雖然過去一年多以來,,不斷有人預測美國將陷入經濟衰退,,美國持續(xù)加息還面臨惡性通脹,但美國的勞動力市場卻繼續(xù)證明著它的彈性,。7月7日,,美國政府數(shù)據(jù)向對一天前出爐的驚人數(shù)據(jù)感到擔憂的華爾街投資者,發(fā)布了一份“恰到好處的”就業(yè)報告,。美國勞工統(tǒng)計局(Bureau of Labor Statistics)7月7日的報告顯示,,6月美國雇主新增209,000個就業(yè)崗位。經濟學家們普遍預測美國將新增230,000個就業(yè)崗位,。這個數(shù)據(jù)未能達到經濟學家們的預期,是自2021年1月以來幅度最小的月度漲幅,,但對交易商而言卻是好消息,。7月6日ADP的私人工資報告稱,6月私營行業(yè)新增497,000個就業(yè)崗位,,這令交易商感到震驚,。ADP的數(shù)據(jù)讓人們擔心,美聯(lián)儲(Federal Reserve)可能需要繼續(xù)加息,,才能放慢經濟增長速度,,真正控制通貨膨脹。但7月7日美國勞工統(tǒng)計局的報告是15個月來美國就業(yè)增長速度首次低于經濟學家們的預期,,而且專家們認為,,這實際上是好消息。

工資處理機構UKG的勞動力經濟學家戴夫·吉爾伯森表示,,盡管就業(yè)增長“或許表現(xiàn)并不出色”,,但他依舊沒有發(fā)現(xiàn)勞動力市場存在任何“裂痕”,而且最近就業(yè)增長放緩讓美聯(lián)儲可以實現(xiàn)軟著陸,,即在不發(fā)生引發(fā)失業(yè)潮的經濟衰退的情況下降低通脹,。他說:“6月,美國勞動力市場有所降溫,,新增就業(yè)增速放緩,,這有助于實現(xiàn)備受期待的經濟軟著陸。7月7日的報告進一步證實了UKG的評估,,即勞動力市場狀態(tài)良好,,但并未出現(xiàn)過熱,。”

最新就業(yè)數(shù)據(jù)顯然并不火爆,,但6月新增就業(yè)足以將失業(yè)率從5月的3.7%下降到3.6%,。美聯(lián)儲的數(shù)據(jù)顯示,相比之下,,過去十年的平均失業(yè)率為5.1%,。

貝萊德(BlackRock)的全球固定收益首席投資官和貝萊德全球配置投資團隊主管里克·里德對《財富》雜志表示:“新增209,000個就業(yè)崗位雖然低于我們和華爾街經濟學家們的一致預估,但勞動力市場數(shù)據(jù)并不妨礙我們認為美國的就業(yè)環(huán)境依舊是穩(wěn)健的,。勞動力市場整體上顯然依舊運轉良好,,并且盡管利率持續(xù)升高,但勞動力市場并沒有出現(xiàn)太多的動蕩跡象,?!?/p>

