“美國例外主義”存在已經(jīng)有數(shù)百年時間,一直飽受爭議,。目前,,民主黨與共和黨均在利用該理論來推進自己提出的議程。這個理論認為,,美國擁有許多與眾不同,、獨一無二的特質,其支持者和反對者均試圖以該理論為依據(jù),,對美國的無數(shù)特征(從槍支暴力犯罪居高不下到不正常的醫(yī)療保健費用,,再到對權威的蔑視和對自力更生的堅持)進行解釋。

盡管對于“美國例外主義”在政治領域能否站得住腳目前尚無定論,,但過去幾年,,美國經(jīng)濟和股市的出色表現(xiàn)卻讓這一理論成為“顯學”。而且?guī)缀鯖]有人想到美國經(jīng)濟可以有如此例外的表現(xiàn),。

美國經(jīng)濟在后疫情時代的反彈讓全美專家都大跌眼鏡,。有一些經(jīng)濟學常識的人都知道,在自20世紀80年代以來最嚴重通脹浪潮和利率快速上升的雙重壓力之下,,美國經(jīng)濟本來應該是“雪上加霜”,。再考慮到受到俄烏、巴以兩場戰(zhàn)爭影響,,供應鏈一片混亂,,能源價格進一步走高,難怪一眾經(jīng)濟學家和華爾街領袖近年來一致認為美國經(jīng)濟將走向衰退,。

不過,,雖然一路經(jīng)歷了各種“驚濤駭浪”,但美國消費者和企業(yè)卻似乎挺了過來,,成功創(chuàng)造了經(jīng)濟奇跡,。美國經(jīng)濟仍在持續(xù)增長,,在極具韌性的勞動力市場支撐下,美國經(jīng)濟取得了出乎意料的成功,。雖然生活成本高昂問題依然嚴峻,,但后疫情時代的美國卻仍然實現(xiàn)了強勁的經(jīng)濟反彈,這一點在與其他發(fā)達國家比較時表現(xiàn)得尤為明顯,。

2023年第四季度,,美國國內生產總值(GDP)的年化增長率為3.3%,而歐元區(qū)20國僅為0.1%,,日本為1.1%,。根據(jù)國際貨幣基金組織(International Monetary Fund)發(fā)布的《世界經(jīng)濟展望》(World Economic Outlook),2023年全年,,美國國內生產總值的增速為2.5%,,在G7經(jīng)濟體中名列首位。

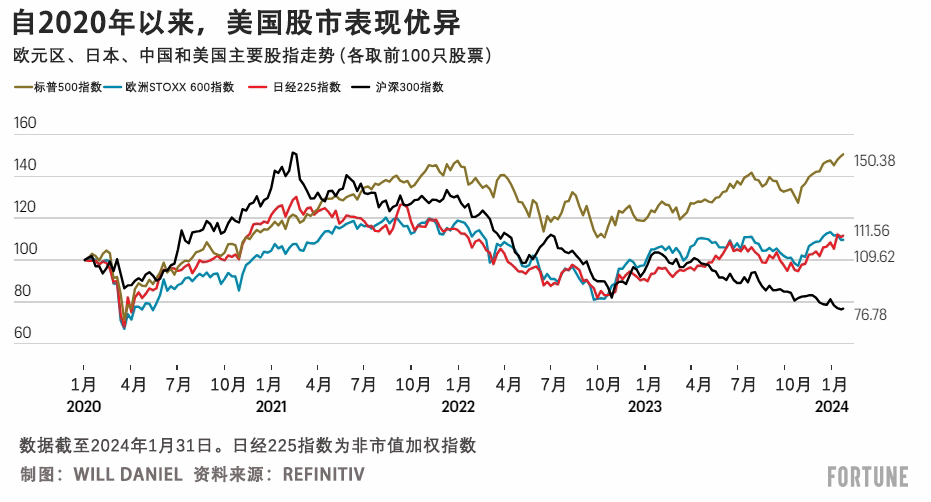

自2020年年初的新冠疫情爆發(fā)以來,,受美國經(jīng)濟強勁表現(xiàn)拉動,,美國股市的表現(xiàn)也優(yōu)于其他發(fā)達國家市場。2020年1月以來,,標準普爾500指數(shù)(S&P 500)上漲了53%,,相比之下,歐洲STOXX 600指數(shù)的漲幅為16%,,日本日經(jīng)225指數(shù)(非加權)的漲幅為52%,,中國滬深300指數(shù)更是下跌了23%。

美國經(jīng)濟之所以能夠在后疫情時代取得優(yōu)異表現(xiàn),,原因有很多,,從美國在能源上的相對獨立到其在應對新冠疫情時采取的積極財政和貨幣政策,不一而足,。這些優(yōu)勢可以幫助美股在未來幾年繼續(xù)保持優(yōu)異表現(xiàn),。

SEI Investments的首席市場策略師兼高級投資組合經(jīng)理詹姆斯·索洛維在接受《財富》雜志采訪時表示:“美國目前的狀況依舊好于其他大多數(shù)國家,其目前的經(jīng)濟增速高于平均水平,,雖然多少有一些出人意料,,但卻是正在發(fā)生的現(xiàn)實,這也給2024年開了一個好頭,?!?/p>

