? 潘興廣場(chǎng)(Pershing Square)對(duì)沖基金經(jīng)理正用自己的資金進(jìn)行一場(chǎng)豪賭,,試圖打造一家多元化金融集團(tuán),,以期能與沃倫·巴菲特畢生的成就相媲美,。這位現(xiàn)年94歲的“奧馬哈先知”在60年前收購(gòu)了一家瀕臨倒閉的紡織品生產(chǎn)商,將其轉(zhuǎn)型為如今市值1萬(wàn)億美元的商業(yè)巨頭,。

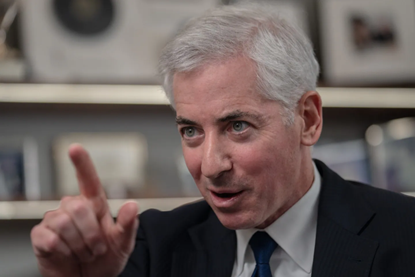

億萬(wàn)富翁比爾·阿克曼或許是華爾街最知名的對(duì)沖基金經(jīng)理之一,,但他尚未達(dá)到沃倫·巴菲特的境界。

如今,,他希望改變這一現(xiàn)狀,。作為潘興廣場(chǎng)的投資者,阿克曼愿意下注9億美元,,賭自己能成為這位94歲的奧馬哈先知的精神傳承者(通過(guò)打造所稱(chēng)的“現(xiàn)代版伯克希爾·哈撒韋公司),?!?

與巴菲特1965年收購(gòu)的紡織品生產(chǎn)商不同,阿克曼看中的標(biāo)的公司是房地產(chǎn)公司霍華德·休斯控股公司(Howard Hughes Holdings),。去年7月,,該公司將一批關(guān)聯(lián)度不高的資產(chǎn)剝離出來(lái),成立了在證券交易所上市的Seaport Entertainment Group,,如今專(zhuān)注于大型公寓開(kāi)發(fā)項(xiàng)目,,比如位于夏威夷威基基海灘、占地面積達(dá)60英畝(約合242811.9平方米)的沃德村項(xiàng)目,。

按照阿克曼的計(jì)劃,,霍華德·休斯控股公司將以每股90美元的價(jià)格發(fā)行1000萬(wàn)股新股,較上周二收盤(pán)價(jià)有12%的可觀溢價(jià),。隨后,,阿克曼及其團(tuán)隊(duì)將買(mǎi)入這些股票,從而使其直接和間接持有的公司總股份達(dá)到48%,。

屆時(shí),,霍華德·休斯控股公司將作為一個(gè)“長(zhǎng)期平臺(tái)”,收購(gòu)并管理上市及私營(yíng)公司的控股權(quán),。阿克曼本人將擔(dān)任該公司的首席執(zhí)行官兼董事長(zhǎng),,而他的兩名主要副手將擔(dān)任高級(jí)職務(wù)。

Pershing Square Holdco LP上周二在一份聲明中表示:“9億美元現(xiàn)金注入將使霍華德·休斯控股公司能夠立即著手收購(gòu)上市及私營(yíng)公司的控股權(quán),,這是其成為多元化控股公司新戰(zhàn)略的一部分,。”

霍華德·休斯控股公司證實(shí)了這一提議,,并補(bǔ)充稱(chēng),,一個(gè)由獨(dú)立董事組成的特別委員會(huì)如今將對(duì)該提議展開(kāi)評(píng)估,并確定適當(dāng)?shù)男袆?dòng)方案,。

這次阿克曼風(fēng)險(xiǎn)自擔(dān)

阿克曼的策略并不僅僅是投資另一家Chipotle,、康寶萊(Herbalife)或美國(guó)城市債券保險(xiǎn)(MBIA),他調(diào)集投資者資金購(gòu)入大量股份,,從而推動(dòng)公司分拆,、管理層重組或資產(chǎn)剝離,然后清算股權(quán)獲利,,轉(zhuǎn)而投資下一家被低估的公司,。

