普遍的能源危機,?通脹高企,?如果說歷史有規(guī)律,那么2022年就讓人回想起20世紀70年代,。當時,,1973年的中東戰(zhàn)爭和1979年的伊朗革命這兩場災(zāi)難,導(dǎo)致中東地區(qū)的石油出口嚴重中斷,,隨后引發(fā)的能源危機令西方經(jīng)濟陷入衰退,,讓許多人警醒尋找替代能源的必要性。

這場危機讓19世紀中葉問世的一種技術(shù)開始走紅,,它就是熱泵,即將地面,、水和空氣中的熱量輸送到建筑當中,。公司競相投資這種笨重的、讓人難以形容的方盒子,,但隨著危機結(jié)束,,化石能源價格回落,,這種簡陋的熱泵基本被淘汰。

如今,,俄羅斯的天然氣戰(zhàn)略迫使歐洲關(guān)閉工廠,,面對寒冬陷入絕望,這時候人們又想起了熱泵,。而這一次,,日益嚴重的氣候危機需要快速采用可再生能源,這意味著熱泵可能不會退出歷史舞臺,。

德國供暖和制冷巨頭菲斯曼集團(Viessmann)的首席執(zhí)行官馬克思·菲斯曼說:“我們有解決方案,。[熱泵]實際上比人們想象的更先進,而且現(xiàn)在它們需要擴大規(guī)模,?!?/p>

450%的效率

熱泵系統(tǒng)由建筑外部和內(nèi)部的連接設(shè)備組成,造型上或許毫無吸引力:最常見的空氣源熱泵與大型空調(diào)機的外形類似,,但它們非常高效,。

雖然基于煤氣爐的供暖系統(tǒng)最高效率為95%,即每燃燒100個單位的能量可以釋放95個單位的能量,,但現(xiàn)代熱泵的效率高達450%,。在系統(tǒng)中投入1個單位的電能,通常至少能夠輸出4.5個單位的熱能,。首先,,系統(tǒng)釋放的熱量已經(jīng)存在于大氣當中,這與化石能源產(chǎn)生的能量不同,。

據(jù)國際能源署(International Energy Agency)2021年11月的報告顯示,,美國接近一半新建多戶住宅和超過40%的新建單戶住宅,都安裝了熱泵,,不難看出背后的原因,。舊建筑也開始安裝熱泵,盡管這意味著需要在墻上開洞,,還要重新進行電氣連接,,因此目前這種舊房改造依舊是相對較小的市場。熱泵的價格當然高于污染更嚴重的同類產(chǎn)品,,但它們的運行成本低得多,。根據(jù)房屋的尺寸,熱泵的售價可能達到數(shù)萬美元,。

