持續(xù)的人工智能熱潮使能源股成為投資領(lǐng)域最熱門(mén)的板塊之一,。隨著科技巨頭尋求為其龐大的數(shù)據(jù)中心提供能源支持,,曾經(jīng)枯燥乏味的公用事業(yè)公司股價(jià)一路飆升,而今年標(biāo)準(zhǔn)普爾500指數(shù)中表現(xiàn)最佳的10只股票中有3只是涉足核能業(yè)務(wù)的批發(fā)電力供應(yīng)商,。與此同時(shí),,對(duì)能源的旺盛需求也帶動(dòng)了另一類(lèi)公司的發(fā)展:幫助建設(shè)和維護(hù)北美電網(wǎng)的公司,包括我們?cè)谧钕旅媪谐龅娜痪x股票。

查閱任何一份能源行業(yè)報(bào)告,,你都不難發(fā)現(xiàn),,美國(guó)的電網(wǎng)基礎(chǔ)設(shè)施需要進(jìn)行重大改造。這意味著投資組合經(jīng)理們正在密切關(guān)注那些制造變壓器和開(kāi)關(guān)設(shè)備等基本設(shè)備的制造商,,或?yàn)閿?shù)據(jù)中心服務(wù)器機(jī)架提供冷卻解決方案等服務(wù)的制造商,。

Hightower Advisors首席投資策略師斯蒂芬妮·林克(Stephanie Link)最近在接受《財(cái)富》雜志采訪時(shí)表示:“工業(yè)企業(yè)正處于最佳時(shí)機(jī)?!?林克負(fù)責(zé)管理的投資組合規(guī)模高達(dá)54億美元,。

投資者已紛紛涌入電網(wǎng)建設(shè)領(lǐng)域,使得眾多熱門(mén)股票交易溢價(jià)過(guò)高,,這也引發(fā)了諸多關(guān)于人工智能交易存在過(guò)度泡沫的警告,。不過(guò),對(duì)于想要長(zhǎng)期投資的投資者而言,,抓住這一機(jī)遇仍會(huì)有所收獲,。

林克被Quanta Services首席執(zhí)行官的一句話震驚了。根據(jù)Visible Alpha的數(shù)據(jù),,Quanta Services在《財(cái)富》美國(guó)500強(qiáng)企業(yè)中進(jìn)入前200位,,預(yù)計(jì)2024年收入將達(dá)到237億美元。杜克·奧斯?。―uke Austin)是電氣和管道承包商負(fù)責(zé)人,,他在第一季度后告訴分析師,公司網(wǎng)絡(luò)中數(shù)據(jù)中心的能源需求“令人震驚”,。

林克說(shuō):“在我有生之年,,我從未聽(tīng)一位首席執(zhí)行官發(fā)表過(guò)如此言論,”他也是美國(guó)全國(guó)廣播公司財(cái)經(jīng)頻道(CNBC)的定期撰稿人,?!斑@些都是傳統(tǒng)的工業(yè)制造業(yè),屬于老派公司范疇,,它們看到了龐大的業(yè)務(wù)量和巨大的增長(zhǎng)空間,。”

隨著電網(wǎng)老化,,美國(guó)的能源需求猛增

這種繁榮景象與當(dāng)前的時(shí)機(jī)緊密相連,。根據(jù)美國(guó)能源部(U.S. Department of Energy)提供的數(shù)據(jù),美國(guó)大部分電網(wǎng)基礎(chǔ)設(shè)施建于上世紀(jì)六七十年代,,目前已有70%的輸電線路使用年限超過(guò)25年,,正逐步逼近其50年至80年的典型設(shè)計(jì)壽命。

這種情況的出現(xiàn)正值美國(guó)電力需求激增之際,,背后的驅(qū)動(dòng)因素有數(shù)個(gè)——如數(shù)據(jù)中心的需求,。根據(jù)高盛集團(tuán)(Goldman Sachs)估計(jì),,到2030年,數(shù)據(jù)中心對(duì)電力的需求將激增160%,。

