今年8月,,美國參議院里的民主黨人正在為一場關鍵投票而努力,這場投票事關美國總統(tǒng)喬·拜登的一項重要國內施政方針——《通脹削減法案》(Inflation Reduction Act),,如果得到通過,,它就將為綠色能源和其他國內支出提供巨量投資。由于參議院的政治立場基本上勢均力敵,,所以民主黨人還得說服一位重要人士,,他就是西弗吉尼亞州民主黨籍參議員喬·曼欽,他希望得到提案方的保證,,即任何新支出法案都不會引發(fā)通脹。

民主黨動用了一門重量級武器——他們沒有求助于內閣成員,,也沒有去找任何知名的政界人士,而是找到了哈佛大學的經(jīng)濟學教授,、美國財政部的前部長拉里·薩默斯,。他自2010年以來就沒有在政府中擔任過任何正式職務了。弗吉尼亞州民主黨籍參議員馬克·沃納回憶道:“當時我一邊從地下通道里趕回哈特大廈,,一邊對還在巴西開會的薩默斯說:‘你必須給喬·曼欽打電話,,你必須現(xiàn)在就打,而且你必須說服他這個法案是沒有問題的,?!?/p>

幾個星期后,薩默斯在布魯克萊恩的家中接受《財富》雜志采訪時證實,,他確實打了那個電話——當然,,有了曼欽的投票,這項法案也順利得以通過,。薩默斯不愿意透露過多細節(jié),,不過他表示:“我確實在后期參與了不少政治活動,我敢說這項法案不會引發(fā)通脹,,幾位參議員也鼓勵我利用自己的信譽給這個法案背書,,而我也確實這樣做了?!?/p>

正因為他是研究通脹的大師,,我們才會在夏末的一天親自登門拜訪他。薩默斯曾經(jīng)擔任美國前總統(tǒng)比爾·克林頓政府的財政部部長和前總統(tǒng)貝拉克·奧巴馬的首席經(jīng)濟顧問。正因為見多識廣,所以他從不害怕做大膽的預測,,特別是最近他還發(fā)表了一項驚人的預言——他指出,美國政府在已經(jīng)拿出巨額的抗疫支出和寬松貨幣政策后,,又擬拿出1.9萬億美元的“美國拯救計劃”(American Rescue Plan),,這很可能會帶來“一代人都未曾見過的通脹壓力”。他愿意跟我們談談美國經(jīng)濟為何會陷入這種岌岌可危的狀態(tài),,以及我們如何才可以擺脫這種狀態(tài),。換句話說,他對當前的經(jīng)濟形勢很不樂觀,。他警告道:“如果我們想要降低通脹,,就需要比當前市場或者美聯(lián)儲所預期的更嚴格的政策。目前美聯(lián)儲還是太樂觀了,?!?/p>

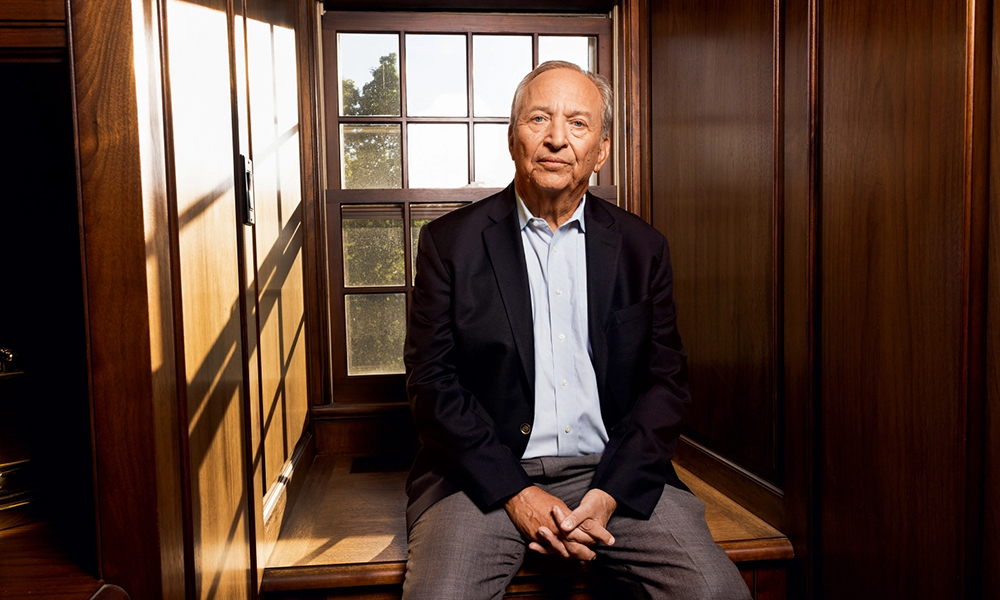

現(xiàn)在,這位著名經(jīng)濟學家每天都往返于哈佛大學和布魯克萊恩之間,。我們見面那天,,他剛從科德角的避暑別墅回來。雖然坐擁哈佛大學的最高教職,,但第二天他還要親自上兩堂政治經(jīng)濟學講座,,出席一場高級研討會,總共要給400多個學生上課,。他的黃色三層別墅坐落在一個山坡上的小區(qū)里,,被掩映在一片有半個世紀樹齡的美國梧桐中。這座房子的歷史能夠追溯到1901年,,他在2006年卸任哈佛大學的校長一職后便一直居住在這里,。房子的橡木地板上鋪著東方風格的地毯,書架上陳列著他在政府任職期間的許多紀念品,,其中包括一份手寫的1999年參議院投票記錄,,當時參議院以97票贊成、2票反對的結果任命他為財政部部長,。