盡管如此,各種不可預測的風險(從美國選舉的結果到國外戰(zhàn)爭的影響等)仍舊不可等閑視之,。而且美股在經(jīng)過過去幾年的暴漲之后,,估值已經(jīng)很高。對投資者來說,,即便美國經(jīng)濟的表現(xiàn)仍將優(yōu)于其他發(fā)達國家,,把全部身家都押在美國股市還會繼續(xù)上漲上可能也并非最好的選擇,。在這個充滿不確定性的時代,把所有雞蛋都放在一個籃子里難免會有風險,。

索洛維說:“我認為,,就當下而言,最好還是進行分散投資,。美國股市之所以一路高歌猛進,,主要得益于美國股市的增長特性,但相對于其他國家,,美國股市的估值已經(jīng)相對偏高,。”

不過,,放眼2024年,,美國經(jīng)濟可能仍將顯著優(yōu)于全球平均水平。對投資者來說,,了解個中原因能夠幫助其更好地選擇下一步的投資方向,,判斷美國經(jīng)濟還可以在多長時間內在全球獨領風騷。

有力的財政應對政策

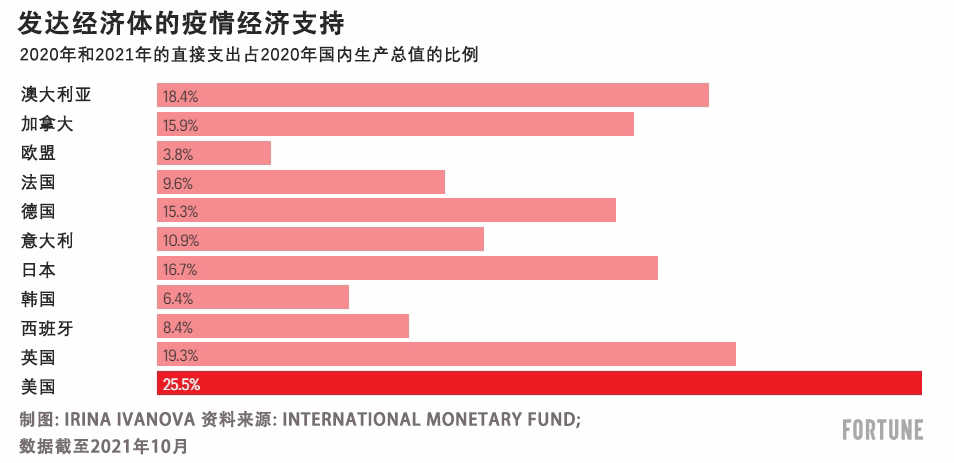

2020年年初,,新冠疫情爆發(fā),全球經(jīng)濟陷于停滯,,為支持本國經(jīng)濟,,各發(fā)達國家政府采取了截然不同的方法。截至目前,,美國聯(lián)邦政府在支出方面的做法最為積極,,通過了六項新冠救濟法案,在2020年和2021年共支出4.6萬億美元,,約占美國國內生產總值的10%,。

SEI的索洛維指出,美國的新冠財政救濟支出不僅占國內生產總值的比重最大,,也“更加直接,,美國政府直接把錢發(fā)到了民眾手中,為企業(yè)提供支持,,而不僅僅是提供貸款擔?!薄?/p>

索洛維說,,這種強力財政對策可能確實推高了通脹,,但也幫助許多美國人在支出自然減少時保持了收入水平。由于收入相對穩(wěn)定,、支出相對較低,,消費者在新冠疫情期間積累了所謂的“超額儲蓄”,。截至2021年8月,美國人的超額儲蓄已經(jīng)超過2萬億美元,,這些儲蓄幫助刺激了消費支出,,防止了經(jīng)濟出現(xiàn)衰退。

抵御利率上升的能力

在貨幣方面,,美聯(lián)儲(U.S. Federal Reserve)在新冠疫情爆發(fā)時采取了激進的降息策略,,把利率降至近零水平。美國消費者和企業(yè)迅速行動,,利用較低的借貸成本,,在利率處于歷史低位時對抵押貸款和其他貸款進行再融資。這種做法幫助他們以比預期更快的速度從疫情引發(fā)的短暫衰退中恢復過來,,并在利率上升時保持了一定的支出能力,。

索洛維稱:“由于家庭和企業(yè)都在非常低的利率水平上進行了再融資,所以在利率上升時,,他們都有一定的抵御能力,。因此,與其他許多國家的民眾相比,,美國人并未立即感受到利率上升的影響,。”

當中央銀行提高利率時,,企業(yè)和消費者的借貸成本就會提高,,放在各國皆是如此。但借貸成本上升對消費者和企業(yè)的影響速度和嚴重程度卻不盡相同,,例如在過去幾年,,美國聯(lián)邦儲備委員會、英格蘭銀行(Bank of England)和歐洲中央銀行(European Central Bank)都提高了利率,,影響卻各不相同,。

以住房貸款為例。根據(jù)Bankrate的數(shù)據(jù),,2023年,,美國79%的抵押貸款為30年或15年期固定利率貸款。相反,,根據(jù)英國金融行為監(jiān)管局(Financial Conduct Authority)的數(shù)據(jù),,英國74%的抵押貸款為2年到5年期固定利率貸款,到期后就需要重新進行融資,。

因此,,據(jù)英國《衛(wèi)報》(Guardian)2023年12月報道,自2021年年底以來,,英國55%的抵押貸款利率出現(xiàn)上升,。而Redfin的數(shù)據(jù)顯示,,即便美國30年期抵押貸款的平均利率在2023年出現(xiàn)了大幅提高(先是飆升至8%,后又回落至近7%),,美國近90%房主的抵押貸款利率依然低于6%,。