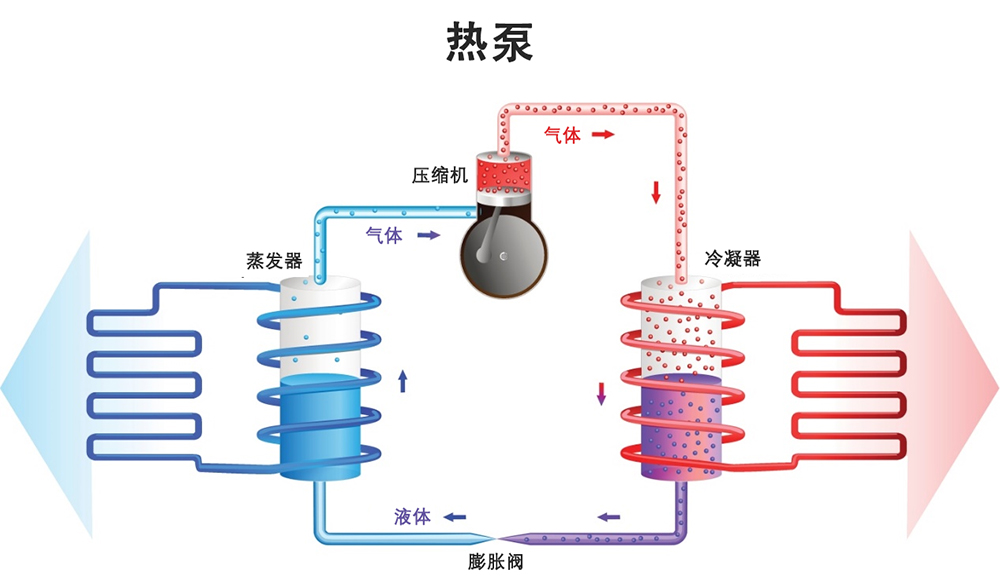

熱泵還有額外的好處:大多數(shù)熱泵還可以作為制冷系統(tǒng)。與冰箱和空調(diào)一樣,熱泵使用名為制冷劑的液體輸送熱量,,只是它們從外向內(nèi)輸送,,而不是從內(nèi)向外輸送。大多數(shù)空氣源熱泵和水源熱泵都能夠進行反向操作,,將室內(nèi)溫度降低5攝氏度,。在氣候更溫暖的地區(qū),熱泵當然不能取代空調(diào),,但在歐洲所處的溫帶,,并不常用空調(diào),高溫卻變得日益普遍和極端,,因此熱泵的制冷效果是一個重要的賣點,。

這意味著熱泵會迎來大量投資。

熱泵投資

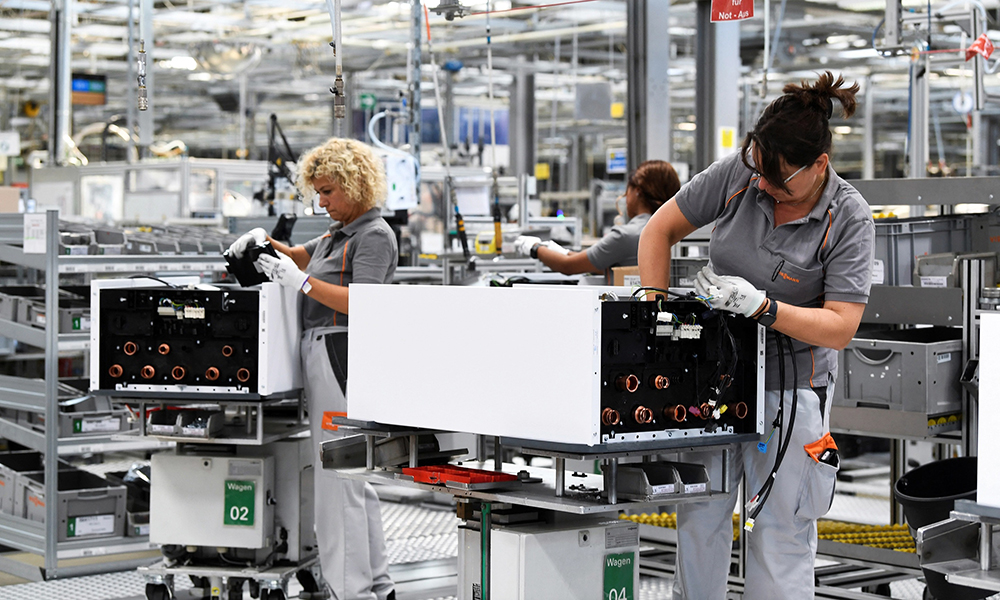

已經(jīng)有105年歷史的菲斯曼集團最近宣布,,未來三年將在熱泵和其他綠色產(chǎn)品領(lǐng)域投資10億美元,。

菲斯曼是德國被稱為中小企業(yè)的中等家族企業(yè)的典型代表,這些中小企業(yè)是德國經(jīng)濟的支柱,。德國正在緊急采取措施,,應(yīng)對快速氣候變化和關(guān)系國家存亡的能源危機。馬克思是該家族企業(yè)的第四代掌門人,,目前公司市值達到34億美元,。菲斯曼在1979年推出了第一款熱泵,但隨著能源危機結(jié)束,,這項技術(shù)便被封存,。二十年前,該公司重啟熱泵業(yè)務(wù),,去年在德國的市場份額達到約15%,。

現(xiàn)在,菲斯曼需要維護其作為德國市場領(lǐng)導(dǎo)者之一的地位,,因為其競爭對手正在加大對熱泵技術(shù)的投入,。

有98年歷史的供暖公司世創(chuàng)電能(Stiebel Eltron)在20世紀70年代進軍熱泵業(yè)務(wù),并且從未放棄,,盡管該技術(shù)成為公司的虧損大戶,,直到最近才有所好轉(zhuǎn)。去年,,為了滿足需求,,公司熱泵產(chǎn)量增長了60%。現(xiàn)在,,世創(chuàng)電能成為歐洲前五大熱泵生產(chǎn)商之一,,今年8月宣布未來五年將再投資6億美元用于熱泵生產(chǎn)和研發(fā),。

