美國(guó)正深陷能源領(lǐng)域的緊迫困局:必須從所有來(lái)源擴(kuò)充電力供應(yīng),否則將面臨潛在失敗,。

這意味著在與中國(guó)爭(zhēng)奪人工智能霸權(quán)的競(jìng)賽中落?。粺o(wú)法為公民提供充足且價(jià)格親民的電力,;以及在氣候變化危機(jī)愈發(fā)嚴(yán)峻的情況下,,無(wú)法實(shí)現(xiàn)能源最大程度清潔化的目標(biāo)。

盡管唐納德·特朗普一直宣揚(yáng)美國(guó)的能源主導(dǎo)地位,,還通過(guò)行政命令加速推進(jìn)天然氣發(fā)電和新核電站項(xiàng)目,,然而監(jiān)管和供應(yīng)鏈瓶頸,卻讓這些項(xiàng)目落地仍需數(shù)年之久,。

與此同時(shí),,特朗普的《大而美法案》蓄意阻礙更易于快速建成的風(fēng)能、太陽(yáng)能和電池儲(chǔ)能項(xiàng)目,,而這些項(xiàng)目本可滿足被稱為“超大規(guī)模企業(yè)”的大型云服務(wù)提供商對(duì)數(shù)據(jù)中心龐大的電力需求,。國(guó)會(huì)于7月3日通過(guò)的最終法案(眾議院以218票對(duì)214票通過(guò))同意迅速取消清潔能源稅收抵免,而這類抵免本可助力強(qiáng)化已趨于緊張的電網(wǎng),。

共和黨正憑借削減清潔能源稅收抵免來(lái)支持化石燃料,,同時(shí)迎合總統(tǒng)本人對(duì)可再生能源的抵觸情緒:特朗普頻繁譴責(zé)風(fēng)能和太陽(yáng)能存在間歇性問(wèn)題——即便這種不穩(wěn)定性正隨著可再生能源電池儲(chǔ)能技術(shù)的持續(xù)進(jìn)步而逐步被抵消。誠(chéng)然,,削減稅收抵免也有助于抵消法案中其他方面的聯(lián)邦支出,。

不出所料,清潔能源行業(yè)對(duì)《大而美法案》表示強(qiáng)烈反對(duì),。太陽(yáng)能產(chǎn)業(yè)協(xié)會(huì)(Solar Energy Industries Association)總裁兼首席執(zhí)行官阿比蓋爾·羅斯·霍珀(Abigail Ross Hopper)表示,,該法案將導(dǎo)致公用事業(yè)賬單上漲、制造工廠關(guān)閉,、數(shù)萬(wàn)個(gè)美國(guó)建筑業(yè)崗位流失,,還會(huì)削弱電網(wǎng)。

她說(shuō):“這項(xiàng)立法將削弱美國(guó)在全球的競(jìng)爭(zhēng)力,,破壞我們的能源未來(lái),,還會(huì)重創(chuàng)那些為經(jīng)濟(jì)發(fā)展注入動(dòng)力,、強(qiáng)化國(guó)家安全的行業(yè)——同時(shí)將21世紀(jì)的科技競(jìng)賽拱手讓給中國(guó)?!?/p>

另一方面,,由于化石燃料利益集團(tuán)去年為特朗普和共和黨提供資金支持,石油和天然氣游說(shuō)團(tuán)體——這些團(tuán)體常譴責(zé)清潔能源稅收抵免不公平——對(duì)最終法案表示贊賞,。

石油和天然氣行業(yè)組織美國(guó)西部能源聯(lián)盟(Western Energy Alliance)總裁梅麗莎·辛普森(Melissa Simpson)稱贊這是“一項(xiàng)具有里程碑意義的法案,,能夠釋放出我們所需的能源”。她特別提及“推動(dòng)在公共土地上進(jìn)行石油和天然氣開采的條款”,,以及叫停針對(duì)天然氣排放實(shí)施“過(guò)度征稅”的做法,。

“能源主導(dǎo)”還是“能源豐裕”,?

最終法案規(guī)定,,將迅速取消所有在2027年底前未能投產(chǎn)的清潔能源項(xiàng)目的稅收抵免,不過(guò)對(duì)2026年6月前就已開工的項(xiàng)目予以豁免,。參議院最初的措辭相對(duì)寬松,,要求在2027年底前開工即可——對(duì)于那些迫切想要啟動(dòng)項(xiàng)目的人而言,這一看似細(xì)微的時(shí)間線差異,,實(shí)則影響巨大,。

這不僅是清潔能源開發(fā)商或環(huán)保倡導(dǎo)者面臨的問(wèn)題;它可能會(huì)大幅延緩美國(guó)計(jì)劃中迫切需要達(dá)成的發(fā)電量快速提升進(jìn)程,。簡(jiǎn)而言之,,這意味著電力需求與日俱增的科技和制造業(yè),以及不斷增長(zhǎng)的人口,,都將面臨供電不足——這意味著所有人將面臨更高的電費(fèi)賬單,,還可能出現(xiàn)電力短缺乃至停電的狀況,。

非營(yíng)利組織Rewiring America的首席執(zhí)行官阿里·馬圖西亞克(Ari Matusiak)表示:“這項(xiàng)法案不僅會(huì)加重家庭負(fù)擔(dān),,還會(huì)損害國(guó)家利益。我們需要低成本,、充足的能源來(lái)參與全球競(jìng)爭(zhēng),。我們將集體陷入更貧困、更脆弱的境地,,也愈發(fā)難以在瞬息萬(wàn)變的世界中保持領(lǐng)先優(yōu)勢(shì),。”畢竟,,根據(jù)美國(guó)能源部的數(shù)據(jù),,去年美國(guó)新增發(fā)電量中近90%來(lái)自可再生能源。

標(biāo)普全球大宗商品洞察預(yù)測(cè),,將大多數(shù)項(xiàng)目的完成期限提前至2027年,,會(huì)導(dǎo)致未來(lái)10年美國(guó)清潔能源項(xiàng)目建設(shè)量減少約20%。

標(biāo)普全球(S&P Global)氣候市場(chǎng)與政策分析主管羅曼·克拉馬丘克(Roman Kramarchuk)表示:“這一影響極為重大,。這并非占比微小的20%,,而是占新增部署量絕對(duì)多數(shù)的20%?!?/p>

