在美國金融史上,,諸多聲名狼藉的事件所發(fā)生的那幾周令人刻骨銘心,,比如1929年的“黑色星期二”股市崩盤,,2008年雷曼兄弟破產(chǎn),或是2020年新冠疫情引發(fā)的沖擊,。如今,,我們可以把唐納德·特朗普在過去兩周內(nèi)接連宣布的全面關(guān)稅政策所引發(fā)的“解放日”市場崩潰也列入這份“不光彩名單”。

隨之造成的損失極為慘重,。投資者陷入恐慌,,紛紛拋售股票和美國國債,導致4月2日至4月9日總統(tǒng)宣布“暫?!辈糠株P(guān)稅期間,,全球股市市值蒸發(fā)了十萬億美元。盡管到周五時,,市場已經(jīng)收復了大部分失地,,但多數(shù)主要股指仍處于回調(diào)區(qū)間,并且由于眾多交易員擔心后續(xù)還將面臨更為嚴重的經(jīng)濟損失,,市場仍處于動蕩狀態(tài),,行情波動劇烈。

在持續(xù)的動蕩局勢中,,事情的來龍去脈以及潛在的長期影響正逐漸變得清晰,。誠然,最顯而易見的是,,關(guān)稅政策無疑是這場危機的直接誘因,,因為近一個世紀以來,美國政府首次背離自由市場原則,,轉(zhuǎn)而奉行重商主義,。除此之外,特朗普以提振美國工業(yè)生產(chǎn)為旗號推行關(guān)稅政策,,但其執(zhí)行過程毫無章法,,政策朝令夕改,加劇了市場的不確定性,。沒人能預測他的下一步行動,;白宮和企業(yè)領(lǐng)導人之間的溝通渠道近乎堵塞,。

資本市場已清晰釋放出對當前狀況不滿的信號。最令人擔憂的是,,眾多投資者選擇拋售美國國債——數(shù)十年來,,美國國債始終被視為最安全的避險資產(chǎn)。在人們的記憶中,,首次出現(xiàn)部分投資者對美國金融體系喪失信心,,轉(zhuǎn)而在歐洲和亞洲尋求安全保障。

這種信心下滑不僅體現(xiàn)在美國短期國債拋售上,,還體現(xiàn)在美元匯率的陡然暴跌上,。企業(yè)領(lǐng)導人此前大多保持沉默,直到“解放日”事件爆發(fā),,如今他們開始對美國經(jīng)濟或?qū)⒃馐艿拈L期損害發(fā)出警告,,而企業(yè)則在努力應對供應鏈的混亂,并為未來做規(guī)劃,。與此同時,,關(guān)稅普遍被認定為通貨膨脹的推手,消費者的擔憂日益加劇,,因為他們意識到雞蛋價格不會下降,,而且汽車和許多其他商品即便不至于完全超出購買力,價格也可能迅速攀升至令人望而卻步的地步,。

在這種前所未有的經(jīng)濟形勢下,,企業(yè)高管和投資者應該如何應對呢?為了提供一些指導,,《財富》雜志借助了資深商業(yè)記者的專業(yè)洞見,,既展開深刻剖析,例如概述了致使特朗普在最新一輪關(guān)稅舉措上有所退縮的債券市場“風波”,,還給出了切實可行的建議,。我們精心挑選了近期的優(yōu)質(zhì)報道,將其匯總于特別報道《危機中的經(jīng)濟》之中,。

我們的指南涵蓋了對黃金,、比特幣等熱門資產(chǎn)表現(xiàn)情況的分析,并就如何調(diào)整投資組合以應對美元貶值及其他可能永久性重塑金融格局的因素給出了建議,。我們還報道了沃爾瑪,、蘋果等《財富》世界500強企業(yè)如何適應跨境貿(mào)易自由化不再被視為理所當然的環(huán)境,。這些報道共同闡釋了過去十年間市場最動蕩的十天里究竟發(fā)生了什么,,并對這場似乎遠未結(jié)束的經(jīng)濟風暴未來走向提供了一些見解。(財富中文網(wǎng))

譯者:中慧言-王芳

在美國金融史上,,諸多聲名狼藉的事件所發(fā)生的那幾周令人刻骨銘心,,比如1929年的“黑色星期二”股市崩盤,,2008年雷曼兄弟破產(chǎn),或是2020年新冠疫情引發(fā)的沖擊,。如今,,我們可以把唐納德·特朗普在過去兩周內(nèi)接連宣布的全面關(guān)稅政策所引發(fā)的“解放日”市場崩潰也列入這份“不光彩名單”。

