不經(jīng)意的旁觀者可能會(huì)驚訝地發(fā)現(xiàn),萬(wàn)事達(dá)卡(Mastercard)的股價(jià)正在飆升,。在多數(shù)人的認(rèn)知里,,萬(wàn)事達(dá)卡不過(guò)是從事向商家收取信用卡刷卡手續(xù)費(fèi)這種平淡無(wú)奇的業(yè)務(wù)。上周,,這家信用卡巨頭的股價(jià)達(dá)到575美元的歷史新高,,許多分析師預(yù)測(cè)其股價(jià)還將繼續(xù)攀升,尤其是因?yàn)槿f(wàn)事達(dá)卡最近預(yù)計(jì)未來(lái)三年的年復(fù)合增長(zhǎng)率將達(dá)到12%至14%,。

這是因?yàn)橄M(fèi)者瘋狂刷卡消費(fèi)嗎,?也不盡然。雖然交易量的上升確實(shí)推動(dòng)了公司的增長(zhǎng),,但真正的增長(zhǎng)動(dòng)力在于萬(wàn)事達(dá)卡近期對(duì)服務(wù)業(yè)務(wù)的拓展,,如今服務(wù)業(yè)務(wù)已占公司收入的40%。

在接受《財(cái)富》雜志采訪時(shí),,萬(wàn)事達(dá)卡首席財(cái)務(wù)官薩欽·梅赫拉將公司當(dāng)前的戰(zhàn)略描述為一個(gè)“良性循環(huán)”,,即網(wǎng)絡(luò)交易產(chǎn)生有價(jià)值的數(shù)據(jù),公司可以利用這些數(shù)據(jù)構(gòu)建諸如網(wǎng)絡(luò)安全和精準(zhǔn)營(yíng)銷等附加服務(wù),。梅赫拉補(bǔ)充說(shuō),,與此同時(shí),該公司日益強(qiáng)大的人工智能能力(主要基于內(nèi)部構(gòu)建)正迅速推動(dòng)這兩項(xiàng)業(yè)務(wù)的優(yōu)化,。

無(wú)論如何,,投資者對(duì)萬(wàn)事達(dá)卡的經(jīng)營(yíng)狀況似乎頗為滿意,,因?yàn)槠溥^(guò)去12個(gè)月的回報(bào)率約為32.3%,遠(yuǎn)超同期標(biāo)準(zhǔn)普爾指數(shù)26.4%的回報(bào)率,。這一表現(xiàn)促使許多人將萬(wàn)事達(dá)卡視為成長(zhǎng)型投資,,尤其是考慮到該公司每年0.55%的派息率相對(duì)較低。

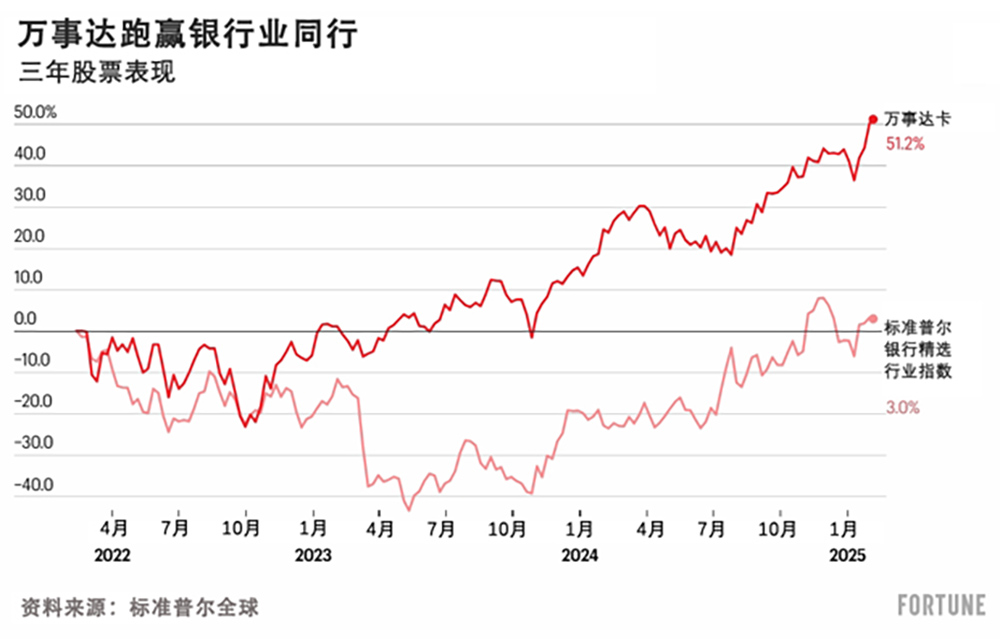

考慮到許多業(yè)內(nèi)同行的表現(xiàn)相對(duì)疲軟,,萬(wàn)事達(dá)卡的業(yè)績(jī)尤為亮眼,。下圖顯示了萬(wàn)事達(dá)卡過(guò)去三年相對(duì)于標(biāo)準(zhǔn)普爾指數(shù)中金融子板塊的表現(xiàn):