《通脹削減法案》的通過讓拜登獲得了一場巨大的勝利,,但它對薩默斯來說也是一場勝利。經(jīng)過幾十年的風風雨雨,,薩默斯已經(jīng)從一位杰出的經(jīng)濟學家,,變成了美國政治經(jīng)濟界一位舉足輕重的運籌帷幄者,。該法案避免了抗疫期間的那種“大撒幣”式的紓困支出——薩默斯對此是很反對的,而是支持對綠色能源進行長期投資,,同時允許聯(lián)邦醫(yī)保(Medicare)開展處方藥成本談判,,這兩項政策的目的都是為了抑制通脹。另外,,薩默斯還同意開放公共土地和水域開采油氣,,這也使他成了今年少數(shù)幾位可以在對立政治陣營之間成功搭橋的人物。但另一方面,,這種折衷的做法既沒有取悅想要增加支出的激進派,,也沒有讓想要減少支出的保守派滿意。

不過由于當前的通脹仍然高得嚇人——今年8月的美國通脹率達到了8.3%,,因此兩大陣營中認同薩默斯的觀點,,覺得形勢很不樂觀的人也越來越多。在薩默斯看來,,目前最大的擔憂,,就是美國本來能夠在接下來的幾個月來個“長痛不如短痛”,但是美聯(lián)儲迄今尚未下定一步加息到位的決心,,這可能導致最終解決方案所需付出的成本也要高得多,。

在布魯克萊恩的家中,薩默斯穿著灰色休閑褲,、藍色上衣和一雙休閑鞋,,打開了一罐原味可樂,開始侃侃而談,。

通脹是怎樣一步步失控的

有一種論調稱,,美國當前的通脹是暫時性現(xiàn)象,是由于供應鏈瓶頸和防疫封控措施導致的,。但薩默斯壓根不認同這種看法,。

在薩默斯看來,當今通脹嚴重的主要原因是需求被夸大了,,是因為過多的貨幣追逐過少的商品導致的,。因此,為了遏制不斷上漲的消費者物價指數(shù)(CPI),,美聯(lián)儲必須持續(xù)收緊貨幣政策,,直至需求大幅下降。那么,,薩默斯認為美聯(lián)儲還得在加息的路上走多遠呢,?

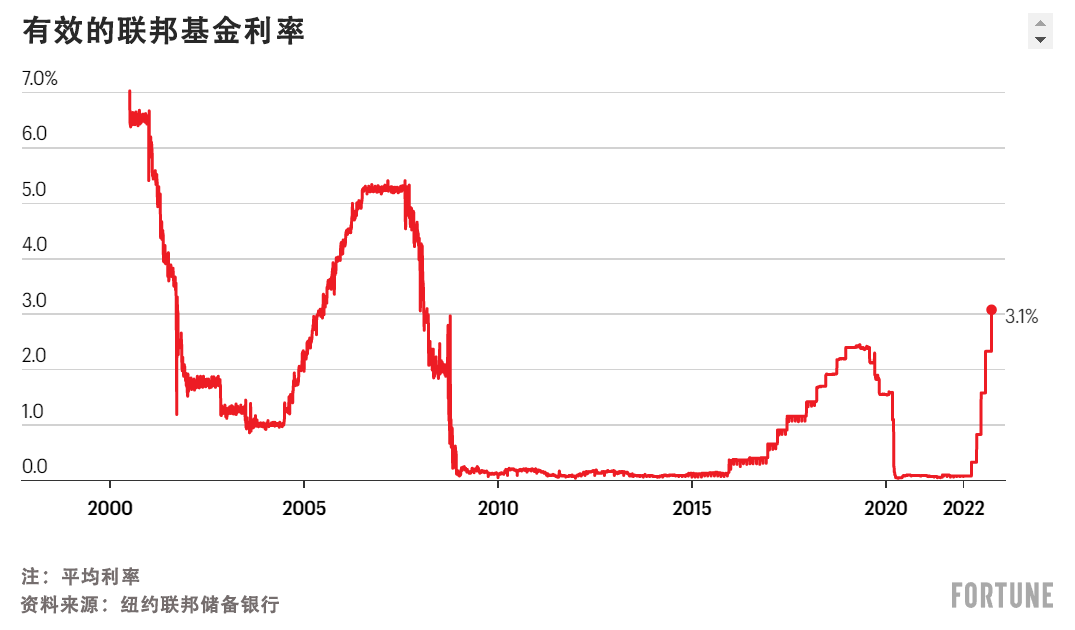

在薩默斯看來,經(jīng)濟學的核心是數(shù)學,,這些問題的答案簡直就是經(jīng)濟學的入門課程,。據(jù)他估算,,美國的“底層通脹”,也就是不包括食品和能源在內的通脹,,大概是在4%到4.5%之間,,與美聯(lián)儲拿來作參考的PCEPI指數(shù)非常接近。[PCEPI又稱“個人消費支出價格指數(shù)”,,由美國經(jīng)濟分析局(Bureau of Economic Analysis)計算,是一個被聯(lián)邦政府廣泛使用的指數(shù),,包括用于調整社保支出,。]根據(jù)薩默斯的劇本,要抑制通脹,,就需要一個“實際”的聯(lián)邦基金利率,,它要比基礎通脹率高1.0%到1.5%。

根據(jù)薩默斯計算,,這個實際利率的正確數(shù)字應該在5.0%到5.5%之間,,這要遠遠高于當前聯(lián)邦基金利率的中間值(3.1%)。當然,,市場和大多數(shù)觀察人士都預計,,美聯(lián)儲還會在接下來幾次會議上有大動作。但是調查顯示,,聯(lián)邦基金期貨市場和公開市場委員會(Open Market Committee)的成員普遍預計,,這個數(shù)值明年最高也只能夠達到4.6%左右。因此,,薩默斯呼吁美聯(lián)儲進一步加大加息和緊縮力度,,而且他呼吁的這個力度要比美聯(lián)儲和投資者的預期大得多。