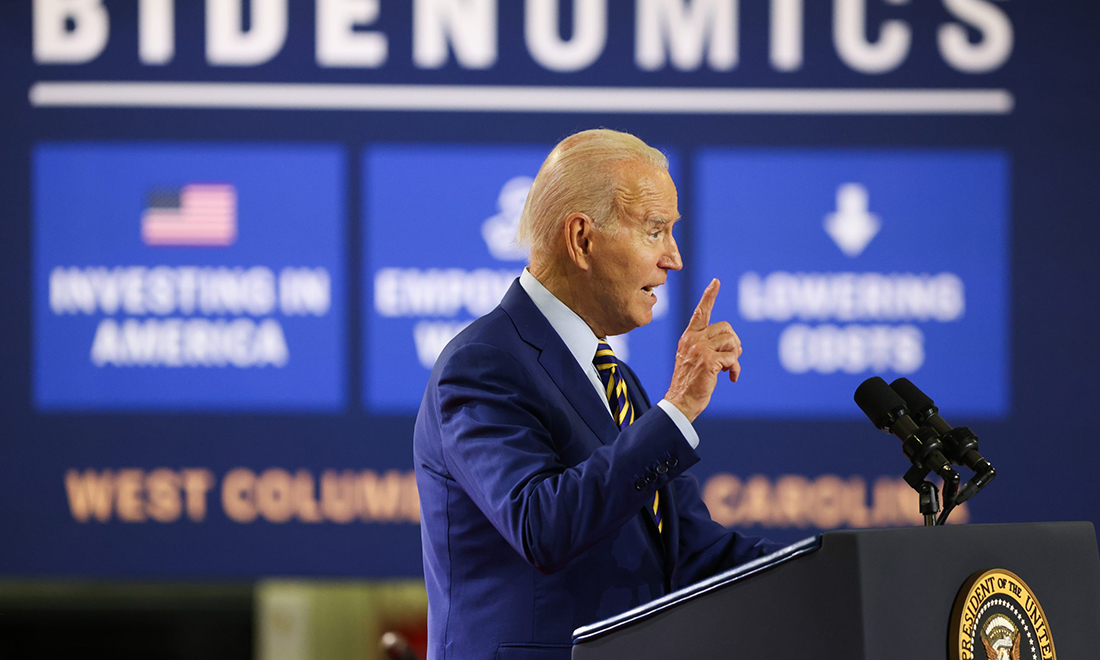

美國總統(tǒng)喬·拜登的政府很快對7月7日穩(wěn)健的就業(yè)報告歡呼雀躍,稱這證明“拜登經濟學正在發(fā)揮作用”,,并表示目前連續(xù)數(shù)月的低失業(yè)率,,是自20世紀60年代以來任何十年間前所未見的。

白宮在一份聲明中指出:“通脹率下降了超過一半,。我們看到經濟增長速度穩(wěn)定,。這就是拜登經濟學,即通過創(chuàng)造就業(yè),、降低努力工作的家庭的生活成本和在美國進行明智的投資等措施發(fā)展經濟,。”

招聘平臺Indeed Hiring Lab的經濟研究負責人尼克·邦克告訴《財富》雜志,,經濟學家或投資者不應該因為209,000個新增就業(yè)崗位而退縮不前,。由于美國人口增長大幅放緩,邦克認為,,美國經濟只需要每個月增加60,000至80,000個就業(yè)崗位,,就能夠維持當前的失業(yè)率。他解釋道:“因此超過200,000個新增就業(yè)崗位,,比維持勞動力市場緊張所需要的新增就業(yè)崗位數(shù)量多了一倍以上,。”

美聯(lián)儲的數(shù)據(jù)顯示,,6月核心勞動力就業(yè)與人口比率,,即25歲至54歲的上班族在勞動力隊伍中的占比,也上漲至22年來的新高80.9%,。女性的這個比例達到75.3%,,達到史上最高水平。

邦克表示,,核心勞動力就業(yè)數(shù)據(jù)證明,,金融界和實體經濟對經濟狀況的悲觀情緒,,并沒有“影響”勞動力市場。

他說:“工資上漲幅度不溫不火,,但按照任何客觀標準來看,,人才招聘依舊強勁。去年,,我們擔心人們可能不會重新就業(yè),,但現(xiàn)在處于最佳工作年齡的人群正在重新進入勞動力隊伍。2023年上半年,,美國勞動力市場表現(xiàn)強勁,。除非發(fā)生任何戲劇性的變化,才會影響就業(yè)市場的發(fā)展軌跡,?!?/p>

美國經濟的另外一個積極信號是,6月末制造業(yè)令人失望的數(shù)據(jù)發(fā)布之后,,7月7日的數(shù)據(jù)顯示服務業(yè)表現(xiàn)依舊強勁,。6月,ISM Services的采購經理人指數(shù)(PMI)從5月的50.3反彈到53.9,,達到自今年2月以來的最高水平,。PMI指數(shù)通過庫存、新訂單和產量等數(shù)據(jù)來衡量服務業(yè)的健康狀況,。PMI指數(shù)高于50意味著服務業(yè)正在擴張,。

PMI指數(shù)還表明服務業(yè)的成本性通脹正在下降,。聯(lián)信銀行(Comerica Bank)的首席經濟學家比爾·亞當斯在提到該數(shù)據(jù)時稱:“6月ISM Services的PMI指數(shù)帶來了好消息,,經濟活動大幅增長,原材料成本壓力顯著下降,?!彼麑⒋朔Q為一個“恰到好處的”驚喜。

未來經濟,、勞動力市場和美聯(lián)儲將會如何變化,?

