英偉達(dá)再度步入財(cái)報(bào)周,其過往的出色業(yè)績令人矚目,,而此次它必須超越以往的成就,。和往常一樣,英偉達(dá)是自身成功的“受害者”,,它必須向市場證明自己將持續(xù)超越預(yù)期,。

數(shù)年來,英偉達(dá)已經(jīng)成功塑造了一種預(yù)期,,即它每個季度的業(yè)績都能超越預(yù)期,。一旦表現(xiàn)不及預(yù)期,其股價(jià)就會受到?jīng)_擊,。

貝雅資本(Baird)董事總經(jīng)理泰德·莫滕森(Ted Mortonson)告訴《財(cái)富》雜志:“英偉達(dá)必須一如既往地超越預(yù)期,,否則將面臨嚴(yán)峻的挑戰(zhàn)?!?/p>

投資者預(yù)計(jì)將在財(cái)報(bào)電話會議中尋找有關(guān)人工智能未來支出以及因DeepSeek帶來的行業(yè)變革的線索,。亞馬遜(Amazon),、Meta、微軟(Microsoft)和Alphabet預(yù)計(jì)今年的資本支出仍將達(dá)到3250億美元,,其中大部分將用于人工智能研發(fā),。盡管DeepSeek引發(fā)了股市震動,但它似乎并未對該行業(yè)巨頭的人工智能支出預(yù)期造成太大影響,。

韋德布什證券公司(Wedbush)的科技分析師丹·艾夫斯(Dan Ives)寫道:“我們尚未看到任何一家人工智能企業(yè)的部署計(jì)劃因DeepSeek的情況而有所放緩或調(diào)整,。”

科技股多頭一致認(rèn)為,,DeepSeek的成功只能證明創(chuàng)新的步伐正在加快,,因此發(fā)展也在加快,對英偉達(dá)芯片的需求只會增加,。瑞銀集團(tuán)(UBS)分析師蒂莫西·阿爾庫里(Timothy Arcuri)上周在給投資者的一份報(bào)告中寫道,,多個國家的政府宣布了重大的公私合作項(xiàng)目,旨在投資人工智能,,其中包括美國的“星際之門項(xiàng)目”和歐洲的“投資人工智能”倡議,。

阿爾庫里表示:“盡管成本有所下降,但流入人工智能基礎(chǔ)設(shè)施的投資資金卻進(jìn)一步擴(kuò)大……我們認(rèn)為英偉達(dá)仍將是所有這些支出的主要受益者,?!?/p>

