十多年前,哪怕有人提到一點點與比亞迪有關(guān)的消息,,都足以讓特斯拉(Tesla)的首席執(zhí)行官埃隆·馬斯克恥笑,。當(dāng)時,他在接受彭博新聞社(Bloomberg News)采訪時說:“你見過他們的車嗎,?”他還表示,,不認(rèn)為這家中國的電動汽車廠商會是特斯拉的競爭對手。他說:“我并不認(rèn)為他們能夠造出優(yōu)秀的產(chǎn)品,?!?/p>

十一年后,,馬斯克可能要收回以前說過的話。比亞迪汽車是中國最暢銷的品牌之一,,隨著中國政府鼓勵國民減少碳足跡,,比亞迪的銷量激增。目前,,比亞迪在中國的汽車年銷量超過了任何其他國內(nèi)品牌,,在整體銷量中排在第二位。比亞迪的股價暴漲,,讓沃倫·巴菲特的伯克希爾-哈撒韋(Berkshire Hathaway)在2008年的投資成為其最有利可圖的一筆投資,。比亞迪成功的最新標(biāo)志是有傳言稱,它將向特斯拉出售電池,。如果傳言得到證實,,這將是一個標(biāo)志性的時刻,表明比亞迪得到了馬斯克的電動汽車巨頭的認(rèn)可,,證明比亞迪事實上已經(jīng)具備技術(shù)實力,。但比亞迪的快速增長正在付出代價;比如據(jù)媒體曝光,,比亞迪的一座工廠的排放量激增,,導(dǎo)致周邊居民生病,使比亞迪以及整個電動汽車行業(yè)的環(huán)保聲譽受損,。

比亞迪(“Build Your Dreams”的首字母縮寫,,意為“成就夢想”)的創(chuàng)始人王傳福現(xiàn)如今在中國富豪榜中排在第20位,。1995年,,王傳福在深圳為從手機到電動工具等各類電子產(chǎn)品生產(chǎn)可充電電池。全球智能手機革命使蘋果(Apple),、諾基亞(Nokia),、華為(Huawei)和三星(Samsung)等客戶,對公司的零組件,、機殼和組裝生產(chǎn)線的需求激增,,而比亞迪將其收入投入到更先進(jìn)的電池研究。2018年,,比亞迪開始為其他汽車公司供應(yīng)電動汽車電池,。

目前,從戴爾(Dell)的筆記本電腦到iRobot公司的Roomba真空吸塵器,,許多全世界最常見的設(shè)備都使用了比亞迪的技術(shù),,因此在2021年,,比亞迪的電池業(yè)務(wù)為公司創(chuàng)造收入154億元(約合24億美元),同比增長了31.6%,。據(jù)韓國可再生技術(shù)公司SNE Research統(tǒng)計,,2022年第一季度,比亞迪取代松下(Panasonic),,成為全球第三大電動汽車電池制造商,,僅落后于中國本土的競爭對手寧德時代和韓國的LG新能源(LG Energy Solution)。

投資者尤其看好比亞迪在2020年面向電動汽車推出的刀片電池技術(shù),。這種薄電池的排列類似于剃須刀的多層刀刃,,電池充電使用磷酸鋰鐵化學(xué)成分,而不是眾所周知高污染且開采危險程度較高的鈷,。比亞迪自2021年4月開始,,在其所有電動汽車中使用刀片電池。

位于美國波士頓的對沖基金Snow Bull Capital的市場研究分析師兼中國業(yè)務(wù)負(fù)責(zé)人布里奇特·麥卡錫說:“比亞迪通過革命性的刀片LFP電池,,讓之前幾近消失的電池化學(xué)再次走紅,。比亞迪的刀片LFP電池是目前業(yè)內(nèi)最安全、成本最低的電池,?!?/p>

現(xiàn)在,比亞迪似乎蓄勢待發(fā),,準(zhǔn)備完成其史上最受關(guān)注的一筆電池銷售,。比亞迪的執(zhí)行副總裁廉玉波在今年6月的早些時候曾經(jīng)暗示,一直傳言的比亞迪與特斯拉的交易正在運作當(dāng)中,。廉玉波在采訪中表示:“我們與馬斯克是好朋友,,馬上也準(zhǔn)備給他供電池?!辈贿^廉玉波的說法并未得到特斯拉方面的證實,。

