年1月15日

“這些大公司靠刮勉強(qiáng)度日的底層人的油水而大賺特賺,這是不合理的,,不但不合理,,也對我們的經(jīng)濟(jì)有害。只有在我們所有人都過得好的時候,,我們的經(jīng)濟(jì)才會好——而不是在只有這些大企業(yè)過得好的時候,。”馬布德說道,。

她還補(bǔ)充說:“毫無疑問,,企業(yè)是受利潤驅(qū)使的。企業(yè)究竟賺多少利潤才合適,,這基本上是一個道德問題,。不過現(xiàn)在有一個顯然非常不合理的現(xiàn)象,那就是投資者和股東都在靠侵蝕普通消費(fèi)者的利益來賺錢,?!?/p>

另一方面,那些大肆宣揚(yáng)自己漲價了的上市公司也的確在股市上獲得了豐厚回報,。彭博社(Bloomberg)最近的一篇報道顯示,,在近一個財(cái)季中,這些上市公司在宣布產(chǎn)品漲價后,,其股價幾乎都是應(yīng)聲上漲,。比如連鎖餐飲企業(yè)Chipotle在2021年12月宣布漲價4%后,其股價已經(jīng)上漲了10%,。而清潔用品高樂氏(Clorox)的漲價行為則低調(diào)得多,,基本上都是悄悄進(jìn)行的,高樂氏還在財(cái)報會議上警告投資者,,未來幾年哪些因素有可能影響公司的利潤率,。結(jié)果該公司的股價直接暴跌14%。

馬布德指出,,這些大企業(yè)一家接著一家地宣布漲價,,這與投資者的慫恿不無關(guān)系。有些企業(yè)看到別人漲后利潤率上去了,,自己也就跟著漲價,,而且投資者也要求它們這樣做,。

馬布德認(rèn)為:“這樣一來,就算通脹消失了,,企業(yè)投機(jī)牟利的傾向也會長期存在,。”

漲價的長期成本

絕大多數(shù)的美國人都意識到,,當(dāng)前的高通脹是有問題的,。哈里斯民調(diào)機(jī)構(gòu)(Harris Poll)的數(shù)據(jù)顯示,90%的美國人注意到,,近幾個月他們經(jīng)常購買的商品價格有所上漲,。有44%的美國成年人表示,通脹目前是他們最擔(dān)心的問題,。

不過有研究顯示,,消費(fèi)者在緊急情況下,對物價上漲的容忍度會有所提升,。比如哥倫比亞大學(xué)(Columbia University)的研究人員最近發(fā)表的一篇論文顯示,,在美國爆發(fā)新冠疫情之初,只有一小半美國消費(fèi)者認(rèn)為洗手液的價格上漲是不合理的,。該論文的合著者克里斯托弗·布卡富斯科向《財(cái)富》雜志指出:“消費(fèi)者對‘合理’的標(biāo)準(zhǔn)是相當(dāng)靈活的,。人們對‘合理’與否的看法,在很大程度上取決于具體情況,?!?/p>

至于消費(fèi)者會不會覺得高通脹是美國市場機(jī)制的結(jié)構(gòu)性弊病導(dǎo)致的,以及消費(fèi)是否愿意繼續(xù)容忍這種高通脹,,目前我們尚不清楚,。不過一旦消費(fèi)者的忍耐到了極限,那么一直追求和縱容漲價的企業(yè)以及政客,,或許都要承受一波民意的強(qiáng)烈反彈,。

當(dāng)前這輪漲價也是有實(shí)際成本的。除了一些自帶波動性的大宗商品,,有些產(chǎn)品的價格漲上來之后,,未來即便供給壓力減輕了,它的價格也不容易再降下去了,,例如一瓶汽水或者一支牙刷,。所以從長遠(yuǎn)來看,消費(fèi)者將長期承受更高的價格,。

馬布德說:“有時我們談?wù)撏?,就像談?wù)撘粋€與我們無關(guān)的問題一樣。但事實(shí)上,,我們之所以非常關(guān)注通脹問題,,是因?yàn)樗鼘ξ覀冇袑?shí)實(shí)在在的影響,。物價的上漲真的會給弱勢群體造成非常非常沉重的打擊?!保ㄘ?cái)富中文網(wǎng))

譯者:樸成奎

美國陷入高通脹已經(jīng)整整一年了,。

不論是房租,、二手車價格還是肉價菜價,,總之在美國,有關(guān)衣食住行的一切都在漲價,,2021年,,美國的通脹水平不斷刷新紀(jì)錄,本輪通脹被公認(rèn)為近40年來最嚴(yán)重的一次,。

在本輪通脹的背后,,有一些客觀原因是真實(shí)存在的,比如消費(fèi)者的需求空前高漲,,同時企業(yè)卻廣泛存在勞動力短缺和供應(yīng)鏈不繼的問題,。除此之外,我們不禁也會想到另一個問題:是不是還有一些企業(yè)在以通脹為借口哄抬物價,,借機(jī)發(fā)“國難財(cái)”呢,?