對(duì)于這位身家約95億美元的投機(jī)者而言,投資霍華德·休斯控股公司無(wú)疑是一場(chǎng)極具個(gè)人色彩且風(fēng)險(xiǎn)自擔(dān)的豪賭,。這筆資金將全部來(lái)自Pershing Square Holdco,,在最近一次股票出售后,他和他的管理團(tuán)隊(duì)持有該公司90%的股份,。

相比之下,,阿克曼更為人熟知的對(duì)沖基金——潘興廣場(chǎng)資本管理公司(Pershing Square Capital Management LP),,其團(tuán)隊(duì)持有該公司28%的股份。除了保留其現(xiàn)有的1890萬(wàn)股股份外,,該公司將不會(huì)額外增持,。

事實(shí)上,如果交易得以持續(xù)推進(jìn),,他的投資者——在業(yè)內(nèi)被稱(chēng)為有限合伙人或LP——所持股份甚至將面臨被稀釋的風(fēng)險(xiǎn),,因?yàn)楦鶕?jù)交易條款,他們的持股比例預(yù)計(jì)將從接近38%下降至僅31%,。

不過(guò),,對(duì)阿克曼而言,這項(xiàng)收購(gòu)計(jì)劃堪稱(chēng)解決其問(wèn)題的上策,。數(shù)月以來(lái),,他一直試圖將霍華德·休斯控股公司實(shí)現(xiàn)價(jià)值變現(xiàn),但該公司股價(jià)卻始終未能上漲,。在過(guò)去10年里,,該公司股價(jià)累計(jì)下跌逾三分之一。

通過(guò)押注自己的資金,,霍華德·休斯控股公司或許最終能為潘興廣場(chǎng)資本管理公司的有限合伙人帶來(lái)潛在的初始投資回報(bào),。這些有限合伙人通常是超高凈值個(gè)人,以及養(yǎng)老基金,、慈善信托和大學(xué)捐贈(zèng)基金,。

‘比瀕臨倒閉的紡織公司好得多’

在這一過(guò)程中,阿克曼可以向巴菲特的忠實(shí)散戶投資者宣傳,,稱(chēng)霍華德·休斯控股公司將成為下一個(gè)伯克希爾·哈撒韋公司,,后者是全球市值排名第11的公司,也是最具價(jià)值的金融機(jī)構(gòu),,市值達(dá)1萬(wàn)億美元,。

眾所周知,,這位奧馬哈先知并沒(méi)有創(chuàng)立這家他過(guò)去60年來(lái)一直掌控的投資控股公司,,而是在伯克希爾·哈撒韋公司還在從事紡織品生產(chǎn)時(shí)收購(gòu)了它。

從這家公司的廢墟中,,他將其重塑為一個(gè)金融工具,,積極管理對(duì)可口可樂(lè)(Coca-Cola)、通用再保險(xiǎn)公司(General Re),、DQ冰淇淋(Dairy Queen)等各類(lèi)公司的持股,,以及近期對(duì)蘋(píng)果公司(Apple)的持股。

阿克曼上周二在社交媒體上發(fā)帖稱(chēng):“伯克希爾·哈撒韋公司的一大吸引力在于,,任何人只要在20世紀(jì)60年代初能夠負(fù)擔(dān)得起一股約20美元的股票,,就能參與長(zhǎng)期的復(fù)利增值,。”

與此同時(shí),,霍華德·休斯控股公司的核心房地產(chǎn)開(kāi)發(fā)業(yè)務(wù)將繼續(xù)由現(xiàn)任首席執(zhí)行官大衛(wèi)·奧萊利(David O 'Reilly)負(fù)責(zé),,并保持原有的戰(zhàn)略方向。

事實(shí)上,,阿克曼甚至宣稱(chēng),,霍華德·休斯控股公司的戰(zhàn)略重點(diǎn)是像沃德村這樣的微型城市(房地產(chǎn)行業(yè)稱(chēng)之為“總體規(guī)劃社區(qū)”),從而使得公司的整體狀況遠(yuǎn)勝于巴菲特最初接管伯克希爾·哈撒韋公司時(shí)所面臨的瀕臨倒閉的艱難境地,。

