2024年2月22日,英偉達(Nvidia)股票的單日漲幅創(chuàng)下了資本市場歷史上的最新紀錄,。到上午10點,,英偉達的股價暴漲約15%,其市值從前一個交易日收盤時的1.66萬億美元增長到1.91萬億美元,。新增的2,500億美元市值相當于特斯拉(Tesla)市值的40%,、甲骨文(Oracle)的80%,,比英特爾(Intel)的市值多出20%。如今,,英偉達在投資界有舉足輕重的影響力,。英偉達在2月21日收盤后發(fā)布的業(yè)績超出預期,讓市場陷入瘋狂,,到22日下午3點左右,,納斯達克100指數(shù)(Nasdaq 100)暴漲3%。

華爾街分析師對英偉達的業(yè)績歡欣鼓舞,,至少有18家證券經(jīng)紀公司上調(diào)了對英偉達到2024年年底的股價漲幅的預測,。其目前的股價接近800美元。高盛集團(Goldman Sachs)將對英偉達的股價預測提高到875美元,,伯恩斯坦(Bernstein)提高到1,000美元,,而KeyBanc則提高到1,100美元。

這種樂觀的態(tài)度當然可以理解,,因為英偉達不僅取得了非凡的業(yè)績,,還有一種普遍觀點認為,英偉達占據(jù)主導地位的人工智能領(lǐng)域,,將是這個千年的顛覆性技術(shù),。在2024財年(截至1月31日),英偉達按公認會計準則(GAAP)計算的營收增長126%,,達到610億美元,,凈收益增長近六倍,達到298億美元,。英偉達展現(xiàn)出前所未有的大規(guī)模運營杠桿效應,,這意味著公司新增利潤在新增收入中占較大比例。例如,,英偉達的毛利潤率提高了57%,,達到73%,這表明通過對比商品售價與公司為生產(chǎn)或采購產(chǎn)品和原材料支付的成本,,英偉達向客戶提供的每一件可比商品的利潤比2023年提高了30%,。還有更好的消息??鄢厥忭椖恳酝?,英偉達的研發(fā)、日常開支和其他運營成本僅上漲了11%,,只有銷售額增長幅度的十分之一,。

雖然業(yè)績令人矚目,但未來收益的門檻已經(jīng)被大幅提高

分析師指出,,英偉達的市盈率倍數(shù)并沒有高到離譜,。在英偉達的股價于2月22日大幅上漲之前,,根據(jù)其2024財年全年的收益298億美元計算,其市盈率為56倍,,而華爾街的分析師們根據(jù)對未來幾個季度巨大收益的遠期預估,,使用了更低的市盈率倍數(shù)。一夜之間,,股價大漲15%把英偉達的市盈率倍數(shù)提高到64,。在投資界,沒有人會對這個數(shù)字感到擔心,。

值得關(guān)注的是,,對英偉達在未來十年為維持當前1.91萬億美元的市值需要實現(xiàn)的收益水平的預測。事實上,,有趣的是探究此次史無前例的單日漲幅,,將收益門檻提高了多少。假如投資者希望英偉達能夠?qū)崿F(xiàn)10%的年度總回報率,。畢竟,,這是一只高風險的股票。在英偉達公布業(yè)績之前的期權(quán)活動表明,,投資者非常擔心即使公司業(yè)績稍微差強人意,,都可能影響股價,因為市場對其股價有極高的預期,。

將2月21日英偉達市值為1.66萬億美元時需要產(chǎn)生的收益,與目前市值增加2,400億美元之后需要產(chǎn)生的收益進行對比,,得出的結(jié)果非常有趣,。

首先我們來計算在此次股價大漲之前,英偉達如何實現(xiàn)10%的年回報率,。當英偉達的市值為1.66萬億美元時,,到2034年其估值必須達到4.33萬億美元,才可以實現(xiàn)我們的回報率目標,。假設(shè)到那時英偉達依舊能夠維持快速增長但趨于成熟,,我們假定它的市盈率是高于平均水平的25倍。在這種情況下,,未來十年英偉達的利潤需要達到1,730億美元,,才可以實現(xiàn)10%的回報率目標。這相當于平均年利潤增長率為18.9%,。

這已經(jīng)非常難以實現(xiàn),。但在2月22日,情況變得更加夸張,。按當前的1.91萬億美元的市值和我們假定的25倍市盈率,,到2034年英偉達需要實現(xiàn)的利潤不是1,730億美元,,而是2,000億美元。這是蘋果和微軟目前不到1,000億美元利潤的兩倍之多,。按未來十年2.5%的年通脹率進行調(diào)整,,這個數(shù)字比蘋果過去四個季度的收益多出50%。到2034年利潤達到2,000億美元,,需要維持21%的年利潤增長率,,這比2月22日股價大漲之前需要達到的18.9%的年增長率高出2.1個百分點。

