科爾士百貨公司(Kohl's)的首席執(zhí)行官米歇爾·加斯在3月7日公布了一項(xiàng)計(jì)劃,終于讓公司停滯不前的銷售業(yè)績和股價(jià)有了一些起色,。在面向投資者的網(wǎng)播中,,她認(rèn)為公司應(yīng)該繼續(xù)投資優(yōu)勢產(chǎn)品門類,例如運(yùn)動裝,,并尋求品牌合作,。不過,一位激進(jìn)投資者也在緊鑼密鼓地謀劃要改革這家四面楚歌的零售商的董事會,,并尋找潛在的買家,。

這并非是什么全新的提議,而更像是加斯對科爾士在2020年年底重振計(jì)劃的更新,。作為該提議的一部分,,加斯打算于未來四年內(nèi)在科爾士百貨傳統(tǒng)上認(rèn)為不適合自己的小市場開設(shè)100家店面。她還預(yù)測,,基于當(dāng)前店面的初步業(yè)績,,即將進(jìn)駐850家科爾士店面的絲芙蘭(Sephora)專賣店到2025年有望帶來20億美元的年收入。

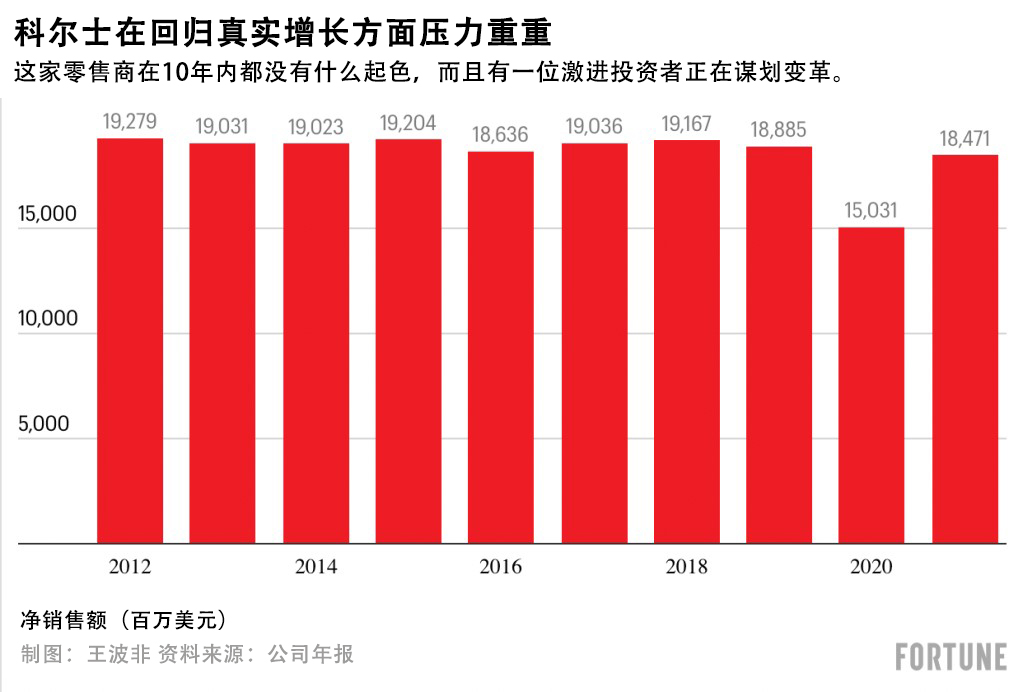

科爾士百貨在上周宣布,,其2021年凈銷售總額約為185億美元,。較其新冠疫情之前的凈銷售額下滑了2%,這是繼2020年公司遭到封鎖令毀滅性打擊之后在業(yè)務(wù)恢復(fù)方面取得的一個(gè)可觀成就,。然而,,公司銷售額在長達(dá)近10年的時(shí)間中一直停留在190億美元上下,盡管加斯采取了一系列增長策略,,但都未能突破這個(gè)數(shù)字,。這些策略包括大肆進(jìn)軍運(yùn)動服裝領(lǐng)域,以及與亞馬遜(Amazon)合作,,在科爾士店面處理這家電商巨頭的退貨,。