圖表中顯示的顯著差異在一定程度上可以歸因于該分類指數(shù)納入了一組地區(qū)性銀行,由于利率上升導(dǎo)致該行業(yè)出現(xiàn)危機(jī),,這些銀行的股價(jià)遭受重創(chuàng),。還需要注意的是,萬(wàn)事達(dá)卡的主要競(jìng)爭(zhēng)對(duì)手Visa的表現(xiàn)也優(yōu)于標(biāo)準(zhǔn)普爾指數(shù)的整體水平,,而且這兩家公司都可能因美國(guó)第一資本金融公司(Capital One)收購(gòu)Discover及其網(wǎng)絡(luò)而面臨壓力,。

不過(guò),萬(wàn)事達(dá)卡在快速增長(zhǎng)的服務(wù)領(lǐng)域的投入力度超越了兩家競(jìng)爭(zhēng)對(duì)手,。據(jù)梅赫拉稱,,這一戰(zhàn)略有望在未來(lái)幾年帶來(lái)巨大收益。

人工智能與即將到來(lái)的反欺詐之戰(zhàn)

萬(wàn)事達(dá)卡去年斥資26.5億美元收購(gòu)了Recorded Future(一家專門揭露海外黑客威脅的公司),,這凸顯了網(wǎng)絡(luò)安全已成為這家信用卡巨頭戰(zhàn)略和商業(yè)計(jì)劃的關(guān)鍵組成部分,。

萬(wàn)事達(dá)卡在12月底才完成對(duì)Recorded Future的收購(gòu),因此此次收購(gòu)對(duì)該公司最新財(cái)報(bào)的貢獻(xiàn)微乎其微,,但未來(lái)有望大幅提升公司收入,。盡管該公司沒(méi)有提供其服務(wù)業(yè)務(wù)收入的詳細(xì)細(xì)分?jǐn)?shù)據(jù),但從梅赫拉及其他高管的言論來(lái)看,,網(wǎng)絡(luò)安全業(yè)務(wù)顯然占據(jù)了相當(dāng)大的比例,。

實(shí)際上,萬(wàn)事達(dá)卡的網(wǎng)絡(luò)業(yè)務(wù)是以向商家出售先進(jìn)的欺詐檢測(cè)服務(wù)的形式開(kāi)展的,,這些服務(wù)能夠幫助商家決定如何在減少交易摩擦和甄別不良行為者之間找到最佳平衡點(diǎn),。作為對(duì)這一過(guò)程的補(bǔ)充,萬(wàn)事達(dá)卡還大力推廣“令牌化”(tokenization),,即用更通用的標(biāo)識(shí)符取代可能被攔截和竊取的卡號(hào),。

然而,在未來(lái)幾年,,信用卡網(wǎng)絡(luò)可能會(huì)面臨前所未有的考驗(yàn),,因?yàn)槠墼p團(tuán)伙——其中許多是來(lái)自俄羅斯和中國(guó)的資深黑客犯罪分子——利用生成人工智能工具來(lái)創(chuàng)建深度偽造內(nèi)容和開(kāi)展其他形式的高級(jí)仿冒活動(dòng)。不過(guò),,梅赫拉表示,,萬(wàn)事達(dá)卡已經(jīng)做好了應(yīng)對(duì)新威脅的準(zhǔn)備,部分原因是人工智能不僅是攻擊者的工具,,也是企業(yè)加強(qiáng)防御的工具,。

他解釋說(shuō),,無(wú)論是從網(wǎng)絡(luò)安全還是公司整體運(yùn)營(yíng)的角度來(lái)看,萬(wàn)事達(dá)卡都擁有一套完善的人工智能戰(zhàn)略,,這得益于2017年對(duì)舊金山人工智能初創(chuàng)公司Brighterion的收購(gòu),。該戰(zhàn)略由三部分框架組成,,為人工智能的使用提供了依據(jù),。

