美國(guó)最大的線上二手車交易商Carvana在過(guò)去十年中一直在鉚足馬力向前沖。

這家公司借助人們對(duì)亞馬遜式購(gòu)車體驗(yàn)的強(qiáng)勁需求,,幫助客戶規(guī)避了到訪車場(chǎng)以及與固執(zhí)銷售人員打交道的種種不便,。

然后,新冠疫情爆發(fā)了,,盡管人們?cè)谝咔槌跗谝黄只?,但Carvana的業(yè)務(wù)卻一路高歌,因?yàn)樵谌蛐酒倘?、汽車產(chǎn)量下滑的大環(huán)境下,,買家很難買到新車。

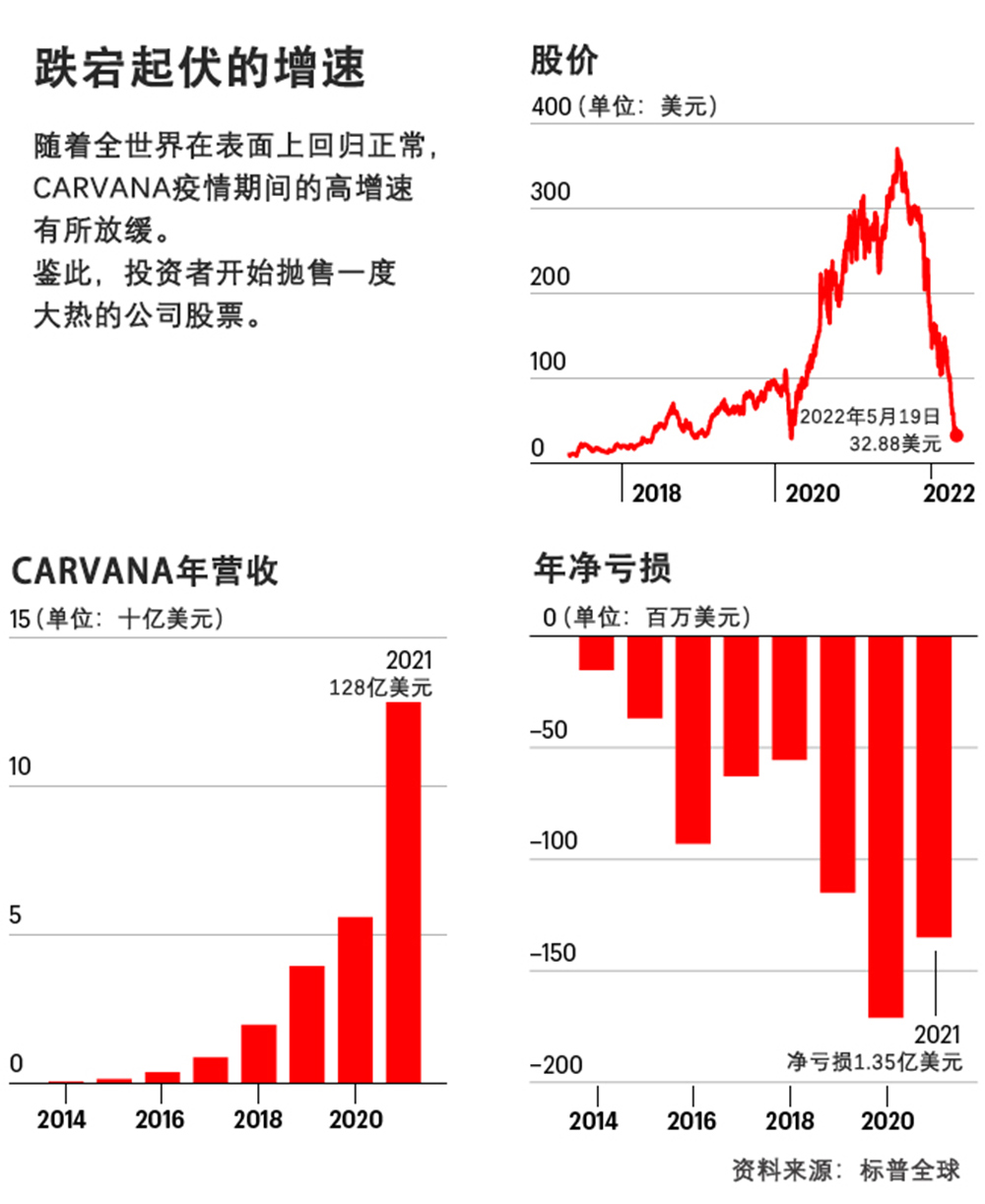

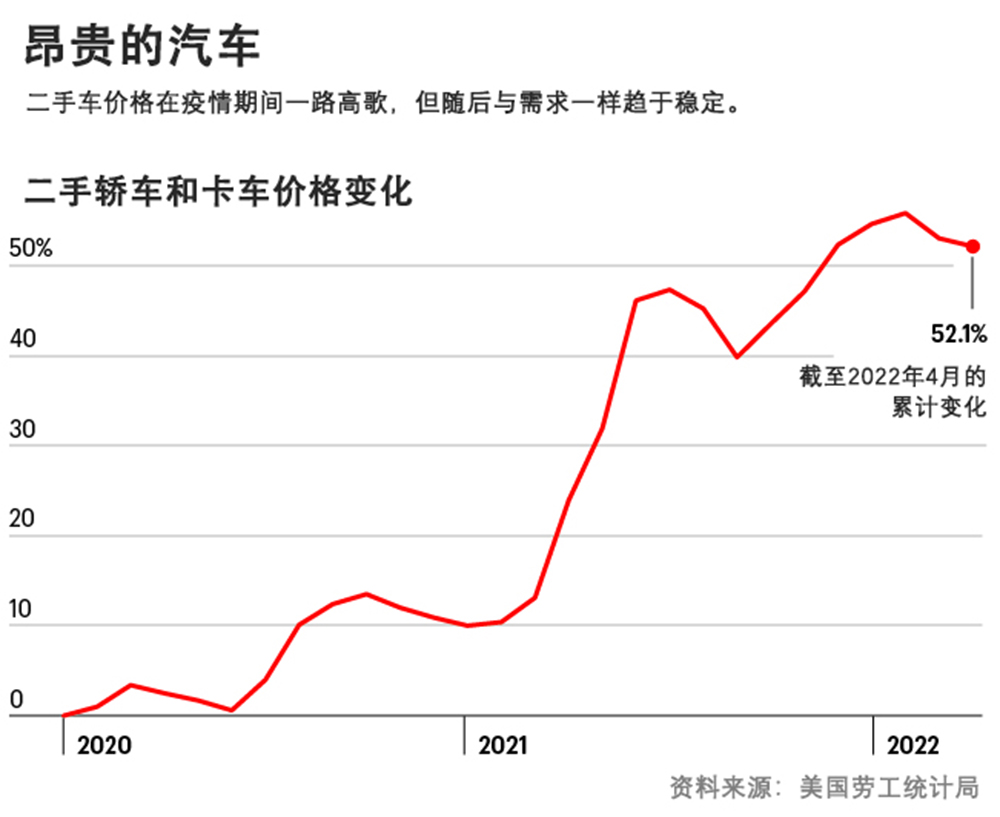

然而從2021年底開(kāi)始,,Carvana的好景卻戛然而止,。隨著疫情退潮,很多購(gòu)車者開(kāi)始再次光顧當(dāng)?shù)仄嚱?jīng)銷商,。與此同時(shí),,居高不下的二手車價(jià)格,不斷上漲的車貸款利率,,以及宏觀經(jīng)濟(jì)通脹導(dǎo)致錢包見(jiàn)底,,讓很多人不得不重新考慮是否花錢購(gòu)買一輛新車。