盡管在過去10年中,,科爾士百貨的業(yè)績要好于梅西百貨(Macy's)、彭尼百貨(J.C. Penney)和西爾斯百貨(Sears),,但其從新冠疫情中恢復(fù)過程中的業(yè)績一直要遠(yuǎn)低于這些位于或靠近主商業(yè)區(qū)的競爭對手,,尤其是塔吉特(Target)、Ulta Beauty,、迪克體育用品(Dick's Sporting Goods),,甚至是沃爾瑪(Walmart),而科爾士百貨在這些地段亦有很多店面,。自新冠疫情爆發(fā)以來,,科爾士的股價(jià)就像過山車一樣上上下下。在3月7日的投資者講演之前,,其股價(jià)較其2018年的水平下跌了約15%,,而加斯正是在這一年開始擔(dān)任首席執(zhí)行官??茽柺堪儇浀墓蓛r(jià)在講演后又下滑了13%,,這表明華爾街對其計(jì)劃表示懷疑。

這樣的銷售和股價(jià)表現(xiàn)必然會吸引激進(jìn)投資者的注意,。持有科爾士5%股份的Macellum Capital Management最近列出了10名新董事名單,,同時(shí)向科爾士施加壓力,要求其考慮對外出售,。

然而,,加斯堅(jiān)持認(rèn)為,新公布的計(jì)劃最終會發(fā)揮作用,。

加斯在科爾士投資者日之前的采訪中對《財(cái)富》雜志說:“我們手頭的這個(gè)計(jì)劃可謂是前所未有,。”其中很多都是面向客戶的,,比如她與絲芙蘭在2020年年末達(dá)成的協(xié)議,,在73%的科爾士店面(共1160家)中開設(shè)絲芙蘭美妝店,并加大對運(yùn)動裝的投入力度,。運(yùn)動裝如今已經(jīng)占到了該公司銷售額的20%,。

科爾士大轉(zhuǎn)型

科爾士有著精美的店面,但附加值較低,,數(shù)十年來,,其消費(fèi)主力的目標(biāo)對象是打折品牌。然而在過去約五年時(shí)間中,,科爾士的受歡迎程度有所下降,,事實(shí)證明,塔吉特,、Ulta和亞馬遜更擅長招攬年輕購物者,。公司依然受累于大規(guī)模美容業(yè)務(wù)的匱乏,,這一點(diǎn)對于吸引客戶前往科爾士至關(guān)重要,不過,,科爾士此前也曾經(jīng)多次嘗試引入美容業(yè)務(wù),。

加斯曾經(jīng)是一位營銷神童,在加入科爾士之前曾經(jīng)供職于星巴克(Starbucks),。她將公司與絲芙蘭的合作稱之為“具有顛覆性意義”,,絲芙蘭已經(jīng)進(jìn)駐了全美250個(gè)百貨店。她說,,絲芙蘭的出現(xiàn)提升了顧客訪問量,,而且更為重要的是,它將帶來更年輕的新顧客,,而這部分顧客長期以來對科爾士及其眾多競爭對手沒有什么好感。為了接觸到更加年輕的消費(fèi)者,,加斯與亞馬遜簽署了備受贊譽(yù)的2018年退貨服務(wù)合作協(xié)議,。她指出,這一活動為科爾士帶來了約200萬名新客戶,。

加斯注意到,,公司在其成本結(jié)構(gòu)上取得了一些進(jìn)步。確實(shí),,在2021年第四季度,,其中包括假日季,科爾士報(bào)出了其數(shù)年來的最佳營收利潤率,。她還表示,,科爾士更加高效地使用實(shí)體店來滿足和交付電商訂單,此舉推高了其在線業(yè)務(wù)的盈利能力,。她說:“我們已經(jīng)徹底重構(gòu)了我們的業(yè)務(wù),,并為盈利做好了準(zhǔn)備?!?/p>

然而,,盡管有加斯各種計(jì)劃的加持,科爾士的業(yè)務(wù)依然沒有什么太大的起色,。塔吉特,、迪克體育用品和Ulta均已經(jīng)超過了新冠疫情前的銷售水平,而且還搶奪了競爭對手的市場份額,,包括科爾士,。科爾士在某些領(lǐng)域的巨大收益則被其他方面的弱勢所抵消,,例如科爾士的王牌門類——女裝,。加斯也承認(rèn)存在這一問題,。她說:“我們必須改善的單個(gè)最大機(jī)遇就是女裝業(yè)務(wù)?!?/p>

公司還砍掉了多個(gè)銷量不好的女裝品牌,,從16個(gè)品牌縮減至6個(gè),同時(shí)進(jìn)一步擴(kuò)大了這六個(gè)品牌的規(guī)模,。然而,,科爾士還無法證明自己在創(chuàng)建或改造店面品牌之后能夠像競爭對手一樣吸引客戶。加斯在3月7日向投資者承諾,,公司將開始采取這一舉措,。她說:“這對我們來說是一場豪賭?!?/p>