隨著比亞迪電池業(yè)務(wù)的繁榮,,其電動汽車銷量也大幅增長。

2002年,,比亞迪收購秦川汽車,,開始進(jìn)軍汽車業(yè),利用中國政府大力推動減少空氣污染和交通擁堵的機會,,在全國各大城市銷售電動公共汽車和單軌鐵路車,。比亞迪從最初就與其他汽車廠商不同,,它選擇在內(nèi)部生產(chǎn)從電池到半導(dǎo)體等許多零部件。這一策略吸引了投資者,,包括巴菲特,。巴菲特的長期合作伙伴查理·芒格曾經(jīng)稱贊王傳福是兼具托馬斯·愛迪生的技術(shù)專業(yè)知識和杰克·韋爾奇的商業(yè)智慧的創(chuàng)始人,于是在2008年,,巴菲特的公司收購了比亞迪10%的股份,。

今年5月,比亞迪汽車銷量創(chuàng)下114943輛的最高紀(jì)錄,。今年到目前為止,,比亞迪已經(jīng)銷售汽車509619輛,在所有在華汽車廠商中的排名從去年的第15位升至第2位,,其中價格便宜的插電式混合動力車的銷量是其超越競爭對手的主要原因,。據(jù)中國乘用車市場信息聯(lián)席會(China Passenger Car Association)統(tǒng)計,目前只有德國汽車廠商大眾公司(Volkswagen)的中國合資企業(yè)一汽大眾(FAW-Volkswagen)領(lǐng)先比亞迪,。比亞迪在2022年前五個月的銷量較去年同期翻了一番以上,,盡管公司在今年3月停止生產(chǎn)內(nèi)燃機汽車,集中精力生產(chǎn)混合動力車和電動汽車,。

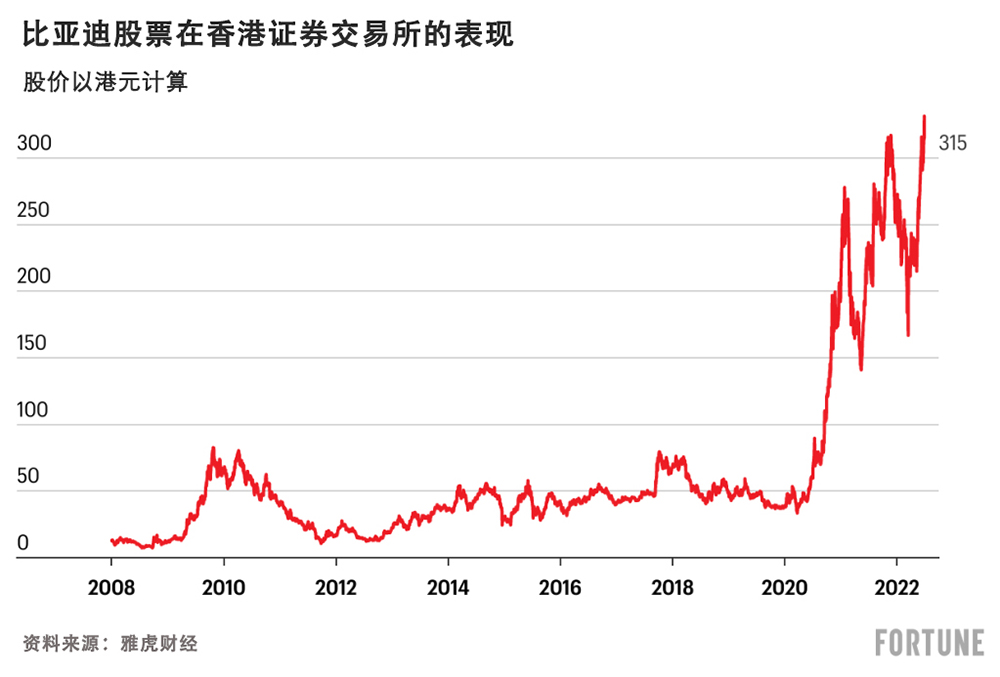

今年到目前為止,,在中國香港上市的比亞迪股價已經(jīng)上漲了18.3%。自從巴菲特的伯克希爾-哈撒韋在比亞迪投資2.32億美元以來,,比亞迪的股價持續(xù)飆升,。到2021年年底,這筆投資的價值達(dá)到77億美元,,是初始價值的33倍,。

然而,比亞迪的發(fā)展也付出了代價,。

據(jù)國內(nèi)媒體報道,,由于工廠附近居民投訴流鼻血、呼吸困難和嘔吐等癥狀,,今年5月,,湖南省長沙市的市委、市政府對比亞迪位于該市的工廠啟動調(diào)查,。據(jù)報道,,一位24歲的組裝線工人出現(xiàn)中風(fēng)。

