? 今年以來,,美元已下跌近9%,。盡管股市下跌,但美國國債收益率卻持續(xù)高企——這與投資者通常預(yù)期的情況相反,。部分人士指責(zé)日本與中國拋售美債,認為此行為是美元貶值的誘因,。也有人認為,,對沖基金平倉債券杠桿頭寸可能是罪魁禍首。但分析師和經(jīng)濟學(xué)家告訴《財富》雜志,,只要白宮繼續(xù)制造經(jīng)濟不確定性,,全球投資者都會逃離美元。

在特朗普總統(tǒng)態(tài)度發(fā)生轉(zhuǎn)變,,稱他無意解雇美聯(lián)儲主席杰羅姆·鮑威爾之后,,美元匯率迎來回升。對于這一全球“儲備貨幣”而言,,這是一則難得的利好消息,。今年以來,美元指數(shù)(DXY,,美元相對于一籃子主要貨幣)已下跌了9%,。

這就引出了一個問題:究竟是誰在拋售美元,抑或是誰在拋售那些致使美元貶值的資產(chǎn),,其背后的動因又是什么,?

最初,,日本和中國被視為可能的“幕后推手”。畢竟,,兩國出口市場因特朗普挑起的貿(mào)易戰(zhàn)而受到?jīng)_擊,,而且它們分別是美國國債的第一和第二大外國持有國?;蛟S,,這些國家意在借此向特朗普釋放信號:記住,我們同樣具備反制之力,。

然而,,消息人士告訴《財富》雜志,并無充分證據(jù)表明中日兩國在蓄意壓低美元匯率,。

此外,,或許令人頗感意外的是,據(jù)這些消息人士透露,,目前幾乎沒有證據(jù)顯示,,面臨流動性困境的對沖基金突然被迫平倉美國債券杠桿頭寸,進而引發(fā)了近期的拋售潮,,最終導(dǎo)致美元匯率承壓下行,。

相反,責(zé)任在于他人

特朗普經(jīng)濟政策的搖擺不定給全球帶來了極大的不確定性,,以至于包括股票,、債券和貨幣在內(nèi)的各類資產(chǎn)投資者紛紛選擇撤離美國市場,直至市場出現(xiàn)確定性信號,。

牛津經(jīng)濟研究院(Oxford Economics)首席分析師約翰·卡納文(John Canavan)表示,,日本正大規(guī)模拋售其持有的各類外國債券,近期已拋售達200億美元之多,,“且并非僅局限于美國國債”,。"由于美國國債在日本所持外國債券中占據(jù)相當(dāng)大的比重,其動向通常被視為重要參考指標,?!?/p>

不過,他表示:“目前尚不清楚中國和/或日本是否是近期美國國債市場拋售和波動的幕后推手,。無論哪種情況,,要找到確鑿證據(jù)都并非易事。鑒于外國交易及美國國債持有狀況的數(shù)據(jù)通常存在公布滯后的情況,,它們或許在一定程度上對市場產(chǎn)生了影響,,但初步分析顯示,這些因素似乎并非導(dǎo)致市場動蕩的主因,?!?/p>

對沖基金不是幕后推手

卡納文同樣不認可對沖基金是美元下跌“幕后推手”的觀點,。

他向《財富》雜志透露:“最初推測大規(guī)模杠桿基差交易平倉是推動美元走低的關(guān)鍵因素,但這一猜測似乎并不成立,。美國商品期貨交易委員會(CFTC)過去兩周發(fā)布的交易持倉報告數(shù)據(jù)顯示,,并未出現(xiàn)任何基差交易平倉的情況?!?/p>

