唐納德·特朗普的“解放日”關(guān)稅政策震動全球市場,,再度引發(fā)對持久貿(mào)易戰(zhàn)的擔(dān)憂。盡管這位美國總統(tǒng)正在重新考慮部分最有破壞性的關(guān)稅措施,,并釋放出可能達成協(xié)議的信號,,但他仍在威脅對半導(dǎo)體、藥品等領(lǐng)域?qū)嵤┬轮撇?,試圖重塑全球貿(mào)易體系,。

這些關(guān)稅措施將如何影響中國科技行業(yè)?就在不久前,,中國科技界還因深度求索(DeepSeek)AI模型的成功而士氣高漲,。

自2018年特朗普發(fā)起首輪關(guān)稅戰(zhàn)以來,中國一直在備戰(zhàn),。中國早已預(yù)料到美國會發(fā)動第二輪關(guān)稅戰(zhàn),。面對美國對先進技術(shù)更嚴格的封鎖,中國有條不紊地構(gòu)建了技術(shù)供應(yīng)鏈,。除了興建本土芯片工廠外,,中國還在提升可再生能源產(chǎn)能,通過“東數(shù)西算”等國家級工程提升云計算能力,,以及投資激光雷達和電池技術(shù),。

中國并未試圖在人工智能基礎(chǔ)設(shè)施領(lǐng)域與美國創(chuàng)新正面競爭,而是充分發(fā)揮制造業(yè)優(yōu)勢,,聚焦機器人,、智能電動汽車等人工智能實體應(yīng)用領(lǐng)域。

雖然中國芯片產(chǎn)業(yè)仍落后于尖端水平,但與五年前美國首次收緊芯片出口時相比,,中國已大幅提升自給自足的能力,。中國科技實力不僅體現(xiàn)在硬件領(lǐng)域,深度求索的開源AI模型更降低了大語言模型的應(yīng)用門檻,。

即便特朗普收回他的關(guān)稅威脅,,美國對華科技遏制的態(tài)勢仍將持續(xù),芯片出口管制等措施已獲得美國兩黨共識,。

阿里巴巴(Alibaba),、字節(jié)跳動(ByteDance)和深度求索等中國AI企業(yè)曾嚴重依賴備受爭議的英偉達(Nvidia)H20芯片——不久前,這款中國境內(nèi)可合法銷售的最先進處理器,,是這些公司發(fā)展AI業(yè)務(wù)的關(guān)鍵,。全面禁令將迫使中國科技巨頭調(diào)整芯片戰(zhàn)略,,華為(Huawei)產(chǎn)品可能成為替代選擇,。

分析師預(yù)測,隨著客戶放棄英偉達,,轉(zhuǎn)而選用華為的人工智能系統(tǒng),,華為的營收可能會大幅增長。半導(dǎo)體分析機構(gòu)SemiAnalysis的最新報告顯示,,華為的最新產(chǎn)品在某些配置上甚至可能超越英偉達,。

對擔(dān)憂戰(zhàn)略競爭、需要更有韌性的供應(yīng)鏈的美國而言,,出口管制,、針對性關(guān)稅和產(chǎn)業(yè)政策或許有其邏輯。這也正是中國采取類似舉措的原因,。

供應(yīng)鏈轉(zhuǎn)移

自2018年以來,,大小企業(yè)紛紛將制造和采購轉(zhuǎn)移至越南、孟加拉國和泰國等國,。但它們無法徹底放棄中國市場,。正如蘋果(Apple)首席執(zhí)行官蒂姆·庫克在2015年所言,中國的市場規(guī)模,、勞動力技能水平和基礎(chǔ)設(shè)施的綜合優(yōu)勢,,至少在短期內(nèi)是其他國家難以企及的。至今仍有超80%的iPhone手機在中國生產(chǎn),。

