在底特律,一條公路的兩側(cè)展現(xiàn)了汽車行業(yè)的過去與未來,。

在羅格河,,福特汽車公司(Ford Motor Co.)大規(guī)模生產(chǎn)A型車的大型工廠,已有百年歷史,。在這個占地600英畝的園區(qū)內(nèi),,這座工廠是最忙碌的工廠之一,生產(chǎn)出了美國過去四十年最暢銷的汽油驅(qū)動F-150皮卡車,,這也是福特利潤最高的車型,。

然而,在街對面的羅格電動汽車中心(Rouge Electric Vehicle Center),,則是新時代的標志,。4月末,首批電池驅(qū)動F-150 Lightning電動汽車在該工廠下線,,這款汽車將成為底特律制造的第一款重量級電動汽車,。

福特汽車的過去與未來在這里交相輝映,不僅代表了該公司在電動汽車領(lǐng)域500億美元的豪賭,,也展現(xiàn)了全球汽車行業(yè)的格局,。新建成的羅格工廠是檢驗美國消費者的一塊試金石,Lightning車型則是福特自發(fā)布Model T以來最重要的一次新車發(fā)布,。福特希望通過這款車型,,證明它有能力向基于軟件的、電池驅(qū)動電動汽車轉(zhuǎn)型,,能夠成功生產(chǎn)和銷售不同于傳統(tǒng)卡車,、更像是iPhone手機但可載重10,000磅的汽車,。

福特CEO吉姆·法利告訴《財富》雜志:“這讓我們有機會重新定義公司在十幾二十歲的年輕人心目中的形象,就像我們之前推出Model T一樣,?!?/p>

底特律的三家老牌汽車廠商通用汽車(General Motors)、福特和擁有克萊斯勒(Chrysler)的歐洲合資公司Stellantis都在重新調(diào)整公司的業(yè)務(wù),。這三家公司共投資了1,200億美元,將在2030年前生產(chǎn)數(shù)百萬輛電動汽車,。這些投資的力度遠遠超過了汽車行業(yè)以往遭遇的挫折,,正在重新改造汽車城,對當?shù)鼐用竦乃季S,、工作和生活產(chǎn)生了顛覆性影響,。

所謂的改造,一方面是字面意義上的重建,,比如底特律三巨頭為適應(yīng)電動汽車時代對工廠進行的改造,。有些是在公司層面,比如三巨頭大力開發(fā)和收購軟件業(yè)務(wù)和電動汽車電池技術(shù)等,。然而,,難度最大的改造在于人力資源方面,因為汽車行業(yè)在密歇根州雇傭了29萬人,,而電氣化轉(zhuǎn)型正在對該行業(yè)產(chǎn)生連鎖反應(yīng),。

底特律大多數(shù)人都承認但很少有人愿意討論的一個話題是,即使轉(zhuǎn)型成功,,也意味著汽車行業(yè)的傳統(tǒng)就業(yè)崗位將越來越少,。推動變革的力量來自兩個方面:電池組的零部件遠少于內(nèi)燃機(ICE),因此電動汽車裝配線需要的工時減少了約30%,。正如法利所說:“制造業(yè)崗位將從生產(chǎn)燃油汽車轉(zhuǎn)變?yōu)樯a(chǎn)數(shù)字化產(chǎn)品,。”

與此同時,,電動汽車的電氣化傳動系統(tǒng)需要電氣工程師,、軟件開發(fā)人員和各種技術(shù)人員。電動汽車使用的日益復(fù)雜的軟件系統(tǒng),,還需要大量程序員,、研究人員和設(shè)計師。簡而言之,,行業(yè)的重心正在從裝配線向計算機工作臺轉(zhuǎn)變,。

密歇根州政府在最佳情景下預(yù)測,電氣化生態(tài)系統(tǒng)從電池生產(chǎn)和回收到維護和充電網(wǎng)絡(luò),,將創(chuàng)造30萬個新工作崗位,。但某些現(xiàn)有就業(yè)崗位注定會消失,。密歇根大學(University of Michigan)勞動經(jīng)濟學家唐恩·格里姆斯表示,未來幾年,,美國汽車工廠的就業(yè)崗位將減少約三分之一,。密歇根州政府官員估計,行業(yè)巨變將影響當?shù)?0%的汽車行業(yè)勞動力,,有17萬工人需要學習新技能,,或者到其他行業(yè)就業(yè)。

福特和通用汽車分別在密歇根州雇傭了5萬人和5.2萬人,,遠超過其他美國公司,,他們的決定將重新塑造整個勞動力隊伍。隨著這些公司的數(shù)字化水平越來越高,,他們將面臨一個不同的兩難境地:他們要相互競爭,,要與其他傳統(tǒng)廠商爭奪人才,還要面對電動汽車行業(yè)的先鋒特斯拉(Tesla)以及其他科技驅(qū)動行業(yè)的競爭,,這些行業(yè)同樣需要大量程序員和工程師,。

瑪麗·巴拉對于人才爭奪戰(zhàn)持樂觀態(tài)度。通用汽車CEO瑪麗·巴拉在位于密歇根州沃倫的通用汽車全球技術(shù)中心(GM Global Technical Center)接受了《財富》雜志采訪,,這是一棟中世紀風格的現(xiàn)代辦公大樓,。她表示:“我們在招聘時發(fā)現(xiàn),人們希望為一家能夠改變世界的公司工作,。他們希望雇主與自己有共同的價值觀,。在我們宣布2035年前輕型汽車全部電氣化之后,求職者人數(shù)顯著增加,?!?/p>

但這些求職者將要經(jīng)歷一段困難時期,。雖然傳統(tǒng)汽車廠商的投資力度驚人,也制定了令人瞠目的生產(chǎn)目標,,但這些公司的電氣化未來并非萬無一失,。目前,底特律加快生產(chǎn)電動汽車,,主要是受到政府要求的推動,,而不是源自消費者需求:2021年,美國銷售的1,500萬輛新車,,只有4%是電動汽車,,盡管電動汽車的占比正在快速增長,。供應(yīng)鏈問題,包括半導(dǎo)體和電池原材料短缺,、通貨膨脹,,俄烏沖突造成的破壞以及中國因為新冠疫情導(dǎo)致工廠停工等原因,使電動汽車的物流和資金變得更加困難,。

在這種不確定性當中,,唯一可以確定的是,底特律作為美國的汽車城,,需要做好準備,,迎接這座城市歷史上最聲勢浩大的轉(zhuǎn)型。

****

多年來,,福特和通用汽車一直在試驗電動汽車,但這兩家公司最近正在加快這方面的投入,,投入的力度再怎么夸張也不為過,。巴拉在2021年1月宣布,通用汽車將在2035年前逐步停產(chǎn)內(nèi)燃機汽車,。福特雖然沒有承諾徹底停止生產(chǎn)內(nèi)燃機汽車,,但計劃在2030年前電動汽車的銷售額占比達到50%。今年3月,,福特正式啟動轉(zhuǎn)型,,將電動汽車業(yè)務(wù)與內(nèi)燃機業(yè)務(wù)Ford Blue拆分,現(xiàn)在更名為Ford Model e,。華爾街對于福特的決定表示歡迎,,認為Blue部門強大的現(xiàn)金流能夠支持福特擴大電動汽車業(yè)務(wù)。

這種用內(nèi)燃機汽車的利潤支持零排放未來的策略,,已經(jīng)幫助兩家公司全面改造其實物資產(chǎn),。這種變化在底特律的工廠表現(xiàn)得最為突出,兩家公司在底特律關(guān)閉舊工廠,,開設(shè)新工廠,,并將生產(chǎn)汽油引擎汽車的工廠改造成電動汽車工廠。這些改造不動產(chǎn)的決定產(chǎn)生了深遠影響,,比如城市用水的稅基發(fā)生變化,,以及科尼島24小時餐廳變得火爆等。兩班倒和三班倒工人下班后會到這些餐廳用餐,。

其中最引人關(guān)注的改造是通用汽車的“零號工廠”(Factory Zero),。通用汽車對位于哈姆特拉米克有近40年歷史的工廠改造后選用了這個新名稱。該公司投入22億美元對該工廠進行改造,,用于生產(chǎn)電動汽車,,包括雪佛蘭(Chevrolet)Silverado和GMC悍馬(Hummer)皮卡等,;美國總統(tǒng)拜登在11月參加了工廠的開工儀式,底特律市長邁克·達根3月在這座工廠發(fā)表了市情咨文,。福特投資7億美元改造Rouge工廠,,用于生產(chǎn)Lightning;投資1.85億美元在底特律機場附近新建了一座電池實驗室Ford Ion Park,;投資2.5億美元改造小型地方工廠,,以增加Lightning的產(chǎn)能。

巴拉認為,,這種制造基礎(chǔ)設(shè)施使底特律在電氣化競賽中占據(jù)了獨特優(yōu)勢,。她表示,即使軟件成為汽車的核心部分,,“我們依舊對于制造企業(yè)的身份非常自豪,。隨著其他公司進入這個行業(yè),他們開始認識到制造業(yè)務(wù)的艱難,?!?/p>

