2023年伊始,有關(guān)裁員計劃的諸多新聞,,似乎成為美國社會關(guān)注的首要問題,。從科技行業(yè)開始的裁員潮,現(xiàn)在似乎蔓延到其他行業(yè),,高盛集團(Goldman Sachs)上周剛剛宣布將進行大規(guī)模裁員,。

這足以令普通上班族對自己的工作安全感到擔憂,尤其是許多專家預(yù)測美國今年將陷入經(jīng)濟衰退,。

盡管裁員的消息占據(jù)了媒體頭條,,但從美國的就業(yè)數(shù)據(jù)中,卻看不出美國正在發(fā)生大規(guī)模裁員,。失業(yè)率依舊很低,。美國勞工統(tǒng)計局(Bureau of Labor Statistics)的數(shù)據(jù)顯示,2022年11月的裁員和解雇人數(shù)約為140萬人,。這似乎是一個很龐大的數(shù)字,,然而過去兩年,盡管各大媒體紛紛呼號未來一片黑暗,,但美國的失業(yè)人數(shù)基本上維持穩(wěn)定,,沒有出現(xiàn)大規(guī)模增長。

Indeed Hiring Lab的北美區(qū)經(jīng)濟研究總監(jiān)尼克·邦克最近對《財富》雜志表示,,實際上與新冠疫情之前相比,,裁員率較低。以建筑業(yè)為例,。過去六個月,,建筑行業(yè)的平均裁員率為1.8%,是整個經(jīng)濟體綜合裁員率的兩倍以上,。但這低于2019年2.9%的平均裁員率,。

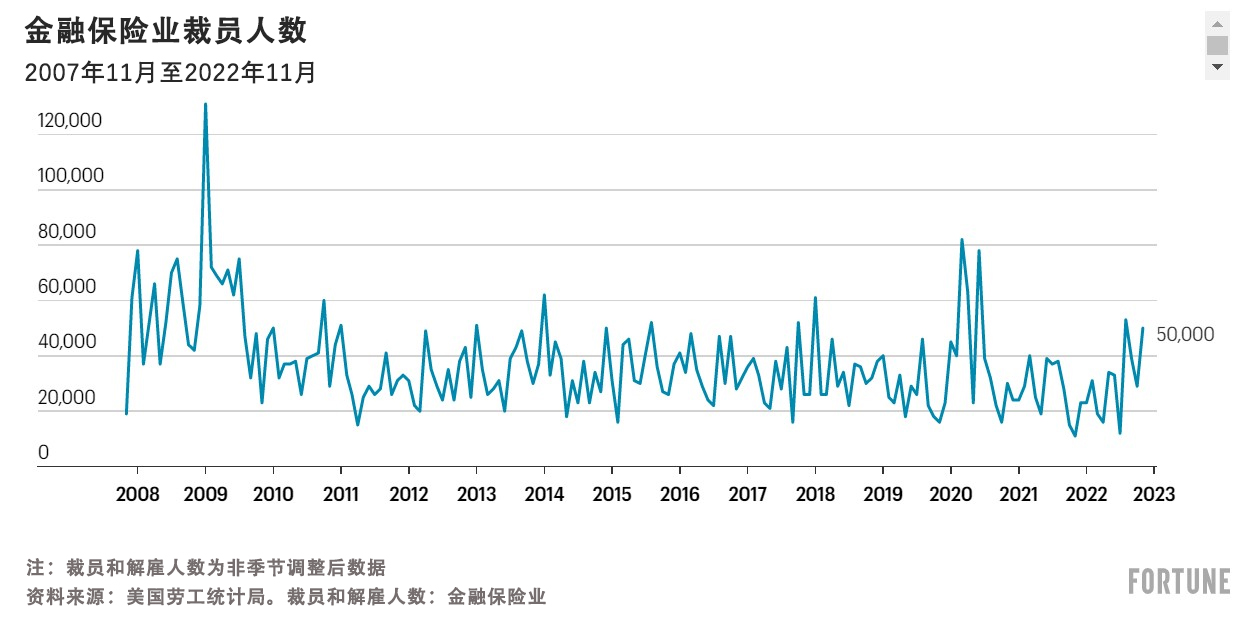

在某些行業(yè),裁員和解雇人數(shù)可能發(fā)生變化。例如,,從2022年10月到11月,,金融保險業(yè)裁員人數(shù)增加了約19,000人。增長幅度確實較大,,但并不是過去三年該行業(yè)裁員人數(shù)漲幅最大的一次,。