阿克曼寫(xiě)道:"它比一家瀕臨倒閉的紡織公司要好得多,。”(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

? 潘興廣場(chǎng)(Pershing Square)對(duì)沖基金經(jīng)理正用自己的資金進(jìn)行一場(chǎng)豪賭,,試圖打造一家多元化金融集團(tuán),,以期能與沃倫·巴菲特畢生的成就相媲美。這位現(xiàn)年94歲的“奧馬哈先知”在60年前收購(gòu)了一家瀕臨倒閉的紡織品生產(chǎn)商,,將其轉(zhuǎn)型為如今市值1萬(wàn)億美元的商業(yè)巨頭,。

億萬(wàn)富翁比爾·阿克曼或許是華爾街最知名的對(duì)沖基金經(jīng)理之一,但他尚未達(dá)到沃倫·巴菲特的境界,。

如今,,他希望改變這一現(xiàn)狀。作為潘興廣場(chǎng)的投資者,,阿克曼愿意下注9億美元,,賭自己能成為這位94歲的奧馬哈先知的精神傳承者(通過(guò)打造所稱(chēng)的“現(xiàn)代版伯克希爾·哈撒韋公司)?!?

與巴菲特1965年收購(gòu)的紡織品生產(chǎn)商不同,,阿克曼看中的標(biāo)的公司是房地產(chǎn)公司霍華德·休斯控股公司(Howard Hughes Holdings)。去年7月,,該公司將一批關(guān)聯(lián)度不高的資產(chǎn)剝離出來(lái),,成立了在證券交易所上市的Seaport Entertainment Group,如今專(zhuān)注于大型公寓開(kāi)發(fā)項(xiàng)目,,比如位于夏威夷威基基海灘,、占地面積達(dá)60英畝(約合242811.9平方米)的沃德村項(xiàng)目。

按照阿克曼的計(jì)劃,,霍華德·休斯控股公司將以每股90美元的價(jià)格發(fā)行1000萬(wàn)股新股,,較上周二收盤(pán)價(jià)有12%的可觀溢價(jià)。隨后,,阿克曼及其團(tuán)隊(duì)將買(mǎi)入這些股票,,從而使其直接和間接持有的公司總股份達(dá)到48%。

屆時(shí),霍華德·休斯控股公司將作為一個(gè)“長(zhǎng)期平臺(tái)”,,收購(gòu)并管理上市及私營(yíng)公司的控股權(quán),。阿克曼本人將擔(dān)任該公司的首席執(zhí)行官兼董事長(zhǎng),而他的兩名主要副手將擔(dān)任高級(jí)職務(wù),。

Pershing Square Holdco LP上周二在一份聲明中表示:“9億美元現(xiàn)金注入將使霍華德·休斯控股公司能夠立即著手收購(gòu)上市及私營(yíng)公司的控股權(quán),,這是其成為多元化控股公司新戰(zhàn)略的一部分?!?/p>

霍華德·休斯控股公司證實(shí)了這一提議,,并補(bǔ)充稱(chēng),一個(gè)由獨(dú)立董事組成的特別委員會(huì)如今將對(duì)該提議展開(kāi)評(píng)估,,并確定適當(dāng)?shù)男袆?dòng)方案,。

這次阿克曼風(fēng)險(xiǎn)自擔(dān)

阿克曼的策略并不僅僅是投資另一家Chipotle、康寶萊(Herbalife)或美國(guó)城市債券保險(xiǎn)(MBIA),,他調(diào)集投資者資金購(gòu)入大量股份,,從而推動(dòng)公司分拆、管理層重組或資產(chǎn)剝離,,然后清算股權(quán)獲利,,轉(zhuǎn)而投資下一家被低估的公司。

對(duì)于這位身家約95億美元的投機(jī)者而言,,投資霍華德·休斯控股公司無(wú)疑是一場(chǎng)極具個(gè)人色彩且風(fēng)險(xiǎn)自擔(dān)的豪賭,。這筆資金將全部來(lái)自Pershing Square Holdco,在最近一次股票出售后,,他和他的管理團(tuán)隊(duì)持有該公司90%的股份,。