梅赫拉表示:“僅僅擁有數(shù)據(jù)是不夠的……關(guān)鍵在于如何整合數(shù)據(jù),以充分發(fā)揮模型的效能,。第一步,,你必須擁有數(shù)據(jù)。第二步,,你必須對(duì)數(shù)據(jù)進(jìn)行結(jié)構(gòu)化處理并加以整合,,以充分發(fā)揮模型的效能。第三步是配備相關(guān)領(lǐng)域的數(shù)據(jù)科學(xué)家和人工智能專業(yè)人才,,這樣才能真正構(gòu)建出自適應(yīng)學(xué)習(xí)模型,,以提升效率?!?

至于在即將到來(lái)的生成式人工智能對(duì)決中,,網(wǎng)絡(luò)攻擊者與萬(wàn)事達(dá)卡誰(shuí)能更勝一籌,只有時(shí)間能給出答案,。與此同時(shí),,萬(wàn)事達(dá)卡正利用人工智能優(yōu)化其他服務(wù)產(chǎn)品,包括為星巴克(Starbucks)等大型客戶提供的基于數(shù)據(jù)的營(yíng)銷服務(wù),,這些客戶希望提升線上和線下廣告投放的精準(zhǔn)度,。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

萬(wàn)事達(dá)卡首席財(cái)務(wù)官薩欽·梅赫拉(Sachin Mehra)。

不經(jīng)意的旁觀者可能會(huì)驚訝地發(fā)現(xiàn),,萬(wàn)事達(dá)卡(Mastercard)的股價(jià)正在飆升,。在多數(shù)人的認(rèn)知里,萬(wàn)事達(dá)卡不過(guò)是從事向商家收取信用卡刷卡手續(xù)費(fèi)這種平淡無(wú)奇的業(yè)務(wù),。上周,,這家信用卡巨頭的股價(jià)達(dá)到575美元的歷史新高,許多分析師預(yù)測(cè)其股價(jià)還將繼續(xù)攀升,,尤其是因?yàn)槿f(wàn)事達(dá)卡最近預(yù)計(jì)未來(lái)三年的年復(fù)合增長(zhǎng)率將達(dá)到12%至14%,。

這是因?yàn)橄M(fèi)者瘋狂刷卡消費(fèi)嗎?也不盡然,。雖然交易量的上升確實(shí)推動(dòng)了公司的增長(zhǎng),,但真正的增長(zhǎng)動(dòng)力在于萬(wàn)事達(dá)卡近期對(duì)服務(wù)業(yè)務(wù)的拓展,如今服務(wù)業(yè)務(wù)已占公司收入的40%,。

在接受《財(cái)富》雜志采訪時(shí),,萬(wàn)事達(dá)卡首席財(cái)務(wù)官薩欽·梅赫拉將公司當(dāng)前的戰(zhàn)略描述為一個(gè)“良性循環(huán)”,,即網(wǎng)絡(luò)交易產(chǎn)生有價(jià)值的數(shù)據(jù),公司可以利用這些數(shù)據(jù)構(gòu)建諸如網(wǎng)絡(luò)安全和精準(zhǔn)營(yíng)銷等附加服務(wù),。梅赫拉補(bǔ)充說(shuō),,與此同時(shí),該公司日益強(qiáng)大的人工智能能力(主要基于內(nèi)部構(gòu)建)正迅速推動(dòng)這兩項(xiàng)業(yè)務(wù)的優(yōu)化,。

無(wú)論如何,,投資者對(duì)萬(wàn)事達(dá)卡的經(jīng)營(yíng)狀況似乎頗為滿意,因?yàn)槠溥^(guò)去12個(gè)月的回報(bào)率約為32.3%,,遠(yuǎn)超同期標(biāo)準(zhǔn)普爾指數(shù)26.4%的回報(bào)率,。這一表現(xiàn)促使許多人將萬(wàn)事達(dá)卡視為成長(zhǎng)型投資,尤其是考慮到該公司每年0.55%的派息率相對(duì)較低,。

考慮到許多業(yè)內(nèi)同行的表現(xiàn)相對(duì)疲軟,,萬(wàn)事達(dá)卡的業(yè)績(jī)尤為亮眼。下圖顯示了萬(wàn)事達(dá)卡過(guò)去三年相對(duì)于標(biāo)準(zhǔn)普爾指數(shù)中金融子板塊的表現(xiàn):