密歇根州汽車行業(yè)協(xié)會MICHauto的執(zhí)行董事格倫·史蒂文斯也認同這種觀點:“實際上我們有一種優(yōu)勢,但多年來我們一直認為這種優(yōu)勢是理所當然的,?!痹谄嚭徒煌üこ膛c制造領(lǐng)域,沒有一個地方的產(chǎn)業(yè)密集程度能夠超過密歇根州,?!钡滋芈善噺S商的領(lǐng)導(dǎo)者們認為,改造當?shù)氐漠a(chǎn)業(yè)集群,,比從零開始更容易,。

通用汽車和福特還在圍繞電動汽車平臺開發(fā)更多新業(yè)務(wù)。例如,,通用汽車內(nèi)部的創(chuàng)新實驗室(Innovation Lab)已經(jīng)孵化了一家電動商用快遞車制造商BrightDrop,,該公司已經(jīng)獲得了聯(lián)邦快遞(FedEx)和沃爾瑪(Walmart)的廂式貨車生產(chǎn)合同;BrightDrop目前正在帕洛阿爾托,、底特律和亞特蘭大招聘數(shù)百名工程師,、軟件開發(fā)人員和產(chǎn)品設(shè)計師。通用汽車還預(yù)計自動駕駛汽車公司Cruise明年將在零號工廠生產(chǎn)第一款商用車型Cruise Origin班車:通用汽車認為到2030年,,Cruise在網(wǎng)約車和汽車租賃公司的年銷售額可能達到500億美元,。通用汽車是Cruise的大股東。

在采訪過程中,,巴拉生動介紹了通用汽車正在開發(fā)的基于云的訂閱軟件服務(wù)Ultifi,。Ultifi將在明年發(fā)布,,有望成為通用汽車各車型的操作系統(tǒng),可以像智能手機(和特斯拉)一樣經(jīng)常升級:通用汽車表示,,到2030年,,該項服務(wù)每年可創(chuàng)收250億美元。訂閱Ultifi的用戶不需要買新車也可以下載各種汽車功能,,目前這些功能仍在設(shè)計階段,,例如用攝像頭通過面部識別啟動汽車,或者與車主的智能家居應(yīng)用溝通等,。Ultifi還可以與第三方應(yīng)用互動,;而且隨著軟件控制車內(nèi)的功能越來越多,它將是高效修復(fù)任何漏洞的一種方式,。

巴拉表示:“我們的理念是,,在你擁有車輛之后,它會變得越來越好,。兩三年后,,我可能獲得一項買車時還不存在的功能,這將重新定義我們的業(yè)務(wù),。”

****

當然,,重新定義業(yè)務(wù)也意味著重新定義勞動力:有一個不可避免的問題是改造后的工廠需要怎樣的勞動力,,以及工廠能提供怎樣的工資水平。比如生產(chǎn)一輛福特野馬所需要的技能,,與制造一臺車輪上的iPhone手機所需要的技能截然不同,。

有人認為底特律的傳統(tǒng)汽車裝配線崗位將逐漸消失,取而代之的是人數(shù)更少但更精通技術(shù)的勞動力,,但三家傳統(tǒng)汽車廠商很快就打消了這個念頭,。Stellantis位于阿姆斯特丹的CEO卡洛斯·塔瓦雷斯對《財富》雜志表示:“第一個重要的預(yù)期是,我們不應(yīng)該害怕改變,。汽車裝配線肯定會有一些改變,,但改變并不可怕?!?/p>

通用汽車用零號工廠反駁了人們對于裁員的恐慌,。零號工廠的執(zhí)行董事吉姆·奎克表示:“有人認為我們正在縮小規(guī)模,電氣化意味著就業(yè)崗位減少,,但這并不是我們所看到的情形,。我們已經(jīng)宣布工廠將有約2,200多個就業(yè)崗位。我們很長時間以來在這里都沒有如此多的就業(yè)崗位,?!贝蠖鄶?shù)崗位都有工會支持:美國汽車工人聯(lián)盟(United Auto Workers)已經(jīng)在向底特律三巨頭施壓,,以保證工會的成員不會在這場轉(zhuǎn)型中被淘汰。

盡管如此,,有“模擬”背景的工人,,生產(chǎn)電動汽車傳動系統(tǒng)和電池,需要接受再培訓(xùn),。在通用汽車的奧萊恩裝配廠,,1,000多名工人在2020年經(jīng)過重新培訓(xùn),全部從生產(chǎn)汽油引擎汽車,,轉(zhuǎn)崗為生產(chǎn)雪佛蘭Bolt電動汽車,。(通用汽車表示,工廠開始生產(chǎn)電動皮卡車時,,工人人數(shù)將增加兩倍以上,。)零號工廠的許多員工也接受了再培訓(xùn)。巴拉認為,,留住原有工人除了保障就業(yè),,還有其他好處,例如工廠可以此為契機,,改造企業(yè)文化,,使工人憑借自身的技能而不是學歷獲得發(fā)展機會。她表示:“我認為這將給其他人帶來發(fā)展機會,,他們認為四年本科學歷并不能代表一切,。”

還有許多公共和私人利益相關(guān)者也在圍繞電動汽車技能開發(fā)新的教育課程,。密歇根州向開發(fā)電動汽車職業(yè)認證課程的機構(gòu)提供資助,,包括經(jīng)銷商技術(shù)人員和充電站的電工等。

就連硅谷巨頭也參與了進來,。去年夏天,,蘋果(Apple)在底特律建立了一所開發(fā)者學院;該學院為第一批100名學員提供的10個月免費編程和應(yīng)用開發(fā)培訓(xùn)剛剛結(jié)束,。這批學員的年齡在18至60歲之間,。谷歌(Google)計劃從明年開始在底特律開辦免費編程課,幫助高中生為從事高科技崗位做好準備,。

已經(jīng)三次連任的底特律市長達根一直在努力游說,希望將電動汽車制造崗位留在當?shù)?。達根在市政廳11層的辦公室里接受記者采訪時,,回想起他說服三大巨頭的理由:“我告訴他們:‘我希望你們不只是在這里生產(chǎn)電動汽車,我還希望設(shè)計未來電動汽車和自動化汽車的創(chuàng)業(yè)者們,也想搬到這里,?!狈苼喬乜巳R斯勒(Fiat Chrysler)在考慮為新吉普大切諾基(Jeep Grand Cherokee)插電式混合動力車型選址時,底特律提出安排招聘會進行招聘,,并對底特律居民進行預(yù)先篩選,。作為交換,菲亞特克萊斯勒承諾投資16億美元,,將麥克大街發(fā)動機綜合大樓(Mack Avenue Engine Complex)改造成生產(chǎn)電動汽車傳動系統(tǒng)的工廠,;2021年6月工廠重新開工。

達根表示:“如果你把工廠設(shè)在底特律,,當?shù)氐膭趧恿δ転槟銕砭薮髱椭?。如果你打算在芝加哥郊區(qū)40英里的玉米地里建設(shè)工廠,工人招聘將會面臨更大的挑戰(zhàn),?!?/p>

當然,并非所有現(xiàn)有員工都能在電氣化時代找到工作,。勞動經(jīng)濟學家格里姆斯表示:“電動汽車革命將讓許多人失業(yè),。但幾乎所有技術(shù)進步都會帶來這樣的后果。

想想有多少秘書工作被計算機所淘汰,?!北M管如此,格里姆斯補充道:“人們更換職業(yè)并搬到新的城鎮(zhèn)生活,,這確實是一項挑戰(zhàn),,但終究是值得的?!钡滋芈擅媾R的長期挑戰(zhàn):保證再培訓(xùn)和技能提升能夠讓人們掌握繼續(xù)工作所需要的技能,盡管這意味著更換職業(yè),。

****

在開展在培訓(xùn)的同時,,汽車廠商也在努力吸引各類白領(lǐng)技術(shù)人員,但這并不意味著吸引他們搬到底特律

巴拉表示,,通用汽車在幾年前就開始用新一代軟件人才取代退休人員,,招聘并沒有遇到太大困難。但并非所有軟件人才都將來到密歇根州,。通用汽車還在舊金山,、特拉維夫和位于安大略省馬卡姆的技術(shù)中心大力招聘。巴拉表示,,位于馬卡姆附近的滑鐵盧大學(University of Waterloo)是“硅谷重要的人才庫”,。

通用汽車今年計劃招聘8,000名技術(shù)工人,但將招聘地點的決定權(quán)下放給了業(yè)務(wù)部門經(jīng)理。通用汽車發(fā)言人表示:“這種做法讓我們可以與科技公司競爭,,尤其是在軟件,、分析和自動駕駛汽車等領(lǐng)域?!?MICHauto的史蒂文斯表示:“隨著遠程經(jīng)濟的興起,,面對對軟件工程師的巨大需求,[汽車廠商]將變得更加靈活,,就像微軟(Microsoft),、谷歌或亞馬遜(Amazon)一樣?!?/p>

對于程序員和軟件工程師們而言,,底特律并非未知之地:福特和通用汽車已經(jīng)在底特律雇傭了數(shù)千名開發(fā)人員,而且年輕的技術(shù)人員已經(jīng)在重新塑造這座城市的形象,。

如果說裝配工人往往生活在斯特林高地或圣克萊爾肖爾斯的平房社區(qū),,會到中密歇根州或密歇根上半島的小屋里過周末,軟件開發(fā)者更有可能住在市區(qū)的公寓,,晚上在Shelby用餐,。Shelby是曾經(jīng)榮獲詹姆斯·比爾德基金會半決賽獎的一家雞尾酒酒吧,原址是一家銀行的地下室,。