持有這種看法的人不在少數(shù),美國總統(tǒng)喬·拜登政府里的不少高官,,包括一些消費(fèi)者權(quán)益保護(hù)人士甚至一些經(jīng)濟(jì)學(xué)家都是這么認(rèn)為的,。例如馬薩諸塞州參議員伊麗莎白·沃倫本月致信美國司法部(Department of Justice),敦促后者對一些涉嫌違反反壟斷法和哄抬物價的企業(yè)采取措施,。沃倫在信中指出:“美國的通脹已經(jīng)達(dá)到幾十年來的最高水平,,這在相當(dāng)程度上是企業(yè)的貪婪和反競爭行為造成的,聯(lián)邦政府必須采取一切手段避免有人哄抬物價,,為美國人民把物價降下來,。”

最讓普通消費(fèi)者感到壓力的,,是食品和家庭用品價格的上漲,。《財(cái)富》雜志的一項(xiàng)分析顯示,,在“《財(cái)富》美國500強(qiáng)”中上榜的28家食品與消費(fèi)品制造商中,,有半數(shù)企業(yè)的平均凈利潤率甚至較新冠疫情前有所上升。不過雖然它們的利潤上漲了,,卻很難說這是不是與價格的上漲直接相關(guān),。

那么,這些企業(yè)真的在哄抬物價嗎,?它們是借疫情發(fā)“國難財(cái)”的奸商嗎,?首先需要強(qiáng)調(diào)的是,,我們在本文中探討的并不是法律問題,因?yàn)槟壳?,美國在?lián)邦層面尚無具體法律規(guī)范這種行為,。

其次,股市是這種貪婪,,投資者會“用腳投票”“口嫌體直”地回報上市公司的這種貪婪,。不過股市畢竟不等同于經(jīng)濟(jì)本身,一個東西在技術(shù)層面合法,,并不代表它就是好的,。有些東西對投資者來說是好事,但很有可能對普通老百姓來說就是一件壞事,。

什么是健康的利潤,?

首先需要說明一下,企業(yè)追逐健康的利潤,,與哄抬物價甚至借疫情之機(jī)不當(dāng)?shù)美⒉皇且换厥?。單純地漲價也并不構(gòu)成哄抬物價。

奧本大學(xué)哈伯特商學(xué)院(Auburn University’s Harbert College of Business)的供應(yīng)鏈管理系主任格倫·里奇對《財(cái)富》雜志表示:“不知道出于什么原因,,現(xiàn)在企業(yè)的利潤變得更高了,。”他認(rèn)為,,這既有可能是出于企業(yè)經(jīng)營的必要,,但也有可能是出于企業(yè)高管的“機(jī)會主義行為”。

里奇指出,,在討論漲價的問題時,,很多人會將投機(jī)倒把與哄抬物價混為一談,但它們實(shí)際上是兩碼事,。投機(jī)倒把主要是指企業(yè)試圖賺取超量或不公平利潤的行為,。

哄抬物價是指銷售者將商品或服務(wù)的價格提升到遠(yuǎn)高于合理或公平的水平。這種情況經(jīng)常發(fā)生在自然災(zāi)害之后,,比如某地遭遇了颶風(fēng)災(zāi)害,,當(dāng)?shù)氐纳碳揖陀锌赡芎逄锉匦杵返膬r格。

不過,,要想精準(zhǔn)評判很多哄抬物價行為是不是由企業(yè)策劃的,,這卻是一件很困難的事情,因?yàn)槲飪r受到很多因素影響,,而且制造商通常不會直接制定零售價格,。一般來說,制造商只會給出一個建議零售價,,零售商可以接受,,也可以不接受,。晨星公司(Morningstar)的消費(fèi)板塊證券研究主管埃林·拉什指出:“光看這些干巴巴的數(shù)字,并不一定能夠反映故事的全貌,?!?/p>

拉什在接受《財(cái)富》雜志采訪時稱:“從歷史上看,大多數(shù)時候,,企業(yè)在漲價時都會明確表示,,這不是為了抵消通脹造成的全部成本,而是為了抵消部分成本,?!币哉{(diào)味料生產(chǎn)商味好美(McCormick & Company)為例,該公司也在2021年上調(diào)了價格,。

味好美公司的首席執(zhí)行官勞倫斯·庫茲尤斯在今年1月的財(cái)報會議上說:“為了抵消部分成本的上漲,我們?nèi)ツ暝谶m當(dāng)時機(jī)提高了價格,。隨著成本繼續(xù)加速上漲,,我們將在2022年再次適時提價?!?/p>

另外,,也不是每家公司在漲價后都可以獲得更高的利潤。比如“《財(cái)富》美國500強(qiáng)”上榜企業(yè)金佰利公司(Kimberly Clark)的首席執(zhí)行官邁克爾·蘇在近期的財(cái)報會議上指出,,金佰利公司已經(jīng)實(shí)施了“數(shù)輪”的“重大定價行動”,。

由Datasembly公司為《財(cái)富》雜志進(jìn)行的一項(xiàng)分析顯示,2021年,,金佰利公司生產(chǎn)的舒潔(Kleenex)紙巾和好奇(Huggies Little Snugglers)紙尿褲的價格分別上漲了16.4%和9.4%,。但根據(jù)《財(cái)富》雜志的分析,即便是在漲價之后,,目前金伯利的利潤率仍然只有9.4%,,低于新冠疫情以前的水平。

漲價

毫無疑問,,現(xiàn)在不光是美國企業(yè),,就連很多外國公司也在全面漲價。目前不光是消費(fèi)者物價指數(shù)(CPI)這種基準(zhǔn)指數(shù)在上漲,,各大公司也是喊漲聲一片,。

有些公司坦承,它們之所以被迫提價,,是因?yàn)樽陨沓杀旧蠞q得過高了,。比如“《財(cái)富》美國500強(qiáng)”上榜的零食和飲料公司億滋國際(Mondelez)今年1月宣布要將產(chǎn)品價格上漲6%至7%。億滋國際的首席執(zhí)行官德克·范迪普特在1月的財(cái)報會議上表示:“我們已經(jīng)大幅上調(diào)了產(chǎn)品價格,,以確保能夠保價有效對沖大宗商品的通脹風(fēng)險,,另外我們也在持續(xù)提升生產(chǎn)率指標(biāo),。”他也沒有排除今年晚些時候會進(jìn)一步漲價的可能,。