他在高盛(Goldman Sachs)的同事們也在一定程度上認同這一觀點,。

在4月22日呈遞給客戶的一份研究報告中,分析師卡瑪克夏·特里維迪(Kamakshya Trivedi)和多米尼克·威爾遜(Dominic Wilson)寫道:“我們在市場‘足跡’或資金流向數(shù)據(jù)中,,均未發(fā)現(xiàn)充分證據(jù)支持外國大規(guī)模拋售資產(chǎn)的論斷,,不過有更多證據(jù)表明,杠桿頭寸的平倉操作(尤其是互換利差的大幅波動)或許對市場產(chǎn)生了一定影響,?!?/p>

中國與日本實質(zhì)上并無拋售美國債券的動機,畢竟此舉不僅會削弱它們對穩(wěn)定資產(chǎn)的需求,,還將導(dǎo)致本國貨幣升值,,進而對出口市場造成沖擊。

Convera公司的外匯與宏觀策略師凱文·福特(Kevin Ford)說:“以中國為例,?!?/p>

“作為僅次于日本的美國第二大外國債權(quán)國,中國持有約7800億美元的美國國債,。雖然其市場動向備受關(guān)注,,但大規(guī)模拋售的可能性微乎其微,因為資金回流會促使人民幣升值,,而當(dāng)前中國正通過調(diào)控人民幣匯率來緩沖關(guān)稅帶來的影響,。”

他告訴《財富》雜志:“另一方面,,對沖基金或許在其中起到了推波助瀾的作用,。隨著債券拋售潮愈演愈烈,,追加保證金的壓力可能迫使基金拋售美國國債以回籠資金,,尤其是那些采用債券基差交易策略的基金?!?/p>

所有人都想逃離美國

事實上,,存在一個更為直白的解釋:美元匯率持續(xù)走低,美國債券收益率居高不下,,究其原因,,全球投資者——事實上是整個國際社會——如今都急于抽身,逃離美國這個“是非之地”,。

這涵蓋了股票,、債券與貨幣領(lǐng)域,。鑒于特朗普的貿(mào)易政策朝令夕改,加之日復(fù)一日地對央行行長施壓,,各類投資者都在減少對美國的投資敞口,。如今,他們不再將美國視作避險港灣,,而是將其歸入風(fēng)險資產(chǎn)的行列,。