環(huán)境分析師將這些疾病歸咎于比亞迪汽車涂層使用的油性涂料所產(chǎn)生的廢氣,。

據(jù)比亞迪向香港證券交易所提交的企業(yè)社會責(zé)任報告顯示,,2021年隨著對比亞迪產(chǎn)品的需求激增,全年銷售額增長了37%,,揮發(fā)性有機化合物排放幾乎是前一年的三倍,。這種廢氣是長沙市此次污染調(diào)查的重點,。雖然中國在2020年出臺了減少相關(guān)排放的新規(guī)定,但排放量依舊在增加,。

比亞迪并未答復(fù)《財富》雜志的置評請求,。5月,比亞迪曾經(jīng)在微博發(fā)文否認(rèn)其工廠引起疾病,,并表示公司的排放符合國家相關(guān)法規(guī),,但公司已經(jīng)積極采取措施減少異味情況。之后比亞迪告訴分析師,,其長沙工廠目前僅在白天運行,,將產(chǎn)量減半,但公司并未將減產(chǎn)措施特別歸因于減少排放,。

位于北京的綠色和平東亞分部(Greenpeace East Asia)的分析師鮑航(音譯)對比亞迪長沙工廠在努力完成訂單的同時能否減少污染表示質(zhì)疑,。他說:“[比亞迪]不可能及時將電動汽車交付給客戶,因此他們需要大幅加快生產(chǎn)速度,。此事將會影響公司為樹立氣候先鋒的形象所做的努力,。”

比亞迪在長沙的遭遇也暴露出電動汽車行業(yè)所面臨的挑戰(zhàn):當(dāng)汽車廠商努力滿足激增的需求時,,生產(chǎn)過程產(chǎn)生的排放量就會翻倍,,進(jìn)而影響他們作為化石能源汽車污染問題的解決者這一形象。

電動汽車行業(yè)承諾通過淘汰內(nèi)燃機汽車和尾氣降低碳排放,,但該行業(yè)現(xiàn)在依舊存在污染,。位于北京的公益組織公眾環(huán)境研究中心(Institute of Public & Environmental Affairs)6月的報告稱,化石燃料充電站和電池組需要消耗大宗商品,,而許多商品并不比石油更有社會責(zé)任,。例如,許多電池中使用的鈷在剛果民主共和國的生產(chǎn)過程中普遍使用童工,。剛果民主共和國是全球最大的鈷出口國,。

德意志銀行(Deutsche Bank)的分析師艾迪森·于表示:“在許多地方,電動汽車并不環(huán)保,。不只是比亞迪,,也不只是特斯拉,所有人都不得不面對一個事實,,那就是我們正在用歷史上有問題的做法,,構(gòu)建這些新的供應(yīng)鏈?!?/p>

今年2月,,特斯拉支付27.5萬美元罰款,就其美國加州弗里蒙特工廠違反《清潔空氣法案》(Clean Air Act )一案,,與美國環(huán)境保護(hù)署(U.S. Environmental Protection Agency)達(dá)成和解,。據(jù)特斯拉向美國證券交易委員會(Securities and Exchange Commission)提交的文件顯示,德國的監(jiān)管部門因為特斯拉違反二手電池回收規(guī)定而對其罰款1200萬歐元(約合1350萬美元),。

特斯拉并未對置評請求做出回復(fù),。

公眾環(huán)境研究中心提到,有五家上市的中國電動汽車零部件生產(chǎn)商因為污染而被地方政府行政處罰,。

到目前為止,,比亞迪接受污染調(diào)查并未對股市造成影響。從宣布啟動調(diào)查至今,,公司的股價已經(jīng)上漲了37.8%,。

麥卡錫指出:“比亞迪度過封城和芯片荒的韌性,比[調(diào)查]更重要,?!?/p>

艾迪森·于稱,,雖然投資者可能會關(guān)心污染問題,但他們似乎已經(jīng)接受了整個電動汽車行業(yè)所面臨的現(xiàn)實,,即為了應(yīng)對更高的需求,,該行業(yè)正在經(jīng)歷一場“混亂”且“痛苦的”轉(zhuǎn)型。 “如果你是投資者并且關(guān)心[污染問題],,你可以選擇投資設(shè)備系統(tǒng)的不同部分,。還有其他方式能夠投資電動汽車?!?/p>