寶潔公司(P&G)表示,,該公司之所以漲價,主要是為了抵消供應(yīng)鏈風(fēng)險,,以及下步有可能會面臨的匯率風(fēng)險,。寶潔公司的首席財(cái)務(wù)官安德烈·舒爾滕在1月的財(cái)報會議上稱:“我們將通過漲價和生產(chǎn)環(huán)節(jié)中的節(jié)約來抵消一部分成本壓力?!睂殱嵐镜漠a(chǎn)品包括剃須刀,、尿布和洗衣粉等各種日用品。舒爾滕指出,,寶潔在美國銷售的所有產(chǎn)品類別都將漲價,。這也是寶潔公司自2019年春季以來實(shí)施的最大規(guī)模的漲價。

寶潔公司的財(cái)報顯示,,2021年第4季度(截至12月31日),,該公司的銷售額較上年同期增長了6%,這一定程度上可能也是由于漲價造成的,。

實(shí)際上,,到目前為止,美國很多大型食品和消費(fèi)品生產(chǎn)商都已經(jīng)實(shí)施了漲價,。受《財(cái)富》雜志委托,,Datasembly公司對2021年1月至2022年1月間“《財(cái)富》美國500強(qiáng)”上榜食品和消費(fèi)品企業(yè)生產(chǎn)的18種主要產(chǎn)品的全美平均售價進(jìn)行了調(diào)查,結(jié)果發(fā)現(xiàn),,有11種產(chǎn)品的價格漲幅已經(jīng)超過了通脹水平,。

調(diào)查顯示,在美國的主要食品與消費(fèi)品生產(chǎn)企業(yè)中,,JBS,、家樂氏(Kellogg)、金佰利和泰森食品(Tyson Foods)等,,其部分產(chǎn)品的漲價幅度均超過了今年1月美國的通脹幅度(7.5%),。

該調(diào)查顯示,在被調(diào)查的產(chǎn)品中,,漲價幅度最高的是有JBS公司品牌認(rèn)證的8盎司安格斯牛排(Angus Beef),,其去年的漲價幅度達(dá)到了34%。泰森食品的一款無骨雞肉的價格也從2021年1月的6.62美元上漲到上個月的8.39美元,,漲幅達(dá)到26.7%,。相比之下,今年1月發(fā)布的CPI指數(shù)顯示,2021年美國的牛肉價格上漲了16%,,雞肉價格上漲了10.3%,。

另外,其中一些公司的利潤率也確實(shí)比新冠疫情前更高了,。在“《財(cái)富》美國500強(qiáng)”的上榜食品和消費(fèi)品制造商中,,有13家公司2021年的平均利潤高于2019年,其中11家公司的利潤增幅高于通脹率,。不過這也未必表明它們一定有投機(jī)牟利行為,。

比如,據(jù)《財(cái)富》雜志調(diào)查,,酒精飲料巨頭摩森康勝(Molson Coors)和日用品龍頭企業(yè)寶潔公司有5款產(chǎn)品的提價幅度基本與通脹水平一致,,甚至略低于通脹率。但摩森康勝和寶潔去年的利潤率卻比新冠疫情前的水平翻了一番,。這兩家公司的利潤上漲,,有可能與銷量上漲或者與削減開支有關(guān),不過也有可能與售價的小幅上漲有關(guān),。

泰森食品和JBS的利潤率也出現(xiàn)了顯著的增長——雖然漲幅不算業(yè)界最高,,但也相當(dāng)可觀。如前所述,,2021年,它們的一些關(guān)鍵產(chǎn)品的價格出現(xiàn)了大幅上漲,。家樂氏的利潤率也有一定上漲,,而且它旗下的幾款產(chǎn)品的售價漲幅也超過了通脹率。

寶潔公司于2月18日對《財(cái)富》雜志指出,,該公司的生產(chǎn)成本近來持續(xù)上升,,最近兩個季度,它的大宗商品成本和運(yùn)輸成本環(huán)比上漲了13億美元(稅后成本),。寶潔公司發(fā)言人稱:“這是近20年來我們看到的最大幅度的成本上漲,,雖然我們需要轉(zhuǎn)嫁部分成本,但我們也將同時推動各方面的創(chuàng)新,,以繼續(xù)為消費(fèi)者帶來巨大價值,。”

這位發(fā)言人還表示,,寶潔公司專注于“為消費(fèi)者提供最佳性能的優(yōu)異產(chǎn)品,,從而最終為消費(fèi)者帶去價值?!钡⑽粗苯釉u論公司的利潤率為何變高的問題,。

摩森康勝和ADM公司拒絕就此發(fā)表評論。JBS公司則未回應(yīng)《財(cái)富》雜志的置評請求。

困難是真實(shí)存在的

穆迪投資者服務(wù)公司(Moody's Investors Service)的零售與消費(fèi)品部高級副總裁裁琳達(dá)·蒙塔格指出,,目前,,幾乎每家公司都面臨著供應(yīng)鏈卡脖子、“用工荒”和大宗商品成本上漲的問題,,這些問題導(dǎo)致了企業(yè)運(yùn)營預(yù)算上漲,、利潤率下降。而且就算企業(yè)宣布漲價,,從漲價到利潤上漲之間,,往往也還有一個時間差。

比如據(jù)拉什介紹,,上個季度寶潔公司公布的毛利率是49.11%,。其中,通脹因素對公司利潤的影響達(dá)到了負(fù)4%,,運(yùn)費(fèi)上漲對利潤的影響也有負(fù)0.6%,。

家樂氏公司的發(fā)言人克里斯·巴納指出,目前,,全球?qū)Υ笞谏唐返男枨蟪掷m(xù)增加,,而供應(yīng)卻相對緊張,這種供需失衡的影響是不容忽視的,?!斑@導(dǎo)致食用油、小麥,、玉米,、大米、紙張和硬紙板等食品生產(chǎn)銷售所需的原材料價格包括運(yùn)輸成本創(chuàng)下歷史新高,?!蓖瑫r巴納也對《財(cái)富》雜志表示:“我們這個行業(yè)對哄抬物價和網(wǎng)絡(luò)詐騙等違法欺詐行為是零容忍的?!?