該公司是總經(jīng)理石富本(Kai Schiefelbein)表示:“盡管天然氣會產(chǎn)生大量二氧化碳,,但人們還是會首選使用天然氣,,這時候,這種更昂貴的設(shè)備就很難銷售,,即使它的二氧化碳排放更低,。目前的狀況是,由于氣候保護的原因,,歐洲熱泵市場正在快速增長,。”

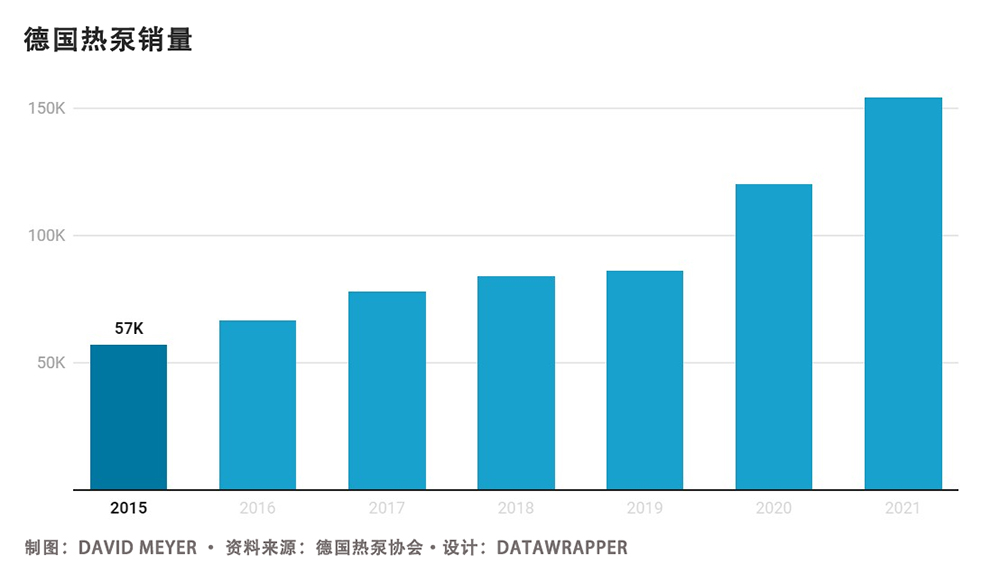

事實上,,雖然烏克蘭危機導(dǎo)致今年熱泵需求激增,,許多買家要等幾個月才能夠收到新熱泵,但從2019年以來,,德國的熱泵需求便已經(jīng)在大幅增長,,當時德國政府為了努力實現(xiàn)其氣候目標增加了對熱泵的補貼。

在全世界,,建筑供暖,、制冷和供電占溫室氣體排放量的四分之一。據(jù)政府支持的氣候透明組織(Climate Transparency)統(tǒng)計,,2020年,,德國人均建筑相關(guān)碳排放量比G20國家平均水平高56%,主要原因是建筑普遍使用天然氣和石油供暖,。這導(dǎo)致供暖和交通運輸,,成為立法者關(guān)注的首要目標。

隨著新補貼政策的實施,,從2019年到2020年,,德國熱泵銷量增長了40%,2021年又增長了28%,,達到154,000臺,,其中有900,000臺在本土銷售。(據(jù)國際能源署統(tǒng)計,,2020年全球共安裝熱泵1.77億臺,,之前五年每年增長約10%。)

今年8月,,注重環(huán)保的德國新政府改革了補貼制度,,將熱泵的最高補貼從標價的50%下降到40%。

這對熱泵行業(yè)影響不大,,因為政府還停止向燃氣鍋爐和基于石油的供熱系統(tǒng)發(fā)放補貼,。目前燃氣鍋爐依舊是最常用的建筑供暖方式,。德國政府承諾將制定一項法律,要求所有新供暖系統(tǒng)使用的可再生能源不少于65%,。

德國熱泵協(xié)會(German Heat Pump Association)的宣傳總監(jiān)卡帝亞·魏因霍爾德說:“為了保障熱泵行業(yè)能夠提前進行規(guī)劃并且保證規(guī)劃的執(zhí)行,,必須有明確的法律規(guī)定,這非常重要,。這將發(fā)出重要的信號,,向外界表明德國的標準做法不再是安裝燃氣鍋爐,而是電氣熱泵,?!?/p>

