與美國住房市場已經(jīng)觸底的最新觀點不同,,經(jīng)濟研究咨詢公司Pantheon Macroeconomics不久前發(fā)布的一份報告稱,美國住房市場還遠(yuǎn)未迎來真正的反彈,。

在他們看來,,今年春季美國住房市場的回暖只是一個假象。

的資深美國經(jīng)濟學(xué)家基蘭?克蘭西(Kieran Clancy)寫道:“越來越多的評論員稱住房市場正在復(fù)蘇,,但這并不屬實,,為此我們感到很困惑。在2022年底房貸利率下降后,,今年年初房地產(chǎn)銷售量飆升,,但近期因房貸利率回升該數(shù)值已經(jīng)有所下跌。而房貸申請數(shù)量也表明,,房地產(chǎn)銷售量很快就會跌至周期內(nèi)新低,。”

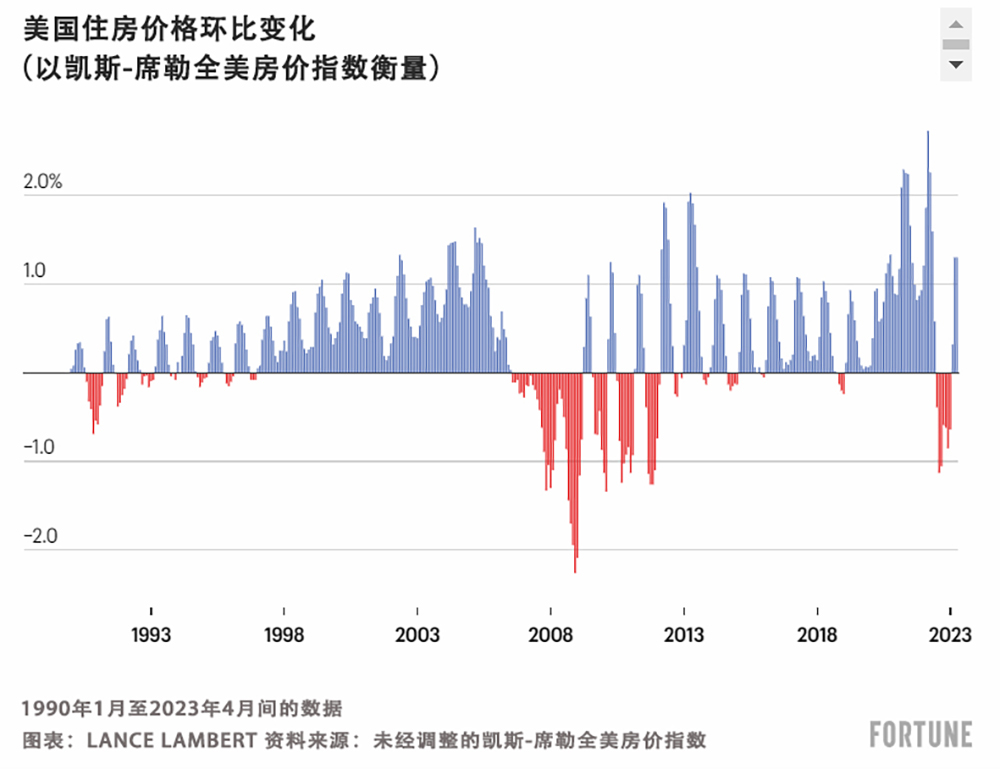

克蘭西寫道,,阻礙住房市場真正復(fù)蘇的關(guān)鍵因素在于負(fù)擔(dān)能力,。去年房貸利率的暴漲給市場帶來沖擊,加上疫情房產(chǎn)熱(Pandemic Housing Boom)期間全美房價飆升超過40%,,住房市場的負(fù)擔(dān)能力受到了嚴(yán)重削弱,,這是2006年房地產(chǎn)泡沫鼎盛時期以來從未見過的。