這兩個數(shù)字聽起來或許差異不大,。但要知道,,從2033年到2034年,要實現(xiàn)年度利潤增長21%,,英偉達的凈收益需要在一年內(nèi)增長350億美元,。相比之下,按前一天1.66萬億美元的市值(低了15%),,到第十年年度凈收益需要增長270億美元,。

簡而言之,問題不在于21%的利潤增長率,,對科技巨頭們而言,,這并非遙不可及。問題在于英偉達已經(jīng)賺取了大量收益,,而且市盈率倍數(shù)較高,。值得警惕的是:英偉達未來要為投資者帶來豐厚回報需要實現(xiàn)的利潤,以及未來需要維持的150億美元,、200億美元甚至350億美元的年增長幅度,。競爭對手將會爭相搶占其豐厚的利潤,更激烈的競爭會導致價格和盈利能力下跌,。最近創(chuàng)紀錄的股價上漲,,只會讓英偉達必須面對的挑戰(zhàn)變得更加艱巨。沒有任何一家公司能夠像英偉達這樣快速取得驚人的業(yè)績,,也沒有一家公司可以達到英偉達這樣的高度,,能夠克服大數(shù)定律。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

2024年2月22日,,英偉達(Nvidia)股票的單日漲幅創(chuàng)下了資本市場歷史上的最新紀錄,。到上午10點,英偉達的股價暴漲約15%,,其市值從前一個交易日收盤時的1.66萬億美元增長到1.91萬億美元,。新增的2,500億美元市值相當于特斯拉(Tesla)市值的40%、甲骨文(Oracle)的80%,比英特爾(Intel)的市值多出20%,。如今,,英偉達在投資界有舉足輕重的影響力。英偉達在2月21日收盤后發(fā)布的業(yè)績超出預期,,讓市場陷入瘋狂,,到22日下午3點左右,納斯達克100指數(shù)(Nasdaq 100)暴漲3%,。

華爾街分析師對英偉達的業(yè)績歡欣鼓舞,,至少有18家證券經(jīng)紀公司上調(diào)了對英偉達到2024年年底的股價漲幅的預測。其目前的股價接近800美元,。高盛集團(Goldman Sachs)將對英偉達的股價預測提高到875美元,,伯恩斯坦(Bernstein)提高到1,000美元,而KeyBanc則提高到1,100美元,。

這種樂觀的態(tài)度當然可以理解,,因為英偉達不僅取得了非凡的業(yè)績,還有一種普遍觀點認為,,英偉達占據(jù)主導地位的人工智能領(lǐng)域,,將是這個千年的顛覆性技術(shù)。在2024財年(截至1月31日),,英偉達按公認會計準則(GAAP)計算的營收增長126%,,達到610億美元,凈收益增長近六倍,,達到298億美元,。英偉達展現(xiàn)出前所未有的大規(guī)模運營杠桿效應,這意味著公司新增利潤在新增收入中占較大比例,。例如,,英偉達的毛利潤率提高了57%,達到73%,,這表明通過對比商品售價與公司為生產(chǎn)或采購產(chǎn)品和原材料支付的成本,英偉達向客戶提供的每一件可比商品的利潤比2023年提高了30%,。還有更好的消息,。扣除特殊項目以外,,英偉達的研發(fā),、日常開支和其他運營成本僅上漲了11%,只有銷售額增長幅度的十分之一,。

雖然業(yè)績令人矚目,,但未來收益的門檻已經(jīng)被大幅提高

分析師指出,英偉達的市盈率倍數(shù)并沒有高到離譜。在英偉達的股價于2月22日大幅上漲之前,,根據(jù)其2024財年全年的收益298億美元計算,,其市盈率為56倍,而華爾街的分析師們根據(jù)對未來幾個季度巨大收益的遠期預估,,使用了更低的市盈率倍數(shù),。一夜之間,股價大漲15%把英偉達的市盈率倍數(shù)提高到64,。在投資界,,沒有人會對這個數(shù)字感到擔心。

值得關(guān)注的是,,對英偉達在未來十年為維持當前1.91萬億美元的市值需要實現(xiàn)的收益水平的預測,。事實上,有趣的是探究此次史無前例的單日漲幅,,將收益門檻提高了多少,。假如投資者希望英偉達能夠?qū)崿F(xiàn)10%的年度總回報率。畢竟,,這是一只高風險的股票,。在英偉達公布業(yè)績之前的期權(quán)活動表明,投資者非常擔心即使公司業(yè)績稍微差強人意,,都可能影響股價,,因為市場對其股價有極高的預期。

將2月21日英偉達市值為1.66萬億美元時需要產(chǎn)生的收益,,與目前市值增加2,400億美元之后需要產(chǎn)生的收益進行對比,,得出的結(jié)果非常有趣。

