? 對(duì)于任何人而言,,找到負(fù)擔(dān)得起的出租房都可能頗具挑戰(zhàn)性,尤其是對(duì)剛畢業(yè)的大學(xué)生而言,,他們通常起薪較低,,正處于努力站穩(wěn)腳跟階段。不過,,Realtor.com根據(jù)平均租金,、失業(yè)率、通勤時(shí)間以及其他幾大因素,,發(fā)布了2025年最適合應(yīng)屆大學(xué)畢業(yè)生租房的市場(chǎng)榜單,。

受關(guān)稅與通貨膨脹影響,,人們感覺幾乎所有物品的價(jià)格都在不斷攀升。與此同時(shí),,自疫情爆發(fā)以來,,住房成本始終呈穩(wěn)步上升態(tài)勢(shì):據(jù)CoreLogic數(shù)據(jù)顯示,租金漲幅約達(dá)30%,。

根據(jù)Zillow的數(shù)據(jù),,截至5月25日,美國平均月租金為2100美元,,而SoFi的數(shù)據(jù)顯示平均工資略高于6.3萬美元,。這意味著部分美國人每月在房租上的支出約占其收入的40%,超出了建議的30%,。

這對(duì)剛畢業(yè)的大學(xué)生而言尤為不利,,因?yàn)樗麄兊氖杖肟赡芴幱诨虻陀诿绹骄べY水平。事實(shí)上,,美國銀行(Bank of America)的一份報(bào)告顯示,,Z世代是受租金上漲沖擊最為嚴(yán)重的一代。不過,,對(duì)于剛剛獲得學(xué)位的人來說,,仍有很多城市的租金處于他們可承受的范圍。而且,,隨著部分市場(chǎng)租金下降,,住房可負(fù)擔(dān)性也開始有所改善。

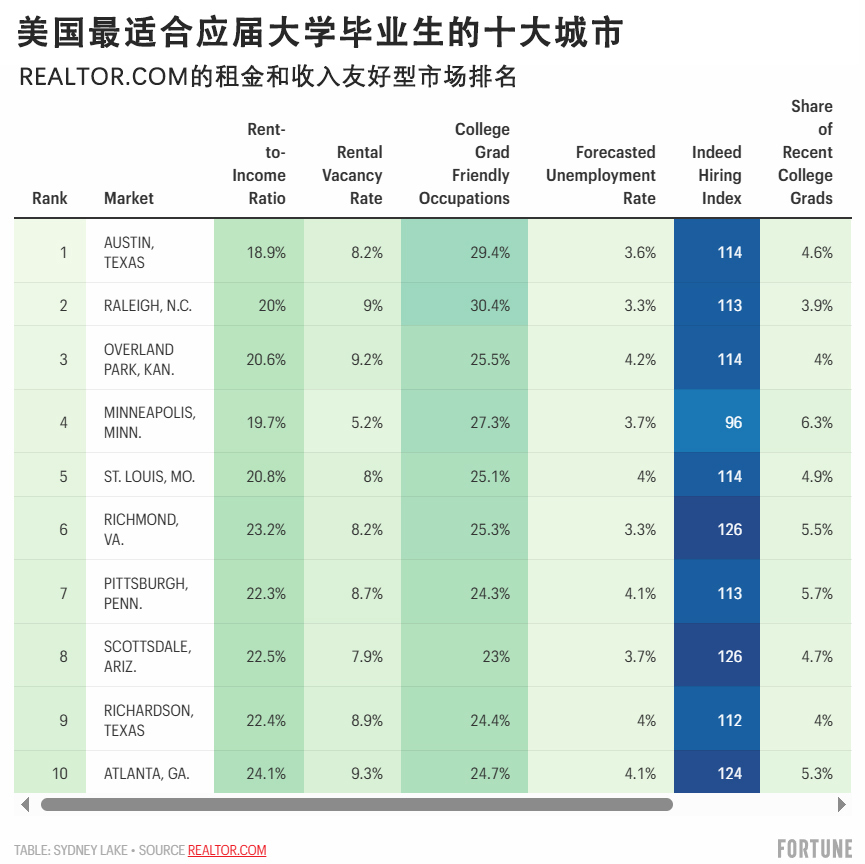

本周二,,Realtor.com根據(jù)租金收入比,、房屋空置率、適合應(yīng)屆大學(xué)畢業(yè)生的工作崗位數(shù)量,、失業(yè)率以及平均通勤時(shí)間等因素,,發(fā)布了一份被稱為“最適合畢業(yè)生租房”的城市榜單。上榜城市幾乎橫跨美國東西海岸,。