美國商會(U.S. Chamber of Commerce)的常務(wù)副會長兼首席政策官尼爾·布拉德利于今年1月在一份聲明中表示:“與許多其他產(chǎn)品一樣,,推動肉類價格上漲的因素包括需求上升、疫情導(dǎo)致的供應(yīng)鏈問題,,以及投入成本上升等等,,特別是能源和勞動力成本的上升?!?/p>

普渡大學(xué)(Purdue University)的農(nóng)業(yè)經(jīng)濟(jì)學(xué)系主任杰森·盧斯克指出,,2021年,用于飼養(yǎng)牲畜的谷物和油籽價格有所上漲,,這反過來也推高了牲畜和家禽的飼養(yǎng)成本,。

全美雞肉協(xié)會(National Chicken Council)的發(fā)言人湯姆·休珀指出,盡管玉米、大豆,、汽油,、包裝和運(yùn)輸成本都上漲了至少兩位數(shù),但美國雞肉價格的漲幅卻僅僅略高于總體通脹率(今年1月發(fā)布的2021年美國雞肉價格增幅為10.3%,,而美國的總體通脹率為7.5%),。

泰森食品的發(fā)言人加里·米克爾森在回答《財(cái)富》雜志關(guān)于漲價和利潤的問題時稱:“經(jīng)濟(jì)學(xué)家和行業(yè)分析師都已經(jīng)證明,目前肉類價格的上漲,,是供應(yīng)鏈?zhǔn)芟?,以及糧食、勞動力,、能源等投入成本上漲,,加上消費(fèi)者需求強(qiáng)勁共同作用的直接結(jié)果?!?/p>

穆迪投資者服務(wù)公司的零售與消費(fèi)品部高級副總裁裁琳達(dá)·蒙塔格認(rèn)為:“問題的癥結(jié)并非是有些公司想發(fā)‘國難財(cái)’,。”雖然目前有些公司的利潤率有所上升,,但這種情形未必會一直持續(xù)下去,。例如,一些公司利潤率上升的原因,,可能是由于在新冠疫情期間砍掉了一些營銷預(yù)算,,或者是銷量增加了。還有一些公司加大了生產(chǎn)和銷售速度,,這也有助于緩沖運(yùn)營成本上升帶來的影響,。

“通脹是真實(shí)存在的,。”蒙塔格認(rèn)為,,任何聲稱企業(yè)漲價是為了哄抬物價,、投機(jī)倒把的人都是在“信口胡說”。

是“體制問題”在鼓勵企業(yè)漲價,?

盡管通脹問題引發(fā)了極大擔(dān)憂,,但去年美國經(jīng)濟(jì)的增長率仍然達(dá)到了5.7%——或許這其中還有通脹的功勞。這不禁令人思考,,對于40年來早已習(xí)慣了低通脹和全球化的美國來說,,目前這種高需求、高就業(yè)率甚至是高通脹的環(huán)境,,是否才是經(jīng)濟(jì)增長真正應(yīng)有的樣子,?當(dāng)然,美國經(jīng)濟(jì)目前還在從新冠疫情泥潭中復(fù)蘇的路上,但自20世紀(jì)中葉以來,,美國還沒有經(jīng)歷過像這樣的真正的經(jīng)濟(jì)繁榮,。而在那一次的繁榮期,美國也遭遇了高通脹問題,。

也有一些專家認(rèn)為,,目前美國的高通脹并不是經(jīng)濟(jì)健康增長的表現(xiàn),甚至也不是為了抵消運(yùn)營成本的上漲,,而是放松監(jiān)管和缺乏競爭的結(jié)果,。

美國前勞工部長、經(jīng)濟(jì)學(xué)家羅伯特·賴克最近就這個話題撰文稱:“如果市場是具有競爭性的,,企業(yè)就會壓低價格,,以防止競爭對手搶走顧客?!?/p>

拜登政府最近也點(diǎn)名批評一些行業(yè)缺乏競爭,,并指出這有可能導(dǎo)致成本上升。美國四大肉制品公司嘉吉(Cargill),、JBS,、國家牛肉包裝公司(National Beef Packing)和泰森食品就在被點(diǎn)名之列,這四家公司控制了美國豬肉,、牛肉和雞肉市場的大半壁江山,。美國財(cái)政部(Treasury Department)近期也發(fā)布了一份63頁的報告,指出百威英博公司(nheuser-Busch InBev)和摩森康勝公司控制了美國啤酒市場65%的收入,。因此有批評人士指出,,這些公司之所以能夠隨心所欲地漲價,就是因?yàn)橄M(fèi)者沒有太多的品牌和產(chǎn)品可以選擇,。

今年1月,,美國總統(tǒng)拜登曾經(jīng)指出:“我們在過去幾十年里看到的情況是,競爭越來越少,,集中程度越來越高,,這實(shí)際上阻礙了經(jīng)濟(jì)的發(fā)展,很多行業(yè)都是由少數(shù)幾個大公司主導(dǎo)著整個市場,?!?/p>

不過,北美肉類協(xié)會(North American Meat Institute)的會長兼首席執(zhí)行官朱莉·安娜·波茨并不這樣認(rèn)為,。她表示,,美國的肉類行業(yè)并不像拜登政府描述的那樣集中化,25年來,,美國肉類市場的結(jié)構(gòu)基本上沒有變化,?!叭绻羌谢瘜?dǎo)致了近期肉禽產(chǎn)品價格上漲,那么5年前或者10年前,,集中化為什么沒有導(dǎo)致肉禽產(chǎn)品價格上漲呢,?”美國四大肉制品公司都是該協(xié)會的會員,不過它們并未專門對《財(cái)富》雜志就拜登政府的有關(guān)言論作出評論,。