汽車廠商也在開發(fā)協(xié)作空間,,吸引喜歡冒險的STEM人才。福特將在2026年前在美國各地投入5.25億美元用于勞動力開發(fā),,其中知名度最高的是在迪爾伯恩興建的研究與工程設(shè)計中心(Research & Engineering Center),,占地200萬平方英尺,到2025年改造完成后,,將對20,000名福特設(shè)計師,、工程師和產(chǎn)品開發(fā)者提供培訓(xùn),他們是電動汽車革命的主力,。

有些空間是多家公司合作的成果。在一條市中心主干道沿線,,有一座不起眼的停車場,,這里是底特律智能停車實驗室(Detroit Smart Parking Lab)的所在地。這是由福特,、零部件供應(yīng)商博世(Bosch),、密西根州政府以及快速貸款公司(Quicken Loans)聯(lián)合創(chuàng)始人丹·吉爾伯特的商業(yè)地產(chǎn)公司Bedrock聯(lián)合成立的一個實驗室。

該實驗室由美國移動中心(American Center for Mobility)負責運營,,是從充電站到云服務(wù)等各種汽車技術(shù)的聯(lián)合試驗場,。參與試驗的公司既有Enterprise Rent-A-Car,,也有專注于電動汽車無線充電的初創(chuàng)公司Hevo。美國移動中心總裁兼CEO魯本·薩卡爾表示:“我們看到許多項目都只代表了一片拼圖,。而通過這個實驗室,,不同領(lǐng)域可以進行協(xié)作?!?/p>

或許最能體現(xiàn)這種跨領(lǐng)域合作的是密歇根中央車站(Michigan Central Station),。自從1988年美國鐵路公司(Amtrak)的最后一列火車從這里出發(fā)以來,密歇根中央車站一直被作為底特律城市衰敗的典型例子,。在底特律考克鎮(zhèn)社區(qū),,曾經(jīng)宏偉的古典建筑風格的密歇根中央車站,依舊被鐵絲網(wǎng)包圍,,阻擋著蓄意破壞者和非法占據(jù)者闖入,。

但福特投資9.5億美元,計劃將這座車站開發(fā)成交通科技合作中心,。這棟綜合建筑定于明年啟用,,將有福特的大批骨干技術(shù)人員入駐,還為其他公司提供了辦公空間,,例如谷歌和自動駕駛汽車公司Argo AI等,。創(chuàng)新人員將在這里開發(fā)、測試和發(fā)布與自動駕駛汽車,、公共交通,、智能公路和電動汽車基礎(chǔ)設(shè)施等有關(guān)的技術(shù)。福特在園區(qū)安排的5,000名員工中,,約一半將是現(xiàn)有員工,,這在創(chuàng)新前沿與母公司之間構(gòu)建了一條通道。

****

很長時間以來,,底特律都被作為美國汽車行業(yè)的代名詞,,因此人們很容易忘記,美國汽車業(yè)國內(nèi)的產(chǎn)量大部分并非來自底特律,。三大巨頭的傳統(tǒng)汽車生產(chǎn)業(yè)務(wù)大多位于密歇根州以外,,電動汽車業(yè)務(wù)同樣如此。

通用汽車投資20億美元,,用于對位于田納西州斯普林希爾的工廠進行改造。該工廠依舊是通用汽車在北美最大的工廠,。改造之后,,該工廠將生產(chǎn)各種電動汽車,包括凱迪拉克(Cadillac)品牌旗下的第一款電池電動汽車Lyriq,。但這與福特和韓國SK Innovation公司在田納西州和肯塔基州的114億美元投資相比,,只是小巫見大巫:位于田納西州斯坦頓的藍瓦城工廠將生產(chǎn)F系列電動皮卡和先進的電池,再加上位于肯塔基州格倫代爾的兩座電池工廠,將創(chuàng)造11,000個就業(yè)崗位,。

事實上,,福特和通用汽車的日益全球化,已經(jīng)促使一些地方官員開始質(zhì)疑,,為了留住汽車工人和吸引技術(shù)人才所花費的納稅人的錢,,是否可以更好地用于其他領(lǐng)域,例如基礎(chǔ)設(shè)施和公共教育等,。(巴拉在接受《財富》雜志采訪時強調(diào),,底特律飽受指責的學校體系是阻礙家庭搬到這里的障礙之一。)

與此同時,,與20世紀相比,密歇根和底特律對于汽車行業(yè)的依賴有所減少,。物流,、金融、醫(yī)療和IT行業(yè)都在當?shù)貛砹朔€(wěn)定的就業(yè)增長,。雖然底特律的失業(yè)率為10%左右,,依舊遠高于全國平均水平,但與大衰退期間相比,,當?shù)亟?jīng)濟已經(jīng)有明顯好轉(zhuǎn),。通用汽車、克萊斯勒和底特律市都在大衰退期間宣布破產(chǎn),。

簡而言之,,底特律不會上演王者歸來的橋段。在電動汽車轉(zhuǎn)型的過程中,,底特律市的籌碼是質(zhì)量而不是數(shù)量:福特,、通用汽車和地方官員不見得希望在這里生產(chǎn)更多汽車,但他們希望汽車城的工人依舊在電動汽車創(chuàng)新的核心,,參與設(shè)計,、連接和自動駕駛等領(lǐng)域。

福特CEO法利表示:“幾十年來,,底特律這座城市一直在努力重新定義自己的身份?,F(xiàn)在我們開始找到屬于自己的魔力?!?這種魔力在以電動汽車為主的零號工廠和停車實驗室中顯而易見,,底特律似乎在這些地方爆發(fā)出新的能量,。 明年,在底特律市中心將會展現(xiàn)出這種能量,。在密歇根大街的一條支線上,,當?shù)毓賳T將宣布啟用美國第一條公共電氣化公路。這條公路由以色列公司Electreon和密歇根州交通部聯(lián)合開發(fā),,公路下方的基礎(chǔ)設(shè)施將為在路上行駛,、停靠或等待的電動汽車無線充電,。在這條公路的不遠處,,就是底特律100多年前推出美國第一個三色四向交通燈的十字路口,它可能是底特律未來與歷史的另外一個交匯點,。

****

押注電動汽車

美國三大汽車廠商,、《財富》500強福特、通用汽車和克萊斯勒(已被阿姆斯特丹的Stellantis公司收購),,共承諾在未來幾年投資超過1,200億美元,,將更多產(chǎn)品線轉(zhuǎn)變?yōu)殡妱悠嚒R韵率歉骷夜镜耐度搿?/p>

福特汽車

承諾:

到2030年50%的銷售收入來自電動汽車

投資:

到2026年在電動汽車工廠,、軟件和培訓(xùn)方面投資500億美元

策略:

福特的重點首先是將其暢銷品牌電氣化,,尤其是F-150 Lightning皮卡車,其汽油版四十年來持續(xù)暢銷,。

早期主要電動汽車型號:

F-150 Lightning,、Mustang Mach-E SUV和E-Transit商用貨車(目前均已上市)。

通用汽車

承諾:

到2035年全球100%的銷售收入來自電動汽車

投資:

到2025年在電動汽車和自動駕駛汽車技術(shù)方面投資350億美元

策略:

通用汽車計劃到2025年在全球發(fā)布30款新電動汽車,,幾乎全部為新型號,,而不是舊型號的升級版。

早期主要電動汽車型號:

凱迪拉克Lyriq豪華轎車和GMC悍馬皮卡車(現(xiàn)已上市),;悍馬SUV和雪佛蘭Silverado皮卡車(2023年),。

STELLANTIS

承諾:

到2030年歐洲100%的銷售收入和北美洲50%的銷售收入來自電動汽車

投資:

到2025年在電氣化、軟件和技術(shù)方面投資355億美元,。

策略:

到目前為止,,Stellantis在北美洲的業(yè)務(wù)重點是研發(fā)暢銷車型的插電式混合動力版本,但計劃發(fā)布至少25款新電動汽車品牌,。

早期主要電動汽車型號:

克萊斯勒Pacifica和吉普大切諾基4xe(現(xiàn)已上市),;吉普Wagoneer 4xe(今年晚些時候)。

(財富中文網(wǎng))

譯者:Biz

在底特律,,一條公路的兩側(cè)展現(xiàn)了汽車行業(yè)的過去與未來,。

在羅格河,福特汽車公司(Ford Motor Co.)大規(guī)模生產(chǎn)A型車的大型工廠,,已有百年歷史,。在這個占地600英畝的園區(qū)內(nèi),這座工廠是最忙碌的工廠之一,,生產(chǎn)出了美國過去四十年最暢銷的汽油驅(qū)動F-150皮卡車,,這也是福特利潤最高的車型。

然而,,在街對面的羅格電動汽車中心(Rouge Electric Vehicle Center),,則是新時代的標志。4月末,,首批電池驅(qū)動F-150 Lightning電動汽車在該工廠下線,,這款汽車將成為底特律制造的第一款重量級電動汽車。

福特汽車的過去與未來在這里交相輝映,,不僅代表了該公司在電動汽車領(lǐng)域500億美元的豪賭,,也展現(xiàn)了全球汽車行業(yè)的格局。新建成的羅格工廠是檢驗美國消費者的一塊試金石,,Lightning車型則是福特自發(fā)布Model T以來最重要的一次新車發(fā)布,。福特希望通過這款車型,證明它有能力向基于軟件的,、電池驅(qū)動電動汽車轉(zhuǎn)型,,能夠成功生產(chǎn)和銷售不同于傳統(tǒng)卡車、更像是iPhone手機但可載重10,000磅的汽車,。