索洛維解釋道,對美國的許多房主而言,,只有當“他們自身的情況發(fā)生變化,,比如有了孩子,需要換一套大房子時,,才會開始感受到更高利率帶來的影響”,。

能源獨立

與其他發(fā)達國家相比,美國的能源相對獨立,,這也是其在過去幾年里表現(xiàn)優(yōu)異的另一個原因,。

過去五年,美國天然氣產量激增,,在2023年創(chuàng)下歷史新高,。而這一變化的意義在于,2022年2月俄烏沖突爆發(fā)后,,美國經(jīng)濟比許多發(fā)達國家更不容易受到天然氣價格上漲的影響,。高度依賴俄羅斯天然氣的歐洲國家的天然氣價格在2022年8月達到了每百萬英國熱量單位(BTU)70余美元的歷史峰值,而在美國,,這一數(shù)字僅為10美元,。

近年來,美國能源業(yè)在全球液化天然氣(LNG)市場逐步占據(jù)了主導地位,,歐洲對美國液化天然氣的依賴也越來越大。牛津經(jīng)濟研究院(Oxford Economics)的首席全球經(jīng)濟學家英尼斯·麥克菲解釋道,,由于缺乏能源獨立性,,“歐洲工業(yè)在與美國同行競爭時處于結構性劣勢”。

除此之外,,雖然由于俄烏沖突引發(fā)油價上漲,,美國經(jīng)濟也受到了一定影響,但在美國總統(tǒng)喬·拜登釋放1.8億桶戰(zhàn)略石油儲備后,,相關影響得到了有效的緩解,。美國的能源公司也因為產量飆升創(chuàng)造了盈利紀錄。這些都有助于提高美國公司的收益和股票價格,,同時也為許多美國人提供了高薪工作,。

美國石油產量在2023年創(chuàng)下歷史新高,據(jù)美國能源信息署(U.S. Energy Information Agency)預計,,在“油井產量提升”推動下,,2024年和2025年的石油產量將再創(chuàng)新高,。這對于防止油價進一步飆升、加劇通貨膨脹會很有幫助,。

美國經(jīng)濟能否繼續(xù)獨占鰲頭,?

為解釋美國經(jīng)濟為何可以在后疫情時代表現(xiàn)優(yōu)異,專家們給出了許多解釋,,上述因素只是其中幾個而已,。有經(jīng)濟學家指出,由于美國的資本市場更為發(fā)達,,所以美國企業(yè)能夠在困難時期隨時獲得現(xiàn)金,,并幫助雇主留住工人。還有更多人認為,,由于美國在科技領域占據(jù)主導地位,,美國經(jīng)濟和股市得以成為這輪人工智能熱潮的主要受益者。也有人指出,,由于新冠疫情期間美國政府以經(jīng)濟刺激金的形式為美國消費者提供了直接支持,,一批新企業(yè)應運而生,員工技能提升也蔚然成風,,進而推動了生產率提升和經(jīng)濟增長,。說了這么多,我們甚至還沒有觸及其他發(fā)達國家所面臨的國內經(jīng)濟問題,。

美國銀行研究部(Bank of America Research)的經(jīng)濟學家們曾經(jīng)預測美國將會陷入衰退,,結果卻欣喜地發(fā)現(xiàn)美國經(jīng)濟的表現(xiàn)出乎意料的強勁,對于究竟是什么因素在推動美國股市不斷走高,,他們給出了另一種解讀,,那就是投資者的“FOMO” (fear of missing out,意為害怕錯過)心態(tài),。本杰明·鮑勒領導的全球股票衍生品研究(Global Equity Derivatives Research)團隊在其2024年展望中寫道,,“害怕錯過”成了“投資者腦海中最關心的事情”,對于增加更大宏觀不確定性的許多重大基本面和政策面風險,,則放在了次要位置,。

“FOMO”是千禧一代的口頭禪,由哈佛商學院(Harvard Business School)的一名學生于2004年在其于??习l(fā)表的一篇評論文章中首次提出,。但這種情緒不禁讓人想起幾十年前也有過用于形容投資者熱情的類似委婉說法:20世紀90年代美聯(lián)儲主席艾倫·格林斯潘口中的“非理性繁榮”,和20世紀30年代傳奇經(jīng)濟學家約翰·梅納德·凱恩斯最喜歡用的“動物精神”,。這種東西多了就會產生泡沫,,然后就會突然破滅,就像互聯(lián)網(wǎng)泡沫那樣,格林斯潘時代的非理性繁榮就是因為這種泡沫的破滅而宣告終結,。

但真正的問題依舊沒有找到答案,,那就是:美國目前良好的狀態(tài)能否持續(xù)下去?在推動美國經(jīng)濟實現(xiàn)強勁增長方面,,有些因素目前確實發(fā)揮著積極作用,,但在未來卻有可能成為拖累。對科技壟斷和赤字支出的依賴可能會讓美國在未來付出沉痛的代價,。同樣,,超額儲蓄的消退和高昂的生活成本也會打擊消費者信心,抑制經(jīng)濟增長,。但牛津經(jīng)濟研究院的麥克菲認為,,“與其他發(fā)達市場相比,美國的前景實際上仍然相當不錯”,。