Macellum公司的執(zhí)行合伙人喬恩·達(dá)斯金是首位在2021年敦促科爾士進(jìn)行改革的人,,他認(rèn)為公司的董事會和高管在過去數(shù)年都未能改善公司的業(yè)務(wù)。他在科爾士的投資者講演結(jié)束之后對《財(cái)富》雜志說:“這個(gè)董事會及其管理團(tuán)隊(duì)無法讓公司股價(jià)超過當(dāng)前的水平,?!?/p>

他提交了一份董事候選人名單,建議在即將舉行的春季股東大會上換掉科爾士的大多數(shù)董事,,而就在提交名單數(shù)周前,,Acacia Research給出了每股64美元也就是90億美元的收購主動報(bào)價(jià)??茽柺烤芙^了這一報(bào)價(jià),,并采取了反兼并手段,以防止未來的惡意收購,。不過,,它也聘請了投行來評估這一報(bào)價(jià)。

達(dá)斯金表示,,科爾士的策略是“不利于股東的”,,并稱他建議的候選董事有的有并購經(jīng)驗(yàn),有的是零售行業(yè)資深人士,。就其本身而言,,科爾士已經(jīng)調(diào)整了其包含14名董事的董事會,如今的董事成員包括前Jones Apparel Group和Lululemon的首席執(zhí)行官,,以及沃爾瑪?shù)拿绹娚虡I(yè)務(wù)首席運(yùn)營官,。

激進(jìn)對沖基金并不贊成科爾士的新策略,包括科爾士在絲芙蘭品牌(不過達(dá)斯金承認(rèn)此舉十分明智)的引入方面耗費(fèi)了過多的資金,,未能在假日季解決產(chǎn)品短缺的根本原因,,以及在變現(xiàn)其房地產(chǎn)資產(chǎn)組合方面并沒有下功夫。達(dá)斯金還反對科爾士今年用于股票回購的10億美元開支,,稱此舉雖然提振了科爾士的每股收益,,但并沒有真正改善其基礎(chǔ)業(yè)務(wù),。他說:“這種方法無法提振運(yùn)營業(yè)績?!?/p>

加斯承認(rèn),,科爾士的董事會正在評估報(bào)價(jià),但她堅(jiān)信,,自己已經(jīng)為公司的增長鋪設(shè)了一條康莊大道,。當(dāng)被問及科爾士是否會重現(xiàn)其2012年之前的輝煌時(shí),她斬釘截鐵地說:“是的”,。她還說:“這是我們必須要做的事情,。”

不過,,至于投資者是否會給她和她的團(tuán)隊(duì)更多的時(shí)間來完成這一目標(biāo),,還有待于觀望。(財(cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

科爾士百貨公司(Kohl's)的首席執(zhí)行官米歇爾·加斯在3月7日公布了一項(xiàng)計(jì)劃,,終于讓公司停滯不前的銷售業(yè)績和股價(jià)有了一些起色,。在面向投資者的網(wǎng)播中,她認(rèn)為公司應(yīng)該繼續(xù)投資優(yōu)勢產(chǎn)品門類,,例如運(yùn)動裝,,并尋求品牌合作,。不過,,一位激進(jìn)投資者也在緊鑼密鼓地謀劃要改革這家四面楚歌的零售商的董事會,并尋找潛在的買家,。

這并非是什么全新的提議,,而更像是加斯對科爾士在2020年年底重振計(jì)劃的更新。作為該提議的一部分,,加斯打算于未來四年內(nèi)在科爾士百貨傳統(tǒng)上認(rèn)為不適合自己的小市場開設(shè)100家店面,。她還預(yù)測,基于當(dāng)前店面的初步業(yè)績,,即將進(jìn)駐850家科爾士店面的絲芙蘭(Sephora)專賣店到2025年有望帶來20億美元的年收入,。

科爾士百貨在上周宣布,其2021年凈銷售總額約為185億美元,。較其新冠疫情之前的凈銷售額下滑了2%,,這是繼2020年公司遭到封鎖令毀滅性打擊之后在業(yè)務(wù)恢復(fù)方面取得的一個(gè)可觀成就。然而,,公司銷售額在長達(dá)近10年的時(shí)間中一直停留在190億美元上下,,盡管加斯采取了一系列增長策略,但都未能突破這個(gè)數(shù)字,。這些策略包括大肆進(jìn)軍運(yùn)動服裝領(lǐng)域,,以及與亞馬遜(Amazon)合作,,在科爾士店面處理這家電商巨頭的退貨。