Realtor.com首席經(jīng)濟(jì)學(xué)家丹妮爾·黑爾(Danielle Hale)在一份聲明中表示:“這些市場(chǎng)不僅租金相對(duì)便宜,,可供選擇的房源也相對(duì)較多,而且充滿活力,、機(jī)遇和社區(qū)歸屬感,,是應(yīng)屆畢業(yè)生夢(mèng)寐以求的地方?!?/p>

得克薩斯州奧斯汀憑借最低租金收入比(18.9%)位居榜首,,這意味著租房者每月用于支付房租的收入占比較低。此外,奧斯汀還因要求學(xué)士學(xué)位卻無需工作經(jīng)驗(yàn)的職位占比較高而名列前茅,。Realtor.com的排名還考慮了Indeed的招聘指數(shù)(Hiring Index),該指數(shù)跟蹤相較于疫情前水平的職位空缺情況,。

根據(jù)Realtor.com的排名,,最適合應(yīng)屆大學(xué)畢業(yè)生的十大城市及其相應(yīng)的租金中位數(shù)情況如下:

1. 得克薩斯州奧斯汀(1504美元)

2. 北卡羅來納州羅利(1524美元)

3. 堪薩斯州歐弗蘭帕克(1351美元)

4. 明尼蘇達(dá)州明尼阿波利斯(1528美元)

5. 密蘇里州圣路易斯(1335美元)

6. 弗吉尼亞州里士滿(1502美元)

7. 賓夕法尼亞州匹茲堡(1461美元)

8. 亞利桑那州斯科茨代爾(1530美元)

9. 得克薩斯州理查森(1472美元)

10. 佐治亞州亞特蘭大(1604美元)

根據(jù)Realtor.com的數(shù)據(jù),,租房者在這些市場(chǎng)租房可節(jié)省7%的費(fèi)用,,且這些市場(chǎng)的應(yīng)屆畢業(yè)生人數(shù)是全美前50大都市區(qū)的兩倍。

不過,,這些租賃市場(chǎng)并非在任何標(biāo)準(zhǔn)下都堪稱完美,。

Realtor.com稱:“雖然這些城市總體排名很高,但許多城市仍存在優(yōu)勢(shì)與不足,,潛在租房者需在租賃房源的可獲得性與可負(fù)擔(dān)性,、就業(yè)市場(chǎng)的強(qiáng)勁程度以及生活方式的便利性之間做出權(quán)衡?!?

另一方面,,穆迪分析公司(Moody's Analytics)商業(yè)地產(chǎn)部門在去年五月編制了一份美國租金負(fù)擔(dān)最重城市榜單,其中紐約,、邁阿密,、洛杉磯和波士頓赫然在列。在這些城市,,租房者每月的租金支出預(yù)計(jì)會(huì)超過其收入的30%,。

此外,個(gè)人理財(cái)技術(shù)公司Self Financial在2024年8月開展的一項(xiàng)研究發(fā)現(xiàn),,典型的美國租房者在租房期間預(yù)計(jì)支出會(huì)超過33.3萬美元,,涵蓋賬單及其他額外費(fèi)用。該分析運(yùn)用Zillow的數(shù)據(jù)計(jì)算各州月租金與公用事業(yè)費(fèi)用中位數(shù),,使用RentCafe的數(shù)據(jù)計(jì)算平均公用事業(yè)成本,,并使用Insure.com的數(shù)據(jù)估算租房者保險(xiǎn)費(fèi)用。該研究假設(shè)人們自22歲起租房,,35歲時(shí)購置首套住房,。

然而,鑒于年輕一代推遲結(jié)婚,、購房等人生關(guān)鍵里程碑事件,,到這一時(shí)間節(jié)點(diǎn),租房者可能需要承擔(dān)更高費(fèi)用,。

紐約蘇富比國際地產(chǎn)公司(Sotheby's International Realty)副經(jīng)紀(jì)人尼基·博尚(Nikki Beauchamp)此前接受《財(cái)富》雜志采訪時(shí)表示:“組建家庭計(jì)劃的推遲,,會(huì)讓人們租房的時(shí)長進(jìn)一步延長。”(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

? 對(duì)于任何人而言,,找到負(fù)擔(dān)得起的出租房都可能頗具挑戰(zhàn)性,,尤其是對(duì)剛畢業(yè)的大學(xué)生而言,他們通常起薪較低,,正處于努力站穩(wěn)腳跟階段,。不過,Realtor.com根據(jù)平均租金,、失業(yè)率,、通勤時(shí)間以及其他幾大因素,發(fā)布了2025年最適合應(yīng)屆大學(xué)畢業(yè)生租房的市場(chǎng)榜單,。