突然間,,Carvana因?qū)ξ磥?lái)快速增長(zhǎng)的預(yù)期而開(kāi)展的瘋狂招聘,,以及龐大的汽車庫(kù)存,讓公司反受其害,。在過(guò)去三個(gè)季度中,,公司總虧損擴(kuò)大至3.81億美元。

前些年,,投資者對(duì)Carvana因發(fā)展成本而造成的虧損并不在意,。確實(shí),在他們的幫助下,,公司的股價(jià)從2020年3月的低點(diǎn)飆升至2021年8月的頂峰,,增長(zhǎng)了12倍。然而最近,,市場(chǎng)瘋了:截至5月,公司的股價(jià)從其高點(diǎn)暴跌了90%,,華爾街也開(kāi)始懷疑,,當(dāng)前的重挫到底是一個(gè)小小的失足,還是一蹶不振的慘敗,。

Carvana首席執(zhí)行官歐內(nèi)斯特·加西亞三世對(duì)《財(cái)富》說(shuō):“全世界都在質(zhì)問(wèn)我們,,質(zhì)問(wèn)經(jīng)濟(jì),,質(zhì)問(wèn)整個(gè)行業(yè)。這都沒(méi)什么,,也是必然的,。我們的工作是最大化地利用涌現(xiàn)出來(lái)的各種機(jī)遇,并盡自己所能進(jìn)行調(diào)整,。如果我們做到了,,而且我們?cè)谶^(guò)去做到過(guò),那么故事的結(jié)局將是美好的,,并不是負(fù)面的,。”

加西亞的父親創(chuàng)建了Carvana的前身DriveTime,,后者是一家實(shí)體二手車經(jīng)銷商和融資機(jī)構(gòu),。Carvana是該公司的線上業(yè)務(wù),最終獨(dú)立成為了一家自營(yíng)公司,。該公司最為知名的莫過(guò)于令人眼前一亮的玻璃“販賣機(jī)”,,客戶可通過(guò)放入定制的客戶幣來(lái)取走車輛。(Carvana也提供送貨上門服務(wù),。)

對(duì)于加西亞的員工來(lái)說(shuō),,如今的挑戰(zhàn)在于如何迅速地削減公司的開(kāi)支,并在2023年之前回歸盈利,。去年,,Carvana實(shí)現(xiàn)了兩個(gè)季度的盈利(不計(jì)某些費(fèi)用),這在公司歷史上尚屬首次,。

面對(duì)新局勢(shì),,Carvana在五月采取了初步舉措,宣布裁員12%(2500人),。高管還計(jì)劃削減薪酬,、廣告和物流開(kāi)支。

Carvana過(guò)緊日子的舉措恰逢其在5月以22億美元收購(gòu)ADESA這個(gè)糟糕時(shí)機(jī),,后者是一家領(lǐng)先的車輛批發(fā)拍賣公司,。Carvana計(jì)劃使用ADESA的56個(gè)設(shè)施來(lái)翻新和存儲(chǔ)車輛,繼而實(shí)現(xiàn)新市場(chǎng)的業(yè)務(wù)增長(zhǎng),。然而,,分析師擔(dān)心,公司為資助收購(gòu)而發(fā)行的高利率債券將在未來(lái)數(shù)年蠶食掉Carvana現(xiàn)有的大部分現(xiàn)金,。

盡管Carvana似乎在短期內(nèi)前景黯淡,,但分析師表示,Carvana也并非是軟柿子,,它是線上二手車市場(chǎng)中的主導(dǎo)零售商,,去年賣出了42.52萬(wàn)輛車,,是僅次于其后的純線上競(jìng)爭(zhēng)對(duì)手Vroom的幾乎六倍。

相對(duì)于意欲進(jìn)軍線上市場(chǎng)的傳統(tǒng)二手車經(jīng)銷商,,Carvana也有著很大的優(yōu)勢(shì),。例如,知名競(jìng)爭(zhēng)對(duì)手中規(guī)模最大的CarMax在線上的銷售量?jī)H占其總銷量的9%,,還不到8.77萬(wàn)輛,。

