美國人在償還信用卡賬單方面遭遇重重困難,這迫使貸款機構(gòu)放棄追討債務(wù),,進而承受更大的損失,。

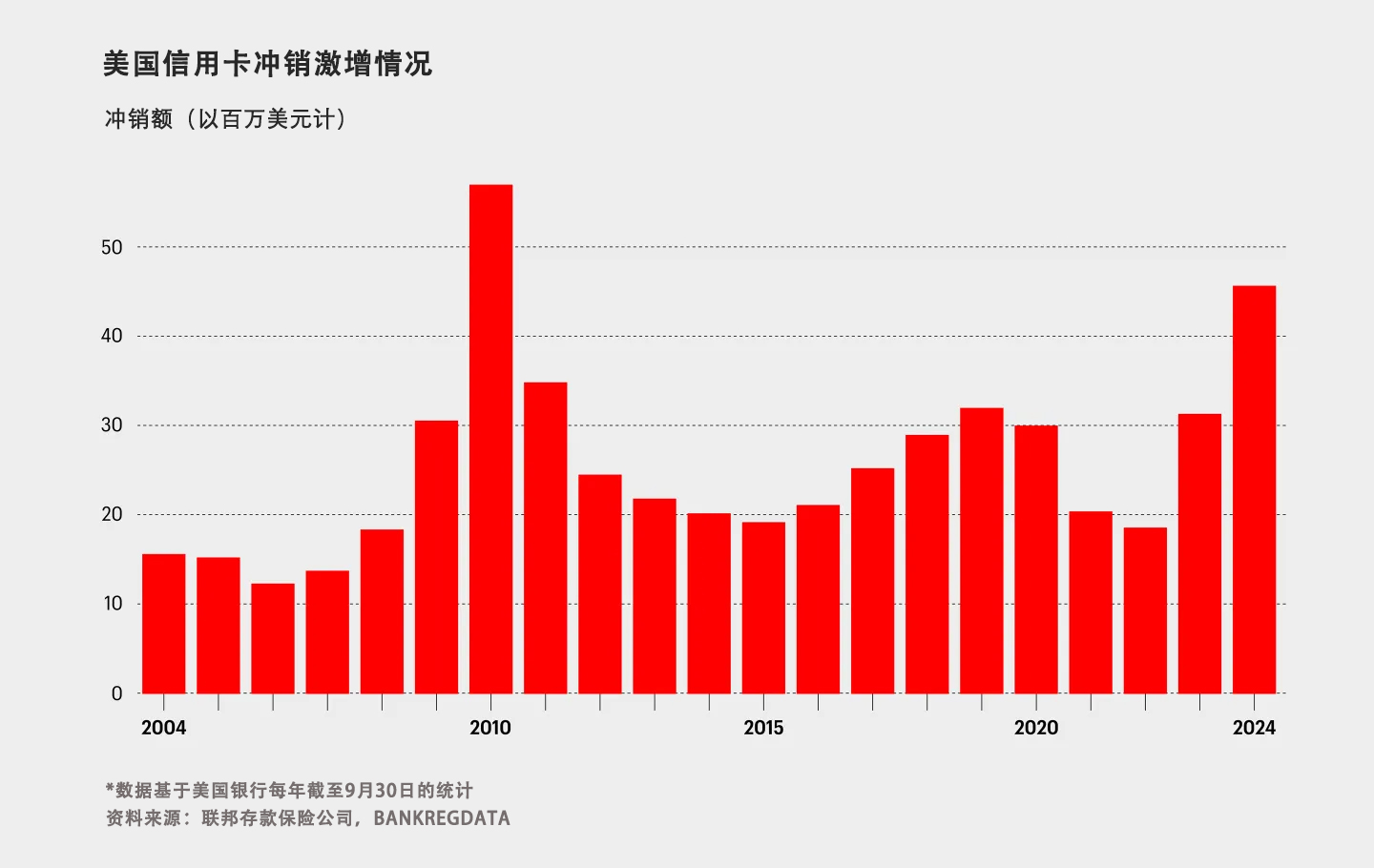

銀行信用卡債務(wù)沖銷達到了2010年以來的最高水平,彼時消費者仍在努力擺脫金融危機和大衰退的影響,。

根據(jù)BankRegData編制的聯(lián)邦存款保險公司(FDIC)季度統(tǒng)計數(shù)據(jù),,截至2024年前三季度,信用卡債務(wù)沖銷總額達到457億美元,,較上年同期增長46%,。

