英偉達上周公布的季度財報成績亮眼,,但其中也暗藏一則重大利空消息:因原定交付給中國客戶的芯片最終無法交付,公司為此計提了45億美元的資產(chǎn)減值,。

為遵循拜登政府關(guān)于禁止向“外國對手”出口可能助力其人工智能發(fā)展的技術(shù)的規(guī)定,,英偉達開發(fā)了所謂的H20芯片——此類芯片性能較其頂級半導(dǎo)體產(chǎn)品有所遜色。然而,,今年4月初,,特朗普政府再度加碼,甚至禁止出口性能稍次的芯片,。

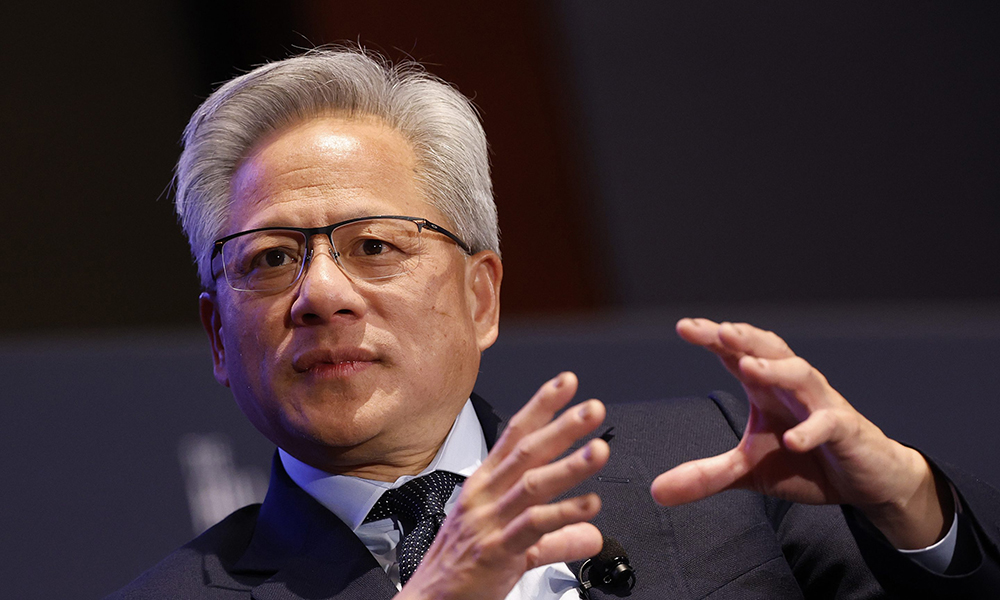

英偉達(Nvidia)首席執(zhí)行官黃仁勛(Jensen Huang)在5月28日的財報電話會議上表示:“我們正對無法出售或重新利用的庫存計提數(shù)十億美元減值,。”

關(guān)于將芯片價值減記至零(而非出售給其他客戶)的決策細節(jié),,公司并未作出解釋,,僅補充稱正在“探索有限選項”來處置未使用的庫存,不過并未詳細說明——顯然這些舉措并不包括直接銷售芯片,。

根據(jù)舊出口規(guī)則,,H20芯片是專為中國市場打造的。鑒于其芯片設(shè)計和功能存在局限性,,可能難以在其他國家投入使用,。羅格斯商學(xué)院(Rutgers Business School)供應(yīng)鏈管理教授阿拉什·阿扎德甘(Arash Azadegan)表示:“若不投入大量資金進行調(diào)試,這些芯片確實無法在其他任何地方適用,?!?/p>

此類調(diào)試可能讓英偉達承擔(dān)額外成本。此外,,田納西大學(xué)(University of Tennessee)供應(yīng)鏈教授查德·奧特里(Chad Autry)指出,,部分芯片可能“無法滿足其他地區(qū)客戶的性能需求”,或在設(shè)計層面“專門針對中國客戶的要求或需求”,。