雖然最近美國經濟有一連串好消息,但一些專家依舊認為,,經濟衰退不可避免,。例如,富國銀行投資研究所(Wells Fargo Investment Institute)的總裁達雷爾·科朗克在今年6月的年中前景展望報告中指出,,依舊有充分的證據(jù)證明“經濟衰退近在眼前”,,他提到了世界大型企業(yè)聯(lián)合會(Conference Board)持續(xù)下降的先行經濟指數(shù)(Leading Economic Index)。該指數(shù)以建筑許可證,、平均每周工作時間和制造商新訂單等數(shù)據(jù),,分析經濟健康狀況,。

Indeed Hiring Lab的邦克承認,勞動力市場也表現(xiàn)出“增長放緩”的跡象,,但他認為在此之前,,勞動力市場一直表現(xiàn)強勁。他說:“雖然萬事無保證,,但美國勞動力市場依舊強勁意味著美國經濟將以更緩慢但更可持續(xù)的速度增長,。經濟衰退會發(fā)生。但目前,,對新招聘崗位的需求持續(xù)高漲,,而且雇主依舊在努力留住現(xiàn)有員工?!?/p>

并非只有邦克從最新就業(yè)報告里看到了好的一面,。

ZipRecruiter的首席經濟學家茱莉婭·波拉克對《財富》雜志表示,盡管有跡象表明美聯(lián)儲“終于開始產生不利影響”,,但她仍然對勞動力市場的未來感到樂觀,。這位經濟學家稱,就業(yè)水平依舊遠低于沒有新冠疫情的情況下應該達到的水平,,這意味著在許多行業(yè)將迎來持續(xù)的“追趕性招聘”,。

她說:“最近去過餐廳或機場的人都知道美國仍然存在人手不足的問題?!彼€表示,,6月的每周平均收益增長率為3.7%,這也符合“通脹持續(xù)放緩”的趨勢,,將為美聯(lián)儲提供幫助,。

高盛資產管理(Goldman Sachs Asset Management)的全球戰(zhàn)略咨詢解決方案主管康迪斯·謝指出,最近的就業(yè)數(shù)據(jù)證明,,勞動力市場依舊“緊張”,,這會讓美聯(lián)儲官員持續(xù)加息,但這不會持續(xù)太久,。

她告訴《財富》雜志:“數(shù)據(jù)再次證明,,勞動力再平衡問題仍然存在。美聯(lián)儲本月準備繼續(xù)加息……然而,,我們依舊預計,,美聯(lián)儲將很快達到其終點利率,使其數(shù)十年來最激進的緊縮行動接近尾聲,?!保ㄘ敻恢形木W)

譯者:劉進龍

審校:汪皓

雖然過去一年多以來,不斷有人預測美國將陷入經濟衰退,,美國持續(xù)加息還面臨惡性通脹,,但美國的勞動力市場卻繼續(xù)證明著它的彈性,。7月7日,美國政府數(shù)據(jù)向對一天前出爐的驚人數(shù)據(jù)感到擔憂的華爾街投資者,,發(fā)布了一份“恰到好處的”就業(yè)報告,。美國勞工統(tǒng)計局(Bureau of Labor Statistics)7月7日的報告顯示,6月美國雇主新增209,000個就業(yè)崗位,。經濟學家們普遍預測美國將新增230,000個就業(yè)崗位,。這個數(shù)據(jù)未能達到經濟學家們的預期,是自2021年1月以來幅度最小的月度漲幅,,但對交易商而言卻是好消息,。7月6日ADP的私人工資報告稱,6月私營行業(yè)新增497,000個就業(yè)崗位,,這令交易商感到震驚,。ADP的數(shù)據(jù)讓人們擔心,美聯(lián)儲(Federal Reserve)可能需要繼續(xù)加息,,才能放慢經濟增長速度,,真正控制通貨膨脹。但7月7日美國勞工統(tǒng)計局的報告是15個月來美國就業(yè)增長速度首次低于經濟學家們的預期,,而且專家們認為,,這實際上是好消息。