受關(guān)稅與通貨膨脹影響,,人們感覺幾乎所有物品的價(jià)格都在不斷攀升。與此同時(shí),,自疫情爆發(fā)以來,,住房成本始終呈穩(wěn)步上升態(tài)勢(shì):據(jù)CoreLogic數(shù)據(jù)顯示,租金漲幅約達(dá)30%,。

根據(jù)Zillow的數(shù)據(jù),,截至5月25日,美國平均月租金為2100美元,,而SoFi的數(shù)據(jù)顯示平均工資略高于6.3萬美元,。這意味著部分美國人每月在房租上的支出約占其收入的40%,超出了建議的30%,。

這對(duì)剛畢業(yè)的大學(xué)生而言尤為不利,,因?yàn)樗麄兊氖杖肟赡芴幱诨虻陀诿绹骄べY水平。事實(shí)上,,美國銀行(Bank of America)的一份報(bào)告顯示,,Z世代是受租金上漲沖擊最為嚴(yán)重的一代。不過,,對(duì)于剛剛獲得學(xué)位的人來說,,仍有很多城市的租金處于他們可承受的范圍。而且,,隨著部分市場(chǎng)租金下降,,住房可負(fù)擔(dān)性也開始有所改善。

本周二,,Realtor.com根據(jù)租金收入比,、房屋空置率、適合應(yīng)屆大學(xué)畢業(yè)生的工作崗位數(shù)量,、失業(yè)率以及平均通勤時(shí)間等因素,,發(fā)布了一份被稱為“最適合畢業(yè)生租房”的城市榜單,。上榜城市幾乎橫跨美國東西海岸。

Realtor.com首席經(jīng)濟(jì)學(xué)家丹妮爾·黑爾(Danielle Hale)在一份聲明中表示:“這些市場(chǎng)不僅租金相對(duì)便宜,,可供選擇的房源也相對(duì)較多,,而且充滿活力、機(jī)遇和社區(qū)歸屬感,,是應(yīng)屆畢業(yè)生夢(mèng)寐以求的地方,。”

得克薩斯州奧斯汀憑借最低租金收入比(18.9%)位居榜首,,這意味著租房者每月用于支付房租的收入占比較低,。此外,,奧斯汀還因要求學(xué)士學(xué)位卻無需工作經(jīng)驗(yàn)的職位占比較高而名列前茅,。Realtor.com的排名還考慮了Indeed的招聘指數(shù)(Hiring Index),該指數(shù)跟蹤相較于疫情前水平的職位空缺情況,。

根據(jù)Realtor.com的排名,,最適合應(yīng)屆大學(xué)畢業(yè)生的十大城市及其相應(yīng)的租金中位數(shù)情況如下:

1. 得克薩斯州奧斯汀(1504美元)

2. 北卡羅來納州羅利(1524美元)

3. 堪薩斯州歐弗蘭帕克(1351美元)

4. 明尼蘇達(dá)州明尼阿波利斯(1528美元)

5. 密蘇里州圣路易斯(1335美元)

6. 弗吉尼亞州里士滿(1502美元)

7. 賓夕法尼亞州匹茲堡(1461美元)

8. 亞利桑那州斯科茨代爾(1530美元)

9. 得克薩斯州理查森(1472美元)

10. 佐治亞州亞特蘭大(1604美元)

根據(jù)Realtor.com的數(shù)據(jù),,租房者在這些市場(chǎng)租房可節(jié)省7%的費(fèi)用,,且這些市場(chǎng)的應(yīng)屆畢業(yè)生人數(shù)是全美前50大都市區(qū)的兩倍。

不過,,這些租賃市場(chǎng)并非在任何標(biāo)準(zhǔn)下都堪稱完美,。

Realtor.com稱:“雖然這些城市總體排名很高,但許多城市仍存在優(yōu)勢(shì)與不足,,潛在租房者需在租賃房源的可獲得性與可負(fù)擔(dān)性,、就業(yè)市場(chǎng)的強(qiáng)勁程度以及生活方式的便利性之間做出權(quán)衡?!?

另一方面,,穆迪分析公司(Moody's Analytics)商業(yè)地產(chǎn)部門在去年五月編制了一份美國租金負(fù)擔(dān)最重城市榜單,其中紐約,、邁阿密,、洛杉磯和波士頓赫然在列。在這些城市,,租房者每月的租金支出預(yù)計(jì)會(huì)超過其收入的30%,。