房地產(chǎn)是一個對利率波動比較敏感的行業(yè),,最近的幾輪加息已經(jīng)給房市造成了很大沖擊,。美國企業(yè)研究所的住房中心的主任埃德·平托指出,如果基準利率達到5%或5.5%,,“可能當我們達到這個數(shù)字時,,經(jīng)濟已經(jīng)陷入衰退了?!?月20日,,美國的30年期抵押貸款利率已經(jīng)達到6.4%,與一年前相比有了大幅上升,,這已經(jīng)使美國的住房銷量比2021年同期低了三分之一,,回落到了2015年的水平。據(jù)平托預計,,從現(xiàn)在開始起一年內,,美聯(lián)儲的大幅加息將美國房價平均下降8%到10%,。

薩默斯認為,要使通脹率回落到美聯(lián)儲的2%的目標,,就要抑制過度膨脹的需求,。但收入的快速上漲正在削弱美聯(lián)儲的抗通脹努力。目前美國的個人收入增長率超過了5%,,失業(yè)率在3.5%左右,,達到了20世紀60年代末以來的最低的失業(yè)率水平。而只有當人們感到手頭拮據(jù),,大幅減少了支出時,,通脹壓力才會緩解。薩默斯認為,,經(jīng)濟現(xiàn)實決定了這種情況只會在失業(yè)率上升的時候發(fā)生,,失業(yè)率一旦上升,每個空缺職位就會有更多人競爭,。只有就業(yè)市場的熱度冷下來,,才會抑制工資的急劇上漲。

薩默斯指出:“現(xiàn)在每一個就業(yè)者背后,,幾乎都有兩個空缺的招聘崗位,。可以看出,,目前的失業(yè)率處于十分罕見的水平,。我不確定在失業(yè)率重回5%之前,你能否有效抑制通脹,。而且你可能需要失業(yè)率一定時間內保持在6%,。當然,我最希望的是這個計算出了錯,?!彼_默斯最不希望看到老百姓的工作機會被毀掉。但他認為,,只有短期內堅決遏制愈演愈烈的災難性通脹,,才能夠確保未來的就業(yè)市場更加穩(wěn)健發(fā)展,。

薩默斯認為,,目前美國陷入經(jīng)濟衰退的可能性為75%。他表示:“歷史告訴我們,,軟著陸就代表著希望戰(zhàn)勝了經(jīng)驗,。而在通脹率高于4%且失業(yè)率低于4%的情況下,,還沒有經(jīng)濟能夠實現(xiàn)軟著陸的先例,。因此如果經(jīng)濟不顯著放緩,,我們就不太可能達到美聯(lián)儲的抑制通脹目標,。”

如果美聯(lián)儲按照薩默斯的劇本,,采取堅定立場,,美國需要多久才可以使通脹率回落到2%的目標?作為美國財政部前部長,,薩默斯抨擊了華爾街普遍存在的一種觀點,,即美聯(lián)儲能夠迅速遏制通脹,然后在不久的將來再次開始放松政策,。薩默斯稱:“我認為這會需要好幾年的時間,,這一切都要取決于實體經(jīng)濟的情況,如果失業(yè)率上升到6%或7%,,那么通脹回落的速度要比失業(yè)率在5%到5.5%時快得多。但有觀點認為,,美聯(lián)儲會在明年年中放松政策,,而且這與我們讓通脹率重回2%的路徑一致。實際上,,這種觀點真的不太可能,。”

億萬富翁,、生物能源與下次疫情

當然,,通貨膨脹并不是目前薩默斯唯一關心的問題。我們在布魯克萊恩采訪時發(fā)現(xiàn),,他的想法簡直是層出不窮,,甚至在我們給他拍照的時候都談興甚濃。臨走的時候,,我忍不住還是問了這位大師對股價有什么看法,。他說:“總的來看,股市似乎沒有出現(xiàn)可能與嚴重衰退相關的那種利潤下降,,因此在我看來,,股市還是很富裕的。而且我對股市的任何看法都是非常初步的,?!彼€引用了哈佛捐贈基金負責人、傳奇投資者杰克·邁耶的故事:“在被問到他的成功秘訣時,,他說他從不聽信一個學經(jīng)濟學的,。”

薩默斯認為,,美國保持自由的創(chuàng)業(yè)文化是十分重要的,,這種文化締造了很多億萬富翁,,但這些億萬富翁也創(chuàng)造了大量的就業(yè)機會。但同時這些億萬富翁的價值也被低估了,?!叭缥覀冇懈嘞窠芊颉へ愖羲埂⒈葼枴どw茨和史蒂夫·喬布斯這樣既打造了龐大的企業(yè),,也賺到了巨額財富的人……那對美國就是有好處的,。”同時薩默斯也支持“進行一系列稅收改革,,讓他們交更多的稅,,同時防止這些大企業(yè)從商業(yè)帝國發(fā)展成代代相傳的商業(yè)王朝。如果富人能夠輕易將財富傳給繼承人,,這就將是對機會均等的美國夢的侮辱,。”

他還支持用水力壓裂技術開采更多油氣,,以及增加油氣管道取代危險的卡車運輸,。“最重要的是加快對能源和電力的運輸審批流程,。環(huán)保界對所有碳氫能源本能地一刀切地反對,,這不僅對經(jīng)濟沒有好處,也不符合他們自己的目標,?!?/p>

從這一點上也可以看出,薩默斯對政府是不是應該干預,、何時應該干預經(jīng)濟的問題上也有著自己的看法,。“我一直認為,,最好的將軍是那些最不愿意發(fā)動戰(zhàn)爭,,最不愿意將軍事和暴力手段當成工具的人,他們雖然不好戰(zhàn),,但是如果必要的時候也愿意戰(zhàn)斗,。”

他繼續(xù)說道:“長期以來,,我們一直在進行一場無結果的辯論,,一方是在意識形態(tài)上反對任何扭曲完全自由市場政策的人,另一方則堅持政府必須要在商品和服務生產(chǎn)中發(fā)揮作用,。而我們真正需要的,,就是政府扮演一個‘避戰(zhàn)而能戰(zhàn)’的角色,以促進特定行業(yè)和政策?!?/p>