即使英偉達能通過降價方式出售這些芯片,,也可能損害其作為頂級創(chuàng)新產(chǎn)品供應(yīng)商的形象。畢竟,,該公司新推出的Blackwell圖形處理器(GPU)為OpenAI尚未發(fā)布的GPT-5模型等前沿人工智能技術(shù)提供算力支持。阿扎德甘提到,,Blackwell系列被用于亞馬遜AWS,、微軟Azure、谷歌云及甲骨文等公司的新產(chǎn)品,“英偉達可能不希望折扣芯片充斥市場——這可能會擾亂其定價策略,,讓客戶感到困惑,,還會分散其大力推廣新一代Blackwell產(chǎn)品線的精力?!?

除高管在上周財報電話會議上的發(fā)言外,,英偉達拒絕置評。

據(jù)路透社2月報道,,在中國深度求索(DeepSeek)于1月推出ChatGPT競品后,,阿里巴巴、字節(jié)跳動和騰訊等中國主要企業(yè)便采購了英偉達的H20芯片,。這些公司很可能已借助H20芯片開發(fā)出強大的人工智能能力,,因此幾乎沒有理由認為,倘若英偉達將H20芯片售予美國公司,,它們會無法做到這一點,。

然而,韋德布什證券(Wedbush Securities)負責(zé)英偉達業(yè)務(wù)的執(zhí)行董事馬修·布賴森(Matthew Bryson)表示,,英偉達和美國本土客戶或許對此毫無興趣,。“這些產(chǎn)品之所以銷往中國,,是因為人們總會傾向于選擇更優(yōu)的選項,,”布賴森解釋稱,若非出于有意設(shè)計以阻止中國企業(yè)構(gòu)建與美國先進人工智能應(yīng)用相仿的模型,,H20的基礎(chǔ)技術(shù)“根本就不會被開發(fā)出來”,。他還稱,若英偉達按美國市場價值大幅折價出售這些芯片,,可能會“侵蝕”更優(yōu)質(zhì)產(chǎn)品的銷量,。

首席財務(wù)官科萊特·克雷斯(Colette Kress)在上周的財報電話會議上表示,英偉達最初預(yù)計需從資產(chǎn)負債表中減記55億美元的芯片庫存,,不過通過“對部分材料進行重新利用”,,成功挽回了約10億美元的H20庫存,使第一季度實際減記額降至45億美元,。

不出所料,,她指出,受特朗普政府新出臺的出口規(guī)定影響,,英偉達今年上半年的營收將因特朗普的對華禁令而受到?jīng)_擊,。該公司第一季度營收虧損25億美元,預(yù)計第二季度營收虧損將大幅攀升至80億美元,。

問題在于這些庫存的H20芯片會如何處置,?!敦敻弧冯s志采訪的供應(yīng)鏈專家懷疑它們會被丟棄。田納西大學(xué)哈斯拉姆商學(xué)院供應(yīng)鏈教授艾倫·阿姆林(Alan Amling)在給《財富》雜志的電子郵件中寫道:“這些芯片最終會如同你從姨媽那里得到的‘酷炫熔巖燈’一樣,,被扔進某個垃圾填埋場,。鑒于存在如此多其他增長機遇,重新利用,、重新測試和重新認證這些芯片的機會成本顯然過高,。”

田納西大學(xué)的奧特里表示,,因特朗普政府出口新規(guī)生效速度極快,,這些無法交付的H20芯片或許目前正存放在中國臺灣和中國香港等對美友好地區(qū)??偛课挥谥袊_灣的臺積電(TSMC)為英偉達生產(chǎn)了大量面向中國客戶的芯片庫存,,而英偉達的物流履約合作伙伴也位于周邊國家。

對H20芯片進行減值沖銷,,對英偉達本就蒸蒸日上的業(yè)務(wù)而言,,短期影響幾乎可以忽略不計。該公司第一季度營收高達441億美元(同比增長69%),,凈利潤達188億美元,,凈利潤率保持在健康的42.6%。