有人卻對未來的任務(wù)卻并不樂觀,。

鮑航說:“我們不想在解決氣候問題的時候,引發(fā)污染問題或資源問題,。我們希望新能源革命可以真正做到清潔無污染,,不只是汽車本身,還包括整個生產(chǎn)過程,?!?/p>

公眾環(huán)境研究中心建議加大力度減少電動汽車生產(chǎn)過程中的排放,包括增加使用可再生能源,,要求電動汽車廠商增加對環(huán)境問題和解決方案的披露等,。

與投資者一樣,消費者似乎并不擔(dān)心電動汽車生產(chǎn)造成的環(huán)境代價。據(jù)國際能源署(International Energy Agency)統(tǒng)計,,去年,,全球電動汽車銷量較前一年翻了一番,每周的電動汽車銷量都超過了2012年全年,。電動汽車銷量增長的一半來自中國,。2022年第一季度,全球電動汽車銷量達(dá)到200萬輛,,較去年同期增長了75%,。

據(jù)中國乘用車市場信息聯(lián)席會統(tǒng)計,在今年到目前為止中國最暢銷的五款電動汽車中,,比亞迪占三款,。特斯拉的Model 3排在第7位;比亞迪最暢銷電動汽車“秦”的銷量是特斯拉汽車的三倍,。(財富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

十多年前,,哪怕有人提到一點點與比亞迪有關(guān)的消息,都足以讓特斯拉(Tesla)的首席執(zhí)行官埃隆·馬斯克恥笑,。當(dāng)時,,他在接受彭博新聞社(Bloomberg News)采訪時說:“你見過他們的車嗎?”他還表示,,不認(rèn)為這家中國的電動汽車廠商會是特斯拉的競爭對手,。他說:“我并不認(rèn)為他們能夠造出優(yōu)秀的產(chǎn)品?!?/p>

十一年后,,馬斯克可能要收回以前說過的話。比亞迪汽車是中國最暢銷的品牌之一,,隨著中國政府鼓勵國民減少碳足跡,,比亞迪的銷量激增。目前,,比亞迪在中國的汽車年銷量超過了任何其他國內(nèi)品牌,,在整體銷量中排在第二位。比亞迪的股價暴漲,,讓沃倫·巴菲特的伯克希爾-哈撒韋(Berkshire Hathaway)在2008年的投資成為其最有利可圖的一筆投資,。比亞迪成功的最新標(biāo)志是有傳言稱,它將向特斯拉出售電池,。如果傳言得到證實,,這將是一個標(biāo)志性的時刻,表明比亞迪得到了馬斯克的電動汽車巨頭的認(rèn)可,,證明比亞迪事實上已經(jīng)具備技術(shù)實力,。但比亞迪的快速增長正在付出代價,;比如據(jù)媒體曝光,比亞迪的一座工廠的排放量激增,,導(dǎo)致周邊居民生病,,使比亞迪以及整個電動汽車行業(yè)的環(huán)保聲譽受損。

比亞迪(“Build Your Dreams”的首字母縮寫,,意為“成就夢想”)的創(chuàng)始人王傳?,F(xiàn)如今在中國富豪榜中排在第20位,。1995年,,王傳福在深圳為從手機到電動工具等各類電子產(chǎn)品生產(chǎn)可充電電池。全球智能手機革命使蘋果(Apple),、諾基亞(Nokia),、華為(Huawei)和三星(Samsung)等客戶,對公司的零組件,、機殼和組裝生產(chǎn)線的需求激增,,而比亞迪將其收入投入到更先進(jìn)的電池研究。2018年,,比亞迪開始為其他汽車公司供應(yīng)電動汽車電池,。

目前,從戴爾(Dell)的筆記本電腦到iRobot公司的Roomba真空吸塵器,,許多全世界最常見的設(shè)備都使用了比亞迪的技術(shù),,因此在2021年,比亞迪的電池業(yè)務(wù)為公司創(chuàng)造收入154億元(約合24億美元),,同比增長了31.6%,。據(jù)韓國可再生技術(shù)公司SNE Research統(tǒng)計,2022年第一季度,,比亞迪取代松下(Panasonic),,成為全球第三大電動汽車電池制造商,僅落后于中國本土的競爭對手寧德時代和韓國的LG新能源(LG Energy Solution),。

投資者尤其看好比亞迪在2020年面向電動汽車推出的刀片電池技術(shù),。這種薄電池的排列類似于剃須刀的多層刀刃,電池充電使用磷酸鋰鐵化學(xué)成分,,而不是眾所周知高污染且開采危險程度較高的鈷,。比亞迪自2021年4月開始,在其所有電動汽車中使用刀片電池,。