圖表中顯示的顯著差異在一定程度上可以歸因于該分類指數(shù)納入了一組地區(qū)性銀行,,由于利率上升導(dǎo)致該行業(yè)出現(xiàn)危機(jī),,這些銀行的股價(jià)遭受重創(chuàng)。還需要注意的是,,萬(wàn)事達(dá)卡的主要競(jìng)爭(zhēng)對(duì)手Visa的表現(xiàn)也優(yōu)于標(biāo)準(zhǔn)普爾指數(shù)的整體水平,,而且這兩家公司都可能因美國(guó)第一資本金融公司(Capital One)收購(gòu)Discover及其網(wǎng)絡(luò)而面臨壓力。

不過(guò),,萬(wàn)事達(dá)卡在快速增長(zhǎng)的服務(wù)領(lǐng)域的投入力度超越了兩家競(jìng)爭(zhēng)對(duì)手,。據(jù)梅赫拉稱,這一戰(zhàn)略有望在未來(lái)幾年帶來(lái)巨大收益,。

人工智能與即將到來(lái)的反欺詐之戰(zhàn)

萬(wàn)事達(dá)卡去年斥資26.5億美元收購(gòu)了Recorded Future(一家專門揭露海外黑客威脅的公司),,這凸顯了網(wǎng)絡(luò)安全已成為這家信用卡巨頭戰(zhàn)略和商業(yè)計(jì)劃的關(guān)鍵組成部分。

萬(wàn)事達(dá)卡在12月底才完成對(duì)Recorded Future的收購(gòu),,因此此次收購(gòu)對(duì)該公司最新財(cái)報(bào)的貢獻(xiàn)微乎其微,,但未來(lái)有望大幅提升公司收入。盡管該公司沒(méi)有提供其服務(wù)業(yè)務(wù)收入的詳細(xì)細(xì)分?jǐn)?shù)據(jù),,但從梅赫拉及其他高管的言論來(lái)看,,網(wǎng)絡(luò)安全業(yè)務(wù)顯然占據(jù)了相當(dāng)大的比例。

實(shí)際上,,萬(wàn)事達(dá)卡的網(wǎng)絡(luò)業(yè)務(wù)是以向商家出售先進(jìn)的欺詐檢測(cè)服務(wù)的形式開(kāi)展的,,這些服務(wù)能夠幫助商家決定如何在減少交易摩擦和甄別不良行為者之間找到最佳平衡點(diǎn)。作為對(duì)這一過(guò)程的補(bǔ)充,,萬(wàn)事達(dá)卡還大力推廣“令牌化”(tokenization),,即用更通用的標(biāo)識(shí)符取代可能被攔截和竊取的卡號(hào)。

然而,在未來(lái)幾年,,信用卡網(wǎng)絡(luò)可能會(huì)面臨前所未有的考驗(yàn),,因?yàn)槠墼p團(tuán)伙——其中許多是來(lái)自俄羅斯和中國(guó)的資深黑客犯罪分子——利用生成人工智能工具來(lái)創(chuàng)建深度偽造內(nèi)容和開(kāi)展其他形式的高級(jí)仿冒活動(dòng)。不過(guò),,梅赫拉表示,,萬(wàn)事達(dá)卡已經(jīng)做好了應(yīng)對(duì)新威脅的準(zhǔn)備,部分原因是人工智能不僅是攻擊者的工具,,也是企業(yè)加強(qiáng)防御的工具,。

他解釋說(shuō),無(wú)論是從網(wǎng)絡(luò)安全還是公司整體運(yùn)營(yíng)的角度來(lái)看,,萬(wàn)事達(dá)卡都擁有一套完善的人工智能戰(zhàn)略,,這得益于2017年對(duì)舊金山人工智能初創(chuàng)公司Brighterion的收購(gòu),。該戰(zhàn)略由三部分框架組成,,為人工智能的使用提供了依據(jù)。

梅赫拉表示:“僅僅擁有數(shù)據(jù)是不夠的……關(guān)鍵在于如何整合數(shù)據(jù),,以充分發(fā)揮模型的效能,。第一步,你必須擁有數(shù)據(jù),。第二步,,你必須對(duì)數(shù)據(jù)進(jìn)行結(jié)構(gòu)化處理并加以整合,以充分發(fā)揮模型的效能,。第三步是配備相關(guān)領(lǐng)域的數(shù)據(jù)科學(xué)家和人工智能專業(yè)人才,,這樣才能真正構(gòu)建出自適應(yīng)學(xué)習(xí)模型,以提升效率,?!?