將芯片全額減值,,通過減少應(yīng)納稅所得額,,為公司帶來了直接的稅收優(yōu)惠。根據(jù)英偉達未來的銷售前景和成本情況,,這種稅收優(yōu)惠可能超過或接近大幅折價出售芯片所帶來的財務(wù)收益,。

羅格斯大學(xué)的阿扎德甘表示:“英偉達會安然無恙,英偉達的投資者也無需擔(dān)憂,?!彼赋觯罢嬲膯栴}”在于,,像臺積電這樣的制造合作伙伴以及包括三星(Samsung)和美光(Micron)在內(nèi)的供應(yīng)商,,可能受H20庫存減值沖擊最大,因為它們通過在英偉達供應(yīng)鏈中承擔(dān)關(guān)鍵職能來開展業(yè)務(wù),。阿扎德甘指出,,這些合作伙伴受影響的程度將在未來數(shù)月甚至數(shù)年里逐漸明晰?!稗D(zhuǎn)型絕非一朝一夕之事,。”

派杰證券(Piper Sandler)英偉達分析師哈什·庫馬爾(Harsh Kumar)希望特朗普最終能解除對H20芯片對華出口的封鎖,。若真如此,,假設(shè)英偉達仍保留著H20庫存,,就能最終完成H20的銷售,或?qū)⑿酒桓督o中國的新客戶,。在特朗普政府就法官對其“解放日”關(guān)稅實施的禁令提出上訴后,這種情況成為現(xiàn)實的可能性目前尚不明晰,。

盡管如此,,特朗普新出臺的出口禁令以國家安全為由,阻止英偉達向中國交付芯片,,因此這一舉措與他的關(guān)稅議程或許幾乎毫無關(guān)聯(lián),。庫馬爾向《財富》雜志表示:“在我看來,這幾乎表明黃仁勛和英偉達找到了將這批H20芯片重新銷往中國的途徑,?!边@或許能助力這家股價本就高企的公司未來再攀新高。(財富中文網(wǎng))

譯者:中慧言-王芳

英偉達上周公布的季度財報成績亮眼,,但其中也暗藏一則重大利空消息:因原定交付給中國客戶的芯片最終無法交付,,公司為此計提了45億美元的資產(chǎn)減值。

為遵循拜登政府關(guān)于禁止向“外國對手”出口可能助力其人工智能發(fā)展的技術(shù)的規(guī)定,,英偉達開發(fā)了所謂的H20芯片——此類芯片性能較其頂級半導(dǎo)體產(chǎn)品有所遜色,。然而,今年4月初,,特朗普政府再度加碼,,甚至禁止出口性能稍次的芯片。

英偉達(Nvidia)首席執(zhí)行官黃仁勛(Jensen Huang)在5月28日的財報電話會議上表示:“我們正對無法出售或重新利用的庫存計提數(shù)十億美元減值,?!?/p>

關(guān)于將芯片價值減記至零(而非出售給其他客戶)的決策細節(jié),公司并未作出解釋,,僅補充稱正在“探索有限選項”來處置未使用的庫存,,不過并未詳細說明——顯然這些舉措并不包括直接銷售芯片。

根據(jù)舊出口規(guī)則,,H20芯片是專為中國市場打造的,。鑒于其芯片設(shè)計和功能存在局限性,可能難以在其他國家投入使用,。羅格斯商學(xué)院(Rutgers Business School)供應(yīng)鏈管理教授阿拉什·阿扎德甘(Arash Azadegan)表示:“若不投入大量資金進行調(diào)試,,這些芯片確實無法在其他任何地方適用?!?/p>

此類調(diào)試可能讓英偉達承擔(dān)額外成本,。此外,田納西大學(xué)(University of Tennessee)供應(yīng)鏈教授查德·奧特里(Chad Autry)指出,,部分芯片可能“無法滿足其他地區(qū)客戶的性能需求”,,或在設(shè)計層面“專門針對中國客戶的要求或需求”,。