美國啤酒協(xié)會(Beer Institute)的會長兼首席執(zhí)行官吉姆·麥克格里維也指出,,美國財(cái)政部的報告“曲解了繁榮發(fā)展中的美國啤酒產(chǎn)業(yè)?!彼赋?,自2010年以來,美國新注冊的啤酒廠超過1萬家,?!跋M(fèi)者也受益于越來越多的啤酒廠和進(jìn)口啤酒商,他們有了比以往任何時候更多的選擇,?!卑偻⒉┖湍ι祫俣际敲绹【茀f(xié)會的會員,不過他們也未對拜登政府的有關(guān)言論進(jìn)行評論,。

據(jù)《華盛頓郵報》(Washington Post)報道,,即使在白宮內(nèi)部,也有一些經(jīng)濟(jì)學(xué)家反對政府將通脹歸咎于企業(yè),。

蒙塔格指出,,實(shí)際上,食品和消費(fèi)品領(lǐng)域是存在著“大量激烈的競爭”的,。很多上市公司不僅互為競爭對手,,還要面臨著很多非上市公司的競爭。據(jù)美國自有品牌制造商協(xié)會(Private Label Manufacturers Association)統(tǒng)計(jì),,從銷售額上看,,美國零售店的門店自有品牌大約占據(jù)了市場的17.7%;從銷量上看,,則占據(jù)了市場的19.6%,。

還有一些人認(rèn)為,當(dāng)前的物價上漲是不合理的,。比如關(guān)注經(jīng)濟(jì)問題的激進(jìn)社會組織Groundwork Collaborative的首席經(jīng)濟(jì)學(xué)家拉金·馬布德對《財(cái)富》雜志表示,她認(rèn)為當(dāng)前企業(yè)紛紛漲價的現(xiàn)狀“非常不合理”,,理由是首席執(zhí)行官和企業(yè)高管們能夠任意向消費(fèi)者漲價,,但美國的普通老百姓卻毫無選擇,只能被迫支付更高的價格——但與此同時,,這些企業(yè)卻在分更高的紅利給股東,。

大公司通過漲價獲得了創(chuàng)紀(jì)錄的利潤,,首席執(zhí)行官們悄悄說了大實(shí)話——他們很樂意推高通脹。

美國家庭支付了更高的物價,,企業(yè)高管獲得了更豐厚的獎金,。你們自己看看高管們是怎么說的吧。

——伊麗莎白·沃倫(@SenWarren),,2022年1月15日

“這些大公司靠刮勉強(qiáng)度日的底層人的油水而大賺特賺,,這是不合理的,不但不合理,,也對我們的經(jīng)濟(jì)有害,。只有在我們所有人都過得好的時候,我們的經(jīng)濟(jì)才會好——而不是在只有這些大企業(yè)過得好的時候,?!瘪R布德說道,。

她還補(bǔ)充說:“毫無疑問,企業(yè)是受利潤驅(qū)使的,。企業(yè)究竟賺多少利潤才合適,,這基本上是一個道德問題。不過現(xiàn)在有一個顯然非常不合理的現(xiàn)象,,那就是投資者和股東都在靠侵蝕普通消費(fèi)者的利益來賺錢,。”

另一方面,,那些大肆宣揚(yáng)自己漲價了的上市公司也的確在股市上獲得了豐厚回報,。彭博社(Bloomberg)最近的一篇報道顯示,在近一個財(cái)季中,,這些上市公司在宣布產(chǎn)品漲價后,,其股價幾乎都是應(yīng)聲上漲。比如連鎖餐飲企業(yè)Chipotle在2021年12月宣布漲價4%后,,其股價已經(jīng)上漲了10%,。而清潔用品高樂氏(Clorox)的漲價行為則低調(diào)得多,基本上都是悄悄進(jìn)行的,,高樂氏還在財(cái)報會議上警告投資者,,未來幾年哪些因素有可能影響公司的利潤率。結(jié)果該公司的股價直接暴跌14%,。

馬布德指出,,這些大企業(yè)一家接著一家地宣布漲價,這與投資者的慫恿不無關(guān)系,。有些企業(yè)看到別人漲后利潤率上去了,,自己也就跟著漲價,,而且投資者也要求它們這樣做。

馬布德認(rèn)為:“這樣一來,,就算通脹消失了,,企業(yè)投機(jī)牟利的傾向也會長期存在?!?/p>

漲價的長期成本

絕大多數(shù)的美國人都意識到,,當(dāng)前的高通脹是有問題的。哈里斯民調(diào)機(jī)構(gòu)(Harris Poll)的數(shù)據(jù)顯示,,90%的美國人注意到,近幾個月他們經(jīng)常購買的商品價格有所上漲,。有44%的美國成年人表示,,通脹目前是他們最擔(dān)心的問題,。

不過有研究顯示,消費(fèi)者在緊急情況下,,對物價上漲的容忍度會有所提升。比如哥倫比亞大學(xué)(Columbia University)的研究人員最近發(fā)表的一篇論文顯示,,在美國爆發(fā)新冠疫情之初,只有一小半美國消費(fèi)者認(rèn)為洗手液的價格上漲是不合理的,。該論文的合著者克里斯托弗·布卡富斯科向《財(cái)富》雜志指出:“消費(fèi)者對‘合理’的標(biāo)準(zhǔn)是相當(dāng)靈活的。人們對‘合理’與否的看法,,在很大程度上取決于具體情況?!?/p>