此外,個(gè)人理財(cái)技術(shù)公司Self Financial在2024年8月開展的一項(xiàng)研究發(fā)現(xiàn),,典型的美國租房者在租房期間預(yù)計(jì)支出會(huì)超過33.3萬美元,,涵蓋賬單及其他額外費(fèi)用。該分析運(yùn)用Zillow的數(shù)據(jù)計(jì)算各州月租金與公用事業(yè)費(fèi)用中位數(shù),,使用RentCafe的數(shù)據(jù)計(jì)算平均公用事業(yè)成本,,并使用Insure.com的數(shù)據(jù)估算租房者保險(xiǎn)費(fèi)用。該研究假設(shè)人們自22歲起租房,35歲時(shí)購置首套住房,。

然而,,鑒于年輕一代推遲結(jié)婚、購房等人生關(guān)鍵里程碑事件,,到這一時(shí)間節(jié)點(diǎn),,租房者可能需要承擔(dān)更高費(fèi)用。

紐約蘇富比國際地產(chǎn)公司(Sotheby's International Realty)副經(jīng)紀(jì)人尼基·博尚(Nikki Beauchamp)此前接受《財(cái)富》雜志采訪時(shí)表示:“組建家庭計(jì)劃的推遲,,會(huì)讓人們租房的時(shí)長進(jìn)一步延長,。”(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

? Finding an affordable rental can be challenging for anyone—but especially for recent college graduates getting their footing typically at a lower salary. Realtor.com, however, released its 2025 list of the best markets for recent college graduates based on average rental costs, unemployment rates, commute times, and several other factors.

Thanks to tariffs and inflation, pretty much everything feels as if it’s getting more expensive. Meanwhile, housing costs have been increasing steadily since the pandemic: rent is up about 30%, according to CoreLogic.

As of May 25, the average monthly rent in the U.S. is $2,100, according to Zillow, but the average salary is just above $63,000, SoFi data shows. That means some Americans are spending about 40% of their income on rent each month, which is above the recommended 30%.

This can be especially debilitating for recent college graduates who likely make at or below the average U.S. salary. In fact, a Bank of America report showed Gen Zers are the generation most squeezed by higher rents. But there are still many cities that can be affordable for people who just earned their degree. Plus, affordability is starting to improve with rents declining in some markets.

On Tuesday, Realtor.com released a list of cities they dub “the ultimate grad-friendly rental markets” based on factors like rent-to-income ratios, rental vacancy rates, the number of jobs suitable for recent college graduates, unemployment rate, and average commute time. The cities that made the list reach nearly coast-to-coast.

“These markets aren’t just affordable areas with relatively more abundant rental options, they’re full of energy, opportunity, and a sense of community, everything a recent grad could want,” Danielle Hale, chief economist at Realtor.com, said in a statement.

Austin, Texas, claimed the No. 1 spot with the lowest rent-to-income ratio at 18.9%—which means renters are spending less of their income on rent each month. Austin was also ranked well for having a high share of jobs requiring a bachelor’s degree but no prior experience. Realtor.com’s ranking also takes into consideration Indeed’s Hiring Index, which tracks job openings relative to pre-pandemic levels.

The top 10 cities for recent college grads, according to Realtor.com’s ranking, are as follows, along with their respective median rent:

1. Austin, Texas ($1,504)

2. Raleigh, N.C. ($1,524)

3. Overland Park, Kan. ($1,351)

4. Minneapolis, Minn. ($1,528)

5. St. Louis, Mo. ($1,335)

6. Richmond, Va. ($1,502)

7. Pittsburgh, Pa. ($1,461)

8. Scottsdale, Ariz. ($1,530)

9. Richardson, Texas ($1,472)

10. Atlanta, Ga. ($1,604)

According to Realtor.com, renters can save 7% by renting in these markets, which have twice as many recent grads as compared to the top 50 metros across the U.S.

Still, not all of these rental markets are perfect by any standard.

“While these cities ranked highly overall, many still have strengths and weaknesses that require prospective renters to consider trade-offs between the availability and affordability of rentals, the strength of the employment market, and access to lifestyle,” according to Realtor.com

On the other end of the spectrum, Moody’s Analytics CRE last May compiled a list of the most rent-burdened cities in the U.S. Unsurprisingly, the list included New York, Miami, Los Angeles, and Boston. Renters can expect to spend more than 30% of their income each month on rent in those cities.

Plus, an August 2024 study by personal finance technology company Self Financial found the typical American renter can expect to pay more than $333,000 during their time as a renter, including bills or additional expenses. The analysis used Zillow data to calculate median monthly rent and utilities by state, RentCafe data for average utility costs, and Insure.com for renters’ insurance estimates. The study assumes people start renting at age 22 and buy their first home at 35.

But at this point, renters could expect to spend even more, considering younger generations are delaying major life milestones like getting married and buying a house.

“Delays in household formation will keep people as renters for longer periods of time,” Nikki Beauchamp, an associate broker at Sotheby’s International Realty in New York, previously told Fortune.