特朗普的懲罰性關(guān)稅不僅會推高消費者成本,,更會迫使美國科技巨頭重新評估數(shù)十年構(gòu)建的供應(yīng)鏈戰(zhàn)略。對依賴長期規(guī)劃和穩(wěn)定環(huán)境的跨國企業(yè)而言,,真正的“隱形稅負”是政策的不可預(yù)測性,,而不是關(guān)稅。無論是關(guān)稅調(diào)整、出口禁令,、實體清單還是豁免政策,,政策的任何風(fēng)吹草動都會在全球市場引發(fā)漣漪效應(yīng)。

目前部分中國企業(yè)為規(guī)避風(fēng)險,,采取了審慎的觀望策略:暫停在美業(yè)務(wù),,聚焦非美市場。中國企業(yè)已經(jīng)在悄然布局以應(yīng)對貿(mào)易中斷:優(yōu)先深耕國內(nèi)市場,,調(diào)整擴張戰(zhàn)略,,或?qū)⒀邪l(fā)和銷售轉(zhuǎn)向友好地區(qū)。

關(guān)稅也間接影響到中國的人工智能規(guī)劃,。中國的人工智能初創(chuàng)公司服務(wù)整個科技行業(yè),;高管重新評估AI計劃,將對中國的AI初創(chuàng)公司生態(tài)系統(tǒng)產(chǎn)生下游影響,。

人工智能,、云計算和半導(dǎo)體并非孤立的行業(yè),其發(fā)展依賴跨國學(xué)術(shù)界,、商界和政府協(xié)作,。盡管戰(zhàn)略自主價值凸顯,但技術(shù)進步仍受益于開放的環(huán)境,。

未來會發(fā)生些什么,?

美國或許期待通過關(guān)稅、補貼和出口管制的組合拳保持其科技領(lǐng)導(dǎo)地位,。但現(xiàn)實是,,美國繼續(xù)限制中國獲得先進技術(shù),正倒逼中國加速實現(xiàn)自給自足,。即便貿(mào)易戰(zhàn)最終達成協(xié)議,,也將強化中國對科技領(lǐng)域的投入。未來若美國再實施類似H20芯片禁令,,對中國AI生態(tài)系統(tǒng)的影響或?qū)⑽⒑跗湮ⅰ?/p>

競爭可以是良性的,,無需走向零和博弈。中美面臨的共同挑戰(zhàn)是如何設(shè)定明確的邊界,,以保障各自的國家安全,,但又不能因此完全關(guān)閉彼此之間的合作渠道。氣候科技,、醫(yī)療健康,、AI安全與開源開發(fā)等領(lǐng)域,仍存在合作引領(lǐng)全球創(chuàng)新的現(xiàn)實空間,。

本文作者格蕾絲·邵為行業(yè)通訊AI Proem的創(chuàng)始人,。AI Proem提供對中國AI和科技發(fā)展的深度洞察分析,,曾與亞太地區(qū)的大型科技公司和AI初創(chuàng)公司合作。

Fortune.com上發(fā)表的評論文章中表達的觀點,,僅代表作者本人的觀點,,不代表《財富》雜志的觀點和立場。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

唐納德·特朗普的“解放日”關(guān)稅政策震動全球市場,,再度引發(fā)對持久貿(mào)易戰(zhàn)的擔(dān)憂,。盡管這位美國總統(tǒng)正在重新考慮部分最有破壞性的關(guān)稅措施,并釋放出可能達成協(xié)議的信號,,但他仍在威脅對半導(dǎo)體,、藥品等領(lǐng)域?qū)嵤┬轮撇茫噲D重塑全球貿(mào)易體系,。

這些關(guān)稅措施將如何影響中國科技行業(yè),?就在不久前,中國科技界還因深度求索(DeepSeek)AI模型的成功而士氣高漲,。

自2018年特朗普發(fā)起首輪關(guān)稅戰(zhàn)以來,,中國一直在備戰(zhàn)。中國早已預(yù)料到美國會發(fā)動第二輪關(guān)稅戰(zhàn),。面對美國對先進技術(shù)更嚴格的封鎖,,中國有條不紊地構(gòu)建了技術(shù)供應(yīng)鏈,。除了興建本土芯片工廠外,,中國還在提升可再生能源產(chǎn)能,通過“東數(shù)西算”等國家級工程提升云計算能力,,以及投資激光雷達和電池技術(shù),。