相比之下,阿克曼更為人熟知的對(duì)沖基金——潘興廣場(chǎng)資本管理公司(Pershing Square Capital Management LP),,其團(tuán)隊(duì)持有該公司28%的股份,。除了保留其現(xiàn)有的1890萬(wàn)股股份外,該公司將不會(huì)額外增持,。

事實(shí)上,,如果交易得以持續(xù)推進(jìn),他的投資者——在業(yè)內(nèi)被稱(chēng)為有限合伙人或LP——所持股份甚至將面臨被稀釋的風(fēng)險(xiǎn),,因?yàn)楦鶕?jù)交易條款,,他們的持股比例預(yù)計(jì)將從接近38%下降至僅31%。

不過(guò),,對(duì)阿克曼而言,,這項(xiàng)收購(gòu)計(jì)劃堪稱(chēng)解決其問(wèn)題的上策,。數(shù)月以來(lái),,他一直試圖將霍華德·休斯控股公司實(shí)現(xiàn)價(jià)值變現(xiàn),但該公司股價(jià)卻始終未能上漲。在過(guò)去10年里,,該公司股價(jià)累計(jì)下跌逾三分之一,。

通過(guò)押注自己的資金,霍華德·休斯控股公司或許最終能為潘興廣場(chǎng)資本管理公司的有限合伙人帶來(lái)潛在的初始投資回報(bào),。這些有限合伙人通常是超高凈值個(gè)人,,以及養(yǎng)老基金、慈善信托和大學(xué)捐贈(zèng)基金,。

‘比瀕臨倒閉的紡織公司好得多’

在這一過(guò)程中,,阿克曼可以向巴菲特的忠實(shí)散戶投資者宣傳,稱(chēng)霍華德·休斯控股公司將成為下一個(gè)伯克希爾·哈撒韋公司,,后者是全球市值排名第11的公司,,也是最具價(jià)值的金融機(jī)構(gòu),市值達(dá)1萬(wàn)億美元,。

眾所周知,,這位奧馬哈先知并沒(méi)有創(chuàng)立這家他過(guò)去60年來(lái)一直掌控的投資控股公司,而是在伯克希爾·哈撒韋公司還在從事紡織品生產(chǎn)時(shí)收購(gòu)了它,。

從這家公司的廢墟中,,他將其重塑為一個(gè)金融工具,積極管理對(duì)可口可樂(lè)(Coca-Cola),、通用再保險(xiǎn)公司(General Re),、DQ冰淇淋(Dairy Queen)等各類(lèi)公司的持股,以及近期對(duì)蘋(píng)果公司(Apple)的持股,。

阿克曼上周二在社交媒體上發(fā)帖稱(chēng):“伯克希爾·哈撒韋公司的一大吸引力在于,,任何人只要在20世紀(jì)60年代初能夠負(fù)擔(dān)得起一股約20美元的股票,就能參與長(zhǎng)期的復(fù)利增值,?!?/p>

與此同時(shí),霍華德·休斯控股公司的核心房地產(chǎn)開(kāi)發(fā)業(yè)務(wù)將繼續(xù)由現(xiàn)任首席執(zhí)行官大衛(wèi)·奧萊利(David O 'Reilly)負(fù)責(zé),,并保持原有的戰(zhàn)略方向,。

事實(shí)上,阿克曼甚至宣稱(chēng),,霍華德·休斯控股公司的戰(zhàn)略重點(diǎn)是像沃德村這樣的微型城市(房地產(chǎn)行業(yè)稱(chēng)之為“總體規(guī)劃社區(qū)”),,從而使得公司的整體狀況遠(yuǎn)勝于巴菲特最初接管伯克希爾·哈撒韋公司時(shí)所面臨的瀕臨倒閉的艱難境地。

阿克曼寫(xiě)道:"它比一家瀕臨倒閉的紡織公司要好得多,?!保ㄘ?cái)富中文網(wǎng))

譯者:中慧言-王芳

? The Pershing Square hedge fund manager is wagering his own money in a bid to build a diversified financial conglomerate that could rival the life’s work of Warren Buffett. The 94 year-old Oracle of Omaha bought into a dying textile producer 60 years ago, transforming it into the $1 trillion behemoth it is today.