麥克菲預測,,美國今年的實際收入增長率將達到2.5%,有助于支持消費支出,,而歐洲的實際收入增長率僅為1%,。他還預計美國的財政政策將比歐洲“支持力度更大”,因為歐洲的趨勢是“整頓和控制預算赤字”,。

他補充道:“美國經(jīng)濟的供應面看起來更強勁一些,。今年美國的生產率增長非常強勁,其他國家可不是這樣,?!迸c之觀點類似,國際貨幣基金組織的經(jīng)濟學家預測,,2024年美國經(jīng)濟的國內生產總值的增速將達到2.1%,,高于七國集團的其他所有經(jīng)濟體。

盡管如此,,麥克菲依然警告說,,今年的總統(tǒng)大選給美國經(jīng)濟的發(fā)展打上了一個“大大的問號”,選舉結果將是決定經(jīng)濟未來走向的關鍵,。

“大選之后,美國將會推出怎樣的政策,?”他問道,。“唐納德·特朗普的減稅政策將于明年到期,。因此,,下屆政府很可能會對稅收政策進行調整。我認為,,這將對美國能否繼續(xù)跑贏其他發(fā)達市場產生重大影響,?!?/p>

SEI的索洛維也認為大選給2024年帶來了很多“不確定性”,但他補充道,,美國經(jīng)濟還有一個或許可以使其免受大選結果影響,、繼續(xù)蓬勃發(fā)展的特點。索洛維指出:“即便在經(jīng)濟低谷期,,美國經(jīng)濟和投資者也能夠適應環(huán)境的變化,。實際上,在過去十多年里一些非常艱難的時期,,我們的經(jīng)濟表現(xiàn)也十分亮眼,,股市業(yè)績也十分優(yōu)異?!保ㄘ敻恢形木W(wǎng))

譯者:梁宇

審校:夏林

“美國例外主義”存在已經(jīng)有數(shù)百年時間,,一直飽受爭議。目前,,民主黨與共和黨均在利用該理論來推進自己提出的議程,。這個理論認為,美國擁有許多與眾不同,、獨一無二的特質,,其支持者和反對者均試圖以該理論為依據(jù),對美國的無數(shù)特征(從槍支暴力犯罪居高不下到不正常的醫(yī)療保健費用,,再到對權威的蔑視和對自力更生的堅持)進行解釋,。

盡管對于“美國例外主義”在政治領域能否站得住腳目前尚無定論,但過去幾年,,美國經(jīng)濟和股市的出色表現(xiàn)卻讓這一理論成為“顯學”,。而且?guī)缀鯖]有人想到美國經(jīng)濟可以有如此例外的表現(xiàn)。

美國經(jīng)濟在后疫情時代的反彈讓全美專家都大跌眼鏡,。有一些經(jīng)濟學常識的人都知道,,在自20世紀80年代以來最嚴重通脹浪潮和利率快速上升的雙重壓力之下,美國經(jīng)濟本來應該是“雪上加霜”,。再考慮到受到俄烏,、巴以兩場戰(zhàn)爭影響,供應鏈一片混亂,,能源價格進一步走高,,難怪一眾經(jīng)濟學家和華爾街領袖近年來一致認為美國經(jīng)濟將走向衰退。

不過,,雖然一路經(jīng)歷了各種“驚濤駭浪”,,但美國消費者和企業(yè)卻似乎挺了過來,成功創(chuàng)造了經(jīng)濟奇跡。美國經(jīng)濟仍在持續(xù)增長,,在極具韌性的勞動力市場支撐下,,美國經(jīng)濟取得了出乎意料的成功。雖然生活成本高昂問題依然嚴峻,,但后疫情時代的美國卻仍然實現(xiàn)了強勁的經(jīng)濟反彈,,這一點在與其他發(fā)達國家比較時表現(xiàn)得尤為明顯。

2023年第四季度,,美國國內生產總值(GDP)的年化增長率為3.3%,,而歐元區(qū)20國僅為0.1%,日本為1.1%,。根據(jù)國際貨幣基金組織(International Monetary Fund)發(fā)布的《世界經(jīng)濟展望》(World Economic Outlook),,2023年全年,美國國內生產總值的增速為2.5%,,在G7經(jīng)濟體中名列首位,。

自2020年年初的新冠疫情爆發(fā)以來,受美國經(jīng)濟強勁表現(xiàn)拉動,,美國股市的表現(xiàn)也優(yōu)于其他發(fā)達國家市場,。2020年1月以來,標準普爾500指數(shù)(S&P 500)上漲了53%,,相比之下,,歐洲STOXX 600指數(shù)的漲幅為16%,日本日經(jīng)225指數(shù)(非加權)的漲幅為52%,,中國滬深300指數(shù)更是下跌了23%,。

美國經(jīng)濟之所以能夠在后疫情時代取得優(yōu)異表現(xiàn),原因有很多,,從美國在能源上的相對獨立到其在應對新冠疫情時采取的積極財政和貨幣政策,,不一而足。這些優(yōu)勢可以幫助美股在未來幾年繼續(xù)保持優(yōu)異表現(xiàn),。

SEI Investments的首席市場策略師兼高級投資組合經(jīng)理詹姆斯·索洛維在接受《財富》雜志采訪時表示:“美國目前的狀況依舊好于其他大多數(shù)國家,,其目前的經(jīng)濟增速高于平均水平,雖然多少有一些出人意料,,但卻是正在發(fā)生的現(xiàn)實,,這也給2024年開了一個好頭?!?/p>