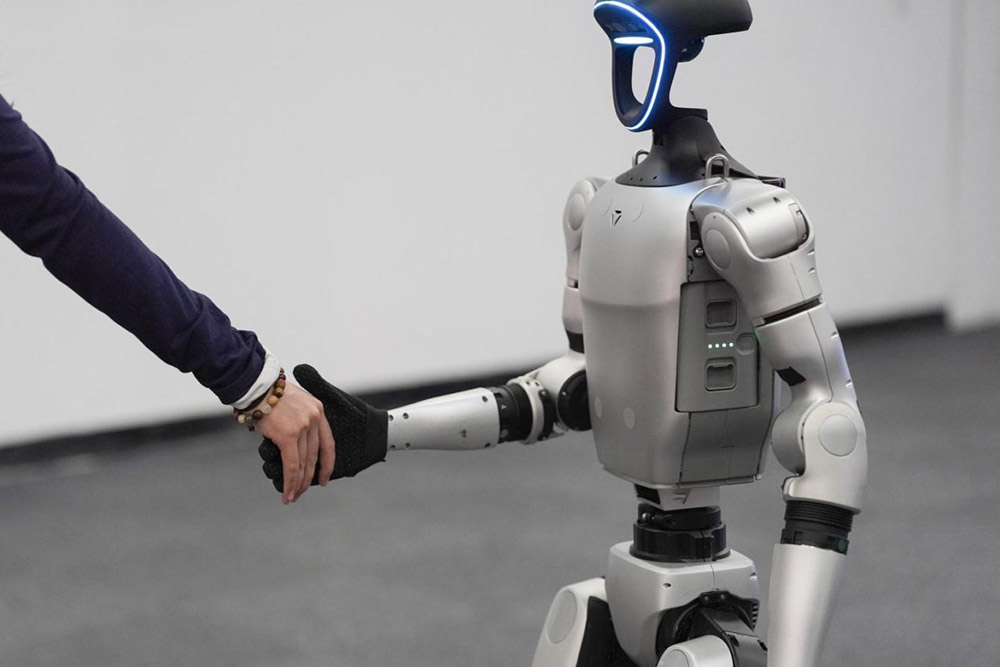

中國并未試圖在人工智能基礎(chǔ)設(shè)施領(lǐng)域與美國創(chuàng)新正面競爭,而是充分發(fā)揮制造業(yè)優(yōu)勢,,聚焦機器人,、智能電動汽車等人工智能實體應(yīng)用領(lǐng)域。

雖然中國芯片產(chǎn)業(yè)仍落后于尖端水平,,但與五年前美國首次收緊芯片出口時相比,,中國已大幅提升自給自足的能力。中國科技實力不僅體現(xiàn)在硬件領(lǐng)域,,深度求索的開源AI模型更降低了大語言模型的應(yīng)用門檻,。

即便特朗普收回他的關(guān)稅威脅,美國對華科技遏制的態(tài)勢仍將持續(xù),,芯片出口管制等措施已獲得美國兩黨共識,。

阿里巴巴(Alibaba)、字節(jié)跳動(ByteDance)和深度求索等中國AI企業(yè)曾嚴重依賴備受爭議的英偉達(Nvidia)H20芯片——不久前,,這款中國境內(nèi)可合法銷售的最先進處理器,,是這些公司發(fā)展AI業(yè)務(wù)的關(guān)鍵,。全面禁令將迫使中國科技巨頭調(diào)整芯片戰(zhàn)略,華為(Huawei)產(chǎn)品可能成為替代選擇,。

分析師預(yù)測,,隨著客戶放棄英偉達,轉(zhuǎn)而選用華為的人工智能系統(tǒng),,華為的營收可能會大幅增長,。半導(dǎo)體分析機構(gòu)SemiAnalysis的最新報告顯示,華為的最新產(chǎn)品在某些配置上甚至可能超越英偉達,。

