周三,,美國股市在連續(xù)兩天下跌后回升,。事實(shí)證明,這兩天的下跌只是股市自4月低點(diǎn)以來持續(xù)攀升過程(盡管存在震蕩)中的小插曲,。與此同時,,科技巨頭英偉達(dá)市值突破4萬億美元,創(chuàng)下歷史新高,。

標(biāo)普500指數(shù)上漲0.6%,;以科技股為主的納斯達(dá)克指數(shù)上漲0.9%;在此前兩日的下跌中表現(xiàn)最差的道瓊斯指數(shù)則上漲218點(diǎn),,漲幅為0.5%,。

交易者們似乎對新一輪關(guān)稅消息反應(yīng)冷淡,這與他們在4月份的反應(yīng)形成天壤之別,。當(dāng)時,,唐納德·特朗普首次推出關(guān)稅政策時,,美股、美債和美元市場均遭遇大幅拋售,。上周在7月4日假期前夕,關(guān)稅問題再度成為焦點(diǎn)時,,投資者早已嚴(yán)陣以待,。市場雖有小幅回調(diào),但整體仍維持在近期高位區(qū)間內(nèi),。

7月9日星期三是90天關(guān)稅暫停期的最后期限,,但特朗普隨后將該期限延長至8月1日。當(dāng)日,,特朗普向包括菲律賓,、摩爾多瓦和文萊在內(nèi)的七個新國家發(fā)出了“關(guān)稅函”。

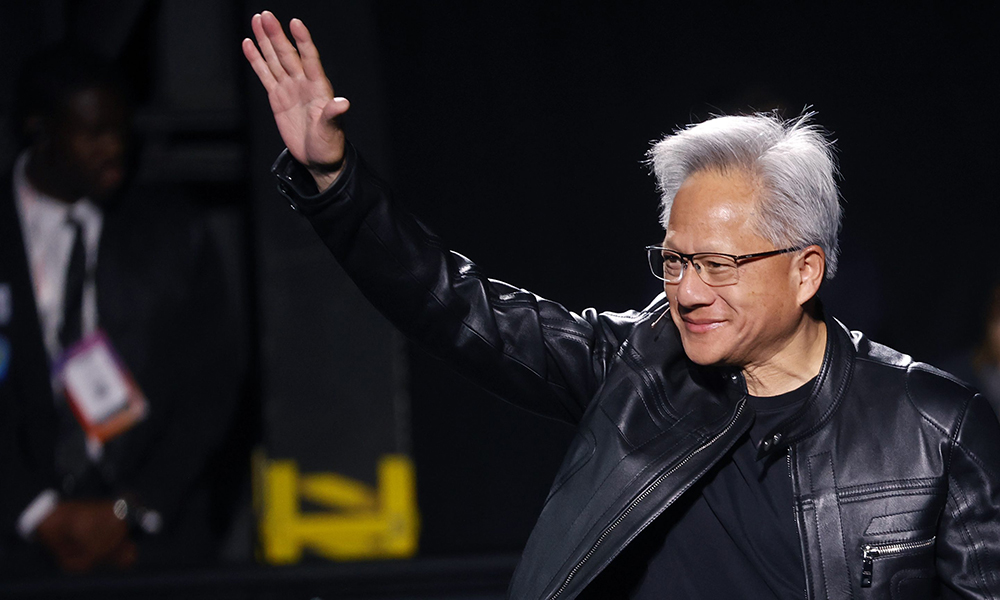

英偉達(dá)市值突破4萬億美元,,創(chuàng)歷史新高

在美國市場,,半導(dǎo)體巨頭、投資者寵兒英偉達(dá)成為全球首家市值達(dá)到4萬億美元的公司,。

周三,,英偉達(dá)股價上漲1.8%,收于每股162.86美元,。周四,,英偉達(dá)續(xù)創(chuàng)歷史新高,股價收漲0.75%,,報164.1美元,。英偉達(dá)成為引領(lǐng)AI市場上漲行情的標(biāo)桿企業(yè),正是這一輪行情推動標(biāo)普500指數(shù)連續(xù)兩年實(shí)現(xiàn)超過20%的增長,。

英偉達(dá)擊敗了蘋果(Apple)和微軟(Microsoft)等傳奇科技巨頭,,市值突破4萬億美元。自年初以來,,英偉達(dá)股價累計上漲超過18%,。但相比這家芯片制造商過去五年高達(dá)1,453%的漲幅,其今年的表現(xiàn)反而顯得較為平穩(wěn),。(財富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