65%的規(guī)定并沒有最終確定,這是目前讓熱泵行業(yè)擔心的多個不確定性之一,。

芯片,、技術(shù)和氟化氣體

但有一個迫在眉睫的問題,尤其是在熱泵需求激增的情況下,,那就是全球芯片荒,。世創(chuàng)電能的石富本稱:“目前很難買到微芯片,尤其是處理器,?!瘪R克思·菲斯曼表示:“芯片的主要供應(yīng)對象是汽車行業(yè)。我們是需要更多汽車,,還是更多熱泵,,讓我們的家庭和工業(yè)生產(chǎn)變得不依賴[化石能源]?”

Rystad Energy的高級分析師拉爾斯·伊瓦爾·尼特·哈弗羅稱,,芯片供應(yīng)鏈依舊“可以感受到新冠疫情造成的一些后續(xù)影響”,。他預(yù)計到2050年,全球熱泵需求將增長7倍,。

另外一個嚴重的不確定性是熱泵運行所需要的制冷劑,。目前使用的制冷劑通常是所謂的氟化氣體,例如氫氟碳化合物,,諷刺的是,,如果這種氣體從系統(tǒng)中泄露,其全球變暖潛力就是二氧化碳的1,700倍,。

歐洲可能在今年晚些時候命令淘汰這類物質(zhì),,這將令熱泵行業(yè)陷入困境。一些公司已經(jīng)開始采用天然的,、更環(huán)保的替代品,,比如菲斯曼的部分產(chǎn)品使用丙烷,但許多人擔心過快轉(zhuǎn)型會在需求最旺盛的時候,,扼殺熱泵市場,。

石富本認為:“與能效增益相比,,制冷劑對氣候的影響很小。當然,,所有人都希望熱泵中使用丙烷這種天然的制冷劑,,但如果我們太快淘汰氟氯烴,就會降低整個熱泵市場的增長速度……許多產(chǎn)品目前無法使用天然制冷劑,。我個人建議,,如果有新熱泵首次投放市場,,那么[規(guī)則可以要求]這類產(chǎn)品就必須使用天然制冷劑,。”

安裝熱泵的熟練技術(shù)工人不足是熱泵行業(yè)面臨的另外一個問題,,還有一個關(guān)鍵問題是,,如何保證用戶的住宅隔熱性能良好,足以讓他們安裝的熱泵充分發(fā)揮作用,。關(guān)于應(yīng)該用多大力度強制人們安裝熱泵,,這也是一個未知數(shù)。馬克思·菲斯曼警告,,德國采取過于嚴厲的做法,,可能引發(fā)類似于法國的“黃馬甲運動”。黃馬甲運動是法國因為高能源價格而引發(fā)的暴動,。

但熱泵的環(huán)保效益是顯而易見的,,而且全世界的政策制定者都看好這項技術(shù)。例如,,占全球熱泵市場一半規(guī)模的美國,,將進一步通過《通脹削減法案》(Inflation Reduction Act)中的補貼鼓勵安裝熱泵。

與電動汽車一樣,,熱泵證明,,全世界應(yīng)對氣候危機所需要的技術(shù),大多數(shù)都是現(xiàn)成的,,問題只是如何將它們變成我們默認的選擇,。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

普遍的能源危機?通脹高企,?如果說歷史有規(guī)律,,那么2022年就讓人回想起20世紀70年代。當時,,1973年的中東戰(zhàn)爭和1979年的伊朗革命這兩場災(zāi)難,,導(dǎo)致中東地區(qū)的石油出口嚴重中斷,隨后引發(fā)的能源危機令西方經(jīng)濟陷入衰退,,讓許多人警醒尋找替代能源的必要性,。

這場危機讓19世紀中葉問世的一種技術(shù)開始走紅,,它就是熱泵,即將地面,、水和空氣中的熱量輸送到建筑當中,。公司競相投資這種笨重的、讓人難以形容的方盒子,,但隨著危機結(jié)束,,化石能源價格回落,這種簡陋的熱泵基本被淘汰,。

如今,,俄羅斯的天然氣戰(zhàn)略迫使歐洲關(guān)閉工廠,面對寒冬陷入絕望,,這時候人們又想起了熱泵,。而這一次,日益嚴重的氣候危機需要快速采用可再生能源,,這意味著熱泵可能不會退出歷史舞臺,。