科技行業(yè)在美國總體就業(yè)人口中所占的“比例較小”。因此,,顯然其他非科技公司在裁員方面的表現(xiàn)可能更好,。此外,1月16日發(fā)布的高盛經(jīng)濟研究報告顯示,,科技行業(yè)在過去20年經(jīng)歷的多次大規(guī)模裁員,,并不能代表整體經(jīng)濟趨勢。

公平地說,,現(xiàn)在更準確的說法是,,數(shù)據(jù)并未顯示裁員人數(shù)高漲。有專家指出,,許多公司,,尤其是科技公司,在裁員時會提前幾周發(fā)布通知,,并提供最長六個月的離職補償,。這意味著與裁員有關(guān)的數(shù)據(jù)可能滯后,等到這些被裁員工正式從公司的工資單中消失后才會有所體現(xiàn),。這可能導(dǎo)致數(shù)據(jù)滯后,。

但高盛分析師最近評估了根據(jù)《工人調(diào)整和再培訓(xùn)通知法案》(Worker Adjustment and Retraining Notification)發(fā)布的提前裁員通知,雖然最近有更多公司發(fā)布這類通知,,但依舊“略低于新冠疫情之前已經(jīng)處于歷史低位的比例”,。有趣的是,高盛發(fā)現(xiàn),,許多最近失業(yè)的上班族以“健康的速度”找到了新工作,。

高盛的分析師說道:“上述這些趨勢表明,目前,,勞動力市場可能會繼續(xù)致力于再平衡,,再平衡的主要方法迄今為止是有益的?!保ㄘ敻恢形木W(wǎng))

譯者:劉進龍

審校:汪皓

2023年伊始,,有關(guān)裁員計劃的諸多新聞,似乎成為美國社會關(guān)注的首要問題,。從科技行業(yè)開始的裁員潮,,現(xiàn)在似乎蔓延到其他行業(yè),,高盛集團(Goldman Sachs)上周剛剛宣布將進行大規(guī)模裁員。

這足以令普通上班族對自己的工作安全感到擔憂,,尤其是許多專家預(yù)測美國今年將陷入經(jīng)濟衰退,。

盡管裁員的消息占據(jù)了媒體頭條,但從美國的就業(yè)數(shù)據(jù)中,,卻看不出美國正在發(fā)生大規(guī)模裁員,。失業(yè)率依舊很低。美國勞工統(tǒng)計局(Bureau of Labor Statistics)的數(shù)據(jù)顯示,,2022年11月的裁員和解雇人數(shù)約為140萬人,。這似乎是一個很龐大的數(shù)字,然而過去兩年,,盡管各大媒體紛紛呼號未來一片黑暗,,但美國的失業(yè)人數(shù)基本上維持穩(wěn)定,沒有出現(xiàn)大規(guī)模增長,。

Indeed Hiring Lab的北美區(qū)經(jīng)濟研究總監(jiān)尼克·邦克最近對《財富》雜志表示,,實際上與新冠疫情之前相比,,裁員率較低,。以建筑業(yè)為例。過去六個月,,建筑行業(yè)的平均裁員率為1.8%,,是整個經(jīng)濟體綜合裁員率的兩倍以上。但這低于2019年2.9%的平均裁員率,。

在某些行業(yè),,裁員和解雇人數(shù)可能發(fā)生變化。例如,,從2022年10月到11月,,金融保險業(yè)裁員人數(shù)增加了約19,000人。增長幅度確實較大,,但并不是過去三年該行業(yè)裁員人數(shù)漲幅最大的一次,。