位于美國波士頓的對沖基金Snow Bull Capital的市場研究分析師兼中國業(yè)務(wù)負(fù)責(zé)人布里奇特·麥卡錫說:“比亞迪通過革命性的刀片LFP電池,,讓之前幾近消失的電池化學(xué)再次走紅。比亞迪的刀片LFP電池是目前業(yè)內(nèi)最安全,、成本最低的電池,?!?/p>

現(xiàn)在,比亞迪似乎蓄勢待發(fā),,準(zhǔn)備完成其史上最受關(guān)注的一筆電池銷售,。比亞迪的執(zhí)行副總裁廉玉波在今年6月的早些時候曾經(jīng)暗示,一直傳言的比亞迪與特斯拉的交易正在運作當(dāng)中,。廉玉波向國有媒體中國國際電視臺(CGTN)表示:“我們與馬斯克是好朋友,,馬上也準(zhǔn)備給他供電池?!辈贿^廉玉波的說法并未得到特斯拉方面的證實,。

隨著比亞迪電池業(yè)務(wù)的繁榮,其電動汽車銷量也大幅增長,。

2002年,,比亞迪收購秦川汽車,,開始進(jìn)軍汽車業(yè),,利用中國政府大力推動減少空氣污染和交通擁堵的機會,在全國各大城市銷售電動公共汽車和單軌鐵路車,。比亞迪從最初就與其他汽車廠商不同,,它選擇在內(nèi)部生產(chǎn)從電池到半導(dǎo)體等許多零部件。這一策略吸引了投資者,,包括巴菲特,。巴菲特的長期合作伙伴查理·芒格曾經(jīng)稱贊王傳福是兼具托馬斯·愛迪生的技術(shù)專業(yè)知識和杰克·韋爾奇的商業(yè)智慧的創(chuàng)始人,于是在2008年,,巴菲特的公司收購了比亞迪10%的股份,。

今年5月,比亞迪汽車銷量創(chuàng)下114943輛的最高紀(jì)錄,。今年到目前為止,,比亞迪已經(jīng)銷售汽車509619輛,在所有在華汽車廠商中的排名從去年的第15位升至第2位,,其中價格便宜的插電式混合動力車的銷量是其超越競爭對手的主要原因,。據(jù)中國乘用車市場信息聯(lián)席會(China Passenger Car Association)統(tǒng)計,目前只有德國汽車廠商大眾公司(Volkswagen)的中國合資企業(yè)一汽大眾(FAW-Volkswagen)領(lǐng)先比亞迪,。比亞迪在2022年前五個月的銷量較去年同期翻了一番以上,,盡管公司在今年3月停止生產(chǎn)內(nèi)燃機汽車,集中精力生產(chǎn)混合動力車和電動汽車,。

今年到目前為止,,在中國香港上市的比亞迪股價已經(jīng)上漲了18.3%。自從巴菲特的伯克希爾-哈撒韋在比亞迪投資2.32億美元以來,,比亞迪的股價持續(xù)飆升,。到2021年年底,,這筆投資的價值達(dá)到77億美元,是初始價值的33倍,。

然而,,比亞迪的發(fā)展也付出了代價。

據(jù)國內(nèi)媒體報道,,由于工廠附近居民投訴流鼻血、呼吸困難和嘔吐等癥狀,,今年5月,,湖南省長沙市的市委、市政府對比亞迪位于該市的工廠啟動調(diào)查,。據(jù)報道,,一位24歲的組裝線工人出現(xiàn)中風(fēng),。

環(huán)境分析師將這些疾病歸咎于比亞迪汽車涂層使用的油性涂料所產(chǎn)生的廢氣。

據(jù)比亞迪向香港證券交易所提交的企業(yè)社會責(zé)任報告顯示,,2021年隨著對比亞迪產(chǎn)品的需求激增,全年銷售額增長了37%,,揮發(fā)性有機化合物排放幾乎是前一年的三倍。這種廢氣是長沙市此次污染調(diào)查的重點,。雖然中國在2020年出臺了減少相關(guān)排放的新規(guī)定,但排放量依舊在增加,。

比亞迪并未答復(fù)《財富》雜志的置評請求。5月,,比亞迪曾經(jīng)在微博發(fā)文否認(rèn)其工廠引起疾病,,并表示公司的排放符合國家相關(guān)法規(guī),但公司已經(jīng)積極采取措施減少異味情況,。之后比亞迪告訴分析師,,其長沙工廠目前僅在白天運行,將產(chǎn)量減半,,但公司并未將減產(chǎn)措施特別歸因于減少排放,。