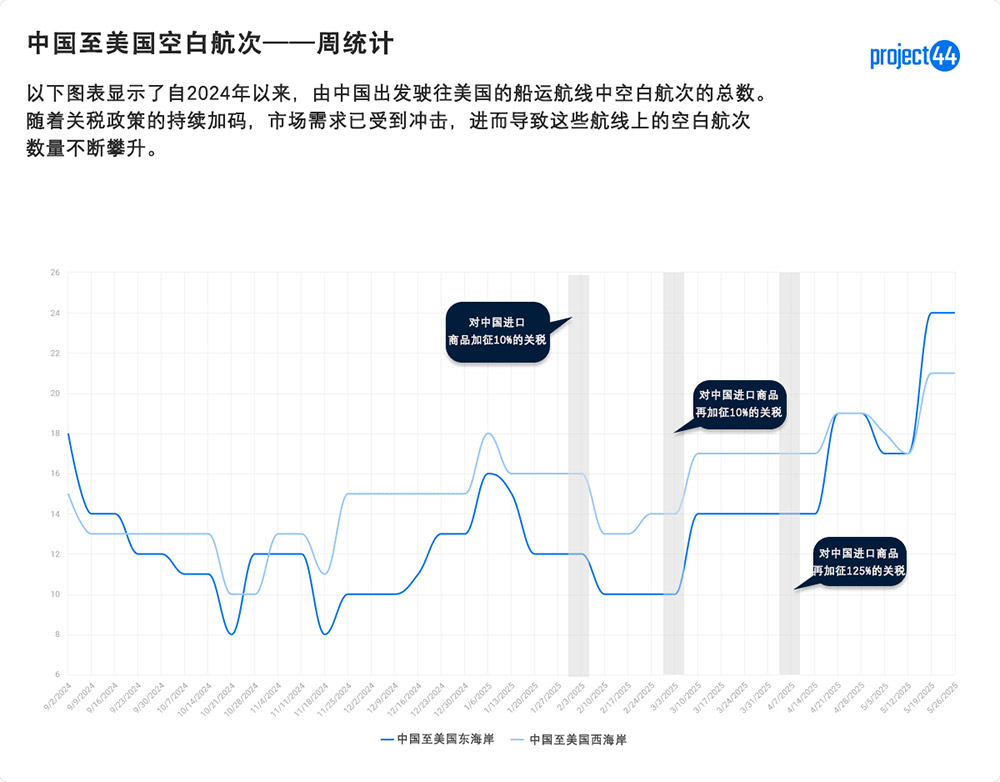

這種對美國市場的回避態(tài)勢,甚至開始在航運領(lǐng)域顯現(xiàn)端倪,。供應(yīng)鏈平臺Project44追蹤的數(shù)據(jù)顯示,,受關(guān)稅政策對貿(mào)易活動的制約,自2月以來,,駛向美國的遠洋貨輪“空白航次”數(shù)量增加了一倍,。所謂空白航次,即船運公司預(yù)先規(guī)劃航線后,,卻最終選擇完全取消該航線,,或跳過其中部分港口。

該公司表示:“東海岸預(yù)計5月最后一周出現(xiàn)24個空白航次的峰值,,較2月新關(guān)稅政策實施以來增長100%,;西海岸緊隨其后,達到21個,,增長了31%,。”

盡管航運活動本身不會直接作用于美元匯率,,但它卻猶如一面鏡子,,清晰地反映出全球范圍內(nèi)減少與美國經(jīng)貿(mào)往來的趨勢。

韋德布什證券公司(Wedbush)科技市場分析師丹尼爾·艾夫斯(Daniel Ives)更是為此現(xiàn)象賦予特定稱謂,。在4月22日向客戶發(fā)布的研究報告中,,他稱之為“拋售美國”交易。

他寫道:“這場關(guān)稅/貿(mào)易戰(zhàn)正在動搖美國科技產(chǎn)業(yè)的根基,,同時助力中國科技產(chǎn)業(yè)崛起,。”

高盛認為,,只要貿(mào)易戰(zhàn)持續(xù)下去,,美元貶值趨勢便難以逆轉(zhuǎn)。

高盛的特里維迪和威爾遜表示:“我們認為,,市場對美元資產(chǎn)風(fēng)險與回報的重新權(quán)衡尚存較大空間,,預(yù)計美元將在未來一段時間內(nèi)持續(xù)走弱。”(財富中文網(wǎng))

譯者:中慧言-王芳

? 今年以來,,美元已下跌近9%,。盡管股市下跌,但美國國債收益率卻持續(xù)高企——這與投資者通常預(yù)期的情況相反,。部分人士指責(zé)日本與中國拋售美債,,認為此行為是美元貶值的誘因。也有人認為,,對沖基金平倉債券杠桿頭寸可能是罪魁禍首,。但分析師和經(jīng)濟學(xué)家告訴《財富》雜志,只要白宮繼續(xù)制造經(jīng)濟不確定性,,全球投資者都會逃離美元,。

在特朗普總統(tǒng)態(tài)度發(fā)生轉(zhuǎn)變,稱他無意解雇美聯(lián)儲主席杰羅姆·鮑威爾之后,,美元匯率迎來回升,。對于這一全球“儲備貨幣”而言,這是一則難得的利好消息,。今年以來,,美元指數(shù)(DXY,美元相對于一籃子主要貨幣)已下跌了9%,。

這就引出了一個問題:究竟是誰在拋售美元,,抑或是誰在拋售那些致使美元貶值的資產(chǎn),其背后的動因又是什么,?