他補(bǔ)充道:“情況不容樂(lè)觀,,最終結(jié)果將是推高電力成本?!?/p>

科技界,、公用事業(yè)公司和政治溫和派不再呼吁所謂的“能源主導(dǎo)”,而是愈發(fā)迫切地懇請(qǐng)擴(kuò)大“能源豐?!本置妗@一立場(chǎng)主張接納所有能源形式,,以更快提升產(chǎn)能并助力壓低價(jià)格。但兩黨都受意識(shí)形態(tài)束縛,,未能對(duì)一項(xiàng)同時(shí)涵蓋清潔能源與天然氣的戰(zhàn)略予以支持——共和黨將矛頭指向可再生能源,,民主黨則抵制化石燃料。

盡管如此,,代表全國(guó)投資者所有的電力公司的愛(ài)迪生電氣研究所(EEI)等組織仍在極力倡導(dǎo)這一策略,。愛(ài)迪生電氣研究所主席兼愛(ài)克斯龍公司(Exelon)首席執(zhí)行官卡爾文·巴特勒(Calvin Butler)在接受《財(cái)富》雜志采訪時(shí)表示:“我們行業(yè)正處于前所未有的時(shí)期,自空調(diào)誕生以來(lái),,從未經(jīng)歷過(guò)如此規(guī)模的負(fù)荷增長(zhǎng),。我們必須新建發(fā)電設(shè)施。這需要采取‘全方位’的能源組合策略——涵蓋核能,、天然氣,、風(fēng)能、太陽(yáng)能以及電池儲(chǔ)能等新技術(shù),?!?

巴特勒表示,如果該法案允許清潔能源項(xiàng)目在2027年前開工(若能再延后些則更為理想),,他會(huì)支持這項(xiàng)立法,。他表示:“我們認(rèn)為稅收抵免至關(guān)重要。我們堅(jiān)信,,如果不將可再生能源納入解決方案,,就無(wú)法實(shí)現(xiàn)能源主導(dǎo)?!?

我們?yōu)楹涡枰绱硕嗟碾娏Γ?/strong>

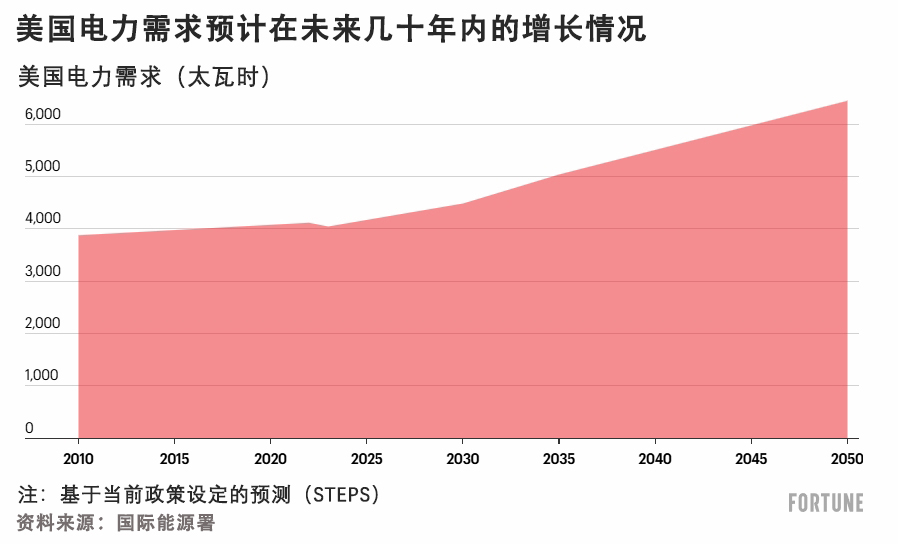

國(guó)際能源署的數(shù)據(jù)顯示,,在過(guò)去幾十年美國(guó)電力需求相對(duì)平穩(wěn)之后,預(yù)計(jì)2023年至2035年國(guó)內(nèi)電力消費(fèi)量將激增25%,,2023年至2050年將增長(zhǎng)約60%,。

需求增長(zhǎng)中很大一部分源于超大規(guī)模企業(yè):亞馬遜(Amazon),、谷歌(Google)和微軟(Microsoft)僅在2025年就計(jì)劃分別投入750億至1000億美元用于數(shù)據(jù)中心建設(shè)。

為更直觀地感受這些投資規(guī)模之巨,,全球石油巨頭英國(guó)石油公司(BP)的總市值僅為800億美元,。例如,Meta計(jì)劃在路易斯安那州建設(shè)的超大型數(shù)據(jù)中心,,所需電力相當(dāng)于新奧爾良全市用電量的兩倍,。

新時(shí)代能源(NextEra Energy)(《財(cái)富》美國(guó)500強(qiáng)排名第173位)——這家大型公用事業(yè)和電力開發(fā)公司的首席執(zhí)行官約翰·凱奇姆(John Ketchum)估計(jì),預(yù)期的燃?xì)獍l(fā)電量甚至無(wú)法滿足2030年前數(shù)據(jù)中心20%的電力需求,。盡管近年來(lái)美國(guó)國(guó)內(nèi)頁(yè)巖氣產(chǎn)量創(chuàng)下紀(jì)錄,,但將天然氣轉(zhuǎn)化為電力的渦輪機(jī)成本不斷攀升,且受供應(yīng)鏈挑戰(zhàn)影響,,產(chǎn)量不足,。

6月,凱奇姆在《政客》能源峰會(huì)上談及數(shù)據(jù)中心剩余80%的電力需求時(shí)說(shuō):“如果不采用可再生能源,,那還能選用什么呢,?”

