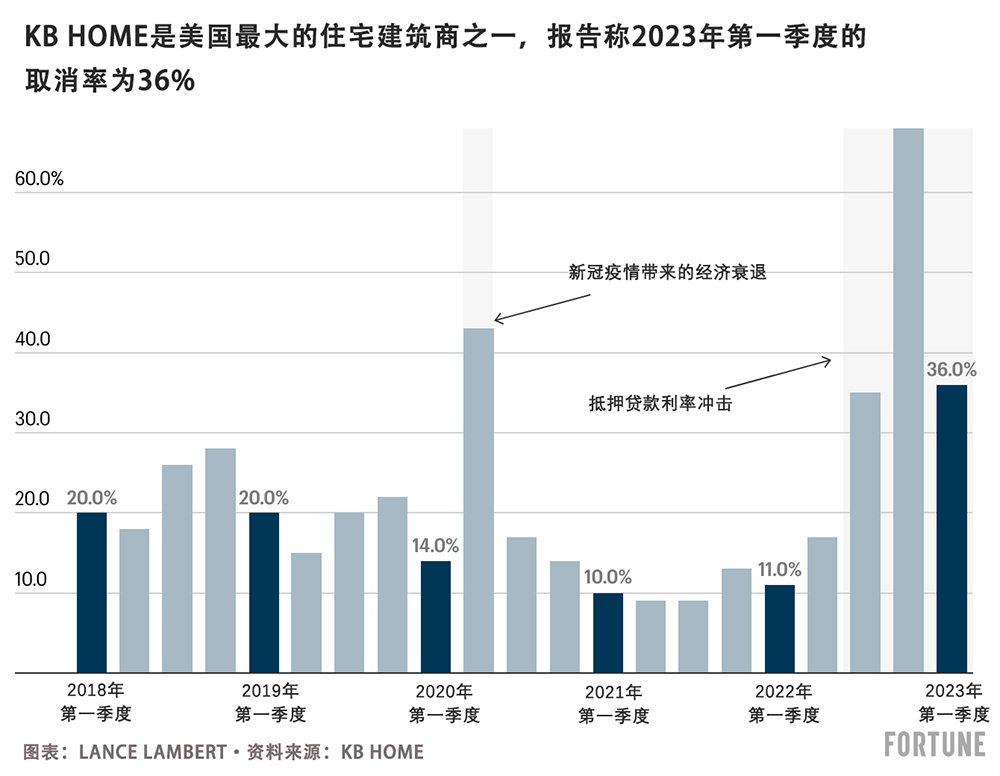

2022年9月,,美聯(lián)儲(Federal Reserve)的主席杰羅姆·鮑威爾承認,,去年的抵押貸款利率沖擊將導致美國房地產市場經歷“艱難的(房地產)修正”。房屋建筑商的收益表明他的說法是正確的:在2022年第四季度,,KB Home的買家取消率飆升至68%,。這一數(shù)字使這家上市住宅建筑商前一年13%的取消率顯得微不足道。這也超過了該行業(yè)在2008年金融危機最黑暗時期47%的取消率峰值,。

但風暴最糟糕的時候可能已經過去了,。至少對建筑商來說是這樣,。

3月22日,KB Home報告稱,,2023年第一季度的取消率為36%,。一方面,取消購房合同的比率仍然很高,。另一方面,,這比上季度68%的比率有所下降,這表明建筑商采取的激勵措施(例如抵押貸款利率折扣)以及房價下調正在慢慢讓購房者回流,。

“在本季度進入春季銷售旺季時,,我們開始看到住房需求增加。這部分反映了我們部署的有針對性的銷售策略,,以及穩(wěn)定的抵押貸款利率環(huán)境,。因此,我們在1月和2月實現(xiàn)了凈訂單量的連續(xù)增加,,而且凈訂單在3月的前幾周仍然保持強勁,。盡管利率依舊較高,經濟仍然存在很大的不確定性,,但這一進展讓我們備受鼓舞,。”KB Home的首席執(zhí)行官杰弗里·梅茨格爾在3月22日告訴投資者,。

在公開上市的住宅建筑商中,,KB Home在所謂的房地產修正中受到的打擊最大。原因是KB Home的新住宅社區(qū)高度集中在過熱的西部市場,,那里的房價回調尤為劇烈,。

為什么KB Home的取消率會下降得如此之快?