薩默斯還建議,,聯(lián)邦政府應該制定一個類似“馬歇爾計劃”的計劃,以應對下一次疫情——他認為最多10年到15年,,我們就會迎來下一次疫情,。“疫情風險與氣候風險在同一個量級上,,但它沒有得到應有的重視,。相比于疫情造成的幾十萬億美元的損失,我們如果在這上面花上一些錢,,就可以在下次疫情時更加從容地應對,。”薩默斯希望聯(lián)邦政府設立一個疫情應對項目,,資助疫苗廠商建造工廠,,盡管這些工廠可能閑置很多年。同時要建立“快速生產(chǎn)疫苗的科研能力”,,并且大量囤積口罩,、注射器和其他設備,并且研發(fā)相關篩查設施,。

在個人愛好上,,薩默斯表示,,他經(jīng)常去布魯克萊恩的鄉(xiāng)村俱樂部打高爾夫球。盡管技術并不高明,,但他打趣道:“我在高爾夫球場上唯一擅長的就是做概率分析,,看是在小溪上方還是在小溪周圍擊球更好??上也惶瞄L揮桿,,而這項技能在球場上更重要?!绷硗馑€會打網(wǎng)球,,小時候他經(jīng)常練習對墻打網(wǎng)球,所以練就了不錯的擊球技能,?!霸诮?jīng)過年齡和體能調整后,我其實是一個很好的網(wǎng)球運動員,,如果從絕對的年齡調整來看,,我真的是還不錯的?!?/p>

當然,,薩默斯還有一個任何經(jīng)濟學家都避免不了的愛好——為未來擔憂,。他批評了美國政府數(shù)萬億美元的抗疫紓困支出。他認為,,這筆錢“可能會限制為抗擊長期經(jīng)濟停滯所能調配的公共資源,。我們就好比一個寧可借錢度假,也不愿意修繕屋頂或者擴建房子的家庭,。我們借了這么多錢,,但是我們只記得開派對?!彼羞@些魯莽行為的后果,,就是薩默斯預見到的大通脹。現(xiàn)在他又給出了另一個警告,,而我們都要明白,,要修復這個問題,我們需要付出多少犧牲,。(財富中文網(wǎng))

譯者:樸成奎

今年8月,,美國參議院里的民主黨人正在為一場關鍵投票而努力,這場投票事關美國總統(tǒng)喬·拜登的一項重要國內施政方針——《通脹削減法案》(Inflation Reduction Act),,如果得到通過,,它就將為綠色能源和其他國內支出提供巨量投資。由于參議院的政治立場基本上勢均力敵,,所以民主黨人還得說服一位重要人士,,他就是西弗吉尼亞州民主黨籍參議員喬·曼欽,他希望得到提案方的保證,,即任何新支出法案都不會引發(fā)通脹,。

民主黨動用了一門重量級武器——他們沒有求助于內閣成員,也沒有去找任何知名的政界人士,,而是找到了哈佛大學的經(jīng)濟學教授,、美國財政部的前部長拉里·薩默斯。他自2010年以來就沒有在政府中擔任過任何正式職務了,。弗吉尼亞州民主黨籍參議員馬克·沃納回憶道:“當時我一邊從地下通道里趕回哈特大廈,,一邊對還在巴西開會的薩默斯說:‘你必須給喬·曼欽打電話,你必須現(xiàn)在就打,,而且你必須說服他這個法案是沒有問題的,。’”

幾個星期后,,薩默斯在布魯克萊恩的家中接受《財富》雜志采訪時證實,,他確實打了那個電話——當然,有了曼欽的投票,這項法案也順利得以通過,。薩默斯不愿意透露過多細節(jié),,不過他表示:“我確實在后期參與了不少政治活動,我敢說這項法案不會引發(fā)通脹,,幾位參議員也鼓勵我利用自己的信譽給這個法案背書,,而我也確實這樣做了?!?/p>

正因為他是研究通脹的大師,,我們才會在夏末的一天親自登門拜訪他。薩默斯曾經(jīng)擔任美國前總統(tǒng)比爾·克林頓政府的財政部部長和前總統(tǒng)貝拉克·奧巴馬的首席經(jīng)濟顧問,。正因為見多識廣,,所以他從不害怕做大膽的預測,特別是最近他還發(fā)表了一項驚人的預言——他指出,,美國政府在已經(jīng)拿出巨額的抗疫支出和寬松貨幣政策后,,又擬拿出1.9萬億美元的“美國拯救計劃”(American Rescue Plan),這很可能會帶來“一代人都未曾見過的通脹壓力”,。他愿意跟我們談談美國經(jīng)濟為何會陷入這種岌岌可危的狀態(tài),,以及我們如何才可以擺脫這種狀態(tài)。換句話說,,他對當前的經(jīng)濟形勢很不樂觀,。他警告道:“如果我們想要降低通脹,就需要比當前市場或者美聯(lián)儲所預期的更嚴格的政策,。目前美聯(lián)儲還是太樂觀了,。”

現(xiàn)在,,這位著名經(jīng)濟學家每天都往返于哈佛大學和布魯克萊恩之間。我們見面那天,,他剛從科德角的避暑別墅回來,。雖然坐擁哈佛大學的最高教職,但第二天他還要親自上兩堂政治經(jīng)濟學講座,,出席一場高級研討會,,總共要給400多個學生上課。他的黃色三層別墅坐落在一個山坡上的小區(qū)里,,被掩映在一片有半個世紀樹齡的美國梧桐中,。這座房子的歷史能夠追溯到1901年,他在2006年卸任哈佛大學的校長一職后便一直居住在這里,。房子的橡木地板上鋪著東方風格的地毯,,書架上陳列著他在政府任職期間的許多紀念品,其中包括一份手寫的1999年參議院投票記錄,當時參議院以97票贊成,、2票反對的結果任命他為財政部部長,。