英國《金融時報》最先報道了今年信用卡債務(wù)沖銷額激增的情況,這對經(jīng)濟而言是一個潛在的警示信號,,因為消費者近年來一直在應(yīng)對通脹壓力和借貸成本上升的雙重挑戰(zhàn),。

第四季度的數(shù)據(jù)尚未公布,但很可能會顯示進一步增長,,原因是年底假日購物熱潮期間,,沖銷額通常會有所上升。

紐約聯(lián)邦儲備銀行的另一份數(shù)據(jù)顯示,,第三季度信用卡余額增加了240億美元,,目前總額為1.17萬億美元,較上年同期增長8.1%,。

盡管信用卡的拖欠率從第二季度的9.1%下降到8.8%,,但整體消費者債務(wù)的拖欠率從3.2%上升至3.5%。

紐約聯(lián)邦儲備銀行(New York Fed)經(jīng)濟研究顧問李東勛(Donghoon Lee)上月在一份聲明中表示:“盡管名義上家庭余額仍在持續(xù)攀升,,但收入增長速度超過了債務(wù)增長速度,。盡管本季度拖欠情況有所緩解,,但拖欠率上升仍表明許多家庭承受著壓力?!?/p>

Capital One等個人發(fā)卡機構(gòu)近期也表示,,其信用卡債務(wù)沖銷率有所上升。

這種壓力表明,,盡管國內(nèi)生產(chǎn)總值增長,、薪資增長以及個人收入等經(jīng)濟數(shù)據(jù)均呈現(xiàn)出積極態(tài)勢,但消費者在疫情期間及其后掀起的大規(guī)模購買熱潮,,如今正逐漸給他們帶來沉重負擔(dān),。

通脹率已從2022年9%的高位大幅降至11月的2.7%,但物價仍高于疫情前的水平,。

與此同時,,盡管政策制定者今年已開始下調(diào)基準利率,但美聯(lián)儲此前大幅上調(diào)基準利率(對信用卡利率產(chǎn)生了影響)所帶來的影響仍在持續(xù),。

據(jù)英國《金融時報》報道,,在截至9月份的12個月里,那些未能全額償還月度信用卡賬單的消費者支付了1700億美元的利息,。

消費者的壓力可能不會很快得到緩解,。當(dāng)選總統(tǒng)唐納德·特朗普(Donald Trump)征收關(guān)稅和打擊移民的計劃預(yù)計將導(dǎo)致消費者面臨物價上漲的局面。

如果這些政策導(dǎo)致通脹持續(xù)高企,,那么美聯(lián)儲在進一步降低利率方面的空間將會變得更加有限,,這無疑會加重信用卡用戶的負擔(dān)。(財富中文網(wǎng))

譯者:中慧言-王芳

美國人在償還信用卡賬單方面遭遇重重困難,,這迫使貸款機構(gòu)放棄追討債務(wù),,進而承受更大的損失。

銀行信用卡債務(wù)沖銷達到了2010年以來的最高水平,,彼時消費者仍在努力擺脫金融危機和大衰退的影響,。

根據(jù)BankRegData編制的聯(lián)邦存款保險公司(FDIC)季度統(tǒng)計數(shù)據(jù),截至2024年前三季度,,信用卡債務(wù)沖銷總額達到457億美元,,較上年同期增長46%。

英國《金融時報》最先報道了今年信用卡債務(wù)沖銷額激增的情況,,這對經(jīng)濟而言是一個潛在的警示信號,,因為消費者近年來一直在應(yīng)對通脹壓力和借貸成本上升的雙重挑戰(zhàn)。