盡管如此,,各種不可預測的風險(從美國選舉的結果到國外戰(zhàn)爭的影響等)仍舊不可等閑視之。而且美股在經(jīng)過過去幾年的暴漲之后,,估值已經(jīng)很高。對投資者來說,即便美國經(jīng)濟的表現(xiàn)仍將優(yōu)于其他發(fā)達國家,,把全部身家都押在美國股市還會繼續(xù)上漲上可能也并非最好的選擇,。在這個充滿不確定性的時代,把所有雞蛋都放在一個籃子里難免會有風險,。

索洛維說:“我認為,,就當下而言,最好還是進行分散投資,。美國股市之所以一路高歌猛進,,主要得益于美國股市的增長特性,但相對于其他國家,,美國股市的估值已經(jīng)相對偏高,。”

不過,,放眼2024年,,美國經(jīng)濟可能仍將顯著優(yōu)于全球平均水平。對投資者來說,,了解個中原因能夠幫助其更好地選擇下一步的投資方向,,判斷美國經(jīng)濟還可以在多長時間內在全球獨領風騷。

有力的財政應對政策

2020年年初,,新冠疫情爆發(fā),,全球經(jīng)濟陷于停滯,為支持本國經(jīng)濟,,各發(fā)達國家政府采取了截然不同的方法,。截至目前,美國聯(lián)邦政府在支出方面的做法最為積極,,通過了六項新冠救濟法案,,在2020年和2021年共支出4.6萬億美元,約占美國國內生產總值的10%,。

SEI的索洛維指出,,美國的新冠財政救濟支出不僅占國內生產總值的比重最大,也“更加直接,,美國政府直接把錢發(fā)到了民眾手中,,為企業(yè)提供支持,而不僅僅是提供貸款擔?!?。

索洛維說,這種強力財政對策可能確實推高了通脹,,但也幫助許多美國人在支出自然減少時保持了收入水平,。由于收入相對穩(wěn)定,、支出相對較低,消費者在新冠疫情期間積累了所謂的“超額儲蓄”,。截至2021年8月,,美國人的超額儲蓄已經(jīng)超過2萬億美元,這些儲蓄幫助刺激了消費支出,,防止了經(jīng)濟出現(xiàn)衰退,。

抵御利率上升的能力

在貨幣方面,美聯(lián)儲(U.S. Federal Reserve)在新冠疫情爆發(fā)時采取了激進的降息策略,,把利率降至近零水平,。美國消費者和企業(yè)迅速行動,利用較低的借貸成本,,在利率處于歷史低位時對抵押貸款和其他貸款進行再融資,。這種做法幫助他們以比預期更快的速度從疫情引發(fā)的短暫衰退中恢復過來,并在利率上升時保持了一定的支出能力,。

索洛維稱:“由于家庭和企業(yè)都在非常低的利率水平上進行了再融資,,所以在利率上升時,他們都有一定的抵御能力,。因此,,與其他許多國家的民眾相比,美國人并未立即感受到利率上升的影響,?!?/p>

當中央銀行提高利率時,企業(yè)和消費者的借貸成本就會提高,,放在各國皆是如此,。但借貸成本上升對消費者和企業(yè)的影響速度和嚴重程度卻不盡相同,例如在過去幾年,,美國聯(lián)邦儲備委員會,、英格蘭銀行(Bank of England)和歐洲中央銀行(European Central Bank)都提高了利率,影響卻各不相同,。

以住房貸款為例,。根據(jù)Bankrate的數(shù)據(jù),2023年,,美國79%的抵押貸款為30年或15年期固定利率貸款,。相反,根據(jù)英國金融行為監(jiān)管局(Financial Conduct Authority)的數(shù)據(jù),,英國74%的抵押貸款為2年到5年期固定利率貸款,,到期后就需要重新進行融資。

因此,,據(jù)英國《衛(wèi)報》(Guardian)2023年12月報道,,自2021年年底以來,,英國55%的抵押貸款利率出現(xiàn)上升。而Redfin的數(shù)據(jù)顯示,,即便美國30年期抵押貸款的平均利率在2023年出現(xiàn)了大幅提高(先是飆升至8%,,后又回落至近7%),美國近90%房主的抵押貸款利率依然低于6%,。

索洛維解釋道,對美國的許多房主而言,,只有當“他們自身的情況發(fā)生變化,,比如有了孩子,需要換一套大房子時,,才會開始感受到更高利率帶來的影響”,。

能源獨立

與其他發(fā)達國家相比,美國的能源相對獨立,,這也是其在過去幾年里表現(xiàn)優(yōu)異的另一個原因,。

過去五年,美國天然氣產量激增,,在2023年創(chuàng)下歷史新高,。而這一變化的意義在于,2022年2月俄烏沖突爆發(fā)后,,美國經(jīng)濟比許多發(fā)達國家更不容易受到天然氣價格上漲的影響,。高度依賴俄羅斯天然氣的歐洲國家的天然氣價格在2022年8月達到了每百萬英國熱量單位(BTU)70余美元的歷史峰值,而在美國,,這一數(shù)字僅為10美元,。