具體答案是:在新冠疫情房地產熱潮(Pandemic Housing Boom)期間,,住房需求似乎是無止境的,像KB Home這樣的建筑商在迅速提高新房價格后獲得了豐厚的利潤,。這一點大有裨益:去年房價暴跌,,KB Home等建筑商由于之前的積累,,贏得了喘息的機會,可以降低利潤率(即降價和/或提供給力的抵押貸款利率折扣),,以尋找市場,,或者等待買家需求恢復后房價上漲,。

KB Home的取消率下降表明該建筑商正在“尋找市場”,。KB Home并不是唯一一家取消率下降的公司:全美各地的房屋建筑商都看到取消率有所下降,。

約翰伯恩斯房地產咨詢公司(John Burns Real Estate Consulting)今年2月調查的建筑商的總取消率為10.8%,。這遠低于2022年10月24.6%的峰值,,僅略高于2022年2月新冠疫情房地產熱潮時7.3%的峰值。

簡而言之:房屋建筑商的取消率正在迅速恢復正常值,。

萊納公司(Lennar)的執(zhí)行總裁斯圖爾特·米勒在今年3月的早些時候對投資者表示:“我們的毛利率下降了……因為我們調整了新房銷售和待售房屋的價格,,以盡快完成交付并降低取消率,?!?/p>

通過這些激勵措施和降價措施,萊納公司第一季度房屋銷售毛利率從26.9%降至21.2%,。

“如今,在大多數(shù)情況下,,建筑商都不得不采取降價策略,。我們認為在全國范圍內,,新房價格(扣除優(yōu)惠政策)比峰值下降了約10%。已經沒有多少降價空間了,?!奔s翰伯恩斯房地產咨詢公司的研究主管小里克·帕拉西奧斯在今年2月發(fā)布的一段視頻里說。

不像房屋建筑商需要降價以出售未售出的庫存,,現(xiàn)有房主通常反對采取降價措施,。這種阻力就是現(xiàn)房價格通常在房地產市場低迷時最后觸底的原因,。

“不過,我們仍然認為,,在轉售方面,,(房屋)價格將出現(xiàn)更多的修正。當涉及到(房屋)價格時,,轉售市場中房價下調粘性較強,?!迸晾鲓W斯說道,。(財富中文網)

譯者:中慧言-王芳

2022年9月,美聯(lián)儲(Federal Reserve)的主席杰羅姆·鮑威爾承認,去年的抵押貸款利率沖擊將導致美國房地產市場經歷“艱難的(房地產)修正”,。房屋建筑商的收益表明他的說法是正確的:在2022年第四季度,,KB Home的買家取消率飆升至68%,。這一數(shù)字使這家上市住宅建筑商前一年13%的取消率顯得微不足道,。這也超過了該行業(yè)在2008年金融危機最黑暗時期47%的取消率峰值,。

但風暴最糟糕的時候可能已經過去了,。至少對建筑商來說是這樣,。

3月22日,,KB Home報告稱,,2023年第一季度的取消率為36%,。一方面,,取消購房合同的比率仍然很高,。另一方面,,這比上季度68%的比率有所下降,這表明建筑商采取的激勵措施(例如抵押貸款利率折扣)以及房價下調正在慢慢讓購房者回流,。

“在本季度進入春季銷售旺季時,,我們開始看到住房需求增加,。這部分反映了我們部署的有針對性的銷售策略,以及穩(wěn)定的抵押貸款利率環(huán)境,。因此,,我們在1月和2月實現(xiàn)了凈訂單量的連續(xù)增加,而且凈訂單在3月的前幾周仍然保持強勁,。盡管利率依舊較高,,經濟仍然存在很大的不確定性,,但這一進展讓我們備受鼓舞?!盞B Home的首席執(zhí)行官杰弗里·梅茨格爾在3月22日告訴投資者,。

在公開上市的住宅建筑商中,,KB Home在所謂的房地產修正中受到的打擊最大。原因是KB Home的新住宅社區(qū)高度集中在過熱的西部市場,,那里的房價回調尤為劇烈。

為什么KB Home的取消率會下降得如此之快,?

具體答案是:在新冠疫情房地產熱潮(Pandemic Housing Boom)期間,,住房需求似乎是無止境的,像KB Home這樣的建筑商在迅速提高新房價格后獲得了豐厚的利潤,。這一點大有裨益:去年房價暴跌,,KB Home等建筑商由于之前的積累,贏得了喘息的機會,,可以降低利潤率(即降價和/或提供給力的抵押貸款利率折扣),,以尋找市場,,或者等待買家需求恢復后房價上漲,。

KB Home的取消率下降表明該建筑商正在“尋找市場”。KB Home并不是唯一一家取消率下降的公司:全美各地的房屋建筑商都看到取消率有所下降,。

約翰伯恩斯房地產咨詢公司(John Burns Real Estate Consulting)今年2月調查的建筑商的總取消率為10.8%,。這遠低于2022年10月24.6%的峰值,僅略高于2022年2月新冠疫情房地產熱潮時7.3%的峰值,。