盡管這項(xiàng)法案并未完全阻斷清潔能源的發(fā)展之路,仍會(huì)建設(shè)大量公用事業(yè)規(guī)模的風(fēng)能和太陽(yáng)能項(xiàng)目,,但它確實(shí)大幅降低了清潔能源獲得稅收減免的可能性,,并抬高了成本。

該法案的早期版本不僅計(jì)劃逐步取消稅收抵免,,還打算對(duì)清潔能源項(xiàng)目征收全新的消費(fèi)稅——即便是可再生能源的反對(duì)者也對(duì)此感到不滿,。部分預(yù)測(cè)表明,此稅項(xiàng)極有可能致使大多數(shù)待建清潔能源項(xiàng)目因經(jīng)濟(jì)上不可行而夭折,。不過(guò),,在參議院最終投票前,這項(xiàng)稅收被移除了,。

另一項(xiàng)在最后關(guān)頭作出的修改規(guī)定,,如果清潔能源項(xiàng)目在2026年6月前開工,即使超出2027年的完工期限,,仍可保留稅收抵免資格——盡管這一時(shí)間表仍然非常緊迫,。

同樣,,該法案保留了稅收抵免的“可轉(zhuǎn)讓性”——取消該條款曾被視為旨在削弱該計(jì)劃的秘密“毒丸條款”,。可轉(zhuǎn)讓性使得小型開發(fā)商能夠?qū)⒍愂盏置庖哉蹆r(jià)方式轉(zhuǎn)讓給大型買家,,以此籌集資金,,而大型買家則可即刻享受稅收優(yōu)惠。法案最初的眾議院版本曾取消可轉(zhuǎn)讓性,。

該法案還針對(duì)可再生能源項(xiàng)目新增了“受關(guān)注外國(guó)實(shí)體”(FEOC)條款,?!笆荜P(guān)注外國(guó)實(shí)體”規(guī)則原本僅適用于《通脹削減法案》中的電動(dòng)汽車稅收抵免,如今將拓展至所有清潔能源稅收抵免領(lǐng)域,,這實(shí)際上對(duì)從中國(guó)進(jìn)口的必要供應(yīng)鏈材料形成了限制,。眾議院版本的法案為項(xiàng)目設(shè)定了嚴(yán)苛的“受關(guān)注外國(guó)實(shí)體”條款,不過(guò)最終版本采用了更為審慎,、分階段實(shí)施的策略,。

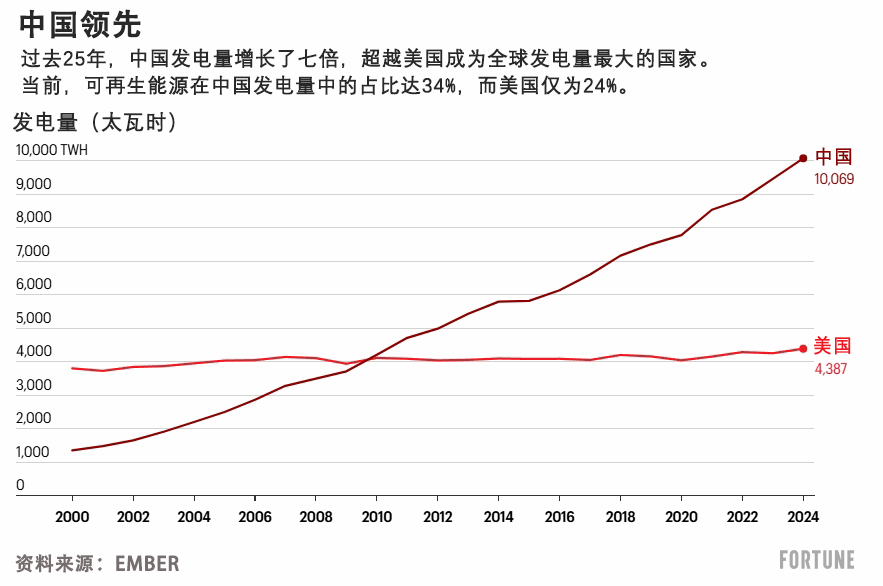

無(wú)論美國(guó)新建多少制造業(yè)設(shè)施,許多原材料仍只能從中國(guó)進(jìn)口,。在這場(chǎng)人工智能主導(dǎo)權(quán)的爭(zhēng)奪戰(zhàn)中,,任何延誤或失誤都將使中國(guó)進(jìn)一步擴(kuò)大優(yōu)勢(shì)——因?yàn)橹袊?guó)正迅速?gòu)拿禾哭D(zhuǎn)向風(fēng)能和太陽(yáng)能,擴(kuò)大發(fā)電規(guī)模,。

盡管當(dāng)前中國(guó)對(duì)煤炭的依賴程度較美國(guó)更高,,但中國(guó)約三分之一的電力源自可再生能源,而美國(guó)這一比例約為22%,。比如,,中國(guó)目前的太陽(yáng)能發(fā)電裝機(jī)容量已超過(guò)世界其他國(guó)家之和。隨著中國(guó)加速建設(shè)更多發(fā)電設(shè)施,,而美國(guó)在新電力基礎(chǔ)設(shè)施建設(shè)上步伐放緩,,中國(guó)將在人工智能主導(dǎo)權(quán)競(jìng)爭(zhēng)中贏得更大的動(dòng)力優(yōu)勢(shì)。

該法案還廢除了多項(xiàng)其他清潔能源和能效相關(guān)措施。電動(dòng)汽車稅收抵免被取消,,住宅太陽(yáng)能項(xiàng)目以及其他家庭能效相關(guān)措施的稅收抵免亦未能幸免,。該法案出臺(tái)之際,特朗普政府正計(jì)劃放寬家用電器等產(chǎn)品的能效標(biāo)準(zhǔn),。

“家庭將承受持續(xù)攀升的電費(fèi)壓力,,卻幾乎找不到應(yīng)對(duì)之策,”Rewiring America的馬圖西亞克表示,?!半S著人工智能、數(shù)據(jù)中心以及制造業(yè)的能源需求激增,,家庭被逼入絕境,,不得不支付更高費(fèi)用,卻只能享受更少的服務(wù),?!?/p>

根據(jù)美國(guó)能源部數(shù)據(jù),自2022年以來(lái),美國(guó)家庭用電成本平均已上漲13%,。隨著數(shù)據(jù)中心需求增長(zhǎng)及天然氣價(jià)格上漲,,加之2030年前液化天然氣出口項(xiàng)目相繼投產(chǎn),用電成本預(yù)計(jì)將繼續(xù)攀升,。

接下來(lái)會(huì)發(fā)生什么,?