位于北京的綠色和平東亞分部(Greenpeace East Asia)的分析師鮑航(音譯)對比亞迪長沙工廠在努力完成訂單的同時能否減少污染表示質(zhì)疑。他說:“[比亞迪]不可能及時將電動汽車交付給客戶,,因此他們需要大幅加快生產(chǎn)速度,。此事將會影響公司為樹立氣候先鋒的形象所做的努力?!?/p>

比亞迪在長沙的遭遇也暴露出電動汽車行業(yè)所面臨的挑戰(zhàn):當(dāng)汽車廠商努力滿足激增的需求時,,生產(chǎn)過程產(chǎn)生的排放量就會翻倍,進(jìn)而影響他們作為化石能源汽車污染問題的解決者這一形象,。

電動汽車行業(yè)承諾通過淘汰內(nèi)燃機汽車和尾氣降低碳排放,,但該行業(yè)現(xiàn)在依舊存在污染。位于北京的公益組織公眾環(huán)境研究中心(Institute of Public & Environmental Affairs)6月的報告稱,,化石燃料充電站和電池組需要消耗大宗商品,,而許多商品并不比石油更有社會責(zé)任。例如,,許多電池中使用的鈷在剛果民主共和國的生產(chǎn)過程中普遍使用童工,。剛果民主共和國是全球最大的鈷出口國。

德意志銀行(Deutsche Bank)的分析師艾迪森·于表示:“在許多地方,,電動汽車并不環(huán)保,。不只是比亞迪,也不只是特斯拉,,所有人都不得不面對一個事實,,那就是我們正在用歷史上有問題的做法,構(gòu)建這些新的供應(yīng)鏈,?!?/p>

今年2月,特斯拉支付27.5萬美元罰款,,就其美國加州弗里蒙特工廠違反《清潔空氣法案》(Clean Air Act )一案,,與美國環(huán)境保護(hù)署(U.S. Environmental Protection Agency)達(dá)成和解。據(jù)特斯拉向美國證券交易委員會(Securities and Exchange Commission)提交的文件顯示,,德國的監(jiān)管部門因為特斯拉違反二手電池回收規(guī)定而對其罰款1200萬歐元(約合1350萬美元),。

特斯拉并未對置評請求做出回復(fù)。

公眾環(huán)境研究中心提到,,有五家上市的中國電動汽車零部件生產(chǎn)商因為污染而被地方政府行政處罰,。

到目前為止,比亞迪接受污染調(diào)查并未對股市造成影響,。從宣布啟動調(diào)查至今,,公司的股價已經(jīng)上漲了37.8%。

麥卡錫指出:“比亞迪度過封城和芯片荒的韌性,,比[調(diào)查]更重要,。”

艾迪森·于稱,,雖然投資者可能會關(guān)心污染問題,,但他們似乎已經(jīng)接受了整個電動汽車行業(yè)所面臨的現(xiàn)實,,即為了應(yīng)對更高的需求,該行業(yè)正在經(jīng)歷一場“混亂”且“痛苦的”轉(zhuǎn)型,。 “如果你是投資者并且關(guān)心[污染問題],,你可以選擇投資設(shè)備系統(tǒng)的不同部分。還有其他方式能夠投資電動汽車,?!?/p>

有人卻對未來的任務(wù)卻并不樂觀。

鮑航說:“我們不想在解決氣候問題的時候,,引發(fā)污染問題或資源問題,。我們希望新能源革命可以真正做到清潔無污染,不只是汽車本身,,還包括整個生產(chǎn)過程,。”

公眾環(huán)境研究中心建議加大力度減少電動汽車生產(chǎn)過程中的排放,,包括增加使用可再生能源,,要求電動汽車廠商增加對環(huán)境問題和解決方案的披露等。

與投資者一樣,,消費者似乎并不擔(dān)心電動汽車生產(chǎn)造成的環(huán)境代價,。據(jù)國際能源署(International Energy Agency)統(tǒng)計,去年,,全球電動汽車銷量較前一年翻了一番,每周的電動汽車銷量都超過了2012年全年,。電動汽車銷量增長的一半來自中國,。2022年第一季度,全球電動汽車銷量達(dá)到200萬輛,,較去年同期增長了75%,。

據(jù)中國乘用車市場信息聯(lián)席會統(tǒng)計,在今年到目前為止中國最暢銷的五款電動汽車中,,比亞迪占三款,。特斯拉的Model 3排在第7位;比亞迪最暢銷電動汽車“秦”的銷量是特斯拉汽車的三倍,。(財富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

Just over a decade ago, the slightest mention of BYD was enough to provoke a fit of giggles from Tesla CEO Elon Musk. “Have you seen their car?” he said during a Bloomberg News interview at the time, adding that he didn’t consider the Chinese EV maker a Tesla competitor. “I don’t think they have a great product,” he said.