即使英偉達能通過降價方式出售這些芯片,也可能損害其作為頂級創(chuàng)新產(chǎn)品供應(yīng)商的形象,。畢竟,,該公司新推出的Blackwell圖形處理器(GPU)為OpenAI尚未發(fā)布的GPT-5模型等前沿人工智能技術(shù)提供算力支持。阿扎德甘提到,,Blackwell系列被用于亞馬遜AWS,、微軟Azure、谷歌云及甲骨文等公司的新產(chǎn)品,,“英偉達可能不希望折扣芯片充斥市場——這可能會擾亂其定價策略,,讓客戶感到困惑,還會分散其大力推廣新一代Blackwell產(chǎn)品線的精力,?!?

除高管在上周財報電話會議上的發(fā)言外,英偉達拒絕置評,。

據(jù)路透社2月報道,,在中國深度求索(DeepSeek)于1月推出ChatGPT競品后,阿里巴巴,、字節(jié)跳動和騰訊等中國主要企業(yè)便采購了英偉達的H20芯片,。這些公司很可能已借助H20芯片開發(fā)出強大的人工智能能力,因此幾乎沒有理由認為,,倘若英偉達將H20芯片售予美國公司,,它們會無法做到這一點。

然而,,韋德布什證券(Wedbush Securities)負責(zé)英偉達業(yè)務(wù)的執(zhí)行董事馬修·布賴森(Matthew Bryson)表示,,英偉達和美國本土客戶或許對此毫無興趣?!斑@些產(chǎn)品之所以銷往中國,,是因為人們總會傾向于選擇更優(yōu)的選項,”布賴森解釋稱,,若非出于有意設(shè)計以阻止中國企業(yè)構(gòu)建與美國先進人工智能應(yīng)用相仿的模型,,H20的基礎(chǔ)技術(shù)“根本就不會被開發(fā)出來”。他還稱,,若英偉達按美國市場價值大幅折價出售這些芯片,,可能會“侵蝕”更優(yōu)質(zhì)產(chǎn)品的銷量。

首席財務(wù)官科萊特·克雷斯(Colette Kress)在上周的財報電話會議上表示,,英偉達最初預(yù)計需從資產(chǎn)負債表中減記55億美元的芯片庫存,,不過通過“對部分材料進行重新利用”,成功挽回了約10億美元的H20庫存,,使第一季度實際減記額降至45億美元,。

不出所料,,她指出,受特朗普政府新出臺的出口規(guī)定影響,,英偉達今年上半年的營收將因特朗普的對華禁令而受到?jīng)_擊,。該公司第一季度營收虧損25億美元,預(yù)計第二季度營收虧損將大幅攀升至80億美元,。

問題在于這些庫存的H20芯片會如何處置,。《財富》雜志采訪的供應(yīng)鏈專家懷疑它們會被丟棄,。田納西大學(xué)哈斯拉姆商學(xué)院供應(yīng)鏈教授艾倫·阿姆林(Alan Amling)在給《財富》雜志的電子郵件中寫道:“這些芯片最終會如同你從姨媽那里得到的‘酷炫熔巖燈’一樣,被扔進某個垃圾填埋場,。鑒于存在如此多其他增長機遇,,重新利用、重新測試和重新認證這些芯片的機會成本顯然過高,?!?

田納西大學(xué)的奧特里表示,因特朗普政府出口新規(guī)生效速度極快,,這些無法交付的H20芯片或許目前正存放在中國臺灣和中國香港等對美友好地區(qū),。總部位于中國臺灣的臺積電(TSMC)為英偉達生產(chǎn)了大量面向中國客戶的芯片庫存,,而英偉達的物流履約合作伙伴也位于周邊國家,。

對H20芯片進行減值沖銷,對英偉達本就蒸蒸日上的業(yè)務(wù)而言,,短期影響幾乎可以忽略不計,。該公司第一季度營收高達441億美元(同比增長69%),凈利潤達188億美元,,凈利潤率保持在健康的42.6%,。