對擔(dān)憂戰(zhàn)略競爭,、需要更有韌性的供應(yīng)鏈的美國而言,出口管制,、針對性關(guān)稅和產(chǎn)業(yè)政策或許有其邏輯,。這也正是中國采取類似舉措的原因。

供應(yīng)鏈轉(zhuǎn)移

自2018年以來,,大小企業(yè)紛紛將制造和采購轉(zhuǎn)移至越南,、孟加拉國和泰國等國。但它們無法徹底放棄中國市場,。正如蘋果(Apple)首席執(zhí)行官蒂姆·庫克在2015年所言,,中國的市場規(guī)模、勞動力技能水平和基礎(chǔ)設(shè)施的綜合優(yōu)勢,,至少在短期內(nèi)是其他國家難以企及的,。至今仍有超80%的iPhone手機在中國生產(chǎn)。

特朗普的懲罰性關(guān)稅不僅會推高消費者成本,,更會迫使美國科技巨頭重新評估數(shù)十年構(gòu)建的供應(yīng)鏈戰(zhàn)略,。對依賴長期規(guī)劃和穩(wěn)定環(huán)境的跨國企業(yè)而言,真正的“隱形稅負”是政策的不可預(yù)測性,,而不是關(guān)稅,。無論是關(guān)稅調(diào)整、出口禁令,、實體清單還是豁免政策,,政策的任何風(fēng)吹草動都會在全球市場引發(fā)漣漪效應(yīng)。

目前部分中國企業(yè)為規(guī)避風(fēng)險,,采取了審慎的觀望策略:暫停在美業(yè)務(wù),,聚焦非美市場。中國企業(yè)已經(jīng)在悄然布局以應(yīng)對貿(mào)易中斷:優(yōu)先深耕國內(nèi)市場,,調(diào)整擴張戰(zhàn)略,,或?qū)⒀邪l(fā)和銷售轉(zhuǎn)向友好地區(qū)。

關(guān)稅也間接影響到中國的人工智能規(guī)劃,。中國的人工智能初創(chuàng)公司服務(wù)整個科技行業(yè),;高管重新評估AI計劃,,將對中國的AI初創(chuàng)公司生態(tài)系統(tǒng)產(chǎn)生下游影響。

人工智能,、云計算和半導(dǎo)體并非孤立的行業(yè),,其發(fā)展依賴跨國學(xué)術(shù)界、商界和政府協(xié)作,。盡管戰(zhàn)略自主價值凸顯,,但技術(shù)進步仍受益于開放的環(huán)境。

未來會發(fā)生些什么,?

美國或許期待通過關(guān)稅,、補貼和出口管制的組合拳保持其科技領(lǐng)導(dǎo)地位。但現(xiàn)實是,,美國繼續(xù)限制中國獲得先進技術(shù),,正倒逼中國加速實現(xiàn)自給自足。即便貿(mào)易戰(zhàn)最終達成協(xié)議,,也將強化中國對科技領(lǐng)域的投入,。未來若美國再實施類似H20芯片禁令,對中國AI生態(tài)系統(tǒng)的影響或?qū)⑽⒑跗湮ⅰ?/p>

競爭可以是良性的,,無需走向零和博弈,。中美面臨的共同挑戰(zhàn)是如何設(shè)定明確的邊界,以保障各自的國家安全,,但又不能因此完全關(guān)閉彼此之間的合作渠道,。氣候科技、醫(yī)療健康,、AI安全與開源開發(fā)等領(lǐng)域,,仍存在合作引領(lǐng)全球創(chuàng)新的現(xiàn)實空間。

本文作者格蕾絲·邵為行業(yè)通訊AI Proem的創(chuàng)始人,。AI Proem提供對中國AI和科技發(fā)展的深度洞察分析,曾與亞太地區(qū)的大型科技公司和AI初創(chuàng)公司合作,。

Fortune.com上發(fā)表的評論文章中表達的觀點,,僅代表作者本人的觀點,不代表《財富》雜志的觀點和立場,。(財富中文網(wǎng))

譯者:劉進龍

審校:汪皓

Donald Trump’s “Liberation Day” tariffs are shocking global markets and rekindling fears of a prolonged trade war. The U.S. president may be reconsidering some of his most disruptive tariffs as he floats the possibility of a deal—but he also continues to threaten new measures on goods like semiconductors and pharmaceuticals as he tries to shake up the global trading system.