最初,,日本和中國被視為可能的“幕后推手”。畢竟,,兩國出口市場因特朗普挑起的貿(mào)易戰(zhàn)而受到?jīng)_擊,,而且它們分別是美國國債的第一和第二大外國持有國?;蛟S,,這些國家意在借此向特朗普釋放信號:記住,我們同樣具備反制之力,。

然而,,消息人士告訴《財富》雜志,并無充分證據(jù)表明中日兩國在蓄意壓低美元匯率,。

此外,,或許令人頗感意外的是,,據(jù)這些消息人士透露,,目前幾乎沒有證據(jù)顯示,面臨流動性困境的對沖基金突然被迫平倉美國債券杠桿頭寸,進而引發(fā)了近期的拋售潮,,最終導(dǎo)致美元匯率承壓下行,。

相反,責(zé)任在于他人

特朗普經(jīng)濟政策的搖擺不定給全球帶來了極大的不確定性,,以至于包括股票,、債券和貨幣在內(nèi)的各類資產(chǎn)投資者紛紛選擇撤離美國市場,直至市場出現(xiàn)確定性信號,。

牛津經(jīng)濟研究院(Oxford Economics)首席分析師約翰·卡納文(John Canavan)表示,,日本正大規(guī)模拋售其持有的各類外國債券,近期已拋售達200億美元之多,,“且并非僅局限于美國國債”,。"由于美國國債在日本所持外國債券中占據(jù)相當(dāng)大的比重,其動向通常被視為重要參考指標,?!?/p>

不過,他表示:“目前尚不清楚中國和/或日本是否是近期美國國債市場拋售和波動的幕后推手,。無論哪種情況,,要找到確鑿證據(jù)都并非易事。鑒于外國交易及美國國債持有狀況的數(shù)據(jù)通常存在公布滯后的情況,,它們或許在一定程度上對市場產(chǎn)生了影響,,但初步分析顯示,這些因素似乎并非導(dǎo)致市場動蕩的主因,?!?/p>

對沖基金不是幕后推手

卡納文同樣不認可對沖基金是美元下跌“幕后推手”的觀點。

他向《財富》雜志透露:“最初推測大規(guī)模杠桿基差交易平倉是推動美元走低的關(guān)鍵因素,,但這一猜測似乎并不成立,。美國商品期貨交易委員會(CFTC)過去兩周發(fā)布的交易持倉報告數(shù)據(jù)顯示,并未出現(xiàn)任何基差交易平倉的情況,?!?/p>

他在高盛(Goldman Sachs)的同事們也在一定程度上認同這一觀點。

在4月22日呈遞給客戶的一份研究報告中,,分析師卡瑪克夏·特里維迪(Kamakshya Trivedi)和多米尼克·威爾遜(Dominic Wilson)寫道:“我們在市場‘足跡’或資金流向數(shù)據(jù)中,,均未發(fā)現(xiàn)充分證據(jù)支持外國大規(guī)模拋售資產(chǎn)的論斷,不過有更多證據(jù)表明,,杠桿頭寸的平倉操作(尤其是互換利差的大幅波動)或許對市場產(chǎn)生了一定影響,。”

中國與日本實質(zhì)上并無拋售美國債券的動機,,畢竟此舉不僅會削弱它們對穩(wěn)定資產(chǎn)的需求,,還將導(dǎo)致本國貨幣升值,,進而對出口市場造成沖擊。

Convera公司的外匯與宏觀策略師凱文·福特(Kevin Ford)說:“以中國為例,?!?/p>

“作為僅次于日本的美國第二大外國債權(quán)國,中國持有約7800億美元的美國國債,。雖然其市場動向備受關(guān)注,,但大規(guī)模拋售的可能性微乎其微,因為資金回流會促使人民幣升值,,而當(dāng)前中國正通過調(diào)控人民幣匯率來緩沖關(guān)稅帶來的影響,。”

他告訴《財富》雜志:“另一方面,,對沖基金或許在其中起到了推波助瀾的作用,。隨著債券拋售潮愈演愈烈,追加保證金的壓力可能迫使基金拋售美國國債以回籠資金,,尤其是那些采用債券基差交易策略的基金,。”