隨之造成的損失極為慘重,。投資者陷入恐慌,,紛紛拋售股票和美國國債,導致4月2日至4月9日總統(tǒng)宣布“暫?!辈糠株P(guān)稅期間,,全球股市市值蒸發(fā)了十萬億美元。盡管到周五時,,市場已經(jīng)收復了大部分失地,,但多數(shù)主要股指仍處于回調(diào)區(qū)間,并且由于眾多交易員擔心后續(xù)還將面臨更為嚴重的經(jīng)濟損失,,市場仍處于動蕩狀態(tài),,行情波動劇烈。

在持續(xù)的動蕩局勢中,,事情的來龍去脈以及潛在的長期影響正逐漸變得清晰,。誠然,最顯而易見的是,,關(guān)稅政策無疑是這場危機的直接誘因,,因為近一個世紀以來,美國政府首次背離自由市場原則,,轉(zhuǎn)而奉行重商主義,。除此之外,特朗普以提振美國工業(yè)生產(chǎn)為旗號推行關(guān)稅政策,,但其執(zhí)行過程毫無章法,,政策朝令夕改,加劇了市場的不確定性,。沒人能預測他的下一步行動,;白宮和企業(yè)領(lǐng)導人之間的溝通渠道近乎堵塞。

資本市場已清晰釋放出對當前狀況不滿的信號,。最令人擔憂的是,,眾多投資者選擇拋售美國國債——數(shù)十年來,美國國債始終被視為最安全的避險資產(chǎn),。在人們的記憶中,首次出現(xiàn)部分投資者對美國金融體系喪失信心,,轉(zhuǎn)而在歐洲和亞洲尋求安全保障,。

這種信心下滑不僅體現(xiàn)在美國短期國債拋售上,,還體現(xiàn)在美元匯率的陡然暴跌上。企業(yè)領(lǐng)導人此前大多保持沉默,,直到“解放日”事件爆發(fā),,如今他們開始對美國經(jīng)濟或?qū)⒃馐艿拈L期損害發(fā)出警告,而企業(yè)則在努力應對供應鏈的混亂,,并為未來做規(guī)劃,。與此同時,關(guān)稅普遍被認定為通貨膨脹的推手,,消費者的擔憂日益加劇,,因為他們意識到雞蛋價格不會下降,而且汽車和許多其他商品即便不至于完全超出購買力,,價格也可能迅速攀升至令人望而卻步的地步,。

在這種前所未有的經(jīng)濟形勢下,企業(yè)高管和投資者應該如何應對呢,?為了提供一些指導,,《財富》雜志借助了資深商業(yè)記者的專業(yè)洞見,既展開深刻剖析,,例如概述了致使特朗普在最新一輪關(guān)稅舉措上有所退縮的債券市場“風波”,,還給出了切實可行的建議。我們精心挑選了近期的優(yōu)質(zhì)報道,,將其匯總于特別報道《危機中的經(jīng)濟》之中。

我們的指南涵蓋了對黃金,、比特幣等熱門資產(chǎn)表現(xiàn)情況的分析,,并就如何調(diào)整投資組合以應對美元貶值及其他可能永久性重塑金融格局的因素給出了建議。我們還報道了沃爾瑪,、蘋果等《財富》世界500強企業(yè)如何適應跨境貿(mào)易自由化不再被視為理所當然的環(huán)境,。這些報道共同闡釋了過去十年間市場最動蕩的十天里究竟發(fā)生了什么,,并對這場似乎遠未結(jié)束的經(jīng)濟風暴未來走向提供了一些見解。(財富中文網(wǎng))

