? 在各界熱議其龐大現(xiàn)金儲備用途之際,,沃倫·巴菲特執(zhí)掌的伯克希爾哈撒韋公司(Berkshire Hathaway)現(xiàn)金儲備規(guī)模持續(xù)攀升,。但在致集團股東的年度信中,這位投資巨擘重申了投資企業(yè)股票而非囤積現(xiàn)金的意愿,。

盡管現(xiàn)金儲備持續(xù)攀升,,但伯克希爾哈撒韋董事長兼首席執(zhí)行官沃倫·巴菲特周六重申了投資承諾。

截至第四季度末,,伯克希爾哈撒韋現(xiàn)金儲備達3,342億美元,,較一年前的1,676億美元近乎翻番。這一增長源于巴菲特過去八個季度持續(xù)凈賣出操作,,減持了蘋果(Apple),、美國銀行(Bank of America)與花旗集團(Citigroup)等公司的股票。目前公司股票投資組合規(guī)模已從一年前的3,540億美元縮減至2,720億美元,。

與此同時,,伯克希爾哈撒韋旗下仍擁有Geico保險公司、伯靈頓北方圣達菲鐵路公司(BNSF),、Dairy Queen,、喜詩糖果(See’s Candy)等子公司的股權(quán)。但近年來市場估值高企,,令這位以價值投資著稱的“奧馬哈先知”望而卻步,,已許久未動用現(xiàn)金進行重大收購交易。

巴菲特在年度股東信中寫道:“盡管某些評論認(rèn)為伯克希爾哈撒韋當(dāng)前現(xiàn)金頭寸非同尋常,,但公司絕大部分資金仍配置于股票資產(chǎn),,這一偏好不會改變?!?/p>

在此封年度信發(fā)布前,,市場對94歲高齡的巴菲特持續(xù)囤積現(xiàn)金的原因猜測不斷。

近25年前互聯(lián)網(wǎng)泡沫破裂前夕,,巴菲特曾以類似今日伯克希爾哈撒韋的操作置身事外,,拒絕投資高估值科技股,并任由現(xiàn)金儲備膨脹,。

在周六發(fā)布的信中,,巴菲特未對當(dāng)前市場前景做出預(yù)測,,但強調(diào)伯克希爾哈撒韋投資立場始終如一。

他寫道:“伯克希爾哈撒韋的股東可以放心,,我們永遠會將他們的大部分資金配置于股票資產(chǎn)——主要是美國公司的股票,,盡管其中許多公司有重要的國際業(yè)務(wù)。無論控股還是參股,,伯克希爾哈撒韋永遠不會認(rèn)為持有類現(xiàn)金資產(chǎn)優(yōu)于持有優(yōu)質(zhì)企業(yè)股權(quán),。”

巴菲特同時表示公司暫無派息計劃,,并指出現(xiàn)金的安全性并不可靠,,其價值“可能轉(zhuǎn)瞬即逝”。

巴菲特表示:“固定收益?zhèn)療o法抵御貨幣失控貶值風(fēng)險,?!?/p>

巴菲特將企業(yè)經(jīng)營比作追逐目標(biāo)的人,強調(diào)只要對商品與服務(wù)存在需求,,企業(yè)“通常能找到應(yīng)對貨幣不穩(wěn)定的方法”,。

他表示:“個人才能亦是如此。由于缺乏運動天賦,、美妙歌喉,、醫(yī)學(xué)法律技能等特殊才能,我畢生不得不仰仗股票投資,。本質(zhì)上,,我的成功依賴于美國企業(yè)的成功,未來仍將如此,。”(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