《通脹削減法案》的通過讓拜登獲得了一場巨大的勝利,但它對薩默斯來說也是一場勝利,。經(jīng)過幾十年的風風雨雨,,薩默斯已經(jīng)從一位杰出的經(jīng)濟學家,變成了美國政治經(jīng)濟界一位舉足輕重的運籌帷幄者,。該法案避免了抗疫期間的那種“大撒幣”式的紓困支出——薩默斯對此是很反對的,,而是支持對綠色能源進行長期投資,同時允許聯(lián)邦醫(yī)保(Medicare)開展處方藥成本談判,,這兩項政策的目的都是為了抑制通脹,。另外,薩默斯還同意開放公共土地和水域開采油氣,,這也使他成了今年少數(shù)幾位可以在對立政治陣營之間成功搭橋的人物,。但另一方面,這種折衷的做法既沒有取悅想要增加支出的激進派,,也沒有讓想要減少支出的保守派滿意,。

不過由于當前的通脹仍然高得嚇人——今年8月的美國通脹率達到了8.3%,因此兩大陣營中認同薩默斯的觀點,,覺得形勢很不樂觀的人也越來越多,。在薩默斯看來,目前最大的擔憂,,就是美國本來能夠在接下來的幾個月來個“長痛不如短痛”,,但是美聯(lián)儲迄今尚未下定一步加息到位的決心,這可能導致最終解決方案所需付出的成本也要高得多,。

在布魯克萊恩的家中,,薩默斯穿著灰色休閑褲、藍色上衣和一雙休閑鞋,,打開了一罐原味可樂,,開始侃侃而談。

通脹是怎樣一步步失控的

有一種論調稱,,美國當前的通脹是暫時性現(xiàn)象,,是由于供應鏈瓶頸和防疫封控措施導致的。但薩默斯壓根不認同這種看法,。

在薩默斯看來,,當今通脹嚴重的主要原因是需求被夸大了,是因為過多的貨幣追逐過少的商品導致的,。因此,,為了遏制不斷上漲的消費者物價指數(shù)(CPI),,美聯(lián)儲必須持續(xù)收緊貨幣政策,直至需求大幅下降,。那么,,薩默斯認為美聯(lián)儲還得在加息的路上走多遠呢?

在薩默斯看來,,經(jīng)濟學的核心是數(shù)學,,這些問題的答案簡直就是經(jīng)濟學的入門課程。據(jù)他估算,,美國的“底層通脹”,,也就是不包括食品和能源在內的通脹,大概是在4%到4.5%之間,,與美聯(lián)儲拿來作參考的PCEPI指數(shù)非常接近,。[PCEPI又稱“個人消費支出價格指數(shù)”,由美國經(jīng)濟分析局(Bureau of Economic Analysis)計算,,是一個被聯(lián)邦政府廣泛使用的指數(shù),,包括用于調整社保支出。]根據(jù)薩默斯的劇本,,要抑制通脹,,就需要一個“實際”的聯(lián)邦基金利率,它要比基礎通脹率高1.0%到1.5%,。

根據(jù)薩默斯計算,,這個實際利率的正確數(shù)字應該在5.0%到5.5%之間,這要遠遠高于當前聯(lián)邦基金利率的中間值(3.1%),。當然,,市場和大多數(shù)觀察人士都預計,美聯(lián)儲還會在接下來幾次會議上有大動作,。但是調查顯示,,聯(lián)邦基金期貨市場和公開市場委員會(Open Market Committee)的成員普遍預計,這個數(shù)值明年最高也只能夠達到4.6%左右,。因此,,薩默斯呼吁美聯(lián)儲進一步加大加息和緊縮力度,而且他呼吁的這個力度要比美聯(lián)儲和投資者的預期大得多,。

房地產(chǎn)是一個對利率波動比較敏感的行業(yè),最近的幾輪加息已經(jīng)給房市造成了很大沖擊,。美國企業(yè)研究所的住房中心的主任埃德·平托指出,,如果基準利率達到5%或5.5%,“可能當我們達到這個數(shù)字時,,經(jīng)濟已經(jīng)陷入衰退了,?!?月20日,美國的30年期抵押貸款利率已經(jīng)達到6.4%,,與一年前相比有了大幅上升,,這已經(jīng)使美國的住房銷量比2021年同期低了三分之一,回落到了2015年的水平,。據(jù)平托預計,,從現(xiàn)在開始起一年內,美聯(lián)儲的大幅加息將美國房價平均下降8%到10%,。

薩默斯認為,,要使通脹率回落到美聯(lián)儲的2%的目標,就要抑制過度膨脹的需求,。但收入的快速上漲正在削弱美聯(lián)儲的抗通脹努力,。目前美國的個人收入增長率超過了5%,失業(yè)率在3.5%左右,,達到了20世紀60年代末以來的最低的失業(yè)率水平,。而只有當人們感到手頭拮據(jù),大幅減少了支出時,,通脹壓力才會緩解,。薩默斯認為,經(jīng)濟現(xiàn)實決定了這種情況只會在失業(yè)率上升的時候發(fā)生,,失業(yè)率一旦上升,,每個空缺職位就會有更多人競爭。只有就業(yè)市場的熱度冷下來,,才會抑制工資的急劇上漲,。

薩默斯指出:“現(xiàn)在每一個就業(yè)者背后,幾乎都有兩個空缺的招聘崗位,??梢钥闯觯壳暗氖I(yè)率處于十分罕見的水平,。我不確定在失業(yè)率重回5%之前,,你能否有效抑制通脹。而且你可能需要失業(yè)率一定時間內保持在6%,。當然,,我最希望的是這個計算出了錯?!彼_默斯最不希望看到老百姓的工作機會被毀掉,。但他認為,只有短期內堅決遏制愈演愈烈的災難性通脹,,才能夠確保未來的就業(yè)市場更加穩(wěn)健發(fā)展,。

