股東們對(duì)日本企業(yè)巨頭之一的進(jìn)展表示不滿。

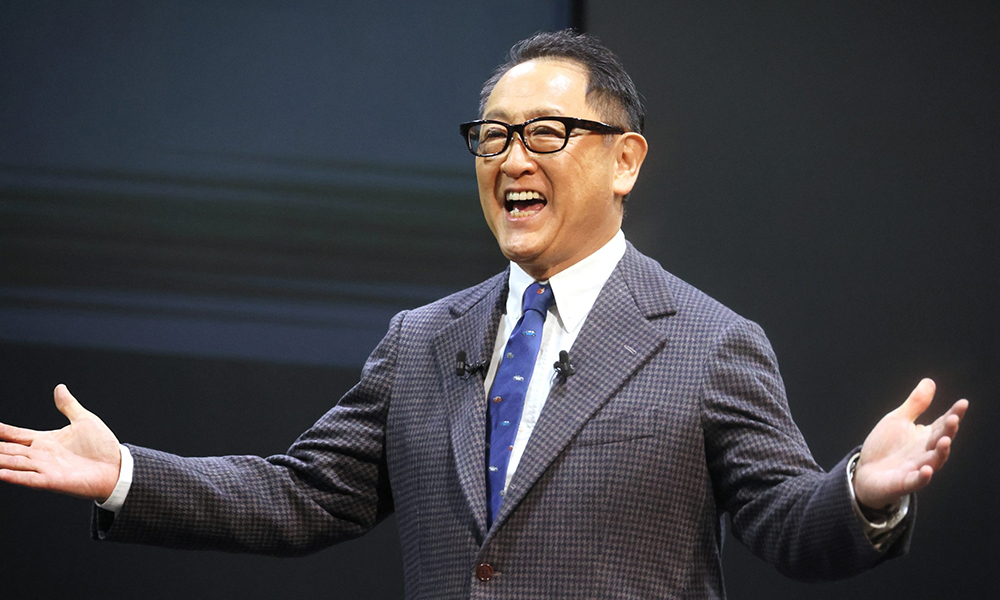

豐田汽車(Toyota Motor Corp.)現(xiàn)任董事長(zhǎng)豐田章男曾擔(dān)任總裁兼首席執(zhí)行官近14年,,直到今年早些時(shí)候才卸任,。在豐田章男的領(lǐng)導(dǎo)下,豐田在2020年首次成為全球最大的汽車制造商,。

但在日本時(shí)間周三上午召開(kāi)股東大會(huì)時(shí),,一些豐田的股東,如紐約州審計(jì)長(zhǎng)辦公室(管理該市養(yǎng)老基金)和加州公務(wù)員退休基金(Calpers),,將提議罷免豐田章男(豐田汽車創(chuàng)始人的孫子),。

原因是:豐田章男——以及豐田公司——在電動(dòng)汽車方面進(jìn)展緩慢。雖然該公司在銷售混合動(dòng)力汽車方面仍處于領(lǐng)先地位,,但在制造純電動(dòng)汽車方面如今只是在盡力追趕福特(Ford)和通用汽車(General Motors)等老牌公司,,以及特斯拉(Tesla)或中國(guó)比亞迪(BYD)等新來(lái)者。

紐約市審計(jì)長(zhǎng)布拉德·蘭德(Brad Lander)對(duì)《華爾街日?qǐng)?bào)》表示:“豐田未能像其同行一樣,,及時(shí)轉(zhuǎn)向,,擁抱電動(dòng)汽車”。

這兩家養(yǎng)老基金還認(rèn)為,,該公司董事會(huì)缺少獨(dú)立董事,,它們都投票支持一項(xiàng)單獨(dú)的決議,要求該公司更多地披露在氣候變化問(wèn)題上的游說(shuō)活動(dòng)信息,。

雖然這一提案不大可能通過(guò),,但《華爾街日?qǐng)?bào)》指出,在日本企業(yè)文化中,,即使只有部分股東持反對(duì)意見(jiàn),,也很罕見(jiàn)。去年豐田章男被重新提名為董事會(huì)成員,,贏得了96%的支持率,。

“即使在如此艱難的商業(yè)環(huán)境中,董事長(zhǎng)豐田章男也一直在從長(zhǎng)遠(yuǎn)的角度出發(fā)來(lái)增強(qiáng)我們的競(jìng)爭(zhēng)力,?!惫景l(fā)言人告訴《華爾街日?qǐng)?bào)》。

豐田和電動(dòng)汽車

與福特的吉姆?法利(Jim Farley),、通用汽車的瑪麗?巴拉(Mary Barra),、特斯拉的埃隆?馬斯克(Elon Musk)等高管不同,豐田章男在擔(dān)任首席執(zhí)行官的最后幾個(gè)月里,,對(duì)電動(dòng)汽車公開(kāi)持懷疑態(tài)度,。