德國供暖和制冷巨頭菲斯曼集團(Viessmann)的首席執(zhí)行官馬克思·菲斯曼說:“我們有解決方案。[熱泵]實際上比人們想象的更先進,,而且現(xiàn)在它們需要擴大規(guī)模,。”

450%的效率

熱泵系統(tǒng)由建筑外部和內(nèi)部的連接設(shè)備組成,,造型上或許毫無吸引力:最常見的空氣源熱泵與大型空調(diào)機的外形類似,,但它們非常高效。

雖然基于煤氣爐的供暖系統(tǒng)最高效率為95%,,即每燃燒100個單位的能量可以釋放95個單位的能量,,但現(xiàn)代熱泵的效率高達450%。在系統(tǒng)中投入1個單位的電能,,通常至少能夠輸出4.5個單位的熱能,。首先,系統(tǒng)釋放的熱量已經(jīng)存在于大氣當中,,這與化石能源產(chǎn)生的能量不同,。

據(jù)國際能源署(International Energy Agency)2021年11月的報告顯示,美國接近一半新建多戶住宅和超過40%的新建單戶住宅,,都安裝了熱泵,,不難看出背后的原因。舊建筑也開始安裝熱泵,,盡管這意味著需要在墻上開洞,,還要重新進行電氣連接,因此目前這種舊房改造依舊是相對較小的市場,。熱泵的價格當然高于污染更嚴重的同類產(chǎn)品,,但它們的運行成本低得多,。根據(jù)房屋的尺寸,熱泵的售價可能達到數(shù)萬美元,。

熱泵還有額外的好處:大多數(shù)熱泵還可以作為制冷系統(tǒng),。與冰箱和空調(diào)一樣,熱泵使用名為制冷劑的液體輸送熱量,,只是它們從外向內(nèi)輸送,,而不是從內(nèi)向外輸送。大多數(shù)空氣源熱泵和水源熱泵都能夠進行反向操作,,將室內(nèi)溫度降低5攝氏度,。在氣候更溫暖的地區(qū),熱泵當然不能取代空調(diào),,但在歐洲所處的溫帶,,并不常用空調(diào),高溫卻變得日益普遍和極端,,因此熱泵的制冷效果是一個重要的賣點。

這意味著熱泵會迎來大量投資,。

熱泵投資

已經(jīng)有105年歷史的菲斯曼集團最近宣布,,未來三年將在熱泵和其他綠色產(chǎn)品領(lǐng)域投資10億美元。

菲斯曼是德國被稱為中小企業(yè)的中等家族企業(yè)的典型代表,,這些中小企業(yè)是德國經(jīng)濟的支柱,。德國正在緊急采取措施,應(yīng)對快速氣候變化和關(guān)系國家存亡的能源危機,。馬克思是該家族企業(yè)的第四代掌門人,,目前公司市值達到34億美元。菲斯曼在1979年推出了第一款熱泵,,但隨著能源危機結(jié)束,,這項技術(shù)便被封存。二十年前,,該公司重啟熱泵業(yè)務(wù),,去年在德國的市場份額達到約15%。

現(xiàn)在,,菲斯曼需要維護其作為德國市場領(lǐng)導(dǎo)者之一的地位,,因為其競爭對手正在加大對熱泵技術(shù)的投入。

有98年歷史的供暖公司世創(chuàng)電能(Stiebel Eltron)在20世紀70年代進軍熱泵業(yè)務(wù),,并且從未放棄,,盡管該技術(shù)成為公司的虧損大戶,直到最近才有所好轉(zhuǎn),。去年,,為了滿足需求,,公司熱泵產(chǎn)量增長了60%。現(xiàn)在,,世創(chuàng)電能成為歐洲前五大熱泵生產(chǎn)商之一,,今年8月宣布未來五年將再投資6億美元用于熱泵生產(chǎn)和研發(fā)。

該公司是總經(jīng)理石富本(Kai Schiefelbein)表示:“盡管天然氣會產(chǎn)生大量二氧化碳,,但人們還是會首選使用天然氣,,這時候,這種更昂貴的設(shè)備就很難銷售,,即使它的二氧化碳排放更低,。目前的狀況是,由于氣候保護的原因,,歐洲熱泵市場正在快速增長,。”