基于公司去年強(qiáng)勁的業(yè)績(jī),Carvana在新發(fā)布的《財(cái)富》500強(qiáng)榜單中的名次有了大幅提升,。公司營(yíng)收增長(zhǎng)了129%,,達(dá)到128億美元,讓公司在榜單中的名次躍升了193個(gè),,至290位,,是今年以來(lái)排名上升第三快的公司。

即便在經(jīng)歷了過(guò)去十年的快速增長(zhǎng)之后,,Carvana在二手車市場(chǎng)依然僅占有1%的市場(chǎng)份額,。公司高管認(rèn)為年銷量200萬(wàn)輛是一個(gè)可以實(shí)現(xiàn)的目標(biāo)。

Wedbush Securities的分析師賽斯·巴沙姆預(yù)測(cè),,Carvana在現(xiàn)金用完之前便會(huì)扭虧為盈(扣除某些費(fèi)用之后),,但投資者要止血的話可能得等到2024年。

巴沙姆表示:“即便是最有力的競(jìng)爭(zhēng)對(duì)手依然難以望其項(xiàng)背,。我認(rèn)為當(dāng)前的局勢(shì)最終并不會(huì)讓該公司大幅偏離其努力實(shí)現(xiàn)的目標(biāo),。”(財(cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

美國(guó)最大的線上二手車交易商Carvana在過(guò)去十年中一直在鉚足馬力向前沖,。

這家公司借助人們對(duì)亞馬遜式購(gòu)車體驗(yàn)的強(qiáng)勁需求,,幫助客戶規(guī)避了到訪車場(chǎng)以及與固執(zhí)銷售人員打交道的種種不便。

然后,,新冠疫情爆發(fā)了,,盡管人們?cè)谝咔槌跗谝黄只牛獵arvana的業(yè)務(wù)卻一路高歌,,因?yàn)樵谌蛐酒倘?、汽車產(chǎn)量下滑的大環(huán)境下,買家很難買到新車,。

然而從2021年底開(kāi)始,,Carvana的好景卻戛然而止。隨著疫情退潮,,很多購(gòu)車者開(kāi)始再次光顧當(dāng)?shù)仄嚱?jīng)銷商,。與此同時(shí),居高不下的二手車價(jià)格,,不斷上漲的車貸款利率,,以及宏觀經(jīng)濟(jì)通脹導(dǎo)致錢包見(jiàn)底,讓很多人不得不重新考慮是否花錢購(gòu)買一輛新車,。

突然間,,Carvana因?qū)ξ磥?lái)快速增長(zhǎng)的預(yù)期而開(kāi)展的瘋狂招聘,以及龐大的汽車庫(kù)存,,讓公司反受其害,。在過(guò)去三個(gè)季度中,公司總虧損擴(kuò)大至3.81億美元,。

前些年,,投資者對(duì)Carvana因發(fā)展成本而造成的虧損并不在意。確實(shí),,在他們的幫助下,,公司的股價(jià)從2020年3月的低點(diǎn)飆升至2021年8月的頂峰,增長(zhǎng)了12倍,。然而最近,,市場(chǎng)瘋了:截至5月,公司的股價(jià)從其高點(diǎn)暴跌了90%,,華爾街也開(kāi)始懷疑,,當(dāng)前的重挫到底是一個(gè)小小的失足,還是一蹶不振的慘敗,。

Carvana首席執(zhí)行官歐內(nèi)斯特·加西亞三世對(duì)《財(cái)富》說(shuō):“全世界都在質(zhì)問(wèn)我們,,質(zhì)問(wèn)經(jīng)濟(jì),質(zhì)問(wèn)整個(gè)行業(yè),。這都沒(méi)什么,,也是必然的。我們的工作是最大化地利用涌現(xiàn)出來(lái)的各種機(jī)遇,,并盡自己所能進(jìn)行調(diào)整,。如果我們做到了,而且我們?cè)谶^(guò)去做到過(guò),,那么故事的結(jié)局將是美好的,,并不是負(fù)面的?!?/p>