接下來(lái)在可再生能源領(lǐng)域,為搶在稅收抵免期限截止前破土動(dòng)工,,各方必將掀起一場(chǎng)激烈角逐,。從某種程度上講,時(shí)間限制越嚴(yán)苛,,各方為爭(zhēng)取稅收減免而發(fā)起的瘋狂沖刺就越激烈——即便最終建成的項(xiàng)目數(shù)量會(huì)減少,。

克拉馬丘克表示:“該行業(yè)此前就曾有過(guò)類似情形??偸羌庇谮s在最后期限前完成項(xiàng)目,。”

在推動(dòng)更多化石燃料發(fā)電方面,,尚未簽訂合同的新型燃?xì)鉁u輪機(jī)項(xiàng)目需要大約五年時(shí)間才能建成,。在此期間,這意味著要提高現(xiàn)有燃?xì)獍l(fā)電廠的利用率,,并設(shè)法讓更多燃煤電廠延長(zhǎng)運(yùn)營(yíng)時(shí)間,。“這需要現(xiàn)有燃?xì)饣蛉济簷C(jī)組加大馬力運(yùn)轉(zhuǎn),?!笨死R丘克說(shuō)道。不出所料,,該法案后期新增了一項(xiàng)針對(duì)煤炭出口的稅收減免條款,。

到2028年,預(yù)計(jì)將有50吉瓦的現(xiàn)有燃煤發(fā)電產(chǎn)能退役,。其中部分電廠必須延長(zhǎng)運(yùn)營(yíng)時(shí)間以填補(bǔ)缺口,,但能延長(zhǎng)多久尚不明確?!斑@些電廠大多極為老舊,,維持運(yùn)營(yíng)需投入巨額資金?!彼f(shuō)道,。

需要明確的是,稅收抵免的終止并不意味著可再生能源的終結(jié),。與共和黨結(jié)盟的超級(jí)政治行動(dòng)委員會(huì)ClearPath Action支持應(yīng)對(duì)氣候變化的努力,,該組織稱該法案相較于此前部分版本有了極大改進(jìn),早期版本曾計(jì)劃對(duì)可再生能源加征額外稅收,,“摧毀”清潔能源行業(yè),。“參議院共和黨人和眾議院盟友拒絕了這種做法,,并保留了一些金融工具以加速美國(guó)創(chuàng)新并推動(dòng)美國(guó)制造業(yè)投資,。”ClearPath首席執(zhí)行官杰里米·哈雷爾(Jeremy Harrell)表示,。

然而,,這確實(shí)意味著風(fēng)能和太陽(yáng)能項(xiàng)目的成本將上升。許多地區(qū)性公用事業(yè)公司和小型開發(fā)商可能會(huì)放棄規(guī)劃中的清潔能源項(xiàng)目,。不過(guò),,超大規(guī)模企業(yè)顯然預(yù)算更為充裕。

克拉馬丘克表示:“那些本就具備建設(shè)條件的新風(fēng)能和太陽(yáng)能項(xiàng)目,,如今仍可推進(jìn),,只是成本會(huì)大幅上升。如果你是超大規(guī)模企業(yè),,那么或許有更大的余地去承擔(dān)更高的成本,。”

至于我們其余人,?電費(fèi)和取暖費(fèi)大概率也會(huì)水漲船高,。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

美國(guó)正深陷能源領(lǐng)域的緊迫困局:必須從所有來(lái)源擴(kuò)充電力供應(yīng),否則將面臨潛在失敗,。

這意味著在與中國(guó)爭(zhēng)奪人工智能霸權(quán)的競(jìng)賽中落?。粺o(wú)法為公民提供充足且價(jià)格親民的電力,;以及在氣候變化危機(jī)愈發(fā)嚴(yán)峻的情況下,,無(wú)法實(shí)現(xiàn)能源最大程度清潔化的目標(biāo)。

盡管唐納德·特朗普一直宣揚(yáng)美國(guó)的能源主導(dǎo)地位,,還通過(guò)行政命令加速推進(jìn)天然氣發(fā)電和新核電站項(xiàng)目,,然而監(jiān)管和供應(yīng)鏈瓶頸,卻讓這些項(xiàng)目落地仍需數(shù)年之久,。

與此同時(shí),,特朗普的《大而美法案》蓄意阻礙更易于快速建成的風(fēng)能、太陽(yáng)能和電池儲(chǔ)能項(xiàng)目,,而這些項(xiàng)目本可滿足被稱為“超大規(guī)模企業(yè)”的大型云服務(wù)提供商對(duì)數(shù)據(jù)中心龐大的電力需求,。國(guó)會(huì)于7月3日通過(guò)的最終法案(眾議院以218票對(duì)214票通過(guò))同意迅速取消清潔能源稅收抵免,而這類抵免本可助力強(qiáng)化已趨于緊張的電網(wǎng),。

共和黨正憑借削減清潔能源稅收抵免來(lái)支持化石燃料,,同時(shí)迎合總統(tǒng)本人對(duì)可再生能源的抵觸情緒:特朗普頻繁譴責(zé)風(fēng)能和太陽(yáng)能存在間歇性問(wèn)題——即便這種不穩(wěn)定性正隨著可再生能源電池儲(chǔ)能技術(shù)的持續(xù)進(jìn)步而逐步被抵消。誠(chéng)然,削減稅收抵免也有助于抵消法案中其他方面的聯(lián)邦支出,。

不出所料,,清潔能源行業(yè)對(duì)《大而美法案》表示強(qiáng)烈反對(duì)。太陽(yáng)能產(chǎn)業(yè)協(xié)會(huì)(Solar Energy Industries Association)總裁兼首席執(zhí)行官阿比蓋爾·羅斯·霍珀(Abigail Ross Hopper)表示,,該法案將導(dǎo)致公用事業(yè)賬單上漲,、制造工廠關(guān)閉、數(shù)萬(wàn)個(gè)美國(guó)建筑業(yè)崗位流失,,還會(huì)削弱電網(wǎng),。

她說(shuō):“這項(xiàng)立法將削弱美國(guó)在全球的競(jìng)爭(zhēng)力,破壞我們的能源未來(lái),,還會(huì)重創(chuàng)那些為經(jīng)濟(jì)發(fā)展注入動(dòng)力,、強(qiáng)化國(guó)家安全的行業(yè)——同時(shí)將21世紀(jì)的科技競(jìng)賽拱手讓給中國(guó)?!?/p>

另一方面,,由于化石燃料利益集團(tuán)去年為特朗普和共和黨提供資金支持,石油和天然氣游說(shuō)團(tuán)體——這些團(tuán)體常譴責(zé)清潔能源稅收抵免不公平——對(duì)最終法案表示贊賞,。

石油和天然氣行業(yè)組織美國(guó)西部能源聯(lián)盟(Western Energy Alliance)總裁梅麗莎·辛普森(Melissa Simpson)稱贊這是“一項(xiàng)具有里程碑意義的法案,,能夠釋放出我們所需的能源”。她特別提及“推動(dòng)在公共土地上進(jìn)行石油和天然氣開采的條款”,,以及叫停針對(duì)天然氣排放實(shí)施“過(guò)度征稅”的做法,。

“能源主導(dǎo)”還是“能源豐裕”,?