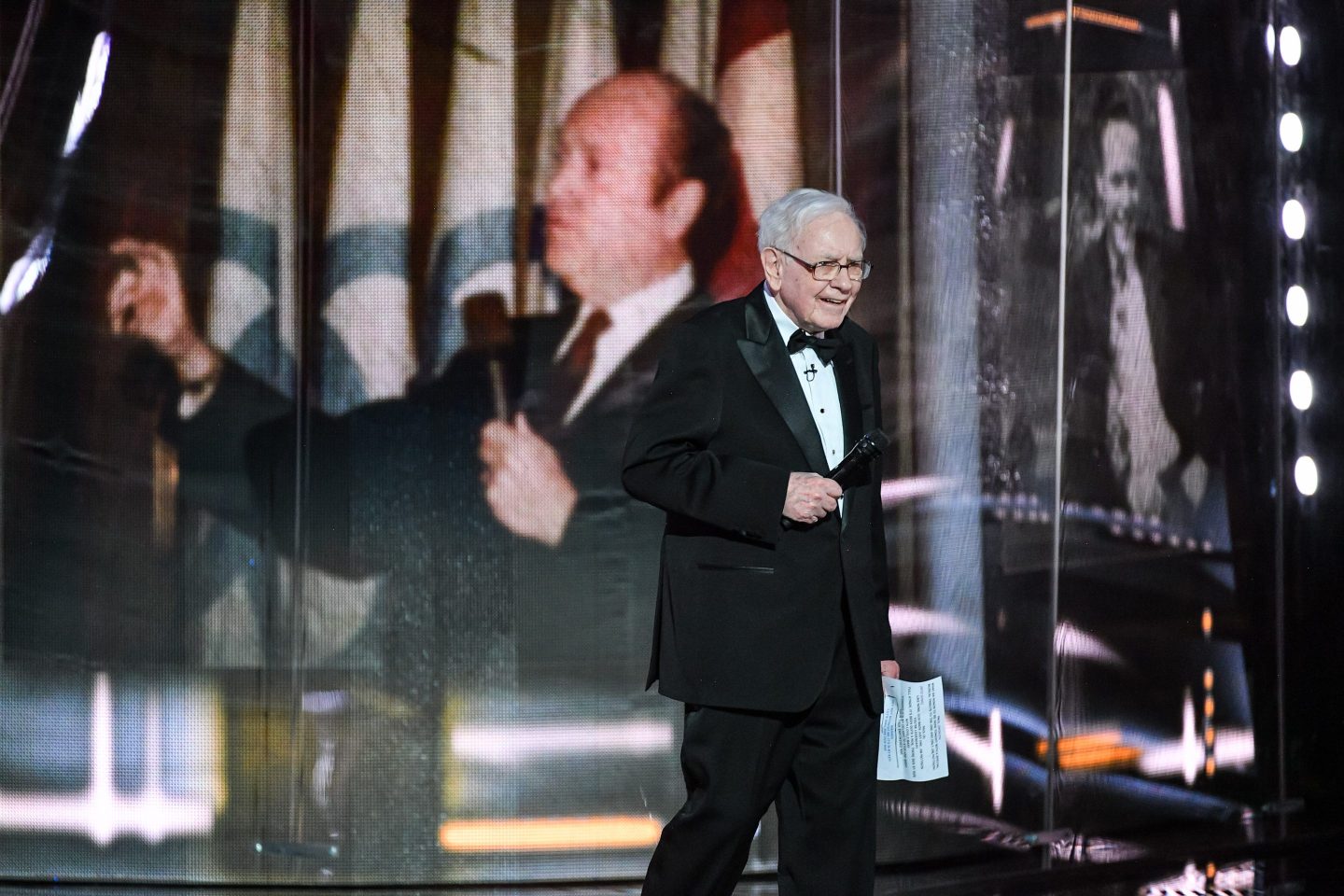

伯克希爾哈撒韋首席執(zhí)行官兼董事長沃倫·巴菲特,,拍攝于2018年,。George Pimentel—Getty Images

? 在各界熱議其龐大現(xiàn)金儲備用途之際,沃倫·巴菲特執(zhí)掌的伯克希爾哈撒韋公司(Berkshire Hathaway)現(xiàn)金儲備規(guī)模持續(xù)攀升,。但在致集團股東的年度信中,,這位投資巨擘重申了投資企業(yè)股票而非囤積現(xiàn)金的意愿。

盡管現(xiàn)金儲備持續(xù)攀升,,但伯克希爾哈撒韋董事長兼首席執(zhí)行官沃倫·巴菲特周六重申了投資承諾,。

截至第四季度末,伯克希爾哈撒韋現(xiàn)金儲備達3,342億美元,,較一年前的1,676億美元近乎翻番,。這一增長源于巴菲特過去八個季度持續(xù)凈賣出操作,減持了蘋果(Apple),、美國銀行(Bank of America)與花旗集團(Citigroup)等公司的股票,。目前公司股票投資組合規(guī)模已從一年前的3,540億美元縮減至2,720億美元,。

與此同時,伯克希爾哈撒韋旗下仍擁有Geico保險公司,、伯靈頓北方圣達菲鐵路公司(BNSF),、Dairy Queen、喜詩糖果(See’s Candy)等子公司的股權(quán),。但近年來市場估值高企,,令這位以價值投資著稱的“奧馬哈先知”望而卻步,已許久未動用現(xiàn)金進行重大收購交易,。