科技行業(yè)在美國總體就業(yè)人口中所占的“比例較小”。因此,,顯然其他非科技公司在裁員方面的表現(xiàn)可能更好,。此外,1月16日發(fā)布的高盛經(jīng)濟研究報告顯示,,科技行業(yè)在過去20年經(jīng)歷的多次大規(guī)模裁員,,并不能代表整體經(jīng)濟趨勢。

公平地說,,現(xiàn)在更準確的說法是,,數(shù)據(jù)并未顯示裁員人數(shù)高漲。有專家指出,許多公司,,尤其是科技公司,,在裁員時會提前幾周發(fā)布通知,并提供最長六個月的離職補償,。這意味著與裁員有關(guān)的數(shù)據(jù)可能滯后,,等到這些被裁員工正式從公司的工資單中消失后才會有所體現(xiàn)。這可能導(dǎo)致數(shù)據(jù)滯后,。

但高盛分析師最近評估了根據(jù)《工人調(diào)整和再培訓(xùn)通知法案》(Worker Adjustment and Retraining Notification)發(fā)布的提前裁員通知,,雖然最近有更多公司發(fā)布這類通知,但依舊“略低于新冠疫情之前已經(jīng)處于歷史低位的比例”,。有趣的是,,高盛發(fā)現(xiàn),許多最近失業(yè)的上班族以“健康的速度”找到了新工作,。

高盛的分析師說道:“上述這些趨勢表明,,目前,勞動力市場可能會繼續(xù)致力于再平衡,,再平衡的主要方法迄今為止是有益的,。”(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

News of upcoming layoffs seems to dominate the landscape as the U.S. rings in 2023. What started in the tech sector now seems to be gaining momentum in other industries, with Goldman Sachs announcing a major round of cuts just last week.

It’s enough to give the average worker more than a bit of anxiety about their own job security, especially given that many experts have predicted the U.S. will enter a recession this year.

But for all the headlines, national employment data isn’t backing up the story of massive layoffs. Unemployment is still fairly low. And in November 2022, there were about 1.4 million layoffs and discharges, according to data from the Bureau of Labor Statistics. Now, that may sound like a lot, but that number has remained relatively flat throughout the last two years—essentially with no real massive shifts upward even as the headlines scream doom and gloom.

Layoff rates are actually low compared to pre-pandemic years, Nick Bunker, economic research director for North America at the Indeed Hiring Lab, recently told?Fortune. Take the construction industry, for example. Over the past six months, the average layoff rate in the construction sector was 1.8%, which is more than double the aggregate rate for the whole economy. But that's less than the 2.9% average layoff rate in 2019.

Within specific industries, layoffs and discharges can vary. The finance and insurance sector, for example, had an increase of about 19,000 layoffs from October to November 2022. It’s a jump, to be sure, but it’s not even the biggest spike seen in the last three years.

And the tech sector accounts for a “small share” of overall U.S. employment. So it stands to reason that other non-tech companies are perhaps doing better on the layoff front. Further, this particular sector has experienced many spikes in layoffs over the last 20 years that were not reflective of broader economic trends, according to a Goldman Sachs economic research report published on January 16.

Now, to be fair, it’s probably most accurate to say data isn’t showing a spike in layoffs yet. Some experts point to the fact that many companies, particularly in tech, provide several weeks of notice when it comes to layoffs and severance packages of up to six months. That means the data around discharges may be delayed until after those employees officially exit the payroll. That may be contributing to a lag in the data.

But then again, Goldman analysts recently reviewed advance layoff notices filed under the Worker Adjustment and Retraining Notification (WARN) Act and found that while these filings have ticked up recently, they remain a “bit below the already historically low pre-pandemic rate.” Interestingly, Goldman found that many recently unemployed workers have managed to find new jobs at a “healthy pace.”

“The trends above suggest that, for now, the labor market is likely to continue to rebalance mainly in the favorable way it has so far,” Goldman analysts write.