加西亞的父親創(chuàng)建了Carvana的前身DriveTime,,后者是一家實(shí)體二手車經(jīng)銷商和融資機(jī)構(gòu)。Carvana是該公司的線上業(yè)務(wù),,最終獨(dú)立成為了一家自營(yíng)公司,。該公司最為知名的莫過(guò)于令人眼前一亮的玻璃“販賣機(jī)”,客戶可通過(guò)放入定制的客戶幣來(lái)取走車輛。(Carvana也提供送貨上門服務(wù),。)

對(duì)于加西亞的員工來(lái)說(shuō),,如今的挑戰(zhàn)在于如何迅速地削減公司的開(kāi)支,并在2023年之前回歸盈利,。去年,,Carvana實(shí)現(xiàn)了兩個(gè)季度的盈利(不計(jì)某些費(fèi)用),這在公司歷史上尚屬首次,。

面對(duì)新局勢(shì),,Carvana在五月采取了初步舉措,宣布裁員12%(2500人),。高管還計(jì)劃削減薪酬,、廣告和物流開(kāi)支。

Carvana過(guò)緊日子的舉措恰逢其在5月以22億美元收購(gòu)ADESA這個(gè)糟糕時(shí)機(jī),,后者是一家領(lǐng)先的車輛批發(fā)拍賣公司,。Carvana計(jì)劃使用ADESA的56個(gè)設(shè)施來(lái)翻新和存儲(chǔ)車輛,繼而實(shí)現(xiàn)新市場(chǎng)的業(yè)務(wù)增長(zhǎng),。然而,,分析師擔(dān)心,公司為資助收購(gòu)而發(fā)行的高利率債券將在未來(lái)數(shù)年蠶食掉Carvana現(xiàn)有的大部分現(xiàn)金,。

盡管Carvana似乎在短期內(nèi)前景黯淡,,但分析師表示,Carvana也并非是軟柿子,,它是線上二手車市場(chǎng)中的主導(dǎo)零售商,,去年賣出了42.52萬(wàn)輛車,是僅次于其后的純線上競(jìng)爭(zhēng)對(duì)手Vroom的幾乎六倍,。

相對(duì)于意欲進(jìn)軍線上市場(chǎng)的傳統(tǒng)二手車經(jīng)銷商,,Carvana也有著很大的優(yōu)勢(shì)。例如,,知名競(jìng)爭(zhēng)對(duì)手中規(guī)模最大的CarMax在線上的銷售量?jī)H占其總銷量的9%,,還不到8.77萬(wàn)輛。

基于公司去年強(qiáng)勁的業(yè)績(jī),,Carvana在新發(fā)布的《財(cái)富》500強(qiáng)榜單中的名次有了大幅提升,。公司營(yíng)收增長(zhǎng)了129%,達(dá)到128億美元,,讓公司在榜單中的名次躍升了193個(gè),,至290位,是今年以來(lái)排名上升第三快的公司,。

即便在經(jīng)歷了過(guò)去十年的快速增長(zhǎng)之后,,Carvana在二手車市場(chǎng)依然僅占有1%的市場(chǎng)份額。公司高管認(rèn)為年銷量200萬(wàn)輛是一個(gè)可以實(shí)現(xiàn)的目標(biāo)。

Wedbush Securities的分析師賽斯·巴沙姆預(yù)測(cè),,Carvana在現(xiàn)金用完之前便會(huì)扭虧為盈(扣除某些費(fèi)用之后),,但投資者要止血的話可能得等到2024年。

巴沙姆表示:“即便是最有力的競(jìng)爭(zhēng)對(duì)手依然難以望其項(xiàng)背,。我認(rèn)為當(dāng)前的局勢(shì)最終并不會(huì)讓該公司大幅偏離其努力實(shí)現(xiàn)的目標(biāo),?!保ㄘ?cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

Carvana, the nation’s largest online used auto dealer, has spent most of its 10-year journey with its accelerator punched to the floor.