最終法案規(guī)定,,將迅速取消所有在2027年底前未能投產(chǎn)的清潔能源項(xiàng)目的稅收抵免,不過(guò)對(duì)2026年6月前就已開工的項(xiàng)目予以豁免,。參議院最初的措辭相對(duì)寬松,,要求在2027年底前開工即可——對(duì)于那些迫切想要啟動(dòng)項(xiàng)目的人而言,這一看似細(xì)微的時(shí)間線差異,,實(shí)則影響巨大,。

這不僅是清潔能源開發(fā)商或環(huán)保倡導(dǎo)者面臨的問(wèn)題;它可能會(huì)大幅延緩美國(guó)計(jì)劃中迫切需要達(dá)成的發(fā)電量快速提升進(jìn)程,。簡(jiǎn)而言之,,這意味著電力需求與日俱增的科技和制造業(yè),以及不斷增長(zhǎng)的人口,,都將面臨供電不足——這意味著所有人將面臨更高的電費(fèi)賬單,,還可能出現(xiàn)電力短缺乃至停電的狀況。

非營(yíng)利組織Rewiring America的首席執(zhí)行官阿里·馬圖西亞克(Ari Matusiak)表示:“這項(xiàng)法案不僅會(huì)加重家庭負(fù)擔(dān),,還會(huì)損害國(guó)家利益,。我們需要低成本,、充足的能源來(lái)參與全球競(jìng)爭(zhēng)。我們將集體陷入更貧困,、更脆弱的境地,,也愈發(fā)難以在瞬息萬(wàn)變的世界中保持領(lǐng)先優(yōu)勢(shì)?!碑吘?,根據(jù)美國(guó)能源部的數(shù)據(jù),,去年美國(guó)新增發(fā)電量中近90%來(lái)自可再生能源,。

標(biāo)普全球大宗商品洞察預(yù)測(cè),將大多數(shù)項(xiàng)目的完成期限提前至2027年,,會(huì)導(dǎo)致未來(lái)10年美國(guó)清潔能源項(xiàng)目建設(shè)量減少約20%,。

標(biāo)普全球(S&P Global)氣候市場(chǎng)與政策分析主管羅曼·克拉馬丘克(Roman Kramarchuk)表示:“這一影響極為重大。這并非占比微小的20%,,而是占新增部署量絕對(duì)多數(shù)的20%,。”

他補(bǔ)充道:“情況不容樂(lè)觀,,最終結(jié)果將是推高電力成本,。”

科技界,、公用事業(yè)公司和政治溫和派不再呼吁所謂的“能源主導(dǎo)”,,而是愈發(fā)迫切地懇請(qǐng)擴(kuò)大“能源豐裕”局面——這一立場(chǎng)主張接納所有能源形式,,以更快提升產(chǎn)能并助力壓低價(jià)格,。但兩黨都受意識(shí)形態(tài)束縛,未能對(duì)一項(xiàng)同時(shí)涵蓋清潔能源與天然氣的戰(zhàn)略予以支持——共和黨將矛頭指向可再生能源,,民主黨則抵制化石燃料,。

盡管如此,代表全國(guó)投資者所有的電力公司的愛(ài)迪生電氣研究所(EEI)等組織仍在極力倡導(dǎo)這一策略,。愛(ài)迪生電氣研究所主席兼愛(ài)克斯龍公司(Exelon)首席執(zhí)行官卡爾文·巴特勒(Calvin Butler)在接受《財(cái)富》雜志采訪時(shí)表示:“我們行業(yè)正處于前所未有的時(shí)期,,自空調(diào)誕生以來(lái),從未經(jīng)歷過(guò)如此規(guī)模的負(fù)荷增長(zhǎng),。我們必須新建發(fā)電設(shè)施,。這需要采取‘全方位’的能源組合策略——涵蓋核能、天然氣,、風(fēng)能,、太陽(yáng)能以及電池儲(chǔ)能等新技術(shù)?!?

巴特勒表示,,如果該法案允許清潔能源項(xiàng)目在2027年前開工(若能再延后些則更為理想),,他會(huì)支持這項(xiàng)立法。他表示:“我們認(rèn)為稅收抵免至關(guān)重要,。我們堅(jiān)信,,如果不將可再生能源納入解決方案,就無(wú)法實(shí)現(xiàn)能源主導(dǎo),?!?

我們?yōu)楹涡枰绱硕嗟碾娏Γ?/strong>

國(guó)際能源署的數(shù)據(jù)顯示,在過(guò)去幾十年美國(guó)電力需求相對(duì)平穩(wěn)之后,,預(yù)計(jì)2023年至2035年國(guó)內(nèi)電力消費(fèi)量將激增25%,,2023年至2050年將增長(zhǎng)約60%。

需求增長(zhǎng)中很大一部分源于超大規(guī)模企業(yè):亞馬遜(Amazon),、谷歌(Google)和微軟(Microsoft)僅在2025年就計(jì)劃分別投入750億至1000億美元用于數(shù)據(jù)中心建設(shè),。

為更直觀地感受這些投資規(guī)模之巨,全球石油巨頭英國(guó)石油公司(BP)的總市值僅為800億美元,。例如,,Meta計(jì)劃在路易斯安那州建設(shè)的超大型數(shù)據(jù)中心,所需電力相當(dāng)于新奧爾良全市用電量的兩倍,。

新時(shí)代能源(NextEra Energy)(《財(cái)富》美國(guó)500強(qiáng)排名第173位)——這家大型公用事業(yè)和電力開發(fā)公司的首席執(zhí)行官約翰·凱奇姆(John Ketchum)估計(jì),,預(yù)期的燃?xì)獍l(fā)電量甚至無(wú)法滿足2030年前數(shù)據(jù)中心20%的電力需求。盡管近年來(lái)美國(guó)國(guó)內(nèi)頁(yè)巖氣產(chǎn)量創(chuàng)下紀(jì)錄,,但將天然氣轉(zhuǎn)化為電力的渦輪機(jī)成本不斷攀升,,且受供應(yīng)鏈挑戰(zhàn)影響,產(chǎn)量不足,。

6月,,凱奇姆在《政客》能源峰會(huì)上談及數(shù)據(jù)中心剩余80%的電力需求時(shí)說(shuō):“如果不采用可再生能源,那還能選用什么呢,?”