福特CEO吉姆·法利告訴《財富》雜志:“這讓我們有機會重新定義公司在十幾二十歲的年輕人心目中的形象,,就像我們之前推出Model T一樣?!?/p>

底特律的三家老牌汽車廠商通用汽車(General Motors),、福特和擁有克萊斯勒(Chrysler)的歐洲合資公司Stellantis都在重新調(diào)整公司的業(yè)務(wù)。這三家公司共投資了1,200億美元,,將在2030年前生產(chǎn)數(shù)百萬輛電動汽車,。這些投資的力度遠遠超過了汽車行業(yè)以往遭遇的挫折,正在重新改造汽車城,,對當?shù)鼐用竦乃季S,、工作和生活產(chǎn)生了顛覆性影響。

所謂的改造,,一方面是字面意義上的重建,,比如底特律三巨頭為適應(yīng)電動汽車時代對工廠進行的改造。有些是在公司層面,,比如三巨頭大力開發(fā)和收購軟件業(yè)務(wù)和電動汽車電池技術(shù)等,。然而,難度最大的改造在于人力資源方面,,因為汽車行業(yè)在密歇根州雇傭了29萬人,,而電氣化轉(zhuǎn)型正在對該行業(yè)產(chǎn)生連鎖反應(yīng),。

底特律大多數(shù)人都承認但很少有人愿意討論的一個話題是,即使轉(zhuǎn)型成功,,也意味著汽車行業(yè)的傳統(tǒng)就業(yè)崗位將越來越少,。推動變革的力量來自兩個方面:電池組的零部件遠少于內(nèi)燃機(ICE),因此電動汽車裝配線需要的工時減少了約30%,。正如法利所說:“制造業(yè)崗位將從生產(chǎn)燃油汽車轉(zhuǎn)變?yōu)樯a(chǎn)數(shù)字化產(chǎn)品,。”

與此同時,,電動汽車的電氣化傳動系統(tǒng)需要電氣工程師,、軟件開發(fā)人員和各種技術(shù)人員。電動汽車使用的日益復(fù)雜的軟件系統(tǒng),,還需要大量程序員,、研究人員和設(shè)計師。簡而言之,,行業(yè)的重心正在從裝配線向計算機工作臺轉(zhuǎn)變,。

密歇根州政府在最佳情景下預(yù)測,電氣化生態(tài)系統(tǒng)從電池生產(chǎn)和回收到維護和充電網(wǎng)絡(luò),,將創(chuàng)造30萬個新工作崗位,。但某些現(xiàn)有就業(yè)崗位注定會消失。密歇根大學(University of Michigan)勞動經(jīng)濟學家唐恩·格里姆斯表示,,未來幾年,,美國汽車工廠的就業(yè)崗位將減少約三分之一。密歇根州政府官員估計,,行業(yè)巨變將影響當?shù)?0%的汽車行業(yè)勞動力,,有17萬工人需要學習新技能,或者到其他行業(yè)就業(yè),。

福特和通用汽車分別在密歇根州雇傭了5萬人和5.2萬人,,遠超過其他美國公司,他們的決定將重新塑造整個勞動力隊伍,。隨著這些公司的數(shù)字化水平越來越高,,他們將面臨一個不同的兩難境地:他們要相互競爭,要與其他傳統(tǒng)廠商爭奪人才,,還要面對電動汽車行業(yè)的先鋒特斯拉(Tesla)以及其他科技驅(qū)動行業(yè)的競爭,,這些行業(yè)同樣需要大量程序員和工程師。

瑪麗·巴拉對于人才爭奪戰(zhàn)持樂觀態(tài)度,。通用汽車CEO瑪麗·巴拉在位于密歇根州沃倫的通用汽車全球技術(shù)中心(GM Global Technical Center)接受了《財富》雜志采訪,,這是一棟中世紀風格的現(xiàn)代辦公大樓。她表示:“我們在招聘時發(fā)現(xiàn),人們希望為一家能夠改變世界的公司工作,。他們希望雇主與自己有共同的價值觀,。在我們宣布2035年前輕型汽車全部電氣化之后,求職者人數(shù)顯著增加,?!?/p>

但這些求職者將要經(jīng)歷一段困難時期。雖然傳統(tǒng)汽車廠商的投資力度驚人,,也制定了令人瞠目的生產(chǎn)目標,但這些公司的電氣化未來并非萬無一失,。目前,,底特律加快生產(chǎn)電動汽車,主要是受到政府要求的推動,,而不是源自消費者需求:2021年,,美國銷售的1,500萬輛新車,只有4%是電動汽車,,盡管電動汽車的占比正在快速增長,。供應(yīng)鏈問題,包括半導(dǎo)體和電池原材料短缺,、通貨膨脹,,俄烏沖突造成的破壞以及中國因為新冠疫情導(dǎo)致工廠停工等原因,使電動汽車的物流和資金變得更加困難,。

在這種不確定性當中,,唯一可以確定的是,底特律作為美國的汽車城,,需要做好準備,,迎接這座城市歷史上最聲勢浩大的轉(zhuǎn)型。

****

多年來,,福特和通用汽車一直在試驗電動汽車,,但這兩家公司最近正在加快這方面的投入,投入的力度再怎么夸張也不為過,。巴拉在2021年1月宣布,,通用汽車將在2035年前逐步停產(chǎn)內(nèi)燃機汽車。福特雖然沒有承諾徹底停止生產(chǎn)內(nèi)燃機汽車,,但計劃在2030年前電動汽車的銷售額占比達到50%,。今年3月,福特正式啟動轉(zhuǎn)型,,將電動汽車業(yè)務(wù)與內(nèi)燃機業(yè)務(wù)Ford Blue拆分,,現(xiàn)在更名為Ford Model e。華爾街對于福特的決定表示歡迎,,認為Blue部門強大的現(xiàn)金流能夠支持福特擴大電動汽車業(yè)務(wù),。

這種用內(nèi)燃機汽車的利潤支持零排放未來的策略,,已經(jīng)幫助兩家公司全面改造其實物資產(chǎn)。這種變化在底特律的工廠表現(xiàn)得最為突出,,兩家公司在底特律關(guān)閉舊工廠,,開設(shè)新工廠,并將生產(chǎn)汽油引擎汽車的工廠改造成電動汽車工廠,。這些改造不動產(chǎn)的決定產(chǎn)生了深遠影響,,比如城市用水的稅基發(fā)生變化,以及科尼島24小時餐廳變得火爆等,。兩班倒和三班倒工人下班后會到這些餐廳用餐,。

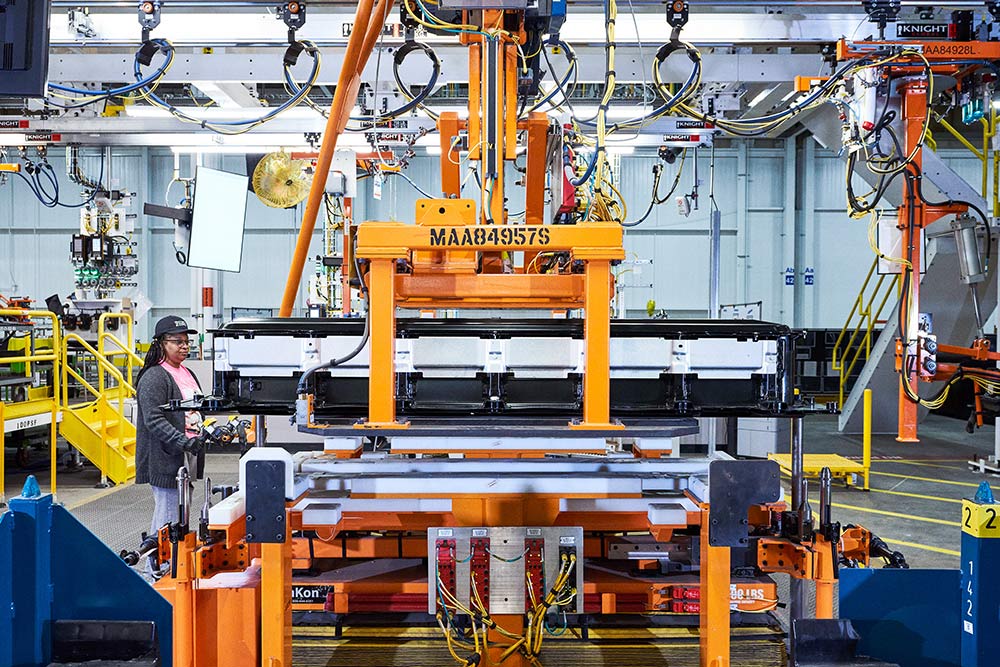

其中最引人關(guān)注的改造是通用汽車的“零號工廠”(Factory Zero)。通用汽車對位于哈姆特拉米克有近40年歷史的工廠改造后選用了這個新名稱,。該公司投入22億美元對該工廠進行改造,,用于生產(chǎn)電動汽車,包括雪佛蘭(Chevrolet)Silverado和GMC悍馬(Hummer)皮卡等,;美國總統(tǒng)拜登在11月參加了工廠的開工儀式,,底特律市長邁克·達根3月在這座工廠發(fā)表了市情咨文。福特投資7億美元改造Rouge工廠,,用于生產(chǎn)Lightning,;投資1.85億美元在底特律機場附近新建了一座電池實驗室Ford Ion Park;投資2.5億美元改造小型地方工廠,,以增加Lightning的產(chǎn)能,。