周三,,美國股市在連續(xù)兩天下跌后回升。事實(shí)證明,,這兩天的下跌只是股市自4月低點(diǎn)以來持續(xù)攀升過程(盡管存在震蕩)中的小插曲,。與此同時,科技巨頭英偉達(dá)市值突破4萬億美元,,創(chuàng)下歷史新高,。

標(biāo)普500指數(shù)上漲0.6%;以科技股為主的納斯達(dá)克指數(shù)上漲0.9%;在此前兩日的下跌中表現(xiàn)最差的道瓊斯指數(shù)則上漲218點(diǎn),,漲幅為0.5%,。

交易者們似乎對新一輪關(guān)稅消息反應(yīng)冷淡,這與他們在4月份的反應(yīng)形成天壤之別,。當(dāng)時,,唐納德·特朗普首次推出關(guān)稅政策時,美股,、美債和美元市場均遭遇大幅拋售,。上周在7月4日假期前夕,關(guān)稅問題再度成為焦點(diǎn)時,,投資者早已嚴(yán)陣以待,。市場雖有小幅回調(diào),但整體仍維持在近期高位區(qū)間內(nèi),。

7月9日星期三是90天關(guān)稅暫停期的最后期限,,但特朗普隨后將該期限延長至8月1日。當(dāng)日,,特朗普向包括菲律賓,、摩爾多瓦和文萊在內(nèi)的七個新國家發(fā)出了“關(guān)稅函”。

英偉達(dá)市值突破4萬億美元,,創(chuàng)歷史新高

在美國市場,,半導(dǎo)體巨頭、投資者寵兒英偉達(dá)成為全球首家市值達(dá)到4萬億美元的公司,。

周三,,英偉達(dá)股價上漲1.8%,收于每股162.86美元,。周四,,英偉達(dá)續(xù)創(chuàng)歷史新高,股價收漲0.75%,,報164.1美元,。英偉達(dá)成為引領(lǐng)AI市場上漲行情的標(biāo)桿企業(yè),正是這一輪行情推動標(biāo)普500指數(shù)連續(xù)兩年實(shí)現(xiàn)超過20%的增長,。

英偉達(dá)擊敗了蘋果(Apple)和微軟(Microsoft)等傳奇科技巨頭,,市值突破4萬億美元。自年初以來,,英偉達(dá)股價累計上漲超過18%,。但相比這家芯片制造商過去五年高達(dá)1,453%的漲幅,其今年的表現(xiàn)反而顯得較為平穩(wěn),。(財富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

Stocks rose on Wednesday after two days of declines. Those downturns proved to be little more than blips in the continuous—albeit choppy—march the stock market has had since its recent nadirs in April. Meanwhile, tech juggernaut Nvidia hit a historic new $4 trillion milestone.

The S&P 500 rose 0.6%. The tech-heavy Nasdaq climbed 0.9%. While the Dow Jones ticked up 218 points, good for a 0.5% increase, after taking the worst of the two-day slump.

Traders seemed to ignore this latest round of tariff news—a stark contrast to their reaction in April when President Donald Trump’s initial burst of tariff policies caused a broad market selloff that hit equities, the U.S. dollar, and the bond market. When tariffs returned to the forefront right before the July Fourth holiday last week, investors had already braced themselves. Markets dipped a little but stayed largely in the range of their recent highs.

Wednesday, July 9 marked the deadline for a 90-day pause on tariffs. However, Trump has since extended the deadline to Aug. 1. On Wednesday, the president sent “tariff letters” to seven new countries including the Philippines, Moldova, and Brunei.

Nvidia’s historic $4 trillion market cap

Back in the U.S., stock market darling and semiconductor juggernaut Nvidia became the first company with a $4 trillion valuation.

Shares rose 1.8% on Wednesday hitting a share price of $162.86. Nvidia became the poster child for the AI market rally that led the S&P 500 to back-to-back years of more than 20% growth.

Nvidia beat other legendary tech giants Apple and Microsoft to the $4 trillion mark. Since the start of the year, Nvidia’s stock is up 17%—though that proves a relatively calm performance for the chipmaker, which has seen its stock rise 1,453% over the past five years.