簡而言之:房屋建筑商的取消率正在迅速恢復正常值,。

萊納公司(Lennar)的執(zhí)行總裁斯圖爾特·米勒在今年3月的早些時候對投資者表示:“我們的毛利率下降了……因為我們調整了新房銷售和待售房屋的價格,,以盡快完成交付并降低取消率?!?/p>

通過這些激勵措施和降價措施,,萊納公司第一季度房屋銷售毛利率從26.9%降至21.2%,。

“如今,,在大多數(shù)情況下,建筑商都不得不采取降價策略,。我們認為在全國范圍內,,新房價格(扣除優(yōu)惠政策)比峰值下降了約10%,。已經沒有多少降價空間了,?!奔s翰伯恩斯房地產咨詢公司的研究主管小里克·帕拉西奧斯在今年2月發(fā)布的一段視頻里說,。

不像房屋建筑商需要降價以出售未售出的庫存,,現(xiàn)有房主通常反對采取降價措施,。這種阻力就是現(xiàn)房價格通常在房地產市場低迷時最后觸底的原因,。

“不過,我們仍然認為,,在轉售方面,,(房屋)價格將出現(xiàn)更多的修正。當涉及到(房屋)價格時,,轉售市場中房價下調粘性較強,。”帕拉西奧斯說道,。(財富中文網)

譯者:中慧言-王芳

In September, Fed Chair Jerome Powell acknowledged that last year’s mortgage rate shock would cause the U.S. housing market to pass through a “difficult [housing] correction.” Homebuilders’ earnings showed he was correct: In the fourth quarter of 2022, KB Home’s buyer cancellation rate spiked to 68%. That figure dwarfed the publicly traded homebuilder’s 13% cancellation rate from the previous year’s period. It also surpassed the industry’s peak cancellation rate of 47% during the darkest days of the 2008-era crash.

But the worst of the storm might be behind us. At least for builders.

On March 22, KB Home reported that its cancellation rate was 36% in the first quarter of 2023. On one hand, that’s still an elevated share of sales under contract being cancelled. On the other hand, it’s a deceleration from the 68% rate last quarter, and a sign that aggressive builder incentives, like mortgage rate buydowns, alongside home price reductions are slowly bringing back buyers.

“As we entered the spring selling season during the quarter, we began to see an increase in [housing] demand. This reflected in part the targeted sales strategies we deployed, together with a stabilizing mortgage interest rate environment. As a result, we achieved a sequential improvement in our net orders in both January and February, and net orders have remained strong in the early weeks of March. Although there are still considerable interest rates and economic uncertainties, we are encouraged by this progression,” Jeffrey Mezger, CEO of KB Home, told investors on March 22.

Among publicly traded homebuilders, KB Home got hit the hardest by the so-called housing correction. The reason being that KB Home has a high concentration of its new home communities in overheated Western markets where the housing correction has been particularly sharp.

Why did KB Home’s cancellation rate drop so quickly?

Here’s the long winded answer: During the Pandemic Housing Boom—a time with seemingly unlimited housing demand—builders like KB Home achieved frothy profit margins as they quickly raised new house prices. That came in handy: As the housing market slumped last year, builders like KB Home had the breathing room to reduce margins (i.e. cutting prices and/or aggressive rate buydowns) in pursuit of finding the market, or the price point at which buyer demand would return.

The drop in KB Home’s cancellation rate suggests the builder is, well, “finding the market.” And the firm isn’t alone: Homebuilders across the country are seeing their cancellation rates improve.

Builders surveyed by John Burns Real Estate Consulting in February had an aggregate cancellation rate of 10.8%. That’s far below the peak of 24.6% hit in October, and just slightly above the 7.3% hit at the height of?the Pandemic Housing Boom in February 2022.

Simply put: Homebuilder cancellation rates are normalizing—quickly.

“Our gross margin declined… as we adjusted the price of both our new home sales and homes in [the] backlog to market to promote deliveries and reduce cancellation rates,” Stuart Miller, executive chairman of Lennar, told investors in earlier March.

By offering those incentives and price cuts, Lennar’s first quarter gross profit margin on home sales declined from 26.9% to 21.2%.

“Builders have taken their medicine for the most part right now on pricing. And we think nationally, home prices—on the new-home side, net of incentives—are down about 10% from peak,” Rick Palacios Jr., head of research at John Burns Real Estate Consulting, said in a video posted in February. “There’s probably not a ton of runway there left.”

Unlike homebuilders, who need to cut prices in order to move unsold inventory, existing homeowners are usually more resistant to such cuts. That resistance is why existing-home prices usually bottom out last in a housing market downturn.

“We still think that there’s more [home] price correction to come on the resale side, though. And the resale market is always stickier to the downside when it comes to [home] prices,” says Palacios.