事實上,,雖然烏克蘭危機導(dǎo)致今年熱泵需求激增,,許多買家要等幾個月才能夠收到新熱泵,但從2019年以來,,德國的熱泵需求便已經(jīng)在大幅增長,,當時德國政府為了努力實現(xiàn)其氣候目標增加了對熱泵的補貼。

在全世界,,建筑供暖,、制冷和供電占溫室氣體排放量的四分之一。據(jù)政府支持的氣候透明組織(Climate Transparency)統(tǒng)計,,2020年,,德國人均建筑相關(guān)碳排放量比G20國家平均水平高56%,主要原因是建筑普遍使用天然氣和石油供暖,。這導(dǎo)致供暖和交通運輸,,成為立法者關(guān)注的首要目標。

隨著新補貼政策的實施,,從2019年到2020年,,德國熱泵銷量增長了40%,2021年又增長了28%,,達到154,000臺,,其中有900,000臺在本土銷售。(據(jù)國際能源署統(tǒng)計,,2020年全球共安裝熱泵1.77億臺,,之前五年每年增長約10%。)

今年8月,注重環(huán)保的德國新政府改革了補貼制度,,將熱泵的最高補貼從標價的50%下降到40%,。

這對熱泵行業(yè)影響不大,因為政府還停止向燃氣鍋爐和基于石油的供熱系統(tǒng)發(fā)放補貼,。目前燃氣鍋爐依舊是最常用的建筑供暖方式,。德國政府承諾將制定一項法律,要求所有新供暖系統(tǒng)使用的可再生能源不少于65%,。

德國熱泵協(xié)會(German Heat Pump Association)的宣傳總監(jiān)卡帝亞·魏因霍爾德說:“為了保障熱泵行業(yè)能夠提前進行規(guī)劃并且保證規(guī)劃的執(zhí)行,,必須有明確的法律規(guī)定,這非常重要,。這將發(fā)出重要的信號,,向外界表明德國的標準做法不再是安裝燃氣鍋爐,而是電氣熱泵,?!?/p>

65%的規(guī)定并沒有最終確定,這是目前讓熱泵行業(yè)擔心的多個不確定性之一,。

芯片,、技術(shù)和氟化氣體

但有一個迫在眉睫的問題,尤其是在熱泵需求激增的情況下,,那就是全球芯片荒,。世創(chuàng)電能的石富本稱:“目前很難買到微芯片,尤其是處理器,。”馬克思·菲斯曼表示:“芯片的主要供應(yīng)對象是汽車行業(yè),。我們是需要更多汽車,,還是更多熱泵,讓我們的家庭和工業(yè)生產(chǎn)變得不依賴[化石能源],?”

Rystad Energy的高級分析師拉爾斯·伊瓦爾·尼特·哈弗羅稱,,芯片供應(yīng)鏈依舊“可以感受到新冠疫情造成的一些后續(xù)影響”。他預(yù)計到2050年,,全球熱泵需求將增長7倍,。

另外一個嚴重的不確定性是熱泵運行所需要的制冷劑。目前使用的制冷劑通常是所謂的氟化氣體,,例如氫氟碳化合物,,諷刺的是,如果這種氣體從系統(tǒng)中泄露,,其全球變暖潛力就是二氧化碳的1,700倍,。

歐洲可能在今年晚些時候命令淘汰這類物質(zhì),這將令熱泵行業(yè)陷入困境,。一些公司已經(jīng)開始采用天然的,、更環(huán)保的替代品,,比如菲斯曼的部分產(chǎn)品使用丙烷,但許多人擔心過快轉(zhuǎn)型會在需求最旺盛的時候,,扼殺熱泵市場,。

石富本認為:“與能效增益相比,制冷劑對氣候的影響很小,。當然,,所有人都希望熱泵中使用丙烷這種天然的制冷劑,但如果我們太快淘汰氟氯烴,,就會降低整個熱泵市場的增長速度……許多產(chǎn)品目前無法使用天然制冷劑,。我個人建議,如果有新熱泵首次投放市場,,那么[規(guī)則可以要求]這類產(chǎn)品就必須使用天然制冷劑,。”

安裝熱泵的熟練技術(shù)工人不足是熱泵行業(yè)面臨的另外一個問題,,還有一個關(guān)鍵問題是,,如何保證用戶的住宅隔熱性能良好,足以讓他們安裝的熱泵充分發(fā)揮作用,。關(guān)于應(yīng)該用多大力度強制人們安裝熱泵,,這也是一個未知數(shù)。馬克思·菲斯曼警告,,德國采取過于嚴厲的做法,,可能引發(fā)類似于法國的“黃馬甲運動”。黃馬甲運動是法國因為高能源價格而引發(fā)的暴動,。