工資處理機構UKG的勞動力經濟學家戴夫·吉爾伯森表示,,盡管就業(yè)增長“或許表現(xiàn)并不出色”,,但他依舊沒有發(fā)現(xiàn)勞動力市場存在任何“裂痕”,而且最近就業(yè)增長放緩讓美聯(lián)儲可以實現(xiàn)軟著陸,,即在不發(fā)生引發(fā)失業(yè)潮的經濟衰退的情況下降低通脹,。他說:“6月,美國勞動力市場有所降溫,,新增就業(yè)增速放緩,,這有助于實現(xiàn)備受期待的經濟軟著陸,。7月7日的報告進一步證實了UKG的評估,,即勞動力市場狀態(tài)良好,但并未出現(xiàn)過熱,?!?/p>

最新就業(yè)數(shù)據(jù)顯然并不火爆,但6月新增就業(yè)足以將失業(yè)率從5月的3.7%下降到3.6%,。美聯(lián)儲的數(shù)據(jù)顯示,,相比之下,過去十年的平均失業(yè)率為5.1%,。

貝萊德(BlackRock)的全球固定收益首席投資官和貝萊德全球配置投資團隊主管里克·里德對《財富》雜志表示:“新增209,000個就業(yè)崗位雖然低于我們和華爾街經濟學家們的一致預估,,但勞動力市場數(shù)據(jù)并不妨礙我們認為美國的就業(yè)環(huán)境依舊是穩(wěn)健的,。勞動力市場整體上顯然依舊運轉良好,并且盡管利率持續(xù)升高,,但勞動力市場并沒有出現(xiàn)太多的動蕩跡象,。”

美國總統(tǒng)喬·拜登的政府很快對7月7日穩(wěn)健的就業(yè)報告歡呼雀躍,,稱這證明“拜登經濟學正在發(fā)揮作用”,,并表示目前連續(xù)數(shù)月的低失業(yè)率,是自20世紀60年代以來任何十年間前所未見的,。

白宮在一份聲明中指出:“通脹率下降了超過一半,。我們看到經濟增長速度穩(wěn)定。這就是拜登經濟學,,即通過創(chuàng)造就業(yè),、降低努力工作的家庭的生活成本和在美國進行明智的投資等措施發(fā)展經濟?!?/p>

招聘平臺Indeed Hiring Lab的經濟研究負責人尼克·邦克告訴《財富》雜志,,經濟學家或投資者不應該因為209,000個新增就業(yè)崗位而退縮不前。由于美國人口增長大幅放緩,,邦克認為,,美國經濟只需要每個月增加60,000至80,000個就業(yè)崗位,就能夠維持當前的失業(yè)率,。他解釋道:“因此超過200,000個新增就業(yè)崗位,,比維持勞動力市場緊張所需要的新增就業(yè)崗位數(shù)量多了一倍以上?!?/p>

美聯(lián)儲的數(shù)據(jù)顯示,,6月核心勞動力就業(yè)與人口比率,即25歲至54歲的上班族在勞動力隊伍中的占比,,也上漲至22年來的新高80.9%,。女性的這個比例達到75.3%,達到史上最高水平,。

邦克表示,,核心勞動力就業(yè)數(shù)據(jù)證明,金融界和實體經濟對經濟狀況的悲觀情緒,,并沒有“影響”勞動力市場,。

他說:“工資上漲幅度不溫不火,但按照任何客觀標準來看,,人才招聘依舊強勁,。去年,我們擔心人們可能不會重新就業(yè),但現(xiàn)在處于最佳工作年齡的人群正在重新進入勞動力隊伍,。2023年上半年,,美國勞動力市場表現(xiàn)強勁。除非發(fā)生任何戲劇性的變化,,才會影響就業(yè)市場的發(fā)展軌跡,。”

美國經濟的另外一個積極信號是,,6月末制造業(yè)令人失望的數(shù)據(jù)發(fā)布之后,,7月7日的數(shù)據(jù)顯示服務業(yè)表現(xiàn)依舊強勁。6月,,ISM Services的采購經理人指數(shù)(PMI)從5月的50.3反彈到53.9,,達到自今年2月以來的最高水平。PMI指數(shù)通過庫存,、新訂單和產量等數(shù)據(jù)來衡量服務業(yè)的健康狀況,。PMI指數(shù)高于50意味著服務業(yè)正在擴張。

PMI指數(shù)還表明服務業(yè)的成本性通脹正在下降,。聯(lián)信銀行(Comerica Bank)的首席經濟學家比爾·亞當斯在提到該數(shù)據(jù)時稱:“6月ISM Services的PMI指數(shù)帶來了好消息,,經濟活動大幅增長,原材料成本壓力顯著下降,?!彼麑⒋朔Q為一個“恰到好處的”驚喜。

未來經濟,、勞動力市場和美聯(lián)儲將會如何變化,?