盡管這項(xiàng)法案并未完全阻斷清潔能源的發(fā)展之路,,仍會(huì)建設(shè)大量公用事業(yè)規(guī)模的風(fēng)能和太陽(yáng)能項(xiàng)目,但它確實(shí)大幅降低了清潔能源獲得稅收減免的可能性,,并抬高了成本,。

該法案的早期版本不僅計(jì)劃逐步取消稅收抵免,還打算對(duì)清潔能源項(xiàng)目征收全新的消費(fèi)稅——即便是可再生能源的反對(duì)者也對(duì)此感到不滿,。部分預(yù)測(cè)表明,,此稅項(xiàng)極有可能致使大多數(shù)待建清潔能源項(xiàng)目因經(jīng)濟(jì)上不可行而夭折。不過(guò),,在參議院最終投票前,,這項(xiàng)稅收被移除了。

另一項(xiàng)在最后關(guān)頭作出的修改規(guī)定,,如果清潔能源項(xiàng)目在2026年6月前開工,,即使超出2027年的完工期限,,仍可保留稅收抵免資格——盡管這一時(shí)間表仍然非常緊迫。

同樣,,該法案保留了稅收抵免的“可轉(zhuǎn)讓性”——取消該條款曾被視為旨在削弱該計(jì)劃的秘密“毒丸條款”,。可轉(zhuǎn)讓性使得小型開發(fā)商能夠?qū)⒍愂盏置庖哉蹆r(jià)方式轉(zhuǎn)讓給大型買家,,以此籌集資金,,而大型買家則可即刻享受稅收優(yōu)惠。法案最初的眾議院版本曾取消可轉(zhuǎn)讓性,。

該法案還針對(duì)可再生能源項(xiàng)目新增了“受關(guān)注外國(guó)實(shí)體”(FEOC)條款,。“受關(guān)注外國(guó)實(shí)體”規(guī)則原本僅適用于《通脹削減法案》中的電動(dòng)汽車稅收抵免,,如今將拓展至所有清潔能源稅收抵免領(lǐng)域,,這實(shí)際上對(duì)從中國(guó)進(jìn)口的必要供應(yīng)鏈材料形成了限制,。眾議院版本的法案為項(xiàng)目設(shè)定了嚴(yán)苛的“受關(guān)注外國(guó)實(shí)體”條款,,不過(guò)最終版本采用了更為審慎、分階段實(shí)施的策略,。

無(wú)論美國(guó)新建多少制造業(yè)設(shè)施,,許多原材料仍只能從中國(guó)進(jìn)口。在這場(chǎng)人工智能主導(dǎo)權(quán)的爭(zhēng)奪戰(zhàn)中,,任何延誤或失誤都將使中國(guó)進(jìn)一步擴(kuò)大優(yōu)勢(shì)——因?yàn)橹袊?guó)正迅速?gòu)拿禾哭D(zhuǎn)向風(fēng)能和太陽(yáng)能,,擴(kuò)大發(fā)電規(guī)模。

盡管當(dāng)前中國(guó)對(duì)煤炭的依賴程度較美國(guó)更高,,但中國(guó)約三分之一的電力源自可再生能源,,而美國(guó)這一比例約為22%。比如,,中國(guó)目前的太陽(yáng)能發(fā)電裝機(jī)容量已超過(guò)世界其他國(guó)家之和,。隨著中國(guó)加速建設(shè)更多發(fā)電設(shè)施,而美國(guó)在新電力基礎(chǔ)設(shè)施建設(shè)上步伐放緩,,中國(guó)將在人工智能主導(dǎo)權(quán)競(jìng)爭(zhēng)中贏得更大的動(dòng)力優(yōu)勢(shì),。

該法案還廢除了多項(xiàng)其他清潔能源和能效相關(guān)措施。電動(dòng)汽車稅收抵免被取消,,住宅太陽(yáng)能項(xiàng)目以及其他家庭能效相關(guān)措施的稅收抵免亦未能幸免,。該法案出臺(tái)之際,特朗普政府正計(jì)劃放寬家用電器等產(chǎn)品的能效標(biāo)準(zhǔn),。

“家庭將承受持續(xù)攀升的電費(fèi)壓力,,卻幾乎找不到應(yīng)對(duì)之策,”Rewiring America的馬圖西亞克表示,?!半S著人工智能,、數(shù)據(jù)中心以及制造業(yè)的能源需求激增,家庭被逼入絕境,,不得不支付更高費(fèi)用,,卻只能享受更少的服務(wù)?!?/p>

根據(jù)美國(guó)能源部數(shù)據(jù),,自2022年以來(lái),美國(guó)家庭用電成本平均已上漲13%,。隨著數(shù)據(jù)中心需求增長(zhǎng)及天然氣價(jià)格上漲,,加之2030年前液化天然氣出口項(xiàng)目相繼投產(chǎn),用電成本預(yù)計(jì)將繼續(xù)攀升,。

接下來(lái)會(huì)發(fā)生什么,?