薩默斯認為,,目前美國陷入經(jīng)濟衰退的可能性為75%。他表示:“歷史告訴我們,,軟著陸就代表著希望戰(zhàn)勝了經(jīng)驗,。而在通脹率高于4%且失業(yè)率低于4%的情況下,還沒有經(jīng)濟能夠實現(xiàn)軟著陸的先例,。因此如果經(jīng)濟不顯著放緩,,我們就不太可能達到美聯(lián)儲的抑制通脹目標?!?/p>

如果美聯(lián)儲按照薩默斯的劇本,,采取堅定立場,美國需要多久才可以使通脹率回落到2%的目標,?作為美國財政部前部長,,薩默斯抨擊了華爾街普遍存在的一種觀點,即美聯(lián)儲能夠迅速遏制通脹,,然后在不久的將來再次開始放松政策,。薩默斯稱:“我認為這會需要好幾年的時間,這一切都要取決于實體經(jīng)濟的情況,,如果失業(yè)率上升到6%或7%,,那么通脹回落的速度要比失業(yè)率在5%到5.5%時快得多。但有觀點認為,,美聯(lián)儲會在明年年中放松政策,,而且這與我們讓通脹率重回2%的路徑一致。實際上,,這種觀點真的不太可能,。”

億萬富翁,、生物能源與下次疫情

當然,,通貨膨脹并不是目前薩默斯唯一關心的問題。我們在布魯克萊恩采訪時發(fā)現(xiàn),,他的想法簡直是層出不窮,,甚至在我們給他拍照的時候都談興甚濃。臨走的時候,,我忍不住還是問了這位大師對股價有什么看法,。他說:“總的來看,股市似乎沒有出現(xiàn)可能與嚴重衰退相關的那種利潤下降,,因此在我看來,,股市還是很富裕的。而且我對股市的任何看法都是非常初步的,?!彼€引用了哈佛捐贈基金負責人、傳奇投資者杰克·邁耶的故事:“在被問到他的成功秘訣時,,他說他從不聽信一個學經(jīng)濟學的,。”

薩默斯認為,,美國保持自由的創(chuàng)業(yè)文化是十分重要的,,這種文化締造了很多億萬富翁,但這些億萬富翁也創(chuàng)造了大量的就業(yè)機會,。但同時這些億萬富翁的價值也被低估了,。“如我們有更多像杰夫·貝佐斯,、比爾·蓋茨和史蒂夫·喬布斯這樣既打造了龐大的企業(yè),,也賺到了巨額財富的人……那對美國就是有好處的?!蓖瑫r薩默斯也支持“進行一系列稅收改革,,讓他們交更多的稅,同時防止這些大企業(yè)從商業(yè)帝國發(fā)展成代代相傳的商業(yè)王朝,。如果富人能夠輕易將財富傳給繼承人,,這就將是對機會均等的美國夢的侮辱?!?/p>

他還支持用水力壓裂技術開采更多油氣,,以及增加油氣管道取代危險的卡車運輸?!白钪匾氖羌涌鞂δ茉春碗娏Φ倪\輸審批流程,。環(huán)保界對所有碳氫能源本能地一刀切地反對,這不僅對經(jīng)濟沒有好處,,也不符合他們自己的目標,。”

從這一點上也可以看出,,薩默斯對政府是不是應該干預,、何時應該干預經(jīng)濟的問題上也有著自己的看法?!拔乙恢闭J為,,最好的將軍是那些最不愿意發(fā)動戰(zhàn)爭,最不愿意將軍事和暴力手段當成工具的人,,他們雖然不好戰(zhàn),,但是如果必要的時候也愿意戰(zhàn)斗?!?/p>

他繼續(xù)說道:“長期以來,,我們一直在進行一場無結果的辯論,,一方是在意識形態(tài)上反對任何扭曲完全自由市場政策的人,另一方則堅持政府必須要在商品和服務生產(chǎn)中發(fā)揮作用,。而我們真正需要的,,就是政府扮演一個‘避戰(zhàn)而能戰(zhàn)’的角色,以促進特定行業(yè)和政策,?!?/p>

薩默斯還建議,聯(lián)邦政府應該制定一個類似“馬歇爾計劃”的計劃,,以應對下一次疫情——他認為最多10年到15年,,我們就會迎來下一次疫情?!耙咔轱L險與氣候風險在同一個量級上,,但它沒有得到應有的重視。相比于疫情造成的幾十萬億美元的損失,,我們如果在這上面花上一些錢,,就可以在下次疫情時更加從容地應對?!彼_默斯希望聯(lián)邦政府設立一個疫情應對項目,,資助疫苗廠商建造工廠,盡管這些工廠可能閑置很多年,。同時要建立“快速生產(chǎn)疫苗的科研能力”,,并且大量囤積口罩、注射器和其他設備,,并且研發(fā)相關篩查設施,。

在個人愛好上,薩默斯表示,,他經(jīng)常去布魯克萊恩的鄉(xiāng)村俱樂部打高爾夫球,。盡管技術并不高明,但他打趣道:“我在高爾夫球場上唯一擅長的就是做概率分析,,看是在小溪上方還是在小溪周圍擊球更好,。可惜我不太擅長揮桿,,而這項技能在球場上更重要,。”另外他還會打網(wǎng)球,,小時候他經(jīng)常練習對墻打網(wǎng)球,,所以練就了不錯的擊球技能。“在經(jīng)過年齡和體能調整后,,我其實是一個很好的網(wǎng)球運動員,,如果從絕對的年齡調整來看,我真的是還不錯的,?!?/p>

當然,薩默斯還有一個任何經(jīng)濟學家都避免不了的愛好——為未來擔憂,。他批評了美國政府數(shù)萬億美元的抗疫紓困支出。他認為,,這筆錢“可能會限制為抗擊長期經(jīng)濟停滯所能調配的公共資源,。我們就好比一個寧可借錢度假,也不愿意修繕屋頂或者擴建房子的家庭,。我們借了這么多錢,,但是我們只記得開派對?!彼羞@些魯莽行為的后果,,就是薩默斯預見到的大通脹。現(xiàn)在他又給出了另一個警告,,而我們都要明白,,要修復這個問題,我們需要付出多少犧牲,。(財富中文網(wǎng))

譯者:樸成奎

Senate Democrats were careening toward a pivotal vote this August—one that could either resuscitate President Biden’s domestic agenda, or pull the plug on it. They wanted to pass the Inflation Reduction Act, a huge bill that would fund dramatic green energy investments and other domestic spending. The Dems needed to flip one senator to squeeze the legislation through the evenly divided chamber—that of their own colleague, Joe Manchin (D-W.Va.), who wanted assurances that any new spending bill wouldn’t be inflationary.