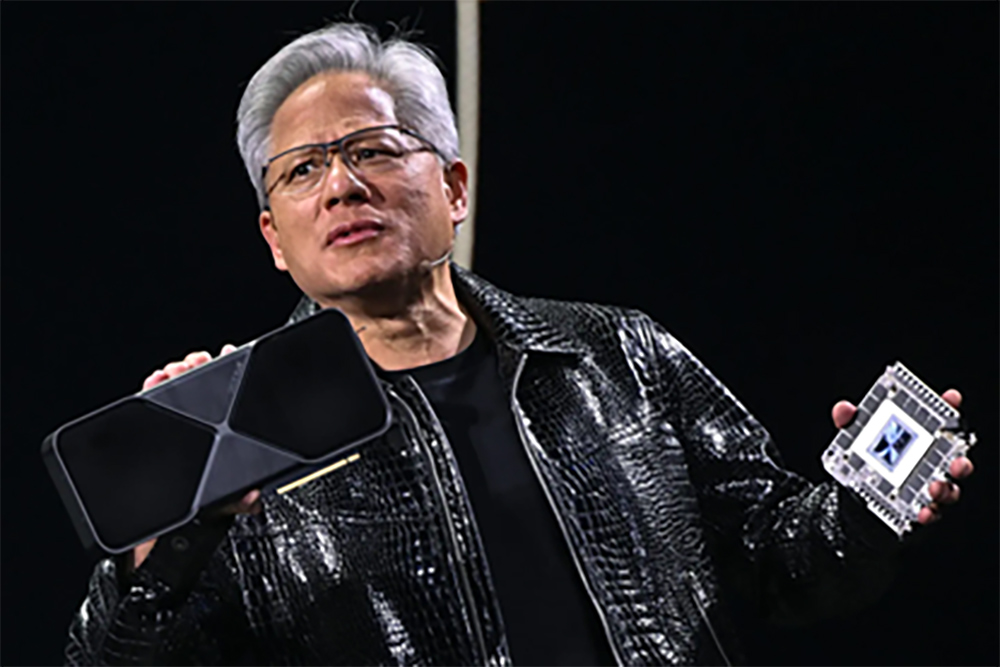

投資者對英偉達(dá)的預(yù)期是,該公司將超額完成營收目標(biāo),,并進(jìn)一步上調(diào)業(yè)績指引,。上一季度,英偉達(dá)的營收為351億美元,,同比增長94%,。在那次財(cái)報(bào)電話會議上,首席執(zhí)行官黃仁勛大肆宣揚(yáng)了對其新款Blackwell芯片的預(yù)期需求,,稱生產(chǎn)已“全速推進(jìn)”,。黃仁勛隨后向投資者透露,英偉達(dá)將交付的Blackwell芯片數(shù)量將超過此前的預(yù)期,。

英偉達(dá)Blackwell芯片的推出將受到客戶和投資者的密切關(guān)注,。此前曾有一些關(guān)于Blackwell芯片問題的傳言??萍济襟wThe Information報(bào)道稱,,Blackwell芯片導(dǎo)致某些服務(wù)器機(jī)架過熱,需要采取特定的配置方案才能規(guī)避這一問題,。(英偉達(dá)表示,,這是“正常且符合預(yù)期的情況”。)

不過,,截至目前,,客戶們似乎并未因此類傳言而卻步,,這讓投資者倍感欣慰。相反,,客戶正競相囤積英偉達(dá)所能提供的盡可能多的Blackwell芯片,。投資者預(yù)計(jì),,英偉達(dá)的客戶不會因?yàn)閷π酒^熱問題的擔(dān)憂,,或是像DeepSeek這樣的新興企業(yè)的出現(xiàn),而對Blackwell芯片訂單采取觀望態(tài)度,。

艾夫斯強(qiáng)調(diào):“沒有客戶愿意放棄自己在訂購隊(duì)列中的位置,。”

盡管如此,,Blackwell芯片的推出確實(shí)會引發(fā)投資者的擔(dān)憂,,原因在于它會拉低英偉達(dá)的利潤率,而公司方面已提前向華爾街預(yù)警,,本季度需對此有所準(zhǔn)備,。然而,如果英偉達(dá)的利潤率下滑幅度超出預(yù)期,,對于這家歷來以超預(yù)期表現(xiàn)著稱的企業(yè)而言,,這無疑將是一個罕見的負(fù)面消息。更令人憂慮的是,,隨著越來越多的英偉達(dá)客戶著手構(gòu)建自身的人工智能系統(tǒng),,它們可能僅對Blackwell圖形處理器感興趣,而對于有助于將圖形處理器集成到現(xiàn)有基礎(chǔ)設(shè)施的GB200系統(tǒng)則興趣缺缺,。貝雅資本的莫滕森指出,,此類情況若頻繁發(fā)生,英偉達(dá)利潤率下滑的風(fēng)險(xiǎn)也將隨之加劇,。

他說:“人們擔(dān)心毛利率和產(chǎn)品組合問題——這是關(guān)鍵所在,。”

其他投資者對Blackwell芯片的利潤率的問題不以為然,,認(rèn)為這只是短期問題,,最終會自行解決。Hamilton Capital Partners首席投資官阿隆索·穆尼奧斯(Alonso Munoz)表示,,只要大型科技公司持續(xù)投入數(shù)十億美元采購新款Blackwell芯片,,英偉達(dá)的業(yè)績就不會受到?jīng)_擊?!霸谶^去兩年中,,英偉達(dá)一直是一顆耀眼的明星,我們總是試圖尋找其不足之處,,而利潤率無疑是其中一個被關(guān)注的方面,?!?