Billionaire Bill Ackman may be one of the best-known hedge fund managers on Wall Street, but he’s no Warren Buffett.

He hopes to change that now as the investor behind Pershing Square is willing to stake $900 million on a bet he can become the 94-year-old Oracle of Omaha’s spiritual successor by forging what Ackman pitches as a “modern-day Berkshire Hathaway.”

Instead of the textile producer Buffett bought into in 1965, Ackman’s vessel is real estate company Howard Hughes Holdings (HHH). After spinning off a collection of loosely affiliated assets into the exchange-listed Seaport Entertainment Group last July, it now focuses on large condominium developments like the 60-acre Ward Village on Hawaii’s Waikiki Beach.

Under Ackman’s plan, HHH would issue 10 million shares of newly minted stock at $90 apiece, a tidy 12% premium to Tuesday’s closing price. This equity would then be purchased by Ackman and his team, collectively raising their overall direct and indirect stake to 48% of the company.

HHH would then function as a “l(fā)ong-term platform” for acquiring and managing controlling interests in public and private operating companies. Ackman himself would serve as its CEO and chairman, while two of his chief lieutenants would assume senior roles.

“The $900 million cash infusion will enable HHH to immediately begin to pursue the acquisition of controlling interests in public and private companies as part of its new strategy of becoming a diversified holding company,” Pershing Square Holdco LP said in a statement on Tuesday.

Howard Hughes Holdings confirmed the offer, adding that a special committee made up of independent directors will now evaluate the proposal and determine the appropriate course of action.

Ackman’s own skin in the game this time

Ackman’s gambit isn’t just another Chipotle, Herbalife, or MBIA, where he marshals investor cash to buy a stake big enough to agitate for a breakup, management reshuffle, or asset strip before liquidating his interest for a profit and moving on to the next undervalued corporation.

HHH would represent a deeply personal wager as the speculator, worth roughly $9.5 billion, would have his own skin in the game. The cash would come entirely from Pershing Square Holdco, which he and his management team own 90% of following a recent stock sale.

Ackman’s better-known hedge fund, Pershing Square Capital Management LP, in which his team has a 28% interest by comparison, would not be involved beyond retaining its existing 18.9 million shares.

In fact, his investors—known in the business as limited partners or LPs—will even be diluted if the transaction proceeds, as their stake would shrink from nearly 38% to just 31% under the deal.

Yet the planned acquisition would represent an elegant solution to Ackman’s problems. He’s been trying to crystallize value from HHH for months now, only to see the share price fail to ignite. In total the stock has shed over a third of its value during the past 10 years.

By risking his own cash, Howard Hughes Holdings might finally provide a potential return on that initial investment for Pershing Square’s LPs that might typically be ultrahigh-net-worth individuals as well as pension funds, charitable trusts, and university endowments.

‘A lot better than a dying textile company’

In the process, Ackman could pitch to Buffett’s devoted following of retail investors that HHH is the next Berkshire Hathaway, the world’s 11th largest company by market cap and the most valuable financial institution, worth $1 trillion.

Omaha’s most famous son famously didn’t found the investment holding he has controlled for the past 60 years, either, but rather bought into Berkshire Hathaway when it still manufactured textiles.

From the ashes of that business, he transformed it into a financial vehicle that actively manages stakes in corporations as diverse as Coca-Cola, General Re, and Dairy Queen—and more recently Apple.

“A big part of the appeal of Berkshire is that anyone who could afford one share, about $20 back in the early 1960s, could participate in the compounding of that value over time,” Ackman posted to social media on Tuesday.

The core property development operations of HHH would meanwhile continue under current CEO David O’Reilly with the same strategic direction.

In fact, Ackman even went so far as to claim that HHH—with its strategy of focusing on miniature cities like Ward Village, which the real estate sector calls “master-planned communities”—is healthier than Berkshire Hathaway was when Buffett first took control.

“It’s a lot better than a dying textile company,” Ackman wrote.