所有人都想逃離美國

事實上,,存在一個更為直白的解釋:美元匯率持續(xù)走低,,美國債券收益率居高不下,究其原因,,全球投資者——事實上是整個國際社會——如今都急于抽身,,逃離美國這個“是非之地”。

這涵蓋了股票,、債券與貨幣領(lǐng)域,。鑒于特朗普的貿(mào)易政策朝令夕改,加之日復(fù)一日地對央行行長施壓,,各類投資者都在減少對美國的投資敞口,。如今,他們不再將美國視作避險港灣,,而是將其歸入風(fēng)險資產(chǎn)的行列,。

這種對美國市場的回避態(tài)勢,甚至開始在航運領(lǐng)域顯現(xiàn)端倪,。供應(yīng)鏈平臺Project44追蹤的數(shù)據(jù)顯示,,受關(guān)稅政策對貿(mào)易活動的制約,自2月以來,,駛向美國的遠洋貨輪“空白航次”數(shù)量增加了一倍,。所謂空白航次,即船運公司預(yù)先規(guī)劃航線后,,卻最終選擇完全取消該航線,,或跳過其中部分港口,。

該公司表示:“東海岸預(yù)計5月最后一周出現(xiàn)24個空白航次的峰值,較2月新關(guān)稅政策實施以來增長100%,;西海岸緊隨其后,達到21個,,增長了31%,。”

盡管航運活動本身不會直接作用于美元匯率,,但它卻猶如一面鏡子,,清晰地反映出全球范圍內(nèi)減少與美國經(jīng)貿(mào)往來的趨勢。

韋德布什證券公司(Wedbush)科技市場分析師丹尼爾·艾夫斯(Daniel Ives)更是為此現(xiàn)象賦予特定稱謂,。在4月22日向客戶發(fā)布的研究報告中,,他稱之為“拋售美國”交易。

他寫道:“這場關(guān)稅/貿(mào)易戰(zhàn)正在動搖美國科技產(chǎn)業(yè)的根基,,同時助力中國科技產(chǎn)業(yè)崛起,。”

高盛認為,,只要貿(mào)易戰(zhàn)持續(xù)下去,,美元貶值趨勢便難以逆轉(zhuǎn)。

高盛的特里維迪和威爾遜表示:“我們認為,,市場對美元資產(chǎn)風(fēng)險與回報的重新權(quán)衡尚存較大空間,,預(yù)計美元將在未來一段時間內(nèi)持續(xù)走弱?!保ㄘ敻恢形木W(wǎng))

譯者:中慧言-王芳

? The U.S. dollar is down nearly 9%, year to date. Yields on Treasuries have stayed high even though the stock market has gone down—the opposite of what investors normally expect. Some are blaming Japan and China for selling U.S. bonds, which would hurt the dollar. Others believe hedge funds unwinding leveraged positions in bonds may be to blame. But analysts and economists tell Fortune that as long as the White House continues to generate economic uncertainty, everyone is going to flee the dollar.

The value of the U.S. dollar ticked up yesterday after President Trump did a U-turn and said he had no intention of firing Jerome Powell, chair of the Federal Reserve. It was a rare piece of good news for the world’s “reserve currency,” whose value has fallen 9% year-to-date against the DXY index of foreign currencies.

That raises a question: Who is selling the dollar—or selling assets that drive down the dollar—and why?

Initial suspicions targeted Japan and China. After all, they are both seeing their export markets hurt by Trump’s trade war, and they are the first and second largest foreign holders of U.S. Treasuries. Perhaps those countries were trying to send a message to Trump: Remember, we can hurt you too!

However, sources tell Fortune that there is little to no evidence that either country is deliberately tanking the dollar.