至于消費(fèi)者會不會覺得高通脹是美國市場機(jī)制的結(jié)構(gòu)性弊病導(dǎo)致的,,以及消費(fèi)是否愿意繼續(xù)容忍這種高通脹,目前我們尚不清楚,。不過一旦消費(fèi)者的忍耐到了極限,那么一直追求和縱容漲價的企業(yè)以及政客,,或許都要承受一波民意的強(qiáng)烈反彈。

當(dāng)前這輪漲價也是有實(shí)際成本的,。除了一些自帶波動性的大宗商品,,有些產(chǎn)品的價格漲上來之后,,未來即便供給壓力減輕了,,它的價格也不容易再降下去了,,例如一瓶汽水或者一支牙刷,。所以從長遠(yuǎn)來看,,消費(fèi)者將長期承受更高的價格。

馬布德說:“有時我們談?wù)撏?,就像談?wù)撘粋€與我們無關(guān)的問題一樣,。但事實(shí)上,,我們之所以非常關(guān)注通脹問題,,是因?yàn)樗鼘ξ覀冇袑?shí)實(shí)在在的影響。物價的上漲真的會給弱勢群體造成非常非常沉重的打擊,?!保ㄘ?cái)富中文網(wǎng))

譯者:樸成奎

You’ve been paying more for stuff for a year now.

From used cars to rent to the price of groceries, inflation set record after record throughout 2021 and came to be widely acknowledged as the worst in 40 years.

There are very real reasons behind why inflation is high, including unusually strong consumer demand at a time when businesses are navigating worker shortages and continuing supply-chain issues. But one nagging question hasn’t been answered yet: Are you getting screwed by companies using inflation as an excuse to raise prices on you?

Sen. Elizabeth Warren, the Biden administration, consumer advocates, and even some economists think so. “The nation is dealing with inflation at its highest level in decades, much of it driven by corporate greed and anticompetitive behavior, and the federal government must use every tool available to prevent price gouging and reduce prices for Americans,” the Massachusetts senator wrote in a letter this month, urging the Department of Justice to take action against companies violating antitrust laws to hike prices for consumers.

Rising prices on food and household items, in particular, are starting to really worry consumers. The average net income margins, or profit margins, of about half of the 28 food and consumer goods manufacturers listed on the Fortune 500 have risen compared to the pre-pandemic levels, according to an analysis performed by Fortune. While those profit margins are up, it’s difficult to say whether or not that’s directly tied to higher prices.

So are these corporations really price gouging? Are they pandemic profiteers? Well, first off, it’s not a settled legal issue, given that there are currently no federal laws against it.

And secondly, the stock market largely loves it, with many investors rewarding public companies for their so-called greed. But the stock market is not the economy, and just because something is technically legal doesn’t mean it’s good. What’s good for investors may be very bad for the American consumer.

What is a healthy profit, anyway?

Let’s clear the air: Making a healthy profit is not the same as price gouging or even unfairly profiting off the pandemic. Nor does simply raising prices constitute price gouging.

“There's this issue of companies that are more profitable now for whatever reason,” Glenn Richey, the chair of the department of supply-chain management at Auburn University’s Harbert College of Business, tells Fortune. That could be a top-line issue where prices have been driven up out of necessity for the business; it also could be due to “opportunistic behaviors” by corporate executives, he says.

In fact, the discussions around companies’ price increases often conflate the idea of profiteering and price gouging, but they’re really two different things, Richey says. Profiteering essentially occurs when a business makes, or seeks to make, an excessive or unfair profit.

Price gouging happens on the consumer level when a seller increases the prices of goods, services, or commodities to a level much higher than is considered reasonable or fair. Many times this happens after a natural disaster, like a hurricane, when local stores and suppliers jack up the price of necessities.

It’s difficult to pinpoint a lot of price gouging at the corporate level, however, because there are a vast number of factors at play and the manufacturers themselves generally don’t directly set the retail prices. Instead, there’s a suggested retail price that retailers can take or leave. “Just looking at the flat numbers doesn't necessarily tell the whole story,” says Erin Lash, a director of consumer sector equity research for Morningstar.

“Most of the time, historically, when firms have raised prices, they've been very explicit about the fact that this is not to cover the entirety of the costs they're incurring—it's to offset a portion of it,” Lash tells Fortune. Take the case of McCormick & Company, the spice and condiment supplier, which raised their prices in 2021.

“To partially offset rising costs, we raised prices where appropriate last year,” McCormick CEO Lawrence Kurzius said on a January earnings call. “As costs have continued to accelerate, we are raising prices again where appropriate in 2022.”

And not every company has a fatter profit margin after raising prices. Fortune 500 company Kimberly Clark’s CEO Mike Hsu noted during the company’s latest earnings call that the personal goods manufacturer had already implemented “multiple rounds” of “significant pricing actions.”

The prices of its products like Kleenex tissues and Huggies Little Snugglers diapers rose 16.4% and 9.4% respectively over the past year, according to a Datasembly analysis for Fortune. But that didn't help Kimberly Clark’s profit margin, which is at 9.4%, still below pre-pandemic levels, according to Fortune’s analysis.

Price increases

There’s no doubt that U.S. and even international companies have raised prices across the board. Not only are benchmarks like the consumer price index on the rise, the companies themselves are crowing about it.

Companies contend that they have been forced to raise those prices because their own costs have increased so significantly. Mondelez, a Fortune 500–listed snack food and beverage company, announced price increases of 6% to 7% took effect in January. “We have implemented material price increases, ensuring we are significantly hedged across key commodities and we are continuing to drive productivity measures,” Mondelez CEO Dirk Van de Put said during the company’s January earnings call. Van de Put did not rule out additional hikes later in the year.