然而,如果英偉達(dá)的下一季度業(yè)績預(yù)測低于預(yù)期,,那么其股價(jià)或?qū)⒂瓉硗顿Y者們的首次真正考驗(yàn),。此外,還有一個雖次要但絕不容忽視的事實(shí)是,,由于英偉達(dá)在支撐標(biāo)準(zhǔn)普爾500指數(shù)方面發(fā)揮著重要作用,,投資者信心的任何一絲動搖都可能波及整個市場,引發(fā)不必要的麻煩,。

摩根士丹利(Morgan Stanley)旗下E*Trade的董事總經(jīng)理兼交易與投資主管克里斯·拉金(Chris Larkin)認(rèn)為,,英偉達(dá)的財(cái)報(bào)與本周公布的個人消費(fèi)支出(PCE)價(jià)格指數(shù)以及國內(nèi)生產(chǎn)總值(GDP)增長報(bào)告一道,影響著投資者對整體經(jīng)濟(jì)的看法,。 (財(cái)富中文網(wǎng))

譯者:中慧言-王芳

英偉達(dá)再度步入財(cái)報(bào)周,,其過往的出色業(yè)績令人矚目,而此次它必須超越以往的成就,。和往常一樣,,英偉達(dá)是自身成功的“受害者”,它必須向市場證明自己將持續(xù)超越預(yù)期,。

數(shù)年來,,英偉達(dá)已經(jīng)成功塑造了一種預(yù)期,即它每個季度的業(yè)績都能超越預(yù)期,。一旦表現(xiàn)不及預(yù)期,,其股價(jià)就會受到?jīng)_擊。

貝雅資本(Baird)董事總經(jīng)理泰德·莫滕森(Ted Mortonson)告訴《財(cái)富》雜志:“英偉達(dá)必須一如既往地超越預(yù)期,,否則將面臨嚴(yán)峻的挑戰(zhàn),。”

投資者預(yù)計(jì)將在財(cái)報(bào)電話會議中尋找有關(guān)人工智能未來支出以及因DeepSeek帶來的行業(yè)變革的線索,。亞馬遜(Amazon),、Meta、微軟(Microsoft)和Alphabet預(yù)計(jì)今年的資本支出仍將達(dá)到3250億美元,,其中大部分將用于人工智能研發(fā),。盡管DeepSeek引發(fā)了股市震動,但它似乎并未對該行業(yè)巨頭的人工智能支出預(yù)期造成太大影響,。

韋德布什證券公司(Wedbush)的科技分析師丹·艾夫斯(Dan Ives)寫道:“我們尚未看到任何一家人工智能企業(yè)的部署計(jì)劃因DeepSeek的情況而有所放緩或調(diào)整,。”

科技股多頭一致認(rèn)為,,DeepSeek的成功只能證明創(chuàng)新的步伐正在加快,,因此發(fā)展也在加快,對英偉達(dá)芯片的需求只會增加。瑞銀集團(tuán)(UBS)分析師蒂莫西·阿爾庫里(Timothy Arcuri)上周在給投資者的一份報(bào)告中寫道,,多個國家的政府宣布了重大的公私合作項(xiàng)目,,旨在投資人工智能,其中包括美國的“星際之門項(xiàng)目”和歐洲的“投資人工智能”倡議,。

阿爾庫里表示:“盡管成本有所下降,,但流入人工智能基礎(chǔ)設(shè)施的投資資金卻進(jìn)一步擴(kuò)大……我們認(rèn)為英偉達(dá)仍將是所有這些支出的主要受益者?!?/p>

投資者對英偉達(dá)的預(yù)期是,,該公司將超額完成營收目標(biāo),并進(jìn)一步上調(diào)業(yè)績指引,。上一季度,,英偉達(dá)的營收為351億美元,,同比增長94%,。在那次財(cái)報(bào)電話會議上,首席執(zhí)行官黃仁勛大肆宣揚(yáng)了對其新款Blackwell芯片的預(yù)期需求,,稱生產(chǎn)已“全速推進(jìn)”,。黃仁勛隨后向投資者透露,英偉達(dá)將交付的Blackwell芯片數(shù)量將超過此前的預(yù)期,。