第四季度的數(shù)據(jù)尚未公布,,但很可能會顯示進一步增長,,原因是年底假日購物熱潮期間,沖銷額通常會有所上升,。

紐約聯(lián)邦儲備銀行的另一份數(shù)據(jù)顯示,,第三季度信用卡余額增加了240億美元,,目前總額為1.17萬億美元,較上年同期增長8.1%,。

盡管信用卡的拖欠率從第二季度的9.1%下降到8.8%,,但整體消費者債務(wù)的拖欠率從3.2%上升至3.5%。

紐約聯(lián)邦儲備銀行(New York Fed)經(jīng)濟研究顧問李東勛(Donghoon Lee)上月在一份聲明中表示:“盡管名義上家庭余額仍在持續(xù)攀升,,但收入增長速度超過了債務(wù)增長速度。盡管本季度拖欠情況有所緩解,,但拖欠率上升仍表明許多家庭承受著壓力,。”

Capital One等個人發(fā)卡機構(gòu)近期也表示,,其信用卡債務(wù)沖銷率有所上升,。

這種壓力表明,盡管國內(nèi)生產(chǎn)總值增長,、薪資增長以及個人收入等經(jīng)濟數(shù)據(jù)均呈現(xiàn)出積極態(tài)勢,,但消費者在疫情期間及其后掀起的大規(guī)模購買熱潮,如今正逐漸給他們帶來沉重負擔(dān),。

通脹率已從2022年9%的高位大幅降至11月的2.7%,,但物價仍高于疫情前的水平。

與此同時,,盡管政策制定者今年已開始下調(diào)基準利率,,但美聯(lián)儲此前大幅上調(diào)基準利率(對信用卡利率產(chǎn)生了影響)所帶來的影響仍在持續(xù)。

據(jù)英國《金融時報》報道,,在截至9月份的12個月里,,那些未能全額償還月度信用卡賬單的消費者支付了1700億美元的利息。

消費者的壓力可能不會很快得到緩解,。當(dāng)選總統(tǒng)唐納德·特朗普(Donald Trump)征收關(guān)稅和打擊移民的計劃預(yù)計將導(dǎo)致消費者面臨物價上漲的局面,。

如果這些政策導(dǎo)致通脹持續(xù)高企,那么美聯(lián)儲在進一步降低利率方面的空間將會變得更加有限,,這無疑會加重信用卡用戶的負擔(dān),。(財富中文網(wǎng))

譯者:中慧言-王芳

Americans are having more trouble paying credit card bills, forcing lenders to take steeper losses as they give up on collecting those debts.

Banks are writing off credit card debt at the highest level since 2010, when consumers were still emerging from the aftermath of the financial crisis and Great Recession.

According to quarterly FDIC stats compiled by BankRegData, the total amount charged off through the first three quarters of 2024 reached $45.7 billion, up 46% from the same period a year ago.

This year’s surge, which was first reported by the Financial Times, represents a potential red flag for the economy as consumers have juggled inflation and higher borrowing costs in recent years.

Numbers for the fourth quarter aren’t available yet but likely will show a further increase as write-offs typically tick higher at the end of the year amid the holiday-shopping frenzy.

Separate data from the New York Federal Reserve shows credit card balances grew by $24 billion during the third quarter and now total $1.17 trillion, up 8.1% from a year ago.

While the delinquency rate on card balances improved to 8.8% from 9.1% in the second quarter, the rate across all consumer debt ticked up to 3.5%, from 3.2%.

“Although household balances continue to rise in nominal terms, growth in income has outpaced debt,” Donghoon Lee, economic research advisor at the New York Fed, said in a statement last month. “Still, elevated delinquency rates reveal stress for many households, even amid some moderation in delinquency trends this quarter.”

Individual card issuers like Capital One have also recently flagged increases in their write-off rates.

Such strains indicate the massive buying spree that consumers embarked on during the pandemic and afterward is starting to catch up to them now. That’s despite otherwise positive economic readings on GDP growth, payroll gains, and personal income.

Inflation has cooled sharply from a high of 9% in 2022 to 2.7% in November, but prices are still elevated from pre-pandemic levels.

Meanwhile, the Federal Reserve’s aggressive hiking of benchmark interest rates, which influence credit card rates, is still being felt even as policymakers have started to bring them down this year.

In the 12 months that ended in September, consumers who didn’t fully pay off their monthly credit card bills paid $170 billion in interest, according to the FT.

Consumers may not see much relief soon. President-elect Donald Trump’s plans to impose tariffs and crack down on immigration are expected to result in higher prices for consumers.

And if those policies keep inflation sticky, the Fed will have less leeway to further lower rates, keeping the burden heavy on credit card users.