但熱泵的環(huán)保效益是顯而易見的,,而且全世界的政策制定者都看好這項技術(shù)。例如,,占全球熱泵市場一半規(guī)模的美國,,將進一步通過《通脹削減法案》(Inflation Reduction Act)中的補貼鼓勵安裝熱泵。

與電動汽車一樣,,熱泵證明,,全世界應(yīng)對氣候危機所需要的技術(shù),大多數(shù)都是現(xiàn)成的,,問題只是如何將它們變成我們默認的選擇,。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

A widespread energy crisis? Rampant inflation? If history rhymes, 2022 is crammed with callbacks to the 1970s. Back then, the double whammy of 1973’s Arab-Israeli war and 1979’s Iranian revolution caused major interruptions to the Middle East’s oil exports, with the ensuing energy crisis feeding Western recessions and alerting many to the need for alternative energy sources.

The crisis marked the coming-of-age for a technology first developed in the mid-19th century: the heat pump, which transfers heat from the ground, water, and air into buildings. Companies raced to invest in these large, nondescript boxes, but then the crisis ended, fossil fuels became cheap again, and the humble heat pump was largely cast aside.

Now, with Russian natural-gas machinations forcing Europe to shutter factories and stare down the barrel of a cold winter, the heat pump is back. And this time around, the cascading climate crisis—which demands rapid adoption of renewable energy sources—means it’s likely to stay.

“The solutions are available,” said Max Viessmann, CEO of the German heating and cooling giant Viessmann. “[Heat pumps] are actually much more advanced than people realize, and they now need to be scaled.”

450% efficiency

Heat pump systems, which comprise connected devices outside and inside the buildings they serve, may not be much to look at: Air-source heat pumps, which are the most common type, resemble large air-conditioning units—but they are remarkably efficient.

While a gas-furnace–based heating system is at best 95% efficient—that is, it delivers 95 units of energy for every 100 units it burns—modern heat pumps are upwards of 450% efficient. Put one unit of electrical energy in, to power the system, and you will typically get at least 4.5 units of thermal energy out. And the heat that emerges from the system was already in the atmosphere to start with, unlike the energy you get from fossil fuels.

So it’s not hard to see why nearly half of new multifamily buildings in the U.S. and more than 40% of new single-family homes, are being built with heat pumps, according to a November International Energy Agency (IEA) report. Older buildings can also be retrofitted with heat pumps, though this means knocking a hole in the wall and installing new electrical connections, making it a relatively small part of the market for now. Heat pumps are certainly more expensive to buy than their dirtier counterparts—depending on the property size, they can easily run into the tens of thousands of dollars—but they’re a lot cheaper to operate.

Heat pumps have an added bonus: Most can act as cooling systems as well. Like refrigerators and air conditioners, heat pumps use fluids called refrigerants to transfer heat—they just do it from outside in, rather than inside out. Reverse the system, as is possible with most air- and water-source heat pumps, and you can lop as much as 5°C off indoor temperatures. That won’t replace proper air-conditioning in warmer climes, but it’s a big selling point in a relatively temperate region like Europe, where AC is rare but heat waves are becoming more common and extreme.

Cue a fresh flood of investment.

Heat pump investments

Viessmann, a 105-year-old business, recently announced a $1 billion investment into heat pumps and other green products over the next three years.

The firm is a classic example of a Mittelstand midsize family business, a category that forms the backbone of the economy in Germany—a country that’s racing to respond to both rapid climate change and an existential energy crisis. Max represents the fourth generation of his clan to lead the $3.4 billion company. Viessmann introduced its first heat pump in 1979, only to mothball the technology after that energy crisis faded. But it got back into the heat pump business a couple decades ago, and last year it held around 15% of the German market.

Now Viessmann needs to defend its position as one of the country’s market leaders as its rivals sink more money into heat pump technology.

Stiebel Eltron, a 98-year-old heating firm, got into the heat pump business in the 1970s and stuck with it despite the technology becoming a big money loser until relatively recently. The company boosted heat pump production by 60% over the past year to meet demand. It’s now one of Europe’s top five heat pump manufacturers and announced a fresh $600 million investment in heat pump production and R&D over the next five years in August.