盡管在過去10年中,,科爾士百貨的業(yè)績要好于梅西百貨(Macy's),、彭尼百貨(J.C. Penney)和西爾斯百貨(Sears),但其從新冠疫情中恢復(fù)過程中的業(yè)績一直要遠(yuǎn)低于這些位于或靠近主商業(yè)區(qū)的競爭對手,,尤其是塔吉特(Target),、Ulta Beauty、迪克體育用品(Dick's Sporting Goods),,甚至是沃爾瑪(Walmart),,而科爾士百貨在這些地段亦有很多店面。自新冠疫情爆發(fā)以來,,科爾士的股價(jià)就像過山車一樣上上下下,。在3月7日的投資者講演之前,其股價(jià)較其2018年的水平下跌了約15%,,而加斯正是在這一年開始擔(dān)任首席執(zhí)行官,。科爾士百貨的股價(jià)在講演后又下滑了13%,,這表明華爾街對其計(jì)劃表示懷疑,。

這樣的銷售和股價(jià)表現(xiàn)必然會吸引激進(jìn)投資者的注意。持有科爾士5%股份的Macellum Capital Management最近列出了10名新董事名單,,同時(shí)向科爾士施加壓力,,要求其考慮對外出售。

然而,,加斯堅(jiān)持認(rèn)為,,新公布的計(jì)劃最終會發(fā)揮作用。

加斯在科爾士投資者日之前的采訪中對《財(cái)富》雜志說:“我們手頭的這個(gè)計(jì)劃可謂是前所未有,?!逼渲泻芏喽际敲嫦蚩蛻舻模热缢c絲芙蘭在2020年年末達(dá)成的協(xié)議,,在73%的科爾士店面(共1160家)中開設(shè)絲芙蘭美妝店,,并加大對運(yùn)動裝的投入力度。運(yùn)動裝如今已經(jīng)占到了該公司銷售額的20%,。

科爾士大轉(zhuǎn)型

科爾士有著精美的店面,,但附加值較低,數(shù)十年來,,其消費(fèi)主力的目標(biāo)對象是打折品牌,。然而在過去約五年時(shí)間中,科爾士的受歡迎程度有所下降,事實(shí)證明,,塔吉特,、Ulta和亞馬遜更擅長招攬年輕購物者。公司依然受累于大規(guī)模美容業(yè)務(wù)的匱乏,,這一點(diǎn)對于吸引客戶前往科爾士至關(guān)重要,,不過,科爾士此前也曾經(jīng)多次嘗試引入美容業(yè)務(wù),。

加斯曾經(jīng)是一位營銷神童,,在加入科爾士之前曾經(jīng)供職于星巴克(Starbucks)。她將公司與絲芙蘭的合作稱之為“具有顛覆性意義”,,絲芙蘭已經(jīng)進(jìn)駐了全美250個(gè)百貨店,。她說,絲芙蘭的出現(xiàn)提升了顧客訪問量,,而且更為重要的是,,它將帶來更年輕的新顧客,而這部分顧客長期以來對科爾士及其眾多競爭對手沒有什么好感,。為了接觸到更加年輕的消費(fèi)者,,加斯與亞馬遜簽署了備受贊譽(yù)的2018年退貨服務(wù)合作協(xié)議。她指出,,這一活動為科爾士帶來了約200萬名新客戶,。

加斯注意到,公司在其成本結(jié)構(gòu)上取得了一些進(jìn)步,。確實(shí),,在2021年第四季度,其中包括假日季,,科爾士報(bào)出了其數(shù)年來的最佳營收利潤率,。她還表示,,科爾士更加高效地使用實(shí)體店來滿足和交付電商訂單,,此舉推高了其在線業(yè)務(wù)的盈利能力。她說:“我們已經(jīng)徹底重構(gòu)了我們的業(yè)務(wù),,并為盈利做好了準(zhǔn)備,。”

然而,,盡管有加斯各種計(jì)劃的加持,,科爾士的業(yè)務(wù)依然沒有什么太大的起色。塔吉特,、迪克體育用品和Ulta均已經(jīng)超過了新冠疫情前的銷售水平,,而且還搶奪了競爭對手的市場份額,包括科爾士,??茽柺吭谀承╊I(lǐng)域的巨大收益則被其他方面的弱勢所抵消,,例如科爾士的王牌門類——女裝。加斯也承認(rèn)存在這一問題,。她說:“我們必須改善的單個(gè)最大機(jī)遇就是女裝業(yè)務(wù),。”