巴拉認為,這種制造基礎(chǔ)設(shè)施使底特律在電氣化競賽中占據(jù)了獨特優(yōu)勢,。她表示,,即使軟件成為汽車的核心部分,“我們依舊對于制造企業(yè)的身份非常自豪,。隨著其他公司進入這個行業(yè),,他們開始認識到制造業(yè)務(wù)的艱難?!?/p>

密歇根州汽車行業(yè)協(xié)會MICHauto的執(zhí)行董事格倫·史蒂文斯也認同這種觀點:“實際上我們有一種優(yōu)勢,,但多年來我們一直認為這種優(yōu)勢是理所當然的?!痹谄嚭徒煌üこ膛c制造領(lǐng)域,,沒有一個地方的產(chǎn)業(yè)密集程度能夠超過密歇根州?!钡滋芈善噺S商的領(lǐng)導(dǎo)者們認為,,改造當?shù)氐漠a(chǎn)業(yè)集群,比從零開始更容易。

通用汽車和福特還在圍繞電動汽車平臺開發(fā)更多新業(yè)務(wù),。例如,,通用汽車內(nèi)部的創(chuàng)新實驗室(Innovation Lab)已經(jīng)孵化了一家電動商用快遞車制造商BrightDrop,該公司已經(jīng)獲得了聯(lián)邦快遞(FedEx)和沃爾瑪(Walmart)的廂式貨車生產(chǎn)合同,;BrightDrop目前正在帕洛阿爾托,、底特律和亞特蘭大招聘數(shù)百名工程師、軟件開發(fā)人員和產(chǎn)品設(shè)計師,。通用汽車還預(yù)計自動駕駛汽車公司Cruise明年將在零號工廠生產(chǎn)第一款商用車型Cruise Origin班車:通用汽車認為到2030年,,Cruise在網(wǎng)約車和汽車租賃公司的年銷售額可能達到500億美元。通用汽車是Cruise的大股東,。

在采訪過程中,,巴拉生動介紹了通用汽車正在開發(fā)的基于云的訂閱軟件服務(wù)Ultifi。Ultifi將在明年發(fā)布,,有望成為通用汽車各車型的操作系統(tǒng),可以像智能手機(和特斯拉)一樣經(jīng)常升級:通用汽車表示,,到2030年,,該項服務(wù)每年可創(chuàng)收250億美元。訂閱Ultifi的用戶不需要買新車也可以下載各種汽車功能,,目前這些功能仍在設(shè)計階段,,例如用攝像頭通過面部識別啟動汽車,或者與車主的智能家居應(yīng)用溝通等,。Ultifi還可以與第三方應(yīng)用互動,;而且隨著軟件控制車內(nèi)的功能越來越多,它將是高效修復(fù)任何漏洞的一種方式,。

巴拉表示:“我們的理念是,,在你擁有車輛之后,它會變得越來越好,。兩三年后,,我可能獲得一項買車時還不存在的功能,這將重新定義我們的業(yè)務(wù),?!?/p>

****

當然,重新定義業(yè)務(wù)也意味著重新定義勞動力:有一個不可避免的問題是改造后的工廠需要怎樣的勞動力,,以及工廠能提供怎樣的工資水平,。比如生產(chǎn)一輛福特野馬所需要的技能,與制造一臺車輪上的iPhone手機所需要的技能截然不同,。

有人認為底特律的傳統(tǒng)汽車裝配線崗位將逐漸消失,,取而代之的是人數(shù)更少但更精通技術(shù)的勞動力,但三家傳統(tǒng)汽車廠商很快就打消了這個念頭。Stellantis位于阿姆斯特丹的CEO卡洛斯·塔瓦雷斯對《財富》雜志表示:“第一個重要的預(yù)期是,,我們不應(yīng)該害怕改變,。汽車裝配線肯定會有一些改變,但改變并不可怕,?!?/p>

通用汽車用零號工廠反駁了人們對于裁員的恐慌。零號工廠的執(zhí)行董事吉姆·奎克表示:“有人認為我們正在縮小規(guī)模,,電氣化意味著就業(yè)崗位減少,,但這并不是我們所看到的情形。我們已經(jīng)宣布工廠將有約2,200多個就業(yè)崗位,。我們很長時間以來在這里都沒有如此多的就業(yè)崗位,。”大多數(shù)崗位都有工會支持:美國汽車工人聯(lián)盟(United Auto Workers)已經(jīng)在向底特律三巨頭施壓,,以保證工會的成員不會在這場轉(zhuǎn)型中被淘汰,。

盡管如此,有“模擬”背景的工人,,生產(chǎn)電動汽車傳動系統(tǒng)和電池,,需要接受再培訓(xùn)。在通用汽車的奧萊恩裝配廠,,1,000多名工人在2020年經(jīng)過重新培訓(xùn),,全部從生產(chǎn)汽油引擎汽車,轉(zhuǎn)崗為生產(chǎn)雪佛蘭Bolt電動汽車,。(通用汽車表示,,工廠開始生產(chǎn)電動皮卡車時,工人人數(shù)將增加兩倍以上,。)零號工廠的許多員工也接受了再培訓(xùn),。巴拉認為,留住原有工人除了保障就業(yè),,還有其他好處,,例如工廠可以此為契機,改造企業(yè)文化,,使工人憑借自身的技能而不是學歷獲得發(fā)展機會,。她表示:“我認為這將給其他人帶來發(fā)展機會,他們認為四年本科學歷并不能代表一切,?!?/p>

還有許多公共和私人利益相關(guān)者也在圍繞電動汽車技能開發(fā)新的教育課程。密歇根州向開發(fā)電動汽車職業(yè)認證課程的機構(gòu)提供資助,,包括經(jīng)銷商技術(shù)人員和充電站的電工等,。

就連硅谷巨頭也參與了進來,。去年夏天,蘋果(Apple)在底特律建立了一所開發(fā)者學院,;該學院為第一批100名學員提供的10個月免費編程和應(yīng)用開發(fā)培訓(xùn)剛剛結(jié)束,。這批學員的年齡在18至60歲之間。谷歌(Google)計劃從明年開始在底特律開辦免費編程課,,幫助高中生為從事高科技崗位做好準備,。

已經(jīng)三次連任的底特律市長達根一直在努力游說,希望將電動汽車制造崗位留在當?shù)?。達根在市政廳11層的辦公室里接受記者采訪時,,回想起他說服三大巨頭的理由:“我告訴他們:‘我希望你們不只是在這里生產(chǎn)電動汽車,我還希望設(shè)計未來電動汽車和自動化汽車的創(chuàng)業(yè)者們,,也想搬到這里,。’”菲亞特克萊斯勒(Fiat Chrysler)在考慮為新吉普大切諾基(Jeep Grand Cherokee)插電式混合動力車型選址時,,底特律提出安排招聘會進行招聘,,并對底特律居民進行預(yù)先篩選。作為交換,,菲亞特克萊斯勒承諾投資16億美元,,將麥克大街發(fā)動機綜合大樓(Mack Avenue Engine Complex)改造成生產(chǎn)電動汽車傳動系統(tǒng)的工廠;2021年6月工廠重新開工,。

達根表示:“如果你把工廠設(shè)在底特律,,當?shù)氐膭趧恿δ転槟銕砭薮髱椭?。如果你打算在芝加哥郊區(qū)40英里的玉米地里建設(shè)工廠,,工人招聘將會面臨更大的挑戰(zhàn)?!?/p>

當然,,并非所有現(xiàn)有員工都能在電氣化時代找到工作。勞動經(jīng)濟學家格里姆斯表示:“電動汽車革命將讓許多人失業(yè),。但幾乎所有技術(shù)進步都會帶來這樣的后果,。

想想有多少秘書工作被計算機所淘汰?!北M管如此,,格里姆斯補充道:“人們更換職業(yè)并搬到新的城鎮(zhèn)生活,這確實是一項挑戰(zhàn),,但終究是值得的,。”底特律面臨的長期挑戰(zhàn):保證再培訓(xùn)和技能提升能夠讓人們掌握繼續(xù)工作所需要的技能,,盡管這意味著更換職業(yè),。

****

在開展在培訓(xùn)的同時,,汽車廠商也在努力吸引各類白領(lǐng)技術(shù)人員,但這并不意味著吸引他們搬到底特律,。巴拉表示,,通用汽車在幾年前就開始用新一代軟件人才取代退休人員,招聘并沒有遇到太大困難,。但并非所有軟件人才都將來到密歇根州,。通用汽車還在舊金山、特拉維夫和位于安大略省馬卡姆的技術(shù)中心大力招聘,。巴拉表示,,位于馬卡姆附近的滑鐵盧大學(University of Waterloo)是“硅谷重要的人才庫”。