首先我們來計算在此次股價大漲之前,,英偉達如何實現(xiàn)10%的年回報率,。當英偉達的市值為1.66萬億美元時,到2034年其估值必須達到4.33萬億美元,,才可以實現(xiàn)我們的回報率目標,。假設(shè)到那時英偉達依舊能夠維持快速增長但趨于成熟,我們假定它的市盈率是高于平均水平的25倍,。在這種情況下,,未來十年英偉達的利潤需要達到1,730億美元,才可以實現(xiàn)10%的回報率目標,。這相當于平均年利潤增長率為18.9%,。

這已經(jīng)非常難以實現(xiàn)。但在2月22日,,情況變得更加夸張,。按當前的1.91萬億美元的市值和我們假定的25倍市盈率,,到2034年英偉達需要實現(xiàn)的利潤不是1,730億美元,而是2,000億美元,。這是蘋果和微軟目前不到1,000億美元利潤的兩倍之多,。按未來十年2.5%的年通脹率進行調(diào)整,這個數(shù)字比蘋果過去四個季度的收益多出50%,。到2034年利潤達到2,000億美元,,需要維持21%的年利潤增長率,這比2月22日股價大漲之前需要達到的18.9%的年增長率高出2.1個百分點,。

這兩個數(shù)字聽起來或許差異不大,。但要知道,從2033年到2034年,,要實現(xiàn)年度利潤增長21%,,英偉達的凈收益需要在一年內(nèi)增長350億美元。相比之下,,按前一天1.66萬億美元的市值(低了15%),,到第十年年度凈收益需要增長270億美元。

簡而言之,,問題不在于21%的利潤增長率,,對科技巨頭們而言,這并非遙不可及,。問題在于英偉達已經(jīng)賺取了大量收益,,而且市盈率倍數(shù)較高。值得警惕的是:英偉達未來要為投資者帶來豐厚回報需要實現(xiàn)的利潤,,以及未來需要維持的150億美元,、200億美元甚至350億美元的年增長幅度。競爭對手將會爭相搶占其豐厚的利潤,,更激烈的競爭會導致價格和盈利能力下跌,。最近創(chuàng)紀錄的股價上漲,只會讓英偉達必須面對的挑戰(zhàn)變得更加艱巨,。沒有任何一家公司能夠像英偉達這樣快速取得驚人的業(yè)績,,也沒有一家公司可以達到英偉達這樣的高度,能夠克服大數(shù)定律,。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