英偉達(dá)Blackwell芯片的推出將受到客戶和投資者的密切關(guān)注,。此前曾有一些關(guān)于Blackwell芯片問題的傳言??萍济襟wThe Information報(bào)道稱,,Blackwell芯片導(dǎo)致某些服務(wù)器機(jī)架過熱,需要采取特定的配置方案才能規(guī)避這一問題,。(英偉達(dá)表示,,這是“正常且符合預(yù)期的情況”。)

不過,,截至目前,,客戶們似乎并未因此類傳言而卻步,這讓投資者倍感欣慰,。相反,,客戶正競相囤積英偉達(dá)所能提供的盡可能多的Blackwell芯片。投資者預(yù)計(jì),,英偉達(dá)的客戶不會因?yàn)閷π酒^熱問題的擔(dān)憂,,或是像DeepSeek這樣的新興企業(yè)的出現(xiàn),而對Blackwell芯片訂單采取觀望態(tài)度,。

艾夫斯強(qiáng)調(diào):“沒有客戶愿意放棄自己在訂購隊(duì)列中的位置,。”

盡管如此,,Blackwell芯片的推出確實(shí)會引發(fā)投資者的擔(dān)憂,,原因在于它會拉低英偉達(dá)的利潤率,,而公司方面已提前向華爾街預(yù)警,本季度需對此有所準(zhǔn)備,。然而,,如果英偉達(dá)的利潤率下滑幅度超出預(yù)期,對于這家歷來以超預(yù)期表現(xiàn)著稱的企業(yè)而言,,這無疑將是一個罕見的負(fù)面消息,。更令人憂慮的是,隨著越來越多的英偉達(dá)客戶著手構(gòu)建自身的人工智能系統(tǒng),,它們可能僅對Blackwell圖形處理器感興趣,,而對于有助于將圖形處理器集成到現(xiàn)有基礎(chǔ)設(shè)施的GB200系統(tǒng)則興趣缺缺。貝雅資本的莫滕森指出,,此類情況若頻繁發(fā)生,,英偉達(dá)利潤率下滑的風(fēng)險(xiǎn)也將隨之加劇。

他說:“人們擔(dān)心毛利率和產(chǎn)品組合問題——這是關(guān)鍵所在,?!?/p>

其他投資者對Blackwell芯片的利潤率的問題不以為然,認(rèn)為這只是短期問題,,最終會自行解決,。Hamilton Capital Partners首席投資官阿隆索·穆尼奧斯(Alonso Munoz)表示,只要大型科技公司持續(xù)投入數(shù)十億美元采購新款Blackwell芯片,,英偉達(dá)的業(yè)績就不會受到?jīng)_擊,。“在過去兩年中,,英偉達(dá)一直是一顆耀眼的明星,,我們總是試圖尋找其不足之處,而利潤率無疑是其中一個被關(guān)注的方面,?!?

然而,如果英偉達(dá)的下一季度業(yè)績預(yù)測低于預(yù)期,,那么其股價(jià)或?qū)⒂瓉硗顿Y者們的首次真正考驗(yàn),。此外,還有一個雖次要但絕不容忽視的事實(shí)是,,由于英偉達(dá)在支撐標(biāo)準(zhǔn)普爾500指數(shù)方面發(fā)揮著重要作用,,投資者信心的任何一絲動搖都可能波及整個市場,引發(fā)不必要的麻煩,。

摩根士丹利(Morgan Stanley)旗下E*Trade的董事總經(jīng)理兼交易與投資主管克里斯·拉金(Chris Larkin)認(rèn)為,,英偉達(dá)的財(cái)報(bào)與本周公布的個人消費(fèi)支出(PCE)價(jià)格指數(shù)以及國內(nèi)生產(chǎn)總值(GDP)增長報(bào)告一道,影響著投資者對整體經(jīng)濟(jì)的看法。 (財(cái)富中文網(wǎng))

譯者:中慧言-王芳

Yet again, Nvidia enters an earnings week with only its past stellar performance to beat. It is, as usual, a victim of its own success and has only to prove to the market that it will continue raising the bar.