克蘭西表示:“不過,,從長遠(yuǎn)來看,,房價尚有很大的下降空間;銷售量驟減的滯后效應(yīng)將導(dǎo)致房價持續(xù)大幅下跌,。雖然價格變動的速度和幅度尚不確定,,但其走向是顯而易見的?!?/p>

不同于克蘭西對美國房價會進(jìn)一步下跌的預(yù)測,,CoreLogic和Zillow等公司的經(jīng)濟學(xué)家認(rèn)為,美國房價早在今年年初就已經(jīng)觸底,。為了證明這一點,,這些公司指出,現(xiàn)在房價與新房銷售量又開始上漲了,。

然而,,住房市場春季優(yōu)于預(yù)期的表現(xiàn)并不足以說服Pantheon Macroeconomics。該咨詢公司的克蘭西特別指出,,住房建筑商狀況的好轉(zhuǎn)是由“他們大力度的折扣和轉(zhuǎn)售房屋庫存量緊張推動的,,而非因為住房市場已經(jīng)真正開始復(fù)蘇?!?/p>

克蘭西寫道:“然而,,新房變得更加熱銷并不會改變整體情況。換句話說,,在市場負(fù)擔(dān)能力改善之前,,整體市場活動是不可能持久復(fù)蘇的。當(dāng)前,,中等價位現(xiàn)有單戶住宅的購置者每月償還的房貸相當(dāng)于勞動者平均稅后月收入的一半左右,,而新冠疫情前這一比例為30%至35%。除非市場負(fù)擔(dān)能力改善(這需要房貸利率下調(diào),,房價降低,,或兩者并駕齊驅(qū)),否則住房銷售將難以復(fù)蘇,。簡言之,,住房市場并未進(jìn)入復(fù)蘇的早期階段;只不過房地產(chǎn)業(yè)的低迷開始從需求,、銷售量和建筑項目的銳減向價格和住房相關(guān)消費支出的下降演變,。”

記住,,當(dāng)像Pantheon Macroeconomics這樣的公司說到“美國房價”時,,他們指的是全美整體的房價水平。(財富中文網(wǎng))

譯者:中慧言-劉嘉歡

與美國住房市場已經(jīng)觸底的最新觀點不同,,經(jīng)濟研究咨詢公司Pantheon Macroeconomics不久前發(fā)布的一份報告稱,,美國住房市場還遠(yuǎn)未迎來真正的反彈。

在他們看來,,今年春季美國住房市場的回暖只是一個假象,。

的資深美國經(jīng)濟學(xué)家基蘭?克蘭西(Kieran Clancy)寫道:“越來越多的評論員稱住房市場正在復(fù)蘇,但這并不屬實,,為此我們感到很困惑,。在2022年底房貸利率下降后,今年年初房地產(chǎn)銷售量飆升,,但近期因房貸利率回升該數(shù)值已經(jīng)有所下跌,。而房貸申請數(shù)量也表明,房地產(chǎn)銷售量很快就會跌至周期內(nèi)新低,?!?/p>

克蘭西寫道,,阻礙住房市場真正復(fù)蘇的關(guān)鍵因素在于負(fù)擔(dān)能力。去年房貸利率的暴漲給市場帶來沖擊,,加上疫情房產(chǎn)熱(Pandemic Housing Boom)期間全美房價飆升超過40%,,住房市場的負(fù)擔(dān)能力受到了嚴(yán)重削弱,這是2006年房地產(chǎn)泡沫鼎盛時期以來從未見過的,。

克蘭西表示:“不過,,從長遠(yuǎn)來看,房價尚有很大的下降空間,;銷售量驟減的滯后效應(yīng)將導(dǎo)致房價持續(xù)大幅下跌,。雖然價格變動的速度和幅度尚不確定,但其走向是顯而易見的,?!?/p>

不同于克蘭西對美國房價會進(jìn)一步下跌的預(yù)測,CoreLogic和Zillow等公司的經(jīng)濟學(xué)家認(rèn)為,,美國房價早在今年年初就已經(jīng)觸底,。為了證明這一點,這些公司指出,,現(xiàn)在房價與新房銷售量又開始上漲了,。