And, perhaps surprisingly, there isn’t a great deal of evidence that hedge funds with liquidity issues were suddenly forced to unwind levered bets on U.S. bonds, forcing the recent selloff that dragged the dollar down with it, these sources say.

Rather, the blame lies with everyone else

Trump’s chop-change economic pronouncements have generated so much global uncertainty that investors across all assets—stocks, bonds, and currency—are simply withdrawing from the U.S. until some kind of certainty reappears.

Japan is selling a lot of all its foreign bond holdings—it dumped $20 billion recently—“not just U.S. Treasuries,” according to Oxford Economics’ Lead Analyst John Canavan. “Because Treasuries make up such a large portion of Japanese foreign bond holdings, it is generally seen as a good proxy.”

But, he says, “it’s not clear China and/or Japan have been responsible for the extent of the recent Treasury market selloff and volatility. Evidence is difficult to come by either way. Data on foreign transactions and holdings of Treasury debt tend to be released with a lag, so they could have played a role, but it doesn’t appear at first blush that they were the primary factor.”

Not the hedge funds

Canavan is also not keen on the hedge fund theory.

“Early suspicions that an unwinding of large leveraged basis trades were a significant factor appear to have been incorrect. The Commitments of Traders data from the CFTC over the past two weeks offered no evidence of any basis trade unwinds,” he told Fortune.

His colleagues at Goldman Sachs agree, in part.

In a note to clients published April 22, analysts Kamakshya Trivedi and Dominic Wilson said: “We did not see much support either in the ‘footprint’ across markets or in the flow data for the theories of significant foreign selling, though there is more evidence that levered unwinds (particularly the sharp move in swap spreads) may have played a role.”

China and Japan actually have a vested interest in not selling U.S. bonds because that only hurts their need for stable assets and would make their currencies rise, which in turn would hurt their export markets.

“Take China, for instance,” says Kevin Ford, FX & macro strategist at Convera.

“As America’s second-largest foreign creditor after Japan, it holds around $780 billion in Treasury securities. While their market moves are closely watched, a massive sell-off seems unlikely, as it would strengthen the Yuan due to repatriation effects, and Beijing is currently leveraging its currency to counter tariff impacts.”

“Hedge funds, on the other hand, might have added fuel to the fire. As the bond sell-off gained momentum, margin calls could have forced funds to liquidate Treasuries to raise cash, especially those employing bond-basis trades,” he told Fortune.

Everyone wants to get the hell out of Dodge

In fact, there is a simpler explanation: The dollar is in decline and yields on U.S. bonds are staying high because everyone—literally everyone on the planet—wants to get the hell out of Dodge City right now.

That includes stocks, bonds, and currency. With Trump changing his mind by the hour on trade policy and bullying his chief central banker on a daily basis, investors of all kinds are simply limiting their exposure to a nation they now regard as a risk asset rather than a safe haven.

This aversion to the U.S. has even started showing up in shipping routes. With tariffs restricting trade, the number of “blank sailings” to the U.S. by ocean freighters has doubled since February, according to data tracked by Project44, a supply chain platform. Blank sailings occur when a shipping line schedules a route and then cancels it altogether or skips a port on that route.

“The East Coast is set to see a peak of 24 blank sailings in the last week of May, a 100% increase since new tariffs began in February, with the West Coast close behind at 21, or a 31% increase,” the company says.

While shipping doesn’t directly affect the dollar, it is—arguably—a visible symptom of a world withdrawing from doing business with the U.S.

Wedbush analyst Daniel Ives, who covers the tech market, even has a name for it. In a note to clients dated April 22, he called it the “Sell America Trade.”

“This tariff/trade war is cutting US tech at the knees and helping steamroll China tech ahead,” he wrote.

And as long as the trade war continues, expect the dollar to continue to decline, according to Goldman Sachs.

“We believe the re-think of the risk and reward of Dollar assets has room to run and expect the USD to extend its declines over time,” Goldman’s Trivedi and Wilson said.