接下來(lái)在可再生能源領(lǐng)域,為搶在稅收抵免期限截止前破土動(dòng)工,,各方必將掀起一場(chǎng)激烈角逐,。從某種程度上講,時(shí)間限制越嚴(yán)苛,,各方為爭(zhēng)取稅收減免而發(fā)起的瘋狂沖刺就越激烈——即便最終建成的項(xiàng)目數(shù)量會(huì)減少,。

克拉馬丘克表示:“該行業(yè)此前就曾有過(guò)類似情形??偸羌庇谮s在最后期限前完成項(xiàng)目,。”

在推動(dòng)更多化石燃料發(fā)電方面,,尚未簽訂合同的新型燃?xì)鉁u輪機(jī)項(xiàng)目需要大約五年時(shí)間才能建成,。在此期間,這意味著要提高現(xiàn)有燃?xì)獍l(fā)電廠的利用率,,并設(shè)法讓更多燃煤電廠延長(zhǎng)運(yùn)營(yíng)時(shí)間,。“這需要現(xiàn)有燃?xì)饣蛉济簷C(jī)組加大馬力運(yùn)轉(zhuǎn),?!笨死R丘克說(shuō)道。不出所料,,該法案后期新增了一項(xiàng)針對(duì)煤炭出口的稅收減免條款,。

到2028年,預(yù)計(jì)將有50吉瓦的現(xiàn)有燃煤發(fā)電產(chǎn)能退役,。其中部分電廠必須延長(zhǎng)運(yùn)營(yíng)時(shí)間以填補(bǔ)缺口,,但能延長(zhǎng)多久尚不明確?!斑@些電廠大多極為老舊,,維持運(yùn)營(yíng)需投入巨額資金,。”他說(shuō)道,。

需要明確的是,,稅收抵免的終止并不意味著可再生能源的終結(jié)。與共和黨結(jié)盟的超級(jí)政治行動(dòng)委員會(huì)ClearPath Action支持應(yīng)對(duì)氣候變化的努力,,該組織稱該法案相較于此前部分版本有了極大改進(jìn),,早期版本曾計(jì)劃對(duì)可再生能源加征額外稅收,“摧毀”清潔能源行業(yè),?!皡⒆h院共和黨人和眾議院盟友拒絕了這種做法,并保留了一些金融工具以加速美國(guó)創(chuàng)新并推動(dòng)美國(guó)制造業(yè)投資,?!盋learPath首席執(zhí)行官杰里米·哈雷爾(Jeremy Harrell)表示。

然而,,這確實(shí)意味著風(fēng)能和太陽(yáng)能項(xiàng)目的成本將上升,。許多地區(qū)性公用事業(yè)公司和小型開發(fā)商可能會(huì)放棄規(guī)劃中的清潔能源項(xiàng)目。不過(guò),,超大規(guī)模企業(yè)顯然預(yù)算更為充裕,。

克拉馬丘克表示:“那些本就具備建設(shè)條件的新風(fēng)能和太陽(yáng)能項(xiàng)目,如今仍可推進(jìn),,只是成本會(huì)大幅上升。如果你是超大規(guī)模企業(yè),,那么或許有更大的余地去承擔(dān)更高的成本,。”

至于我們其余人,?電費(fèi)和取暖費(fèi)大概率也會(huì)水漲船高,。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

America is facing an energy imperative: Grow power from all sources or face potential failure.

That’s failure in the race against China for AI supremacy; failure to provide ample affordable power for its citizens; and failure to make energy as clean as possible while climate change woes mount with each passing year.

As President Donald Trump has touted American energy dominance, he has leaned on executive orders to expedite natural-gas-fired power and new nuclear plants. But regulatory and supply-chain bottlenecks still put those projects several years out.

Meanwhile, Trump’s “One Big Beautiful Bill” is intentionally handicapping more easily and faster-built wind, solar, and battery storage projects that would help satiate the massive data-center power demands of the large-scale cloud-service providers known as hyperscalers. The final legislation approved by Congress on July 3 (the House concurred on a 218–214 vote) agrees to quickly unwind the clean-energy tax credits that could have helped strengthen an already stretched electric grid.

The GOP is leaning on clean-energy cuts to support fossil fuels, while channeling the president’s own anti-renewables sentiments: He has often decried the intermittent nature of wind and solar—even if that unpredictability is increasingly offset by the growth of battery storage for renewable energy. And of course, cutting tax credits helps offset federal spending elsewhere in the bill.

Unsurprisingly, the clean-energy industry is up in arms about the BBB legislation. Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, said it will increase electricity bills, shut down manufacturing facilities, cost many thousands of U.S. construction jobs, and weaken the grid.

“This legislation [will] set back America’s global competitiveness, destabilize our energy future, and weaken the very industries that power our economy and strengthen our national security—while surrendering the 21st-century tech race to China,” she said.

On the other hand, with money flowing from fossil-fuel interests to support Trump and Republicans last year, oil and gas lobbyists—who frequently decry clean-energy tax credits as unfair—praised the final bill.

Melissa Simpson, president of the oil and gas industry’s Western Energy Alliance, hailed the “monumental bill that’ll unleash the energy we need.” She specifically touted “provisions promoting oil and natural gas production on public lands” and the halting of the emissions-related “excessive tax on natural gas.”

“Energy dominance” or “energy abundance”?

The final legislation rapidly phases out tax credits for all clean energy projects not online by the end of 2027—exempting those that break ground by June 2026. The Senate’s original, less draconian language required starting construction by the end of 2027—a subtle but massive timeline difference for those scrambling to get projects up and running.

This isn’t just a problem for clean energy developers or environmental advocates; it could dramatically slow the country’s planned and much-needed rapid increases in power generation. In simple terms, that means less power for increasingly electricity-hungry tech and manufacturing sectors, and a growing population—meaning higher power bills for everyone, and possible shortfalls and brownouts.

“The bill doesn’t just burden families, it undermines our country,” said Ari Matusiak, CEO of the Rewiring America nonprofit. “We need low-cost, abundant energy to compete globally. We will become collectively poorer, less resilient, and less equipped to lead in a rapidly changing world.” After all, renewables accounted for almost 90% of new power generation installed in the U.S. last year, according to the Department of Energy.

Cutting deadlines back to 2027 for completing most projects will result in about 20% fewer clean-energy projects being built in the U.S. over the next 10 years, according to S&P Global Commodity Insights projections.

“That’s extremely meaningful,” said Roman Kramarchuk, head of climate market and policy analysis for S&P Global. “This isn’t 20% of a small share; this is 20% of the strong majority of the new deployments.

“That’s rough,” he added. “What it will do is increase costs for power.”