通用汽車今年計劃招聘8,000名技術(shù)工人,,但將招聘地點的決定權(quán)下放給了業(yè)務(wù)部門經(jīng)理,。通用汽車發(fā)言人表示:“這種做法讓我們可以與科技公司競爭,尤其是在軟件,、分析和自動駕駛汽車等領(lǐng)域,。” MICHauto的史蒂文斯表示:“隨著遠程經(jīng)濟的興起,,面對對軟件工程師的巨大需求,,[汽車廠商]將變得更加靈活,就像微軟(Microsoft),、谷歌或亞馬遜(Amazon)一樣,。”

對于程序員和軟件工程師們而言,,底特律并非未知之地:福特和通用汽車已經(jīng)在底特律雇傭了數(shù)千名開發(fā)人員,,而且年輕的技術(shù)人員已經(jīng)在重新塑造這座城市的形象。

如果說裝配工人往往生活在斯特林高地或圣克萊爾肖爾斯的平房社區(qū),,會到中密歇根州或密歇根上半島的小屋里過周末,,軟件開發(fā)者更有可能住在市區(qū)的公寓,晚上在Shelby用餐,。Shelby是曾經(jīng)榮獲詹姆斯·比爾德基金會半決賽獎的一家雞尾酒酒吧,,原址是一家銀行的地下室。

汽車廠商也在開發(fā)協(xié)作空間,,吸引喜歡冒險的STEM人才,。福特將在2026年前在美國各地投入5.25億美元用于勞動力開發(fā),其中知名度最高的是在迪爾伯恩興建的研究與工程設(shè)計中心(Research & Engineering Center),,占地200萬平方英尺,,到2025年改造完成后,將對20,000名福特設(shè)計師,、工程師和產(chǎn)品開發(fā)者提供培訓(xùn),,他們是電動汽車革命的主力,。

有些空間是多家公司合作的成果。在一條市中心主干道沿線,,有一座不起眼的停車場,,這里是底特律智能停車實驗室(Detroit Smart Parking Lab)的所在地。這是由福特,、零部件供應(yīng)商博世(Bosch),、密西根州政府以及快速貸款公司(Quicken Loans)聯(lián)合創(chuàng)始人丹·吉爾伯特的商業(yè)地產(chǎn)公司Bedrock聯(lián)合成立的一個實驗室。

該實驗室由美國移動中心(American Center for Mobility)負責運營,,是從充電站到云服務(wù)等各種汽車技術(shù)的聯(lián)合試驗場,。參與試驗的公司既有Enterprise Rent-A-Car,也有專注于電動汽車無線充電的初創(chuàng)公司Hevo,。美國移動中心總裁兼CEO魯本·薩卡爾表示:“我們看到許多項目都只代表了一片拼圖,。而通過這個實驗室,不同領(lǐng)域可以進行協(xié)作,?!?/p>

或許最能體現(xiàn)這種跨領(lǐng)域合作的是密歇根中央車站(Michigan Central Station)。自從1988年美國鐵路公司(Amtrak)的最后一列火車從這里出發(fā)以來,,密歇根中央車站一直被作為底特律城市衰敗的典型例子,。在底特律考克鎮(zhèn)社區(qū),曾經(jīng)宏偉的古典建筑風格的密歇根中央車站,,依舊被鐵絲網(wǎng)包圍,,阻擋著蓄意破壞者和非法占據(jù)者闖入。

但福特投資9.5億美元,,計劃將這座車站開發(fā)成交通科技合作中心,。這棟綜合建筑定于明年啟用,將有福特的大批骨干技術(shù)人員入駐,,還為其他公司提供了辦公空間,,例如谷歌和自動駕駛汽車公司Argo AI等,。創(chuàng)新人員將在這里開發(fā),、測試和發(fā)布與自動駕駛汽車、公共交通,、智能公路和電動汽車基礎(chǔ)設(shè)施等有關(guān)的技術(shù),。福特在園區(qū)安排的5,000名員工中,約一半將是現(xiàn)有員工,,這在創(chuàng)新前沿與母公司之間構(gòu)建了一條通道,。

****

很長時間以來,底特律都被作為美國汽車行業(yè)的代名詞,,因此人們很容易忘記,,美國汽車業(yè)國內(nèi)的產(chǎn)量大部分并非來自底特律,。三大巨頭的傳統(tǒng)汽車生產(chǎn)業(yè)務(wù)大多位于密歇根州以外,電動汽車業(yè)務(wù)同樣如此,。

通用汽車投資20億美元,,用于對位于田納西州斯普林希爾的工廠進行改造。該工廠依舊是通用汽車在北美最大的工廠,。改造之后,,該工廠將生產(chǎn)各種電動汽車,包括凱迪拉克(Cadillac)品牌旗下的第一款電池電動汽車Lyriq,。但這與福特和韓國SK Innovation公司在田納西州和肯塔基州的114億美元投資相比,,只是小巫見大巫:位于田納西州斯坦頓的藍瓦城工廠將生產(chǎn)F系列電動皮卡和先進的電池,再加上位于肯塔基州格倫代爾的兩座電池工廠,,將創(chuàng)造11,000個就業(yè)崗位,。

事實上,福特和通用汽車的日益全球化,,已經(jīng)促使一些地方官員開始質(zhì)疑,,為了留住汽車工人和吸引技術(shù)人才所花費的納稅人的錢,是否可以更好地用于其他領(lǐng)域,,例如基礎(chǔ)設(shè)施和公共教育等,。(巴拉在接受《財富》雜志采訪時強調(diào),底特律飽受指責的學校體系是阻礙家庭搬到這里的障礙之一,。)

與此同時,,與20世紀相比,密歇根和底特律對于汽車行業(yè)的依賴有所減少,。物流,、金融、醫(yī)療和IT行業(yè)都在當?shù)貛砹朔€(wěn)定的就業(yè)增長,。雖然底特律的失業(yè)率為10%左右,,依舊遠高于全國平均水平,但與大衰退期間相比,,當?shù)亟?jīng)濟已經(jīng)有明顯好轉(zhuǎn),。通用汽車、克萊斯勒和底特律市都在大衰退期間宣布破產(chǎn),。

簡而言之,,底特律不會上演王者歸來的橋段。在電動汽車轉(zhuǎn)型的過程中,,底特律市的籌碼是質(zhì)量而不是數(shù)量:福特,、通用汽車和地方官員不見得希望在這里生產(chǎn)更多汽車,但他們希望汽車城的工人依舊在電動汽車創(chuàng)新的核心,,參與設(shè)計,、連接和自動駕駛等領(lǐng)域,。

福特CEO法利表示:“幾十年來,底特律這座城市一直在努力重新定義自己的身份?,F(xiàn)在我們開始找到屬于自己的魔力,。” 這種魔力在以電動汽車為主的零號工廠和停車實驗室中顯而易見,,底特律似乎在這些地方爆發(fā)出新的能量,。 明年,在底特律市中心將會展現(xiàn)出這種能量,。在密歇根大街的一條支線上,,當?shù)毓賳T將宣布啟用美國第一條公共電氣化公路。這條公路由以色列公司Electreon和密歇根州交通部聯(lián)合開發(fā),,公路下方的基礎(chǔ)設(shè)施將為在路上行駛,、停靠或等待的電動汽車無線充電,。在這條公路的不遠處,,就是底特律100多年前推出美國第一個三色四向交通燈的十字路口,它可能是底特律未來與歷史的另外一個交匯點,。

****

押注電動汽車

美國三大汽車廠商,、《財富》500強福特、通用汽車和克萊斯勒(已被阿姆斯特丹的Stellantis公司收購),,共承諾在未來幾年投資超過1,200億美元,,將更多產(chǎn)品線轉(zhuǎn)變?yōu)殡妱悠嚒R韵率歉骷夜镜耐度搿?/p>

福特汽車

承諾:

到2030年50%的銷售收入來自電動汽車

投資:

到2026年在電動汽車工廠,、軟件和培訓(xùn)方面投資500億美元

策略:

福特的重點首先是將其暢銷品牌電氣化,,尤其是F-150 Lightning皮卡車,其汽油版四十年來持續(xù)暢銷,。

早期主要電動汽車型號:

F-150 Lightning,、Mustang Mach-E SUV和E-Transit商用貨車(目前均已上市)。

通用汽車

承諾:

到2035年全球100%的銷售收入來自電動汽車

投資:

到2025年在電動汽車和自動駕駛汽車技術(shù)方面投資350億美元

策略:

通用汽車計劃到2025年在全球發(fā)布30款新電動汽車,,幾乎全部為新型號,,而不是舊型號的升級版。

早期主要電動汽車型號:

凱迪拉克Lyriq豪華轎車和GMC悍馬皮卡車(現(xiàn)已上市),;悍馬SUV和雪佛蘭Silverado皮卡車(2023年),。

STELLANTIS

承諾:

到2030年歐洲100%的銷售收入和北美洲50%的銷售收入來自電動汽車

投資:

到2025年在電氣化,、軟件和技術(shù)方面投資355億美元,。

策略:

到目前為止,Stellantis在北美洲的業(yè)務(wù)重點是研發(fā)暢銷車型的插電式混合動力版本,,但計劃發(fā)布至少25款新電動汽車品牌,。

早期主要電動汽車型號:

克萊斯勒Pacifica和吉普大切諾基4xe(現(xiàn)已上市),;吉普Wagoneer 4xe(今年晚些時候)。

(財富中文網(wǎng))

譯者:Biz

Detroit, the auto industry’s past and future face each other across an access road.