How will the tariffs affect China’s tech sector which—even just a month ago—was riding high on the success of DeepSeek’s AI model?

China has been preparing since Trump first imposed tariffs back in 2018. Beijing has long anticipated a second round with the U.S. Faced with tighter restrictions on its access to advanced technology, China has methodically built out its technology supply chains. It’s not just constructing local chip plants: Beijing’s measures include bolstering renewable energy capacity, building out cloud computing capabilities through national projects like East Data West Compute, and investing in lidar technology and batteries.

Beijing isn’t trying to out-compete U.S. innovation in AI infrastructure. Instead, it’s leveraging its manufacturing expertise and doubling down on physical AI, like robotics and AI-enabled EVs.

China’s chip industry still lags the cutting-edge. But it’s far more self-sufficient today than it was five years ago, when the U.S. first started tightening the screws on chip exports. The country’s strength goes beyond hardware, as DeepSeek’s open-source AI models make affordable LLMs possible.

The U.S. will likely continue to constrain China’s tech sector, even if Trump pulls back on his tariffs threats. Measures like the chip export controls now enjoy bipartisan support in Washington.

AI companies like Alibaba, ByteDance and DeepSeek previously relied heavily on the contentious Nvidia H20 chip, until recently the most cutting-edge processor that could be legally sold in China, were vital to. A full ban will force China’s Big Tech companies to rethink their chip strategy—and maybe consider alternatives, like those made by Huawei.

Analysts suggest Huawei’s revenue will likely see a big jump in revenue as customers turn to its AI systems instead of Nvidia’s. One recent report from SemiAnalysis suggests Huawei’s latest product might even surpass Nvidia’s in some configurations.

Export controls, targeted tariffs and industrial policy may make sense for a U.S. worried about strategic competition and a need for more resilient supply chains. And that’s why China has done the same.

Supply chain moves

Since 2018, companies large and small have moved manufacturing and sourcing to countries like Vietnam, Bangladesh and Thailand. But companies can’t cut out China completely. As Apple CEO Tim Cook noted in 2015, it’s hard to match China’s combination of scale, labor skill, and infrastructure, at least in the short term. More than 80% of iPhones are still made in China.

Trump’s punitive tariffs don’t just raise costs for consumers. They’ll force U.S. Big Tech to rethink supply chain strategies that have taken decades to build. Unpredictability, not tariffs, is the real tax for global firms that rely on long-term planning and stable conditions. Each policy tweak, whether its tariffs, export bans, blacklists or exemptions, ripples through global markets.

For some Chinese firms, it’s translating into a cautious and risk-averse “wait-and-see” stance, pausing U.S. business and focusing on non-U.S. business for now. Chinese companies are already quietly hedging against trade disruption: building for the domestic market first, rethinking their expansion strategies, or rerouting development and sales to friendlier jurisdictions.

Tariffs also affect China’s AI plans, albeit indirectly. China’s AI startups serve the broader tech sector; Executives rethinking AI plans will have a downstream effect on China’s AI startup ecosystem.

AI, cloud computing and semiconductors aren’t isolated sectors. They’re built on academic, commercial and governmental collaboration across borders. Technological progress still benefits from openness, whatever the value of strategic autonomy.

What happens next?

The U.S. may hope that the right mix of tariffs, subsidies and export controls can preserve its tech leadership. But instead, the continued push to cut off China’s access to advanced technology is going to make it more self-sufficient out of necessity. The trade war, even if it leads to a deal, will push China to invest in its tech sector even more. The next time the U.S. tries something like the H20 chip ban, it may mean very little to the China AI ecosystem.

Competition can be healthy, but doesn’t need to mean collapse. The challenge for both the U.S. and China is to draw clear guardrails to support national security without shutting down collaboration entirely. Climate tech, healthcare, AI safety and open-source development could still present real possibilities for cooperative leadership.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.