P&G, meanwhile, said its price increases are meant to offset constrained supply-chain disruptions and even headwinds faced by foreign exchange rates. “We will offset a portion of these cost pressures with price increases and with productivity savings,” Andre Schulten, chief financial officer of P&G, which makes products ranging from razors to diapers to laundry detergent, said on a January earnings call. Schulten noted P&G announced increases across every U.S. product category. The company’s hikes are the largest implemented since the spring of 2019.

Yet P&G reported that sales during its latest quarter ending on Dec. 31 increased 6% compared to the prior year—perhaps fueled, in part, by those price increases.

In fact, many of the biggest food and consumer goods manufacturers have implemented price increases. A review by Datasembly for Fortune of a sampling of national average prices for 18 key products from Fortune 500–ranked consumer goods and food manufacturers January 2021 to 2022 found that 11 products saw inflation-beating price increases.

Companies including JBS, Kellogg, Kimberly-Clark, and Tyson all had products with price jumps that were higher than the 7.5% inflation rate hit in January.

The highest price increase among the products analyzed came from JBS brand Certified Angus Beef’s 8-ounce porterhouse steaks, which spiked nearly 34% over the past year, according to Datasembly. A package of Tyson’s Any’tizers Buffalo-style boneless chicken bites, meanwhile, surged from an average cost of $6.62 in January 2021 to $8.39 last month—a 26.7% increase. By comparison, the January consumer price index for beef and veal rose 16% over the past 12 months, while chicken prices jumped 10.3%.

Some of those same companies also have higher profit margins compared to pre-pandemic levels. Of the 13 foods and consumer goods manufacturers listed on the Fortune 500 that had higher average profit margins in 2021 than in 2019, 11 companies had margin increases that tracked higher than inflation. But that doesn’t necessarily mean that they’re profiteering.

Alcoholic beverage giant Molson Coors and P&G, for example, raised prices on five products that Fortune examined in a way that corresponded with inflation, or even fell below it. Yet Molson Coors and P&G more than doubled their profit margins last year compared to pre-pandemic levels. These higher margins could be due to moving more product or cutting expenses. Or it could be tied to marginally higher prices.

Tyson and JBS also saw significant increases to their profit margins—not the highest seen, true, but still extensive. And as noted earlier, several of their key products saw major price jumps. Kellogg also saw healthy margin growth and above-inflation product price increases.

P&G told Fortune on February 18 that its production costs have simply been higher; the year-over-year increases of commodity and transportation costs have gone up $1.3 billion after taxes over the past two quarters. “These are the largest increases we've seen in about 20 years, and 50% higher than the next highest year,” a spokesperson told Fortune. “Where we need to pass on some costs, we’re pairing those price increases with innovation wherever possible to continue to deliver great value for our consumers.”

The P&G spokesperson said the company’s focus is on “delivering superior products with the best performance, ultimately delivering value to our consumers,” without commenting directly on the higher profit margin.

Molson Coors Beverage and Archer Daniels Midland declined to comment. JBS did not respond to requests for comment.

The struggle is real

Nearly every company is fighting supply-chain bottlenecks, worker shortages, and rising commodity costs—all of which drive up operating budgets and eat into profits, says Linda Montag, a senior vice president in Moody's Investors Service's retail and consumer goods group. And there’s typically a lag between when companies announce price increases and when those increases contribute to the company’s profit margin, if they ever do.

Inflationary headwinds, for example, are credited with creating a four percentage point drag to the 49.11% gross margin P&G reported for the latest earnings quarter. Higher freight costs generated a 0.6 percentage point hit, according to Lash.

The impact of growing global demand and tight supply for commodities on which food manufacturers rely cannot be overstated, says Kellogg spokesperson Kris Bahner. “This is creating record-high prices for ingredients and commodities needed to make and distribute our foods, such as cooking oils, wheat, corn, rice, and paper and cardboard, as well as transportation costs,” Bahner tells Fortune. “Our industry has zero tolerance for illegal and deceptive practices such as price gouging and online scammers.”

“Like so many other products, the factors driving meat prices higher include increased demand, COVID-related supply-chain disruptions, and increased input costs, especially higher energy and labor costs,” Neil Bradley, executive vice president and chief policy officer at the U.S. Chamber of Commerce, said last month in a statement.

Additionally grain and oilseed prices, which are used to feed livestock, have been higher in 2021, according to Jayson Lusk, head of the department of agricultural economics at Purdue University. This, in turn, has pushed up the cost of feed for livestock and poultry.

Price increases for chicken, in particular, are “barely” outpacing inflation—even despite major inputs like corn, soybeans, gasoline, packaging, and transportation increasing by double digit costs, adds National Chicken Council spokesman Tom Super. It’s worth noting, again, January chicken prices rose 10.3% over the past 12 months, compared to the overall inflation rate of 7.5%.

"Economists and industry analysts confirm that today’s higher meat prices are a direct result of constrained supplies due to the labor shortage, higher input costs for such things as grain, labor, and fuel, and strong consumer demand," Gary Mickelson, a Tyson spokesperson, said in response to Fortune's questions to the company around higher profit margins and product prices.

“It's not that some companies are raking in the benefits here,” Montag tells Fortune. The companies that are showing better margins right now aren't necessarily always going to do so, Montag says. The upswings, for instance, could be due to companies’ slashing marketing budgets during the pandemic or increased volume. Some companies are still producing and selling goods at a higher rate, which helps to cushion the impact of higher operating costs.

“The inflation is real,” Montag says. Anybody claiming that corporations raising costs right now are doing so to simply gouge people are “nuts,” she adds.