Eleven years later, Musk may be on the brink of eating his words. BYD cars are among China’s most popular vehicles, and the company’s sales are soaring as Beijing incentivizes citizens to reduce their carbon footprint. BYD now sells more cars per year in China than any other domestic brand and ranks second in sales overall. Its stock has soared, making a 2008 investment from Warren Buffett’s Berkshire Hathaway one of the firm’s most lucrative bets. The latest sign of BYD’s success is a rumored deal to sell batteries to Tesla, which—if confirmed—would be a remarkable admission from Musk’s EV giant that BYD has, in fact, achieved technological prowess. But BYD’s rapid growth is accruing costs; namely, a spike in factory emissions that’s reportedly sickened nearby residents and tainted BYD’s green credentials along with those of the larger EV industry.

Wang Chuanfu, now China’s 20th richest man, founded BYD—short for Build Your Dreams—in Shenzhen in 1995 as a maker of rechargeable batteries for all sorts of gadgets—from mobile phones to power tools. The world’s smartphone revolution stoked demand for the company’s components, casings, and assembly line production from customers including Apple, Nokia, Huawei, and Samsung, and BYD sunk its earnings into more advanced battery research. It started supplying electric vehicle batteries to other car companies in 2018.

With its technology powering many of the world’s most ubiquitous devices—from Dell laptops to Roomba vacuums—BYD’s battery business generated 15.4 billion yuan ($2.4 billion) in 2021, up 31.6% from a year earlier. The company overtook Panasonic as the world’s third-biggest battery maker for EVs in the first quarter of 2022, ranking behind Chinese rival Contemporary Amperex Technology Co. Limited, or CATL, and LG Energy Solution, according to South Korean renewable technology firm SNE Research.

Investors are especially bullish on BYD’s Blade battery technology, which the company launched for electric vehicles in 2020. The thin batteries, whose arrangement resembles the multiple edges on a shaving razor, rely on lithium iron phosphate chemistry for their charge, rather than cobalt, which is notoriously dirty and dangerous to mine. The company has been using Blade batteries in all of its EVs since April last year.

“BYD repopularized a battery chemistry that was previously trending extinct by creating the revolutionary Blade LFP battery, which is the safest and cheapest battery in the industry,” said Bridget McCarthy, market research analyst and head of China operations at Snow Bull Capital, a Boston-based hedge fund.

BYD now seems poised to notch its highest profile battery sale yet. BYD executive vice president Lian Yubo hinted that a long-rumored deal with Tesla was in the works earlier June. “We are now good friends with Elon Musk because we are preparing to supply batteries to Tesla very soon,” Lian told China’s state-owned broadcaster CGTN. Tesla has not confirmed Lian’s statement.

As BYD’s battery business has boomed so have its electric vehicle sales.

After entering the auto business in 2002 with the acquisition of Qinchuan Automobile Co., BYD capitalized on the Chinese government’s push to cut air pollution and traffic congestion, selling electric buses and monorails to cities nationwide. BYD distinguished itself from other automakers early on by making many of its components—from batteries to semiconductors—in house. That strategy drew investors including Buffett, whose firm bought a 10% stake in the company in 2008 after longtime partner Charlie Munger touted Wang as a founder who combined the technical know-how of Thomas Edison with the business smarts of Jack Welch.

In May, BYD vehicle sales rose to a record high of 114,943. Among automakers in China, BYD now ranks second with 509,619 units sold so far this year—up from 15th place last year—with sales of cheap plug-in hybrids helping it surpass its rivals. It trails only FAW-Volkswagen, the German automaker’s local joint venture, according to the China Passenger Car Association. BYD’s sales in the first five months of 2022 are more than double its total for the same period last year, despite BYD discontinuing production of internal combustion engine vehicles in March to concentrate on hybrids and electric vehicles.