然而,,還有許多其他因素在發(fā)揮作用,其中包括美國(guó)制造業(yè)的“回流”浪潮,。與此同時(shí),,全球氣溫的持續(xù)上升也進(jìn)一步推動(dòng)了人們對(duì)空調(diào)使用的需求。另一方面,,清潔能源產(chǎn)業(yè)的蓬勃發(fā)展,,以及電動(dòng)汽車(chē)、熱泵等綠色產(chǎn)品的日漸普及,,都給整個(gè)電力系統(tǒng)帶來(lái)了更為沉重的壓力,。

據(jù)彭博新能源財(cái)經(jīng)報(bào)道,美國(guó)到2050年實(shí)現(xiàn)向凈零排放經(jīng)濟(jì)轉(zhuǎn)型的既定目標(biāo)將孕育出41萬(wàn)億美元的商機(jī),。瑞士百達(dá)資產(chǎn)管理(Pictet Asset Management)清潔能源和環(huán)境投資專(zhuān)家詹妮弗·博斯卡丁-清(Jennifer Boscardin-Ching)表示,,雖然可再生能源公司的股票在特朗普贏得大選后暴跌,,但重建電網(wǎng)以滿足無(wú)止境的需求可能是兩黨的當(dāng)務(wù)之急,。

她在接受《財(cái)富》雜志采訪時(shí)說(shuō)道:“倘若投資者熱衷于科技、人工智能,、計(jì)算以及數(shù)據(jù)中心,,那么他們理應(yīng)對(duì)電力、電網(wǎng)網(wǎng)絡(luò)以及能效解決方案抱有同樣的興趣,?!?/p>

電網(wǎng)轉(zhuǎn)型的三只精選股

博斯卡丁-清和林克都看好所謂的電網(wǎng)轉(zhuǎn)型的“鎬和鏟”公司。以下是林克最看好的三家公司:

?前面提到的Quanta Services(紐約證券交易所代碼:PWR)擁有業(yè)內(nèi)規(guī)模最大的技術(shù)工人隊(duì)伍,,員工人數(shù)超過(guò)6萬(wàn),,這為其帶來(lái)了重要的競(jìng)爭(zhēng)優(yōu)勢(shì)。林克表示:“其他公司無(wú)法招募到這類(lèi)人才,,而Quanta Services已成功吸納并重用這些技術(shù)工人,。”截至上一季度,,該公司過(guò)去12個(gè)月的每股收益相較于兩年前同期增長(zhǎng)了60%以上,。

?在伊頓公司(紐約證券交易所代碼:ETN)最新的財(cái)報(bào)電話會(huì)議上,首席執(zhí)行官克雷格·阿諾德(Craig Arnold)指出,,該公司已簽訂了價(jià)值1.6萬(wàn)億美元的“大型項(xiàng)目”合同,,每個(gè)項(xiàng)目的價(jià)值都在10億美元以上。他表示,,這些項(xiàng)目中只有16%已啟動(dòng)建設(shè),,公司目前積壓了1.8萬(wàn)億美元的項(xiàng)目,,較去年增長(zhǎng)了30%。林克說(shuō):“伊頓公司曾是一家極為傳統(tǒng)且保守的制造企業(yè),,而今突然之間,,它已躋身行業(yè)前沿?!?/p>

?其中最不知名的是Vertiv Holdings(紐約證券交易所代碼:VRT),,它在2021年才開(kāi)始盈利,但其凈收入在過(guò)去兩年中飆升了 650% 以上,。林克是董事長(zhǎng)高德威(David Cote)的忠實(shí)粉絲,,高德威曾長(zhǎng)期擔(dān)任霍尼韋爾(Honeywell)首席執(zhí)行官。她表示:“他是一位出色的經(jīng)營(yíng)者,,而且極有遠(yuǎn)見(jiàn)卓識(shí),。”