近年來,美國能源業(yè)在全球液化天然氣(LNG)市場逐步占據(jù)了主導地位,,歐洲對美國液化天然氣的依賴也越來越大,。牛津經(jīng)濟研究院(Oxford Economics)的首席全球經(jīng)濟學家英尼斯·麥克菲解釋道,由于缺乏能源獨立性,,“歐洲工業(yè)在與美國同行競爭時處于結構性劣勢”,。

除此之外,雖然由于俄烏沖突引發(fā)油價上漲,,美國經(jīng)濟也受到了一定影響,,但在美國總統(tǒng)喬·拜登釋放1.8億桶戰(zhàn)略石油儲備后,相關影響得到了有效的緩解,。美國的能源公司也因為產量飆升創(chuàng)造了盈利紀錄,。這些都有助于提高美國公司的收益和股票價格,同時也為許多美國人提供了高薪工作,。

美國石油產量在2023年創(chuàng)下歷史新高,,據(jù)美國能源信息署(U.S. Energy Information Agency)預計,,在“油井產量提升”推動下,2024年和2025年的石油產量將再創(chuàng)新高,。這對于防止油價進一步飆升,、加劇通貨膨脹會很有幫助。

美國經(jīng)濟能否繼續(xù)獨占鰲頭,?

為解釋美國經(jīng)濟為何可以在后疫情時代表現(xiàn)優(yōu)異,,專家們給出了許多解釋,上述因素只是其中幾個而已,。有經(jīng)濟學家指出,,由于美國的資本市場更為發(fā)達,所以美國企業(yè)能夠在困難時期隨時獲得現(xiàn)金,,并幫助雇主留住工人,。還有更多人認為,由于美國在科技領域占據(jù)主導地位,,美國經(jīng)濟和股市得以成為這輪人工智能熱潮的主要受益者,。也有人指出,由于新冠疫情期間美國政府以經(jīng)濟刺激金的形式為美國消費者提供了直接支持,,一批新企業(yè)應運而生,,員工技能提升也蔚然成風,進而推動了生產率提升和經(jīng)濟增長,。說了這么多,,我們甚至還沒有觸及其他發(fā)達國家所面臨的國內經(jīng)濟問題。

美國銀行研究部(Bank of America Research)的經(jīng)濟學家們曾經(jīng)預測美國將會陷入衰退,,結果卻欣喜地發(fā)現(xiàn)美國經(jīng)濟的表現(xiàn)出乎意料的強勁,,對于究竟是什么因素在推動美國股市不斷走高,他們給出了另一種解讀,,那就是投資者的“FOMO” (fear of missing out,,意為害怕錯過)心態(tài)。本杰明·鮑勒領導的全球股票衍生品研究(Global Equity Derivatives Research)團隊在其2024年展望中寫道,,“害怕錯過”成了“投資者腦海中最關心的事情”,,對于增加更大宏觀不確定性的許多重大基本面和政策面風險,則放在了次要位置,。

“FOMO”是千禧一代的口頭禪,,由哈佛商學院(Harvard Business School)的一名學生于2004年在其于校刊上發(fā)表的一篇評論文章中首次提出,。但這種情緒不禁讓人想起幾十年前也有過用于形容投資者熱情的類似委婉說法:20世紀90年代美聯(lián)儲主席艾倫·格林斯潘口中的“非理性繁榮”,,和20世紀30年代傳奇經(jīng)濟學家約翰·梅納德·凱恩斯最喜歡用的“動物精神”。這種東西多了就會產生泡沫,,然后就會突然破滅,,就像互聯(lián)網(wǎng)泡沫那樣,,格林斯潘時代的非理性繁榮就是因為這種泡沫的破滅而宣告終結。

但真正的問題依舊沒有找到答案,,那就是:美國目前良好的狀態(tài)能否持續(xù)下去,?在推動美國經(jīng)濟實現(xiàn)強勁增長方面,有些因素目前確實發(fā)揮著積極作用,,但在未來卻有可能成為拖累,。對科技壟斷和赤字支出的依賴可能會讓美國在未來付出沉痛的代價。同樣,,超額儲蓄的消退和高昂的生活成本也會打擊消費者信心,,抑制經(jīng)濟增長。但牛津經(jīng)濟研究院的麥克菲認為,,“與其他發(fā)達市場相比,美國的前景實際上仍然相當不錯”,。

麥克菲預測,,美國今年的實際收入增長率將達到2.5%,有助于支持消費支出,,而歐洲的實際收入增長率僅為1%,。他還預計美國的財政政策將比歐洲“支持力度更大”,因為歐洲的趨勢是“整頓和控制預算赤字”,。

他補充道:“美國經(jīng)濟的供應面看起來更強勁一些,。今年美國的生產率增長非常強勁,其他國家可不是這樣,?!迸c之觀點類似,國際貨幣基金組織的經(jīng)濟學家預測,,2024年美國經(jīng)濟的國內生產總值的增速將達到2.1%,,高于七國集團的其他所有經(jīng)濟體。

盡管如此,,麥克菲依然警告說,,今年的總統(tǒng)大選給美國經(jīng)濟的發(fā)展打上了一個“大大的問號”,選舉結果將是決定經(jīng)濟未來走向的關鍵,。

“大選之后,,美國將會推出怎樣的政策?”他問道,?!疤萍{德·特朗普的減稅政策將于明年到期。因此,,下屆政府很可能會對稅收政策進行調整,。我認為,,這將對美國能否繼續(xù)跑贏其他發(fā)達市場產生重大影響?!?/p>