去年12月,豐田章男抱怨說(shuō),,公眾壓力正阻止高管們——他稱之為“沉默的大多數(shù)”——誠(chéng)實(shí)談?wù)撾妱?dòng)汽車,,他們只能聲稱電動(dòng)汽車是“唯一的選擇”。

他暗示:“他們認(rèn)為這是趨勢(shì),所以不敢大聲表述自己的觀點(diǎn),?!?/p>

今年1月,豐田汽車宣布,,豐田章男將辭去總裁職務(wù),,由時(shí)任豐田汽車旗下豪華品牌雷克薩斯(Lexus)負(fù)責(zé)人佐藤恒治(Koji Sato)接任?!霸跀?shù)字化,、電動(dòng)汽車和聯(lián)網(wǎng)汽車方面,我沒(méi)有跟上潮流,?!必S田章男當(dāng)時(shí)表示,。

佐藤恒治于今年4月接任總裁,,并宣布豐田將迅速擴(kuò)大電動(dòng)汽車供應(yīng),到2026年發(fā)布10款新車型,。

然而,,投資者擔(dān)心豐田仍未認(rèn)真對(duì)待向電動(dòng)汽車的轉(zhuǎn)型,并指出該公司仍未給出實(shí)現(xiàn)全電動(dòng)汽車的確切日期,。在電動(dòng)汽車方面的緩慢進(jìn)展也意味著該公司沒(méi)有把握好中國(guó)等大型市場(chǎng)對(duì)電動(dòng)汽車日益增長(zhǎng)的需求,,而且還錯(cuò)過(guò)了美國(guó)和歐盟提供的新補(bǔ)貼。

丹麥基金AkademikerPension的首席投資官安德斯·舍爾德(Anders Schelde)對(duì)《華爾街日?qǐng)?bào)》表示:“豐田的電動(dòng)汽車戰(zhàn)略看起來(lái)根本沒(méi)有吸引力,?!?/p>

信心危機(jī)

對(duì)豐田汽車電動(dòng)汽車戰(zhàn)略的擔(dān)憂,是日本汽車業(yè)更廣泛的信心危機(jī)的一部分,。

今年早些時(shí)候,,中國(guó)超過(guò)日本成為世界上最大的汽車出口國(guó),部分原因是中國(guó)制造的電動(dòng)汽車出口激增,。特斯拉中國(guó)上海超級(jí)工廠交付量占全球一半,,而總部位于深圳的比亞迪也在探索出口機(jī)會(huì)。

由于消費(fèi)者涌向電動(dòng)汽車(無(wú)論是本土汽車制造商自產(chǎn)的還是特斯拉生產(chǎn)的),,日本汽車品牌在中國(guó)國(guó)內(nèi)市場(chǎng)的占有率在下降,。

不僅僅是日本汽車制造商對(duì)中國(guó)感到不安。歐洲的汽車高管們也很擔(dān)心:畢馬威中國(guó)首席經(jīng)濟(jì)學(xué)家康勇(Kevin Kang)向《南華早報(bào)》(South China Morning Post)表示,,到2025年,,中國(guó)制造的電動(dòng)汽車可能占據(jù)歐洲市場(chǎng)的15%,而去年這一比例還不到10%,。

今年5月,,標(biāo)致(Peugeot)首席執(zhí)行官琳達(dá)?杰克遜(Linda Jackson)在英國(guó)《金融時(shí)報(bào)》的一次會(huì)議上表示,電動(dòng)汽車價(jià)格面臨的“最大威脅”是“中國(guó)電動(dòng)汽車的到來(lái)”。

她說(shuō):“中國(guó)電動(dòng)汽車物美價(jià)廉,?!保ㄘ?cái)富中文網(wǎng))

譯者:中慧言-王芳

股東們對(duì)日本企業(yè)巨頭之一的進(jìn)展表示不滿。

豐田汽車(Toyota Motor Corp.)現(xiàn)任董事長(zhǎng)豐田章男曾擔(dān)任總裁兼首席執(zhí)行官近14年,,直到今年早些時(shí)候才卸任,。在豐田章男的領(lǐng)導(dǎo)下,豐田在2020年首次成為全球最大的汽車制造商,。

但在日本時(shí)間周三上午召開(kāi)股東大會(huì)時(shí),,一些豐田的股東,如紐約州審計(jì)長(zhǎng)辦公室(管理該市養(yǎng)老基金)和加州公務(wù)員退休基金(Calpers),,將提議罷免豐田章男(豐田汽車創(chuàng)始人的孫子),。