將芯片全額減值,通過減少應(yīng)納稅所得額,,為公司帶來了直接的稅收優(yōu)惠,。根據(jù)英偉達未來的銷售前景和成本情況,這種稅收優(yōu)惠可能超過或接近大幅折價出售芯片所帶來的財務(wù)收益,。

羅格斯大學(xué)的阿扎德甘表示:“英偉達會安然無恙,,英偉達的投資者也無需擔(dān)憂?!彼赋?,“真正的問題”在于,像臺積電這樣的制造合作伙伴以及包括三星(Samsung)和美光(Micron)在內(nèi)的供應(yīng)商,,可能受H20庫存減值沖擊最大,,因為它們通過在英偉達供應(yīng)鏈中承擔(dān)關(guān)鍵職能來開展業(yè)務(wù),。阿扎德甘指出,這些合作伙伴受影響的程度將在未來數(shù)月甚至數(shù)年里逐漸明晰,?!稗D(zhuǎn)型絕非一朝一夕之事?!?

派杰證券(Piper Sandler)英偉達分析師哈什·庫馬爾(Harsh Kumar)希望特朗普最終能解除對H20芯片對華出口的封鎖,。若真如此,假設(shè)英偉達仍保留著H20庫存,,就能最終完成H20的銷售,,或?qū)⑿酒桓督o中國的新客戶。在特朗普政府就法官對其“解放日”關(guān)稅實施的禁令提出上訴后,,這種情況成為現(xiàn)實的可能性目前尚不明晰,。

盡管如此,特朗普新出臺的出口禁令以國家安全為由,,阻止英偉達向中國交付芯片,,因此這一舉措與他的關(guān)稅議程或許幾乎毫無關(guān)聯(lián)。庫馬爾向《財富》雜志表示:“在我看來,,這幾乎表明黃仁勛和英偉達找到了將這批H20芯片重新銷往中國的途徑,。”這或許能助力這家股價本就高企的公司未來再攀新高,。(財富中文網(wǎng))

譯者:中慧言-王芳

Nvidia’s blockbuster quarterly earnings last week came with a big dose of negative news: A $4.5 billion write down on chips originally destined for customers in China that will ultimately go undelivered.

The company had developed the so-called H20 chips, which are less powerful than its top-of-the-line semiconductors, to comply with Biden Administration regulations against sending technology to foreign adversaries that could help their AI efforts. The Trump Administration, however, went a step further in early April and banned exports of even second-tier chips.

“We are taking a multibillion dollar write off on inventory that cannot be sold or repurposed,” said Nvidia CEO Jensen Huang on a May 28 earnings call.

The details around the decision to write the value of the chips to zero—rather than sell them to other customers—wasn’t explained. The company added, without elaborating, that it’s “exploring limited options” for the unused inventory, a move that would apparently fall short of selling the chips.

The H20 was built specifically for the China market under the old export rules. Because of the chip’s design and limited capabilities, it may be difficult to use in other countries. “It doesn’t really fit anywhere else without a lot of expensive tweaking,” says Arash Azadegan, a professor of supply chain management at Rutgers Business School.

This tweaking could involve additional costs for Nvidia. Furthermore, some of the chips may “not meet the performance needs of customers in other regions” or may be engineered “specific to Chinese customer requests or requirements,” says Chad Autry, a University of Tennessee supply chain professor.

Even if it could sell the chips by cutting their price, Nvidia would risk damaging its image as a seller of top-tier innovation. The company’s new Blackwell GPUs, after all, power cutting-edge AI like OpenAI’s yet-to-be-released GPT-5 model. “Nvidia probably doesn’t want to flood the market with discounted chips—it could mess with their pricing, confuse customers, and distract from their big push into the newer Blackwell lineup,” says Azadegan, referencing Blackwell’s used in new products from Amazon’s AWS, Microsoft Azure, Google Cloud, and Oracle, among others.