SEI的索洛維也認為大選給2024年帶來了很多“不確定性”,,但他補充道,美國經(jīng)濟還有一個或許可以使其免受大選結果影響,、繼續(xù)蓬勃發(fā)展的特點,。索洛維指出:“即便在經(jīng)濟低谷期,美國經(jīng)濟和投資者也能夠適應環(huán)境的變化,。實際上,,在過去十多年里一些非常艱難的時期,我們的經(jīng)濟表現(xiàn)也十分亮眼,,股市業(yè)績也十分優(yōu)異,。”(財富中文網(wǎng))

譯者:梁宇

審校:夏林

The entire concept of “American exceptionalism” is controversial. Used by both major parties to advance their agendas of the moment, the belief that there’s something distinct and unique about America has been present for hundreds of years. It’s been co-opted by both boosters and detractors to explain away countless features of the U.S. landscape—from our high rates of gun violence and abnormal health care costs to our disdain for authority and penchant for self-reliance.

But while American exceptionalism may or may not be real in the political realm, it’s been front and center in the remarkable performance of the U.S. economy and stock market over the past few years. And almost nobody saw this exceptionalism coming.

The United States’ post-COVID rebound thoroughly surprised experts across the nation. Consult the economics textbooks, and the combined force of the worst inflationary wave since the 1980s and rapidly rising interest rates should have left the American economy looking worse for wear. Tack on two foreign wars that have crimped supply chains and boosted energy prices, and it makes sense why a U.S. recession was the near-unanimous expectation of many economists and Wall Street leaders for years.

Still, despite all these storm clouds, it looks like American consumers and businesses have so far defied the odds. The economy continues to grow, with a resilient labor market underpinning its largely unexpected success. And while serious cost of living issues remain, the U.S.’s post-COVID rebound has been particularly strong when compared to its developed peers.

In the fourth quarter of 2023, U.S. GDP grew at an annual rate of 3.3%, compared to just 0.1% for the 20 nations that make up the Euro Area, and 1.1% for Japan. And for all of 2023, U.S. GDP rose 2.5%, more than any other G7 economy, according to the International Monetary Fund’s (IMF) World Economic Outlook.

The economic strength has helped U.S. stocks trounce their developed market peers since the outbreak of COVID in early 2020. The S&P 500 is up over 53% since Jan. 2020, compared to a 16% rise for the STOXX Europe 600 index, a 52% jump for Japan’s Nikkei 225 (non-cap weighted), and a 23% drop for China’s CSI 300 index.

There are a few key reasons why the U.S. economy has outperformed in the post-COVID era, from the country’s relative energy independence to its aggressive fiscal and monetary response to the pandemic. They’re advantages that could help American stocks maintain their exceptional run of performance over the next few years.

“The U.S. is still in a better position than most other countries right now,” James Solloway, chief market strategist and senior portfolio manager at SEI Investments, told Fortune. “We're seeing above average growth, which is somewhat surprising, but nonetheless, it's happening. So we’ve entered 2024 with a bit of momentum.”

That being said, unpredictable risks, from the outcome of domestic elections to the impact of foreign wars, could still rear their head. And after U.S. stocks’ big run-up over the past few years, valuations are high. For investors, that means going all in on another era of U.S. stock market dominance may not be the best choice, even if the U.S. economy is set to outperform its developed peers. In this era of uncertainty, keeping all your eggs in one basket could be risky.

“I think that at this point, it pays to be diversified,” Solloway said. “The United States has had a great run, mainly owing to the growth nature of the stock markets here, but valuations have become quite stretched relative to other countries.”

Still, the U.S. may remain the global economy’s outlier in 2024—in a good way. And understanding why can help investors decide which way to go next, and how long this era of outperformance could go on.

A big fiscal response

When the outbreak of COVID-19 shut down the global economy in early 2020, the governments of developed nations took very different approaches to supporting their domestic economies. The U.S. federal government was by far the most aggressive with spending, dishing out $4.6 trillion, or roughly 10% of U.S. GDP in 2020 and 2021, through six COVID-19 relief laws.

SEI’s Solloway noted that not only did the U.S. have the largest fiscal response to the pandemic relative to the size of its economy, its COVID relief spending was also “much more direct, putting money into people's pockets and supporting businesses directly, as opposed to just providing loan guarantees.”

This forceful fiscal response may have boosted inflation, Solloway said, but it also helped many Americans maintain their incomes during a period when spending was naturally lower. The combination of relatively stable incomes and lower spending helped consumers build up so-called “excess savings” during the pandemic. By August 2021, Americans had over $2 trillion in excess savings, and those savings helped buoy consumer spending and prevent a recession.

Resilience to rising interest rates

On the monetary side of things, the U.S. Federal Reserve was also very aggressive in cutting interest rates to near-zero when the pandemic hit. American consumers and businesses were quick to take advantage of the lower borrowing costs, refinancing mortgages and other loans while rates were historically low. That’s helped them recover from the brief COVID-induced downturn faster than anticipated, and maintain some spending power even as interest rates have risen.

“Households and businesses both had some insulation from the increase in rates… because both refinanced at very low interest rates,” Solloway said. “And therefore they have not immediately felt the impact of higher rates yet, as opposed to a lot of other countries.”

When central banks hike interest rates, it raises borrowing costs for all businesses and consumers—and that’s true in every country. But how quickly and severely higher borrowing costs affect consumers and businesses isn’t the same—a fact on display over the past few years with the U.S. Federal Reserve, the Bank of England, and the European Central Bank all raising rates.