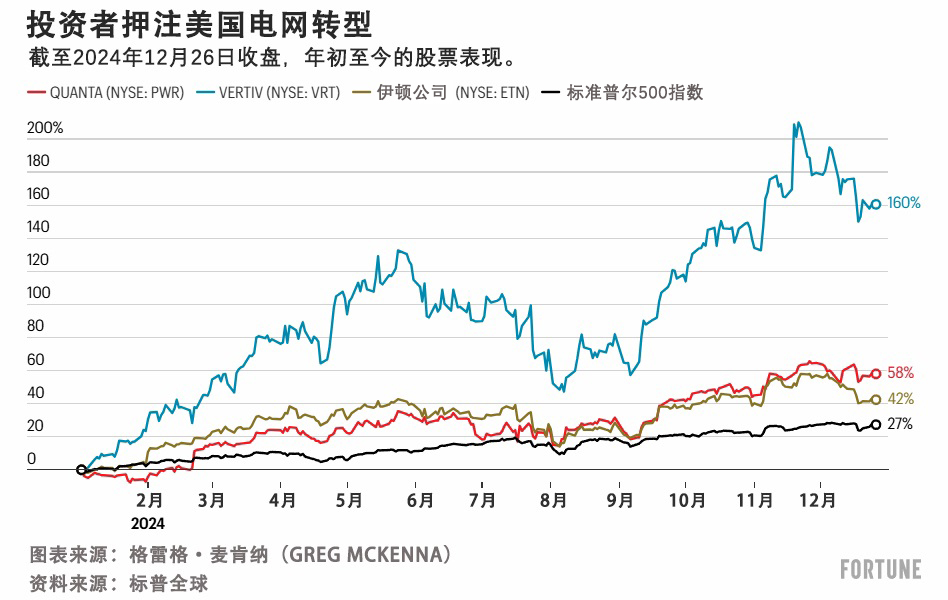

今年以來(lái),,這三只股票的表現(xiàn)均遠(yuǎn)超標(biāo)準(zhǔn)普爾500指數(shù),,因此,這些股票并不便宜也就不足為奇了,。據(jù)S&P Capital IQ平臺(tái)的估算,,Quanta、伊頓和Vertiv當(dāng)前的市盈率分別約為未來(lái)12個(gè)月預(yù)期收益的32倍,、29倍和36倍,。與大多數(shù)同行業(yè)公司及標(biāo)準(zhǔn)普爾當(dāng)前約24倍的遠(yuǎn)期市盈率相比,這些市盈率均處于較高水平,。

林克表示:“這是一個(gè)需要格外留意的問(wèn)題,。但我確實(shí)堅(jiān)信,這些公司擁有許多取勝之道,?!?/p>

在人工智能熱潮中,林克相信,,電網(wǎng)建設(shè)將被證明遠(yuǎn)不只是泡沫,。她說(shuō),長(zhǎng)期投資者可以在增加風(fēng)險(xiǎn)敞口之前,,觀察是否存在回調(diào),。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

持續(xù)的人工智能熱潮使能源股成為投資領(lǐng)域最熱門(mén)的板塊之一。隨著科技巨頭尋求為其龐大的數(shù)據(jù)中心提供能源支持,,曾經(jīng)枯燥乏味的公用事業(yè)公司股價(jià)一路飆升,,而今年標(biāo)準(zhǔn)普爾500指數(shù)中表現(xiàn)最佳的10只股票中有3只是涉足核能業(yè)務(wù)的批發(fā)電力供應(yīng)商。與此同時(shí),,對(duì)能源的旺盛需求也帶動(dòng)了另一類(lèi)公司的發(fā)展:幫助建設(shè)和維護(hù)北美電網(wǎng)的公司,,包括我們?cè)谧钕旅媪谐龅娜痪x股票,。

查閱任何一份能源行業(yè)報(bào)告,你都不難發(fā)現(xiàn),,美國(guó)的電網(wǎng)基礎(chǔ)設(shè)施需要進(jìn)行重大改造,。這意味著投資組合經(jīng)理們正在密切關(guān)注那些制造變壓器和開(kāi)關(guān)設(shè)備等基本設(shè)備的制造商,或?yàn)閿?shù)據(jù)中心服務(wù)器機(jī)架提供冷卻解決方案等服務(wù)的制造商,。