原因是:豐田章男——以及豐田公司——在電動(dòng)汽車方面進(jìn)展緩慢。雖然該公司在銷售混合動(dòng)力汽車方面仍處于領(lǐng)先地位,,但在制造純電動(dòng)汽車方面如今只是在盡力追趕福特(Ford)和通用汽車(General Motors)等老牌公司,,以及特斯拉(Tesla)或中國(guó)比亞迪(BYD)等新來(lái)者。

紐約市審計(jì)長(zhǎng)布拉德·蘭德(Brad Lander)對(duì)《華爾街日?qǐng)?bào)》表示:“豐田未能像其同行一樣,,及時(shí)轉(zhuǎn)向,,擁抱電動(dòng)汽車”。

這兩家養(yǎng)老基金還認(rèn)為,,該公司董事會(huì)缺少獨(dú)立董事,,它們都投票支持一項(xiàng)單獨(dú)的決議,要求該公司更多地披露在氣候變化問(wèn)題上的游說(shuō)活動(dòng)信息,。

雖然這一提案不大可能通過(guò),,但《華爾街日?qǐng)?bào)》指出,在日本企業(yè)文化中,,即使只有部分股東持反對(duì)意見(jiàn),,也很罕見(jiàn)。去年豐田章男被重新提名為董事會(huì)成員,,贏得了96%的支持率,。

“即使在如此艱難的商業(yè)環(huán)境中,董事長(zhǎng)豐田章男也一直在從長(zhǎng)遠(yuǎn)的角度出發(fā)來(lái)增強(qiáng)我們的競(jìng)爭(zhēng)力,?!惫景l(fā)言人告訴《華爾街日?qǐng)?bào)》。

豐田和電動(dòng)汽車

與福特的吉姆?法利(Jim Farley),、通用汽車的瑪麗?巴拉(Mary Barra),、特斯拉的埃隆?馬斯克(Elon Musk)等高管不同,豐田章男在擔(dān)任首席執(zhí)行官的最后幾個(gè)月里,,對(duì)電動(dòng)汽車公開(kāi)持懷疑態(tài)度,。

去年12月,,豐田章男抱怨說(shuō),公眾壓力正阻止高管們——他稱之為“沉默的大多數(shù)”——誠(chéng)實(shí)談?wù)撾妱?dòng)汽車,,他們只能聲稱電動(dòng)汽車是“唯一的選擇”,。

他暗示:“他們認(rèn)為這是趨勢(shì),所以不敢大聲表述自己的觀點(diǎn),?!?/p>

今年1月,豐田汽車宣布,,豐田章男將辭去總裁職務(wù),,由時(shí)任豐田汽車旗下豪華品牌雷克薩斯(Lexus)負(fù)責(zé)人佐藤恒治(Koji Sato)接任?!霸跀?shù)字化,、電動(dòng)汽車和聯(lián)網(wǎng)汽車方面,我沒(méi)有跟上潮流,?!必S田章男當(dāng)時(shí)表示。

佐藤恒治于今年4月接任總裁,,并宣布豐田將迅速擴(kuò)大電動(dòng)汽車供應(yīng),,到2026年發(fā)布10款新車型,。

然而,,投資者擔(dān)心豐田仍未認(rèn)真對(duì)待向電動(dòng)汽車的轉(zhuǎn)型,并指出該公司仍未給出實(shí)現(xiàn)全電動(dòng)汽車的確切日期,。在電動(dòng)汽車方面的緩慢進(jìn)展也意味著該公司沒(méi)有把握好中國(guó)等大型市場(chǎng)對(duì)電動(dòng)汽車日益增長(zhǎng)的需求,,而且還錯(cuò)過(guò)了美國(guó)和歐盟提供的新補(bǔ)貼。

丹麥基金AkademikerPension的首席投資官安德斯·舍爾德(Anders Schelde)對(duì)《華爾街日?qǐng)?bào)》表示:“豐田的電動(dòng)汽車戰(zhàn)略看起來(lái)根本沒(méi)有吸引力,?!?/p>

信心危機(jī)

對(duì)豐田汽車電動(dòng)汽車戰(zhàn)略的擔(dān)憂,是日本汽車業(yè)更廣泛的信心危機(jī)的一部分,。

今年早些時(shí)候,,中國(guó)超過(guò)日本成為世界上最大的汽車出口國(guó),部分原因是中國(guó)制造的電動(dòng)汽車出口激增,。特斯拉中國(guó)上海超級(jí)工廠交付量占全球一半,,而總部位于深圳的比亞迪也在探索出口機(jī)會(huì)。