公司還砍掉了多個(gè)銷量不好的女裝品牌,,從16個(gè)品牌縮減至6個(gè),,同時(shí)進(jìn)一步擴(kuò)大了這六個(gè)品牌的規(guī)模。然而,,科爾士還無法證明自己在創(chuàng)建或改造店面品牌之后能夠像競爭對手一樣吸引客戶,。加斯在3月7日向投資者承諾,公司將開始采取這一舉措,。她說:“這對我們來說是一場豪賭,。”

Macellum公司的執(zhí)行合伙人喬恩·達(dá)斯金是首位在2021年敦促科爾士進(jìn)行改革的人,,他認(rèn)為公司的董事會和高管在過去數(shù)年都未能改善公司的業(yè)務(wù),。他在科爾士的投資者講演結(jié)束之后對《財(cái)富》雜志說:“這個(gè)董事會及其管理團(tuán)隊(duì)無法讓公司股價(jià)超過當(dāng)前的水平?!?/p>

他提交了一份董事候選人名單,,建議在即將舉行的春季股東大會上換掉科爾士的大多數(shù)董事,而就在提交名單數(shù)周前,,Acacia Research給出了每股64美元也就是90億美元的收購主動報(bào)價(jià),。科爾士拒絕了這一報(bào)價(jià),,并采取了反兼并手段,,以防止未來的惡意收購。不過,,它也聘請了投行來評估這一報(bào)價(jià),。

達(dá)斯金表示,科爾士的策略是“不利于股東的”,,并稱他建議的候選董事有的有并購經(jīng)驗(yàn),,有的是零售行業(yè)資深人士。就其本身而言,,科爾士已經(jīng)調(diào)整了其包含14名董事的董事會,,如今的董事成員包括前Jones Apparel Group和Lululemon的首席執(zhí)行官,以及沃爾瑪?shù)拿绹娚虡I(yè)務(wù)首席運(yùn)營官,。

激進(jìn)對沖基金并不贊成科爾士的新策略,,包括科爾士在絲芙蘭品牌(不過達(dá)斯金承認(rèn)此舉十分明智)的引入方面耗費(fèi)了過多的資金,未能在假日季解決產(chǎn)品短缺的根本原因,以及在變現(xiàn)其房地產(chǎn)資產(chǎn)組合方面并沒有下功夫,。達(dá)斯金還反對科爾士今年用于股票回購的10億美元開支,,稱此舉雖然提振了科爾士的每股收益,但并沒有真正改善其基礎(chǔ)業(yè)務(wù),。他說:“這種方法無法提振運(yùn)營業(yè)績,。”

加斯承認(rèn),,科爾士的董事會正在評估報(bào)價(jià),,但她堅(jiān)信,自己已經(jīng)為公司的增長鋪設(shè)了一條康莊大道,。當(dāng)被問及科爾士是否會重現(xiàn)其2012年之前的輝煌時(shí),,她斬釘截鐵地說:“是的”。她還說:“這是我們必須要做的事情,?!?/p>

不過,至于投資者是否會給她和她的團(tuán)隊(duì)更多的時(shí)間來完成這一目標(biāo),,還有待于觀望,。(財(cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

Kohl's CEO Michelle Gass laid out her plan on March 7 to finally shake the company's stagnating sales and share performance. In a webcast presentation to investors, she argued that the company should continue investing in winning categories like activewear and pursue brand partnerships, despite a heightened push from an activist investor to overhaul the embattled retailer's board and find potential buyers.

As part of her proposal, which is more of an update to Kohl's late 2020 turnaround plan than anything radically new, Gass intends to open 100 stores, in the next four years, in markets traditionally too small for a Kohl's. She also projected that Sephora shops, set to open at 850 Kohl's stores, are on pace to become a $2 billion-a-year business by 2025, based on initial results from current stores.

Kohl's announced last week some $18.5 billion in total net sales for 2021. That's about 2% under its pre-pandemic net sales, marking a sizable recovery after the business was decimated by lockdowns in 2020. But the company has hovered around $19 billion in annual sales for about a decade and seems unable to surpass that figure despite Gass' various growth initiatives. They include a major foray into activewear and a partnership with Amazon to handle the e-commerce giant's returns at Kohl's stores.