The company’s stock in Hong Kong is up 18.3% so far this year. Since Buffett’s Berkshire Hathaway invested $232 million, BYD’s share price has soared. At the end of 2021, the investment was worth $7.7 billion, 33 times its initial value.

But that growth is coming at a cost.

In May, the municipal government of Changsha, a city in China’s central Hunan province, and the city’s Communist Party committee launched an investigation into BYD’s factories there after residents living nearby complained of nosebleeds, respiratory difficulties, and vomiting, local media reported. A?24-year-old assembly line worker reportedly suffered a stroke.

Environmental analysts attribute the ailments to waste gases produced by oil-based paints used to coat BYD’s cars.

As demand for BYD’s products surged in 2021—sales rose 37% for the full year—emissions of volatile organic compounds, the kind of waste gases at the center of the Changsha pollution probe, surged almost threefold compared with the previous year, according to a corporate social responsibility report BYD filed with the Hong Kong stock exchange. The increase occurred despite China introducing new regulations in 2020 to reduce such emissions.

BYD did not return Fortune’s request for comment. In May, the company denied that its factory causes illness and said its emissions comply with national regulations, but that it had taken active measures to reduce odors, the company posted on Weibo. BYD has since told analysts that its Changsha plant is currently running only during the daytime, cutting production in half, though it did not attribute the slowdown to reducing emissions, specifically.

Bao Hang, an analyst at Greenpeace East Asia in Beijing, doubts that BYD can slash pollution at its Changsha factory at the same time it’s racing to fill orders. “[BYD] cannot deliver EVs to customers in time so they need to speed up production very quickly,” he says. “This event will hurt the efforts to build their image as a climate champion.”

BYD’s saga in Changsha speaks to the challenge facing the EV industry: As automakers scramble to meet soaring demand, emissions caused by manufacturing processes are multiplying, undercutting their reputation as an answer to fossil-fuel–burning cars.

The electric vehicle industry, for all its promise of lowering carbon emissions by removing internal combustion engines and tailpipes, is still filthy. Fossil fuels power charging stations, and battery packs consume commodities, many of which are no more socially responsible than oil, according to a June report from the Institute of Public & Environmental Affairs (IPE), a Beijing-based nonprofit. For instance, cobalt, a mineral used in many batteries, is produced with widespread use of child labor in the Democratic Republic of the Congo, the world’s biggest cobalt exporter.

“There’s a lot of places where electric vehicles are not so green,” said Edison Yu, a Deutsche Bank analyst. “It’s not just BYD, it’s not just Tesla, everyone has to deal with the fact that we’re building out these new supply chains on what were historically questionable practices.”

Tesla paid a $275,000 penalty in February to settle with the U.S. Environmental Protection Agency over Clean Air Act violations at its plant in Fremont, Calif. German regulators also fined the carmaker 12 million euros ($13.5 million) for breaching regulations for recycling used batteries, according to a Securities and Exchange Commission filing.

Tesla did not respond to requests for comment.

The IPE’s report named five publicly listed Chinese EV component manufacturers that had received administrative penalties from local governments over pollution.

So far, the market has shrugged off BYD’s pollution investigation. Its share price is up 37.8% since the probe was announced.

“The story of BYD’s resilience throughout lockdowns and the chip shortage outweighed [the probe],” says McCarthy.

While investors may be concerned about the pollution issue, they seem resigned to the entire electric vehicle industry enduring a “messy” and “painful” transition to cope with higher demand, says Yu. “If you’re an investor and you’re concerned about [pollution] you might choose to invest in a different part of the equipment system. There are other ways to get exposure to electric vehicles.”

Others are less sanguine about the scale of the task ahead.

“We don’t want to solve the climate problem but create a pollution problem or a resources problem,” Bao says. “We need the new energy revolution to be really clean, not just for the car but for the whole manufacturing process.”

The IPE recommends greater efforts to reduce emissions in EV manufacturing, including increased use of renewable energy and more disclosures from EV makers on their environmental problems and plans to fix them.

Like investors, consumers seem unfazed by the environmental toll of EV manufacturing. Globally, EV sales doubled last year compared with the year prior, with more electric cars sold per week than during all of 2012, according to the International Energy Agency. China accounted for half of that growth. Worldwide EV sales in the first quarter of 2022 hit 2 million, a 75% increase from the same period last year.

For its part, BYD has produced three of the top five bestselling electric vehicles in China so far this year, according to the China Passenger Car Association. Tesla’s Model 3 is in seventh place; BYD’s bestselling electric sedan, the Qin, is outselling the Tesla car three-to-one.