Hightower Advisors首席投資策略師斯蒂芬妮·林克(Stephanie Link)最近在接受《財(cái)富》雜志采訪時(shí)表示:“工業(yè)企業(yè)正處于最佳時(shí)機(jī),。” 林克負(fù)責(zé)管理的投資組合規(guī)模高達(dá)54億美元,。

投資者已紛紛涌入電網(wǎng)建設(shè)領(lǐng)域,,使得眾多熱門(mén)股票交易溢價(jià)過(guò)高,這也引發(fā)了諸多關(guān)于人工智能交易存在過(guò)度泡沫的警告,。不過(guò),,對(duì)于想要長(zhǎng)期投資的投資者而言,抓住這一機(jī)遇仍會(huì)有所收獲,。

林克被Quanta Services首席執(zhí)行官的一句話震驚了,。根據(jù)Visible Alpha的數(shù)據(jù),Quanta Services在《財(cái)富》美國(guó)500強(qiáng)企業(yè)中進(jìn)入前200位,,預(yù)計(jì)2024年收入將達(dá)到237億美元,。杜克·奧斯汀(Duke Austin)是電氣和管道承包商負(fù)責(zé)人,,他在第一季度后告訴分析師,,公司網(wǎng)絡(luò)中數(shù)據(jù)中心的能源需求“令人震驚”,。

林克說(shuō):“在我有生之年,,我從未聽(tīng)一位首席執(zhí)行官發(fā)表過(guò)如此言論,”他也是美國(guó)全國(guó)廣播公司財(cái)經(jīng)頻道(CNBC)的定期撰稿人,?!斑@些都是傳統(tǒng)的工業(yè)制造業(yè),屬于老派公司范疇,,它們看到了龐大的業(yè)務(wù)量和巨大的增長(zhǎng)空間,。”

隨著電網(wǎng)老化,,美國(guó)的能源需求猛增

這種繁榮景象與當(dāng)前的時(shí)機(jī)緊密相連,。根據(jù)美國(guó)能源部(U.S. Department of Energy)提供的數(shù)據(jù),美國(guó)大部分電網(wǎng)基礎(chǔ)設(shè)施建于上世紀(jì)六七十年代,,目前已有70%的輸電線路使用年限超過(guò)25年,,正逐步逼近其50年至80年的典型設(shè)計(jì)壽命。

這種情況的出現(xiàn)正值美國(guó)電力需求激增之際,,背后的驅(qū)動(dòng)因素有數(shù)個(gè)——如數(shù)據(jù)中心的需求,。根據(jù)高盛集團(tuán)(Goldman Sachs)估計(jì),,到2030年,數(shù)據(jù)中心對(duì)電力的需求將激增160%,。

然而,,還有許多其他因素在發(fā)揮作用,其中包括美國(guó)制造業(yè)的“回流”浪潮,。與此同時(shí),,全球氣溫的持續(xù)上升也進(jìn)一步推動(dòng)了人們對(duì)空調(diào)使用的需求。另一方面,,清潔能源產(chǎn)業(yè)的蓬勃發(fā)展,,以及電動(dòng)汽車(chē)、熱泵等綠色產(chǎn)品的日漸普及,,都給整個(gè)電力系統(tǒng)帶來(lái)了更為沉重的壓力,。

據(jù)彭博新能源財(cái)經(jīng)報(bào)道,美國(guó)到2050年實(shí)現(xiàn)向凈零排放經(jīng)濟(jì)轉(zhuǎn)型的既定目標(biāo)將孕育出41萬(wàn)億美元的商機(jī),。瑞士百達(dá)資產(chǎn)管理(Pictet Asset Management)清潔能源和環(huán)境投資專(zhuān)家詹妮弗·博斯卡丁-清(Jennifer Boscardin-Ching)表示,,雖然可再生能源公司的股票在特朗普贏得大選后暴跌,但重建電網(wǎng)以滿足無(wú)止境的需求可能是兩黨的當(dāng)務(wù)之急,。

她在接受《財(cái)富》雜志采訪時(shí)說(shuō)道:“倘若投資者熱衷于科技,、人工智能、計(jì)算以及數(shù)據(jù)中心,,那么他們理應(yīng)對(duì)電力,、電網(wǎng)網(wǎng)絡(luò)以及能效解決方案抱有同樣的興趣?!?/p>