Nvidia declined to comment beyond what its executives said during the company’s earnings call last week.

After China-based DeepSeek released its ChatGPT rival in January, major Chinese firms like Alibaba, ByteDance, and Tencent purchased Nvidia’s H20 chips, Reuters reported in February. These companies have likely developed powerful AI capabilities using H20 chips, so there’s little reason to believe that U.S. companies could not do the same if Nvidia sold H20 to them.

But Nvidia and U.S.-based customers probably have no interest in this, says Matthew Bryson, a Wedbush Securities managing director who covers Nvidia. “The reason that these products are going to China is because everyone would choose something better.” Bryson explains that the technology underpinning H20s “would never have been made” if not intentionally engineered to prevent Chinese firms from building models similar to U.S.-made advanced AI applications. And if Nvidia sold the chips at a big discount to reflect their U.S. market value, it could “cannibalize” sales of better products, he says.

Nvidia had initially expected to have to write off $5.5 billion of chip inventory from its balance sheet. But it managed to salvage about $1 billion of H20 inventory by “[reusing] certain materials,” reducing the realized first-quarter writeoff to $4.5 billion, chief financial officer Colette Kress said on last week’s earnings call.

Unsurprisingly, she noted that as a result of the Trump Administration’s new export rule, Nvidia will take a revenue hit from Trump’s China ban in the first half of the year. The company booked a $2.5 billion loss in first quarter revenue and predicted a steeper $8 billion revenue loss in the second one.

The question remains of what happens with this H20 stockpile. Supply chain experts interviewed by Fortune suspect it will be discarded. “These chips will meet the “cool lava lamp” you got from your aunt in a landfill somewhere,” Alan Amling, a professor of supply chain at the University of Tennessee’s Haslam College of Business, wrote to Fortune via email. “With so many other growth opportunities, the opportunity cost of repurposing, retesting and requalifying these chips was obviously too high a bar.”

Because of how quickly the new export rules under Trump took effect, the undeliverable H20 chips are likely sitting in U.S.-friendly places like Taiwan and Hong Kong, said University of Tennessee’s Autry. Taiwan-based TSMC manufactures much of Nvidia’s inventory meant for China-based customers, and Nvidia’s fulfillment partners are in nearby countries.

Writing off the H20 chips had minimal short-term impact on Nvidia’s otherwise booming business. Nvidia reported first quarter revenue of $44.1 billion (up 69% year-over-year) and $18.8 billion in net income, representing a healthy 42.6% net profit margin.

Writing down the full value of the chips provides an immediate tax benefit by reducing the company’s taxable income. Depending on Nvidia’s future sales prospects and costs, this benefit could outweigh or come close to the financial benefit of selling the chips at a steep discount.

“Nvidia is going to be alright; investors of Nvidia are going to be alright,” says Rutgers’ Azadegan. “The real story,” he said, is that Nvidia’s manufacturing partners like TSMC and suppliers, including Samsung and Micron, could be most impacted by the H20 inventory writeoff because they’ve built businesses by serving critical functions in Nvidia’s supply chain. The magnitude of the impact to these partners will be determined in the months and years ahead, notes Azadegan. “It’s never on a dime that we can pivot.”

Nvidia analyst Harsh Kumar of Piper Sandler is hopeful that Trump eventually undoes the blockade on H20 chips to China. If so, Nvidia could finally complete the H20 sales or deliver the chips to new customers in China, assuming the company holds onto the H20 inventory. It’s unclear how realistic this scenario is after the Trump administration appealed a judge-imposed block on his “Liberation Day” tariffs.

Still, Trump’s new export ban prevents Nvidia from delivering chips to China for national security reasons, so it may have little to no correlation with his tariff agenda. “To me, it almost implied that there is a pathway that Jensen [Huang] and Nvidia see for this H20 chip to be sold back into China,” Kumar told Fortune, potentially helping to propel the company’s already high-flying stock to greater heights in the future.