Some argue the system is rigged—and rewarding price hikes

Despite the concerns over pricing changes—or perhaps because of them, the U.S. economy grew 5.7% last year. Could this environment of high demand, lots of job creation, and yes, even high inflation, be what economic growth actually looks like to an America used to 40 years of deflationary globalization? To be sure, it’s still a rebound from the depths of the coronavirus recession, but America hasn’t had a genuine economic boom like this since the mid-20th century, when it last battled high inflation.

But some experts contend that higher prices aren’t a result of healthy economic growth or even making up for rising operating costs, but rather deregulation and a lack of competition.

“If markets were competitive, companies would keep their prices down in order to prevent competitors from grabbing away customers,” Robert Reich, an economist and former Clinton labor secretary, recently wrote on the topic.

Several sectors have been recently called out by the Biden White House for lack of competition that could be helping to drive up costs. Four major meat companies—Cargill, JBS, National Beef Packing, and Tyson—control half or more of the pork, beef, and chicken markets, according to the administration’s talking points. And the Treasury Department recently released a 63-page report highlighting that Anheuser-Busch InBev and Molson Coors control about 65% of the U.S. beer market by revenue. Those companies, critics say, are able to raise prices as they’d like because customers don’t have much choice between a host of different brands and products.

“What we've seen over the last few decades is less competition and more concentration that literally holds [the] economy back. And in too many industries, a handful of giant companies dominate the entire market,” Biden said in January.

But Julie Anna Potts, president and CEO of the North American Meat Institute, has pushed back on these claims, saying that the industry is not as concentrated as the Biden administration has portrayed and that the structure has largely remained unchanged for 25 years. "If concentration is causing the recent rise in consumer prices for meat and poultry products, why did concentration not cause inflation five or 10 years ago?" Cargill, JBS, National Beef, and Tyson are all members of the institute but did not comment on the Biden administration's claims specifically to Fortune when asked.

Beer Institute president and CEO Jim McGreevy, meanwhile, called the DOJ report a "mischaracterization of the thriving American beer industry," noting there have been more than 10,000 new breweries permitted since 2010. "Consumers are benefiting from the growing number of brewers and beer importers, with more choices for beer than at any other time in our nation’s history," he said. Anheuser-Busch InBev and Molson Coors are members. Anheuser-Busch InBev and Molson Coors did not comment about the Biden administrations' claims specifically to Fortune when asked.

Even inside the White House, some economists have objected to the administration's push to blame corporations for inflation, according to a report from the Washington Post.

In fact, there’s “an awful lot of competition” within the food manufacturing and consumer goods space. Not only are many of the companies competing with each other, they’re also going up against private labels, Montag says. Store brands have cornered about 17.7% of the market in dollars and 19.6% in units sold, according to the Private Label Manufacturers Association.

Yet others argue that the price hikes are unjust, including Rakeen Mabud, chief economist for the Groundwork Collaborative, a progressive activist group focused on economic issues. Mabud tells Fortune what stands out to her as “deeply unfair” about the current situation is that CEOs and corporate executives are saying they’re able to jack up prices on consumers right now, and Americans don’t have a choice but to continue to pay the higher prices—all while these companies are paying bigger dividends to shareholders.

Giant corporations are making record profits by increasing prices, and CEOs are saying the quiet part out loud: theya€?re happy to help drive inflation.

American families pay higher prices and corporate executives get fatter bonuses. See for yourself what executives are saying:

— Elizabeth Warren (@SenWarren) February 15, 2022

“These megacorporations are making bank off of people who are just struggling to keep their heads above water,” Mabud says. “That's unfair. It's unfair, but it's also bad for our economy. Our economy does best when we all do well—not these big corporations.

“There's no doubt that companies are profit-driven. I think there's a real question, in many ways, a moral question, about how much profits are appropriate,” Mabud continues. “What is just very clearly unfair is the fact that investors and shareholders are making money on the backs of consumers right now.”

And public companies are currently being rewarded for trumpeting those price hikes. During the latest earnings season, companies that have touted successful product price increases saw almost immediate gains in their share price, according to a recent Bloomberg report. Chipotle, which heavily focused on its implementation of a 4% price increase in December, had its shares rise 10%. Clorox—which more quietly raised prices—focused more of its earnings call on warning investors that the cleaning supply company could see impacts on its margins for years. It saw its stock dip 14% in the aftermath, Bloomberg reported.

Company after company has announced price increases—and they're being egged on by their investors, Mabud argues. Companies are seeing their profit margins get ever fatter, and so they're hiking prices because it's working and investors are demanding that, she says.

“That's going to perpetuate this problem of profiteering long beyond inflation going away,” Mabud says.

The long-term cost of raising prices

The vast majority of Americans know something is wrong. Nine out of 10 have noticed that the prices on the items they routinely purchase have risen in recent months, according to Harris Poll, and 44% of U.S. adults say inflation is currently their biggest concern.

Consumers, however, are somewhat tolerant of price increases during emergencies, research shows. Less than half of U.S. consumers, for example, thought the price increase in hand sanitizer at the beginning of the pandemic was unfair, according to a recent working paper by Columbia researchers. “Consumer norms about fairness seem pretty flexible. So what people think is fair can be highly context dependent,” coauthor Christopher Buccafusco tells Fortune.

It’s less clear whether consumers are willing to consider there’s something structurally wrong or for how long that tolerance will hold. And if it doesn’t, there could be a huge backlash against both businesses and politicians who let it carry on.

Yet there’s a real cost to these rising prices. With the exception of slightly more volatile commodities, the cost of a can of soda or a toothbrush isn't going to come down that much in the future—even after supply pressures ease. Instead, consumers are going to be stuck with higher prices over the long haul.

“Sometimes we talk about inflation like we care about it for its own sake. We really care about inflation because we care about the way it affects people,” Mabud says. “These price hikes are really, really hitting vulnerable people hard.”