然而,住房市場春季優(yōu)于預(yù)期的表現(xiàn)并不足以說服Pantheon Macroeconomics,。該咨詢公司的克蘭西特別指出,,住房建筑商狀況的好轉(zhuǎn)是由“他們大力度的折扣和轉(zhuǎn)售房屋庫存量緊張推動的,而非因為住房市場已經(jīng)真正開始復(fù)蘇,?!?/p>

克蘭西寫道:“然而,新房變得更加熱銷并不會改變整體情況,。換句話說,,在市場負(fù)擔(dān)能力改善之前,整體市場活動是不可能持久復(fù)蘇的,。當(dāng)前,,中等價位現(xiàn)有單戶住宅的購置者每月償還的房貸相當(dāng)于勞動者平均稅后月收入的一半左右,而新冠疫情前這一比例為30%至35%,。除非市場負(fù)擔(dān)能力改善(這需要房貸利率下調(diào),,房價降低,或兩者并駕齊驅(qū)),,否則住房銷售將難以復(fù)蘇,。簡言之,住房市場并未進(jìn)入復(fù)蘇的早期階段;只不過房地產(chǎn)業(yè)的低迷開始從需求,、銷售量和建筑項目的銳減向價格和住房相關(guān)消費支出的下降演變,。”

記住,,當(dāng)像Pantheon Macroeconomics這樣的公司說到“美國房價”時,,他們指的是全美整體的房價水平。(財富中文網(wǎng))

譯者:中慧言-劉嘉歡

In contrast to the emerging narrative that the U.S. housing market has bottomed, a recent report from economic research consultancy firm Pantheon Macroeconomics argues that the housing market is far from experiencing a true rebound.

In their eyes, the U.S. housing market’s bounce this spring was simply a head fake.

“We are baffled by the emerging narrative in the commentariat that housing is now recovering, because it isn’t. Home sales jumped at the start of the year, lagging the late-2022 dip in mortgage rates, but they have fallen more recently thanks to the latest back-up in rates, and mortgage applications signal that they will soon dip to a new cycle low,” wrote Kieran Clancy, the senior U.S. economist at Pantheon Macroeconomics.

Pantheon Macroeconomics

The key hurdle to a true recovery in the housing market, Clancy writes, is affordability. Last year’s mortgage rate shock, combined with national home prices spiking over 40% during the Pandemic Housing Boom, has deteriorated housing affordability in a way unseen since the housing bubble peak in 2006.

“The broader point here, though, is that the bulk of the drop in home prices is yet to come; the lagged effect of the plunge in sales points to a steep and sustained drop. The speed and scale of the adjustment in prices is uncertain, but the direction of travel is clear,” wrote Clancy.

While Clancy thinks national house prices have further to fall, economists at firms like CoreLogic and Zillow think national home prices bottomed earlier this year. For evidence, those firms have pointed to the fact that national house prices, along with new home sales, are rising again.

However, the housing market's stronger-than-expected spring performance isn't enough to convince Pantheon Macroeconomics. In particular, Pantheon's Clancy points to the homebuilder rebound as driven by "aggressive [builder] discounts and a lack of resale inventory—not an actual housing market recovery.

"The shift in sales towards new homes does not change the bigger picture, however, which is that a durable recovery in overall market activity is out of the question until affordability improves. Mortgage payments for a buyer of a median-priced existing single-family home are now about half of average after-tax incomes, up from 30-to-35% pre-Covid. Home sales can’t recover until affordability improves, which requires lower mortgage rates, or falling home prices, or both," wrote Clancy. "In short, the housing market is not in the early stages of recovery; the downturn merely is morphing from a collapse in demand, sales, and construction, to falling prices and housing-related consumption spending."

Keep in mind, when a firm like Pantheon Macroeconomics says "U.S. home prices" they're talking about a national aggregate.