The company capitalized on strong demand for an Amazon-like car shopping experience, helping customers avoid the inconveniences of visiting vehicle lots and haggling with pushy salespeople.

Then the COVID pandemic hit, and despite initial fears, Carvana’s business surged as buyers struggled to find new vehicles amid a global chip shortage that slowed production.

But starting in late 2021, Carvana’s joyride came to an abrupt halt. With the pandemic ebbing, many shoppers once again felt comfortable visiting local auto dealers. Meanwhile sky-high used car prices, rising interest rates on auto loans, and pinched pocketbooks caused by inflation across the broader economy made many people reconsider splurging on a new ride.

Suddenly Carvana’s aggressive hiring and its large inventory of cars—all pursued in anticipation of rapid future growth—backfired. Over the past three quarters, total losses ballooned to $381 million.

In previous years, investors were willing to shrug off Carvana’s losses as the cost of growth; indeed, they sent shares up 13-fold from their March 2020 low to their August 2021 peak. But recently the markets have lost their nerve: As of late May, the company’s stock was down 90% from its high, leaving Wall Street to wonder whether the current setback is a minor detour or an unrecoverable crash.

“The world is asking questions about us, about the economy, about the industry. And that’s fine. That’s going to happen,” Carvana CEO Ernie Garcia III tells Fortune. “Our job is to make the most of every opportunity that shows up and try to adjust the best we can. If we do, which we have in the past—in the end this story will be a positive one, not a negative one.”

Garcia’s father founded Carvana’s predecessor, DriveTime, a brick-and-mortar used car dealer and financier. That business spawned online arm Carvana, which was ultimately spun out into its own company. It’s perhaps best known for eye-catching glass-walled “vending machines,” where customers can pick up vehicles by inserting a custom coin. (Carvana also makes home deliveries.)

For Garcia’s crew, the challenge now is to quickly trim the company’s spending and return to profitability by 2023. Last year, Carvana reported two profitable quarters excluding certain expenses, its first in company history.

An initial step toward the new reality came in mid-May, when Carvana announced layoffs totaling 12% of its workforce, or 2,500 employees. Executives also plan to cut spending on compensation, advertising, and logistics.

Carvana’s commitment to belt-tightening coincides with an arguably ill-timed acquisition of ADESA, a leading wholesale vehicle auction company, for $2.2 billion in May. Carvana plans to use ADESA’s 56 facilities to refurbish and store vehicles, enabling growth into new markets. Analysts, however, fear the high-interest bonds issued to finance the purchase will eat up a large part of Carvana’s available cash for years to come.

While Carvana’s short-term prospects appear dim, analysts say the company is no lemon. It’s the dominant online used car retailer, selling 425,200 vehicles last year—nearly six times as many as its nearest online-only competitor, Vroom.

Carvana also has a big lead over traditional used car dealers that are trying to push online. For example, CarMax, the largest of the established rivals, sold only 9% of its cars online, or no more than 87,700 vehicles.

Based on its strong business last year, Carvana rose spectacularly on the latest Fortune 500. Revenue grew 129%, to $12.8 billion, vaulting the company 193 spots to No. 290 on the list—the third-biggest leap for any company this year.

Even after its rapid growth over the past decade, Carvana still owns only 1% of the used car market. Company officials believe annual sales of 2 million vehicles is a realistic target.

Wedbush Securities analyst Seth Basham forecasts that Carvana will turn the corner in terms of profits—excluding certain expenses—before it runs out of money, though investors may have to wait until 2024 for the bleeding to stop.

“They’re still way ahead of even the best competition out there,” Basham says. “I don’t think what’s happening now is ultimately going to lead to them arriving at a place much different than where they were headed.”