巴菲特在年度股東信中寫道:“盡管某些評論認(rèn)為伯克希爾哈撒韋當(dāng)前現(xiàn)金頭寸非同尋常,,但公司絕大部分資金仍配置于股票資產(chǎn),這一偏好不會改變,?!?/p>

在此封年度信發(fā)布前,市場對94歲高齡的巴菲特持續(xù)囤積現(xiàn)金的原因猜測不斷,。

近25年前互聯(lián)網(wǎng)泡沫破裂前夕,,巴菲特曾以類似今日伯克希爾哈撒韋的操作置身事外,拒絕投資高估值科技股,,并任由現(xiàn)金儲備膨脹,。

在周六發(fā)布的信中,巴菲特未對當(dāng)前市場前景做出預(yù)測,,但強調(diào)伯克希爾哈撒韋投資立場始終如一,。

他寫道:“伯克希爾哈撒韋的股東可以放心,我們永遠會將他們的大部分資金配置于股票資產(chǎn)——主要是美國公司的股票,,盡管其中許多公司有重要的國際業(yè)務(wù),。無論控股還是參股,伯克希爾哈撒韋永遠不會認(rèn)為持有類現(xiàn)金資產(chǎn)優(yōu)于持有優(yōu)質(zhì)企業(yè)股權(quán),?!?/p>

巴菲特同時表示公司暫無派息計劃,并指出現(xiàn)金的安全性并不可靠,,其價值“可能轉(zhuǎn)瞬即逝”,。

巴菲特表示:“固定收益?zhèn)療o法抵御貨幣失控貶值風(fēng)險?!?/p>

巴菲特將企業(yè)經(jīng)營比作追逐目標(biāo)的人,,強調(diào)只要對商品與服務(wù)存在需求,企業(yè)“通常能找到應(yīng)對貨幣不穩(wěn)定的方法”,。

他表示:“個人才能亦是如此,。由于缺乏運動天賦、美妙歌喉,、醫(yī)學(xué)法律技能等特殊才能,,我畢生不得不仰仗股票投資,。本質(zhì)上,我的成功依賴于美國企業(yè)的成功,,未來仍將如此,。”(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

Berkshire Hathaway CEO and chairman Warren Buffett in 2018.

? Warren Buffett’s Berkshire Hathaway saw its stockpile of cash continue to swell, amid questions about what he plans to do with all that money. But in his annual letter to the conglomerate’s shareholders, he reaffirmed his desire to invest in businesses, rather than hold onto cash.

Berkshire Hathaway Chairman and CEO Warren Buffett reaffirmed his commitment to investing Saturday, even as his conglomerate continued accumulating cash reserves.

Berkshire’s cash pile hit $334.2 billion at the end of the fourth quarter, nearly double from $167.6 billion a year ago. That’s after Buffett has been a net seller over the last eight quarters, trimming his stakes in Apple, Bank of America, and Citigroup. The size of Berkshire’s stock portfolio has shrunk to $272 billion from $354 billion a year ago.

Meanwhile, Berkshire’s other equity holdings include subsidiaries like Geico, BNSF, Dairy Queen, and See’s Candy. But Buffett hasn’t used its cash in a major takeover deal in a while as the famously value-conscious investor has balked at high valuations in recent years.

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” Buffett wrote in his annual letter to shareholders. “That preference won’t change.”

Anticipation rose leading up to the latest letter, as investors speculated why the 94-year-old “Oracle of Omaha” had been stacking up cash reserves.

Prior to the dotcom bubble burst nearly 25 years ago, Buffett famously stayed on the sidelines instead of investing in high-flying tech stocks and let his cash pile grow, similar to what’s seen with Berkshire today.

On Saturday, he refrained from offering a prediction about the current market landscape but vowed that Berkshire’s investing stance hasn’t changed.

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities although many of these will have international operations of significance,” Buffett wrote. “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good business, whether controlled or only partially owned.”

He added that Berkshire doesn’t have plans to offer a dividend, while noting that the security of cash is uncertain and “can see its value evaporate.”

“Fixed bonds provide no protection against runaway currency,” Buffett said.

Buffett said businesses are like people with goals they want to pursue, adding that they “will usually find a way to cope with monetary instability,” if there is a demand for goods and services.

“So, too, with personal skills,” he said. “Lacking such assets as athletic excellence, a wonderful voice, medical or legal skills or, for that matter, any special talents, I have had to rely on equities throughout my life. In effect, I have depended on the success of American businesses and I will continue to do so.”