譯者:中慧言-王芳

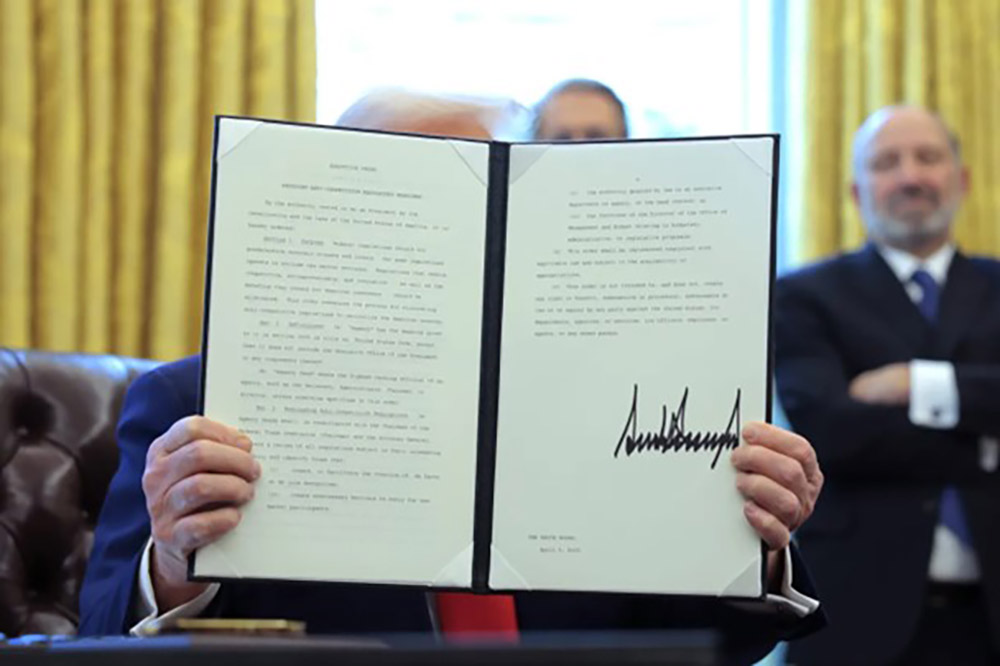

In U.S. financial history, there are weeks that live in infamy—like the “Black Tuesday” stock market crash of 1929, or the 2008 Lehman Brothers bankruptcy, or the COVID-induced shock of 2020. To this list we can add the “Liberation Day” market meltdown triggered by President Donald Trump’s successive announcements of sweeping tariffs over the past two weeks.

The ensuing damage was enormous, as panicked investors sold off both stocks and U.S. Treasuries, leading to a $10 trillion wipeout in global equities between April 2 and April 9, when the president “paused” some of his tariffs. While the markets had recovered much of those losses by Friday, most major stock indexes are still in correction territory, and remain in a state of turmoil defined by wild volatility, as many traders fear there’s far more economic damage to come.

Amid the enduring chaos, a clearer picture is emerging of what happened, and what the potential long-term effects could be. Most obviously, of course, the tariffs themselves have caused the meltdown as, for the first time in nearly a century, the U.S. government has forsaken free markets in favor of mercantilism. On top of this fire, Trump has poured the gasoline of uncertainty, rolling out tariffs in the name of increasing U.S. industrial production, but implementing them in haphazard ways, and then abruptly reversing his decisions. No one knows what he will do next; communication between the White House and business leaders has been scant.

The capital markets have made clear that they don’t like what’s happening. In the most alarming development, many investors have reacted by selling off U.S. Treasury bills—the asset that for decades has represented the safest of safe havens. For the first time in living memory, some players have lost confidence in the U.S. financial system and are seeking security instead in Europe and Asia.

This erosion of confidence is being felt not only in the sell-off of T-bills, but in the sudden plunge of the U.S. dollar. Business leaders, who stayed mostly silent until the Liberation Day fallout, are beginning to sound the alarm about long-term harm to the American economy, while companies are scrambling to address upended supply chains and plan for the future. Tariffs, meanwhile, are widely regarded as inflationary, and consumers are increasingly frightened as they realize that the cost of eggs is not coming down, and that cars and many other goods could soon be punishingly expensive, if not out of their reach altogether.

In these unprecedented economic conditions, how should executives and investors react? To offer some guidance, Fortune has tapped into the expertise of its veteran business journalists to provide both sharp analysis—such as an overview of the “murder mystery” in the bond market that led Trump to flinch on his latest round of tariffs—and practical advice. We’ve curated some of our best recent coverage in a special report, The Economy In Crisis.

Our guidance includes a look at how some popular assets, including gold and Bitcoin, are performing, and advice on how to adjust your portfolio to account for a declining dollar and other potentially permanent shifts in the financial landscape. We report on how Walmart, Apple, and other Fortune 500 companies are adjusting to a climate in which free cross-border trade can no longer be taken for granted. Together, the stories help explain what happened in the most chaotic 10 days in the market in years, and offer a sense of what could happen next in an economic storm that appears far from over. Read on—and buckle up.