Instead of so-called energy dominance, there’s a growing plea from tech, utilities, and political moderates for scaled-up “energy abundance”—a stance that embraces all forms of power to more rapidly build capacity and help push down prices. But both political parties have been tripped up by ideology, failing to support a strategy that includes clean energy and natural gas—with the GOP targeting renewables and Democrats fighting fossil fuels.

That’s despite the urging of the Edison Electric Institute (EEI), an organization representing investor-owned electric utilities nationwide, and many others. “We’re in unprecedented times for our industry; we haven’t seen this type of load growth since the advent of air conditioning,” EEI chairman and Exelon CEO Calvin Butler told Fortune. “We have to get new power generation built. It’s going to take the all-of-the-above portfolio approach—nuclear, gas, wind, solar, and new technologies like battery storage.”

Butler said he would have supported the legislation if it allowed clean energy projects to break ground by 2027, although later was preferred. “We believe the tax credits are key,” he said. “We don’t believe we can get to the energy dominance without having renewables as part of the solution.”

Why do we need so much power?

After a couple of decades during which U.S. power demand has remained relatively stagnant, domestic electricity consumption is expected to spike by 25% from 2023 to 2035 and roughly 60% from 2023 to 2050, according to the International Energy Agency.

A big part of that increase comes from the hyperscalers: Amazon, Google, and Microsoft are investing anywhere from $75 billion to $100 billion each into building data centers for 2025 alone.

To put those dollars in context, the entire market cap of Big Oil giant BP is $80 billion. A planned super-sized Meta data center in Louisiana, for instance, would require twice the power used by the whole city of New Orleans.

John Ketchum, CEO of NextEra Energy (No. 173 on the Fortune 500)—a massive utility and power developer—estimates that anticipated gas-fired generation cannot even meet 20% of the data-center needs from now until 2030. Despite record volumes of shale gas produced domestically in recent years, the turbines required to turn that gas into electricity are getting more costly and there aren’t enough being manufactured because of supply-chain challenges.

“If it’s not renewables, what is it going to be?” Ketchum said of the remaining 80% of data-center power needs, while speaking at the Politico Energy Summit in June.

While the legislation does not cripple clean energy—a lot of utility-scale wind and solar will still be built—it does substantially weaken its access to tax breaks and increase costs.

A prior version of the bill didn’t just phase out the tax credits; it also placed a brand-new excise tax on clean-energy projects—one that even renewable energy opponents bristled at. Some projections estimated the tax easily could have killed most pending clean energy projects, making them economically not viable. That tax was removed just before final Senate voting.

Another last-minute change exempted clean-energy projects from losing the tax credit if they break ground by June 2026, even if they exceed the 2027 completion deadline—although these are still very tight timelines.

Likewise, the legislation keeps the “transferability” of tax credits—the removal of which was considered a backdoor “poison pill” meant to cripple the program. Transferability allows smaller developers to raise capital by transferring tax credits at a discount to larger buyers that can immediately take advantage of the tax benefits. The original House version of the bill had eliminated transferability.

The legislation also places new “foreign entity of concern” (FEOC) provisions on renewable energy projects. The FEOC rules, which only applied to electric vehicle tax credits in the Inflation Reduction Act, would now apply to all clean-energy tax credits, essentially limiting needed supply-chain materials from China. The House bill placed arduous FEOC provisions on projects, but the final version takes a more measured, phased-in approach.

No matter how much new manufacturing is built in the U.S., many of the materials still only come from China and any delays or missteps cede more ground to China in the middle of a brawl for AI dominance as China rapidly builds more power from coal to wind and solar.

While China is currently more reliant on coal than the U.S., China now sources about one-third of its power from renewables—compared to about 22% in the U.S.—and China is currently installing more solar power, for instance, than the rest of the world combined. As China continues to rapidly build more generation, U.S. slowdowns in any forms of new electricity infrastructure will give China more of a power boost in the AI race to supremacy.

The legislation also undoes a bevy of other clean-energy and efficiency efforts. The electric-vehicle tax credit is axed, as are credits for residential solar projects and for other home-energy efficiency efforts. The megabill also comes as the Trump administration aims to roll back energy-efficiency standards for home appliances and more.

“Families will face rising electricity costs with fewer tools to do anything about it,” said Matusiak of Rewiring America. “As energy demand from AI, data centers, and manufacturing explodes, households are boxed in, expected to pay more while getting less.”

Residential electricity costs in the U.S. already have risen by 13% on average from 2022 until now, according to the Department of Energy. And they are projected to keep increasing with demand growth from data centers and higher natural-gas prices as a wave of liquefied natural gas export projects come online between now and 2030.

What happens next?

Next up in the renewables sector is the continuation of a rabid race to break ground on clean-energy projects to beat the tax credit deadlines. In a way, the more stringent the timelines, the bigger and faster is the mad dash to qualify for tax breaks—even if fewer will be built overall

“This sector has done this before,” Kramarchuk said. “There’s always the rush to hit the deadlines.”

In the push for more fossil-fuel-sourced power, new gas-fired turbines that aren’t already contracted will take five years or so to be built. In the meantime, that means increasing the utilization of existing gas-fired power plants and working to keep more coal plants open for longer. “It means running your existing gas or coal units harder,” Kramarchuk said. Not coincidentally, a tax break for coal exports was a late add to the legislation.

By 2028, 50 gigawatts of existing coal capacity are scheduled to be retired. Some of those plants must stay online for longer to bridge the gap, but how much longer is even possible is unclear. “A lot of those plants are very old and require significant capital investments to keep them going,” he said.

To be clear, the end of tax credits does not mean the death of renewables. The GOP-aligned super PAC ClearPath Action, which supports efforts to combat climate change, called the bill a much better draft than some earlier versions that would have imposed additional taxes on renewables and “devasted” the clean energy industry. “Senate Republicans and House allies rejected that approach and preserved some financial tools to accelerate American innovation and invest in American manufacturing,” said ClearPath CEO Jeremy Harrell.

It does mean, however, that wind and solar projects will become more expensive. A lot of regional utilities and smaller developers may kill the clean energy projects on their drawing boards. But the hyperscalers, of course, have bigger budgets.

“New wind and solar that would’ve been built, can be built. It’s just going to cost a lot more,” Kramarchuk said. “If you’re a hyperscaler, then you probably have more latitude to pay more.”

As for the rest of us? Our electricity and heating bills will likely rise too.