雖然最近美國經濟有一連串好消息,但一些專家依舊認為,,經濟衰退不可避免,。例如,富國銀行投資研究所(Wells Fargo Investment Institute)的總裁達雷爾·科朗克在今年6月的年中前景展望報告中指出,,依舊有充分的證據(jù)證明“經濟衰退近在眼前”,,他提到了世界大型企業(yè)聯(lián)合會(Conference Board)持續(xù)下降的先行經濟指數(shù)(Leading Economic Index)。該指數(shù)以建筑許可證,、平均每周工作時間和制造商新訂單等數(shù)據(jù),,分析經濟健康狀況。

Indeed Hiring Lab的邦克承認,,勞動力市場也表現(xiàn)出“增長放緩”的跡象,,但他認為在此之前,,勞動力市場一直表現(xiàn)強勁,。他說:“雖然萬事無保證,但美國勞動力市場依舊強勁意味著美國經濟將以更緩慢但更可持續(xù)的速度增長。經濟衰退會發(fā)生,。但目前,,對新招聘崗位的需求持續(xù)高漲,而且雇主依舊在努力留住現(xiàn)有員工,?!?/p>

并非只有邦克從最新就業(yè)報告里看到了好的一面。

ZipRecruiter的首席經濟學家茱莉婭·波拉克對《財富》雜志表示,,盡管有跡象表明美聯(lián)儲“終于開始產生不利影響”,,但她仍然對勞動力市場的未來感到樂觀。這位經濟學家稱,,就業(yè)水平依舊遠低于沒有新冠疫情的情況下應該達到的水平,,這意味著在許多行業(yè)將迎來持續(xù)的“追趕性招聘”。

她說:“最近去過餐廳或機場的人都知道美國仍然存在人手不足的問題,?!彼€表示,6月的每周平均收益增長率為3.7%,,這也符合“通脹持續(xù)放緩”的趨勢,,將為美聯(lián)儲提供幫助。

高盛資產管理(Goldman Sachs Asset Management)的全球戰(zhàn)略咨詢解決方案主管康迪斯·謝指出,,最近的就業(yè)數(shù)據(jù)證明,,勞動力市場依舊“緊張”,這會讓美聯(lián)儲官員持續(xù)加息,,但這不會持續(xù)太久,。

她告訴《財富》雜志:“數(shù)據(jù)再次證明,勞動力再平衡問題仍然存在,。美聯(lián)儲本月準備繼續(xù)加息……然而,,我們依舊預計,美聯(lián)儲將很快達到其終點利率,,使其數(shù)十年來最激進的緊縮行動接近尾聲,。”(財富中文網)

譯者:劉進龍

審校:汪皓

Despite more than a year of consistent recession predictions, rising interest rates, and stubborn inflation, the labor market continues to prove its resilience. On July 7, government data revealed something like a Goldilocks jobs report to Wall Street investors who had been worried by a shocking data drop the day before. U.S. employers added 209,000 jobs in June, the Bureau of Labor Statistics (BLS) reported on July 7. The figure missed economists’ consensus forecast for 230,000 new jobs and amounted to the smallest monthly gain since January 2021—but that was good news for traders who were jarred by July 6’s ADP private payrolls report, claiming that 497,000 jobs were added to the private sector in June. The ADP data had sparked concerns that the Federal Reserve may need to keep raising interest rates in order to slow the economy and truly tame inflation. But July 7’s BLS report was the first time in 15 months that job growth has come in below economists’ expectations, and the experts argue that actually, that’s good news.

Dave Gilbertson, a labor economist at payroll processor UKG, said that although job growth “might not blow the doors off,” he still doesn’t see any “cracks” in the labor market, and the recent slowdown could enable the Fed to achieve a soft landing after all—where inflation fades without a job-killing recession. “The U.S. labor market moderated in June, as new job creation edged down—a step towards the much sought-after soft landing in the economy. July 7’s report reinforced UKG’s assessment that the labor market is holding up very well, but it’s not on fire,” he said.

The latest jobs data clearly weren’t red-hot, but June’s job gains were enough to push the unemployment rate down to 3.7%, from 3.6% the month before. That compares with an average unemployment rate of 5.1% over the past decade, according to Federal Reserve data.