The Dems called in the heavy artillery—but they didn’t turn to a cabinet member, or a big-name lobbyist, or any current political headliner. They called on Larry Summers, the rumpled, cerebral Harvard economics professor and former Treasury secretary who hasn’t held a formal role in government since 2010. Sen. Mark Warner (D-Va.) recalled the frenetic home stretch in a press report: “I was walking the tunnels back to the Hart Building and saying to Larry, who was at some conference in Brazil at the time, ‘You gotta call Joe Manchin, and you gotta do it right now and convince him this is all cool.’”

A few weeks later, visiting with Fortune in his living room in tony Brookline, Summers confirms it: He placed the call. (The bill passed, of course, with Manchin’s vote.) Summers won’t go into specifics, but says, “I was quite involved in the politics in the late stages.” He adds: “I had credibility to say that [this bill] would not be inflationary. Several senators encouraged me to deploy that credibility, and I did.”

That credibility is the reason we’re talking in his parlor on a late summer day. Larry Summers has never been one to shy away from bold predictions, and recently he has stood out for one particular pronouncement. Summers—Treasury secretary under Bill Clinton, and chief economic adviser to Barack Obama—strenuously warned that the proposed $1.9 trillion American Rescue Plan, following already gigantic COVID relief spending and loose monetary policy, could “set off inflationary pressures?…?unseen for a generation.” He’s agreed to meet with us to discuss how the economy got into its current shaky state—and how we might get out of it. He is, to say the least, not very upbeat. “If we’re going to bring down inflation, you likely need a policy more restrictive than the policy that’s contemplated by the markets or the Fed,” he warns. “The Fed continues to be excessively optimistic.”

Today, the noted economist commutes from Brookline to Harvard, where he holds the highest faculty rank, as university professor. When we met, he’d just returned from his summer house in Cape Cod; the next day, he would teach more than 400 students, at two political economics lectures and an advanced seminar. His yellow, columned three-story house, in a hilly neighborhood shaded by half-century-old sycamores, dates from 1901—he’s lived here since leaving the Harvard presidency in 2006. Oriental rugs cover the oak floors, and the shelves feature a number of trophies from his time in government—including a handwritten record of the Senate roll call from 1999 that confirmed him as Treasury secretary by a vote of 97 to two.

The passage of the Inflation Reduction Act gave Biden a huge win. But it was a win for Summers, too, who has risen over the decades from a brilliant economist (if prone to foot-in-mouth moments) to an éminence grise in the economic and political realms. The bill eschewed the COVID-style stimulus checks Summers railed against in favor of longer-term investments in green energy and a provision that allows Medicare to negotiate prescription drug costs, both aimed at lowering inflation. With nods toward opening up public lands and waters to drilling and fracking, it also solidified Summers’ status as a rare public figure in 2022 who is able to build bridges between opposing camps. On the flip side, this meet-in-the-middle approach manages to please neither progressives who want more spending nor conservatives who want less.

Still, as inflation remains worryingly high—clocking in at 8.3% in the latest August reading—a growing number of people in both camps now share Summers’ view that things are not, exactly, cool. For Summers, the greatest worry is that the Fed won’t have the resolve to raise rates high enough, and that the eventual cure will be far more costly than shouldering what could be a shorter, shallower downturn in the months ahead.

Back in Brookline, Summers—wearing gray slacks, a blue blazer and loafers sans visible socks—cracks open a can of Coke Original and starts talking.

How inflation spiraled out of control

Summers never bought the “transitory” argument, that inflation was a passing phenomenon caused by supply-chain bottlenecks and COVID-related shutdowns.

For Summers, the chief source of today’s heavy inflation is over-the-top demand caused by too much money chasing too few goods. So to throttle a runaway consumer price index, the Fed must keep tightening monetary policy to the point where demand falls—sharply. Just how far does Summers think the Fed needs to go?

Getting to the answers is a primer in Summers’ view that the heart of economics is arithmetic. He reckons that “underlying inflation,” excluding food and energy, is running at 4% to 4.5%, pretty close to the PCEPI (personal consumption expenditure price index) numbers that guide the Fed. (The PCEPI is calculated by the Bureau of Economic Analysis and widely used by the federal government, including to adjust Social Security payments.) In the Summers playbook, taming inflation requires a “real,” Fed funds rate that’s 1.0% to 1.5% higher than the pace of bedrock inflation.

By his reckoning, the right number is 5.0% to 5.5%. That’s far above the current Fed funds benchmark which is at a midpoint of 3.1%. Of course, the markets and most observers expect the Fed to go big again at the next several meetings. But the Fed funds futures markets, and the members of the Open Market Committee in their most recent poll, expect the number to max out at 4.6% next year. So Summers is calling for much higher Fed funds rate, and tighter policies, than investors or the Fed itself are anticipating.

Rising rates are already pummeling the giant industry most influenced by their fluctuations: housing. According to Ed Pinto, director of the American Enterprise Institute’s Housing Center, at 5% or 5.5%, “it’s likely that by the time we’d get to that number, the economy would already be in recession.” 30-year mortgage rates clocked in at 6.4% on Sept. 20—a collossal jump from just a year ago, and one that has already pushed home sales volumes one-third below 2021 numbers to where they stood in 2015. Pinto projects that by a year from now, the campaign of rates hikes will have pushed home values down an average of 8-10% across the board.