電網(wǎng)轉(zhuǎn)型的三只精選股

博斯卡丁-清和林克都看好所謂的電網(wǎng)轉(zhuǎn)型的“鎬和鏟”公司,。以下是林克最看好的三家公司:

?前面提到的Quanta Services(紐約證券交易所代碼:PWR)擁有業(yè)內(nèi)規(guī)模最大的技術(shù)工人隊(duì)伍,員工人數(shù)超過(guò)6萬(wàn),,這為其帶來(lái)了重要的競(jìng)爭(zhēng)優(yōu)勢(shì),。林克表示:“其他公司無(wú)法招募到這類(lèi)人才,而Quanta Services已成功吸納并重用這些技術(shù)工人,?!苯刂辽弦患径龋摴具^(guò)去12個(gè)月的每股收益相較于兩年前同期增長(zhǎng)了60%以上,。

?在伊頓公司(紐約證券交易所代碼:ETN)最新的財(cái)報(bào)電話會(huì)議上,,首席執(zhí)行官克雷格·阿諾德(Craig Arnold)指出,該公司已簽訂了價(jià)值1.6萬(wàn)億美元的“大型項(xiàng)目”合同,,每個(gè)項(xiàng)目的價(jià)值都在10億美元以上,。他表示,這些項(xiàng)目中只有16%已啟動(dòng)建設(shè),,公司目前積壓了1.8萬(wàn)億美元的項(xiàng)目,,較去年增長(zhǎng)了30%,。林克說(shuō):“伊頓公司曾是一家極為傳統(tǒng)且保守的制造企業(yè),而今突然之間,,它已躋身行業(yè)前沿,。”

?其中最不知名的是Vertiv Holdings(紐約證券交易所代碼:VRT),,它在2021年才開(kāi)始盈利,,但其凈收入在過(guò)去兩年中飆升了 650% 以上。林克是董事長(zhǎng)高德威(David Cote)的忠實(shí)粉絲,,高德威曾長(zhǎng)期擔(dān)任霍尼韋爾(Honeywell)首席執(zhí)行官,。她表示:“他是一位出色的經(jīng)營(yíng)者,而且極有遠(yuǎn)見(jiàn)卓識(shí),?!?

今年以來(lái),這三只股票的表現(xiàn)均遠(yuǎn)超標(biāo)準(zhǔn)普爾500指數(shù),,因此,,這些股票并不便宜也就不足為奇了。據(jù)S&P Capital IQ平臺(tái)的估算,,Quanta,、伊頓和Vertiv當(dāng)前的市盈率分別約為未來(lái)12個(gè)月預(yù)期收益的32倍、29倍和36倍,。與大多數(shù)同行業(yè)公司及標(biāo)準(zhǔn)普爾當(dāng)前約24倍的遠(yuǎn)期市盈率相比,,這些市盈率均處于較高水平。

林克表示:“這是一個(gè)需要格外留意的問(wèn)題,。但我確實(shí)堅(jiān)信,,這些公司擁有許多取勝之道?!?/p>

在人工智能熱潮中,,林克相信,,電網(wǎng)建設(shè)將被證明遠(yuǎn)不只是泡沫,。她說(shuō),長(zhǎng)期投資者可以在增加風(fēng)險(xiǎn)敞口之前,,觀察是否存在回調(diào),。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

The ongoing AI boom has made energy stocks one of the hottest corners of investing. Once-boring utility companies are soaring as tech giants look to feed their ravenous data centers, while three of the top 10 best performing stocks in the S&P 500 this year are wholesale power providers with nuclear businesses. Meanwhile, all this demand for energy is lifting another set of companies: firms that help build and maintain North America’s electrical grids, including our three picks listed farther below.

Consult any energy sector report, and you’ll discover that the country’s grid infrastructure requires a major facelift. This means portfolio managers are keeping a close eye on manufacturers that build essential equipment like transformers and switchgear—or provide services like cooling solutions for the server racks in data centers.