“Despite coming in a bit below our and Street economists’ consensus estimates today, at 209,000 jobs gained, the labor market data did little to dissuade us from the view that the employment dynamic in the U.S. is still solid,” Rick Rieder, BlackRock’s chief investment officer of global fixed income and head of the BlackRock global allocation investment team, told Fortune. “The full labor market picture is clearly still running at a decent level and shows little sign of rolling over, even as interest rates move higher and higher.”

The Biden administration was quick to celebrate the solid jobs report on July 7, calling it evidence of “Bidenomics in action” and noting that the current streak of consecutive months of low unemployment is unmatched in any decade going all the way back to the 1960s.

“Inflation has come down by more than half. We are seeing stable and steady growth. That’s Bidenomics—growing the economy by creating jobs, lowering costs for hardworking families, and making smart investments in America,” the White House said in a statement.

Nick Bunker, head of economic research at the Indeed Hiring Lab, told Fortune that 209,000 new jobs shouldn’t be balked at by economists or investors, either. Owing to a major slowdown in U.S. population growth, Bunker argued the economy only needs to add between 60,000 and 80,000 jobs per month to maintain current unemployment levels. “So gains in excess of 200,000 are more than double the pace needed to keep the labor market tight,” he explained.

The prime-age employment-to-population ratio, which measures the share of workers ages 25 to 54 in the labor force, also rose to a 22-year high of 80.9% in June, according to Federal Reserve data. And among women, it reached 75.3%, the highest level on record.

Bunker said the prime-age employment data is evidence that persistent pessimism about the state of the economy from both Wall Street and Main Street hasn’t yet “weighed down” the labor market.

“Payroll gains have moderated, but hiring continues to be strong by any objective standard. People in their prime working years are rejoining the labor force after concerns last year that workers would never return,” he said. “The U.S. labor market wrapped up the first half of 2023 in a position of strength. It’ll take something dramatic happening to derail it anytime soon.”

In another positive sign for the U.S. economy, after disappointing data from the manufacturing sector came in late June, the services sector showed continued strength on July 7. The ISM Services Purchasing Managers’ Index (PMI), which measures the health of the services sector by looking at data like inventories, new orders, and production, rebounded from 50.3 in May to 53.9 last month, its highest level since February. A reading above 50 indicates expansion in the sector.

The index also revealed fading cost inflation in the services sector. “The ISM Services PMI delivered excellent news in June, with a solid increase in activity and input cost pressures cooling notably,” Bill Adams, Comerica Bank’s chief economist, said of the data, calling it a “Goldilocks” surprise.

What’s next for the economy, the labor market, and the Fed?

Despite the recent string of good news for the economy, some experts remain convinced that a recession is inevitable. Wells Fargo Investment Institute president Darrell Cronk, for example, said the evidence remains overwhelming that a “recession is at our doorstep” at a midyear outlook presentation in June, pointing to the consistent drop in the Conference Board’s Leading Economic Index, which looks at data like building permits, average weekly hours worked, and manufacturers’ new orders to get a sense of the health of the economy.

Indeed’s Bunker admitted that the labor market is also showing signs of “slowing,” but he noted that it’s doing so from a position of strength. “Nothing is guaranteed, but the U.S. labor market continues to point toward a slower, but more sustainable pace of economic growth,” he said. “Recessions happen. But for now, demand for new hires remains elevated and employers are still holding on to the workers they have.”

Bunker is not the only one seeing the bright side of the latest jobs report, either.

ZipRecruiter’s chief economist Julia Pollak told Fortune that even though there were signs that the Fed’s rate hikes are “finally biting,” she remains optimistic about the future of the labor market. The economist noted that employment levels are still well below what they would have been without the pandemic, which means there’s ongoing “catch-up hiring” in many industries.

“Anyone who has been to a restaurant or airport lately knows America is still understaffed,” she said, adding that average weekly earnings growth of 3.7% in June was also “consistent with a continued slowdown in inflation” that will help the Fed.

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, said that the latest jobs data shows the labor market remains “tight,” which will lead Fed officials to continue raising interest rates—but not for much longer.

“The print reinforces the fact that labor rebalancing issues persist,” she told Fortune. “The Fed is poised to continue its hiking cycle this month…However, we continue to expect that the Fed will soon reach its terminal rate, bringing it closer toward the end of its most aggressive tightening campaign in generations.”