“In a world where no one thought twice about using gas and emitting loads of CO2, it’s difficult to sell something that’s more expensive, where the benefit is emitting less CO2,” said managing director Kai Schiefelbein. “We are in the situation today where the heat pump market in Europe is growing rapidly, mainly due to climate protection.”

Indeed, while the Ukraine crisis has prompted a sudden spike in demand for heat pumps this year—leaving many buyers waiting months for their new heat pumps—German demand had already been rising sharply since 2019, when the government boosted subsidies as it scrambled to meet its climate goals.

Globally, the heating, cooling, and powering of buildings account for over a quarter of greenhouse gas emissions. And according to the government-backed organization Climate Transparency, Germany’s per capita building-related carbon emissions were 56% above the G20 average in 2020, largely thanks to the widespread use of gas and oil for heating buildings. That made heating, along with transportation, a top priority for lawmakers.

With the new subsidies in place, German heat pump sales leapt 40% between 2019 and 2020, then another 28% the year after, reaching 154,000 units in 2021, out of roughly 900,000 heating units sold in Germany that year. (Globally, according to the IEA, 177 million heat pumps were installed by 2020, with increases of around 10% per year in the preceding five years.)

In August, Germany’s environmentally focused new government reformed the subsidy scheme, reducing the maximum subsidy available for heat pump installations from 50% to 40% of the sticker price.

That wasn’t a big blow to the heat pump sector, because the government also ended subsidies for gas-fired boilers—still the most popular means of heating buildings—and oil-based heating systems. It promised to introduce a law that will demand all new heating system installations take at least 65% of their energy from renewable sources.

“For the industry to be able to plan and have security in their planning, it’s very important that this is specified in law,” said Katja Weinhold, communications chief at the German Heat Pump Association. “This would send out an important signal that the standard case in Germany would no longer be the installation of a gas boiler but the electric heat pump.”

The 65% rule isn’t yet set in stone, and it’s just one of several uncertainties worrying the heat pump industry right now.

Chips, skills, and F-gases

One immediate problem, especially given the sharp rise in demand for heat pumps, is the ongoing global chip shortage. “Microchips and especially processors are very difficult to get at the moment,” said Stiebel Eltron’s Schiefelbein. “Chips are primarily being allocated to the automotive industry,” said Max Viessmann. “Do we need more cars, or do we need more heat pumps to make our households and industrial processes become independent [of fossil fuels]?”

Lars Ivar Nitter Havro, a senior analyst at Rystad Energy—who expects to see a global sevenfold increase in demand for heat pumps by 2050—said chip supply chains were still “feeling some of the aftermath” of COVID lockdowns.

Another major source of uncertainty concerns the refrigerants that make heat pumps work. Currently, these tend to be so-called F-gases such as hydrofluorocarbons, which somewhat ironically have a global-warming potential as much as 1,700 times that of CO2—if they leak out of the system.

Europe will likely order a phaseout of these substances later this year, putting the heat pump industry in a bind. Some companies have already started turning to natural, more climate-friendly alternatives—some of Viessmann’s products use propane, for example—but many fear that a too-quick transition could lead to strangling the heat pump market at a time when it is most needed.

“The influence of the refrigerant on the climate is very small compared to the energy efficiency gains,” argued Schiefelbein. “Of course, everyone wants to have natural refrigerants in the heat pumps like propane, but if we phase out hydrofluorocarbons too quickly we will just reduce the speed of the growth of the whole heat pump market…A lot of products cannot be done with natural refrigerants today. I personally propose that if someone develops a new heat pump and puts it into the market for the first time, then [the rules can say] it must have a natural refrigerant.”

There are other issues around finding enough skilled workers to install heat pumps and, crucially, ensuring homes are well-enough insulated to reap the full benefits of having them installed. The question of how strongly people should be compelled to install them also remains open. Max Viessmann warned that an excessively heavy-handed approach in Germany could lead to “a yellow vest movement like we’ve seen in France”—a reference to a popular uprising that was sparked by high energy prices.

But the green benefits of heat pumps are clear, and policymakers across the world are embracing the technology. For example, the U.S., which already accounts for half the market, is further incentivizing the installation of heat pumps through subsidies featured in the Inflation Reduction Act.

As with electric cars, heat pumps show that much of the technology the world need to fight the climate crisis is already here—it’s just a matter of making it the default.