The location is Rouge River, the sprawling century-old factory complex where Ford Motor Co. made Model A’s for the masses. One of the busiest plants on the 600-acre campus churns out the gas-powered F-150 pickup, America’s bestselling vehicle for the past four decades and Ford’s most profitable model.

But just across the street stands a building whose signage places it in a new era: the Rouge Electric Vehicle Center. In late April, that plant produced the first batch of the Lightning battery-electric version of the F-150—a model that could be poised to become the first Detroit- made EV hit.

The juxtaposition of Ford’s past and future represents not only the company’s $50 billion bet on EVs, but the larger story playing out across the global automotive industry. The new Rouge plant is a litmus test for American consumers, and the Light- ning is Ford’s most important launch since the Model T. It’s a way for Ford to prove that it can master the transition to software-based, battery- electric vehicles—to successfully build and sell something that’s less like a workaday truck and more akin to an iPhone that can tow 10,000 pounds.

“That gives us a chance to redefine the company like we did in the teens and ’20s with the Model T,” Ford CEO Jim Farley tells Fortune.

Detroit’s three legacy automakers—General Motors; Ford; and Stellantis, the European joint venture that owns Chrysler—are all in the redefinition business. They’re investing a combined $120 billion to put millions of EVs on the road by 2030. And that collective investment—even more than the automotive industry’s past twists and turns—is remaking the Mo- tor City, creating a seismic shift in how its residents think, work, and live.

Some of this remaking is literal rebuilding, as the Detroit Three repurpose factories for the EV era. Some is corporate, as they develop and acquire businesses that focus on software and EV battery tech. But the trickiest remaking is one of human resources—as the electric transition ripples through an automotive industry that employs 290,000 people in Michigan.

What most people in Detroit acknowledge, but few like to discuss, is that even a successful transition means fewer traditional jobs in the auto industry. The forces driving the change are twofold: Battery packs have fewer parts than internal combustion engines (ICEs)—so EVs require about 30% fewer hours of labor on the assembly line. As Farley puts it, “The manufacturing jobs are going to go from making oily things to digital things.”

At the same time, the electrified powertrains of EVs require electrical engineers, software developers, and all manner of technicians. And the increasingly complex software systems that EVs rely on will need their own cadres of programmers, researchers, and designers. The industry’s center of gravity, in short, is shifting from the assembly line to the computer workbench.

In its best-case scenario, Michigan’s state government forecasts the creation of up to 300,000 new jobs across the electrification ecosystem, from battery manufacturing and recycling to service and charging networks. But some existing jobs are bound to disappear. Over the next few years, the U.S. will start shedding nearly one-third of its automotive factory jobs, according to Don Grimes, a labor economist at the University of Michigan. And state officials have estimated that the overall shift could affect 60% of Michigan’s automotive workforce, putting 170,000 workers in a position where they’ll need to learn new skills—or find work in another industry.

More than any other American companies, Ford and GM—which employ 50,000 and 52,000 people in Michigan, respectively—will make the decisions that reshape that work- force. And as they become more digital, they’ll face a different dilemma: They’ll be competing for talent not only with each other and other legacy automakers, but with EV pioneer Tesla and with countless other tech-driven industries that need programmers and engineers.

Mary Barra, for one, is bullish about the talent battle. “What we’re fi when we hire is that people want to work for a company that’s going to change the world,” GM’s CEO tells Fortune during an interview in a mid-century modern office at the GM Global Technical Center in Warren, Mich. “They want to work for a company that shares their values. When we made our announcement that we were going to make the whole light-duty fleet electric by 2035, we actually saw applications go up.”

Those applicants are signing up for a bumpy ride. Despite their eye- popping investments and production goals, the legacy automakers’ electric future is not guaranteed. For now, Detroit’s accelerated EV pace is fueled more by government mandates than by consumer demand: EVs represented just 4% of the 15 million new vehicles sold in the U.S. in 2021, though the share is quickly growing. And supply-chain challenges, including shortages of semiconductors and raw materials for batteries, rising inflation, and disruptions stemming from Russia’s invasion of Ukraine and COVID-related factory shutdowns in China, are making the logistics and finances of EVs even thornier.

Amid that uncertainty, the only certainty is that the city that put America on wheels needs to buckle in for the most momentous transition in its history.

****

BOTH FORD AND GM have experimented with EVs for years, but it’s hard to overstate how much they’ve recently accelerated that commitment. Barra announced in January 2021 that GM would phase out ICE vehicles by 2035. Ford hasn’t committed to a full phaseout, but it now aims to get 50% of sales from EVs by 2030. This March, Ford formalized its transformation with a restructuring that separated its EV business, now called Ford Model e, from its ICE business, Ford Blue. Wall Street embraced Ford’s decision, positing that strong cash flows from Blue could support Ford’s EV expansion.

That dynamic, of internal- combustion profits paying for a zero-emissions future, has already helped both companies overhaul their physical assets. It shows most dramatically in factory footprints across Metro Detroit, where they’re closing old plants, opening new ones, and retooling gas-engine factories to build EVs instead. These real estate decisions have far-reaching repercussions, from the tax base for municipal water to the vitality of the 24-hour Coney Island diners where second- and third-shifters gather after work.

One of the highest-profile conversions is Factory Zero, GM’s new name for its nearly 40-year-old plant in Hamtramck. GM spent $2.2 billion to retool it for EVs, including the battery-electric Chevrolet Silverado and GMC Hummer pickup trucks; President Biden flew into town for its grand opening in November, and Detroit Mayor Mike Duggan gave his State of the City address there in

March. Ford, meanwhile, has invested $700 million outfitting the Rouge complex to build the Lightning; $185 million building Ford Ion Park, a battery laboratory near Detroit Metro Airport; and $250 million on smaller local plants to increase production capacity for the Lightning.

Barra argues that all this production infrastructure gives Detroit a distinct advantage over other cities in the electrification race. Even as software becomes a core part of the vehicle, “we’re still very proud of the fact that we make things,” she says. “As others come into this industry, they’re recognizing the manufacturing piece is hard.”

“We actually have a position of strength that we took for granted for many years,” agrees Glenn Stevens, executive director of MICHauto, the association for Michigan’s automotive companies. “There is no denser cluster in the world of automotive and mobility engineering and manufacturing than in Michigan.” Converting the cluster, Detroit’s honchos argue, is easier than starting from scratch.

GM and Ford are also building more new businesses around EV plat- forms. At GM, for example, the in- house Innovation Lab has incubated BrightDrop, a commercial-delivery EV maker that has contracts to produce vans for FedEx and Walmart; BrightDrop is now hiring hundreds of engineers, software developers, and product designers in Palo Alto, Detroit, and Atlanta. GM also expects the self-driving car company Cruise, of which it is majority shareholder, to produce its first commercial model, the Cruise Origin shuttle, next year at Factory Zero: GM believes Cruise sales to ride-hailing and rental-car companies could become a $50-billion-a-year business by 2030.

In our conversation, Barra gets particularly animated about Ultifi—the cloud-based subscription software service GM is developing. Slated to arrive next year, Ultifi will essentially be the operating system for GM vehicles, capable of regularly upgrading itself like your smart- phone does (and Teslas do): The company says it could generate as much as $25 billion a year in revenue by 2030. Ultifi owners could essentially download automotive features that are currently on the drawing board—like using cameras for facial recognition to start the vehicle, or communicating with drivers’ smart- home applications—without having to buy a new car. Ultifi will interact with third-party apps too; and in an era when software controls more functions on every vehicle, it’ll be an efficient way to repair any bugs.

“The whole concept is that your vehicle can get better as you own it,” says Barra. “Two or three years from now, I can get a feature that didn’t even exist when I bought the vehicle, which is a whole way to reimagine the business.”

****

REIMAGINING THE BUSINESS, of course, means reimagining the workforce: The lingering question is who will fill the retooled factories and at what kind of wages. The skills to build, say, a Ford Mustang are not the same ones needed to create an iPhone on wheels.

All three legacy automakers are quick to dispel the idea that metro Detroit’s traditional assembly line jobs could fade away, to be supplanted by a smaller, savvier workforce. “That’s the fi t important expectation—that we should not be afraid of change,” Stellantis’s Amsterdam-based CEO, Carlos Tavares, tells Fortune. “There will be some change in the general assembly of the vehicles, but nothing that would be scary.”

GM points to Factory Zero to refute fears of layoffs. “The notion that we’re shrinking, that electrification means less jobs, is not the way that we see it,” says Jim Quick, the plant’s executive director. “We’ve announced that we’re going to have about 2,200 jobs–plus. We haven’t had 2,200-plus jobs here in quite some time.” Most of those jobs are unionized: The United Auto Workers union has leaned on the Detroit Three to make sure its members don’t get left behind in the transition.

That said, for workers with “analog” backgrounds, building EV powertrains and batteries requires new training. At GM’s Orion Assembly plant, the entire 1,000-plus person workforce pivoted in 2020 from making gas-engine cars to building the Chevrolet Bolt EV, retraining along the way. (GM says the plant’s workforce will more than triple when it starts making EV pickup trucks.) Many Factory Zero staff underwent reskilling, too. Barra sees retraining as having benefits beyond job preservation: It’s a chance to retool the culture so that opportunities are based on workers’ skills rather than academic credentials. “I think that’s going to open up [advancement] to a whole other realm of people, who don’t think everything has to be done by a four-year degree,” she says.