“The industrial companies are in the sweet spot,” Stephanie Link, who oversees a $5.4 billion portfolio as chief investment strategist at Hightower Advisors, recently said in an interview with Fortune.

Investors have already piled into the grid-building space, with many top picks trading at the types of lofty premiums that have led to a multitude of warnings about an overly frothy AI trade. For investors playing the long game, however, it could still pay to hop on the bandwagon.

Link was struck by a comment from the CEO of Quanta Services, a Fortune 200 company projected to earn $23.7 billion in revenue for 2024, per Visible Alpha. Duke Austin, who leads the electrical and pipeline contractor, told analysts after Q1 that the energy needs of data centers in the company’s network were “mind-blowing.”

“I don’t think I’ve heard a CEO say anything like that before in my lifetime,” said Link, who is also a regular CNBC contributor. “These are conservative industrial manufacturing, old-school companies that are seeing a lot of business and a lot of upside.”

America’s energy needs skyrocket as its grid ages

The boom has a lot to do with timing. Much of America’s grid infrastructure was built in the 1960s and 1970s, and 70% of its transmission lines are over 25 years old and approaching the end of their typical 50- to 80-year lifespan, according to the U.S. Department of Energy.

That’s happening just as the country’s electricity demand is skyrocketing for several reasons—such as data center demand, which could jump an estimated 160% by 2030, per Goldman Sachs.

But there are plenty of other factors at play, too, including the wave of “reshoring” among American manufacturers. Rising global temperatures, meanwhile, intensify the need for air conditioning. On the other hand, the clean energy boom—and the growing adoption of green products like electric vehicles and heat pumps—all put more strain on the system.

According to Bloomberg New Energy Finance, the stated goal of the U.S. to transition to a net-zero economy by 2050 represents a $41 trillion opportunity. While stocks of renewable energy companies plunged in the wake of Donald Trump’s election victory, rebuilding the grid to meet insatiable demand is likely a bipartisan imperative, said Jennifer Boscardin-Ching, who specializes in clean energy and environmental investing at Geneva’s Pictet Asset Management.

“If investors are as excited about technology, about AI, about computing and data centers,” she told Fortune, “then they should be also as excited about electricity and networks and energy efficiency solutions.”

Three stock picks for the grid transformation

Both Boscardin-Ching and Link are excited about the so-called picks and shovels of grid transformation. Here are three of Link’s favorite companies:

? The aforementioned Quanta Services (NYSE: PWR) boasts one of the largest skilled workforces in the industry at over 60,000 employees, providing a major competitive advantage. “Companies can’t find these people,” Link said, “and [Quanta has] got them locked and loaded.” As of last quarter, earnings per share over the past 12 months are up over 60% compared with the same period two years ago.

? On the latest earnings call for Eaton Corp. (NYSE: ETN), CEO Craig Arnold noted that the company has been contracted for $1.6 trillion worth of “megaprojects,” which are each valued at $1 billion or more. Only 16% of those jobs have been started, he said, and the company currently has a backlog of $1.8 trillion, up 30% from last year. “Eaton used to be a really old, stodgy manufacturing company, and all of a sudden they’re at the cutting edge,” Link said.

? The least established name in the bunch, Vertiv Holdings (NYSE: VRT) only started turning a profit in 2021, but net income has soared over 650% in the past two years. Link is a big fan of chairman David Cote, formerly the longtime CEO of Honeywell. “He’s such a good operator,” she said. “He’s such a good visionary.”

Vertiv has led the way as all three stocks have far outpaced the S&P 500 this year, so it should be no surprise that these stocks are not necessarily cheap. Quanta, Eaton, and Vertiv currently trade at roughly 32, 29, and 36 times their projected earnings over the next 12 months, respectively, according to estimates from S&P Capital IQ. Those multiples are elevated compared with most of their peers and the S&P’s current forward P/E ratio of about 24.

“It’s something to be very mindful of,” Link said. “But I do think there are so many ways for these companies to win.”

Amid the AI frenzy, Link is confident the grid build-out will prove to be far more than a bubble. Long-term investors, she said, can monitor for a pullback before upping their exposure.