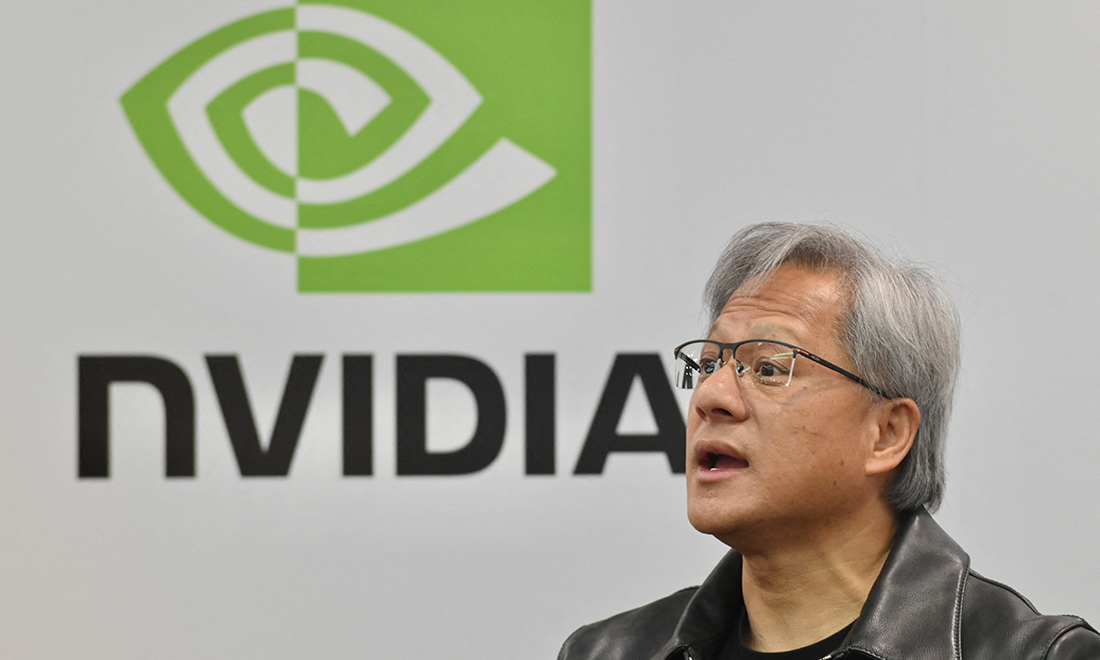

On Feb. 22, 2024, Nvidia’s stock performed one-day heroics probably never matched in the annals of capitalism. By 10 a.m., its shares had soared almost 15%, lifting its market capitalization to $1.91 trillion from $1.66 trillion at the previous close. The gain of $250 billion equals 40% the valuation for Tesla and 80% that of Oracle, and exceeds the worth of Intel by 20%. Nvidia is now the straw stirring the cocktail in the investment world. Its earnings beat, reported after the market close on Feb. 21, ignited a frenzy that sent the Nasdaq 100 soaring 3% by midafternoon on the 22nd.

Wall Street analysts cheered the results, with no fewer than 18 brokerages lifting their forecasts for gains beyond its current price of almost $800 by year-end. Goldman Sachs hiked to $875, while Bernstein raised to $1,000 and KeyBanc to $1,100.

The optimism is certainly understandable, given Nvidia’s sorcerous results, and the widespread view that the AI domain it dominates will prove the transformative technology of the millennium. For FY 2024 (ended Jan. 31), Nvidia grew GAAP revenues by 126% to $61 billion, and raised net income almost sixfold, to $29.8 billion. Nvidia is exhibiting operating leverage on a scale probably never before witnessed, meaning that it is booking big earnings increases as a share of every dollar of new revenue. For example, the gross margin rise of 57% to 73% shows that Nvidia this year pocketed 30% more on each comparable unit shipped to customers over last year, based on the selling price versus what it paid to make or purchase the products and materials. It gets better. Its R&D, overhead and other operating costs, less special items, rose a piddling 11%, one-tenth the rate of increase in its sales.

Despite those spectacular results, the bar just jumped enormously for future earnings

Analysts point out that Nvidia’s P/E multiple doesn’t look outrageous. Prior to the jump on February 22, it stood at 56 based on full FY 2024 earnings of $29.8 billion, and the Wall Street crowd used much lower numbers by citing forward estimates incorporating giant gains in the quarters to come. Overnight, the 15% jump in its share price raised Nvidia’s multiple to 64. In the investment community, that substantial figure appears to scare almost no one.

What should give pause is projections on what Nvidia will need to earn, say, a decade hence to be worth anything like its current cap of $1.91 trillion. In fact, it’s interesting to examine just how much the historic one day leap has raised the bar. Let’s say investors will want a 10% annual total return from Nvidia. After all, it’s a risky stock. The options action prior to the earnings release underscored that investors were extremely nervous that even mildly disappointing results would hammer the stock, simply because of the great expectations built into the price.

It’s especially interesting to compare the earnings Nvidia would have needed to generate when its market cap was $1.66 trillion in February 21 compared to the requirements today, after adding $240 billion.

So let’s start with what was required before the mega-bump, to reach returns of 10% a year. When Nvidia’s cap was $1.66 trillion, it had to notch a valuation of $4.33 trillion by 2034 to reach our goal. Assuming that by then it’s still growing pretty fast, but heading for maturity, we’ll assume it boasts a better-than-average PE of 25. In that scenario, the profit needed to grab the prize is $173 billion 10 years hence. Getting there equates to 18.9% yearly growth in profits, on average, over that span.

That’s one heck of a stretch. But on February 22, the stretch got a lot more elastic. At the current $1.91 trillion cap and our 25 assumption for a P/E, Nvidia must make not $173 billion, but $200 billion by 2034. That’s well over twice the sub-$100 billion numbers Apple and Microsoft are showing today. Adjusted for 2.5% yearly inflation over the next decade, it’s 50% more than Apple earned in the last four quarters. Hitting the $200 billion mark in 2034 requires annual increases of 21%, 2.1 points more than the 18.9% needed before the February 22 run-up.

That may not sound like a huge difference. But consider this: In 2034 over 2033, to add that annualized 21% in profits, Nvidia’s net income would need to wax, in a single year, by $35 billion. That compares with an increase in that 10th year of $27 billion just a day ago, when its valuation was 15% lower at $1.66 trillion.

Put simply, the problem isn’t that 21% earnings growth, for the tech superstar of superstars, looks so daunting. It’s that Nvidia already earns tons of money, and sells at a big multiple to those fat earnings. The cause for caution: The ultimate number Nvidia must achieve to give investors decent returns from here, and the multiple $15 or $20 and eventually $35 billion increases needed in the out years. Competitors will jump rush to capture a share of its sumptuous margins. Stiffer competition will cause prices and profitability to drop. The latest surge just made the adjustable mountain Nvidia must climb far steeper. No company has ever delivered such astounding results so quickly as Nvidia. And no company has ever had to scale such formidable heights to surmount the law of large numbers.