While Kohl's has fared better than rivals like Macy's, J.C. Penney and Sears in the last decade, its performance coming out of the pandemic has been well below that of competitors in or near strip malls where many of Kohl's stores are located, particularly Target, Ulta Beauty, Dick's Sporting Goods and even Walmart. Kohl's stock has been on a roller coaster ride since the pandemic broke out. Before March 7's investor presentation, it was about 15% below its 2018 share price when Gass became CEO. Kohl's stock fell another 13% after the presentation in a sign that Wall Street is skeptical of the retailer's plans.

This kind of sales and stock performance inevitably attracts activist investors. Macellum Capital Management, which owns 5% of Kohl's shares, recently proposed a slate of 10 new board members, and is pressing the company to consider a sale of the company.

But Gass insists the newer roadmap will finally do the trick.

"We have initiatives in our hand that we've never had before," Gass told Fortune in an interview ahead of Kohl's investor day. Many of those are customer-facing, such as the deal she struck with Sephora in late 2020 to set up beauty boutiques at about 73% of Kohl's 1,160 stores, and a continued push into activewear, which now makes up 20% of sales.

Kohl's gets a makeover

Kohl's' nicely maintained but low frills stores have lured shoppers, seeking brand names at a discount, for decades. But in the last five years or so, Kohl's relevancy has declined as stores like Target, Ulta and Amazon have proven more adept at winning younger shoppers. It has also paid the price for lacking a sizable beauty business, crucial to getting customers to Kohl's stores, despite several attempts.

Gass, a marketing wunderkind who worked at Starbucks before joining Kohl's, calls the Sephora collaboration, which can be found in 250 stores nationwide, "transformational." She says it's drummed up store visits and, more crucially, brings in newer, younger shoppers that have long eluded Kohl's and many of its rivals. Reaching a younger subset was also the premise for Gass' lauded 2018 return service partnership with Amazon, which she says has brought Kohl's about 2 million new customers.

Gass notes that the company has made progress on its cost structure. And indeed, in the fourth quarter of 2021, which includes the holiday season, Kohl's reported its best operating income margin in years. She adds that Kohl's uses brick-and-mortar stores to a greater degree to fill and deliver e-commerce orders, leading to higher profitability for its online business. "We have completely restructured our business for profitability," she says.

Yet for all of Gass' initiatives, Kohl's is treading water. Target, Dick's and Ulta are all well above pre-pandemic sales levels and have taken market share from rivals, including Kohl's. The retailer's big gains in some areas have been offset by weakness in others, such as women's apparel, the top category at Kohl's. Gass acknowledges this. "The single biggest opportunity that we have to improve is the women's business," she says.

The company has shed a number of weak store brands in women's, going from 16 brands to six, but has beefed up the remaining six. Still, Kohl's has not proven that it is able to create or refresh store brands that attract customers in the same way its competitors do. Gass promised investors on March 7 that the company will begin to do so. "It's a big bet for us," she says.

Macellum's managing partner Jon Duskin, who first pushed Kohl's to make changes in 2021, argues that the company's board and executives had years to show improvement. "This board and this management team together cannot get the stock above where it is now," he told Fortune after Kohl's investor presentation.

His submission of a board slate that would swap out most directors at Kohl's upcoming spring shareholder meeting came just a few weeks after Acacia Research submitted an unsolicited offer of $64 per share, or $9 billion. Kohl's rejected the offer and initiated a poison pill to prevent a future hostile takeover. But it also hired investment bankers to field bids.

Duskin says Kohl's tactics are "anti-shareholder," adding that his panel of potential board members includes directors with M&A experience as well as retail veterans. For its part, Kohl's has refreshed its 14-director board, which now includes the former CEOs of Jones Apparel Group and Lululemon, and the COO of Walmart's U.S. e-commerce business.

The activist hedge fund has taken exception to Kohl's updated strategy, claiming, among other things, that Kohl's is spending too much on the Sephora shops rollout—though Duskin concedes it's a smart initiative—has failed to address the cause of product shortages over the holidays, and is doing little to monetize its real estate portfolio. Duskin also objects to Kohl's $1 billion spend this year on stock buybacks, saying they goosed Kohl's earnings per share without really improving the underlying business. "That's not how you get good operational performance," he says.

Gass acknowledges that Kohl's board is fielding offers, but she holds steady that she has a sound path to growth. When asked if Kohl's will return to its pre-2012 glory days, she emphatically says "yes." "We've got to see this through," Gass says.

It remains to be seen whether investors will give her and her team more time to do so.