至于在即將到來(lái)的生成式人工智能對(duì)決中,網(wǎng)絡(luò)攻擊者與萬(wàn)事達(dá)卡誰(shuí)能更勝一籌,,只有時(shí)間能給出答案,。與此同時(shí),萬(wàn)事達(dá)卡正利用人工智能優(yōu)化其他服務(wù)產(chǎn)品,,包括為星巴克(Starbucks)等大型客戶提供的基于數(shù)據(jù)的營(yíng)銷服務(wù),,這些客戶希望提升線上和線下廣告投放的精準(zhǔn)度。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

Casual observers might be surprised to learn that shares of Mastercard, which most people associate with the humdrum business of charging merchants for credit card swipes, are soaring. Last week, the card giant’s stock hit an all-time high of $575, and many analysts predict it will keep climbing—not least because Mastercard recently forecast compound annual growth of 12% to 14% for the next three years.

Is this due to consumers charging up a storm? Not exactly. While an uptick in transactions is certainly helping the company’s growth story, the real growth story lies in Mastercard’s recent embrace of services, which now make up 40% of the company’s revenue.

In an interview with Fortune, Mastercard CFO Sachin Mehra described the company’s current strategy as a “virtuous cycle” where network transactions supply valuable data that it can use to build add-on services for things like cybersecurity and targeted marketing. Meanwhile, Mehra added, the company’s growing prowess in AI—which is primarily built in-house—is rapidly improving both sides of the business.

In any event, investors appear to like what the company is doing as Mastercard’s current 12-month return is around 32.3%, significantly outpacing the S&P index figure of 26.4% for the same period. This suggests many regard Mastercard as a growth play—especially considering the company’s modest annual 0.55% dividend payout.

Mastercard’s performance is also notable given the relatively feeble showing of many of its industry peers. The chart below shows its relative three-year performance compared to a financial subset of the S&P index:

The massive discrepancy shown in the chart can be explained in part by the sub-index's inclusion of a group of regional banks whose shares got hammered amid a crisis in the sector caused by rising interest rates. It should also be noted that Mastercard's main competitor, Visa, also outperformed the overall S&P and that both companies could face pressure due to Capital One's acquisition of Discover and its network.

Mastercard, though, has leaned into the fast-growing services segment to a greater degree than either of its competitors, and according to Mehra, that strategy is poised to reap outsize benefits in coming years.

AI and the coming fraud battle

When Mastercard spent $2.65 billion last year to purchase Recorded Future—a firm that specializes in exposing overseas hacking threats—it underscored how cybersecurity has become a key component of the card giant's strategic and business plans.

The Recorded Future acquisition only closed in late December, meaning it made a minimal contribution to Mastercard's latest earnings, but it will likely provide a significant revenue boost going forward. The company did not provide a granular breakdown of the money it is making from services, but based on comments from Mehra and other executives, it's clear cybersecurity contributes to a big portion of that.

In practice, Mastercard's cyber business comes in the form of selling advanced fraud detection services to merchants that help them decide how to best establish a trade-off between reducing transaction friction and screening for bad actors. This process is complemented by the company's push to expand tokenization, a process that replaces card numbers—which can be intercepted and stolen—with a more generic identifier.

In coming years, however, credit card networks are likely to be tested like never before as fraud rings—many of them seasoned criminal hackers from Russia and China—use generative AI tools to create deepfakes and other forms of advanced impersonation. Mehra, though, says Mastercard is ready for the new threat, in part because AI is not just a tool for attackers, but for companies to harden their defenses.

He explained that, both for cybersecurity and the company's operations in general, Mastercard has a sophisticated AI strategy, that has been helped by its 2017 acquisition of Brighterion, a San Francisco artificial intelligence startup. That strategy is formed by a three-part framework that informs the use of AI.

"Just having the data is insufficient... You've got to be able to organize the data in a manner which allows for those models to be effective," said Mehra. "Step one, you've got to have the data. Step two, you have to structure the data and organize it in a manner which can make your models effective. Step three is about having the right kind of data scientists and AI folks to actually create models which are self-learning models which help to improve the efficacy."

When it comes to the coming generative AI clash between cyber attackers and Mastercard, only time will tell who has the upper hand. In the meantime, the company is also using AI to soup up its other service offerings, which include data-based marketing services that it provides to large customers like Starbucks that are looking to improve their ad targeting online and in the real world.