For several years now, Nvidia has accustomed investors to a world in which it outperforms their expectations every quarter. Anything less and the stock takes a beating.

Nvidia has to do its “normal exceed” or else it will get “crapped on,” Baird managing director Ted Mortonson told Fortune.

Investors are expected to parse the call for clues about the future of AI spending and changes to the industry as a result of DeepSeek. Amazon, Meta, Microsoft, and Alphabet still expect to allocate a projected $325 billion to capital expenditures this year, most of which will go toward AI research and development. And while DeepSeek certainly roiled the stock market, it appears to have done little to change the estimated AI spending from the sector’s biggest companies.

“We have seen not one AI enterprise deployment slow down or change due to the DeepSeek situation,” wrote Wedbush tech analyst Dan Ives.

Among tech bulls, the consensus is that DeepSeek’s success only proves the pace of innovation, and therefore development, is accelerating, and that demand for Nvidia chips will only increase. Governments announced major private-public partnerships for AI investment with the U.S.’s Stargate Project and Europe’s InvestAI initiative, UBS analyst Timothy Arcuri wrote in a note to investors last week.

“Even as costs have come down, the spigot of investment dollars flowing into AI infrastructure has only widened further … and we think Nvidia is positioned to remain the primary beneficiary of all this spend,” Arcuri said.

The expectation for Nvidia is that the company will exceed its revenue targets and then further raise its guidance. Last quarter Nvidia had $35.1 billion in revenue, which was a 94% increase from the year before. On that call, CEO Jensen Huang trumpeted the expected demand for its new Blackwell chips, saying production was in “full steam.” Huang then told investors that Nvidia would deliver more Blackwell chips than it had previously expected.

The rollout of Nvidia’s Blackwell chips will be monitored by both the company’s customers and investors. There had been some murmurs of issues with Blackwell when the tech publication The Information reported the chips caused certain server racks to overheat, which required a custom configuration to avoid. (Nvidia said that work was “normal and expected.”)

So far though, customers have seemed undeterred, which has kept investors happy. Instead customers are racing to stockpile as many Blackwell chips as the company will sell them. Investors don’t expect Nvidia’s customers to take a wait-and-see approach to their Blackwell orders based on any concerns about overheating or a new entrant like DeepSeek.

“No customer wants to lose their place in line,” Ives wrote.

That said, Blackwell does elicit some anxiety in investors because it is projected to lower Nvidia’s margins, which the company told Wall Street to expect this quarter. However, if Nvidia’s margins fall further than anticipated, it could be a rare piece of bad news from a company that over-delivers. The fear is that as more and more of Nvidia’s customers build out their own AI systems, they will want Blackwell GPUs but not the GB200 system that helps integrate them into their existing infrastructure. The more that happens, the more Nvidia’s margins risk falling, according to Baird’s Mortonson.

“There’s concern on gross margin and mix—that’s the bottom line,” he said.

Other investors downplayed questions about Blackwell’s margins as a short-term concern that would eventually resolve itself. As long as Big Tech firms keep shelling out billions to buy the new Blackwell chips, Nvidia’s performance won’t suffer, according to Hamilton Capital Partners chief investment officer Alonso Munoz. “This has been such a shining star for the last 24 months that we need something to pick at, and margins are certainly part of that equation.”

However, should Nvidia deliver a lower-than-expected forecast for its following quarter, then the stock would face one of its first real tests with investors. There is also the secondary, but not unimportant, fact that because of the outsize role Nvidia plays in propping up the S&P 500, any loss of faith from investors could spell trouble for the market as a whole.

Chris Larkin, managing director and head of trading and investing at E*Trade from Morgan Stanley, put Nvidia earnings alongside this week’s reports for the personal consumption expenditures (PCE) price index and GDP growth as shaping sentiment about the broader economy.