Wrestling inflation to near the Fed’s 2% target, Summers reckons, means crushing overblown demand. But fast-rising incomes are blunting the Fed’s campaign to fight inflation. Personal incomes are growing at over 5%, driven by a jobless rate in the mid-3% range that’s the lowest since the late 1960s. Inflationary pressures will only ease when Americans are feeling the pinch, when they’re spending a lot less money. Summers believes that economic reality dictates that will only happen when joblessness rises, so that more workers are available for each open job. Creating slack in the super-cramped labor market would curb the steep rise in wages.

“We’re seeing two vacancies for every employed person,” says Summers. “That number and the unemployment rate are at extraordinary levels. I’m not sure you’re restraining inflation until you get the unemployment rate close to 5%, and to significantly restrain inflation you’re likely to need unemployment for some period at 6%. I’d like nothing better than to be wrong in that calculation.” Job destruction is the last thing Summers wants to see. But he thinks that a tough campaign to contain the outbreak that costs jobs in the short run will ensure a much stronger job market in the future than the catastrophic choice of allowing inflation to keep bubbling.

Summers puts the chance of a recession at 75%. “History teaches us that soft landings represent the triumph of hope over experience,” he says. “There are no examples when inflation was above 4% and unemployment was below 4% that the economy achieved a soft landing. We are unlikely to achieve a reduction of inflation to something like the Fed’s target without a significant slowing of the economy.”

How long will it take for the Fed to push inflation back to the 2% goal, providing the central bank maintains the resolute stance Summers recommends? Here, the former Treasury secretary punctures the idea widespread on Wall Street that the central bank can quickly corral inflation, then start easing again in the not-too-distant future. “I suspect [it will take] several years,” he says. “It all depends on what happens in the real economy. If unemployment spikes to 6% or 7%, it will happen more quickly than if it stays at 5% or 5.5%. But the view that the Fed will be in a position to start easing in the middle of next year, and that that is consistent with the path to get us back to 2% inflation, really seems to me quite unlikely.”

Billionaires, biofuels, and the next pandemic

Of course inflation is hardly the only thing on Summers’ mind these days. During our interview in Brookline he was brimming with so many ideas that he wanted to keep talking during a picture-taking session in his top-floor study, a kind of book-lined, paneled aerie overlooking the rolling hills and cupolas of the surrounding suburb. I couldn’t leave without asking the great sage what he thought of today’s stock prices. “In general, it seems that the stock market is not pricing in the kind of decline in profits that would be associated with a meaningful recession, and therefore has looked rich to me,” he noted. “I hold any opinion on the level of the stock market very tentatively.” And he cited Jack Meyer, the legendary investor who headed Harvard’s endowment, “who, when asked the secret of his success, said that he never listened to a member of the economics department.”

Broadly speaking he thinks it’s crucial for America to keep the freewheeling entrepreneurial culture that spawns so many mega-billionaires because they’re also mega-job-creators. But he also believes they’re under-taxed: “If we had more people like Jeff Bezos and Bill Gates and Steve Jobs who built spectacular enterprises and made inordinate fortunes?…?that would be good for America.” But he also favors “a whole set of tax changes that would make them pay more and complicate any efforts to form intergenerational dynasties. The ease with which the wealthy can pass on their wealth to their heirs is an affront to the American ideal of equal opportunity.”

He also supports more fracking and adding pipelines to replace the dangerous shipping of oil and gas on trucks: “What is most important is accelerating approvals for transmission and of both fuels and electricity. Reflex opposition to anything involving hydrocarbons in the environmental community is counterproductive, not only to the economy but to their own objectives.”

This plays into his nuanced view about when and how much governments should intervene in capitalism: “I’ve always believed the best generals are the ones that are most troubled by war and most skeptical about the military and violence as a tool. They’re reluctant warriors, but willing to fight if necessary.”

He adds: “For too long, we’ve had a sterile debate between those who ideologically oppose any policies that distort the perfectly free market and the Curtis LeMays of industrial policy who rush to seize on any argument for the government to take a role in the production of goods and services. What we need is a reluctant warrior approach on policies that promote specific industries and policies.”

Summers is furthermore championing a kind of federal Marshall Plan for countering the next pandemic, which he sees arriving within 10 to 15 years: “The pandemic risk is on the same order of magnitude as climate risk, but it’s not getting nearly the level of attention that it should,” he told me. “For pittances of tens of billions of dollars, relative to the tens of trillions that COVID has cost, we could be in a better position to act next time.” Summers wants a federal program that pays vaccine makers to build plants prepared for an outbreak that could sit idle for years; supports “scientific capacity to make vaccines quickly”; amasses big stockpiles of masks, syringes, and other equipment; and develops an infrastructure for screening.

As for his hobbies, Summers says he’s a frequent golfer at the Country Club in Brookline. Though he sports a 19 handicap, he quips: “The only aspect of the golf game I’m good at is doing a probabilistic analysis of whether it’s better to shoot over the creek or around the creek. Unfortunately, I’m not very good at swinging a golf club, which is a rather more important skill.” As for tennis, hours spent pounding balls against a backboard as a kid forged the reliable baseline game that he marshals at the famed Longwood Cricket Club. “On a physique and age-adjusted basis, I’m actually a very good tennis player, based on those reliable groundstrokes,” he declares. “On an absolute age-adjusted basis, I’m not bad.”

And of course, there’s one hobby that no economist can fully give up: worrying about the future. Summers frets that the legacy from the trillions in COVID relief spending he was so foresighted in criticizing, “may limit the resources available for the public investment needed for fighting secular stagnation. We’re like a family that borrowed a lot for its vacation rather than to fix its roof or expand its house. We have our debt and only memories of the party we had.” The aftermath of all that recklessness is the big inflation that Summers presciently saw coming. Now he’s making another contrarian call we should all heed on the sacrifices needed to fix it.