Take housing. In the U.S., 79% of all mortgages had fixed rates of 30 or 15 years in 2023, according to Bankrate. Conversely, in the U.K., 74% of mortgages currently have interest rates that are fixed for two to five years before they need to be re-financed, according to data from the U.K.’s Financial Conduct Authority.

As a result, 55% of U.K. mortgages saw their interest rate increase since the end of 2021, the Guardian reported in December. But in the U.S., nearly 90% of homeowners still have mortgage rates under 6%, even as average 30-year mortgage rates spiked to 8% last year before falling to nearly 7%, Redfin data shows.

For many U.S. homeowners, it’s only when “their situation changes, they have a family, they need to move to a bigger house that they start feeling the impact of higher interest rates,” Solloway explained.

Energy independence

The U.S.’s relative energy independence compared to its developed nation peers is another reason it managed to outperform over the past few years.

U.S. natural gas production has soared in the past five years, hitting a record high in 2023. When Russia invaded Ukraine in February 2022, that meant the U.S. economy was more insulated from rising natural gas prices than many of its developed peers. European national gas prices, which are highly reliant on Russian gas, peaked at over over $70 per million British Thermal Units (BTU) in August 2022, compared to a peak of just $10 per million BTU in the U.S.

The U.S. energy industry has also developed a dominant position in the liquefied natural gas (LNG) market in recent years, with Europe increasingly relying on the U.S.’s LNG. Innes McFee, chief global economist at Oxford Economics, explained that Europe’s lack of energy independence “puts European industry at a structural disadvantage versus U.S. counterparts.”

On top of that, although the U.S. economy was affected by rising oil prices after the start of the Ukraine war, President Biden’s release of 180 million barrels of oil from the strategic petroleum reserve helped blunt the impact. U.S. energy companies were also able to rake in record profits as their production soared. That helped boost U.S. corporate earnings and stock prices, while providing high-paying jobs for many Americans.

U.S. oil production hit a record high in 2023 as well, and the U.S. Energy Information Agency expects “improved well productivity” will lead to two more record production years in 2024 and 2025. That should help prevent another oil price spike that could exacerbate inflation.

Will the U.S. continue to outperform?

The factors described above are just a few of the many that experts offer to explain the U.S. economies’ post-COVID outperformance. Other economists point to the U.S.’s more developed capital markets, saying they enable U.S. businesses to readily access cash in tough times, and have helped employers hang onto workers. Still more say U.S. tech dominance has made the American economy and stock market the major beneficiary of the AI boom. And others note that the direct support for American consumers in the form of stimulus checks led to a wave of new business formation and the upskilling of workers in the U.S. during the COVID era, which has worked to increase productivity and economic growth ever since. All of this doesn’t even touch on the domestic economic problems that other developed nations are facing—particularly China, with its ailing housing market.

Bank of America Research, whose own economists predicted a recession only to be happily surprised by the U.S. economy’s strong performance, have another idea about what could be driving the U.S. stock market: investors’ “FOMO.” The Global Equity Derivatives Research team, led by Benjamin Bowler, wrote in its 2024 outlook that “fear of missing out” was “winning the war in investors’ minds” over the many material fundamental and policy risks adding to larger macro uncertainty.

The “FOMO” term is a millennial standby, invented in 2004 by a Harvard Business School student writing an opinion piece in the school magazine. But the sentiment recalls similar euphemisms for investor enthusiasm from decades before: “irrational exuberance” was Fed chair Alan Greenspan’s parlance in the 1990s, and “animal spirits” was the preferred description from legendary economist John Maynard Keynes in the 1930s. Too much of this kind of thing can create bubbles that suddenly burst, just as it did during the dotcom bust, finishing off the Greenspan-era irrational exuberance.

The real question, however, remains: can the U.S.’ run of good form last? Some of the drivers of the current strength are also potential liabilities. Dependence on tech monopolies and deficit spending could trigger a painful correction. Similarly, fading excess savings and the high cost of living could dampen consumer confidence, stifling growth. But according to Oxford Economics’ McFee, “the outlook for the U.S. is actually still pretty good relative to other peers in developed markets.”

McFee forecasts 2.5% real income growth in the U.S. this year, which should help support consumer spending, compared to just 1% in Europe. He also expects fiscal policy to be “much more supportive” in the U.S. than in Europe, where the trend is toward “consolidation and reining in budget deficits.”

“The supply side of the U.S. economy looks a bit stronger. And you've seen really strong productivity growth in the U.S. this year— that's not really the case elsewhere,” he added. To his point, IMF economists are forecasting 2.1% GDP growth for the U.S. economy in 2024, more than any other G7 economy.

All of that being said, McFee warned that the presidential election year creates one “big question” that will be key to determining the economy’s future.

“What will policy look like after the election?” he asked. “We've got the Trump tax cuts expiring next year. So there's a really big opportunity to shape tax policy in the next administration. And I think that will have a big influence on whether or not the U.S. can continue to outperform other developed markets.”

SEI’s Solloway agreed that the election creates a lot of “uncertainty” in 2024, but added that the U.S. economy has another feature that should help it thrive no matter who is in office. “You know, the U.S. economy and investors adapt, even in harrowing times,” he noted. “We’ve actually seen a very good economy, and we've seen a very good stock market, during some very trying times over the last decade-plus.”