由于消費(fèi)者涌向電動(dòng)汽車(無(wú)論是本土汽車制造商自產(chǎn)的還是特斯拉生產(chǎn)的),,日本汽車品牌在中國(guó)國(guó)內(nèi)市場(chǎng)的占有率在下降,。

不僅僅是日本汽車制造商對(duì)中國(guó)感到不安。歐洲的汽車高管們也很擔(dān)心:畢馬威中國(guó)首席經(jīng)濟(jì)學(xué)家康勇(Kevin Kang)向《南華早報(bào)》(South China Morning Post)表示,,到2025年,,中國(guó)制造的電動(dòng)汽車可能占據(jù)歐洲市場(chǎng)的15%,,而去年這一比例還不到10%。

今年5月,,標(biāo)致(Peugeot)首席執(zhí)行官琳達(dá)?杰克遜(Linda Jackson)在英國(guó)《金融時(shí)報(bào)》的一次會(huì)議上表示,,電動(dòng)汽車價(jià)格面臨的“最大威脅”是“中國(guó)電動(dòng)汽車的到來(lái)”。

她說(shuō):“中國(guó)電動(dòng)汽車物美價(jià)廉,?!保ㄘ?cái)富中文網(wǎng))

譯者:中慧言-王芳

One of the titans of corporate Japan is facing unhappy shareholders.

Toyota Motor Corp.’s current board chairman, Akio Toyoda, served as president and CEO for almost 14 years, only stepping down earlier this year. Under Toyoda’s leadership, Toyota rose to be the world’s largest automaker, first achieving that status in 2020.

But when shareholders convene on Wednesday morning Japan time, several of Toyota’s shareholders, like the New York City comptroller’s office (which manages the city’s pension fund) and the California Public Employees’ Retirement System (Calpers), will support a measure to oust Toyoda—who is the grandson of the company’s founder—from the board.

The reason: Toyota—and Toyoda’s—slow embrace of electric cars. While the company still leads in selling hybrid cars, it’s only now playing catch-up when it comes to making pure electric vehicles, both to established companies like Ford and General Motors and newcomers like Tesla or China’s BYD.

“Toyota is failing to lean, like its peers, into a timely transition to an electric fleet,” Brad Lander, New York City comptroller, told the Wall Street Journal.

The two pension funds also argue the company’s board does not have enough independent directors, and both have voted for a separate resolution calling for greater disclosure of the company’s lobbying on climate change.

While the measure is unlikely to succeed, the Wall Street Journal notes that shareholder revolts, even minor ones, are rare in Japanese corporate culture. Toyoda won renomination to the board last year with 96% of the vote.

“Even in this difficult business environment, chairman of the board Akio Toyoda has been strengthening our competitiveness from a long-term perspective,” a company spokesperson told the Wall Street Journal.

Toyota and electric cars

Unlike his fellow executives, such as Ford’s Jim Farley or General Motors’ Mary Barra, let alone Tesla’s Elon Musk, Toyoda was a vocal skeptic of electric cars in his final months as Toyota’s CEO.

Last December, Toyoda complained that public pressure was stopping executives, whom he called a “silent majority,” from speaking honestly about electric cars “as a single option.”

“They think it’s the trend so they can’t speak out loudly,” he suggested.

Then, in January, Toyota Motor announced that Toyoda would be stepping down as the company’s president, in favor of Koji Sato, then–head of the company’s Lexus subsidiary. “I am an old-fashioned person in regards to digitalization, electric vehicles, and connected cars,” Toyoda said at the time.

Sato took over as president in April, and quickly announced the carmaker would quickly expand its offering of electric cars, releasing 10 new models by 2026.

Yet investors worry that Toyota still isn’t taking the transition to electric vehicles seriously, noting that the company still hasn’t given a firm date for when it might have an all-electric fleet. A slow embrace of electric cars also means the company can’t capture growing demand for EVs in large markets like China, and also misses out from new subsidies being offered by both the U.S. and the European Union.

“Toyota’s EV strategy is simply not looking attractive,” Anders Schelde, chief investment officer of AkademikerPension, a Danish fund, told the Wall Street Journal.

Crisis of confidence

Worries over Toyota’s EV strategy are part of a broader crisis of confidence in the Japanese auto industry.

Earlier this year, China overtook Japan as the world’s largest exporter of cars, in part owing to a surge in exported EVs made in the country. Tesla produces half its cars in Shanghai, while Shenzhen-based BYD is also exploring export opportunities.

Japanese brands are also losing ground in the domestic Chinese market, as consumers flock to electric cars, whether produced by local companies or by Tesla.

The “biggest danger” for EV prices are “the Chinese coming in,” said Peugeot CEO Linda Jackson at a Financial Times conference in May.

“They are coming in with quite competitive prices and with very good vehicles,” she said.