A wide range of other public and private stakeholders are also developing new educational programs around EV skills. The State of Michigan is awarding grants for groups to develop curriculums for certifications for EV occupations, including dealership technicians and electricians

for charging stations. Even Silicon Valley’s behemoths are getting in on the act. Last summer, Apple opened a Detroit developer academy; it just finished providing its first 100-person cohort, ages 18 to 60, with 10 months of free training in coding and app development. And Google plans to hold free coding classes in the city to help prepare high school students for high-tech jobs, starting next year.

Duggan, Detroit’s three-term mayor, has done his share of lobbying to keep EV jobs local. Talking with a reporter in his 11th-floor City Hall office, Duggan recalls making his case to the Big Three: “I told them, ‘I want you not just to build your electric vehicles here, but I want the entrepreneurs who are designing the electric and automated vehicles of the future to want to locate here.’ ” When Fiat Chrysler was mulling where to build its new Jeep Grand Cherokee plug-in hybrid models, the city offered to handle hiring through job fairs and prescreenings for Detroit residents. In exchange, the automaker made a $1.6 billion commitment to convert its Mack Avenue Engine Complex into a factory that can build EV powertrains; it reopened in June 2021.

“If you put your plant in Detroit, you’re going to have huge help with the workforce,” Duggan says. “If you want to build someplace 40 miles out of Chicago in a cornfield, your hiring is going to be more challenging.”

Still, not every current worker will have a job waiting for them in the electric era. “The EV revolution is going to cost a lot of jobs,” says Grimes, the labor economist. “But so does almost all technological progress.

Think of how many secretarial jobs have been eliminated by computers.” That said, he adds, “it has been a challenge for people to change careers and to move to new towns, but it has ultimately been worth it.” The long-term challenge in Detroit: making sure that retraining and reskilling give people the skills to keep working, even if it means changing professions.

****

RUNNING IN PARALLEL with the retraining is the automakers’ campaign to attract white-collar tech types—which doesn’t necessarily mean attracting them to Detroit. When GM began a few years ago to replace retirees with fresh software talent, the recruitment pitch was not unduly difficult, Barra says. But not all of them are coming to Michigan. The automaker is also staffing up in San Francisco; in Tel Aviv; and at its technical center in Markham, Ontario, where the nearby University of Waterloo is, as Barra notes, “a huge feeder pool to Silicon Valley.”

GM plans to hire 8,000 technical workers this year alone, but it’s giving business-unit managers discretion about where to hire. “This approach helps us compete with tech companies, especially in areas like software, analytics, and AVs [autonomous vehicles],” a spokesman says. “With the remote economy and the absolute thirst for software engineers, [auto- makers are] going to be flexible, just like Microsoft or Google or Amazon,” says Stevens of MICHauto.

Detroit isn’t terra incognita for coders and engineers: Ford and GM already employ thousands of

developers here, and younger techies are already reshaping the city on the surface. If assembly line workers tend to live in bungalows in Sterling Heights or St. Clair Shores and spend weekends at their cottages in Mid-Michigan or the Upper Peninsula, the software crowd is more likely to own condos downtown and spend nights at dining spots like Shelby, a James Beard Award–semifinalist cocktail bar housed in a former bank vault.

But automakers are also develop- ing the kinds of collaborative spaces that draw adventurous STEM talent. Ford is investing $525 million in workforce development around the U.S. by 2026, and one of its most visible efforts is its Research & Engineering Center in Dearborn, a 2-million-square-foot campus that it is redesigning to educate 20,000 Ford designers, engineers, and product developers—the foot soldiers of the EV revolution—by 2025.

Other spaces reach across corporate boundaries. On one downtown artery, an unassuming parking garage houses the Detroit Smart Parking Lab, a new joint effort among Ford, parts supplier Bosch, the State of Michigan, and Bedrock, the commercial real estate firm owned by Quicken Loans cofounder Dan Gilbert.

Operated by the nonprofit American Center for Mobility, the space serves as a collaborative test bed for automotive technology, from charging stations to cloud-based services. Participating companies range from Enterprise Rent-A-Car to Hevo, a startup focused on wireless charging for EVs. “Many of the projects we see, they’re one piece of a puzzle,” said Reuben Sarkar, president and CEO of the mobility center. “By having this laboratory space, we’re actually forming collaborations that wouldn’t have happened otherwise.”

Perhaps the most striking emblem of collaboration is Michigan Central Station. One of the city’s most visible examples of urban blight since the last Amtrak train departed in 1988, the once-grand Beaux Arts building in Detroit’s Corktown neighborhood is still surrounded by barbed wire to discourage vandals and squatters.

But Ford has invested $950 million to develop the property as a hub for cooperation on transportation tech. Slated to open next year, the complex will house a big cadre of techies from Ford, as well as “l(fā)anding pads” for other companies, like Google and self-driving car company Argo AI. The center will be a place where innovators can develop, test, and launch technology around autonomous vehicles, public transit, smart roads, and EV infrastructure. And about half of Ford’s 5,000 employees on the campus will come from its current workforce—creating a pipeline from the innovation frontier back to the parent company.

****

DETROIT HAS BEEN synonymous with the U.S. auto industry for so long that it’s easy to forget that most of its domestic production takes place elsewhere. Each of the Big Three makes the majority of its traditional vehicles outside Michigan state lines, and the same will be true of EVs.

GM spent $2 billion retooling its complex in Spring Hill, Tenn.— already its largest facility in North America—to build a range of EVs, including the Cadillac Lyriq, the first battery-electric model from that brand. And that’s a fraction of the $11.4 billion Ford and South Korea’s SK Innovation are investing in Tennessee and Kentucky: The Blue Oval City complex—which will build electric F-Series pickups and advanced batteries—in Stanton, Tenn., and twin battery factories in Glendale, Ky., will together create 11,000 jobs.

Indeed, the increasing globalization of Ford and GM have prompted some local officials to question whether taxpayer money spent on retraining auto workers and attracting tech talent might be better spent elsewhere, including on infrastructure and public education. (Barra, in her conversation with Fortune, high- lighted the city’s beleaguered school system as an obstacle for families considering moving to Detroit.)

At the same time, Michigan and Detroit are less dependent on the auto industry than they were in the 20th century. The logistics, finance, health care, and IT industries have all created steady job growth in the region. Detroit’s unemployment rate re- mains much higher than the national average, at around 10%, but the local economy is in far better shape than it was in the Great Recession, when GM, Chrysler, and the City of Detroit itself all declared bankruptcy.

In short, Detroit is no longer a comeback story. The stakes for the city in the EV transition have to do with quality rather than quantity: Ford, GM, and local officials don’t necessarily want to make more cars here, but they want the Motor City’s workers to remain at the heart of EV innovation—in design, in connectivity, in autonomous driving.

“After decades of struggling to redefine the city’s identity,” Ford’s Farley says, “we’re starting to find our mojo again.” That mojo is palpable in new EV-centric spaces like Factory Zero and the Parking Lab, where Detroit seems to crackle with new energy. Next year, in downtown Detroit, some of that energy will be made visible. On a stretch of Michigan Avenue, local officials will unveil the country’s first public electrified roadway. Developed by Israeli company Electreon and the Michigan Department of Transportation, the infrastructure embedded beneath the road will recharge EVs wirelessly while they drive, park, or wait in traffic. The roadway won’t be far from the inter- section where Detroit introduced the country’s first three-color, four-way traffic light more than 100 years ago— yet another hopeful juxtaposition of Detroit’s future and its past.

****

THE GREAT ELECTRIC BET

America’s Big Three automakers—Fortune 500 giants Ford and General Motors, and Chrysler, now owned by Amsterdam-based Stellantis—have collectively pledged more than $120 billion over the next few years to convert more of their production lines to electric vehicles. Here’s how their bets stack up.

FORD MOTOR CO.

THE COMMITMENT:

50% of sales to come from EVs by 2030

THE INVESTMENT:

$50 billion in EV plants, software, and training through 2026

THE STRATEGY:

Ford will focus first on electrifying its top- selling models, most notably the F-150 Lightning pickup, whose gas-powered version has been a top seller for four decades.

KEY EARLY EV MODELS:

F-150 Lightning, Mus- tang Mach-E SUV, and

E-Transit commercial van (all on sale now).

GENERAL MOTOR

THE COMMITMENT:

100% of global sales to come from EVs by 2035

THE INVESTMENT:

$35 billion in EV and autonomous-vehicle technology through 2025

THE STRATEGY:

GM plans to launch 30 new EVs globally by 2025, almost all of them new models rather than updates of older ones.

KEY EARLY EV MODELS:

Cadillac Lyriq luxury sedan and GMC Hummer pickup (on sale now); Hummer SUV and Chevrolet Silverado pickup (2023).

STELLANTIS

THE COMMITMENT:

100% of European sales and 50% of North Ameri- can sales to come from EVs by 2030

THE INVESTMENT:

$35.5 billion in electrifica- tion, software, and tech- nology through 2025

THE STRATEGY:

In North America, Stel- lantis has focused to date on plug-in hybrid versions of popular models, but it plans to launch at least 25 new EV nameplates.

KEY EARLY EV MODELS:

Chrysler Pacifica and Jeep Grand Cherokee 4xe (on sale now); Jeep Wagoneer 4xe (later this year).